Overview

The article titled "10 Essential Commercial Real Estate Publications for Investors" serves to identify key resources that investors can utilize to enhance their understanding and decision-making in the commercial real estate sector. It highlights various publications, including:

- Zero Flux

- Aspen Institute

- Journal of Real Estate Research

These publications provide valuable insights, market trends, and strategies crucial for effectively navigating the complexities of real estate investments. By leveraging these resources, investors can significantly improve their investment strategies and outcomes.

Introduction

In the dynamic realm of commercial real estate, staying informed is not merely advantageous—it is essential for success. Investors are perpetually in search of reliable sources that offer timely insights and strategic guidance to adeptly navigate the complexities of the market. This article delves into ten indispensable publications that empower investors with the knowledge necessary for making informed decisions, ranging from daily market trends to comprehensive case studies on inclusively owned properties. Yet, in a landscape flooded with information, how can one discern which resources genuinely deliver the most value?

Zero Flux: Daily Insights on Real Estate Market Trends

Zero Flux delivers a daily newsletter that features 5-12 handpicked insights from over 100 sources, including insights from commercial real estate publications and those behind paywalls. This meticulous selection process guarantees that subscribers receive a comprehensive overview of the latest advancements in the property sector, as presented in commercial real estate publications, focusing on data-driven insights devoid of personal opinions. With a growing subscriber count exceeding 30,000, Zero Flux has established itself as an essential resource for property professionals and financiers by offering insights that are often highlighted in commercial real estate publications, aiding them in navigating the complexities of the industry efficiently.

In a landscape where 97% of homebuyers utilize the internet for property searches, the newsletter's commitment to delivering factual information is crucial for informed decision-making. Moreover, as the global property sector is projected to reach $637.80 trillion by 2024, the insights provided in commercial real estate publications by Zero Flux become increasingly vital for investors aiming to capitalize on emerging trends. As one industry expert noted, 'Curated market trends are invaluable for making strategic investment decisions in today's fast-paced environment.'

Furthermore, Zero Flux addresses the challenge of information overload in the property sector by sifting through extensive volumes of data to highlight only the most pertinent insights from commercial real estate publications. This approach enables its audience to make wise investment decisions, ensuring they stay ahead in a competitive market.

Aspen Institute: Case Studies on Inclusively Owned Commercial Real Estate

The Aspen Institute provides critical case studies that explore the impact of inclusively owned commercial real estate (CRE) models. These studies illustrate how diverse ownership frameworks can expand access to property investments, thereby fostering greater community involvement and stimulating economic growth. For example, initiatives like the Community Investment Trust, which employs a blended capital stack of grants, debt, and equity, alongside Chicago TREND, have effectively shown how shared ownership can empower local communities, enabling residents to reap the benefits of their neighborhoods' economic development.

Moreover, inclusively owned CRE has the potential to mitigate racial and gender wealth disparities within the market, promoting social equity in the property sector. Investors can harness these models to discover opportunities that not only align with their financial objectives but also contribute to a more equitable landscape. As the demand for inclusively owned commercial property continues to rise, understanding the frameworks discussed in commercial real estate publications becomes essential for stakeholders aiming to navigate the evolving property investment landscape in 2025.

The insights presented in these case studies are reinforced by contributions from experts such as Gretchen Beesing and De’Sean Weber, underscoring the importance of collaboration in advancing inclusivity within the property market.

Journal of Real Estate Research: Peer-Reviewed Insights for Investors

The Journal of Real Estate Research serves as a vital resource for investors, publishing peer-reviewed articles that address a diverse array of topics pertinent to the real estate market. By delivering empirical information and comprehensive assessments, this journal enables readers to grasp economic trends, investment strategies, and the various factors influencing property values. Investors can harness these insights to refine their investment approaches and enhance decision-making processes, ultimately positioning themselves for success in a competitive landscape.

CCIM Institute: Comprehensive Articles on Commercial Real Estate Strategies

The CCIM Institute offers a comprehensive array of resources, including commercial real estate publications, that delve into commercial property strategies with a particular emphasis on financial modeling. These in-depth resources provide individuals with essential perspectives on analysis and investment strategies, empowering them to make informed decisions in a complex landscape.

