Overview

The article identifies the fastest appreciating real estate markets to watch in 2025, spotlighting cities such as Miami, Austin, and Nashville. By detailing the economic factors, demographic trends, and property value projections, it underscores the significance of data-driven insights for investors navigating the evolving real estate landscape. Understanding these dynamics is crucial for making informed investment decisions in a competitive market. As we look ahead, the implications of these trends become increasingly relevant, prompting investors to consider how these insights can shape their strategies.

Introduction

In the ever-evolving landscape of real estate, understanding market dynamics is crucial for both investors and homebuyers. The year 2025 is poised to unveil significant trends across various cities, each characterized by unique elements shaping their real estate potential. Consider the luxury boom in Miami, the tech-driven demand in Austin, and the affordability growth in Phoenix; these markets present distinct opportunities and challenges.

This article delves into key insights and predictions for major cities, highlighting the factors influencing property values, buyer behavior, and investment strategies. As the real estate sector navigates economic fluctuations and demographic shifts, staying informed will be paramount for anyone looking to make strategic decisions in this competitive arena.

Zero Flux: Your Source for Real Estate Market Insights

Zero Flux is committed to delivering critical trends and insights within the property sector through a specialized daily newsletter. By meticulously curating information from over 100 diverse sources, including those behind paywalls, Zero Flux offers subscribers a comprehensive summary of the latest property trends. This focus on factual data, free from personal opinions, establishes the newsletter as an indispensable resource for industry experts and enthusiasts alike. Subscribers benefit from a concise format that distills the most pertinent information impacting the property landscape, rendering it an invaluable tool for navigating business dynamics.

As the property sector grapples with challenges such as soaring monthly mortgage payments—up over 113% since the Covid-19 pandemic—investors must critically assess how these rising costs influence affordability and overall investment strategies. The lock-in effect, which keeps many sellers on the sidelines, further complicates matters, restricting available inventory and affecting pricing.

In 2025, the importance of data-driven insights in real estate newsletters is underscored by expert opinions. Selma Hepp, chief economist at CoreLogic, observes that the ongoing lack of affordability will continue to shape behavior, particularly for investors aiming to enter or expand in the market. Additionally, Joel Berner, senior economist at Realtor.com, highlights that buyers now enjoy greater choices due to an increasing supply of existing properties, potentially opening new avenues for investment. This shifting landscape reinforces the necessity for reliable, data-driven resources like Zero Flux, which has experienced significant subscriber growth, now exceeding 30,000, as professionals seek clarity and precision in their decision-making processes.

Moreover, the challenges faced by novice homebuyers, as illustrated in a recent case study, reveal broader implications for the industry, emphasizing the need for strategic investment approaches that consider current circumstances.

