Overview

The article forecasts a moderate recovery in the commercial real estate market by 2025, driven by significant trends such as:

- The resurgence of the office sector

- Growth in industrial properties

- A revitalization of retail spaces

This outlook is bolstered by analyses from various industry experts, who indicate increased leasing activity, rising demand for logistics, and a notable shift in consumer behavior towards in-person shopping. These factors collectively signal positive economic conditions for the sector, suggesting a promising landscape for investors.

As we delve deeper, the resurgence of the office sector stands out, reflecting a renewed interest in physical workspaces. Coupled with the expansion of industrial properties, this trend highlights the evolving nature of commercial real estate. Furthermore, the revitalization of retail spaces underscores a shift towards experiential shopping, which is increasingly appealing to consumers.

In conclusion, the insights presented here not only map the trajectory of the commercial real estate market but also emphasize the importance of adapting investment strategies to leverage these emerging trends. Investors are encouraged to consider these dynamics as they navigate the market landscape, ensuring they remain informed and strategically positioned for future opportunities.

Introduction

The commercial real estate landscape is poised for a significant evolution as it approaches 2025, influenced by emerging trends and shifting market dynamics. Investors and stakeholders can gain valuable insights into the anticipated resurgence of various sectors, including:

- Office

- Industrial

- Retail

spaces, alongside the implications of changing consumer behaviors and economic factors. However, with rising vacancy rates and the complexities introduced by remote work, how can industry players effectively navigate these challenges while seizing new opportunities? This pivotal moment calls for a strategic approach to investment, ensuring that stakeholders are well-prepared to adapt and thrive in a transforming market.

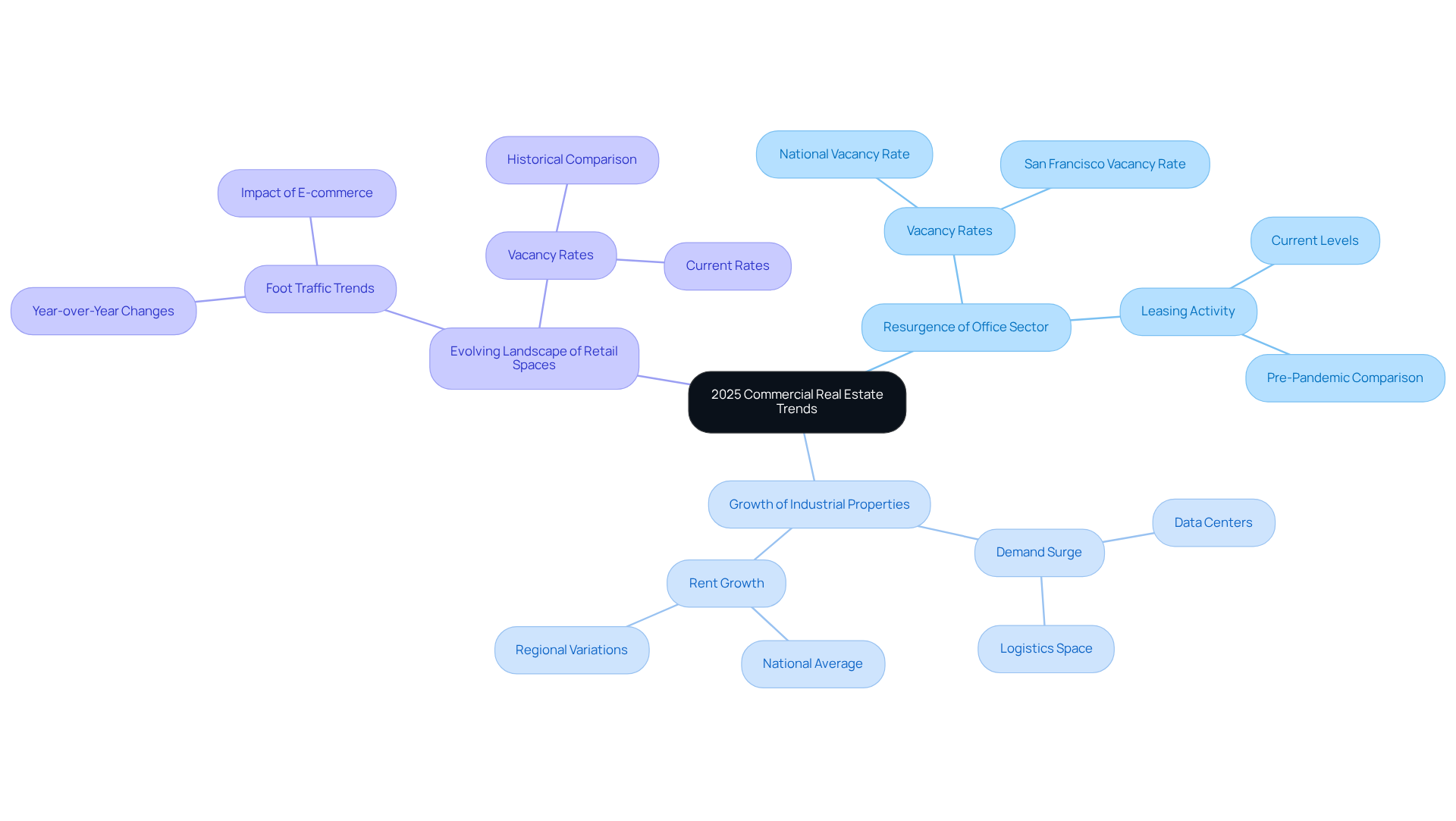

Zero Flux: Essential Insights on 2025 Commercial Real Estate Trends

Zero Flux delivers a daily collection of essential insights that empower property experts to navigate the complexities of the industry. Looking ahead, the newsletter underscores significant trends, including:

- The resurgence of the office sector

- The growth of industrial properties

- The evolving landscape of retail spaces

These trends are reflected in the commercial real estate market predictions. By meticulously filtering through over 100 sources, Zero Flux guarantees that its subscribers gain access to the most relevant information, enabling them to make informed decisions in a rapidly changing environment. This strategic approach not only highlights the importance of staying updated but also positions subscribers to capitalize on emerging opportunities.

