Overview

This article identifies ten cap rate properties for sale, aimed at enhancing investment portfolios. It highlights platforms such as LoopNet, Zillow, and Fundrise, which offer valuable resources, data-driven insights, and user-friendly tools. These elements empower investors to make informed decisions and capitalize on high-yield opportunities within the commercial real estate market.

Introduction

In the realm of real estate investment, capitalization rates emerge as a pivotal metric for assessing the potential profitability of properties. As investors strive to enhance their portfolios, the pursuit of high-cap rate properties becomes increasingly essential, particularly in a volatile market. This article presents a carefully curated list of ten standout cap rate properties currently available for sale, providing investors with the chance to capitalize on lucrative investment opportunities. Yet, with a plethora of options and dynamic market forces at play, how can one effectively navigate this landscape to make informed and profitable decisions?

Zero Flux: Daily Insights on Cap Rate Properties for Investors

Zero Flux provides daily insights specifically centered on cap yield assets, establishing itself as an essential resource for stakeholders. By curating data from over 100 sources, the newsletter guarantees that subscribers receive the most relevant and up-to-date information. This focus on capitalization yields empowers individuals to assess potential returns on their investments, enabling informed decision-making in a rapidly evolving market environment.

In July 2025, the average capitalization values for commercial assets indicated significant trends, with numerous stakeholders seizing market fluctuations as opportunities. For instance, the case study 'Market Fluctuations as Opportunities' illustrates how savvy investors can acquire real estate from motivated sellers during challenging market conditions, thereby enhancing their prospects for long-term financial success.

As Warren Buffett wisely stated, 'Risk arises from lacking knowledge of your actions,' underscoring the importance of understanding capitalization metrics in making informed investment choices.

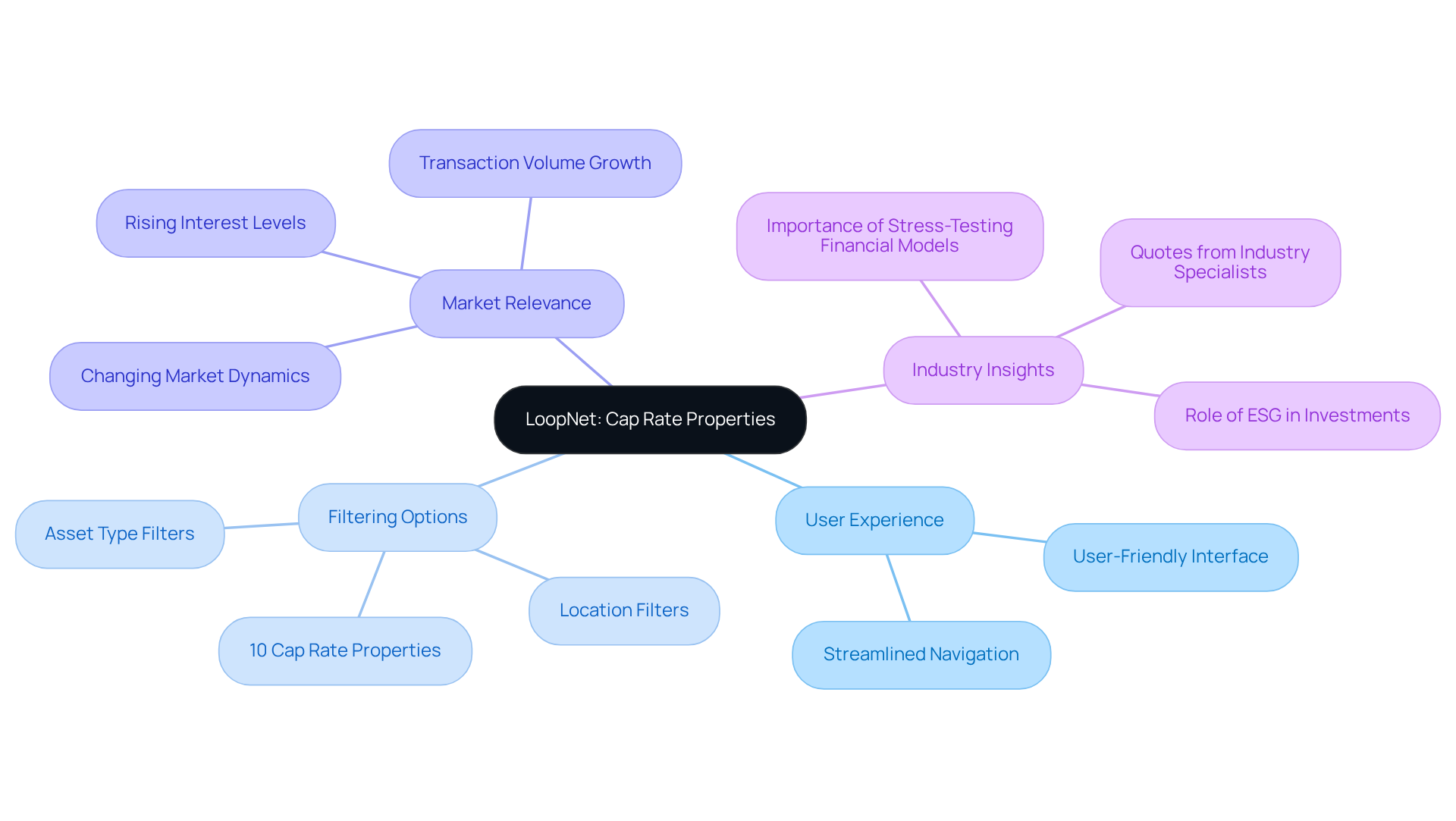

LoopNet: Comprehensive Listings of Cap Rate Properties for Sale

LoopNet stands out as a premier platform for accessing a diverse array of commercial real estate listings, especially for those seeking 10 cap rate properties for sale. In 2025, the site features thousands of cap listings, establishing itself as a vital resource for individuals aiming to enhance their portfolios. Users can effortlessly filter searches by location, asset type, and specifically for 10 cap rate properties for sale, facilitating a tailored search experience that aligns with specific investment objectives. The platform's user-friendly interface streamlines navigation, allowing users to swiftly identify opportunities that resonate with their strategies.

