Overview

The article "10 Key Commercial Real Estate Trends Shaping the Market" identifies and analyzes significant trends currently influencing the commercial real estate sector. It highlights:

- The rise of AI in property management

- The shift towards sustainability

- The impact of remote work on office space

- The growing demand for mixed-use developments

These trends are reshaping investment strategies and property designs in response to evolving market dynamics, prompting investors to adapt and innovate. Understanding these trends is essential for making informed decisions in today’s competitive landscape.

Introduction

The commercial real estate landscape is experiencing a significant transformation, propelled by a convergence of technological advancements, shifting consumer preferences, and evolving market dynamics. For industry professionals navigating these changes, understanding the key trends shaping the market is essential for making informed investment decisions.

Investors must consider what strategies will be necessary to thrive in this rapidly changing environment. Furthermore, emerging trends such as:

- sustainability

- AI integration

- the rise of mixed-use developments

are poised to redefine the future of commercial real estate.

Zero Flux: Your Daily Source for Commercial Real Estate Insights

Zero Flux distinguishes itself as a premier daily newsletter dedicated to delivering essential insights into the business property market. By meticulously curating data from over 100 reputable sources, including those behind paywalls, Zero Flux equips subscribers with a comprehensive overview of the latest developments. This unwavering commitment to factual reporting, devoid of subjective opinions, establishes the newsletter as an indispensable resource for industry professionals and enthusiasts navigating the complexities of the property landscape.

The significance of data-informed insights in business property cannot be overstated. With over 30,000 subscribers relying on Zero Flux for its thorough analysis, the newsletter plays a pivotal role in shaping investor decisions. Curated insights not only enhance understanding of market dynamics but also empower investors to make informed choices in a rapidly evolving environment. As the property market continues to adapt to changing circumstances, the commercial real estate trend highlights the necessity for trustworthy, data-supported information that remains crucial for success.

