Overview

This article presents critical commercial real estate trends expected in 2025, spotlighting the influence of rising interest rates, the transition towards sustainable buildings, and the increasing demand for multifamily housing driven by urbanization. Each of these trends is bolstered by compelling evidence illustrating how shifts in work environments, technological advancements, and demographic changes are transforming investment strategies and market demands within the commercial real estate sector.

As we delve deeper, it becomes evident that the implications of these trends are significant. The rise in interest rates poses challenges for investors, yet it also opens avenues for strategic opportunities. Meanwhile, the shift towards sustainability is not merely a trend; it reflects a growing preference among consumers and investors alike, urging stakeholders to adapt their portfolios accordingly. Additionally, the urbanization phenomenon underscores a robust demand for multifamily housing, positioning it as a key area for investment.

In summary, understanding these trends is essential for informed investment decisions. By recognizing the interplay between these factors, investors can better navigate the evolving landscape of commercial real estate, ensuring they remain ahead of the curve and capitalize on emerging opportunities.

Introduction

As the landscape of commercial real estate shifts dramatically, understanding the trends that will shape the market in 2025 becomes essential for investors and industry professionals alike. The impact of rising interest rates and the increasing demand for sustainable developments are just two of the evolving dynamics that present both challenges and opportunities.

How can stakeholders effectively navigate this rapidly changing environment to ensure strategic investments and capitalize on emerging trends? This article explores ten key commercial real estate trends that will define the industry in the coming years, offering insights that could prove invaluable for informed decision-making.

Zero Flux: Your Daily Source for Commercial Real Estate Insights

Zero Flux serves as an essential resource for property professionals, delivering a daily newsletter that encapsulates 5-12 key insights from over 100 diverse sources. This curated methodology ensures that subscribers receive the most relevant and timely information, devoid of subjective opinions.

With a subscriber base exceeding 30,000, Zero Flux has established itself as a pivotal resource for navigating the complexities of the commercial property market. The newsletter's emphasis on data integrity and factual reporting empowers investors to make informed decisions, providing clarity in an often overwhelming information landscape.

As the commercial property sector continues to evolve, the importance of reliable, curated insights into commercial real estate trends 2025 becomes increasingly vital for strategic investment planning.

Rising Interest Rates: Impact on Investment Strategies

As interest rates rise, the cost of borrowing escalates, significantly impacting investment strategies within the commercial real estate sector. Investors are likely to face increased mortgage payments, which can lead to diminished cash flow and lower real estate valuations.

To effectively navigate this challenging environment, investors should consider:

- Diversifying their portfolios

- Exploring alternative financing options

- Focusing on properties with robust cash flow potential

Furthermore, understanding the timing of rate changes is crucial; it empowers investors to make informed decisions about when to enter or exit the market.

Remote Work Trends: Redefining Office Space Demand

The rise of remote work has ushered in a significant transformation in office space requirements. Companies are increasingly downsizing their physical office footprints, favoring flexible work arrangements that emphasize collaboration over traditional desk setups. This shift has resulted in higher vacancy rates in urban office spaces, while the demand for suburban and adaptable workspaces continues to rise.

Real estate experts must adapt to the commercial real estate trends 2025 by focusing on assets that can accommodate hybrid work models and provide features appealing to tenants who seek a balance between remote and in-office work. This strategic pivot not only aligns with current market demands but also positions investors to capitalize on emerging opportunities.