Real estate professionals commend LoopNet for its efficiency, highlighting that it simplifies the process of locating high-quality investment properties. As the commercial property market evolves, characterized by rising interest levels and changing market dynamics, individuals increasingly rely on LoopNet to navigate these complexities.

Industry specialists assert, "LoopNet has become essential for serious stakeholders, particularly in a market where stress-testing financial models is vital due to varying interest levels."

With its comprehensive database and accessible design, LoopNet remains an indispensable tool for dedicated individuals seeking to capitalize on 10 cap rate properties for sale.

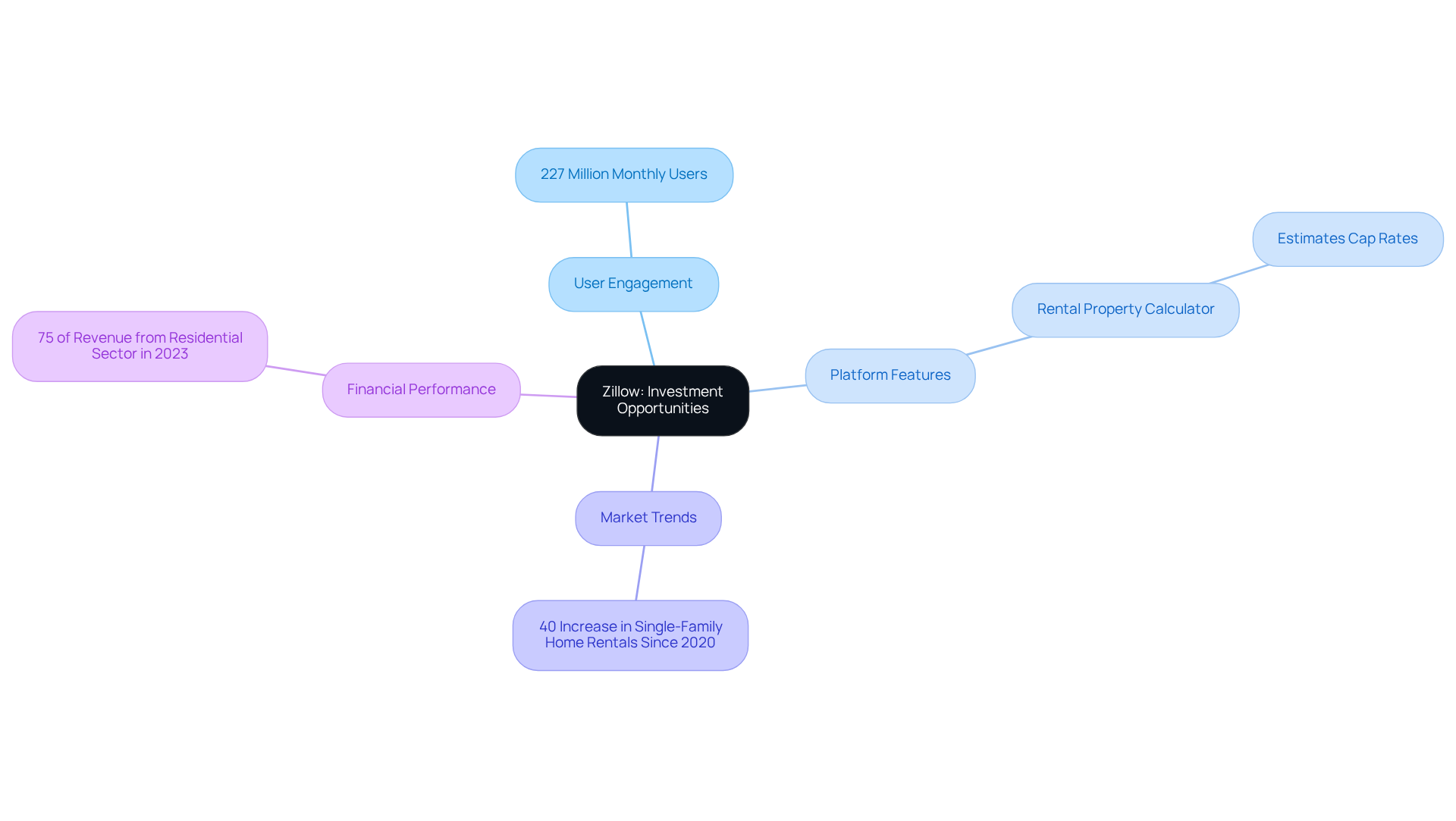

Zillow: User-Friendly Platform for Finding Cap Rate Investment Opportunities

Zillow presents a powerful platform that enables individuals to identify cap return investment opportunities with remarkable efficiency. With over 227 million monthly users, Zillow's extensive reach ensures stakeholders can easily access a wealth of listings, complete with in-depth insights and market trends. A standout feature, the rental property calculator, empowers users to estimate cap rates and assess the potential profitability of various properties. This functionality is particularly vital in 2025, as the rental market evolves, evidenced by a 40% increase in single-family home rentals since 2020.

