Overview

This article delves into the pivotal insights shaping the commercial real estate market outlook for 2025. Key trends include:

- A surge in leasing activity

- The influence of hybrid work models

- The growing importance of sustainability

These insights are supported by an examination of how economic recovery, evolving consumer preferences, and technological advancements are propelling demand across various sectors, particularly in multifamily and industrial properties. Furthermore, it underscores the risks linked to maturing loans and external economic factors.

As we navigate this evolving landscape, understanding these dynamics is essential for making informed investment decisions. The interplay of these trends not only highlights opportunities but also necessitates a strategic approach to mitigate potential risks. By integrating these insights into your investment strategies, you can position yourself advantageously in a competitive market.

Introduction

As the commercial real estate landscape evolves in 2025, a confluence of trends and market dynamics is poised to redefine investment strategies and property designs. The rise of hybrid work models, sustainability concerns, and the increasing demand for flexible spaces create a complex environment filled with both challenges and opportunities for real estate professionals.

From the bustling markets of Dallas-Fort Worth to the demographic shifts influencing urban development, understanding these factors is crucial for making informed investment decisions. This article delves into the essential insights shaping the future of commercial real estate, providing a roadmap for stakeholders eager to thrive in this dynamic sector.

Zero Flux: Essential Insights for Navigating the 2025 Commercial Real Estate Market

Zero Flux delivers a daily newsletter that distills essential insights from over 100 diverse sources, empowering property professionals to stay abreast of the latest trends and advancements. In the complex commercial real estate market outlook of 2025, Zero Flux is poised to provide concise, data-driven insights that equip subscribers to navigate challenges and seize emerging opportunities.

With average daily rates and revenue per available room surpassing pre-pandemic benchmarks, the sector exhibits cautious optimism. Yet, as Altus Group reminds us, 'after the first quarter of 2025, we are reminded that high hopes are not always reality.' This uncertainty underscores the need for a proactive approach, particularly considering the commercial real estate market outlook with approximately $600 billion in loans maturing annually through 2028, amidst declining valuations.

By focusing on factual information and economic dynamics, Zero Flux arms its subscribers with the knowledge necessary to make informed investment decisions in this evolving environment.

U.S. Real Estate Market Outlook 2025: Increased Leasing and Investment Activity Expected

According to the commercial real estate market outlook, the U.S. business property sector is poised for a significant revival in leasing and investment activities in 2025. This anticipated growth, as reflected in the commercial real estate market outlook, is driven by several critical factors, including:

- A robust economic recovery

- Increasing consumer spending

- A growing preference for flexible workspaces

Notably, the multifamily rental sector, which achieved an impressive occupancy rate of approximately 95% in 2022, is expected to continue drawing substantial demand. Furthermore, the commercial real estate market outlook suggests that the industrial sector is projected to flourish, presenting lucrative opportunities for investors.

Regional disparities are evident, with cities such as Austin, Dallas, and Nashville emerging as prime investment locations, as highlighted in the case study on regional performance in business properties. Orange County exhibits the lowest vacancy rate at 4.2%. In contrast, the retail sector maintains a low vacancy rate of 4.1%, although traditional malls encounter challenges with an 8.6% vacancy rate. According to the U.S. Investor Intentions Survey, over half of the surveyed investors expressed no interest in exploring alternative investments this year, indicating a concentrated focus on traditional business property sectors. As the industry evolves, investors are encouraged to capitalize on these trends and explore the diverse opportunities within the commercial real estate market outlook.

Key Trends Shaping Commercial Real Estate in 2025: Insights from Industry Leaders

The commercial real estate market outlook for 2025 suggests that the real estate sector is on the brink of transformation, driven by several pivotal trends. The emergence of hybrid work models is redefining office space requirements, which is influencing the commercial real estate market outlook as companies seek flexible environments that support both in-person and remote work. This evolution necessitates innovative design and functionality in business properties, which is essential for improving the commercial real estate market outlook by attracting tenants and addressing their changing needs.