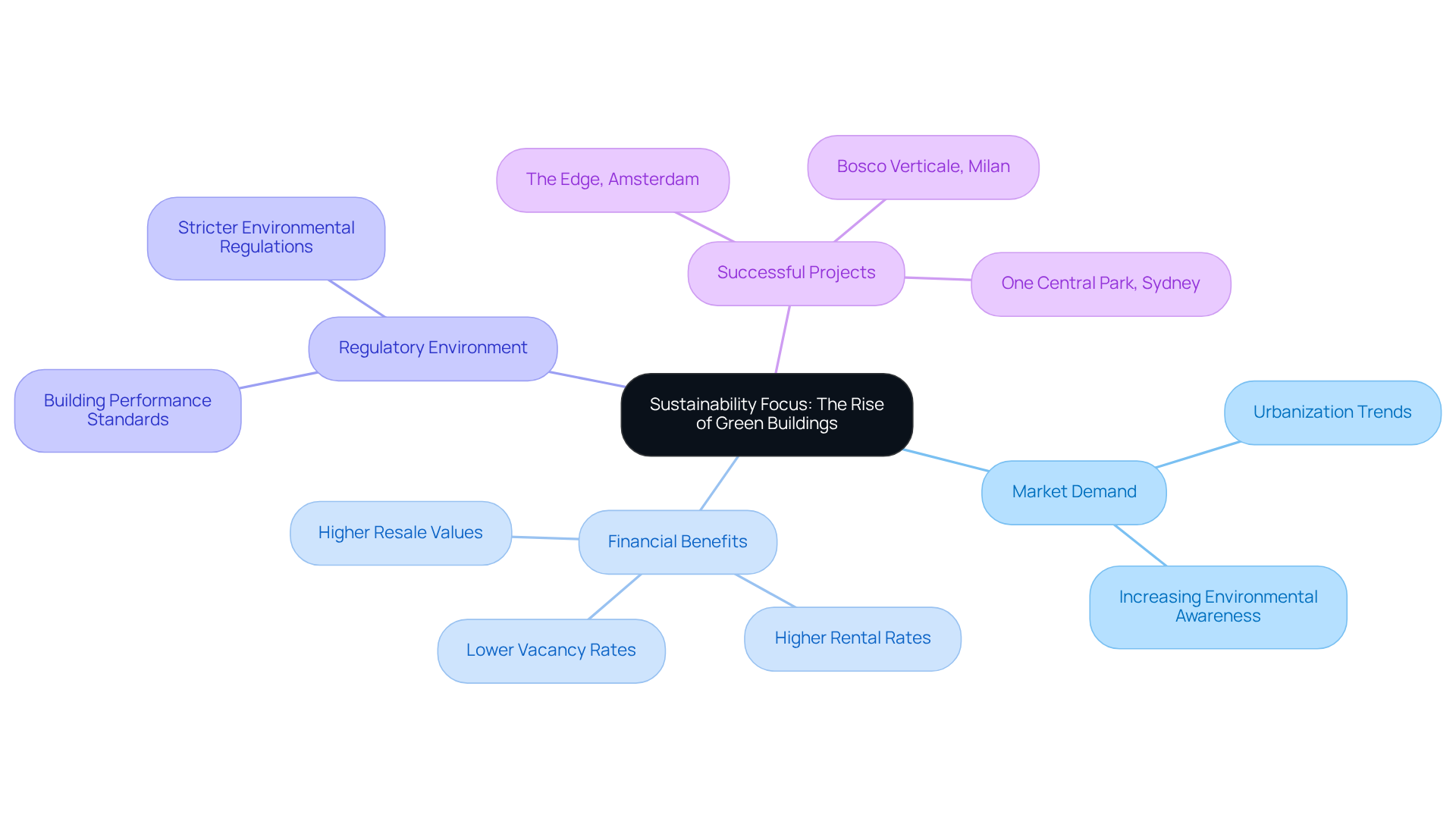

Sustainability Focus: The Rise of Green Buildings

The demand for sustainable and green buildings is surging, as both investors and tenants increasingly prioritize environmental responsibility. Properties that integrate energy-efficient technologies, sustainable materials, and innovative designs not only attract potential tenants but also achieve higher rental rates and lower vacancy rates. Sustainable real estate often commands higher prices; green-certified structures sell for up to 10% more than their traditional counterparts, reflecting their desirability in the market.

As nearly 50 cities in the U.S. implement Building Performance Standards focused on decreasing emissions, property developers are urged to integrate eco-friendly practices into their projects. This is essential to remain competitive and satisfy the demands of a more environmentally aware clientele. Successful projects like One Central Park in Sydney, The Edge in Amsterdam, and Bosco Verticale in Milan exemplify how sustainable design can enhance property value and appeal. These developments improve air quality and aesthetics, showcasing the tangible benefits of sustainability.

As sustainability becomes a necessity rather than a trend, the real estate sector is poised for a transformative shift, which is evident in the commercial real estate trends 2025. This change is driven by stricter regulations and a growing awareness of environmental issues, making it imperative for stakeholders to adapt their strategies accordingly.