Furthermore, Zillow's income from the residential sector constituted approximately 75% of overall revenue in 2023, underscoring its financial robustness and reliability as a resource for stakeholders. Real estate analysts assert that Zillow's tools are indispensable for making informed investment decisions, with one expert stating, 'Zillow isn’t just a website—it’s the real estate market’s main stage.' By leveraging these resources, individuals can adeptly navigate the complexities of the market and effectively enhance their portfolios.

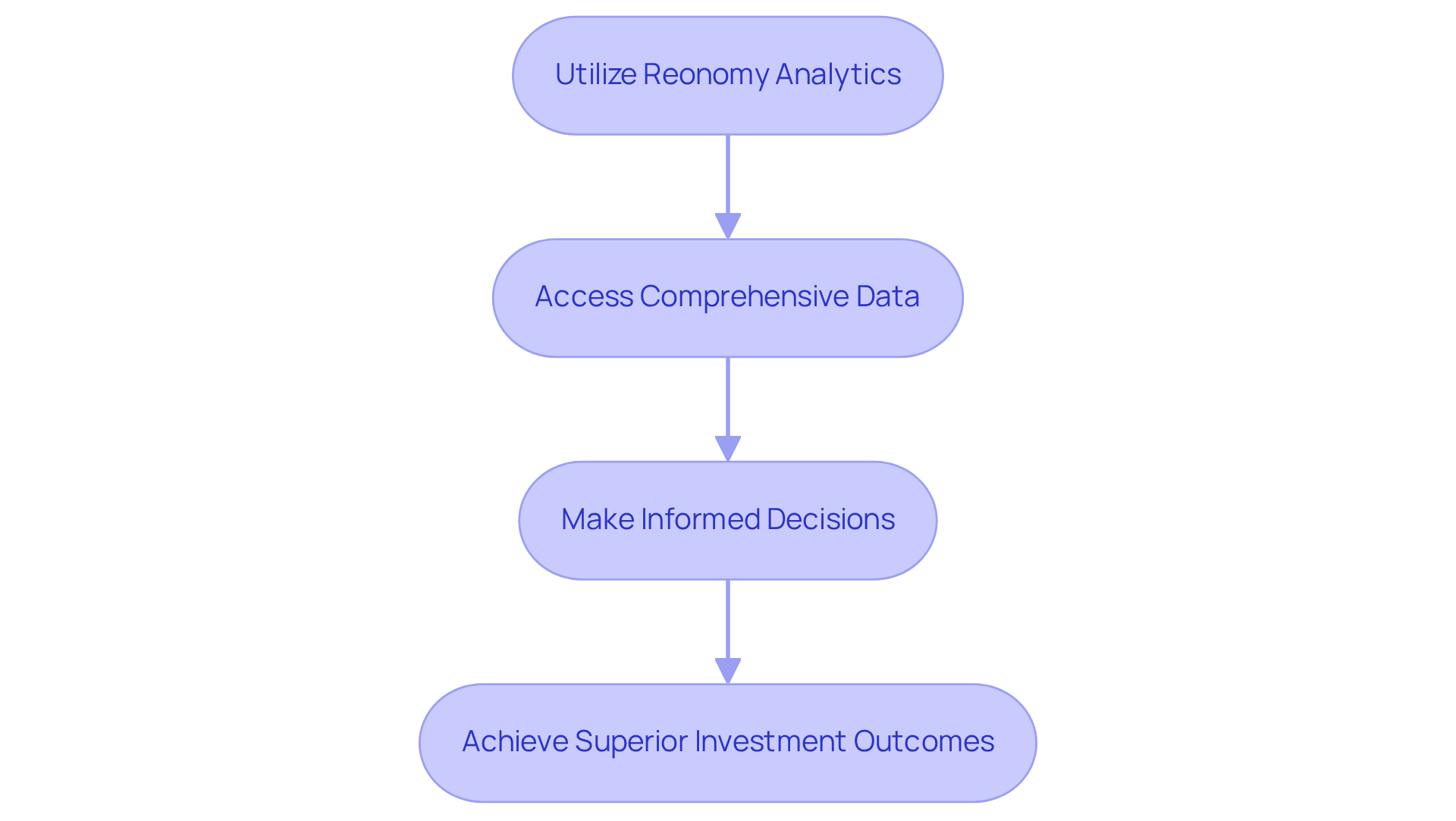

Reonomy: Data-Driven Insights for Cap Rate Property Investments

Reonomy stands out as an indispensable resource for those focused on 10 cap rate properties for sale, providing robust, data-driven insights that significantly enhance investment strategies. By leveraging advanced analytics, Reonomy provides comprehensive information on real estate performance, ownership history, and current market trends. This extensive data empowers stakeholders to make informed decisions, as highlighted by a 2025 survey revealing that over 75% of participants experienced improved decision-making capabilities after incorporating Reonomy into their investment processes.

Industry leaders underscore the critical role of analytics in today’s competitive landscape, with one remarking, "Informed decisions lead to superior investment outcomes," reinforcing the necessity of leveraging analytics for success. User testimonials illustrate how Reonomy's analytics have transformed their approach to cap values, leading many to express increased confidence in their investment choices, especially in relation to 10 cap rate properties for sale.

As the real estate market evolves, tools like Reonomy are vital for individuals seeking to optimize their portfolios and seize emerging opportunities.