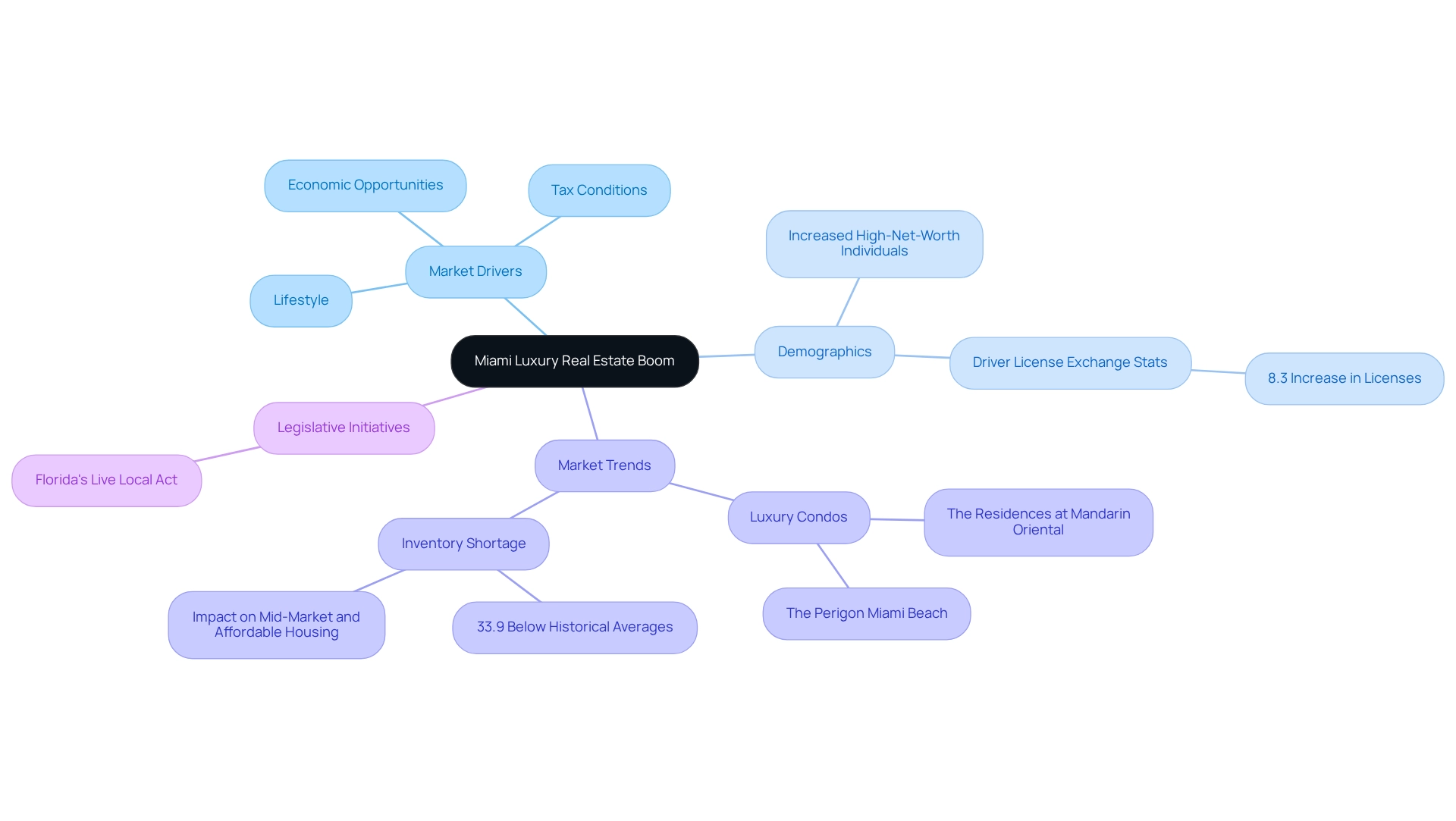

Miami, Florida: The Luxury Real Estate Boom

Miami is among the fastest appreciating real estate markets, experiencing a remarkable luxury boom driven by its appealing lifestyle, advantageous tax conditions, and a significant influx of high-net-worth individuals seeking prime properties. The city's vibrant cultural scene, along with substantial economic opportunities, positions it as a premier destination for luxury buyers in the fastest appreciating real estate markets. In 2025, the demand for ultra-luxury residences is projected to escalate, with new developments achieving record-breaking prices per square foot. This surge is further supported by a notable increase in international buyers and a resilient local economy.

Notably, Miami-Dade County, in conjunction with Broward, Palm Beach, and Martin counties, collectively saw an 8.3% increase from the previous year in the number of driver licenses exchanged for Florida licenses. This statistic indicates a growing population of potential luxury buyers. Furthermore, Miami's luxury condominium sector is thriving and is recognized as one of the fastest appreciating real estate markets, with high-end projects such as The Residences at Mandarin Oriental and The Perigon Miami Beach attracting ultra-high-net-worth individuals. This trend is further boosting demand in the market.

The overall housing inventory in Miami remains 33.9% below historical averages, which particularly impacts the mid-market and affordable housing segments. This shortage has prompted legislative initiatives, such as Florida's Live Local Act, aimed at stimulating development and addressing the challenges faced by these segments. As the luxury sector continues to evolve, it remains a crucial area for investment, driven by the growing presence of wealthy purchasers and the city's distinctive offerings.

Austin, Texas: Tech-Driven Housing Demand

Austin's real estate sector is significantly shaped by its thriving tech industry, which continually draws a diverse array of professionals and families in search of housing. As major tech firms enhance their foothold in the region, the demand for residential properties is on the rise, making it one of the fastest appreciating real estate markets with notable increases in property values.

By 2025, the median home price in Austin is projected to near $600,000, reflecting a steady upward trend driven by the city's robust employment landscape and exceptional quality of life. Current data reveals that the months of inventory in the Austin area stands at 4.8 months, indicating a 0.7-month increase from the previous year, which signals a tightening market.

Moreover, the total dollar volume of leases in Caldwell County reached $8,864, representing a 32.1% decline compared to January 2024, highlighting the evolving dynamics in the leasing sector. Investors should closely monitor Austin as it cements its status as a leading technology hub, making it one of the fastest appreciating real estate markets and presenting lucrative opportunities for property investment.

The expansion of data sources, including Unlock MLS's addition of single-family residential leasing activity, enhances agents' and investors' ability to make informed decisions in this changing environment. With the city's consistent performance in job creation and economic development, as underscored by industry experts, Austin stands out as one of the fastest appreciating real estate markets, making it an attractive destination for property investment.