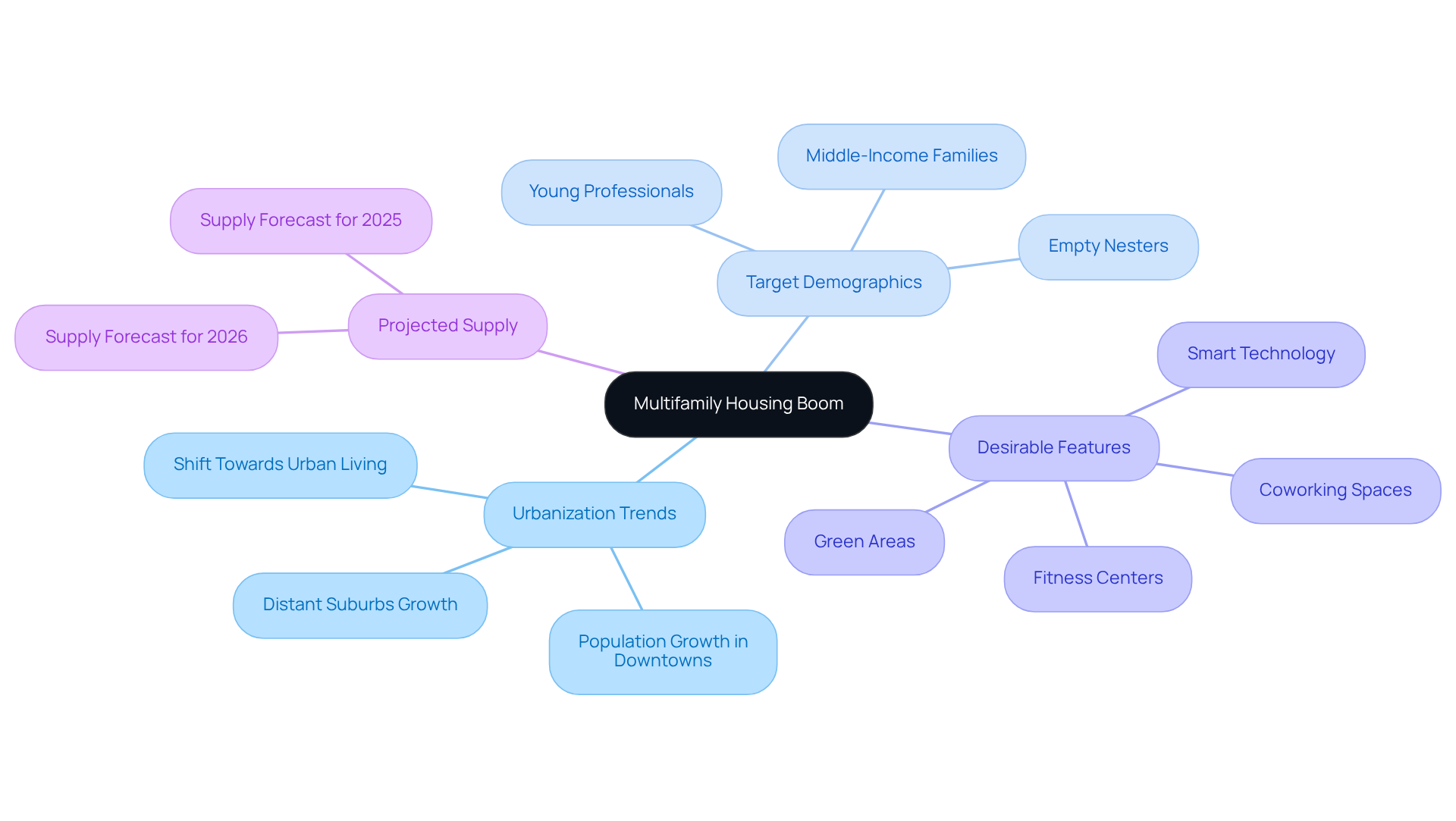

Multifamily Housing Boom: Urban Living Trends

The multifamily housing market is witnessing substantial growth, primarily fueled by urbanization and changing lifestyle preferences. As urban living gains appeal, the demand for multifamily units in city centers intensifies. This trend is particularly pronounced among young professionals and empty nesters, who value proximity to amenities, public transportation, and vibrant community settings. For example, Halifax's downtown has expanded by 26.1% from 2016 to 2021, while Montréal has also experienced significant population growth in its downtown areas, reflecting a broader shift towards urban living.

Investors should strategically target real estate that caters to these demographics, focusing on modern features such as:

- Fitness centers

- Coworking spaces

- Green areas

These features are essential for attracting tenants. Furthermore, developments that integrate smart technology packages and sustainable practices are increasingly desirable, as properties adhering to sustainability standards tend to attract higher-quality tenants and resonate with the preferences of eco-conscious renters.