Effective financial modeling is vital for evaluating potential returns and risks; studies show that well-structured models can significantly improve investment outcomes. Industry leaders consistently underscore the significance of accurate financial projections, asserting that they are foundational to successful investment strategies.

As we look to 2025, the evolving commercial property sector will necessitate the utilization of resources found in commercial real estate publications for individuals aiming to refine their strategic planning and execution. The CCIM Institute's commitment to delivering up-to-date information and practical resources equips individuals to navigate the complexities of the industry with confidence.

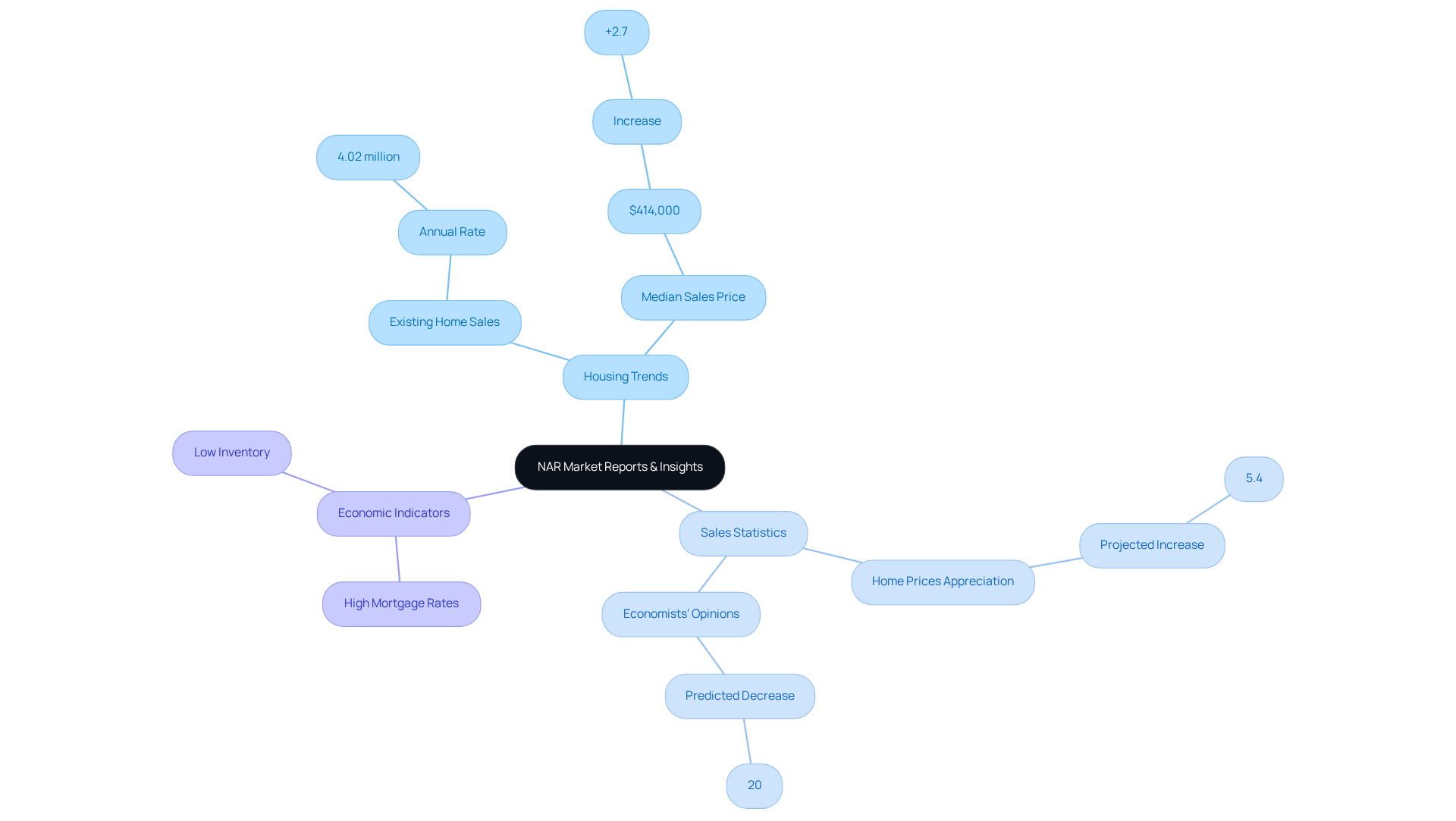

National Association of Realtors: Market Reports and Insights

The National Association of Realtors (NAR) provides essential reports that deliver critical insights into housing trends, sales statistics, and economic indicators impacting the real estate sector. These reports are particularly beneficial for individuals aiming to comprehend economic shifts and pinpoint lucrative investment opportunities.

For example, as of March 2025:

- Existing home sales were recorded at an annual rate of 4.02 million, marking a decline from the previous year.

- The median sales price achieved an unprecedented high of $414,000, reflecting a 2.7% increase over the year, despite prevailing economic challenges.

By harnessing NAR's insights, stakeholders can adapt their strategies to align with current economic conditions, ensuring they maintain competitiveness in a market characterized by high mortgage rates and low inventory.

Furthermore, expert analyses indicate that:

- Home prices are anticipated to appreciate at a slower pace, with values expected to rise by 5.4% month-over-month by Q4 2023.

- The persistent imbalance between supply and demand is likely to inhibit substantial declines.

Notably, only 20% of economists believe home prices may decrease in the next five years, underscoring the necessity for stakeholders to remain informed and flexible in their decision-making processes.

