Overview

This article identifies essential commercial real estate data sources that investors can leverage to make informed decisions. It highlights various reputable organizations and platforms, including:

- Zero Flux

- Deloitte

- PwC

These organizations provide critical insights and statistics on market trends, investment opportunities, and economic forecasts. By utilizing these resources, investors can effectively navigate the evolving landscape of real estate. The information presented not only supports strategic decision-making but also empowers investors to seize opportunities in a competitive market.

Introduction

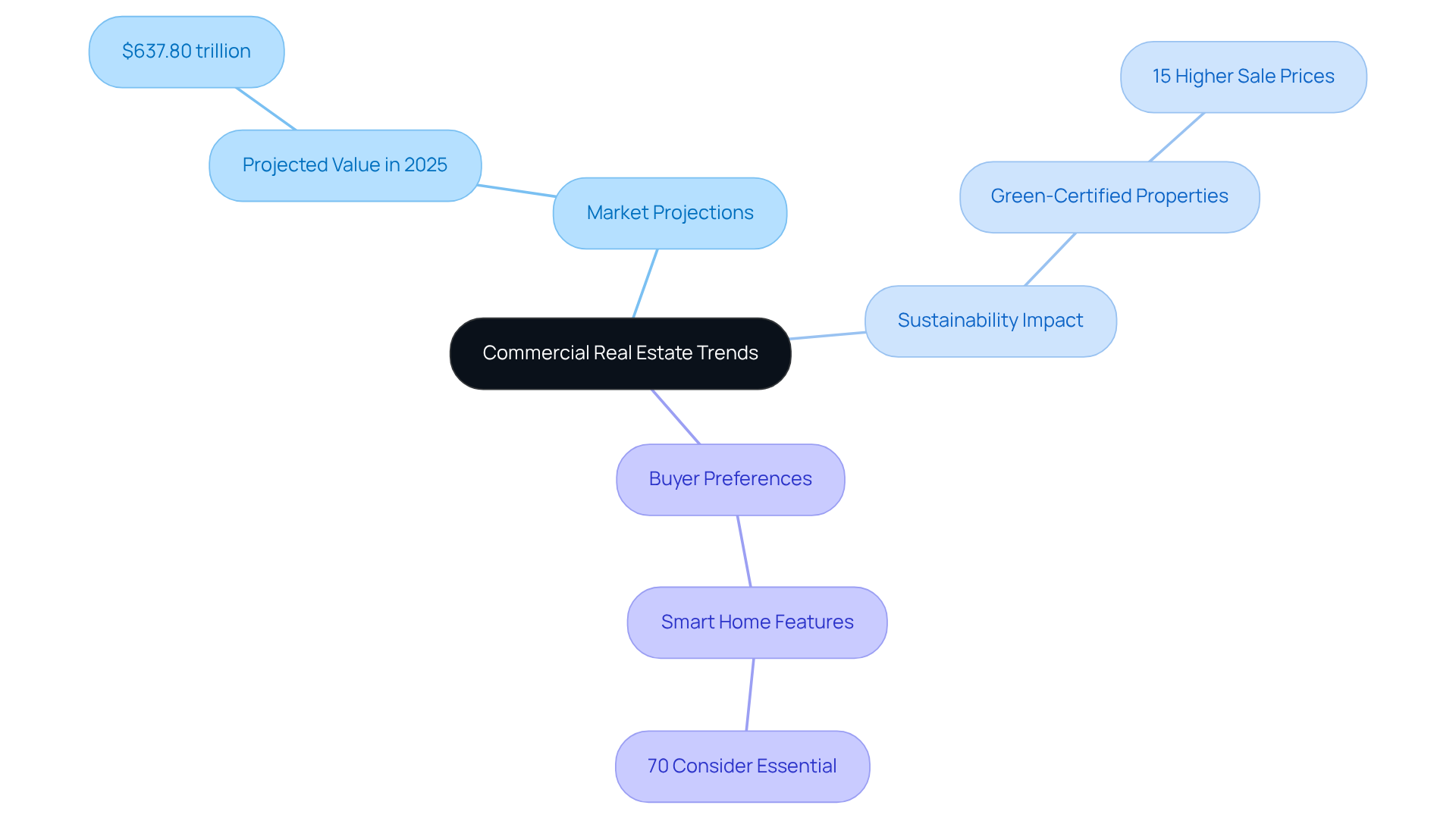

As the commercial real estate landscape undergoes rapid transformation, driven by technological advancements and shifting buyer preferences, investors encounter both exciting opportunities and formidable challenges. With the global real estate sector projected to reach an astounding $637.80 trillion by 2025, it has never been more crucial to stay informed through reliable data sources.

How can investors effectively navigate this evolving market and capitalize on emerging trends? This article unveils ten essential commercial real estate data sources that equip investors with the insights necessary to make informed decisions and thrive in a competitive environment.

Zero Flux: Daily Insights on Commercial Real Estate Trends

Zero Flux presents a compelling daily newsletter that highlights 5-12 carefully curated insights on commercial property trends. By aggregating information from commercial real estate data sources that exceed 100 reputable outlets, it provides essential information while filtering out subjective opinions. This unwavering commitment to accurate reporting empowers subscribers to make informed decisions based on the latest economic trends.

In 2025, the global real estate sector is projected to reach an astounding $637.80 trillion, with the commercial segment undergoing significant transformations, particularly in sustainability and technology integration. For example, properties boasting green certifications are anticipated to command a sale price that is 15% higher, reflecting the increasing buyer preference for eco-friendly options. Additionally, 70% of purchasers now consider smart home features essential, indicating a shift in demand trends.

As the landscape evolves, Zero Flux stands as an indispensable resource by leveraging commercial real estate data sources, ensuring that investors remain ahead of trends like these and make data-driven decisions in a competitive environment. To stay informed, consider subscribing to the Zero Flux newsletter, which has attracted over 30,000 subscribers who value its clarity and precision.