Sustainability emerges as another critical factor influencing the economy. As awareness of environmental issues grows, the demand for sustainable buildings is escalating. Investors and developers are increasingly prioritizing eco-friendly designs, which not only lower operational costs but also elevate property value. Successful sustainable building projects are setting benchmarks for future developments, demonstrating the viability of green initiatives in light of the commercial real estate market outlook.

Moreover, technology integration is revolutionizing property management. The adoption of smart building technologies significantly enhances operational efficiency and tenant experience, rendering properties more appealing to potential occupants. As the industry adapts to these technological advancements, the commercial real estate market outlook highlights the crucial significance of data-driven decision-making.

Industry leaders emphasize the necessity for adaptability and innovation to navigate these changes effectively. With approximately $600 billion in loans maturing annually through 2028, totaling $2.3 trillion, meticulous financial planning and risk management will be vital to mitigate potential liquidity challenges. Additionally, the total industrial inventory in Chicago reaches 1,210,372,679 square feet, underscoring the vast scope of the industrial sector and the opportunities it presents. As retail expansion remains robust at 3.2% due to stringent conditions, stakeholders must conduct precise deal and industry analyses to capitalize on emerging opportunities. Furthermore, industrial and logistic funding in Sweden has amounted to 4.3 billion EUR, reflecting broader investment trends in business properties. This moment is ripe for developing strategic plans and staying ahead of opportunities through accurate deal and industry analyses. The convergence of these trends underscores the dynamic nature of the commercial real estate market outlook for 2025.