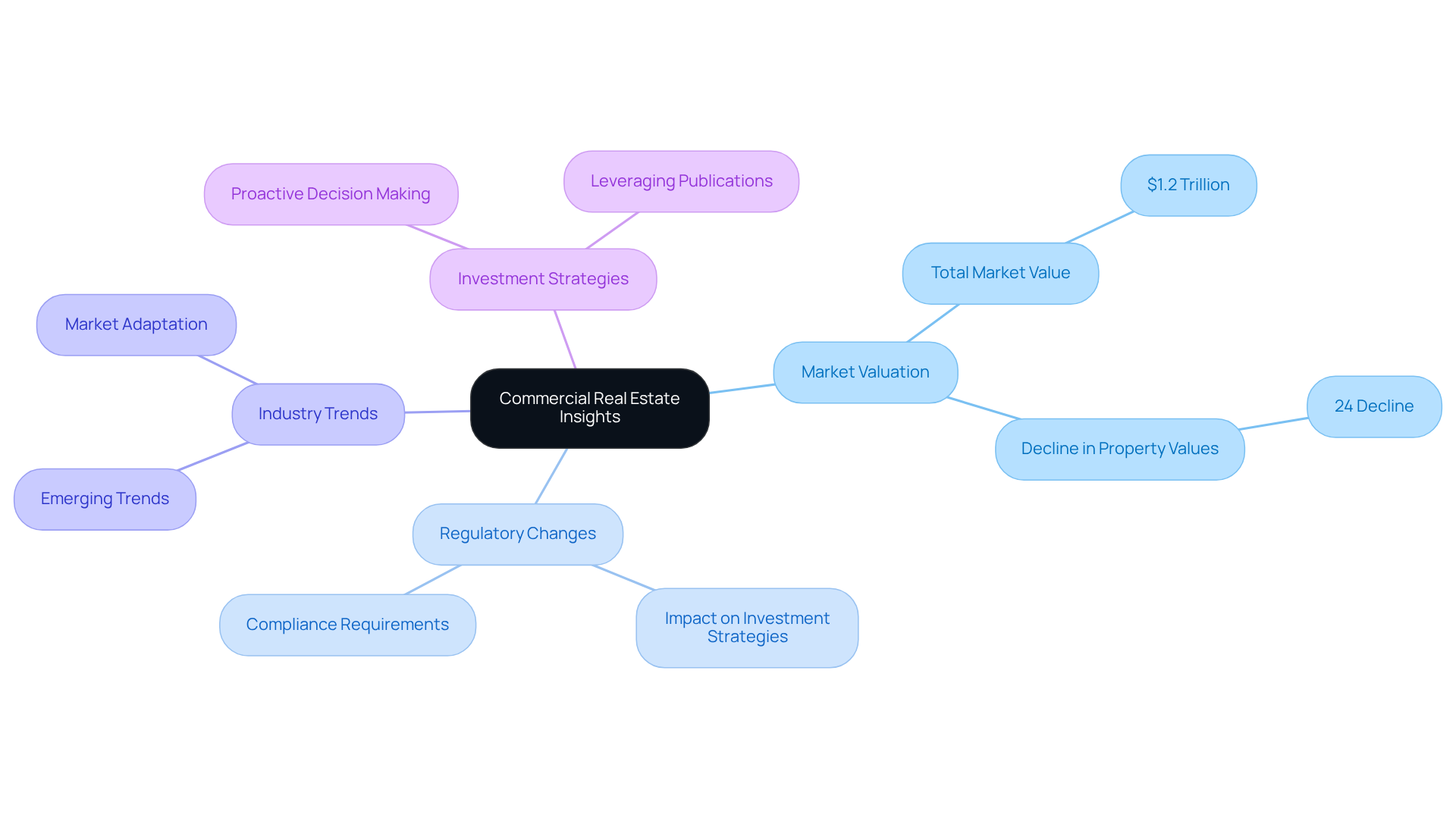

Real Estate Weekly: Current News and Trends in Commercial Real Estate

Real Property Weekly serves as an indispensable resource for stakeholders by delivering timely information and thorough analysis featured in commercial real estate publications regarding the commercial property sector. By addressing a wide array of topics, from industry trends to regulatory changes, commercial real estate publications equip individuals with the necessary insights to navigate an evolving landscape.

With the U.S. commercial property market valued at $1.2 trillion in 2022 and growth rates shaped by regulatory adjustments, it is crucial to stay informed to make proactive investment decisions. Recent data indicates a 24% decline in commercial property values, as reported by the Green Street Commercial Property Price Index, underscoring the imperative for stakeholders to adapt their strategies.

Subscribing to commercial real estate publications, such as Real Estate Weekly, allows stakeholders to uncover emerging trends and regulatory developments, ensuring they maintain a competitive edge in their investment approaches.

Urban Land Institute: Research on Land Use and Real Estate Development

The Urban Land Institute (ULI) stands at the forefront of research on land use and property development, delivering comprehensive reports that illuminate critical trends, zoning regulations, and sustainable development practices. National industrial in-place rents averaged $8.30 per square foot, providing a concrete illustration of the current market landscape relevant to investors. As inflation and persistently high interest rates continue to impact global property markets, ULI's insights become increasingly essential for identifying strategic opportunities in land acquisition and development. Investors can leverage ULI's findings to position their investments effectively in response to evolving industry demands.

Moreover, the positive feedback from the community underscores the clarity and precision of the information presented by Zero Flux, further reinforcing the credibility of these insights. By staying informed through ULI's research and understanding local trends, stakeholders can make informed decisions that align with both current patterns and future growth in the property sector.