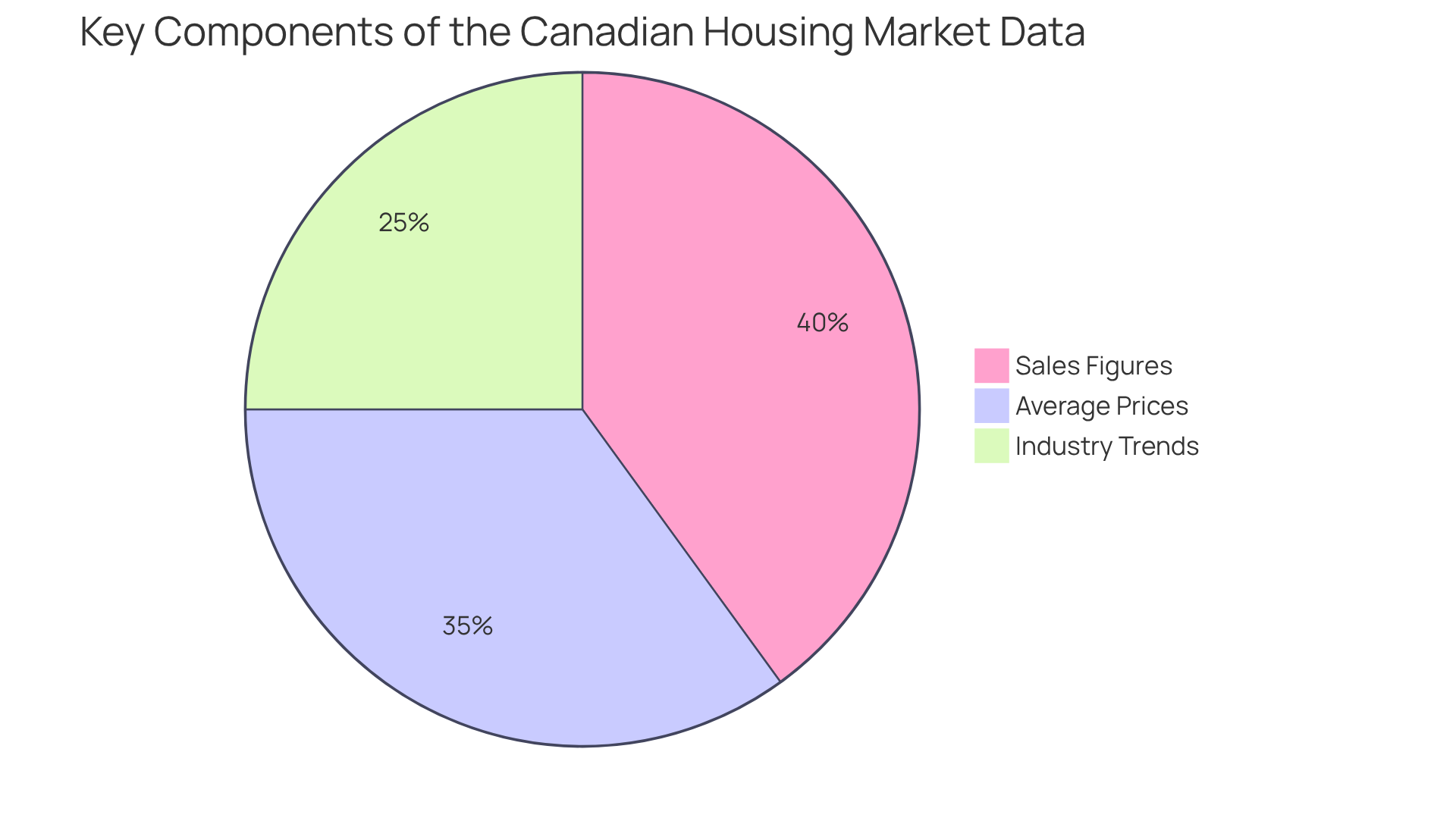

Canadian Real Estate Association: Comprehensive Housing Market Statistics

CREA offers a comprehensive array of data, encompassing sales figures, average prices, and industry trends throughout Canada. This wealth of information empowers investors to pinpoint emerging opportunities and evaluate market conditions effectively. With detailed reports, CREA plays a crucial role in guiding informed financial decisions within the Canadian property market. By leveraging these insights, investors can enhance their strategies and capitalize on favorable market dynamics.

