Overview

The article presents ten pivotal insights into the life science real estate market, spotlighting trends such as the rising demand for specialized lab spaces, the critical nature of data-driven investment strategies, and the influence of demographic shifts on real estate requirements. These insights are bolstered by data projections, expert opinions from the industry, and case studies that exemplify the dynamic landscape and the opportunities available for investors in this sector.

Introduction

The life sciences real estate market stands poised for a transformative shift, propelled by unprecedented growth in biotechnology and healthcare demands. Investors are confronted with a myriad of opportunities, encompassing emerging trends in laboratory spaces and the integration of advanced technologies that redefine property value. As this landscape evolves, investors must consider: how can they effectively navigate the complexities of regulatory challenges and market fluctuations to secure their stake in this lucrative sector?

The emergence of biotechnology and healthcare as dominant forces in the economy signals a pivotal moment for real estate investment. The demand for specialized laboratory spaces is surging, driven by innovation and research needs. Furthermore, the integration of cutting-edge technologies is not merely enhancing property value but is also reshaping the very nature of these investments.

However, with opportunity comes complexity. Investors must grapple with a dynamic regulatory environment and fluctuating market conditions. Understanding these elements is crucial for making informed decisions that will safeguard and enhance their investments. By leveraging insights into current trends and regulatory landscapes, investors can position themselves advantageously in this evolving market.