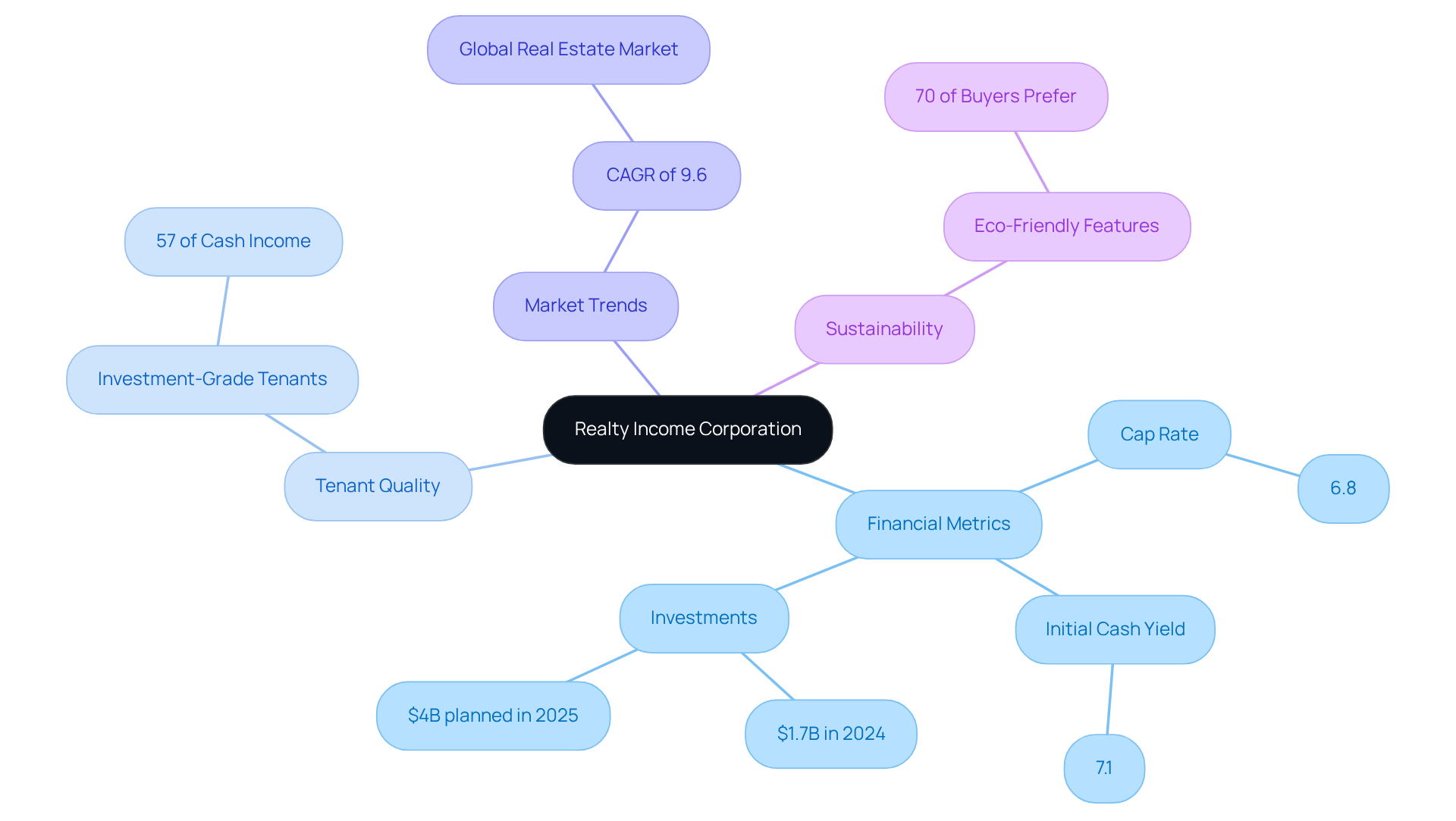

Realty Income Corporation: REIT with Strong Cap Rate Properties

Realty Income Corporation stands out as a leading REIT, focusing on the acquisition and management of properties that yield strong capitalization returns. With a steadfast commitment to monthly dividend payments, Realty Income presents a dependable income stream, appealing to investors seeking stable, income-generating assets. In 2025, the company's portfolio is expected to maintain an average cap rate of approximately 6.8%, aligning with the overall cap rate for commercial real estate. Realty Income has effectively allocated $1.7 billion in investments, achieving an initial cash yield of 7.1%, and plans to invest an additional $4 billion in 2025, underscoring its ability to deliver consistent returns and foster confidence among stakeholders.

Investor experiences with Realty Income have been overwhelmingly positive, with many valuing the predictability of its earnings and the resilience of its business model. Analysts highlight that the REIT's triple-net lease structure enables it to transfer most property-related expenses to tenants, further enhancing profitability. Notably, 57% of Realty Income's cash income derives from investment-grade tenants, contributing to the stability of its income stream. As the global real estate market continues to expand at a CAGR of 9.6%, Realty Income's strategic positioning within the commercial real estate sector offers an enticing opportunity for individuals looking to diversify their portfolios.

In addition to its robust financial performance, Realty Income's commitment to sustainability and green-certified assets aligns with current market trends, as over 70% of buyers now prioritize eco-friendly features. This focus not only elevates real estate values but also attracts a growing demographic of environmentally conscious stakeholders. Overall, Realty Income Corporation represents a solid investment choice for those looking to capitalize on the benefits of REITs and capitalization in today's dynamic market.