By comprehensively understanding the commercial real estate trends 2025 and investing in community-oriented designs, stakeholders can effectively address the rising demand for urban multifamily housing, with a projected supply of 508,089 units anticipated by 2025.

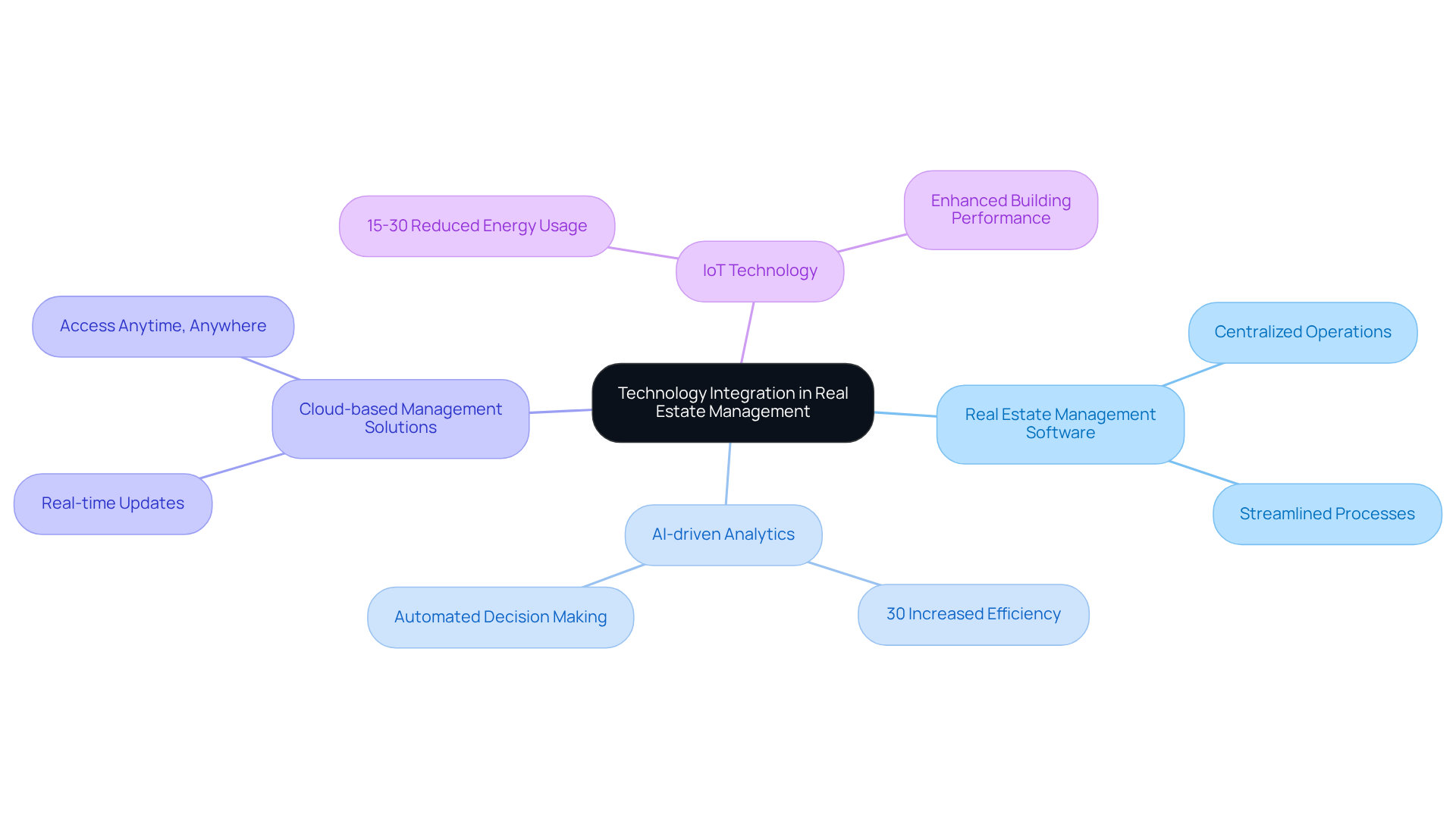

Technology Integration: Innovations in Real Estate Management

The integration of technology in real estate management is revolutionizing the industry. Innovations such as real estate management software, AI-driven analytics, and smart building technologies are optimizing operations and significantly enhancing tenant experiences. For instance, AI can increase operational efficiency by up to 30%, enabling managers to automate routine tasks and improve communication with residents.