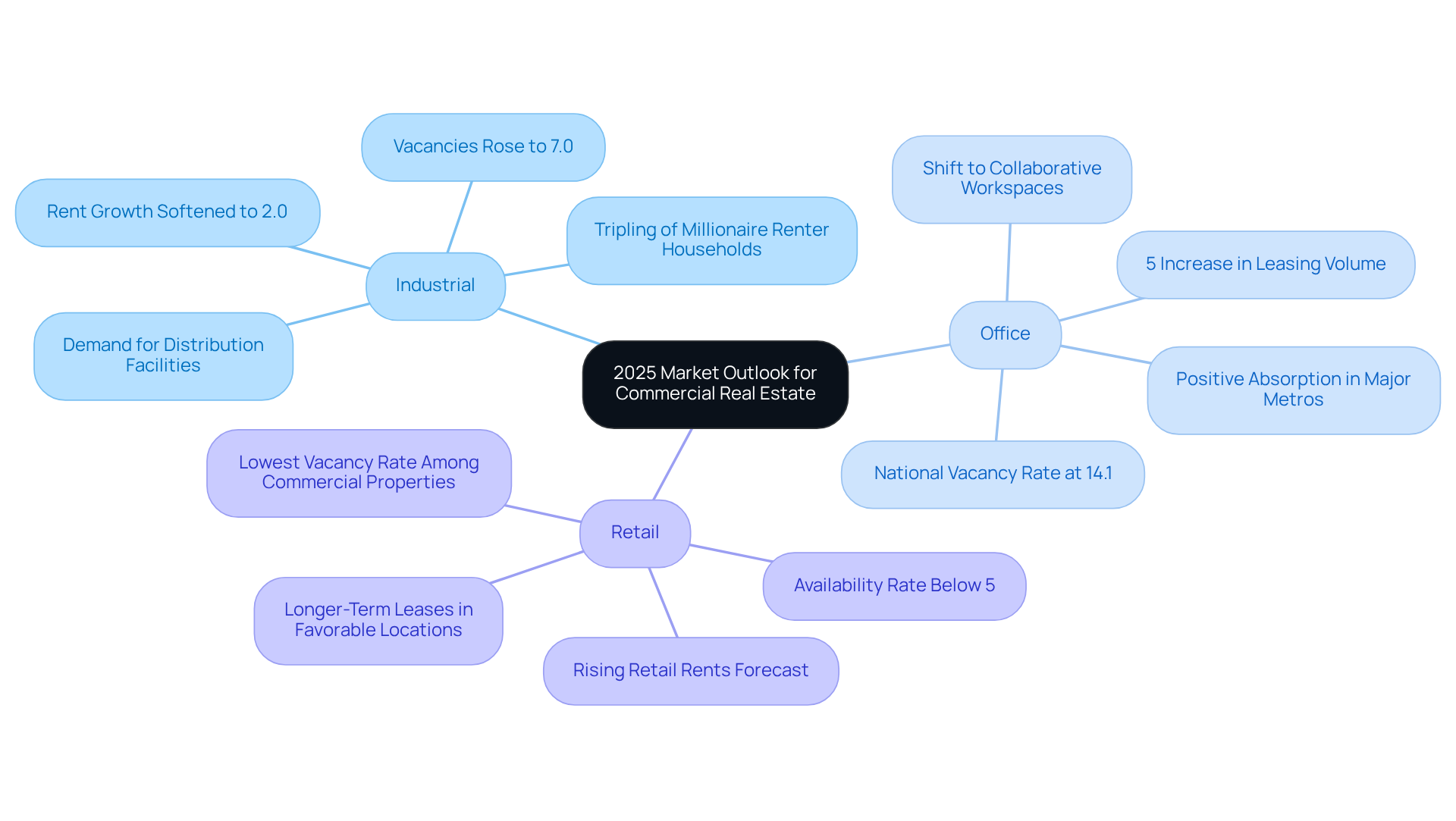

CBRE: 2025 Market Outlook for Commercial Real Estate

CBRE's 2025 outlook indicates a moderate recovery in commercial real estate, driven by economic growth and improving fundamentals. The industrial sector is set for continued success, as demand for distribution facilities near the U.S.-Mexico border is anticipated to rise due to evolving trade policies. Notably, the number of millionaire renter households has more than tripled since 2019, signaling a shift in rental dynamics that could significantly influence industrial growth.

The office sector is projected to stabilize as remote work trends evolve, with an expected 5% increase in overall leasing volume. This transition is evident in the changing design of workspaces, which are shifting from individual offices to collaborative areas that promote teamwork. Despite a national vacancy rate for office properties reaching 14.1%, major metropolitan areas like New York and Sacramento have demonstrated positive absorption, suggesting a potential rebound.

Retail spaces are also poised for a resurgence, particularly as consumer behavior shifts back towards in-person shopping. The national availability rate for retail space has fallen below 5% due to a lack of new construction, leading to forecasts of rising retail rents in the coming years. Retailers are likely to pursue longer-term leases in desirable locations, capitalizing on the tightening market.

Overall, the commercial real estate market predictions for the upcoming year highlight resilience and adaptation, with sectors such as industrial and retail at the forefront of recovery as economic conditions stabilize.