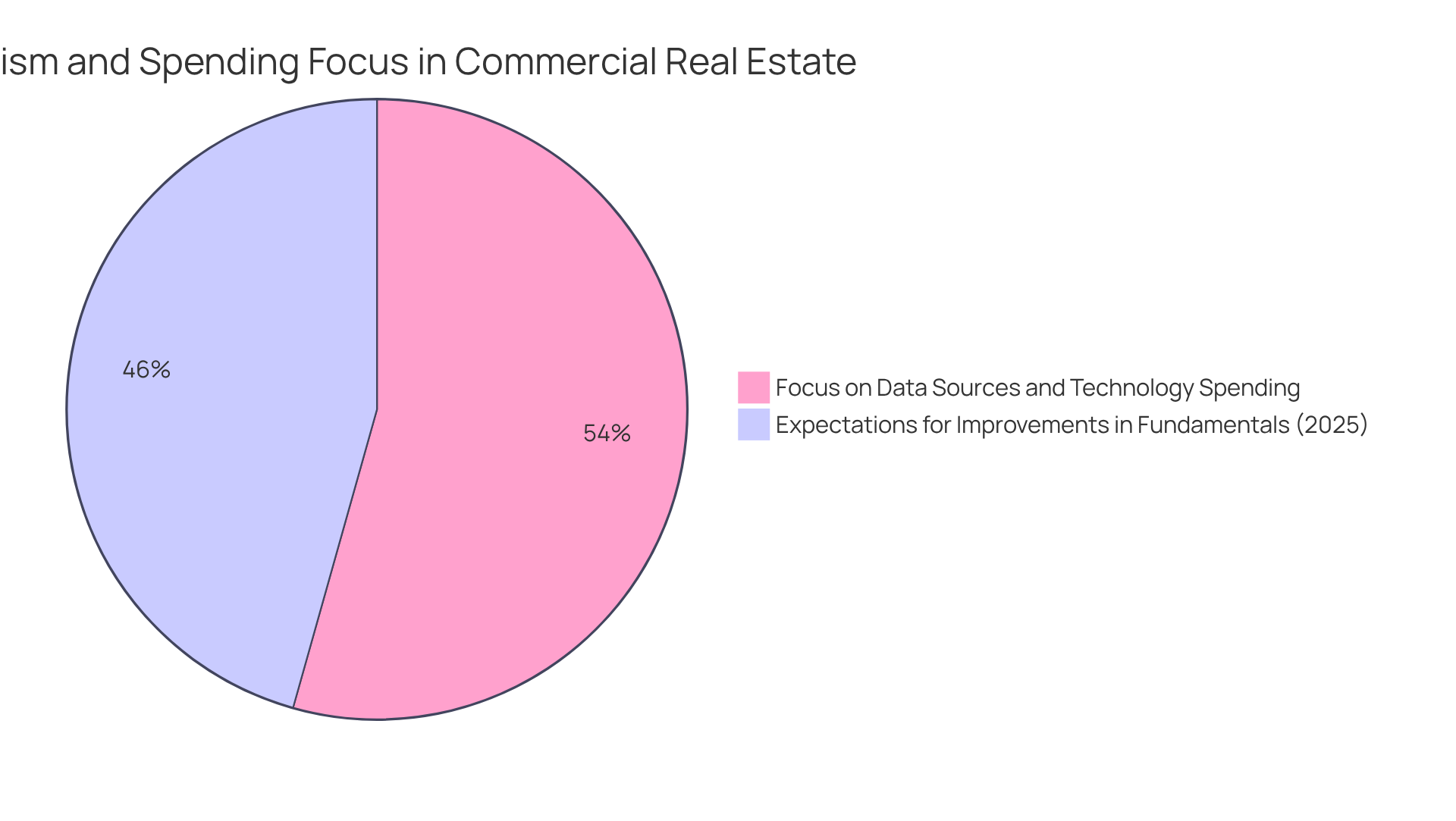

Deloitte: Commercial Real Estate Outlook and Market Guidance

Deloitte frequently releases detailed reports that scrutinize current trends and future forecasts using commercial real estate data sources. Their insights encompass crucial areas such as investment opportunities, financial risks, and economic factors that significantly influence real property dynamics. For instance, a notable 68% of participants in Deloitte's recent survey anticipate enhancements in commercial real estate fundamentals by 2025, reflecting a renewed optimism in the sector. Furthermore, 81% of survey participants identified commercial real estate data sources and technology as key areas for increased spending, underscoring the industry's recognition of the necessity for enhanced analytical capabilities.

Investors can leverage Deloitte's guidance to refine their strategies and make informed decisions. The reports emphasize the importance of adapting to changing economic circumstances, particularly highlighting a significant shift of institutional capital towards the Midwest as gateway locations cool off. This trend suggests that astute investors should explore opportunities in regions where economic fundamentals remain robust and pricing is stable. As illustrated in the case study 'Midwest Multifamily Heats Up as Investors Shift Focus Inland,' this shift signifies an increasing interest in the Midwest multifamily sector, implying potential opportunities for capital in the region.

Deloitte's analysts also caution about potential risks, noting that while 60% of respondents anticipate growth exceeding 5% year over year, challenges such as elevated interest rates and changes in tax policies could impact financial performance in the near term. By leveraging Deloitte's insights, investors can navigate these complexities and align their strategies with the latest industry developments. As one analyst aptly stated, "The connection between sustainable funding and financial returns is becoming clearer," highlighting the importance of strategic decision-making in the current environment.

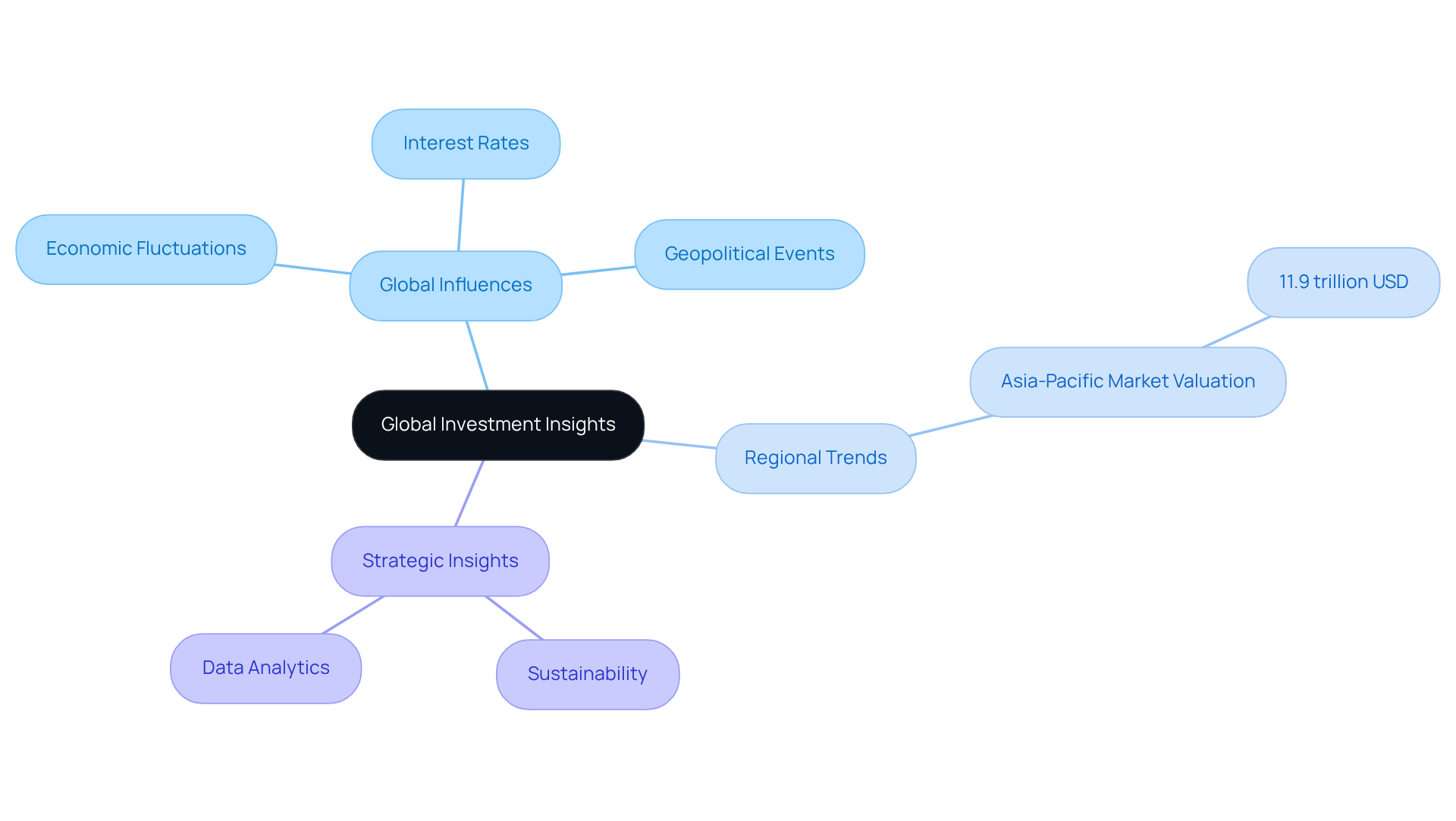

Cushman & Wakefield: Global Insights on Investment and Capital Markets

Cushman & Wakefield presents comprehensive reports that meticulously examine investment trends and capital conditions on a global scale. Their insights are indispensable for stakeholders, clarifying how broad global influences—such as economic fluctuations, interest rates, and geopolitical events—can significantly impact local real estate sectors.