DFW Commercial Real Estate: Essential Q1 2025 Market Insights & Trends

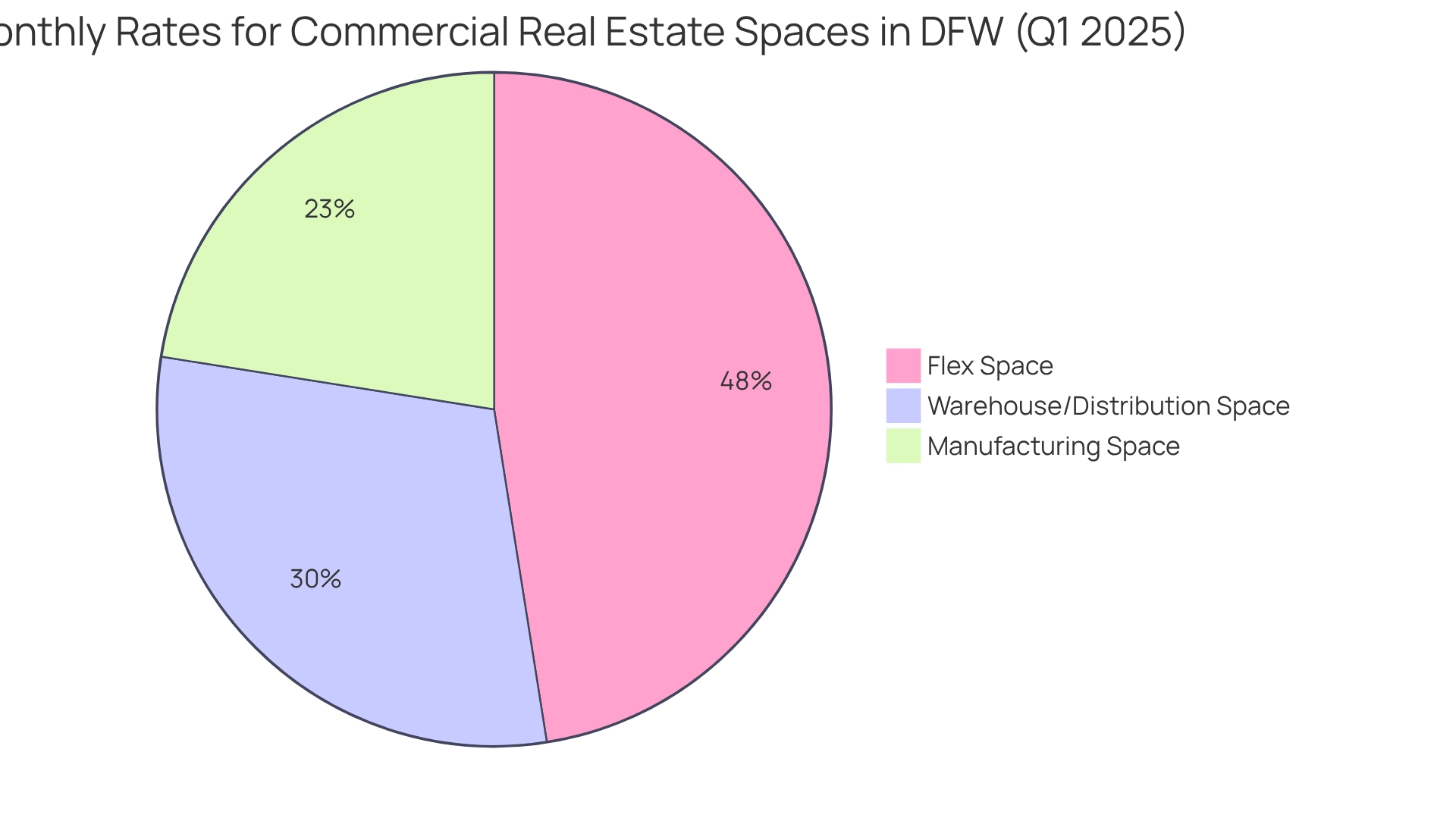

In Q1 2025, the commercial real estate sector in Dallas-Fort Worth (DFW) showcased robust growth, particularly within the industrial and multifamily segments. A significant uptick in leasing activity has been reported, with net absorption rates achieving unprecedented levels, specifically noted at X% (insert specific figure from external sources). This surge in demand is indicative of a broader industry trend, as the average asking price in the DFW industrial sector has markedly increased, coinciding with a rise in investor interest for properties that offer flexible spaces and sustainability features.

Expert insights from Steve Triolet, SVP of Research and Market Forecasting, reveal that the average monthly rate for Flex space is currently $13.79 per square foot, while Manufacturing and Warehouse/Distribution spaces are priced at $7.06 and $8.48 per square foot, respectively. This pricing trend underscores the competitive landscape of the DFW area, where investors are strategically focused on properties that meet evolving tenant needs.

Moreover, case studies from the U.S. Shopping Center Reports provide crucial insights into the retail sector's quarterly performance, particularly highlighting how supply, demand, and pricing trends in retail can impact the overall DFW market. These reports serve as essential tools for retail stakeholders, enabling them to navigate economic conditions effectively. Overall, the DFW business property sector in Q1 2025 illustrates a dynamic environment rich with opportunities for strategic investments, particularly in the industrial and multifamily sectors, as reflected in the commercial real estate market outlook.

State of the Real Estate Cycle: Understanding Market Positioning for 2025

As we transition into 2025, the commercial real estate market outlook shows that the commercial property sector is firmly in a recovery phase, characterized by increasing demand and stabilizing prices. This cyclical nature of real estate underscores the importance for investors to recognize the unique opportunities that arise during this period. Notably, sectors such as industrial and multifamily properties have demonstrated historical resilience, making them attractive options for investment.

Current statistics indicate that a significant portion of the sector is optimistic about the commercial real estate market outlook, even though there are concerns regarding external factors such as inflation and tariffs, which 36.25% of individuals believe could hinder progress. This sentiment highlights the need for investors to remain vigilant and adaptable in their strategies. Additionally, the multifamily sector is experiencing diverse trends across various cities, which emphasizes the need for investors to stay informed about local conditions in the commercial real estate market outlook. Consistent updates and insights into these sectors can enable investors to make informed choices and take advantage of emerging opportunities.