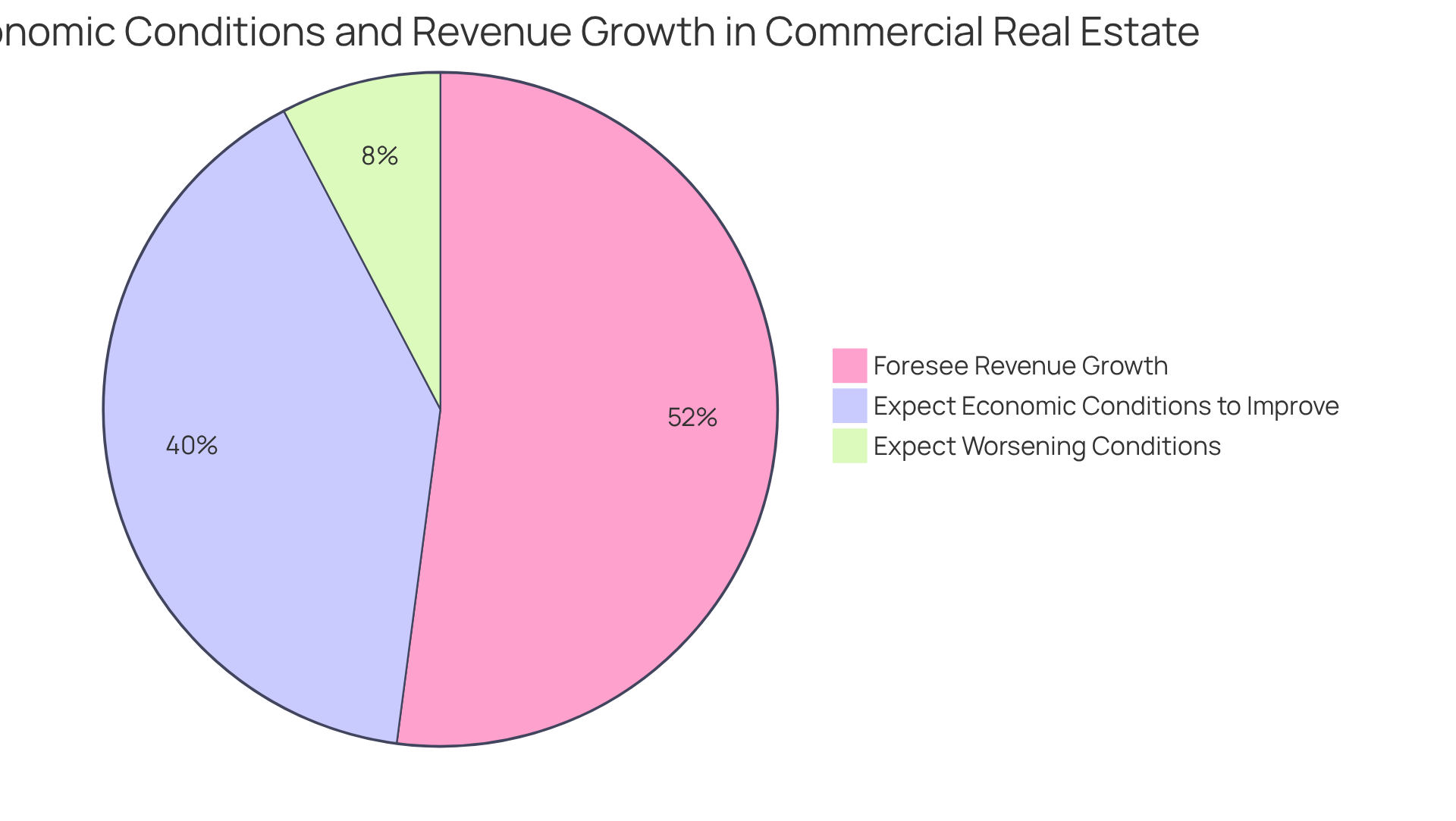

Deloitte: Key Factors Influencing the 2025 Commercial Real Estate Recovery

Deloitte highlights several critical elements poised to drive the recovery of commercial real estate in the coming year, particularly the stabilization of interest rates. With the Federal Reserve expected to implement two rate cuts, the first likely by June, this shift is anticipated to improve lending conditions, subsequently boosting property values and transaction volumes. Improved economic conditions are projected to foster a resurgence in investment activity, particularly in resilient sectors such as multifamily housing and logistics.

The report reveals that:

- 68% of participants expect economic conditions to improve in the upcoming year, a significant increase from 27% last year.

- 88% of respondents foresee revenue growth in 2025, compared to 60% who anticipated declines last year.

- Only 13% expect worsening conditions, down from 44% last year.

Stakeholders are encouraged to remain vigilant regarding evolving market trends and to adapt their strategies to capitalize on emerging opportunities.

Case studies illustrate the impact of interest rates on investment decisions, with many investors gravitating towards areas demonstrating stability and growth potential. For example, the multifamily sector has experienced increased leasing activity, indicating a shift in demand dynamics. As Jeffrey J. Smith, Deloitte’s National Real Estate leader, emphasizes, understanding the interplay between interest rates and market dynamics is essential for making informed investment decisions in the coming year. However, challenges such as limited debt availability and high operational costs persist as significant concerns for the industry. Overall, the stabilization of interest rates is expected to play a pivotal role in shaping the commercial real estate market predictions for the year ahead.