For example, the commercial property sector in the Asia-Pacific region reached nearly 11.9 trillion USD in 2024, with the listed commercial property segment valued at 1.1 trillion USD, reflecting robust growth driven by regional dynamics. Furthermore, the increasing emphasis on sustainability in property markets is reshaping financial strategies, as stakeholders seek assets aligned with eco-friendly practices.

By leveraging these insights, including the integration of data analytics in property decisions, investors can make strategic choices that align with both local conditions and global trends, ensuring a holistic approach to their portfolios. This comprehensive understanding is crucial, especially as global financial systems continue to evolve, presenting both opportunities and challenges for local property ventures in July 2025.

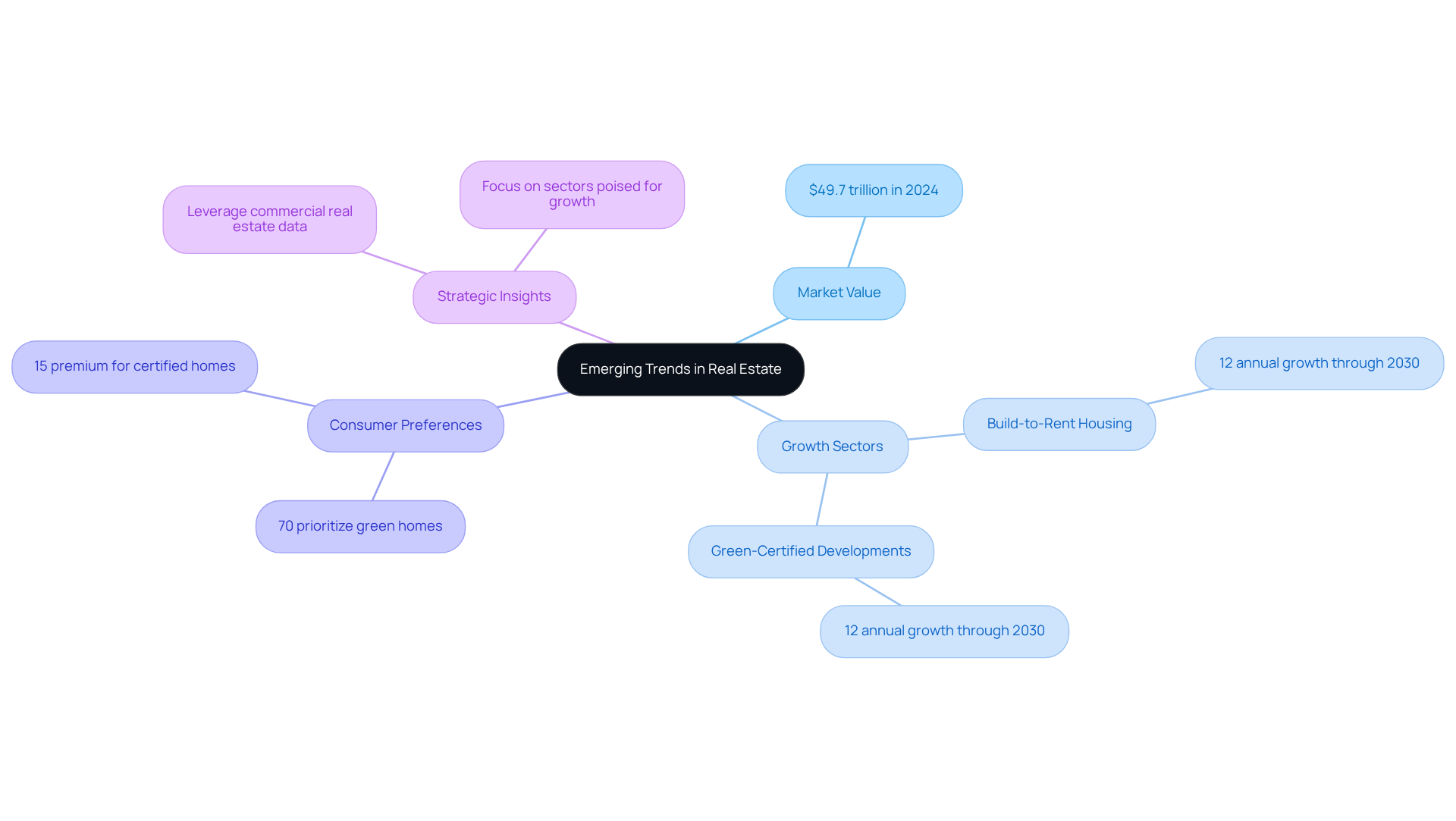

PwC: Emerging Trends and Profitability Prospects in Real Estate

PwC's extensive study on emerging trends in the real estate sector provides invaluable insights into profitability and opportunities for capital allocation. Their reports underscore essential elements influencing returns, including economic dynamics, demographic shifts, and evolving consumer preferences. Notably, the overall value of the U.S. real estate sector reached an impressive $49.7 trillion in 2024, marking a significant increase from previous years and highlighting the potential for lucrative investments.

In July 2025, PwC's analysis indicates that stakeholders should focus on sectors poised for growth, such as build-to-rent housing and green-certified developments, anticipated to expand by approximately 12% annually through 2030. This trend aligns with the rising demand for sustainable living options, as over 70% of buyers now prioritize green-certified homes, which typically command a 15% premium over their non-certified counterparts.

Furthermore, PwC analysts stress the necessity of leveraging insights from commercial real estate data sources to uncover opportunities. As articulated, "Each of these numbers is a window into the economy’s soul—revealing where the opportunities, risks, and surprises reside in 2025." This perspective encourages financiers to adopt a strategic approach, utilizing profitability reports to navigate the complexities of the industry with precision.

In summary, PwC's findings serve as a crucial resource for stakeholders aiming to capitalize on emerging trends and enhance their portfolios in the evolving property market.