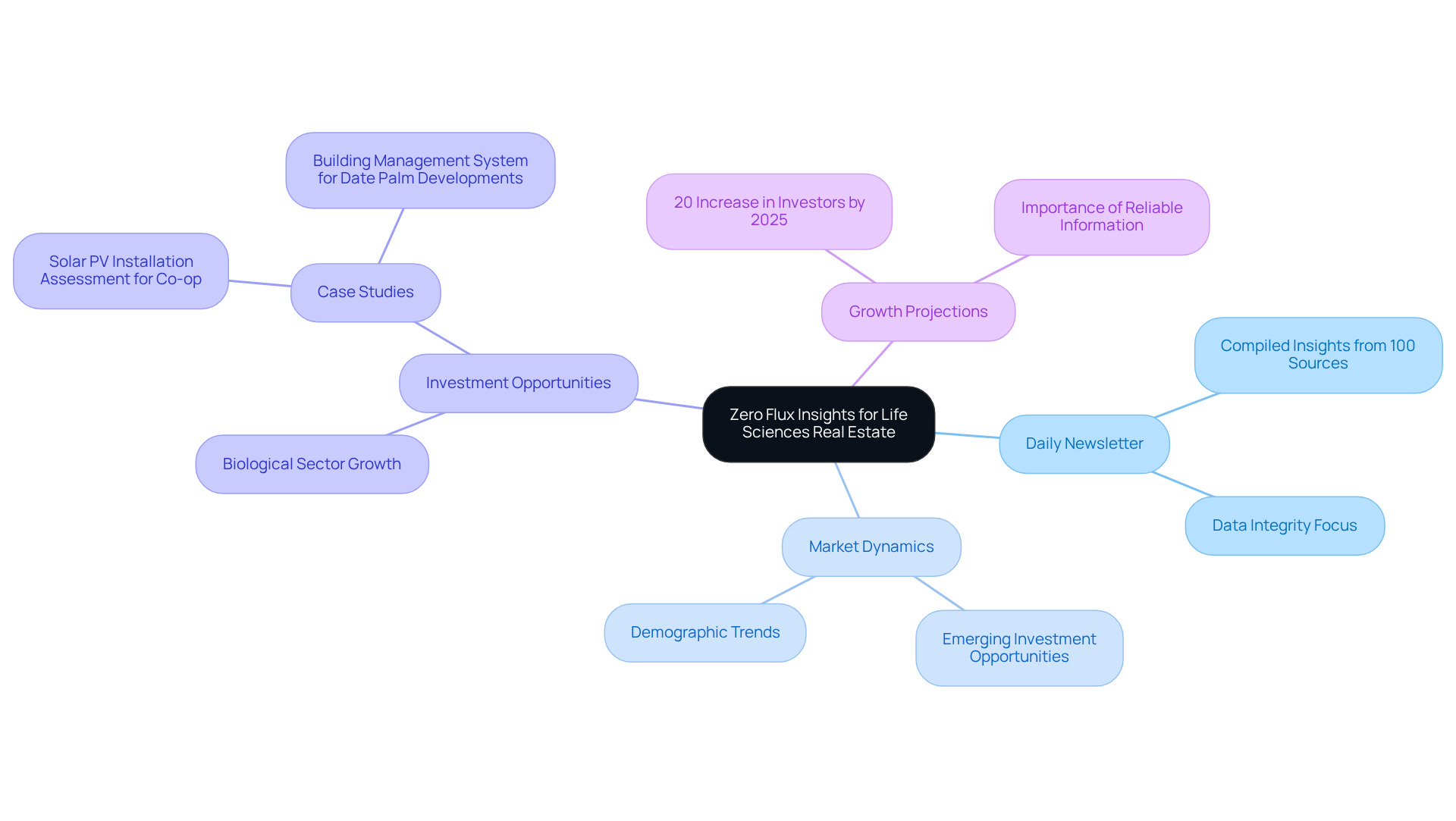

Zero Flux: Essential Insights for Life Sciences Real Estate Investors

Zero Flux delivers a daily newsletter that compiles crucial insights from over 100 sources, specifically tailored for the life science real estate market report. This resource empowers investors to stay informed about the life science real estate market report, along with market dynamics, emerging investment opportunities, and demographic trends that influence their strategies. By meticulously filtering extensive data, Zero Flux ensures that subscribers receive only the most pertinent insights.

The life science real estate market report indicates that in 2025, the number of biological sector property investors is projected to increase significantly, with forecasts showing a rise of more than 20% compared to previous years. This trend highlights the growing importance of reliable information for making informed investment decisions, as outlined in the life science real estate market report. As Mark Tilbee, Head of Building Technologies, asserts, 'Data-driven insights are essential for navigating the complexities highlighted in the life science real estate market report regarding the biological properties sector.'

Furthermore, case studies such as the Solar PV Installation Assessment for Co-op and the Building Management System for Date Palm Developments illustrate how actionable insights can lead to successful investment strategies. Zero Flux's commitment to sourcing information from trustworthy channels positions it as an indispensable resource for investors looking for insights in the life science real estate market report.