Nashville, Tennessee: A Hub for High-Net-Worth Buyers

Nashville has firmly established itself as a prime destination for high-net-worth buyers, fueled by its vibrant culture, celebrated music scene, and strong economic growth. The luxury real estate sector in the city is experiencing substantial demand, with home prices projected to increase by 3-4% in 2025. This upward trend is primarily driven by an influx of affluent individuals relocating to Nashville, attracted by the allure of both primary residences and investment opportunities.

The limited housing availability and increased investor participation further contribute to Nashville's position as one of the fastest appreciating real estate markets, making it an enticing prospect for investors. The historical resilience of Nashville's housing sector, particularly through challenges such as the COVID-19 pandemic and demographic shifts reported by the U.S. Census Bureau, highlights its current dynamics and future potential.

Recent data indicates that the city's rental demand remains robust, supported by ongoing population growth and limited home affordability. This scenario positions Nashville among the fastest appreciating real estate markets, making it an appealing area for investors looking to capitalize on luxury properties.

Promising neighborhoods such as East Nashville, The Nations, and Wedgewood-Houston stand out for investment, offering significant appreciation potential due to ongoing development and lifestyle appeal. Property analysts emphasize that:

- East Nashville

- The Nations

- Wedgewood-Houston

are considered some of the fastest appreciating real estate markets due to ongoing development, lifestyle attraction, and strategic locations. Moreover, Nashville remains more affordable than cities like Austin, Denver, or Los Angeles, presenting higher ROI potential for investors.

As the city continues to attract affluent buyers, Nashville differentiates itself as a compelling area for luxury property investment, characterized by its unique blend of cultural vibrancy and economic potential. Investors should closely monitor these neighborhoods to take advantage of emerging trends and opportunities.