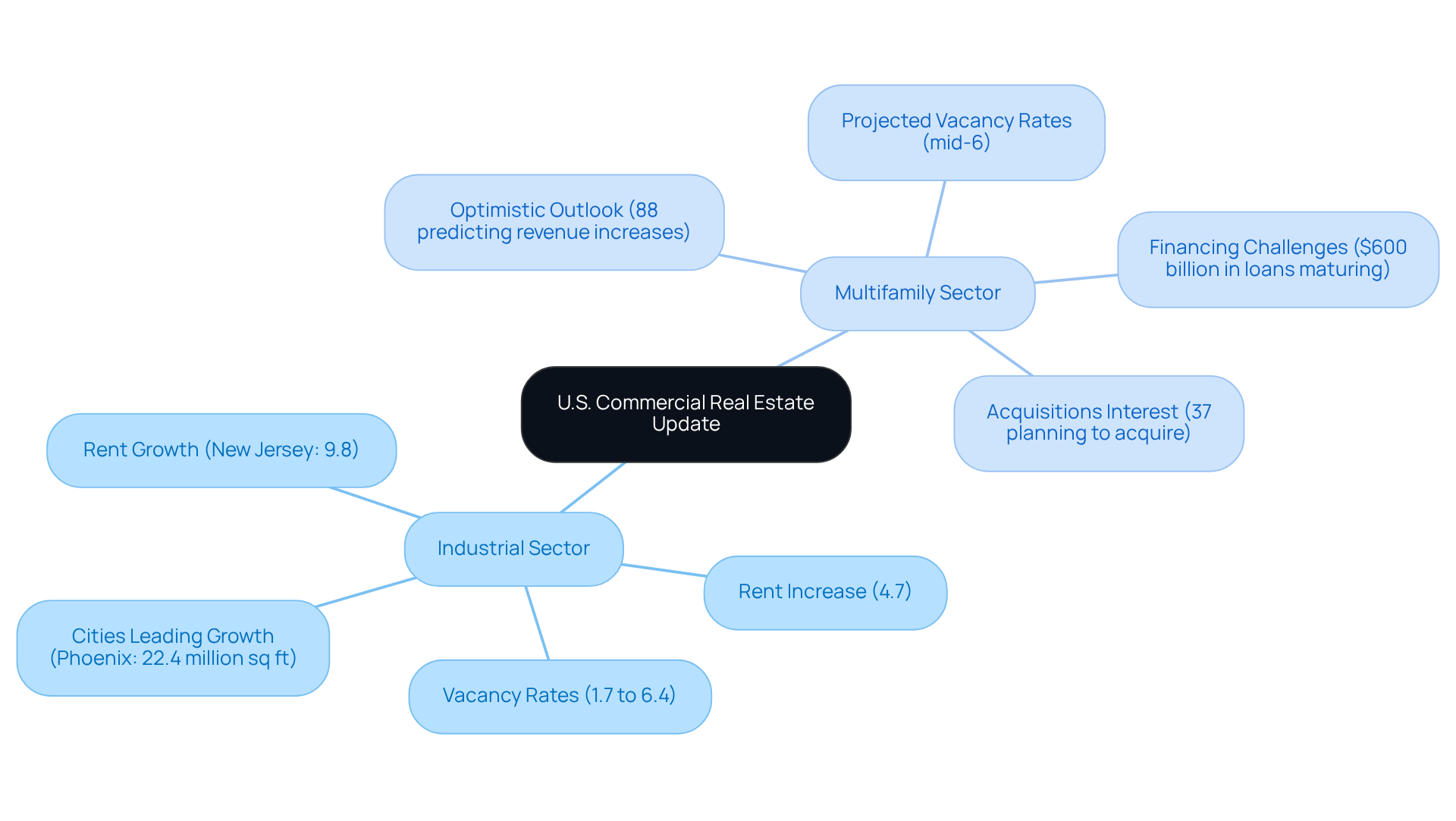

Cohen & Company: U.S. Commercial Real Estate Update and Forecasts

Cohen & Company's update highlights a complex landscape for U.S. commercial property, particularly underscoring the industrial and multifamily sectors as areas ripe for growth. The industrial sector anticipates a notable rent increase of 4.7%, despite rising vacancy rates from 1.7% to 6.4%. This growth is fueled by a surge in demand for logistics and e-commerce facilities, with national industrial in-place rents averaging $8.30 per square foot. Notably, cities like Phoenix are at the forefront, showcasing a robust development pipeline of 22.4 million square feet, while New Jersey leads in industrial rent growth at an impressive 9.8% year-over-year.

In the multifamily market, the outlook remains cautiously optimistic, as 88% of commercial real estate executives are making predictions about revenue increases in 2025. However, challenges loom as vacancy rates are projected to rise, potentially reaching the mid-6% range. The multifamily sector also grapples with significant financing hurdles, with $600 billion in loans maturing annually through 2028. Nevertheless, the sector continues to attract considerable interest, with 37% of respondents planning to acquire multifamily assets in the upcoming year.

Case studies further illustrate the potential for expansion in these domains. For example, the life sciences sector has recorded an average asking rent increase of 4.1%, while data centers have seen an 8.9% rise in demand. These trends indicate a shift towards specialized property types that align with evolving industry needs.

Industry experts note:

- "Multifamily has traditionally been a good investment over the last several years, and it will continue to be a good investment for the foreseeable future, especially as we see the younger generations move into the rental space."

This perspective reflects a broader confidence in the multifamily sector's resilience, even amidst economic uncertainties and anticipated increases in loan delinquency rates.

Ultimately, understanding local economic dynamics and adjusting investment strategies based on commercial real estate market predictions will be crucial for capitalizing on emerging opportunities within the industrial and multifamily sectors in 2025.

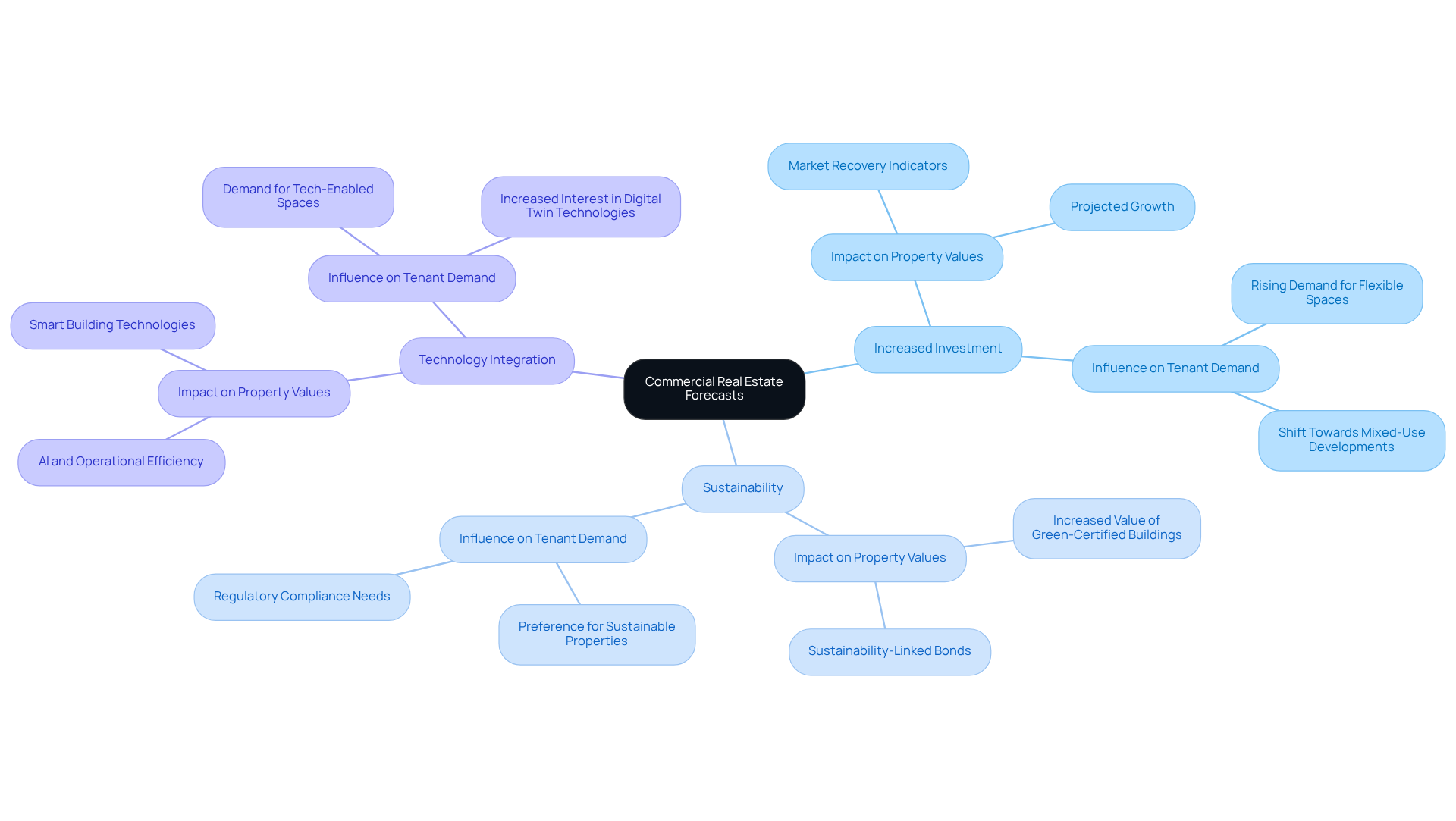

Investopedia: Comprehensive Overview of Commercial Real Estate Forecasts

Investopedia's summary of commercial real estate market predictions for the upcoming year reveals a positive trajectory for the sector, marked by expectations of increased investment and development activity. Notably, key trends highlight a growing emphasis on sustainability and the integration of technology in property management.