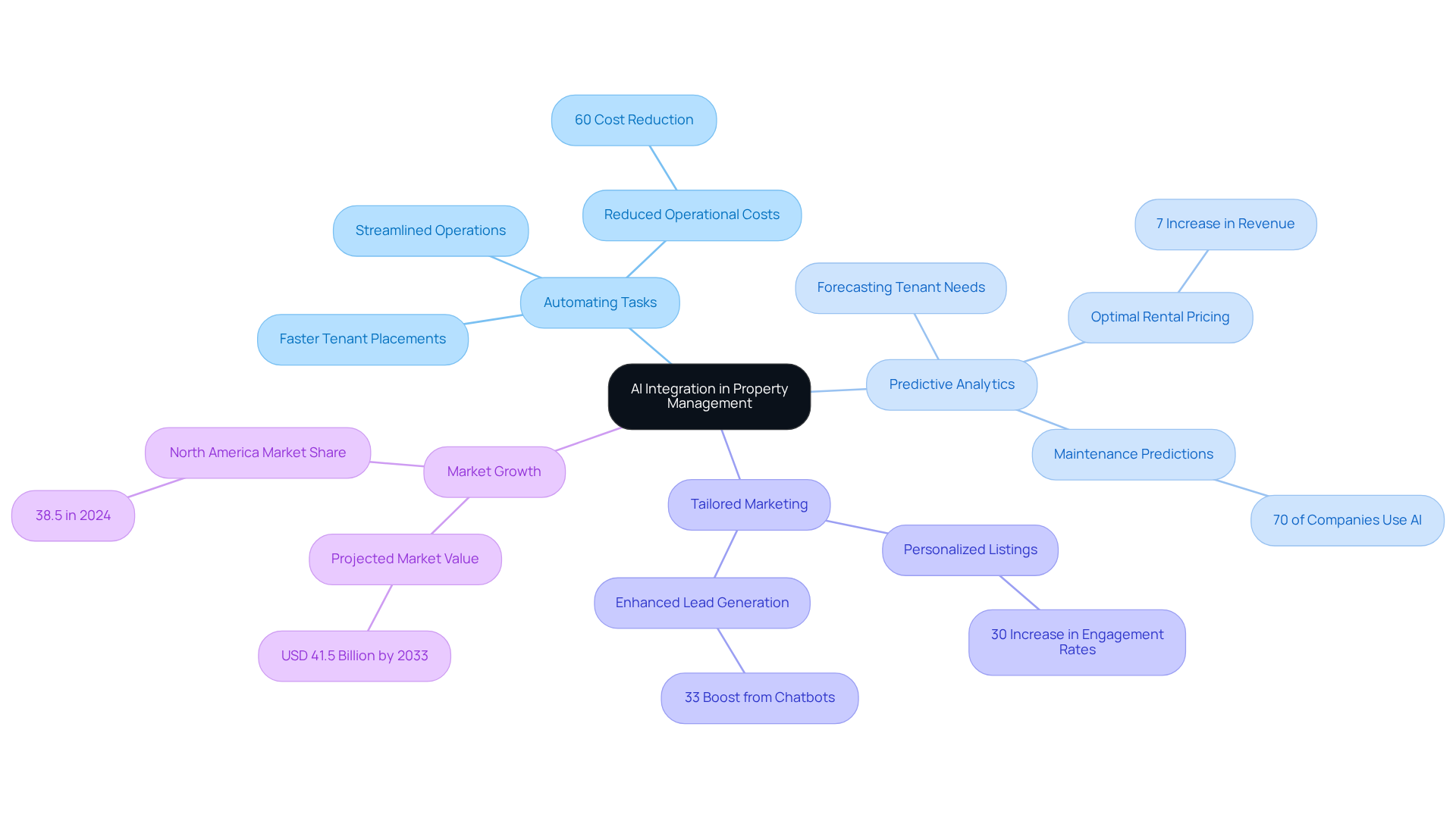

AI Integration: Revolutionizing Property Management and Marketing

Artificial Intelligence (AI) is rapidly becoming an essential element in the commercial real estate trend, fundamentally transforming asset management and marketing strategies. By automating routine tasks, AI tools significantly enhance tenant experiences and streamline operations. For instance, predictive analytics can accurately forecast tenant needs, empowering managers to proactively address issues and boost satisfaction.

Moreover, AI-driven marketing platforms tailor campaigns for specific demographics, leading to engagement rates and conversion rates that can soar by up to 30% through personalized listings. This tailored approach not only elevates conversion rates but also cultivates stronger relationships between landlords and tenants, resulting in a 30% improvement in tenant retention. As AI technology evolves, its integration into property operations is expected to yield even greater efficiencies, thereby influencing the commercial real estate trend and reshaping how assets are managed and marketed in a competitive landscape.

The AI property market is projected to reach USD 41.5 billion by 2033, underscoring the critical role of AI in the sector. This growth highlights the importance for investors to consider AI's impact on their strategies, positioning themselves advantageously in a rapidly changing market.