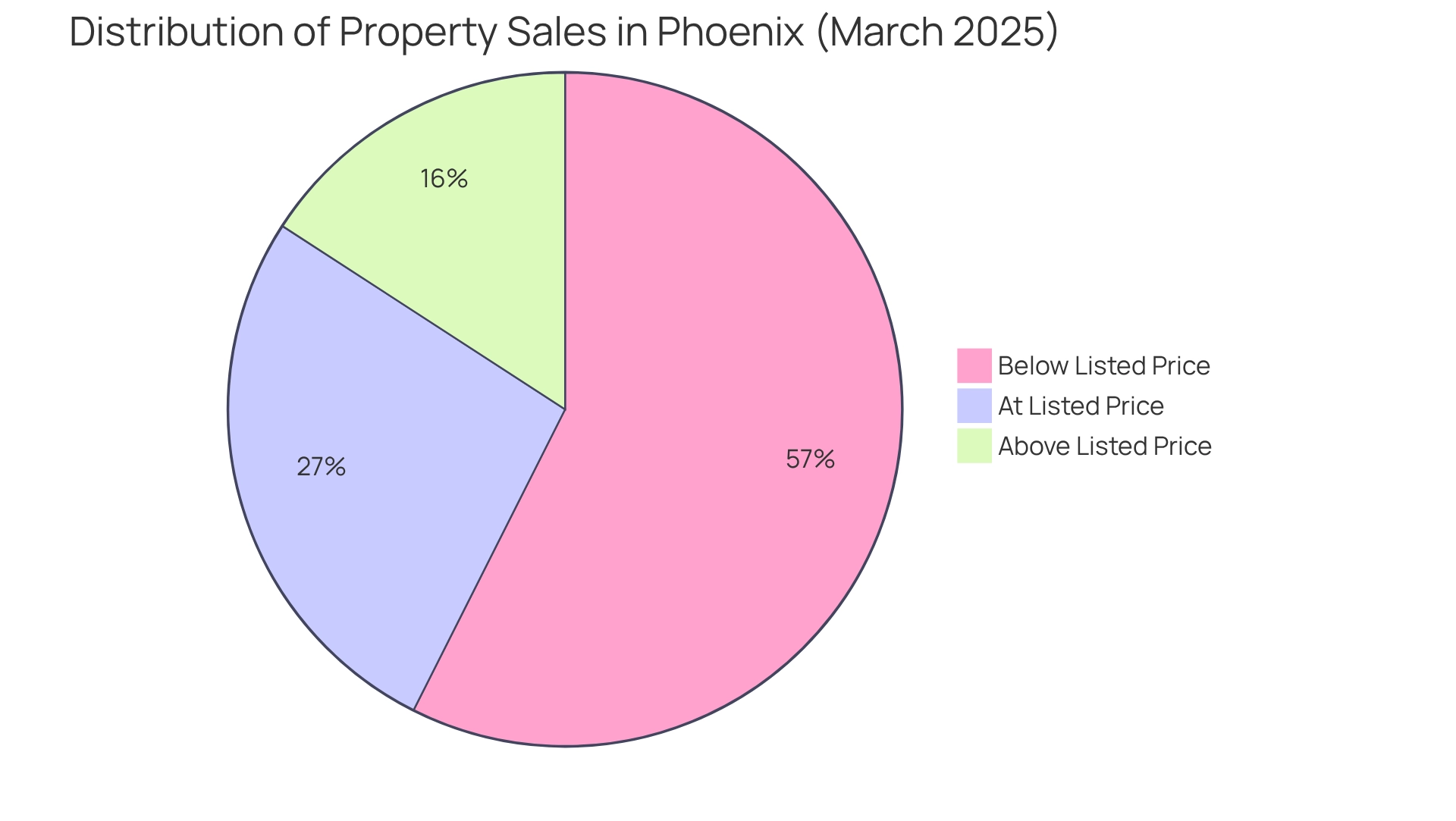

Phoenix, Arizona: Affordable Growth and New Developments

Phoenix is experiencing remarkable growth in affordable housing, establishing itself as a premier destination for both homebuyers and investors. The city's real estate landscape is characterized by a notable increase in new developments and a steady influx of residents seeking budget-friendly options. By 2025, Phoenix is projected to rank among the top housing markets, with property prices expected to rise as demand continues to outstrip supply. Notably, in March 2025, of the 1,411 properties sold or pending in Phoenix:

- 58% were sold below the listed price

- 27% at the listed price

- 16% above the listed price

This data highlights a competitive environment that still offers opportunities for purchasers.

Investors should closely monitor the city's expanding infrastructure and robust employment opportunities, which are critical factors propelling real estate growth. Although specific statistics regarding Phoenix's foreign-born population are not available, the ongoing developments in affordable housing are meeting the needs of residents and creating attractive investment prospects. As the sector evolves, analysts underscore that the combination of new housing initiatives and favorable economic conditions will likely lead to sustained growth in property values. Danielle Hale, Chief Economist at Realtor.com, notes that "these areas – offering relatively lower-priced homes, more new and existing houses to select from, and mortgage products designed to give buyers an advantage – could provide some potential buyers a better opportunity to enter the scene next year." This insight positions Phoenix as a region to watch in 2025 and beyond.