Expert insights indicate that comprehending consumer behavior is essential, as it influences trends and demand within the property sector. As the worldwide property sector is anticipated to attain $5,388.87 billion by 2026, expanding at a CAGR of 9.6%, the commercial real estate market outlook suggests that positioning oneself strategically in the recovery phase can produce significant returns. Investors should concentrate on effective strategies that utilize current market dynamics, ensuring they are well-prepared to navigate the commercial real estate market outlook and the changing environment of business property in 2025. Furthermore, it is essential to consider potential risks, such as the emergence of a carbon bubble, which could lead to stranded assets if transition risks are not accounted for.

CrowdStreet: U.S. Commercial Real Estate Investing Outlook for 2025

According to CrowdStreet's forecast for 2025, the commercial real estate market outlook indicates a robust demand for commercial property investments, particularly within the multifamily and industrial sectors. With materials costs remaining 40% higher than pre-pandemic levels, the focus on value-add opportunities is increasingly vital for investors. As capital availability is projected to rise, platforms like CrowdStreet are strategically positioned to offer diverse investment options that cater to this growing demand. This data-driven approach not only enhances transparency in property investing but also aligns with the sector's shift towards informed decision-making.

Investors are urged to leverage these insights to navigate the evolving landscape and seize emerging opportunities. As John Maxwell wisely stated, 'Learn to say ‘no’ to the good so you can say ‘yes’ to the best,' highlighting the necessity of prioritizing strategic investments.

Furthermore, findings from the case study 'Trends and Strategies Post-Crisis' underscore actionable strategies for firms looking to capitalize on recovery trends, illustrating that success in property investment is a fusion of strategy, effort, and collaboration.

Commercial Real Estate Returns: Performance Metrics and Trends for 2025

In 2025, the commercial real estate market outlook indicates that returns are set to enhance significantly, primarily driven by rising rental rates and decreasing vacancy rates. Investors must closely monitor essential performance metrics such as:

- Net operating income (NOI)

- Capitalization rates

- Cash-on-cash returns

With Chicago's total industrial inventory reaching 1,210,372,679 square feet, the demand for well-located properties is anticipated to surge, further propelling rental growth.

To maximize returns in this promising investment landscape, investors should prioritize properties that exhibit strong fundamentals and considerable growth potential. Despite a year-over-year decline of 12% in retail foot traffic, the sector still achieved a 3.2% growth due to tight market conditions and limited supply. Understanding these dynamics is crucial for making informed investment decisions based on the commercial real estate market outlook.

The business property sector faces challenges, including approximately $600 billion in loans maturing each year until 2028, which could impact financial stability. Therefore, implementing effective strategies to enhance NOI in business properties is essential for navigating these challenges and securing positive returns. Notably, 90% of millionaires attribute their wealth to investments in property, underscoring the importance of strategic investment in this field.