Sustainability Initiatives: The Shift Towards Eco-Friendly Commercial Properties

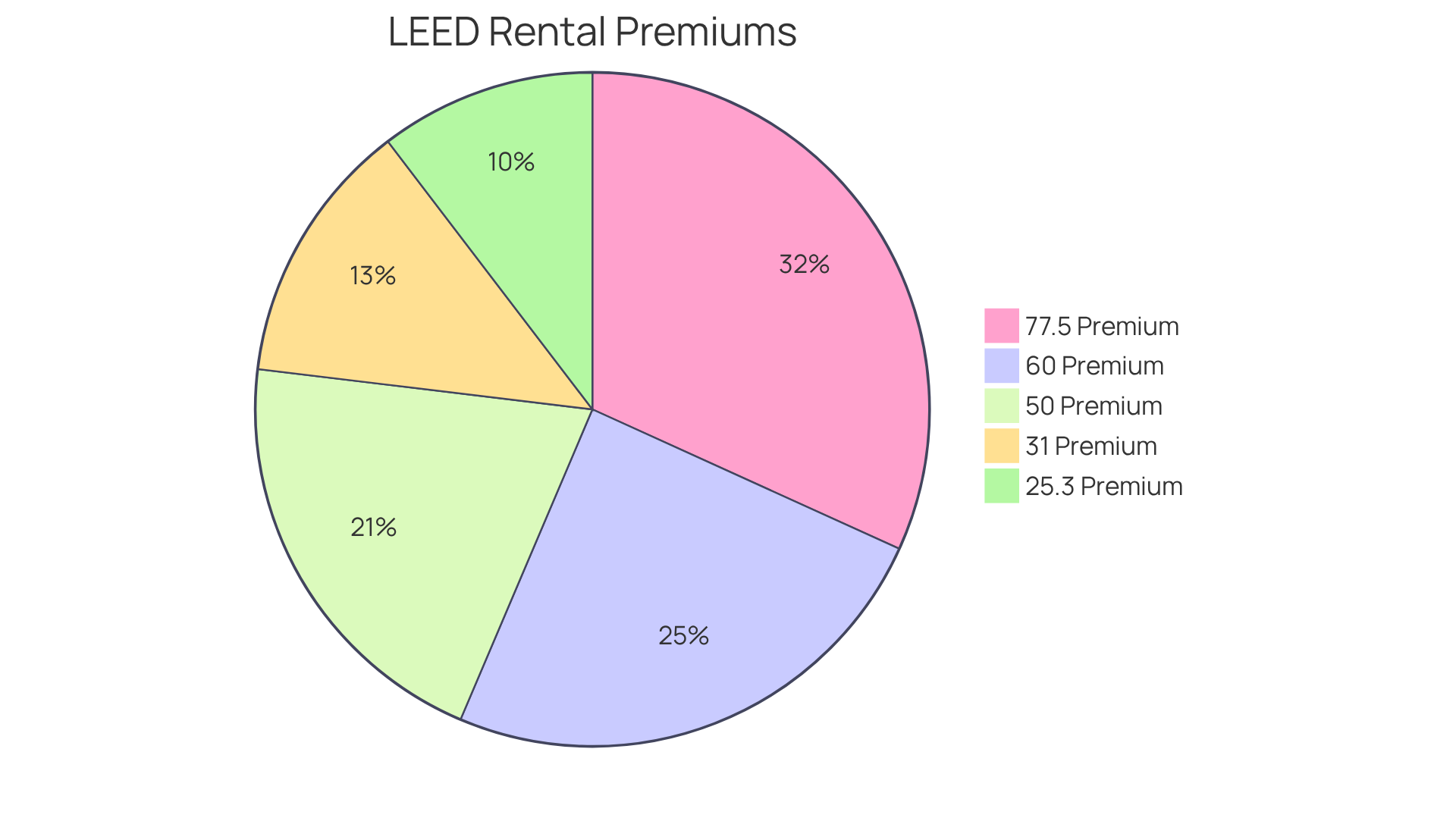

The commercial real estate sector is experiencing a transformative shift towards sustainability, driven by escalating consumer demand and stringent regulatory frameworks. Eco-friendly buildings not only minimize environmental impact but also attract a growing number of tenants who prioritize sustainable living.

Green building certifications, energy-efficient designs, and the use of sustainable materials are swiftly becoming standard practices within the industry. Investors are increasingly recognizing that sustainable properties can command higher rental rates and lower vacancy rates, positioning them as a wise investment choice in today’s competitive market.

For example, LEED-certified buildings can secure rental premiums ranging from 25.3% to 77.5% over their non-certified counterparts, as highlighted in a CBRE analysis, underscoring the financial benefits of eco-friendly investments.

However, accurately valuing green buildings poses challenges, as traditional valuation methods may overlook the long-term advantages of sustainable features. As the market continues to evolve, the emphasis on sustainability is not merely a commercial real estate trend but a fundamental transformation that is reshaping the landscape of business properties.