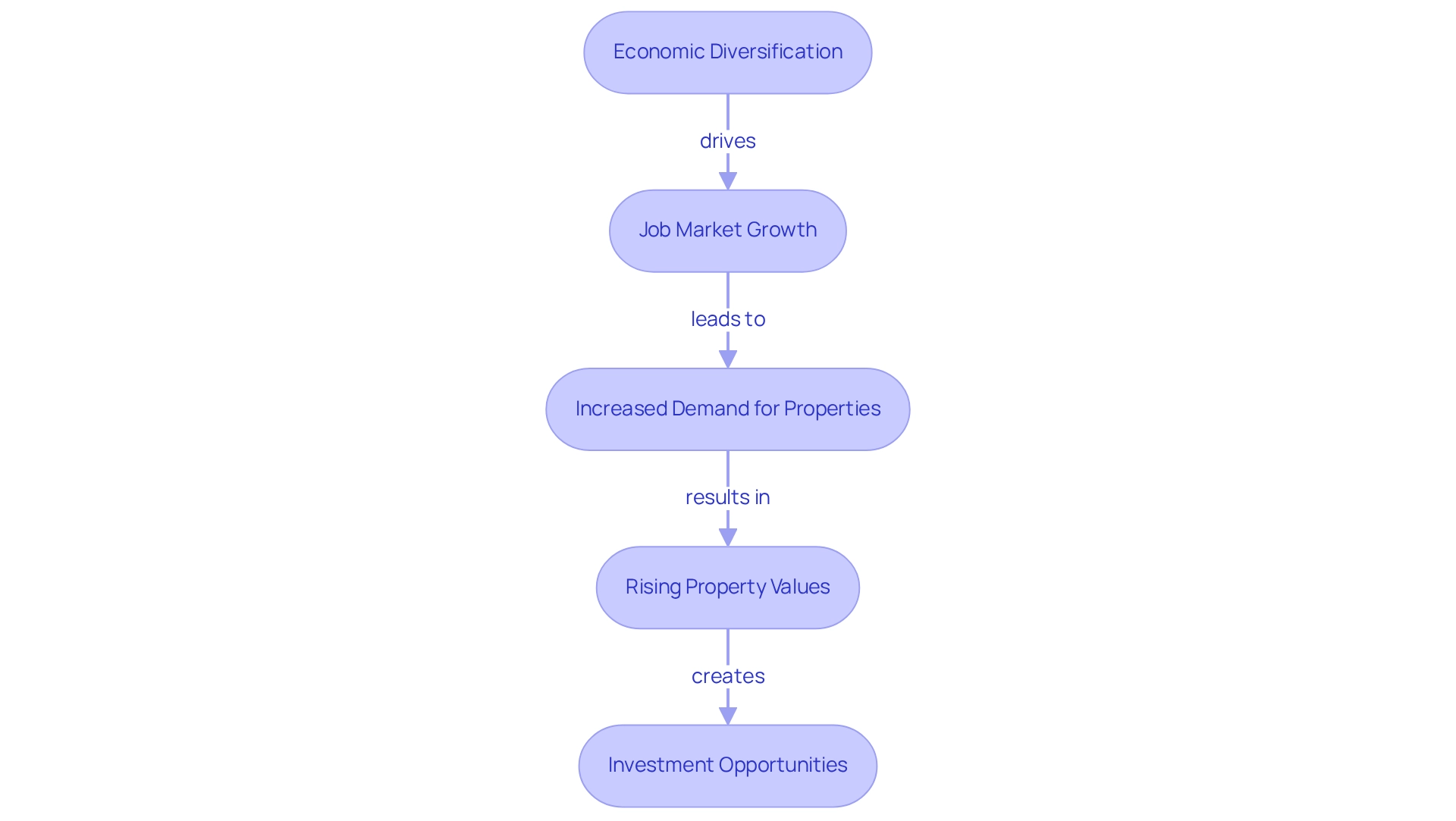

Tampa, Florida: Economic Diversification Fuels Growth

Tampa's real estate sector is experiencing robust expansion, primarily fueled by significant economic diversification. The city’s strategic location, coupled with a thriving job market, has attracted a consistent influx of new residents, thereby increasing demand for both residential and commercial properties. In 2025, property values in Tampa are expected to rise substantially, confirming its position among the fastest appreciating real estate markets and underscoring the region's appeal as a premier investment destination. A recent sale at 4527 W LA Villa Ln exemplifies this upward trend, with the property selling for $290,000, highlighting the growing value of homes in the area.

Furthermore, Tampa's economic landscape is transforming, with various sectors bolstering its resilience. A recent report on neighborhood rankings in Tampa revealed essential factors such as bikeability, walkability, and affordability, assisting potential buyers in identifying desirable areas that align with their lifestyle preferences. This data-driven approach not only facilitates informed decision-making but also illustrates the diverse living options available within the city, especially as Tampa is recognized as one of the fastest appreciating real estate markets, prompting property investors to acknowledge the favorable conditions that position the sector for sustained growth.

Expert assessments indicate that the city’s ongoing development and enhancements in living standards will further solidify its status as one of the fastest appreciating real estate markets for property investment in 2025 and beyond. Additionally, the First Street Foundation anticipates an increase in the number of days exceeding 108 degrees Fahrenheit over the next 30 years, which may impact future housing demand and investment strategies in the region.