How will these trends shape the market? Investors are urged to consider these factors when evaluating potential acquisitions, as they are likely to significantly influence property values and tenant demand. Understanding these dynamics is essential for making informed investment decisions.

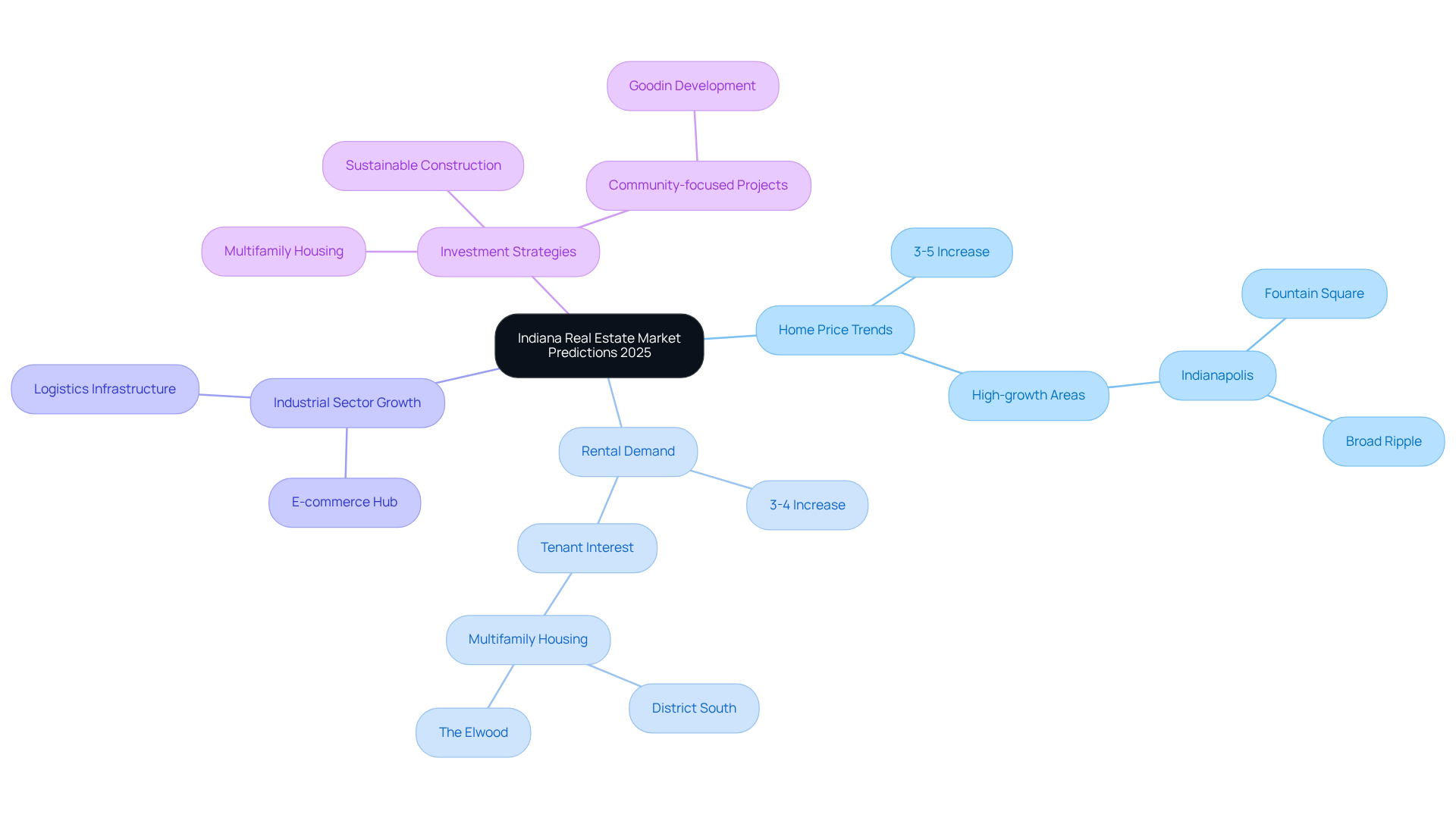

Lockstep Realty: 2025 Real Estate Market Predictions for Indiana

The Indiana commercial real estate market predictions suggest it is poised for significant expansion in the coming years, characterized by moderate home price increases and a surge in rental demand. According to commercial real estate market predictions, home prices are anticipated to rise by 3-5%, reflecting a healthy balance between demand and affordability. This trend is particularly pronounced in high-growth areas such as Indianapolis, where neighborhoods like Fountain Square and Broad Ripple are witnessing rapid gentrification and heightened interest from investors. Furthermore, rental prices are projected to increase by 3-4% in 2025, underscoring strong demand.

The industrial sector is also on track for success, supported by Indiana's robust logistics infrastructure, which positions the state as a pivotal hub for e-commerce. Investors are encouraged to explore mixed-use developments that address the evolving needs of businesses and residents alike, particularly those that provide flexible workspaces.

As the industry adapts to changing economic conditions, strategic investments in multifamily housing and sustainable construction practices will be crucial. Properties such as District South and The Elwood, which align with community needs and sustainability goals, are expected to draw considerable tenant interest, ensuring stable rental income and substantial returns. Goodin Development highlights that their community-focused projects positively impact neighborhood growth.

Overall, the landscape of Indiana's property sector offers a wealth of opportunities for investors who stay informed about commercial real estate market predictions, as well as economic dynamics and demographic shifts. With mortgage rates projected to remain around 6-7%, the financial environment for potential investments is shaping up favorably.