Furthermore, cloud-based management solutions allow for access to essential processes anytime and anywhere, promoting real-time updates and fostering improved collaboration among stakeholders. Case studies demonstrating the effectiveness of cloud-based management software illustrate the operational enhancements achieved through technology adoption.

Moreover, IoT technology can reduce energy usage by 15-30%, showcasing how these innovations not only enhance building performance but also contribute to sustainability—a growing concern in real estate management. As the commercial real estate trends 2025 evolve, industry professionals must remain vigilant about the latest tools and trends to maintain a competitive edge in an ever-changing market.

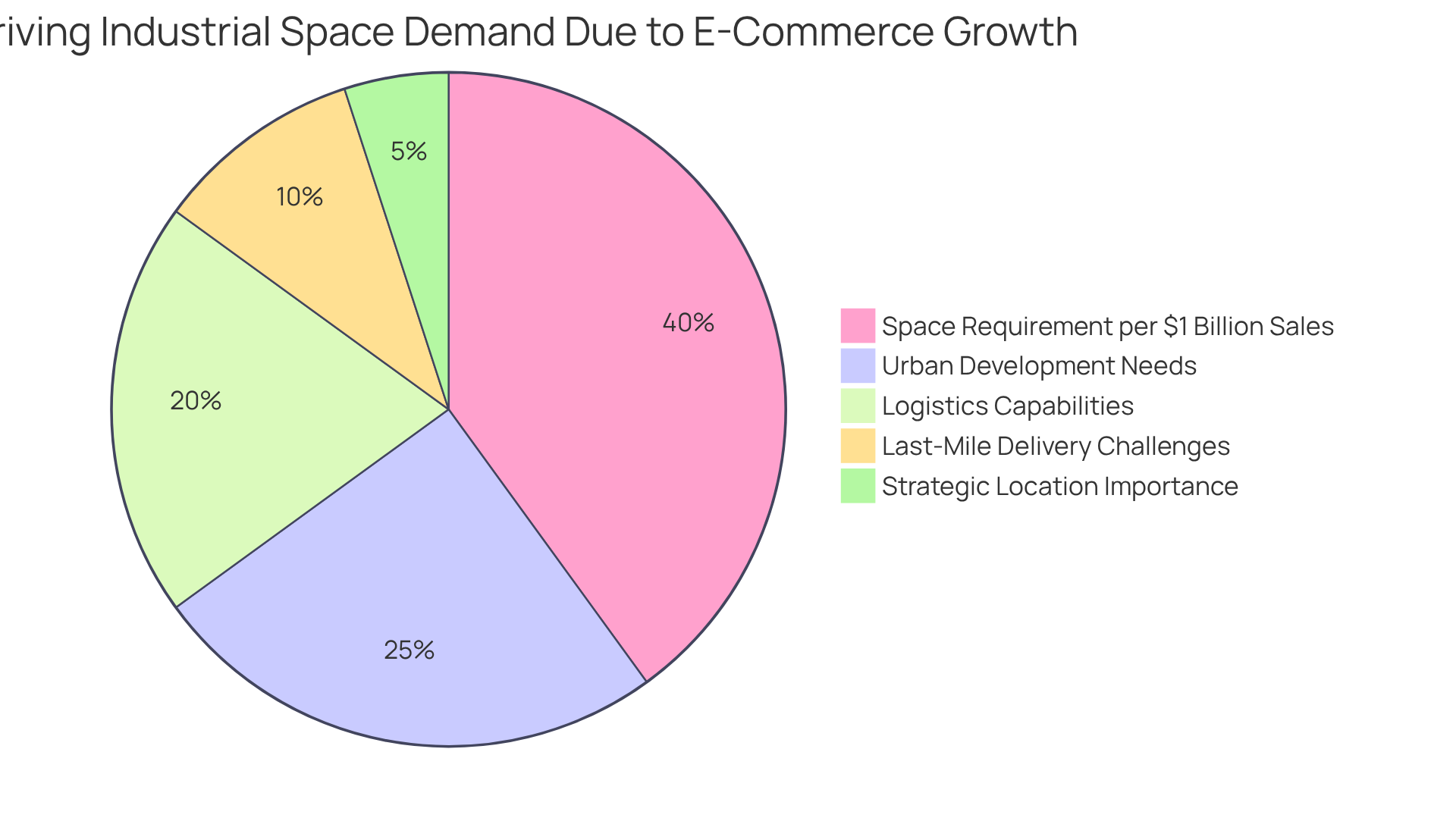

E-commerce Growth: Driving Industrial Space Demand

The rapid expansion of e-commerce serves as a crucial driver for the surging demand for industrial spaces, particularly warehouses and distribution centers. As online shopping increasingly dominates consumer behavior, retailers are enhancing their logistics capabilities to meet growing expectations for swift delivery. Projections reveal that e-commerce will necessitate a substantial portion of new industrial space requirements, with estimates indicating the need for up to 1.25 million square feet of additional distribution space for every $1 billion increase in e-commerce sales. Investors should prioritize properties strategically located near major transportation hubs to capitalize on this burgeoning market.