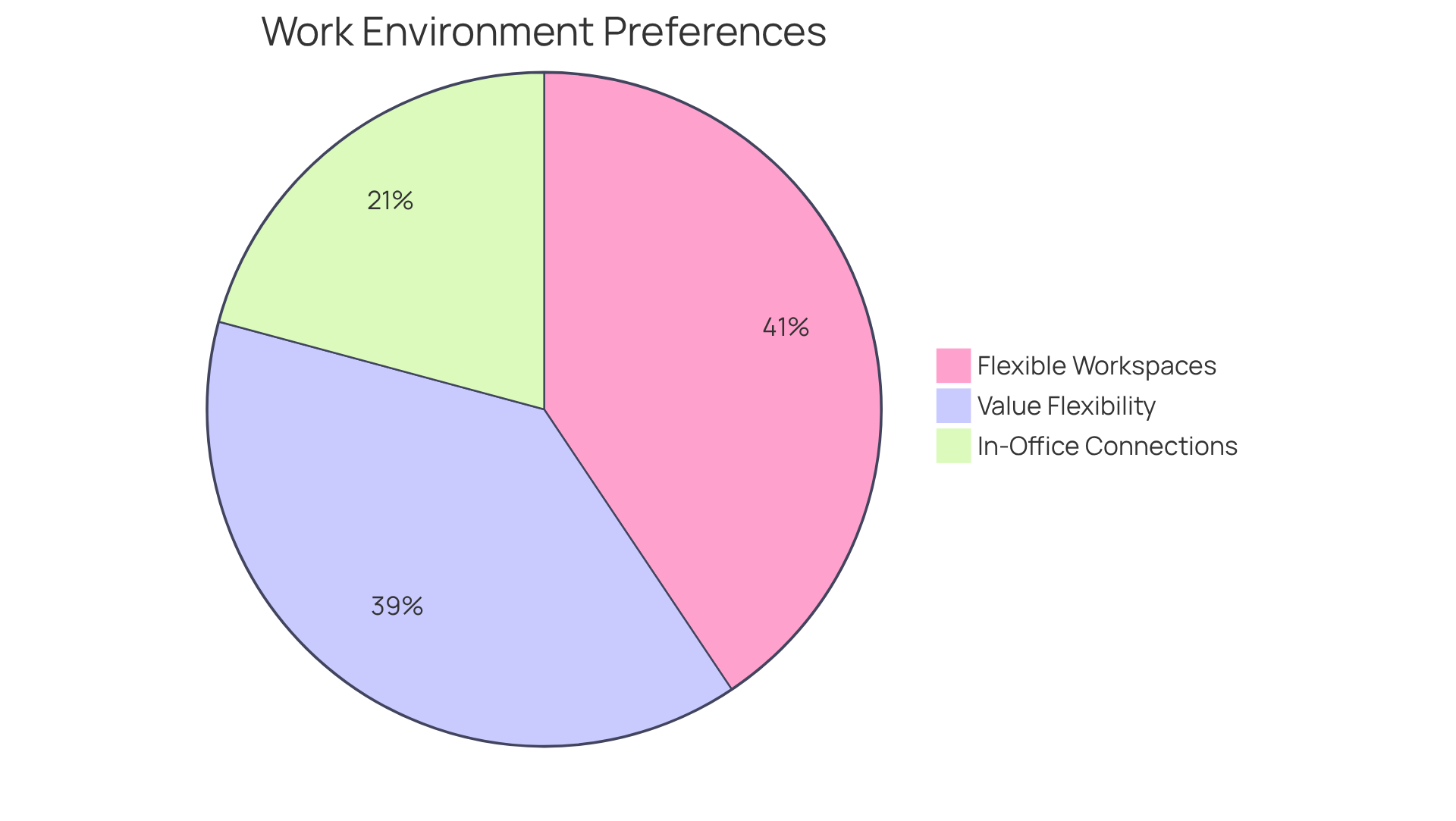

Remote Work Impact: Redefining Office Space Requirements

The rise of remote work has fundamentally transformed the requirements for office space within the business property sector. Companies are increasingly reducing their physical office footprints, with 80% of office occupiers embracing flexible workspaces that support hybrid models. As of Q1 2025, 4 in 10 jobs allow some degree of remote work, reinforcing the trend towards flexible work arrangements.

This shift has resulted in a notable increase in demand for co-working spaces, specifically designed to encourage collaboration when employees are present on-site. In fact, 76% of workers indicate that flexibility in their work environment significantly influences their desire to remain with an employer, underscoring how co-working spaces meet these evolving preferences.

Furthermore, 41% of office workers believe that working in the office fosters connections with colleagues, illustrating the advantages of both remote and in-office work. As businesses navigate this new landscape, it becomes essential for investors and developers to grasp the implications of the commercial real estate trend on office space design and utilization.

The future of co-working spaces appears promising, with industry leaders such as George Penn advocating for the perception of hybrid work as an opportunity, emphasizing adaptable environments that prioritize both individual focus and team interaction. This evolution not only reflects shifting employee preferences but also highlights the necessity for innovative strategies in light of the commercial real estate trend.

Investors should consider incorporating flexible workspace solutions into their portfolios to align with these emerging trends.