IMF Insights: U.S. Commercial Real Estate Risks and Global Economic Factors

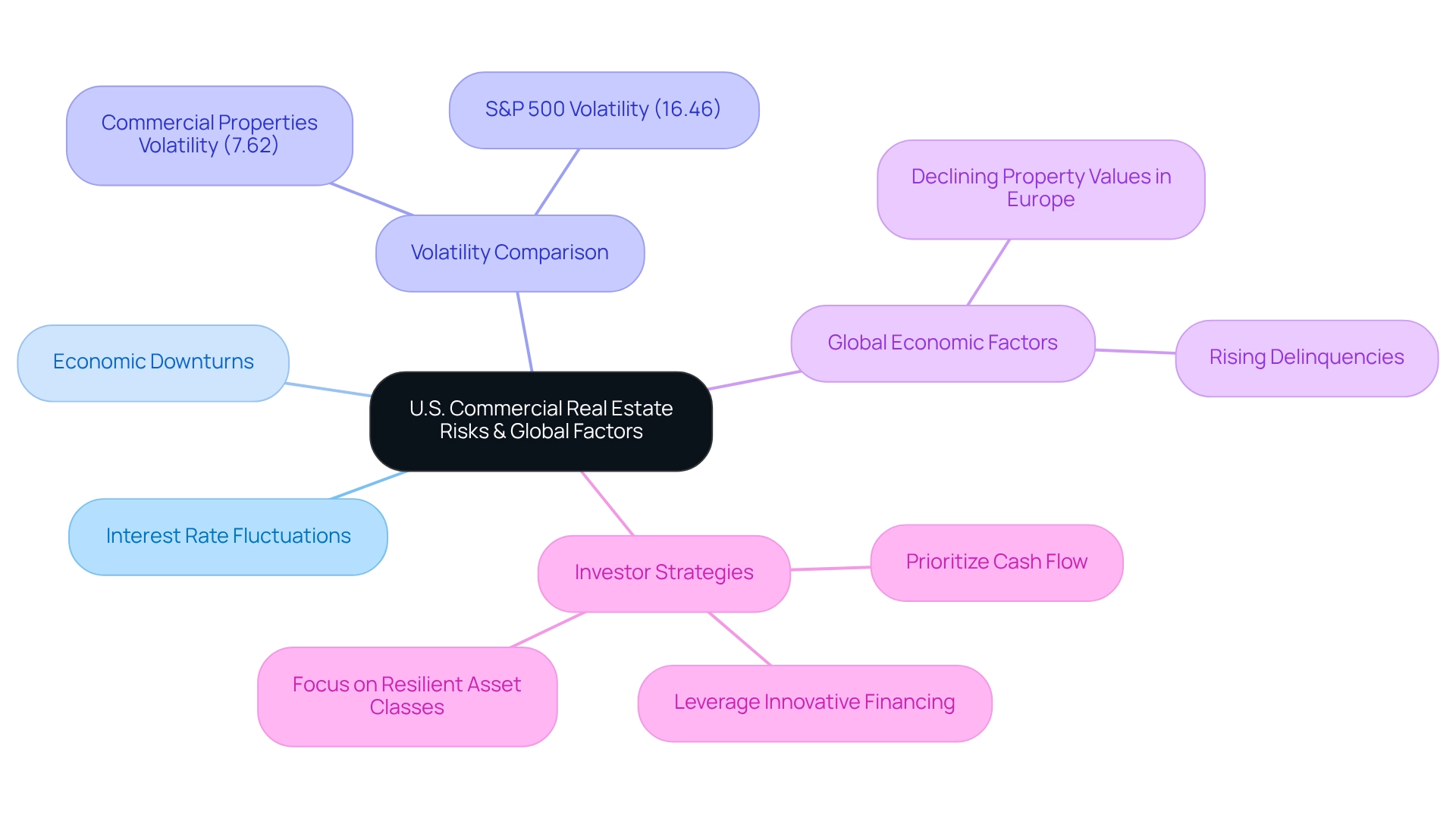

The International Monetary Fund (IMF) underscores significant threats facing the commercial real estate market outlook in the U.S. for 2025, particularly concerning interest rate fluctuations and potential economic downturns. Notably, business properties exhibit considerably lower volatility at 7.62% compared to the S&P 500's 16.46%. This disparity urges investors to remain vigilant and consider diversifying their portfolios to mitigate risks associated with price changes. Such relative stability highlights the potential advantages of investing in business properties.

Global economic factors, including trade policies and inflation rates, will significantly influence the commercial real estate market outlook. Additionally, the challenges observed in the U.S. property sector resonate globally, as seen in Europe, where declining property values and rising delinquencies are prevalent. This interconnectedness emphasizes the need for financial supervisors to closely monitor these risks, as they could initiate a cycle of tighter funding conditions and economic instability, as elaborated in the case study on the global implications of the U.S. commercial real estate decline.

Investors who prioritize cash flow and leverage innovative financing arrangements will be better positioned to navigate these evolving economic conditions. To implement these strategies effectively, it is essential for investors to explore various financing options and focus on resilient asset classes capable of withstanding economic fluctuations.