Successful warehouse developments, especially those exceeding 30,000 square meters, are emerging in urban centers such as Mexico City and Guadalajara, highlighting the urgent need for efficient last-mile delivery solutions. As competition among e-commerce companies intensifies, the demand for quality logistics spaces will only escalate, positioning this sector as a vital focus for astute investors. Furthermore, fostering strategic partnerships between the property and e-commerce sectors can provide valuable insights and opportunities for maximizing returns.

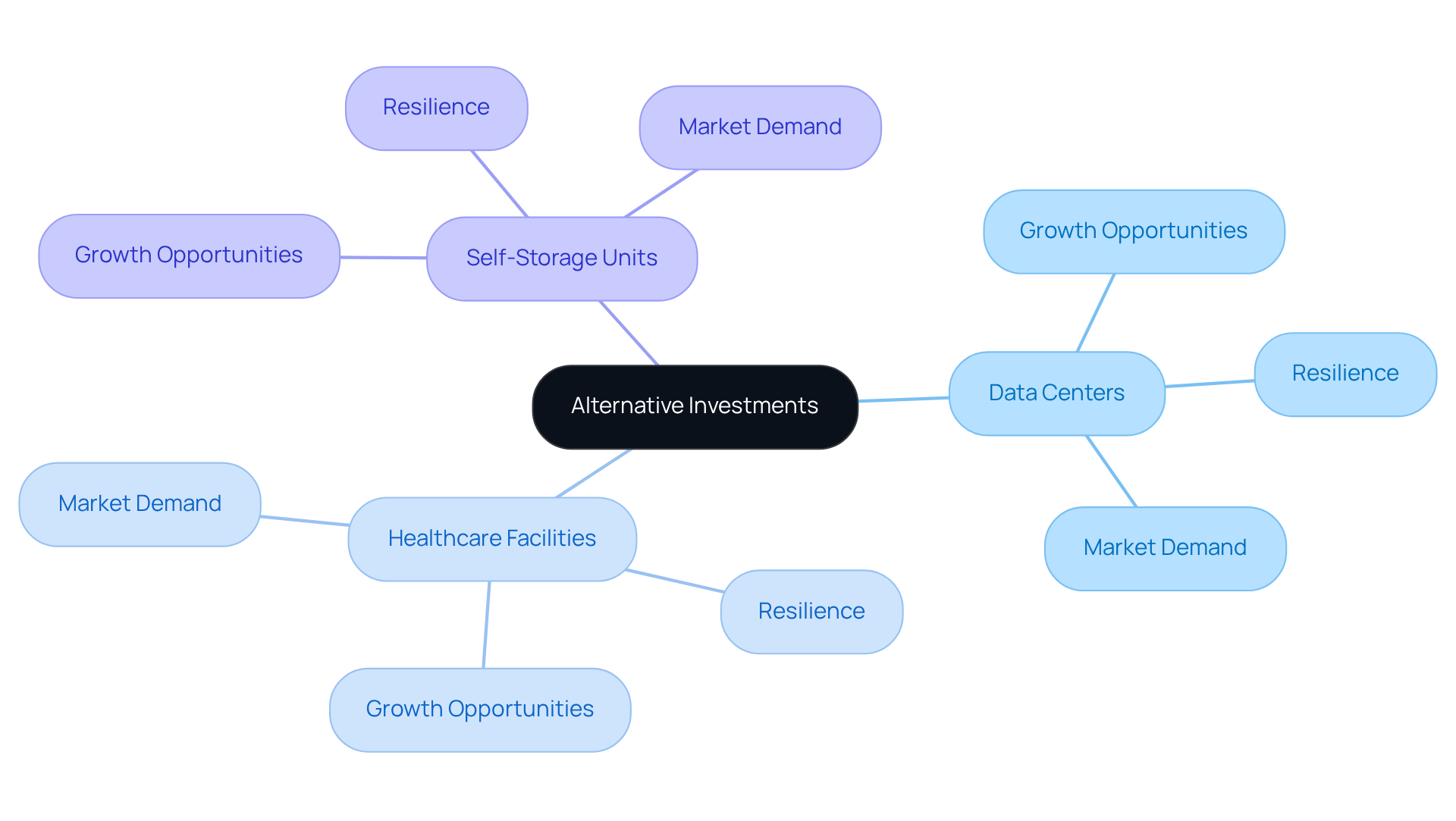

Alternative Investments: Expanding Beyond Traditional Real Estate

As the commercial real estate trends 2025 evolve, investors are increasingly looking beyond traditional property types to alternative investments. This shift includes sectors such as:

- Data centers

- Healthcare facilities

- Self-storage units

These sectors present unique opportunities for growth and diversification. By expanding their portfolios to incorporate these non-traditional assets, investors can effectively mitigate risks associated with market volatility. Moreover, they can capitalize on the commercial real estate trends 2025 that align with changing consumer behaviors and technological advancements.

The allure of alternative investments lies in their potential for resilience in fluctuating markets. For instance, the demand for data centers has surged due to the increasing reliance on cloud computing and digital services. Similarly, healthcare facilities continue to be essential, driven by an aging population and evolving health needs. Self-storage units also thrive, particularly in urban areas where space is at a premium. These sectors not only diversify an investment portfolio but also enhance its stability in uncertain times.

In conclusion, by strategically incorporating alternative investments into their portfolios, investors can navigate the complexities of the current market landscape while considering commercial real estate trends 2025. This proactive approach not only safeguards against potential downturns but also positions them to seize growth opportunities that arise from ongoing technological advancements and shifting consumer preferences.

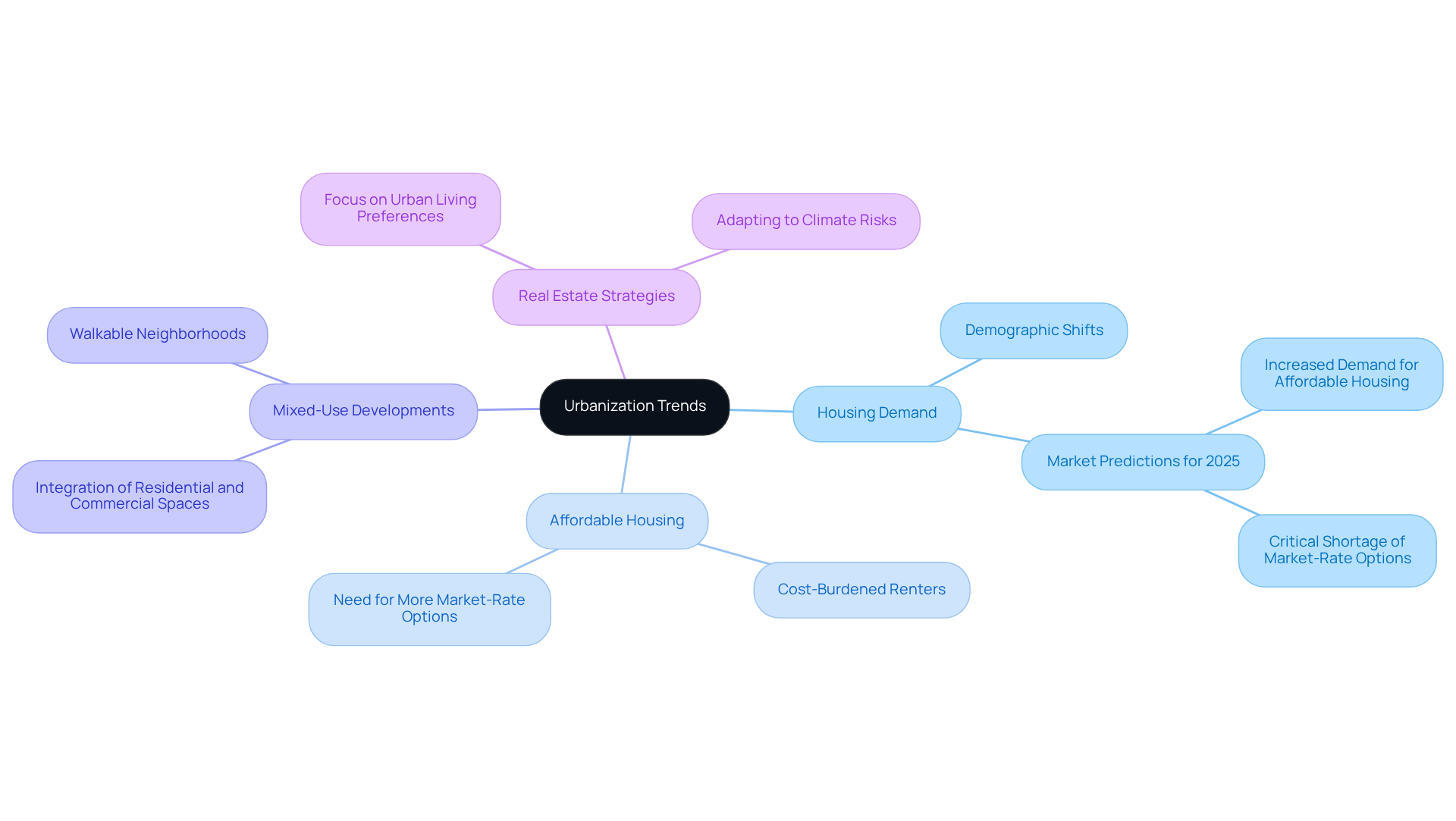

Urbanization Trends: Shaping Housing Demand

Urbanization is significantly reshaping the demand for housing, as an increasing number of individuals move to cities in pursuit of job opportunities and vibrant lifestyles. This demographic shift necessitates a diverse array of housing options, particularly affordable units and mixed-use developments that cater to a wide range of residents. The commercial real estate trends 2025 suggest that by 2025, the demand for affordable housing is projected to rise sharply, with numerous urban areas facing a critical shortage of market-rate options. Recent data indicates that nearly half of homes nationwide are at risk from severe climate events, complicating insurance availability and further intensifying the need for affordable housing solutions.

Real estate professionals must adapt to these evolving demands by focusing on locations that align with urban living preferences, such as walkable neighborhoods and convenient access to public transit. Successful mixed-use developments, which integrate residential, commercial, and recreational spaces, are emerging as effective strategies to address the needs of urban populations. As Ryan Fitzgerald aptly noted, "The housing market in the United States has experienced a standstill over the past year, but commercial real estate trends 2025 predict that there will be relief for both buyers and sellers."

Understanding the complexities of urbanization is essential for making informed investment decisions in the coming years, as the landscape continues to evolve.