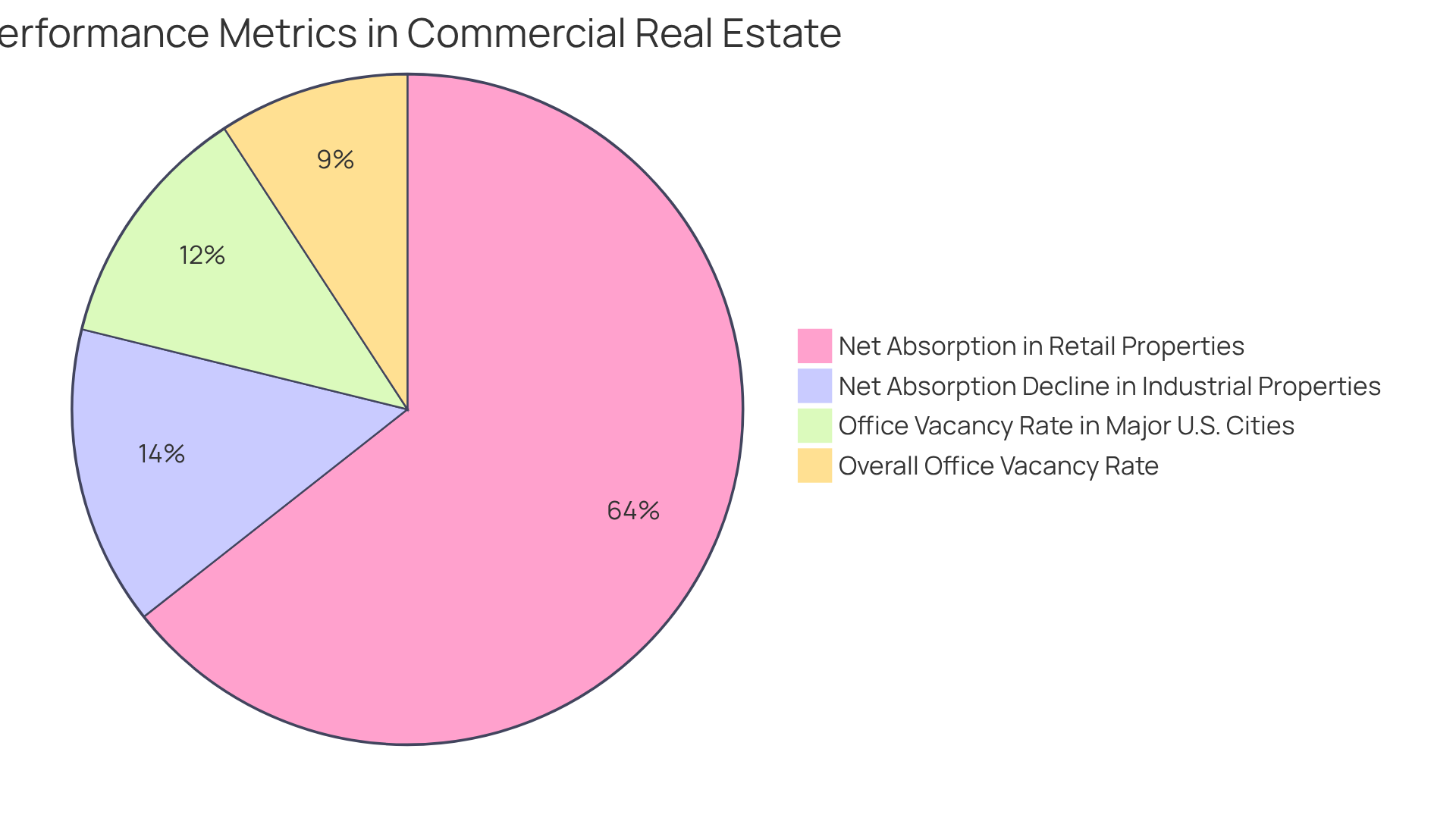

Commercial Property Executive: News and Analysis for Informed Investment Decisions

Commercial Property Executive serves as a vital resource for stakeholders by delivering comprehensive news coverage and analysis through commercial real estate publications in the commercial property sector. It highlights critical trends and shifts, such as the notable 22% decline in net absorption within the industrial property sector prior to April 2025. In contrast, general retail outlets accounted for 98% of net absorption in the 12 months leading to April 2025. Furthermore, the rising vacancy rates in office spaces have reached 14%, with major U.S. cities witnessing office vacancy rates climbing to 18.2% in 2023.

By staying informed through Commercial Property Executive, stakeholders can navigate the complexities of the industry, particularly as the commercial property sector faces challenges, including a 6% contraction over the past year. This understanding empowers stakeholders to make informed strategic decisions, especially in high-demand markets like Austin, Dallas, Nashville, Atlanta, and Phoenix, where investment opportunities are emerging despite overall market fluctuations.