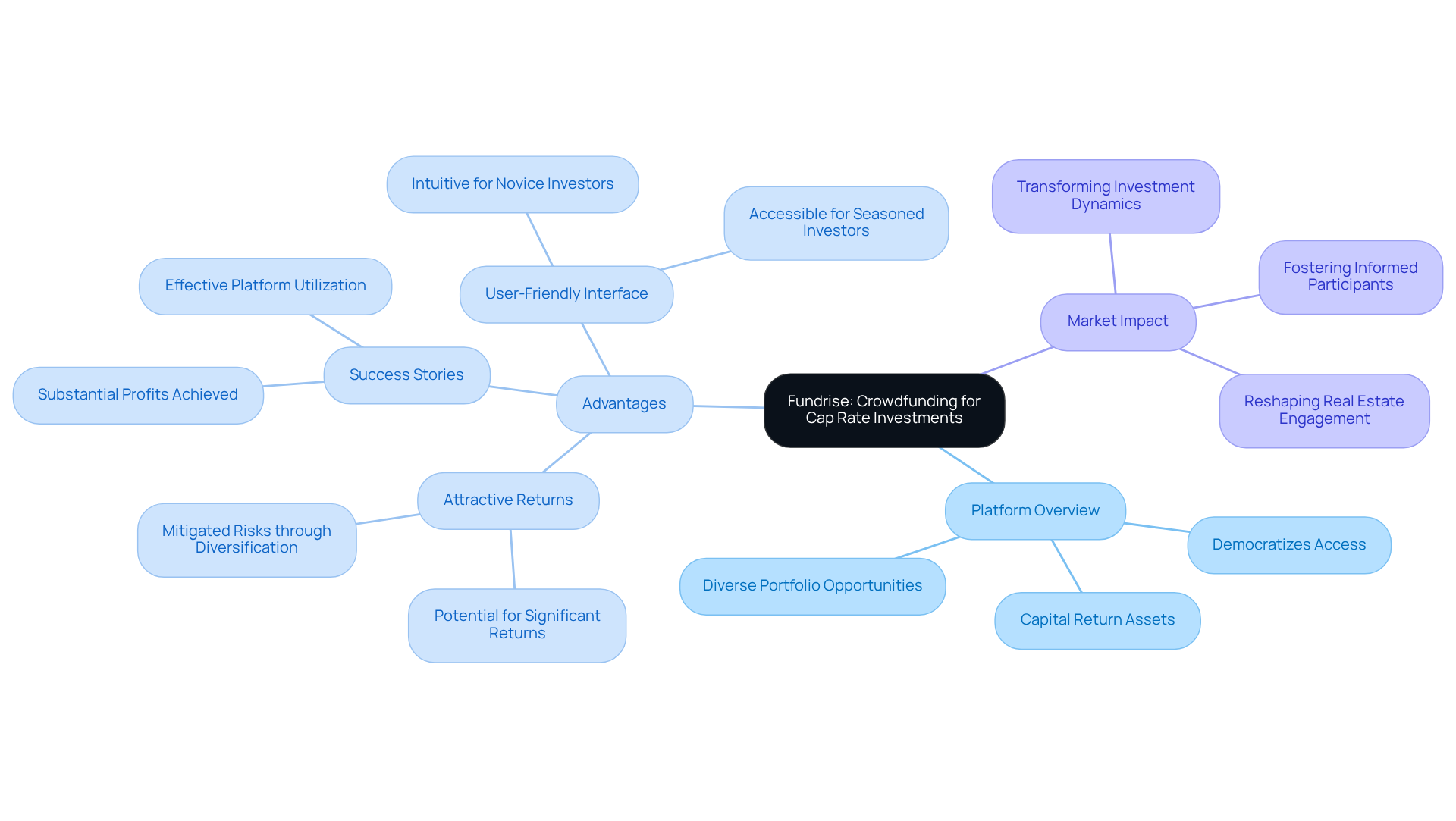

Fundrise: Crowdfunding Platform for Cap Rate Property Investments

Fundrise stands out as a prominent crowdfunding platform, enabling individuals to pool their resources for investing in capital return assets. This innovative approach democratizes access to real estate investments that may have previously been out of reach for many. By investing through Fundrise, individuals can diversify their portfolios and potentially reap the rewards associated with commercial real estate, all while benefiting from a lower barrier to entry.

In 2025, the average investment amount on Fundrise for cap rate assets has become increasingly accessible, allowing a broader range of participants to engage in the market. The advantages of investing through Fundrise are compelling:

- Attractive Returns: Investors can enjoy the potential for significant returns while mitigating risks through diversification across various properties.

- Success Stories: Numerous individuals have leveraged Fundrise to achieve substantial profits in their real estate portfolios, showcasing the platform's effectiveness.

- User-Friendly Interface: Fundrise minimizes obstacles to participation and provides an intuitive platform for both novice and seasoned investors alike.

As the real estate market continues to evolve, platforms like Fundrise are leading the charge, reshaping how individuals engage with real estate investments. By fostering a new generation of informed participants ready to seize opportunities within the sector, Fundrise is transforming the dynamics of capital return investments.