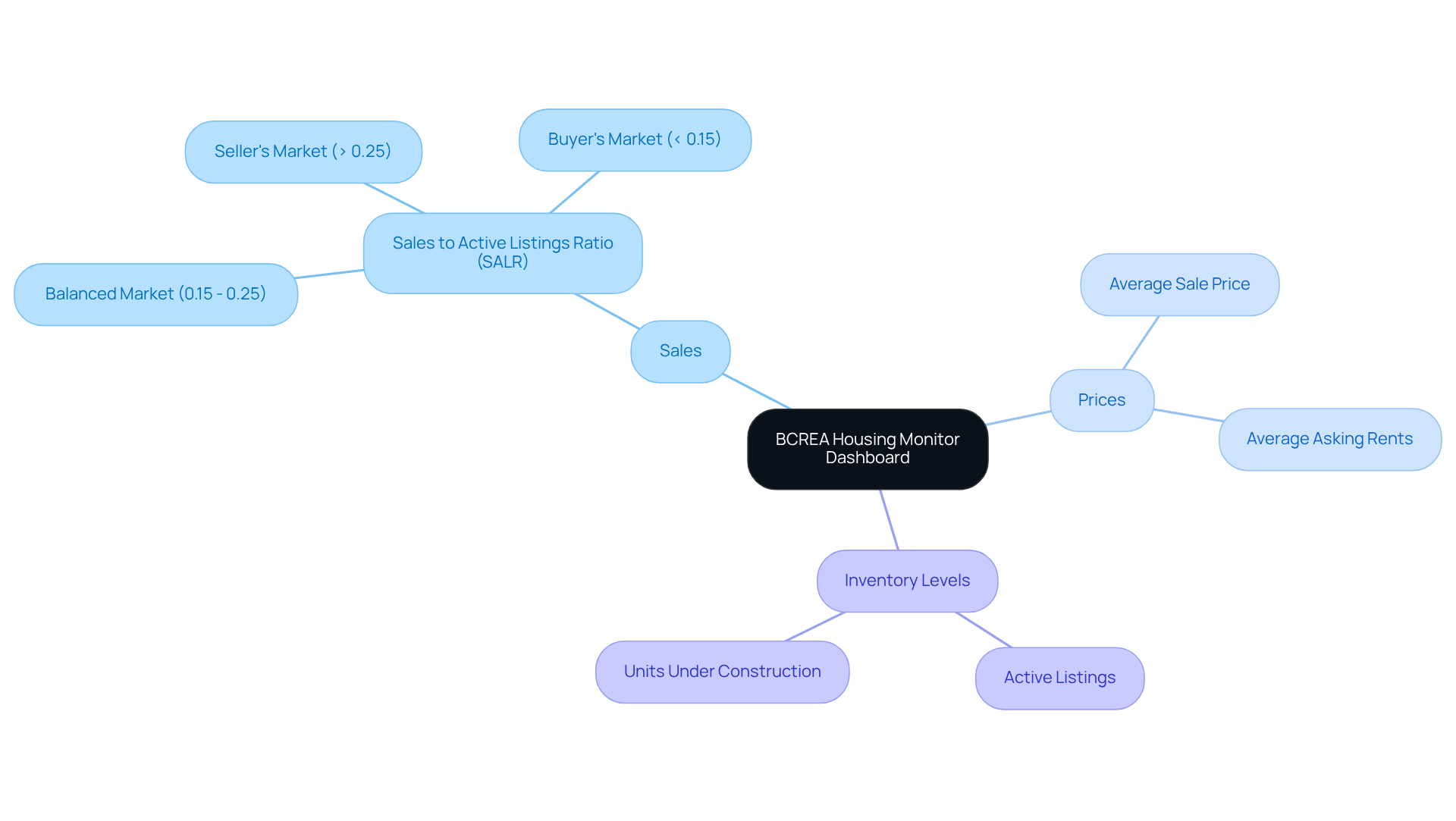

BCREA: Housing Monitor Dashboard for Market Analysis

BCREA's housing monitor dashboard serves as an indispensable resource for those seeking a comprehensive understanding of the British Columbia real estate landscape. This dynamic platform delivers real-time information on critical metrics such as sales, prices, and inventory levels, empowering investors to make informed decisions based on the latest market conditions. Notably, the Sales to Active Listings Ratio (SALR), indicating a balanced environment between 0.15 and 0.25, enables users to effectively gauge market tightness.

Industry professionals underscore the significance of utilizing dashboards powered by commercial real estate data sources, highlighting that they enhance decision-making by presenting clear, actionable insights. As the industry evolves, access to commercial real estate data sources becomes crucial for navigating financial opportunities and understanding emerging trends.