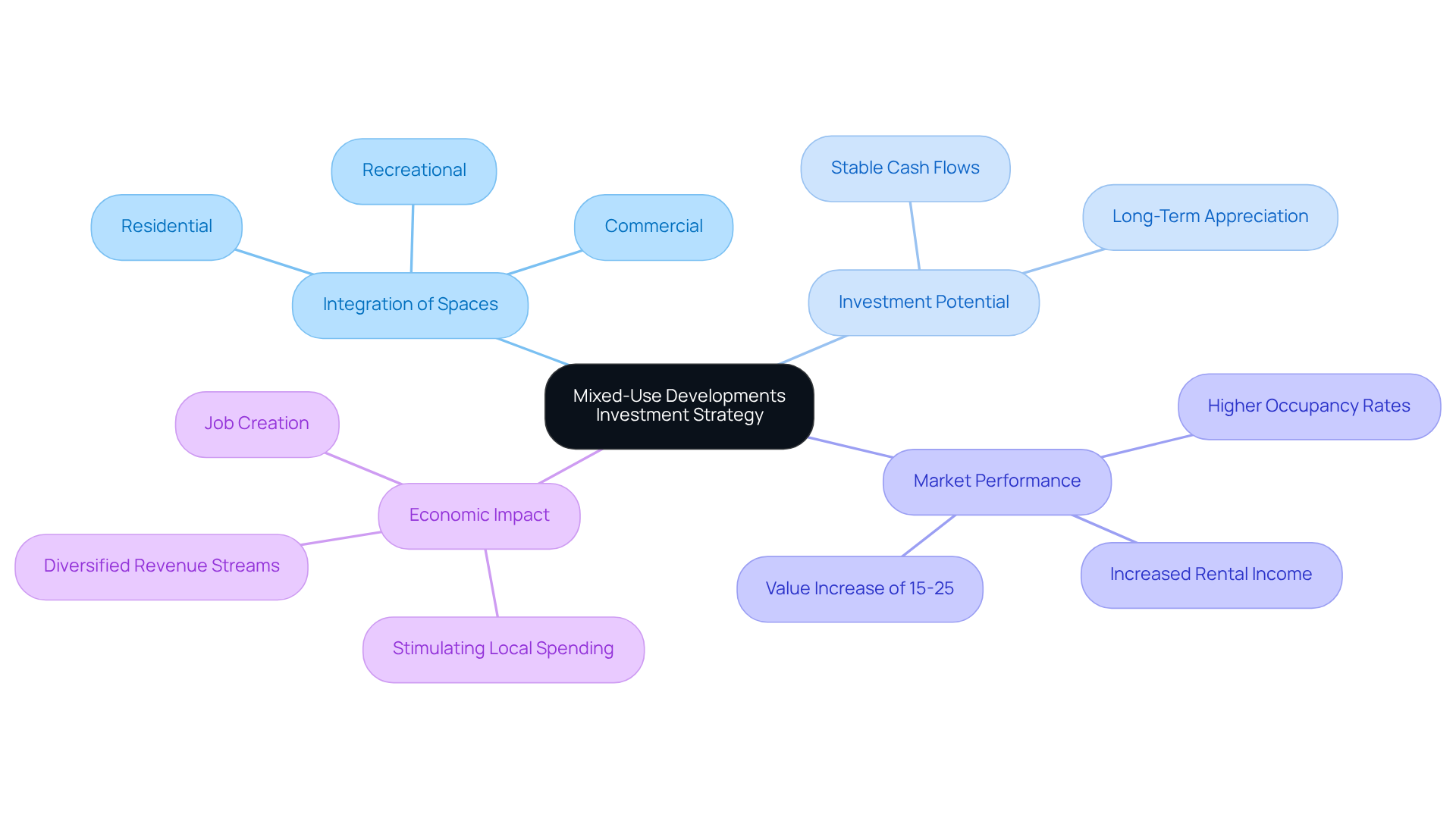

Mixed-Use Developments: A Growing Investment Strategy

Mixed-use developments are increasingly recognized as a strategic investment aligned with the commercial real estate trend. By integrating residential, commercial, and recreational spaces, these projects cultivate vibrant communities that attract a diverse range of tenants. This multifaceted strategy not only enhances real estate values but also aligns with the commercial real estate trend by mitigating risks associated with market fluctuations.

Investors are drawn to the potential for stable cash flows and long-term appreciation, highlighting the commercial real estate trend of mixed-use developments as a focal point in their portfolios. Notably, the commercial real estate trend shows that assets of this kind have demonstrated an average increase in value of 15% to 25% compared to single-use projects, underscoring their investment potential.

Furthermore, the commercial real estate trend of mixed-use developments can achieve higher occupancy rates and rental income, further enhancing their appeal. As John Jacob Astor wisely advised, 'Buy land near a growing city!'—a principle that aligns seamlessly with the rising trend of mixed-use developments, which flourish in urban areas characterized by high foot traffic and accessibility to public transport.

This investment strategy not only diversifies revenue streams but also reflects the commercial real estate trend of contributing to local economic growth by creating jobs and stimulating spending, making it a compelling choice for forward-thinking investors.