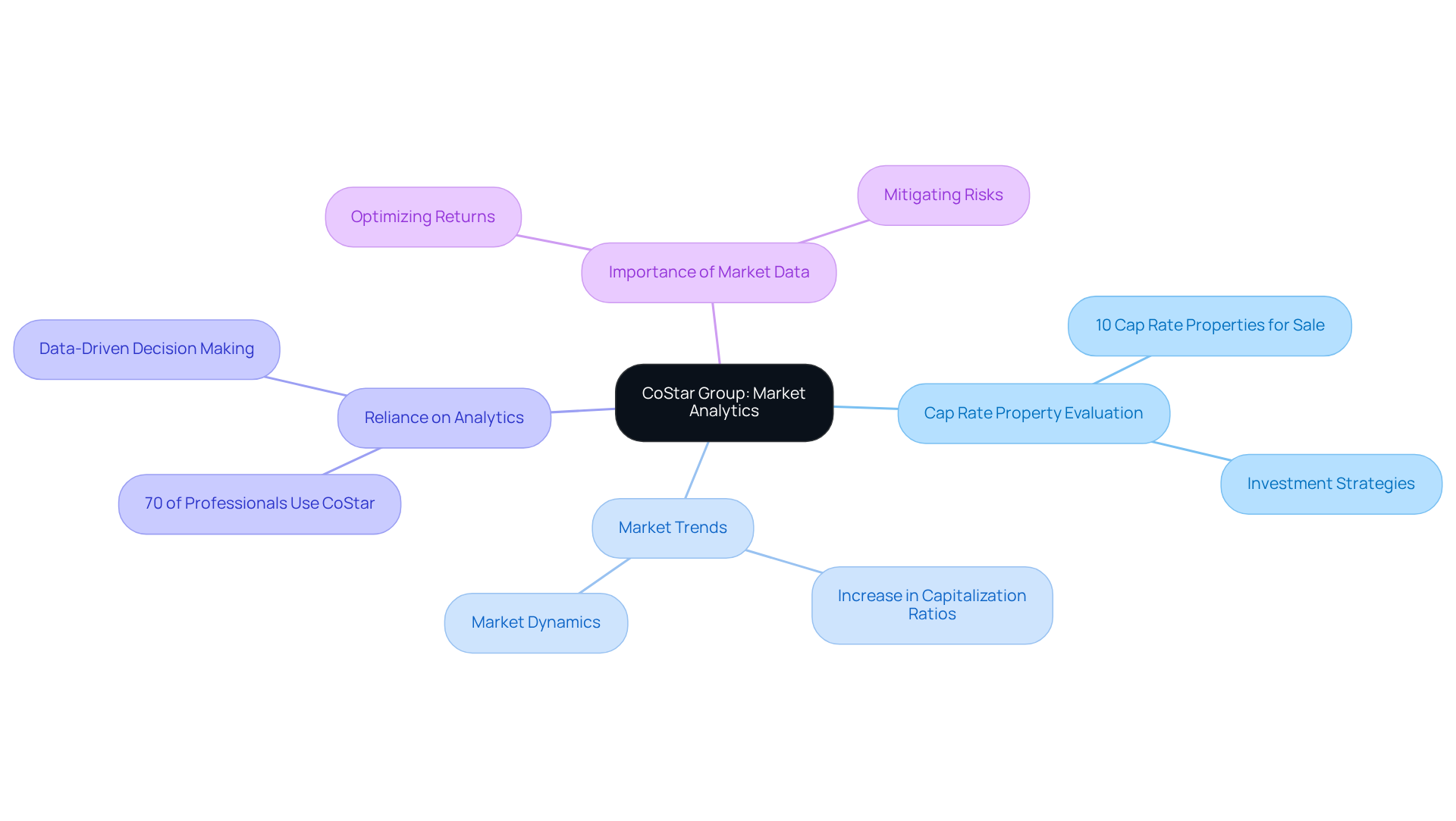

CoStar Group: Market Analytics for Cap Rate Property Evaluation

CoStar Group stands out as a premier provider of commercial real estate information and analytics, offering a comprehensive array of market data crucial for evaluating 10 cap rate properties for sale. In 2025, their platform reveals significant trends, notably a substantial increase in capitalization ratios across various markets, including the availability of 10 cap rate properties for sale, which stakeholders can leverage to make well-informed decisions. Recent statistics show that over 70% of real estate professionals rely on CoStar's analytics to evaluate potential investments and market conditions, highlighting its critical role in the decision-making process.

Industry analysts assert that access to precise market data is essential for successful real estate investments. One expert noted, 'Understanding cap rate trends is vital for those aiming to optimize returns and mitigate risks, especially when evaluating 10 cap rate properties for sale.' This perspective resonates with numerous stakeholders who have reported positive experiences using CoStar for market analysis, emphasizing its function in uncovering profitable opportunities and navigating intricate market dynamics. By integrating CoStar's extensive analytics into their investment strategies, individuals can align their decisions with prevailing market realities, ultimately enhancing their portfolios.