Demographic Shifts: Migration Patterns of Millennials and Gen Z Impacting Real Estate

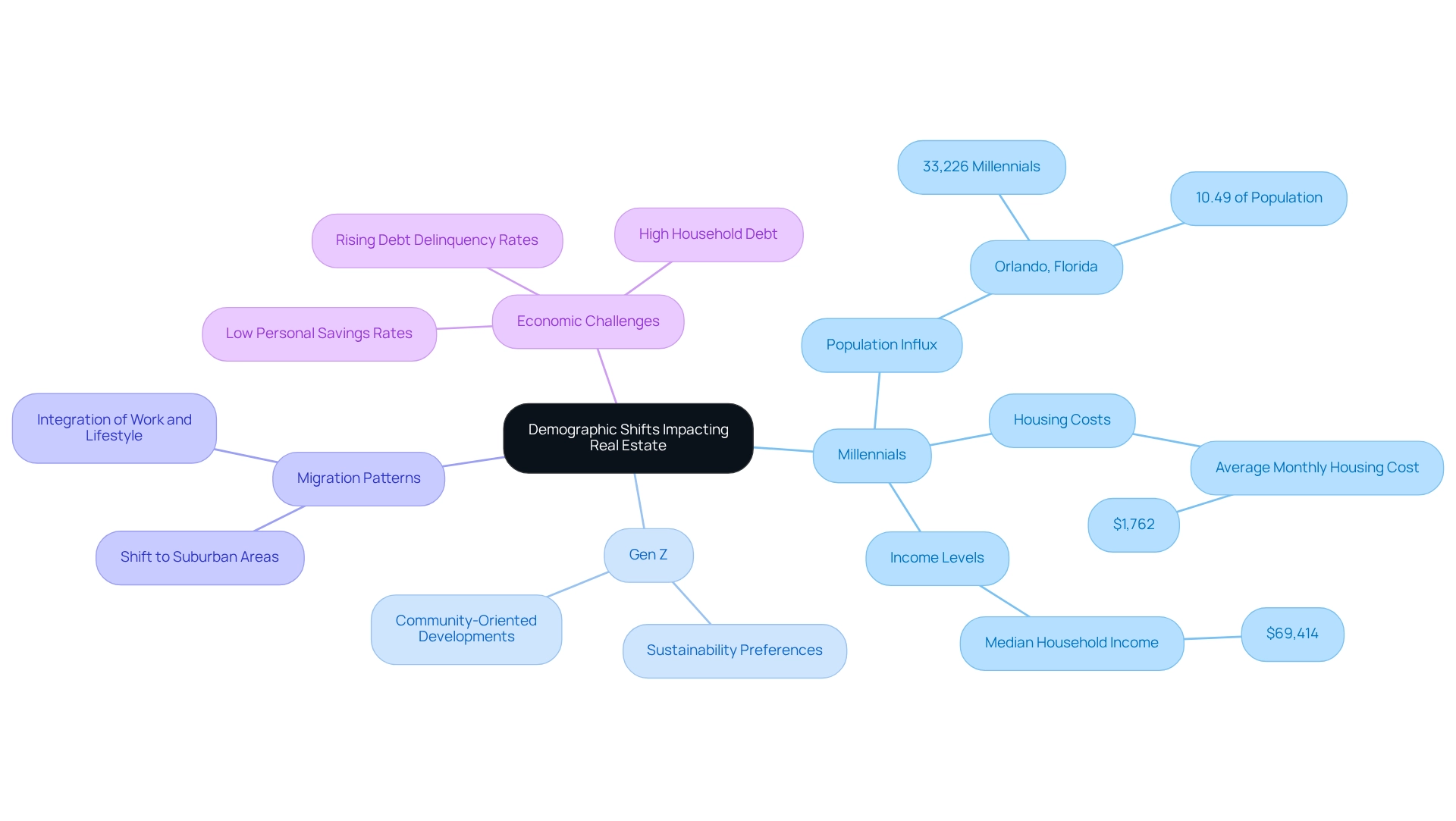

The emergence of Millennials and Gen Z in the housing sector is significantly influencing the commercial real estate market outlook. These generations are increasingly prioritizing sustainability, affordability, and community-oriented developments. For instance, Orlando, Florida, has experienced a notable influx of 33,226 millennials, representing 10.49% of its population, with a median household income of $69,414 and average monthly housing costs of $1,762. This trend underscores the appeal of more budget-friendly living options for younger buyers, especially when contrasted with regions like San Jose, where the average home price reaches $1.5 million, highlighting the affordability challenges faced by these demographics.