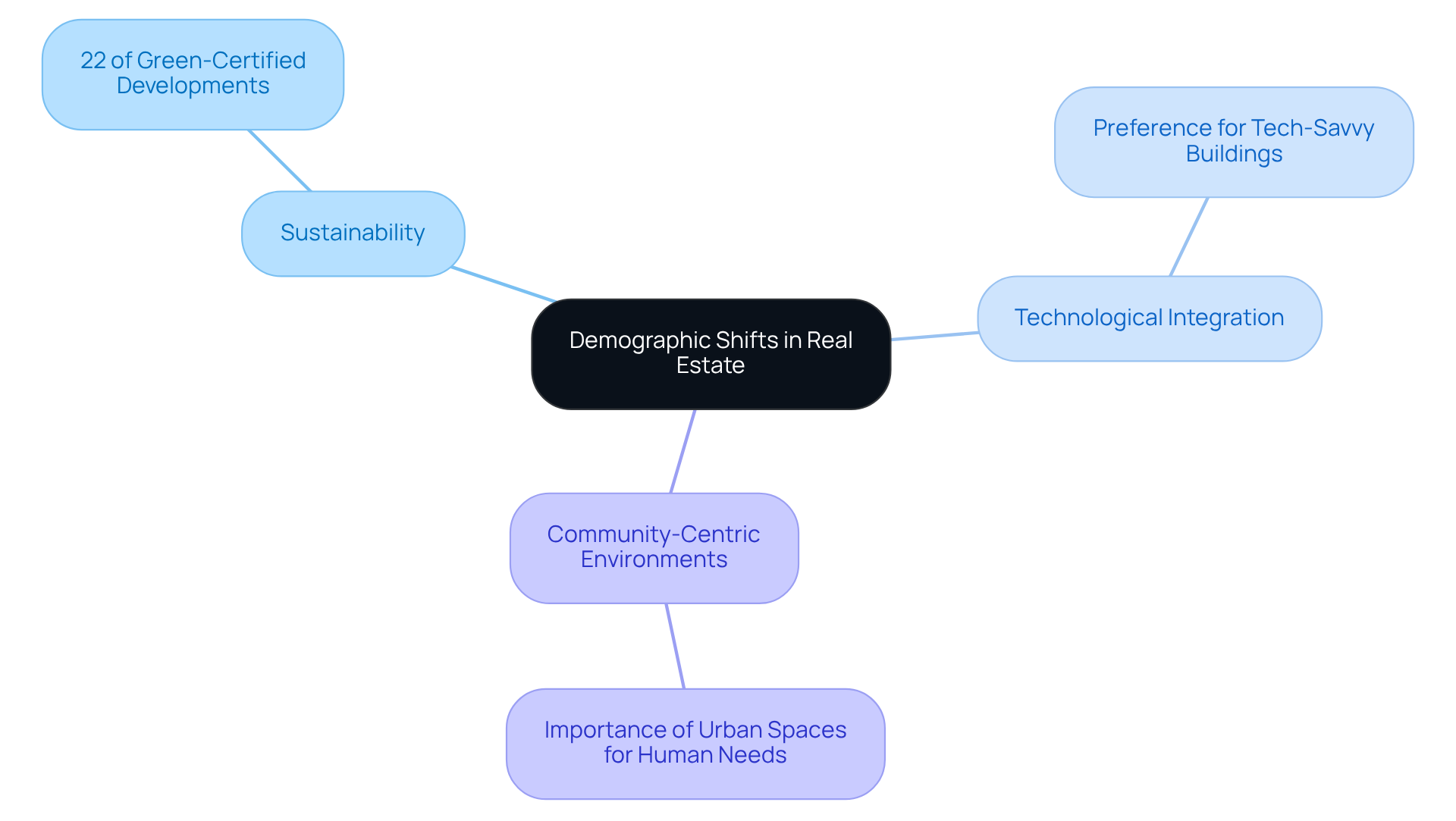

Demographic Shifts: Millennials and Gen Z Driving Market Changes

Millennials and Gen Z are fundamentally reshaping the real estate landscape with their distinct preferences and values. These generations emphasize sustainability, technological integration, and community-centric environments. As they increasingly enter the workforce and assert their purchasing power, their demand for eco-friendly buildings and mixed-use developments is reshaping property design and investment strategies. For instance, green-certified structures now represent 22% of new business developments, reflecting a shift towards sustainability that resonates with these younger demographics.

Additionally, Gen Z currently possesses $360 billion in disposable income, projected to rise to $12 trillion by 2030, underscoring their financial influence on market trends. Comprehending these demographic changes is crucial for stakeholders seeking to adjust their offerings to the shifting market dynamics, as the preferences of these generations will greatly impact future property trends. As Jan Gehl emphasizes, the design of urban spaces must prioritize human needs, further highlighting the importance of community-oriented developments.

E-Commerce Growth: Increasing Demand for Logistics Facilities

The rapid expansion of e-commerce is fundamentally transforming the business property landscape, particularly within the logistics sector. As online shopping gains traction, the demand for strategically located logistics facilities is surging. Companies are increasingly investing in distribution centers and last-mile delivery hubs to fulfill consumer expectations for swift delivery. This commercial real estate trend not only highlights the evolving market dynamics but also presents significant opportunities for investors eager to capitalize on the escalating need for logistics space, particularly in urban areas where demand peaks.