PropertyMetrics: Cap Rate Analysis Tools for Savvy Investors

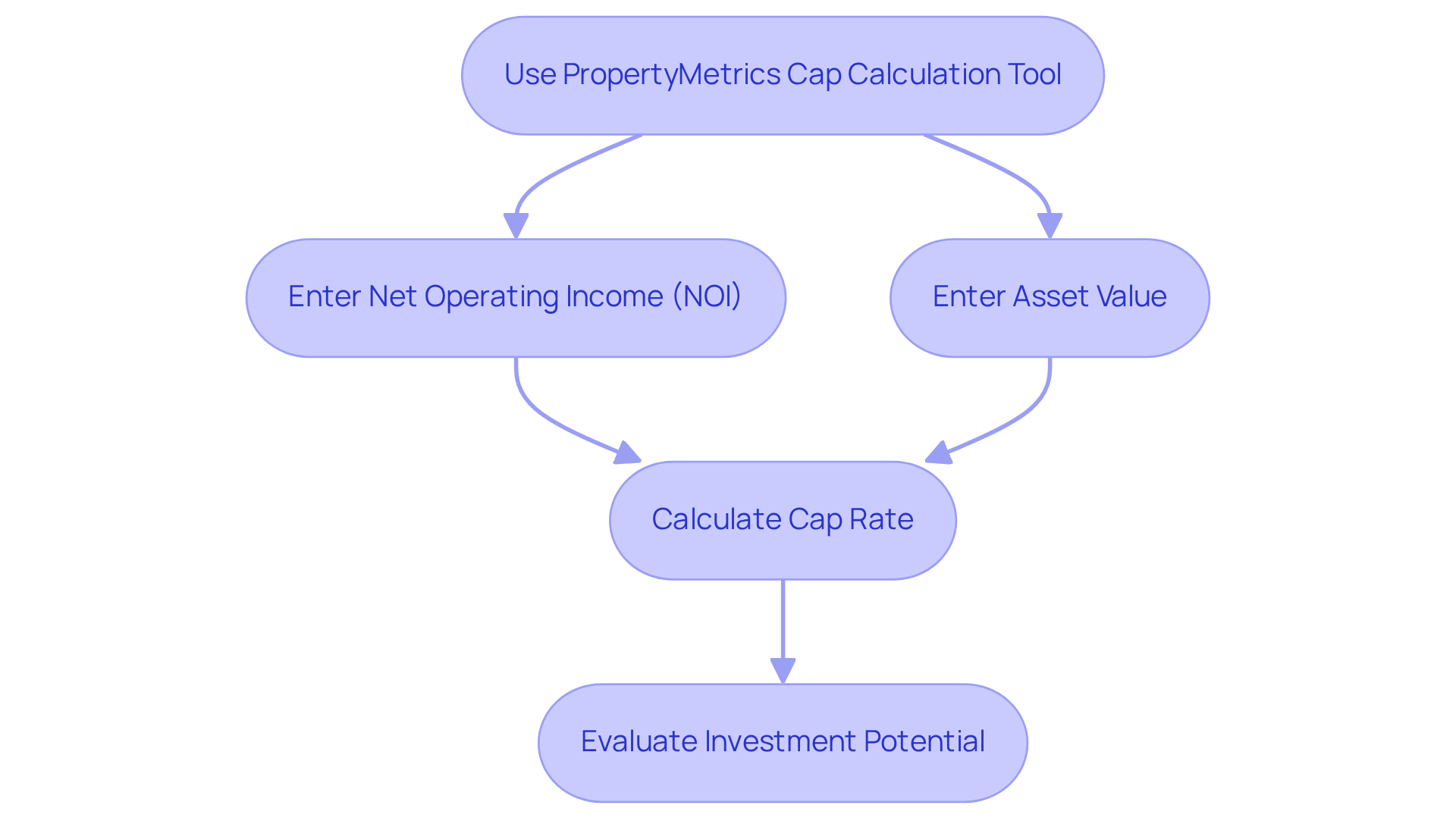

PropertyMetrics offers a comprehensive suite of tools tailored for real estate stakeholders, enabling effective capitalization analysis. The cap calculator allows users to input specific asset data, generating immediate calculations that aid in evaluating potential returns on investment. In 2025, users reported an average capitalization percentage of 7.5%, underscoring the platform's efficacy in helping investors assess real estate performance. Real estate experts emphasize the importance of capitalization calculations; as David Paxton asserts, 'Cap is essential, as it indicates potential cash flow.' User testimonials further illustrate how PropertyMetrics has significantly enhanced investment decision-making, highlighting its value in navigating the complexities of the real estate market.

To utilize the PropertyMetrics cap calculation tool, simply enter the net operating income (NOI) and asset value, and the tool will promptly deliver the cap calculation. For optimal results, consider employing the calculator alongside other metrics such as ROI and GRM to obtain a holistic view of your investment's potential. This streamlined approach not only enhances the analysis process but also empowers investors to make informed decisions regarding their real estate investments.