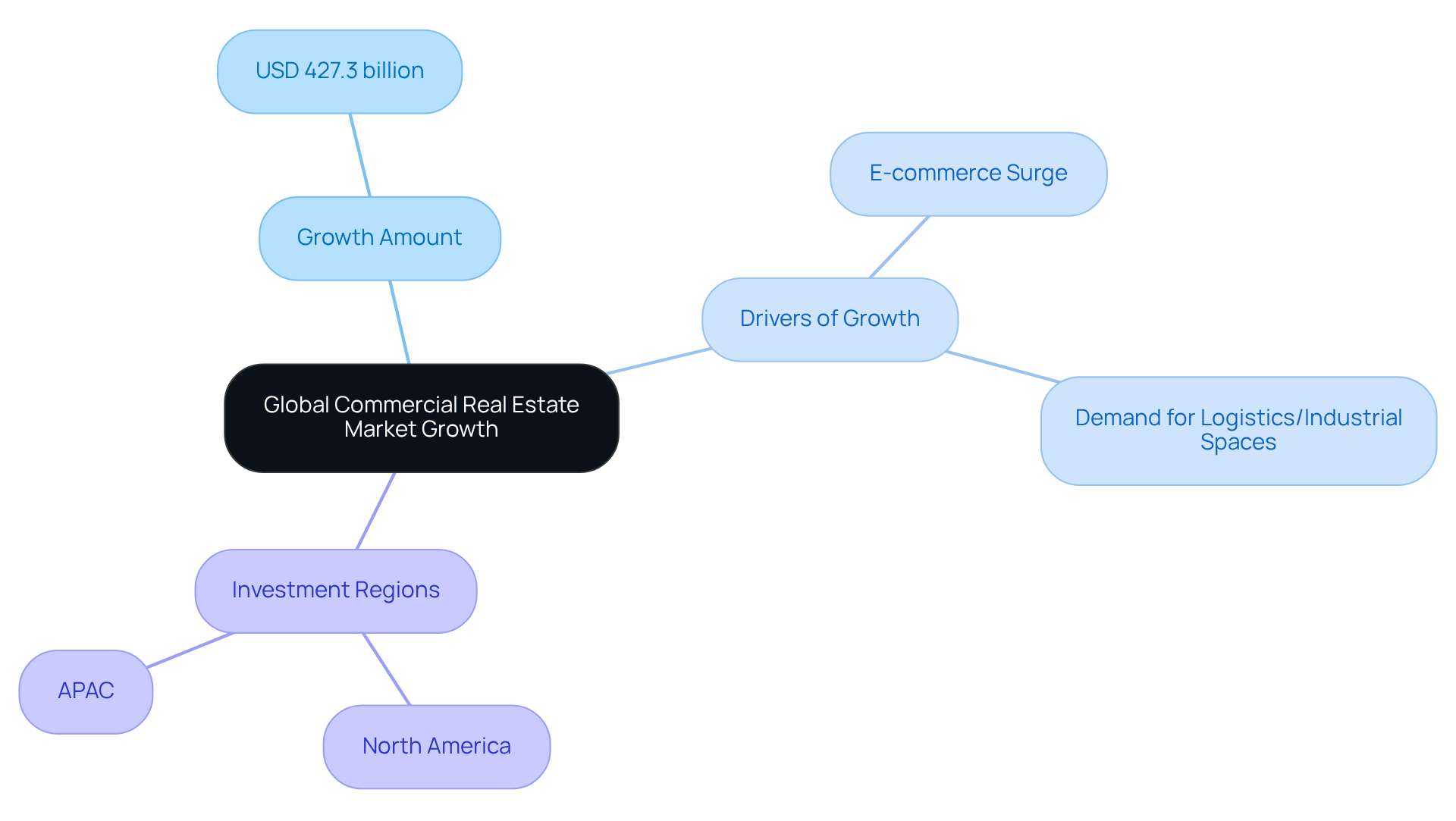

Technavio: Global Commercial Real Estate Market Analysis for 2025

Technavio's analysis predicts substantial growth in the global commercial property sector, forecasting an increase of USD 427.3 billion from 2026 to 2030. This expansion is primarily fueled by the surge in e-commerce, which significantly elevates the demand for logistics and industrial spaces. As businesses adapt to evolving consumer behaviors, the necessity for flexible and efficient logistics solutions becomes critical.

Investors are advised to focus on developing economies, particularly in regions such as North America and APAC, where the potential for growth remains robust, especially in sectors aligned with shifting economic dynamics.

Zero Flux's dedication to sourcing data from over 100 credible outlets ensures that these insights are firmly rooted in factual information, thereby enhancing their reliability for informed investment decisions.