Interest Rate Trends: Navigating Financing Challenges

Interest rates play a pivotal role in the business real estate landscape, exerting a significant influence on borrowing costs and investment strategies. As we look ahead to 2025, the commercial real estate trend suggests that rates are anticipated to remain elevated, driving investors to seek innovative financing solutions and alternative funding sources. The current federal funds rate, held between 4.25% and 4.50%, reflects a cautious stance by the Federal Reserve, which is expected to implement gradual rate cuts in response to evolving economic conditions. In this context, it is imperative for investors to remain vigilant about interest rate trends, enabling them to make informed decisions and optimize their capital structures.

In addressing financing challenges, securing fixed-rate loans becomes essential, as they offer consistent payments and safeguard against rising rates. After experiencing volatility in previous years, commercial mortgage rates stabilized in 2024; however, the commercial real estate trend indicates that increased operating costs—particularly in insurance—continue to pose risks for commercial assets in 2025. Investors must also consider the implications of the loan-to-value (LTV) ratio, as assets financed at lower LTVs often secure better rates, potentially saving thousands in interest expenses. For instance, assets financed at 50-60% LTV can achieve rates 0.25-0.50% lower than those at 65-75% LTV.

Expert insights highlight the importance of understanding the dynamics of business loans, which are often valued based on asset performance rather than solely on borrower credit. Properties exhibiting strong debt service coverage ratios (DSCR) above 1.40x have recently secured rates 0.20-0.35% lower than those barely meeting minimum qualifying ratios. This emphasizes the necessity for investors to maintain robust financial metrics to enhance their financing options, especially considering the current commercial real estate trend.

As the market adapts to these conditions, successful financing strategies will encompass a blend of traditional and creative approaches. Leveraging relationships with private creditors and bridge lenders, who have been instrumental in providing financing during economic challenges, will be crucial. By staying informed and adaptable, investors can navigate the complexities of the business property market and position themselves for success in a high-interest environment.