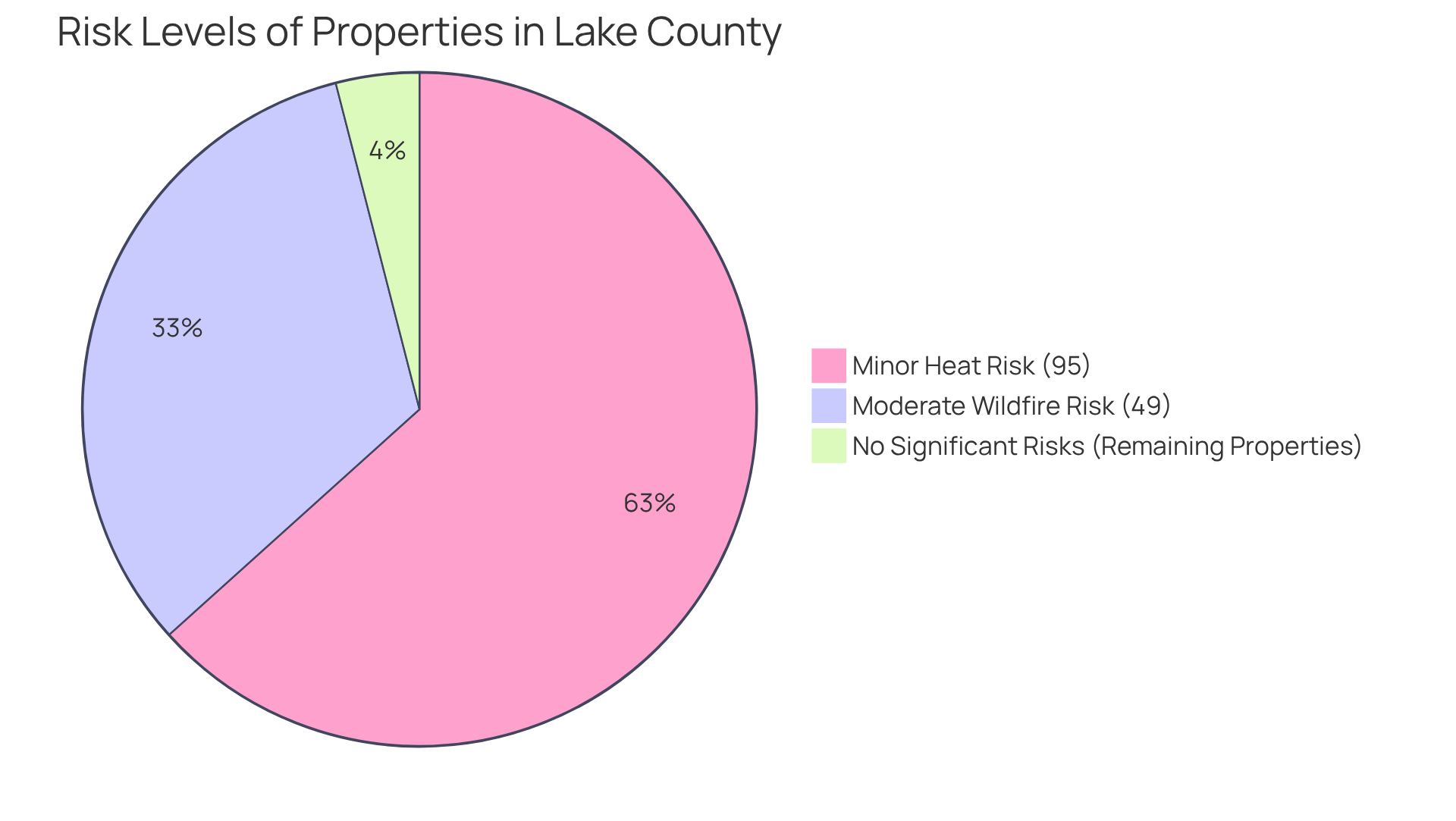

Lake Country Real Estate Data: Localized Market Insights

Lake County's commercial real estate data sources provide essential localized insights into market trends, property values, and demographic shifts—critical for investors looking to refine their strategies. As of July 2025, the median sale price of homes in Lake County reached $420,000, marking a 7.4% increase from the previous year. Additionally, the median sale price per square foot rose to $216, up 3.8%. These figures underscore the region's growing attractiveness and potential for investment.

Understanding the dynamics of Lake County is imperative for tailoring effective investment strategies. Notably:

- 95% of properties face minor heat risks over the next 30 years due to rising 'feels like' temperatures.

- 49% are at moderate wildfire risk, totaling 124,293 properties.

Stakeholders must factor in these environmental considerations when evaluating property values. Furthermore, an aging population is anticipated to drive demand for retirement homes, whereas urbanization trends are likely to heighten interest in both residential and commercial properties in urban areas.

Analysts underscore the importance of demographic shifts on property values, emphasizing that adapting to these changes is vital for sustained growth. As Jessica Lautz, Deputy Chief Economist at the National Association of Realtors, points out, the environment is becoming increasingly favorable, signaling optimism for those looking to capitalize on emerging opportunities. Moreover, home price growth is projected to decelerate to 2.7% in 2025. By leveraging commercial real estate data sources, investors can make informed decisions that align with current market conditions, ultimately enhancing their investment outcomes.