The insights provided by commercial real estate publications are essential for comprehending the evolving landscape of commercial properties. They enable stakeholders to capitalize on potential opportunities while effectively mitigating risks.

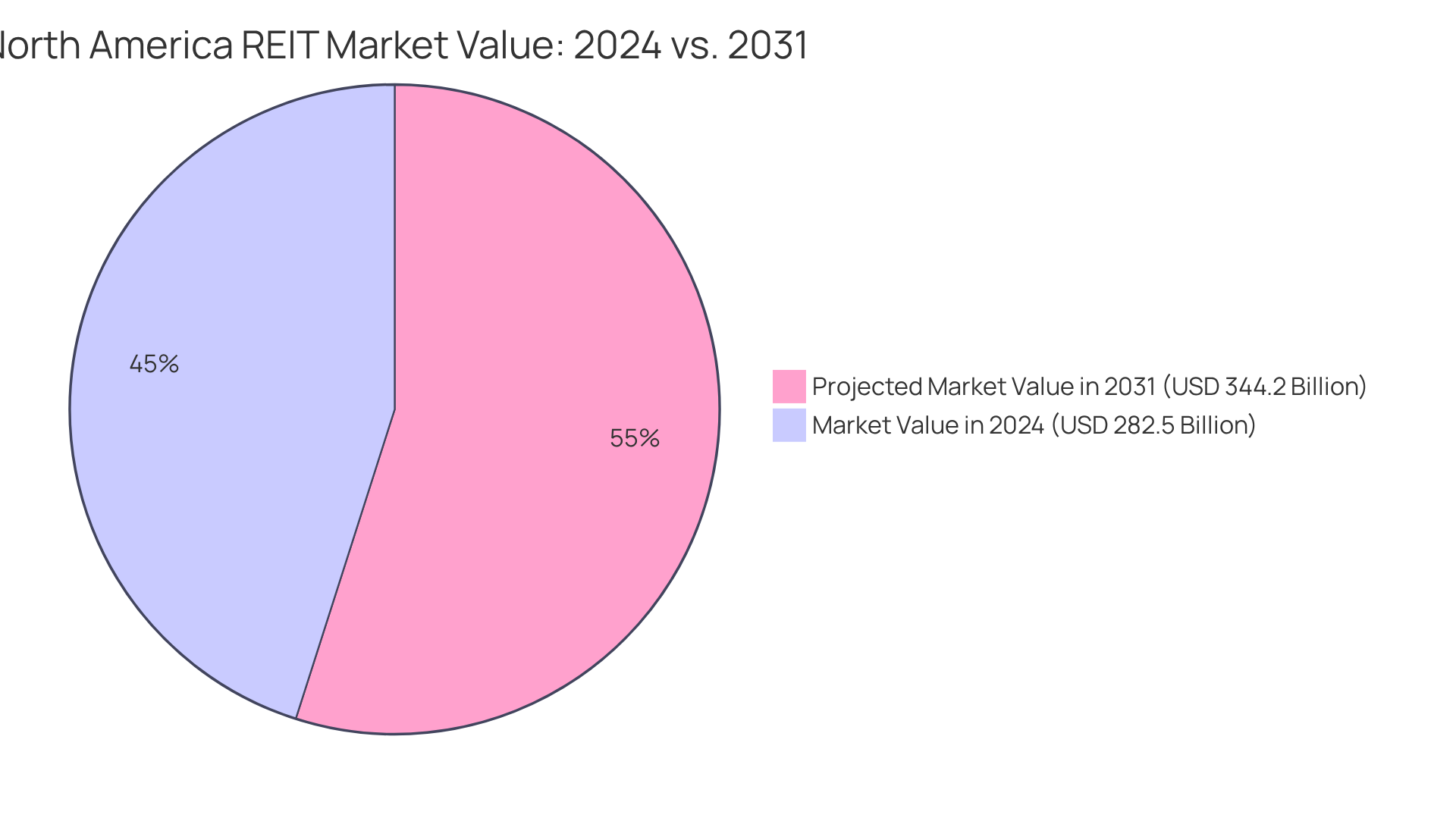

REIT Association: Essential Resources for REIT Investors

The REIT Association serves as a vital resource for those interested in real estate investment trusts (REITs), offering a comprehensive array of insights, regulatory updates, and educational materials. These resources empower individuals to adeptly navigate the complexities of REIT investments. Notably, the North America REIT Market was valued at USD 282.5 billion in 2024 and is projected to reach USD 344.2 billion by 2031, reflecting a compound annual growth rate (CAGR) of 2.50%. This growth underscores the importance of the REIT Association's resources in helping investors refine their strategies within this evolving sector.

Furthermore, the equity capitalization of publicly traded REITs reached USD 1.4 trillion in 2023, emphasizing the scale and significance of the sector. According to Nareit, a robust economy characterized by low unemployment and rising consumer confidence fuels demand for real estate, rendering the insights provided by the REIT Association even more invaluable.

However, stakeholders must remain cognizant of potential challenges posed by rising interest rates and financial fluctuations, which can influence investment decisions. By leveraging the information offered by the REIT Association, stakeholders can enhance their decision-making processes and fine-tune their investment strategies within the REIT sector, particularly in a landscape shaped by evolving regulations and economic dynamics.

National Multifamily Housing Council: Insights on Multifamily Housing Investments