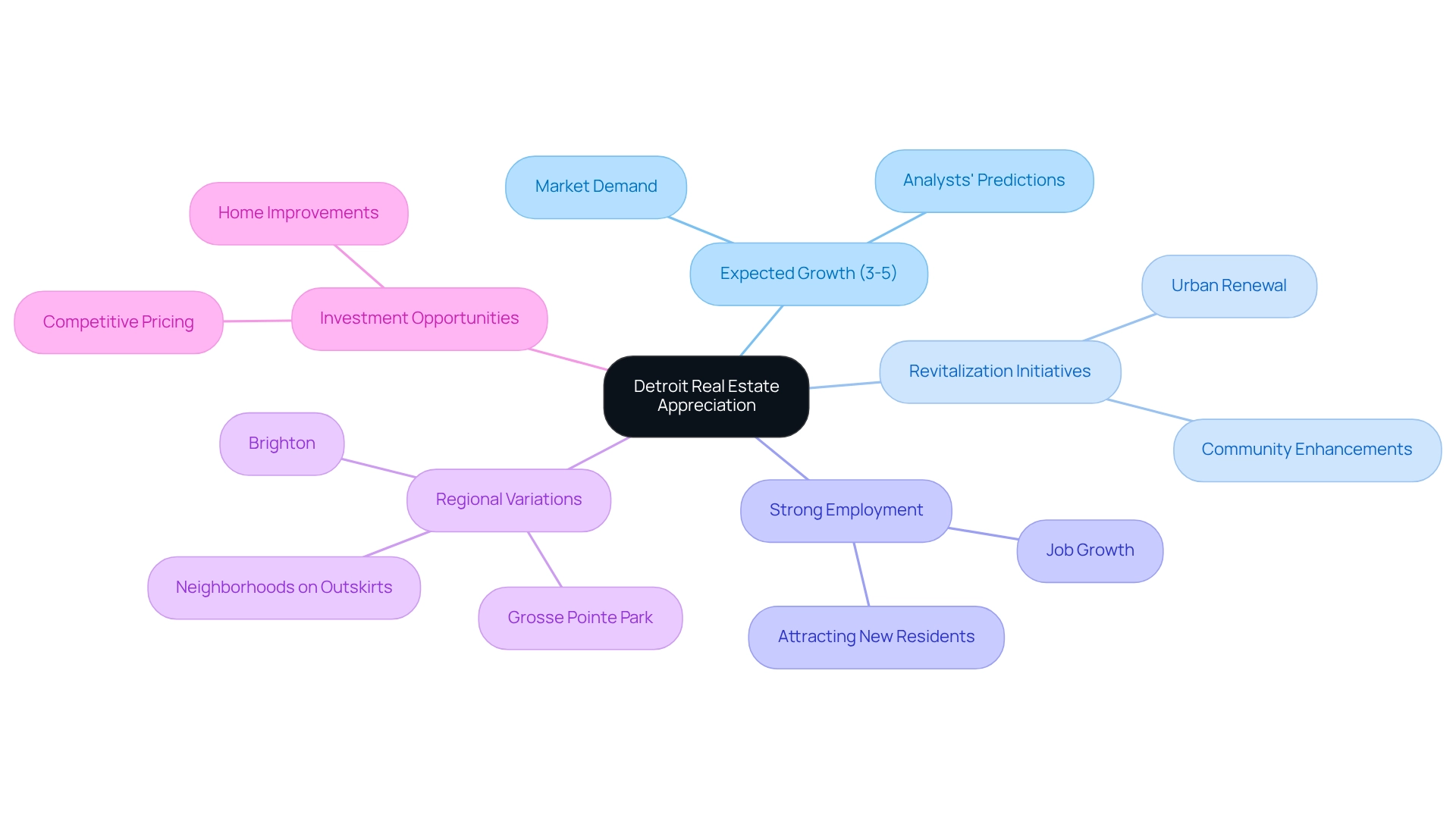

Detroit, Michigan: Surging Ahead in Appreciation

Detroit's real estate sector is witnessing a significant resurgence, positioning it among the fastest appreciating real estate markets, with property values experiencing impressive appreciation. The city's continuous revitalization initiatives, combined with a strong employment landscape, are drawing both new residents and investors. In 2025, property prices in Detroit are expected to increase between 3% and 5%, according to industry analysts, indicating a robust demand fueled by economic recovery and urban renewal initiatives. Notably, areas such as Grosse Pointe Park and Brighton have seen substantial increases in median sales prices, as highlighted in the case study "Price Growth and Regional Variations," underscoring the competitive nature of the market.

Experts highlight that this trend is particularly pronounced in urban centers, where the appeal of city living continues to draw renters and buyers alike. Wheeler notes, "This trend is especially pronounced in urban areas like Detroit, where the appeal of city living continues to draw renters." Analysts predict that any potential slowdown in sales due to rising mortgage rates, which are expected to stabilize between 5.5% and 6.5%, will be short-lived, as pent-up demand is likely to drive a rebound in sales.

The effect of urban revitalization on property prices cannot be exaggerated; as communities enhance, housing values are anticipated to increase, making Detroit one of the fastest appreciating real estate markets for investment. Investors willing to engage in home improvements may find favorable pricing opportunities in 2025, particularly in areas that are currently less competitive, such as certain neighborhoods on the outskirts of the city. Overall, Detroit's property sector is positioned for ongoing expansion, which positions it among the fastest appreciating real estate markets that investors should observe.