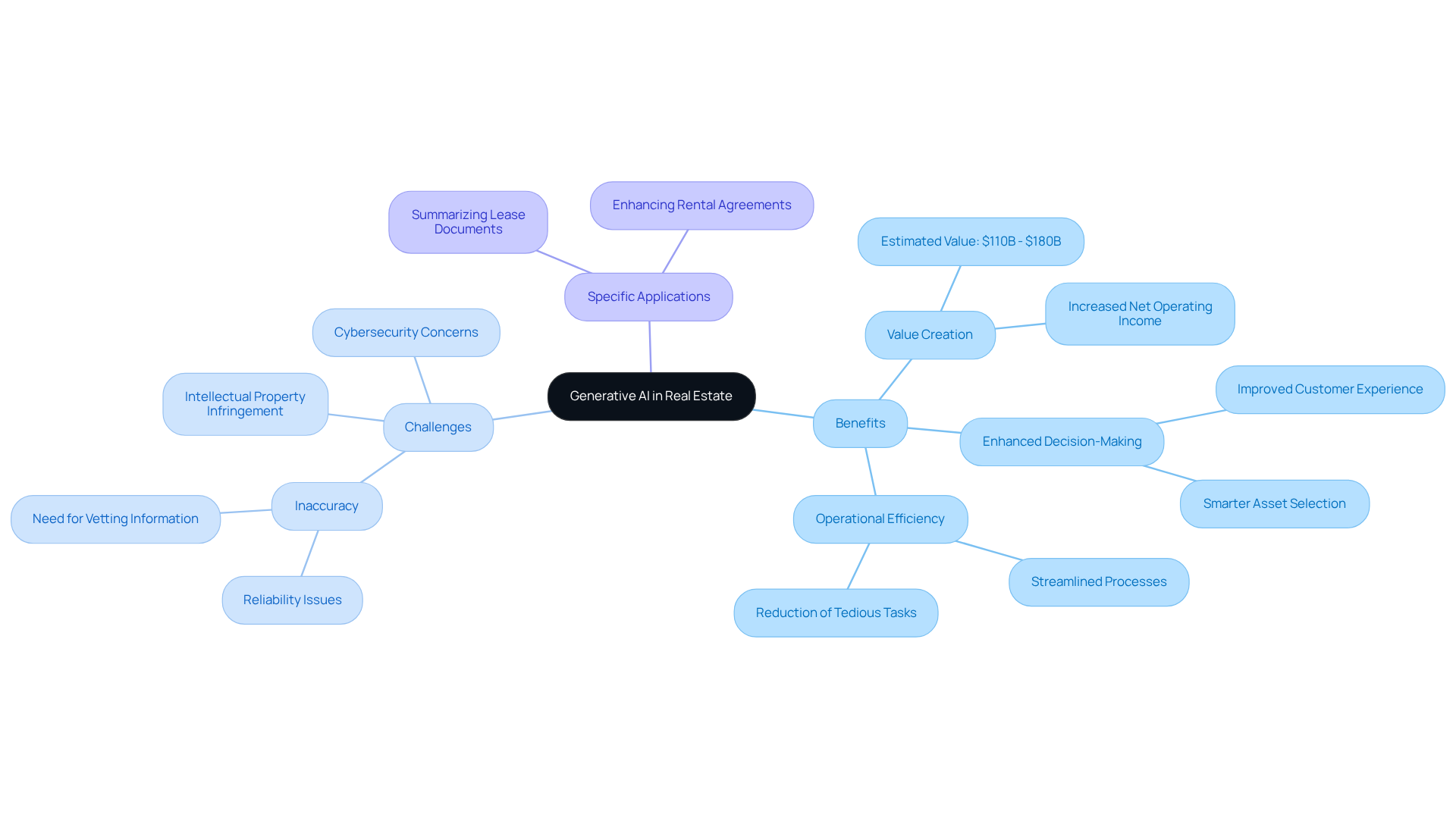

McKinsey: Generative AI Innovations in Real Estate

McKinsey's analysis highlights the transformative impact of generative AI in the real estate sector, showcasing innovations that significantly enhance decision-making and operational efficiency. By leveraging these insights, individuals can adeptly navigate the evolving technological landscape and refine their strategies to seize emerging opportunities. The potential for generative AI to generate between $110 billion and $180 billion in value for the industry underscores its ability to reshape investment approaches, elevate customer experiences, and streamline operations.

However, challenges such as inaccuracy, intellectual property infringement, and cybersecurity concerns must be meticulously addressed. Furthermore, specific applications of generative AI, including:

- Summarizing lease documents

- Enhancing rental agreements

illustrate its practical benefits for stakeholders. As the industry adapts to these advancements, understanding the effects of AI on decision-making becomes crucial for individuals aiming to maintain a competitive edge.

National Association of Realtors: Key Resources and Market Statistics

The National Association of Realtors (NAR) offers a wealth of resources tailored for real estate professionals and stakeholders. These include comprehensive industry statistics, in-depth research reports, and instructional materials. Such resources are vital for understanding current economic conditions and trends, empowering investors to make informed decisions.

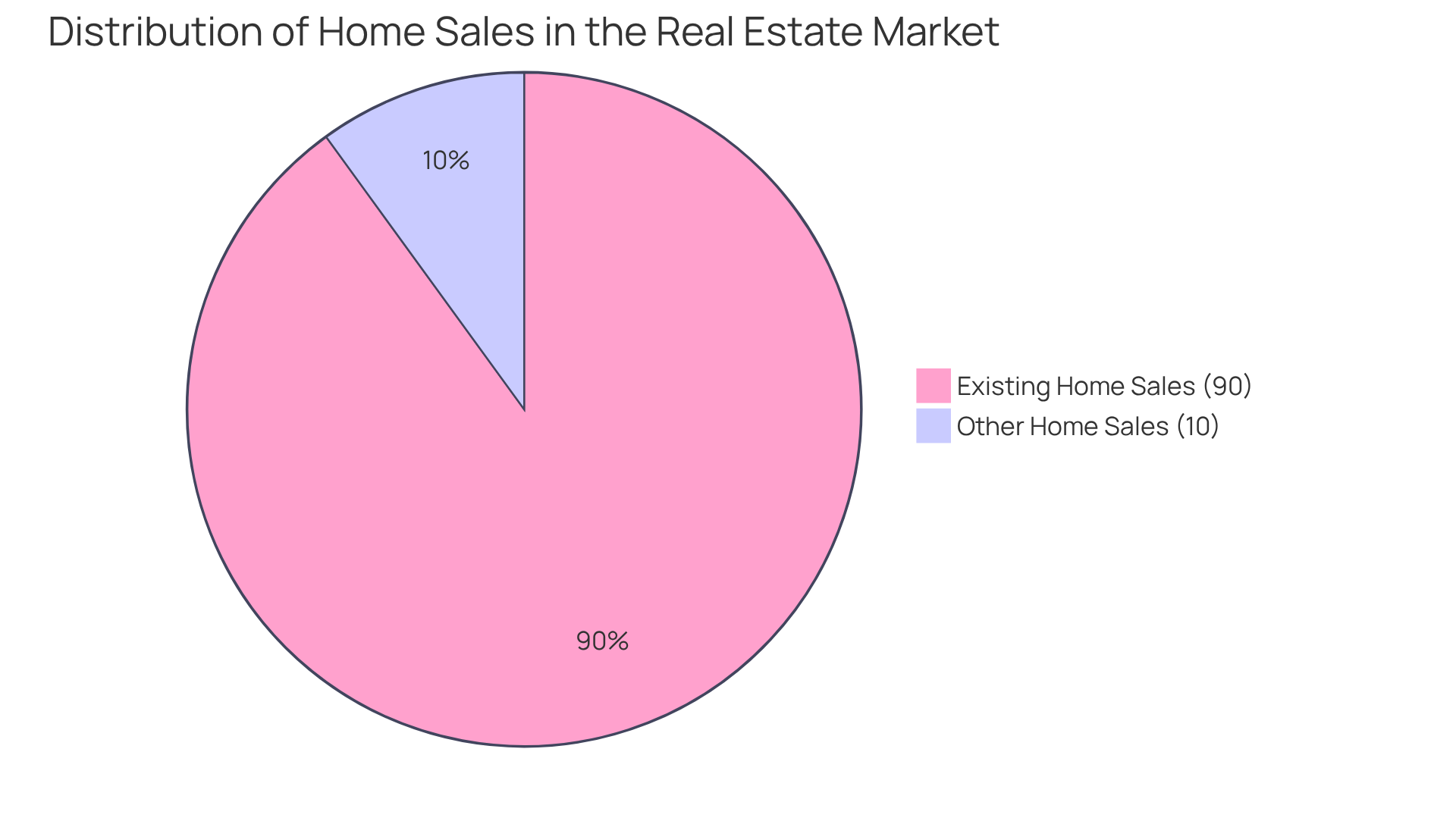

For example, the latest NAR statistics reveal that existing home sales have declined to an annual rate of 4.02 million transactions, which accounts for 90% of all home sales. This decline underscores a challenging environment influenced by rising mortgage rates, currently averaging 6.86%. Moreover, the median sales price for existing homes has reached $403,700, reflecting a 2.7% increase from the previous year, despite fewer transactions—an indication of sustained demand in the sector.

NAR analysts emphasize the importance of these research documents for stakeholders, asserting, 'Grasping economic dynamics through thorough commercial real estate data sources is essential for making informed investment choices.' By leveraging commercial real estate data sources from NAR, investors can enhance their understanding of the real estate landscape, equipping themselves to adeptly navigate the complexities of the industry.