Market Volatility: Strategies for Navigating Uncertainty

In a landscape characterized by significant market fluctuations, property investors must implement proactive strategies to effectively navigate uncertainty. Diversification stands out as a vital tactic; by spreading investments across diverse sectors and geographic areas, investors can markedly mitigate risks linked to economic variability. Current data reveals that approximately 14.4% of family offices' assets are allocated to real estate, highlighting the sector's essential role in diversified portfolios.

Moreover, a strong focus on cash flow and operational efficiency is crucial for maintaining stability during volatile times, as family offices must ensure liquidity and adeptly manage risks. Investors should also harness technology and data analytics, employing tools such as property management software and AI, to refine their decision-making processes. This informed approach empowers investors to capitalize on opportunities while minimizing potential losses, ultimately fostering resilience in their investment strategies.

Successful case studies, such as those illustrated in 'Navigating Real Estate Investment Challenges,' demonstrate that family offices utilizing tailored diversification strategies have effectively mitigated risks and achieved long-term growth, emphasizing the necessity of adaptability in uncertain markets.

Conclusion

The commercial real estate landscape is undergoing significant transformations as it heads toward 2025, driven by a multitude of trends reshaping investment strategies and market dynamics. Understanding these trends is essential for stakeholders aiming to navigate the complexities of this evolving sector, ensuring they remain competitive and well-informed in their decision-making processes.

Key insights from the article highlight the impact of:

- Rising interest rates on investment strategies

- Shift in office space demand due to remote work

- Increasing focus on sustainability

- Booming multifamily housing market

Additionally, the integration of technology, the growth of e-commerce, and the exploration of alternative investments are pivotal in shaping the future of commercial real estate. Each of these factors not only influences market conditions but also presents unique opportunities for investors willing to adapt their strategies accordingly.

As urbanization continues to drive housing demand and market volatility remains a constant challenge, it is crucial for investors to adopt proactive approaches. Embracing diversification, leveraging technology, and focusing on sustainable and community-oriented developments will be vital for seizing growth opportunities in this dynamic environment. By staying attuned to these commercial real estate trends for 2025, stakeholders can effectively position themselves for success in an increasingly competitive marketplace.