Grand Rapids, Michigan: Local Growth and Market Potential

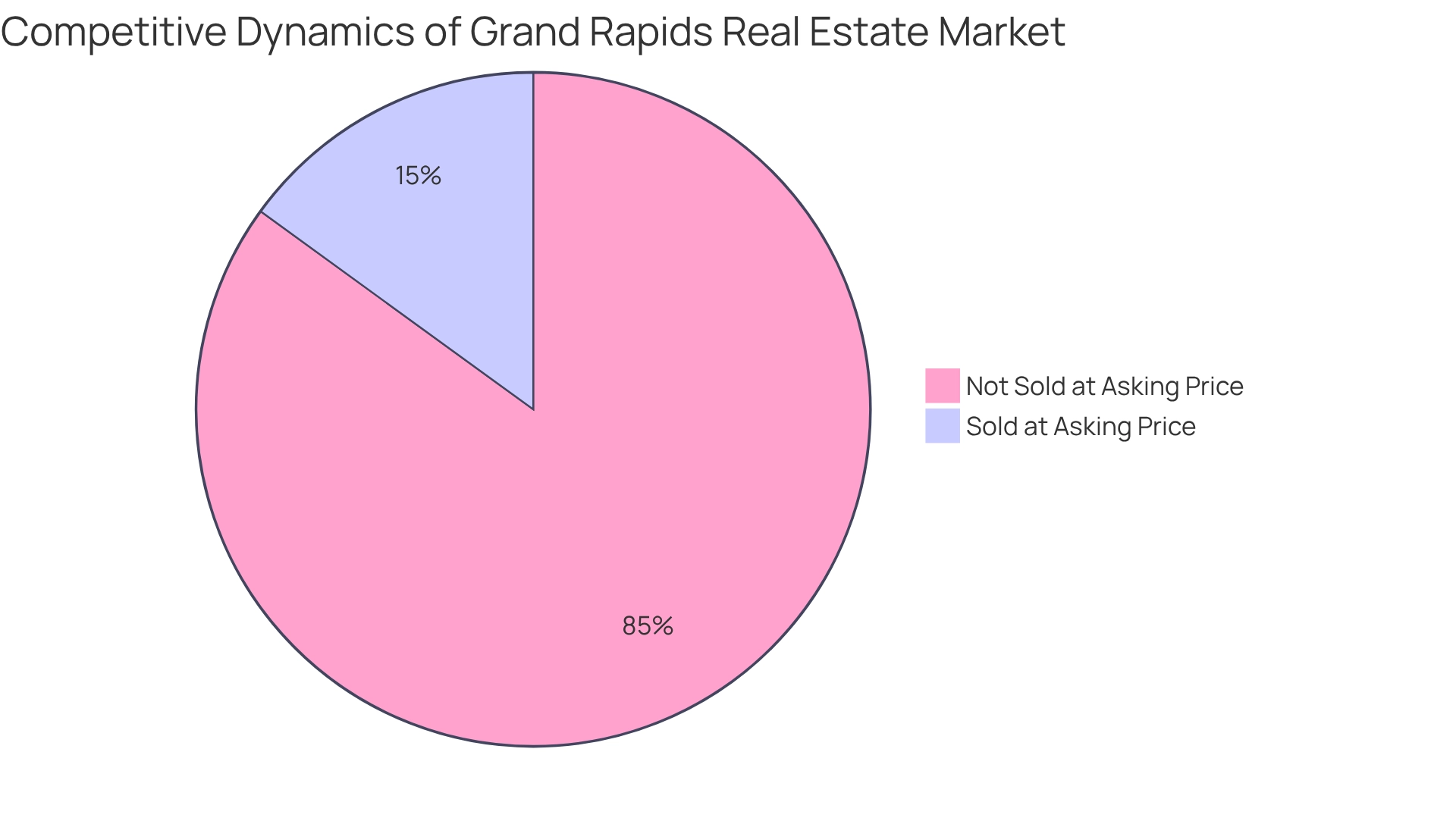

Grand Rapids is rapidly establishing itself as a formidable competitor in the real estate sector, fueled by robust local growth and significant potential. The city boasts affordable housing options, complemented by a thriving job market, making it an appealing destination for both homebuyers and investors. In March 2025, the median sold price reached $640,000, reflecting a modest increase of 0.4% from the previous year, which signals a stable trend in the market. Notably, 15% of homes sold at their asking price, highlighting the competitive nature of the environment and suggesting that investors may need to act quickly to secure properties.

Looking ahead, Grand Rapids is poised for continued appreciation in home values, with projections indicating a rise of 2-3% in 2025. This anticipated growth is supported by the National Association of Realtors' recognition of the Grand Rapids-Kentwood area as one of the top ten housing markets for 2025, alongside cities like Boston and Phoenix. This accolade underscores the city's affordable housing supply, favorable mortgage rates, and strong economic indicators, positioning it as one of the fastest appreciating real estate markets and a prime opportunity for property investment.