Additionally, the inventory of unsold existing homes has surged by 8.1% from last month, providing further context for understanding economic dynamics. As the industry continues to evolve, remaining informed through commercial real estate data sources, including NAR's extensive offerings, will be crucial for successful investment strategies.

Zillow: Property Value Insights and Market Trends

Zillow serves as an essential resource for individuals seeking insights into property values and commercial real estate data sources. Its platform provides access to a wealth of data, including current property listings, historical price fluctuations, and detailed neighborhood trends. As of mid-2025, the typical home value is approximately $368,000, with projections suggesting a modest decline of about 1.4% over the year. This information is crucial for investors navigating the complexities of the financial landscape.

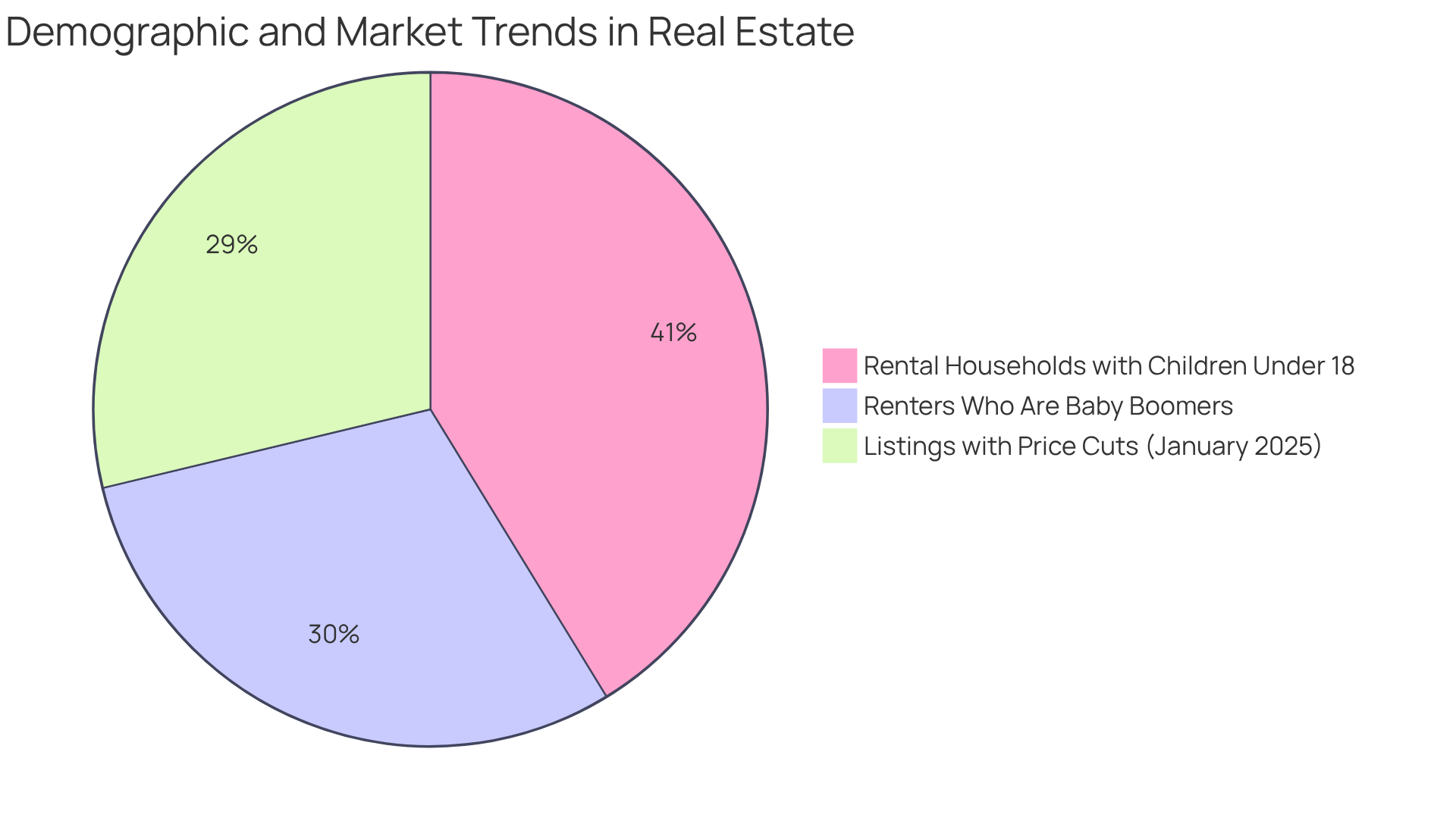

Real estate analysts highlight the significance of commercial real estate data sources, emphasizing that understanding past trends can profoundly influence investment strategies. For example, Zillow's comprehensive analysis reveals that 23% of listings experienced price cuts in January 2025, marking the highest rate for that month since 2018. Such insights empower individuals to identify potential purchasing opportunities and adjust their strategies accordingly.

Current market trends indicate a shift toward balance, with inventory levels rising to about 1.24 million homes, still 26% below pre-2019 norms. This increase in available properties, combined with a cooling rental growth rate of approximately 3-4% annually, suggests a more favorable environment for investors aiming to acquire rental properties.

Moreover, Zillow's neighborhood trend insights provide valuable context as commercial real estate data sources for investment decisions. Demographic changes reveal that:

- One-third of rental households have children under 18

- 24% of renters are Baby Boomers

Understanding local dynamics is essential for investors. They can leverage this information to target areas with growing demand, ensuring their strategies align with evolving market conditions.

Conclusion

Staying informed about the commercial real estate landscape is crucial for investors aiming to successfully navigate its complexities. This article highlights ten essential data sources that provide valuable insights into market trends, investment opportunities, and economic factors influencing real estate dynamics. By leveraging these resources, investors can make informed decisions that align with current market conditions and future projections.

Key insights from sources such as Zero Flux, Deloitte, and PwC reveal the significance of sustainability, technology integration, and demographic shifts in shaping investment strategies. Understanding localized market trends in Lake Country, alongside global insights from Cushman & Wakefield, empowers investors to identify emerging opportunities and potential risks. As the market continues to evolve, access to reliable commercial real estate data becomes increasingly critical.

Ultimately, investors are encouraged to actively engage with these data sources to refine their strategies and capitalize on favorable market dynamics. By doing so, they position themselves for success in an increasingly competitive environment, ensuring they remain at the forefront of the commercial real estate sector as it adapts to new challenges and opportunities in 2025 and beyond.