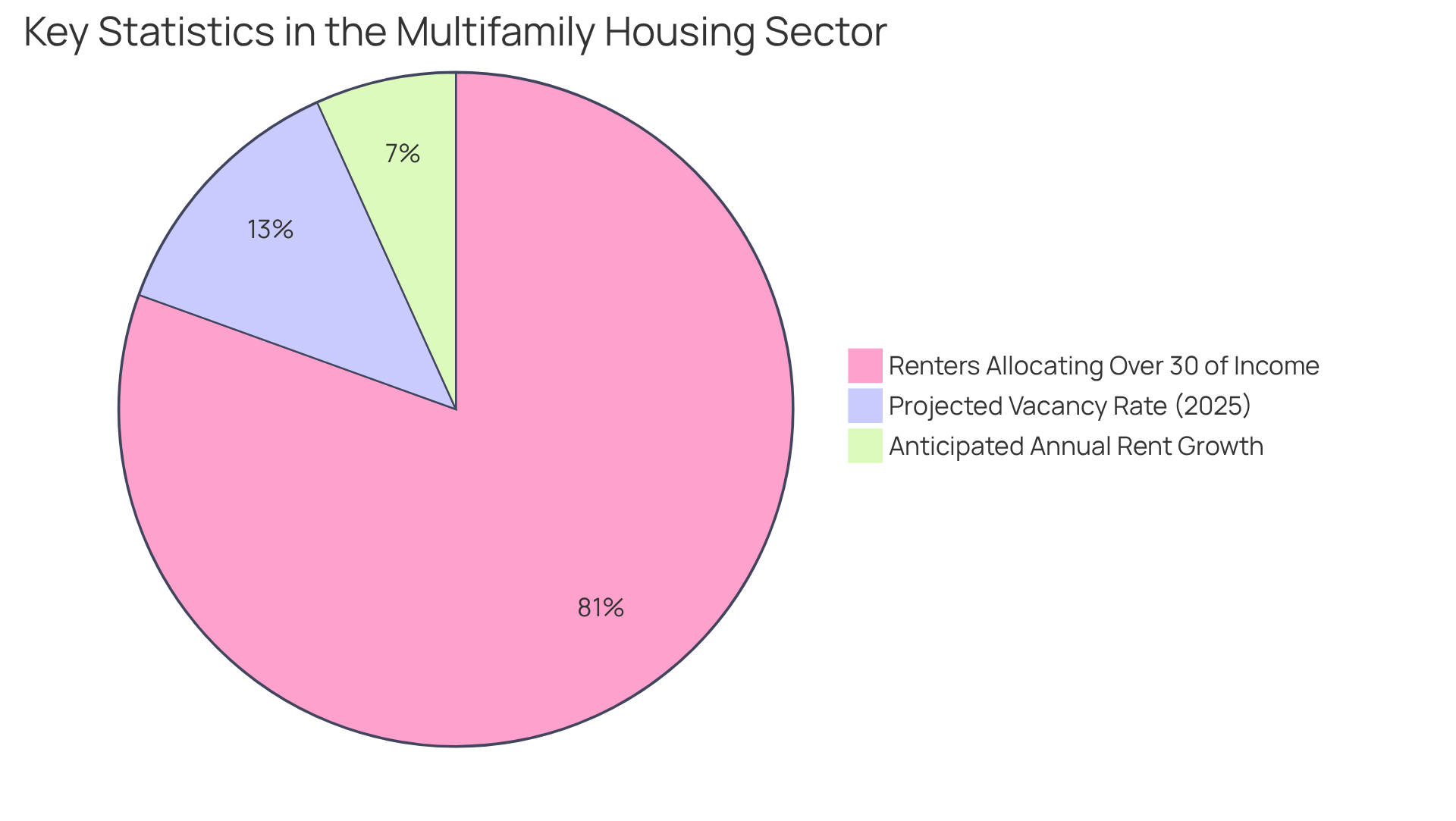

The National Multifamily Housing Council (NMHC) serves as a crucial resource for understanding the multifamily housing sector, offering in-depth insights into trends, statistics, and forecasts. Their comprehensive research equips individuals with the knowledge needed to navigate the complexities of this sector, spotlighting significant investment opportunities. For example, the average multifamily vacancy rate is projected to conclude 2025 at 4.9%, with annual rent growth anticipated to reach 2.6%. This data underscores the resilience of the multifamily sector, even in the face of rising interest rates and new supply challenges.

Moreover, NMHC's findings indicate that the multifamily sector remains the preferred asset category for commercial real estate publications stakeholders in 2025, driven by strong renter demand. As homeownership costs continue to escalate—average newly originated mortgage payments are currently 35% higher than average apartment rents—many households are choosing to rent, further reinforcing the demand for multifamily properties. Notably, 31% of renters allocate over 30% of their income to housing costs, highlighting the affordability crisis shaping this trend. Additionally, the median household income of homeowners in the U.S. stands at $72,615, reflecting the financial realities that many renters confront.

Investors leveraging NMHC's insights from commercial real estate publications can align their strategies with industry trends, ensuring they capitalize on the evolving landscape of multifamily housing. With a focus on data integrity and actionable intelligence, NMHC empowers investors to make informed decisions that resonate with current economic dynamics. As Matt Vance states, "We expect average multifamily rents to grow by 3.1% annually over the next five years, above the pre-pandemic average of 2.7%." This optimistic outlook, paired with the case study on the cost-to-buy premium, illustrates how prevailing market conditions are shaping investment strategies in multifamily housing.

Conclusion

The landscape of commercial real estate investment is continuously evolving, making it essential for investors to stay informed through reliable publications and resources. This article highlights ten pivotal commercial real estate publications that provide invaluable insights, trends, and strategies for navigating the complexities of the market. By leveraging these resources, investors can enhance their decision-making processes and position themselves for success in a competitive environment.

Key insights from publications like Zero Flux, the Aspen Institute, and the Journal of Real Estate Research underscore the importance of data-driven analysis and inclusivity in investment strategies. From understanding market trends to exploring the benefits of inclusively owned commercial real estate, these resources equip stakeholders with the knowledge necessary to make informed decisions. Furthermore, platforms such as the CCIM Institute and the National Association of Realtors offer comprehensive analyses that help investors adapt to shifting economic conditions and emerging opportunities.

In conclusion, the significance of staying updated with essential commercial real estate publications cannot be overstated. As the market continues to grow and adapt, investors must actively seek out reliable information to navigate challenges and seize opportunities. Engaging with these resources not only fosters informed decision-making but also contributes to a more equitable and sustainable real estate landscape. Embracing knowledge and collaboration will ultimately empower investors to thrive in the dynamic world of commercial real estate.