Investors should take note of successful housing developments, particularly recent projects in the downtown area, which feature mixed-use developments and affordable housing initiatives. These projects contribute to overall industry growth and enhance the community's appeal. The combination of budget-friendly housing trends and a commitment to improving the quality of life in Grand Rapids makes it a strategic choice for those looking to capitalize on the evolving property landscape. Furthermore, the 0.4% increase in home prices for five-bedroom houses further solidifies the narrative of price stability and growth in the Grand Rapids area.

Columbia, South Carolina: Rising Market Attraction

Columbia, South Carolina, is emerging as one of the fastest appreciating real estate markets, attracting the attention of both homebuyers and investors alike. The city boasts affordable housing options, a robust job market, and an appealing quality of life, positioning itself among the fastest appreciating real estate markets and establishing itself as a prime destination for property investment. Projections for 2025 indicate a steady appreciation in home values, with estimates ranging from 2% to 4%. This anticipated growth is reinforced by the city’s strategic location near major urban centers such as Atlanta and Charlotte, contributing to its status as one of the fastest appreciating real estate markets.

The employment landscape in Columbia serves as a critical driver of this upward trend, as job growth stimulates demand for housing. Analysts highlight that the city’s economic conditions are favorable for investment, with many experts noting that the combination of affordability and job opportunities makes Columbia one of the fastest appreciating real estate markets. Insights suggest that job growth in the region is expected to remain strong, further bolstering housing demand. Additionally, the Zillow Home Value Index (ZHVI) illustrates this trend, indicating that home values in Columbia are on the rise, making it one of the fastest appreciating real estate markets, which correlates with the increasing interest from investors.

As the market evolves, prospective investors should closely monitor Columbia’s property developments. Marco Santarelli, an investor and founder of Norada Real Estate Investments, underscores the potential of real estate as a powerful vehicle for wealth creation, stating, "My mission is to help 1 million people create wealth and passive income and put them on the path to financial freedom with real estate." This perspective highlights the investment potential in Columbia’s upward trajectory in home price appreciation, as it is one of the fastest appreciating real estate markets, supported by its strong economic fundamentals. Investors are encouraged to track local job growth data and consider current mortgage rates when evaluating investment opportunities, making Columbia an attractive choice for those looking to capitalize on emerging sectors in 2025.

El Paso, Texas: Affordability and Steady Growth

El Paso is swiftly emerging as a pivotal player in the real estate market, characterized by its affordability and steady growth trajectory. The city features a low cost of living, which, combined with a robust economy, fosters a favorable environment for both homebuyers and investors. In 2025, property values in El Paso are projected to rise by 3-5%, driven by increasing housing demand. This trend is particularly pronounced in Northeast El Paso, where there is a sustained interest in single-family residences priced below $250,000.

The reliance on government-supported mortgage loans, such as FHA and VA loans, significantly contributes to promoting property ownership in the region. Notably, these loans accounted for nearly 75% of mortgage transactions in El Paso, underscoring their importance in the local housing market. The presence of Fort Bliss and a considerable veteran population further enhance the attractiveness of these financing options, making home ownership more attainable for many residents.

Real estate experts underscore El Paso's potential, noting that the city's population growth and economic stability are critical indicators of future success. According to the National Association of Realtors, with a population growth rate of -0.4% in 2022 and a job growth rate of 2.5% in Q2 2024, these factors are essential in predicting property trends. El Paso's economic outlook remains promising, positioning it as an appealing destination for real estate investment, particularly as it ranks among the fastest appreciating real estate markets in Texas. In summary, El Paso's blend of affordability, economic growth, and favorable financing options establishes it as a prime market for investors eager to seize emerging opportunities in 2025.

Conclusion

The real estate landscape in 2025 offers a diverse array of opportunities across various cities, each shaped by its unique market dynamics. Miami continues to thrive as a luxury hotspot, driven by its appealing lifestyle and an influx of high-net-worth buyers. Meanwhile, Austin's market is fueled by its robust tech industry, creating steady demand for housing and pushing property values upward. Nashville, with its vibrant culture and economic growth, increasingly attracts affluent buyers, while Phoenix distinguishes itself with affordable housing developments catering to a growing population.

As cities like Tampa and Detroit experience significant appreciation and revitalization, they emerge as attractive options for investors. Grand Rapids presents affordable housing alongside a strong job market, further solidifying its position in the real estate sector. Columbia and El Paso exemplify markets where affordability meets steady growth, making them compelling destinations for both homebuyers and investors.

In this evolving real estate environment, understanding local trends and economic conditions is crucial for making informed investment decisions. By remaining attuned to the factors influencing each market, investors can navigate the complexities of the real estate landscape and seize opportunities that align with their strategies. As 2025 unfolds, the potential for growth and investment across these diverse markets remains significant, underscoring the need for data-driven insights and strategic planning.