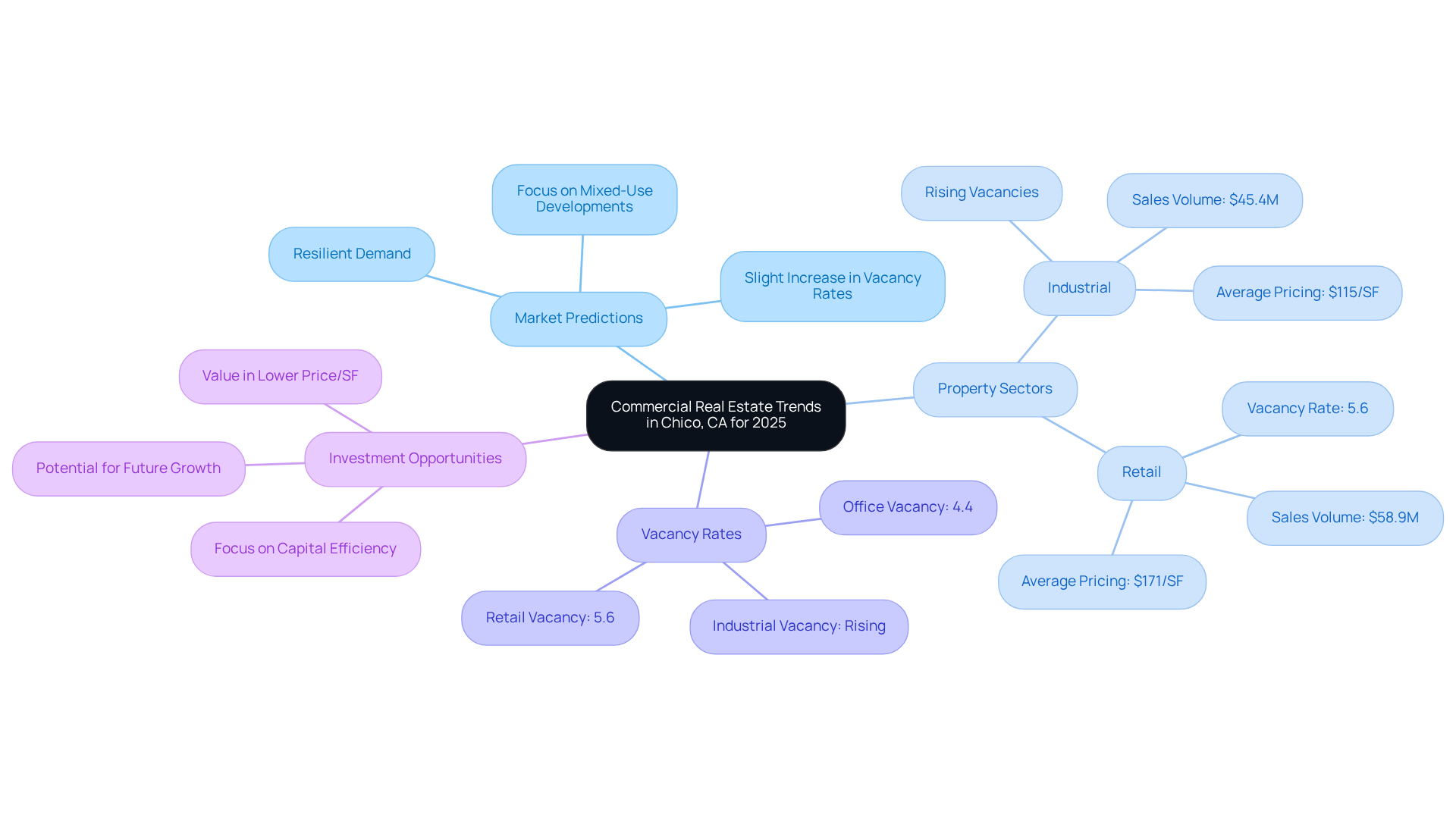

Capital Rivers: Commercial Real Estate Trends in Chico, CA for 2025

Capital Rivers has made commercial real estate market predictions indicating a robust commercial property landscape in Chico, CA, for the upcoming year, particularly focusing on industrial and retail sectors. While the report suggests a slight increase in vacancy rates, it emphasizes that demand for well-located properties will remain resilient.

Investors should explore opportunities in mixed-use developments that align with the evolving needs of the community. This strategic approach not only addresses current market conditions but also positions investors to capitalize on future growth potential.

Texas A&M: 2025 Texas Real Estate Forecast and Market Insights

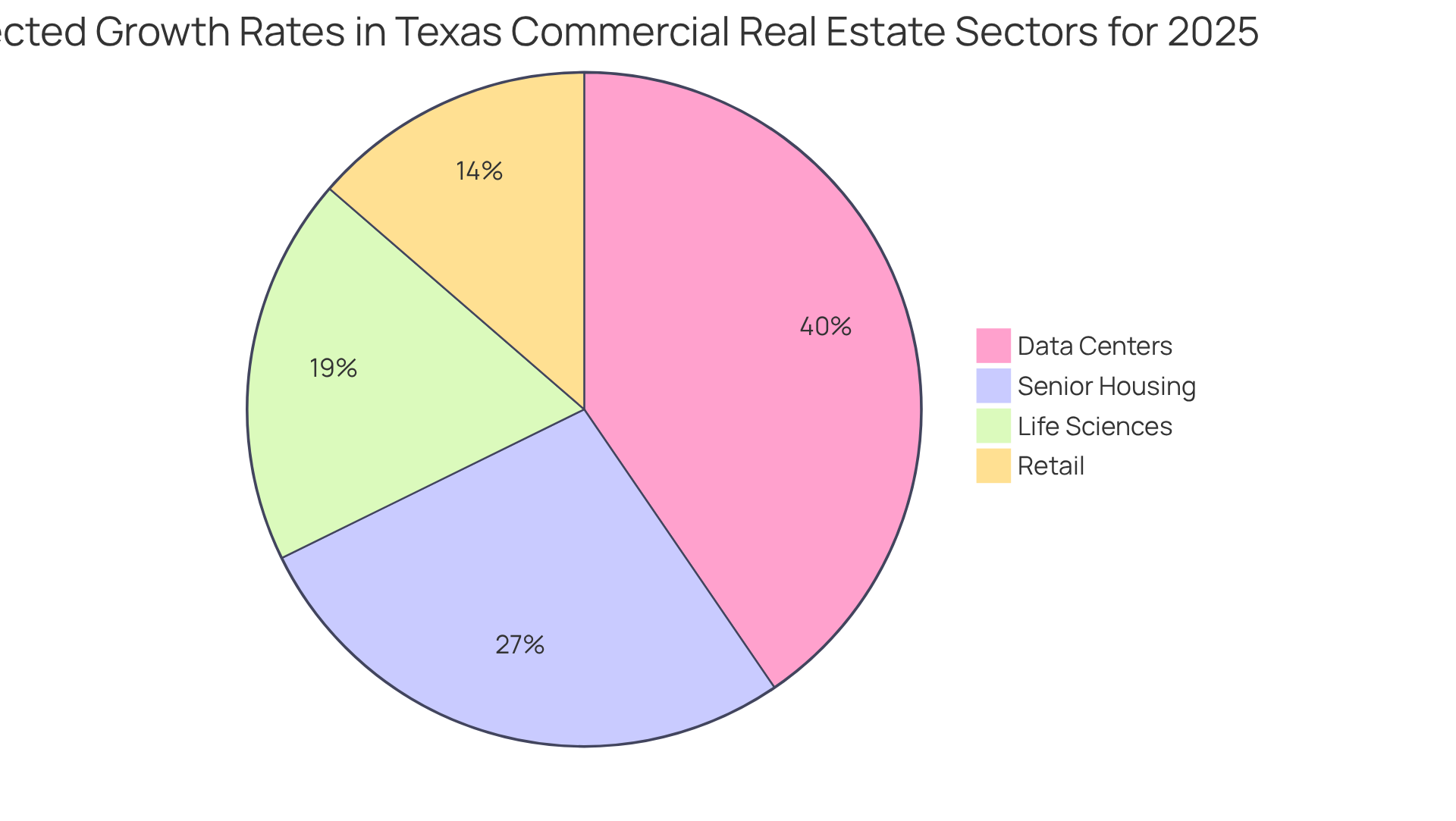

Texas A&M's 2025 commercial real estate market predictions present a promising outlook for the state's commercial real estate sector, with expectations of moderate rent growth across various segments.

- Retail rents are projected to increase by approximately 3% compared to 2024 rates, indicating a cautious yet favorable trend in the retail market, which encompasses 1.5 billion square feet of leasable space.

- However, net absorption has not kept pace with new deliveries, suggesting a careful approach to growth is necessary.

- In 2024, the Texas retail market averaged $22.70 in rent statewide, and while potential slowdowns are anticipated, positive trends are expected to continue.

- Furthermore, the senior housing sector has demonstrated resilience, with a significant 6% rent growth, reflecting the rising demand for specialized housing solutions.

Overall, the commercial real estate market predictions for Texas reflect a blend of challenges and opportunities, highlighted by an anticipated 7% decline in property values over the past year.

Yet, 88% of commercial property executives surveyed express optimism regarding revenue growth in the upcoming years, which highlights a disparity between current conditions and commercial real estate market predictions.

As the market adapts to evolving requirements, strategic investments in sectors such as life sciences and data centers—experiencing rent growth of 4.1% and 8.9% respectively—will be essential for navigating the complexities of the Texas commercial property landscape.