Health and Wellness: Designing Spaces for Better Living

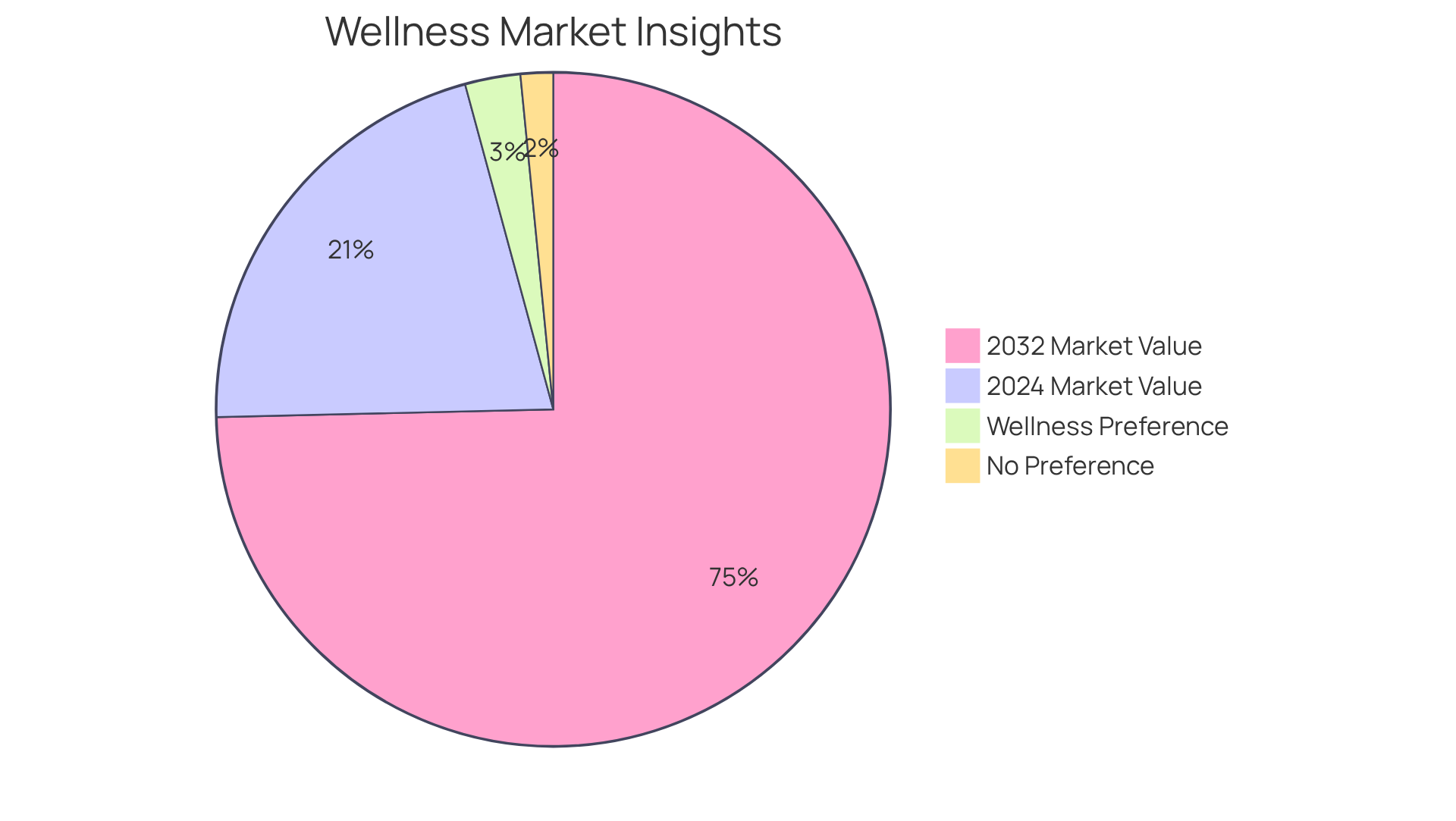

The increasing emphasis on health and wellness is reshaping the commercial real estate trend, as developers increasingly recognize the vital role of creating environments that foster well-being. Key features such as biophilic design, ample natural light, and wellness amenities are becoming essential components of new developments. This transformation not only enhances tenant satisfaction but also aligns with the commercial real estate trend that elevates real estate values.

Studies indicate that properties equipped with wellness attributes experience a significant uptick in demand. Notably, around 63% of homebuyers in urban India favor housing projects that provide comprehensive fitness and wellness facilities, underscoring the market's responsiveness to health-conscious living.

Furthermore, the commercial real estate trend indicates that the wellness housing market is projected to grow from USD 501.70 Billion in 2024 to over USD 1,770.48 Billion by 2032, emphasizing the increasing importance of wellness-focused developments. As consumer interest in wellness continues to rise, integrating these principles into building design will be crucial for attracting and retaining tenants in 2025 and beyond.

As Ophelia Yeung, a senior researcher, aptly stated, "There is no going back to ignoring wellness, as we spend trillions of dollars each year to build homes, infrastructure, and places for work and play.

Smart Cities: The Future of Urban Development and Real Estate

Smart cities are revolutionizing urban development by integrating cutting-edge technologies that enhance sustainability, efficiency, and overall quality of life. As these initiatives gain momentum, the commercial real estate trend is being significantly influenced by the increasing demand for locations equipped with smart technologies. Key features such as:

- energy-efficient systems

- integrated transportation solutions

- enhanced connectivity

are becoming essential components of urban planning. For instance, AI-driven traffic management systems have demonstrated their efficiency by decreasing congestion and travel durations by over 25% in Los Angeles, thereby enhancing the appeal of intelligent real estate to prospective buyers and investors.

Moreover, it is anticipated that 54.4% of homes in the United States will be encompassed by smart home technology by 2023, underscoring the growing demand for intelligent residences. As the smart city concept continues to evolve, real estate stakeholders must adapt to these technological advancements and the commercial real estate trend to maintain a competitive edge in the dynamic market landscape. The integration of smart technologies not only boosts property desirability but also aligns with the increasing emphasis on sustainable development. Thus, it is imperative for industry professionals to stay informed about the commercial real estate trend to effectively navigate the future of urban real estate.

Conclusion

The commercial real estate landscape is experiencing a profound transformation, driven by various emerging trends. This evolution features the integration of technology, a heightened focus on sustainability, and shifting consumer preferences that are reshaping the market's dynamics. As the industry navigates these changes, grasping these trends is essential for stakeholders seeking to excel in a competitive arena.

Key insights underscore the increasing significance of artificial intelligence in property management, the surging demand for eco-friendly buildings, and the ramifications of remote work on office space requirements. Furthermore, the rise of mixed-use developments and the influence of younger generations, such as Millennials and Gen Z, are propelling innovative investment strategies. With e-commerce's rapid expansion, the necessity for logistics facilities is also on the rise, while interest rate trends present both challenges and opportunities for investors.

As the commercial real estate market continues to evolve, it is crucial for industry professionals to remain informed and adaptable. Embracing these trends not only boosts investment potential but also fosters sustainable growth and community development. By prioritizing technology integration, sustainability, and the needs of modern consumers, stakeholders can strategically position themselves in a landscape increasingly defined by innovation and resilience.