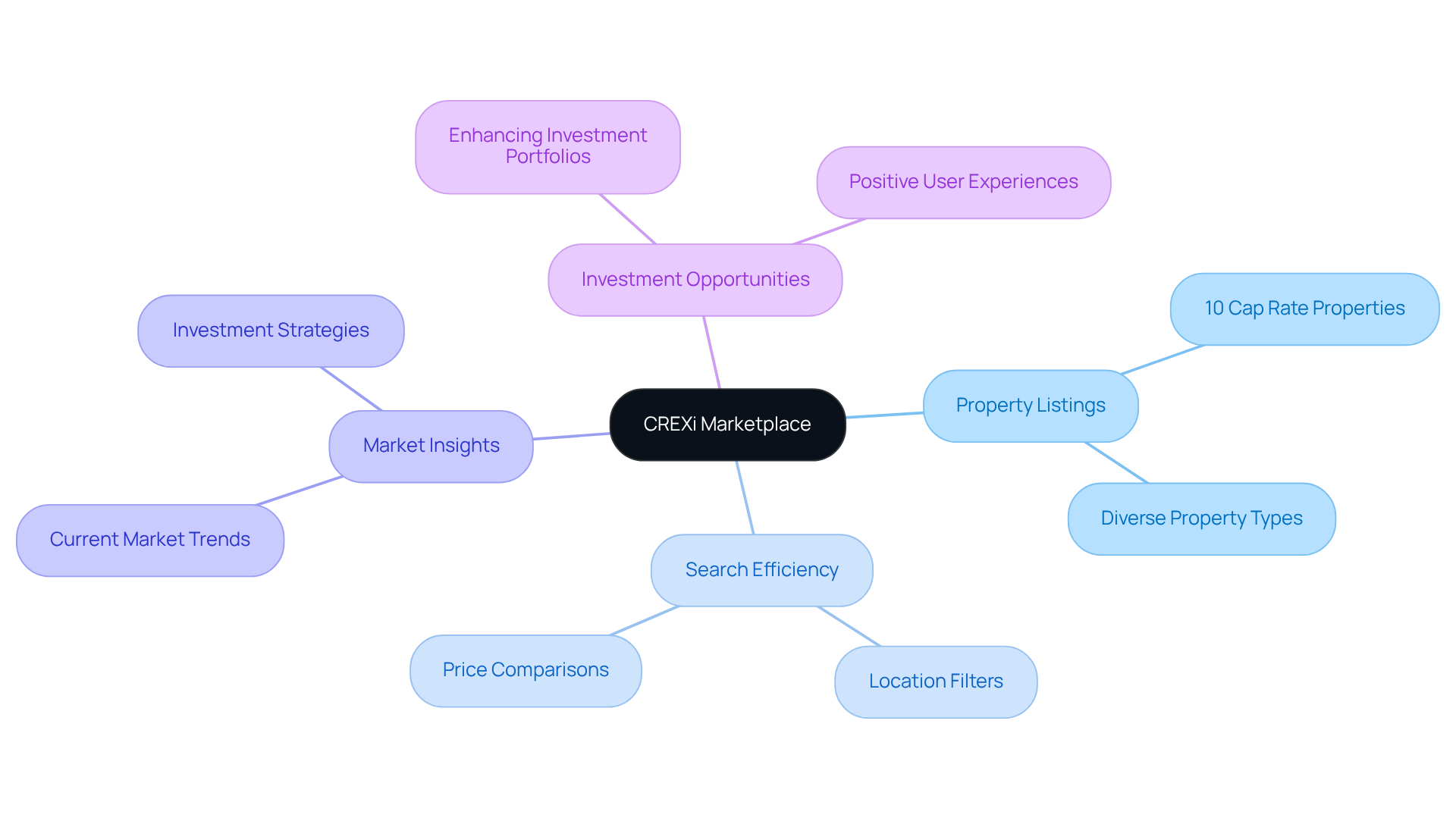

CREXi: Marketplace for Diverse Cap Rate Property Listings

CREXi stands as a formidable marketplace for commercial real estate listings, showcasing a diverse array of 10 cap rate properties for sale. Investors can efficiently search for properties that align with their specific criteria, such as location and price, facilitating straightforward comparisons. This platform not only streamlines the search process but also delivers valuable insights into current market trends, empowering individuals to make well-informed decisions.

Looking ahead to 2025, the average capitalization returns for assets listed on CREXi reflect a competitive landscape, presenting an attractive opportunity for those seeking 10 cap rate properties for sale to enhance their investment portfolios. Real estate analysts have noted the platform's efficiency in simplifying the investment process, with numerous participants sharing positive experiences in locating 10 cap rate properties for sale.

By leveraging CREXi's extensive tools and resources, stakeholders can navigate the complexities of cap return investments with greater confidence and effectiveness. This positions CREXi as an essential ally for investors aiming to optimize their strategies in the ever-evolving real estate market.

Marcus & Millichap: Expert Valuation Services for Cap Rate Properties

Marcus & Millichap provides essential professional valuation services for individuals seeking to accurately assess cap rate assets. Their team conducts comprehensive evaluations of asset values, market conditions, and investment potential, ensuring that stakeholders possess a clear understanding of their opportunities. This meticulous approach not only enhances valuation accuracy but also empowers stakeholders to make informed decisions that can significantly impact their portfolios.

Industry experts assert that precise property valuation is vital in real estate investment, as it directly affects investment strategies and outcomes. Numerous success stories abound, with many stakeholders crediting Marcus & Millichap's insights for their ability to identify lucrative opportunities and improve their investment returns.

By leveraging these expert services, investors can confidently navigate the complexities of the real estate market, ultimately leading to more successful investment outcomes.

Conclusion

Navigating the landscape of cap rate properties presents investors with a unique opportunity to enhance their portfolios with assets that promise strong returns. The insights shared in this article underscore the necessity of leveraging various platforms and tools to effectively identify and evaluate these investment opportunities. By grasping the mechanics of capitalization rates and utilizing resources like Zero Flux, LoopNet, Zillow, and others, investors can make informed decisions that align with their financial goals.

Key arguments highlight the critical role of technology and data in real estate investment. From the comprehensive listings on LoopNet to the analytical capabilities of Reonomy and CoStar Group, each resource offers valuable insights that can guide investors in their pursuit of 10 cap rate properties. Furthermore, the innovative crowdfunding approach provided by Fundrise democratizes access to real estate investments, enabling a broader audience to engage in this lucrative market.

As the real estate sector continues to evolve, staying informed and utilizing the right tools becomes essential for success. Investors are encouraged to explore these platforms and consider how they can integrate these insights into their strategies. By doing so, they can not only optimize their investment decisions but also position themselves to capitalize on emerging trends in the cap rate property market, ultimately fostering long-term financial growth and stability.