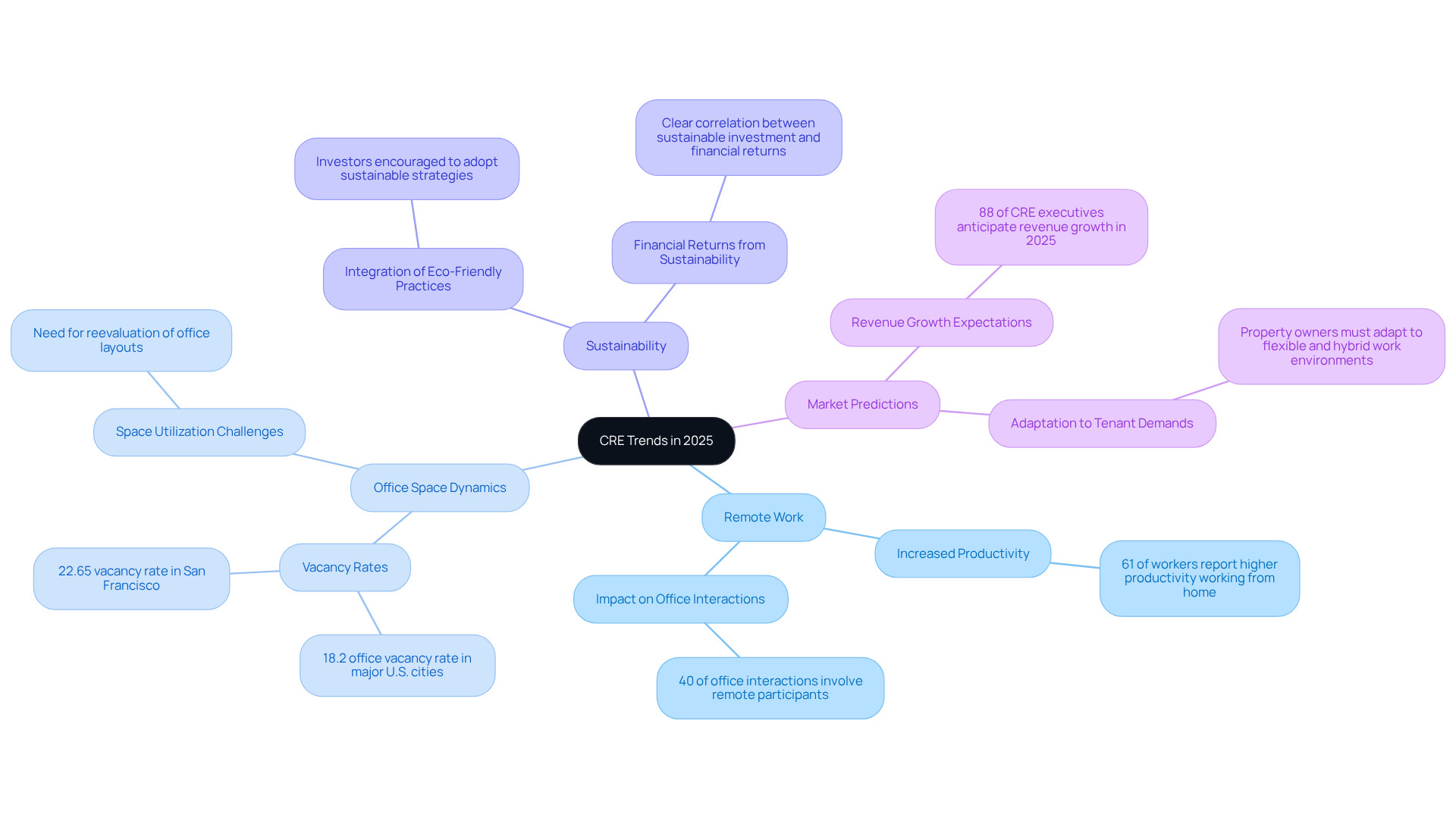

CRE Daily: Key Trends Shaping Commercial Real Estate in 2025

The commercial property landscape in 2025 is undergoing a significant transformation due to the rise of remote work, reshaping the demand for office space. A recent survey reveals that 61% of workers report increased productivity when working from home, signaling a shift in workplace dynamics that investors must heed. As remote work becomes more entrenched, 40% of office interactions now involve remote participants, complicating traditional office layouts and necessitating a reevaluation of space utilization.

Statistics indicate that office vacancy rates in major U.S. cities have surged to 18.2% in 2023, with San Francisco facing a staggering 22.65% vacancy rate. This trend underscores the urgent need for property owners to adapt their offerings to meet the evolving demands of tenants who prioritize flexibility and hybrid work environments. Furthermore, office space availability in the U.S. was recorded at 16.4% in Q2 2024, further emphasizing the necessity for strategic adjustments in office space utilization.

Case studies highlight both the challenges and opportunities presented by this shift. Companies are increasingly focused on creating hybrid workspaces that foster collaboration while accommodating remote employees. The commercial real estate market predictions indicate that the sector is urged to align its strategies with these evolving expectations, particularly as 44% of Gen Z respondents would reject an employer for a disconnect in values. This emphasizes the growing importance of workplace culture and flexibility.

As the market adapts, sustainability remains a critical focus. Investors are encouraged to integrate eco-friendly practices into their developments, as the correlation between sustainable investment and financial returns is becoming increasingly clear. Moreover, 88% of CRE executives anticipate revenue growth for their companies in 2025, offering a positive outlook amidst the challenges posed by remote work trends. Overall, the commercial real estate market predictions indicate that the sector must navigate these trends to remain competitive and responsive to the needs of a changing workforce.

Conclusion

The commercial real estate landscape for 2025 is poised for significant transformations, driven by evolving economic conditions and shifting consumer behaviors. Notably, sectors such as industrial, retail, and multifamily housing are set for growth, reflecting a resilient market that is adapting to new demands and opportunities.

Key insights reveal:

- A resurgence in the office sector as remote work trends evolve.

- Robust expansion in industrial properties fueled by increasing e-commerce activities.

- Retail spaces are also expected to rebound, driven by a return to in-person shopping and an overall tightening of market availability.

- The stabilization of interest rates is anticipated to enhance lending conditions, fostering a favorable environment for investment across various commercial real estate sectors.

In light of these predictions, stakeholders in the commercial real estate market must remain agile and informed. By understanding the intricacies of market dynamics and aligning investment strategies with emerging trends, investors can capitalize on the anticipated growth and navigate potential challenges effectively. The insights presented underscore the importance of adaptability and foresight in a rapidly evolving real estate landscape, making it imperative for industry professionals to stay ahead of the curve as they plan for the future.