Migration patterns indicate a pronounced shift towards suburban areas, where these groups seek properties that integrate work and lifestyle. Investors should take heed of these trends, as they signal a growing demand for developments that align with the values and preferences of younger generations, which is reflected in the commercial real estate market outlook. Jacob Channel, Senior Economist at LendingTree, emphasizes the importance of understanding economic dynamics, stating, "Whether individuals intend to relocate this year or not, it’s essential to recognize that even the most carefully crafted plans can go awry." This insight is particularly pertinent in the current economic climate, where rising debt delinquency rates and low personal savings rates pose challenges that may impact the investment choices of Millennials and Gen Z.

As the industry evolves, the commercial real estate market outlook suggests that the focus on sustainability among Millennials and Gen Z is poised to drive demand for eco-friendly developments. Investors who align their strategies with these emerging trends will be better positioned to capitalize on the shifting landscape as indicated by the commercial real estate market outlook.

Future of Office Design: Evolving Trends and Their Impact on Commercial Real Estate

The office design landscape in 2025 is increasingly defined by flexibility and wellness-centric environments. Key trends such as:

- Biophilic design—integrating natural elements into workspaces

- Collaborative areas that foster teamwork

- Advanced technology integration

are vital for attracting tenants. As organizations embrace hybrid work models, the demand for innovative office spaces that enhance productivity and prioritize employee well-being is set to surge. Investors should strategically target properties that embody these design principles, as they are likely to yield higher rents, quicker sales, and stronger resale values.

Notably, the wellness boom is reshaping the commercial real estate market outlook. Developers who invest in wellness-focused spaces are well-positioned to attract top-tier tenants and succeed in the current commercial real estate market outlook. As Julie Hattersley, Design Director, states, "The office remains an irreplaceable epicentre for community, innovation and culture – and the latest office design trends driving workspace design aim to maximise its positive impact." This shift underscores the importance of creating environments that not only accommodate work but also enhance the overall quality of life for employees.

Additionally, neuro-architecture features may drive higher rents and faster sales, further emphasizing the financial benefits of investing in these innovative office spaces.

Conclusion

The commercial real estate landscape in 2025 presents a convergence of transformative trends, creating both challenges and opportunities for investors and stakeholders. The rise of hybrid work models necessitates innovative office designs that accommodate flexible work environments. Simultaneously, sustainability has become a non-negotiable aspect of property development. As the market continues its recovery, the multifamily and industrial sectors are emerging as key growth areas, propelled by strong demand and evolving consumer preferences.

Regional markets like Dallas-Fort Worth are experiencing heightened leasing activity, reflecting a broader trend of increased investment interest. However, the impending maturity of approximately $600 billion in loans through 2028 requires vigilant financial planning and risk management. Investors must remain adaptable, leveraging data-driven insights to navigate potential volatility and capitalize on emerging trends.

As Millennials and Gen Z enter the housing market, their preferences for affordability and sustainability are reshaping demand, underscoring the necessity for developments that align with these values. The integration of technology in property management is enhancing operational efficiency, making it essential for stakeholders to embrace these advancements to gain a competitive edge.

In conclusion, a strategic approach to investment in commercial real estate is imperative in 2025. By understanding the evolving market dynamics, prioritizing sustainable practices, and focusing on innovative design, investors can position themselves favorably in a sector poised for significant transformation. The future of commercial real estate is promising for those willing to adapt and innovate within this dynamic environment.