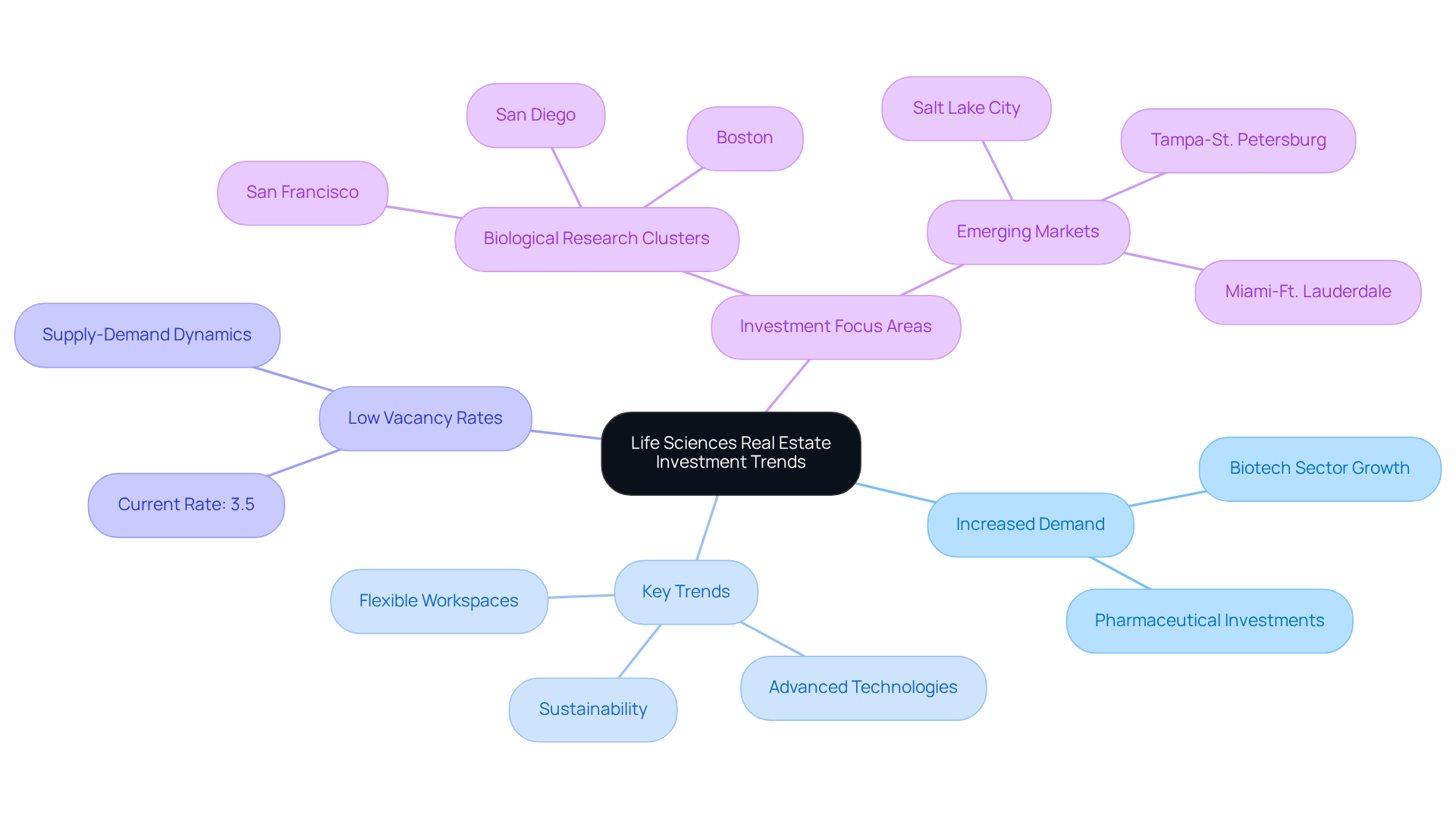

Current Trends in Life Sciences Real Estate Investment

According to the life science real estate market report, in 2025, the life sciences property sector is experiencing a significant surge in demand for laboratory and research facilities, primarily fueled by increased investment in the biotech and pharmaceutical industries. Notably, the biotech sector raised $72.5 billion in 2020, nearly doubling the previous year's total, which highlights the robust investment landscape. As Brian Abrahams, Co-Head of Biotechnology Research, articulates, 'the fundamentals for lab real estate appear solid,' indicating that this influx of funding is directly influencing the demand for lab spaces.

Key trends shaping the life science real estate market report include:

- A transition towards flexible workspaces

- The integration of advanced technologies in lab design

- An amplified focus on sustainability

Currently, lab vacancy rates in premium submarkets stand at a low 3.5%, reflecting a constrained environment for high-quality lab spaces. This low vacancy rate underscores the supply-demand dynamics in the industry, where 'supply and demand is the most fundamental factor for property,' according to Abrahams.

According to the life science real estate market report, investors should particularly focus on regions with established biological research clusters, such as Boston and San Francisco, where the demand for laboratory spaces is expected to remain strong. These markets account for approximately 70% of all biotechnology private equity and venture capital funds raised since 2016, positioning them as prime targets for successful property investments. To capitalize on these trends, investors should consider targeting properties that align with the evolving needs of biological research firms, especially those that emphasize adaptability and technological integration.

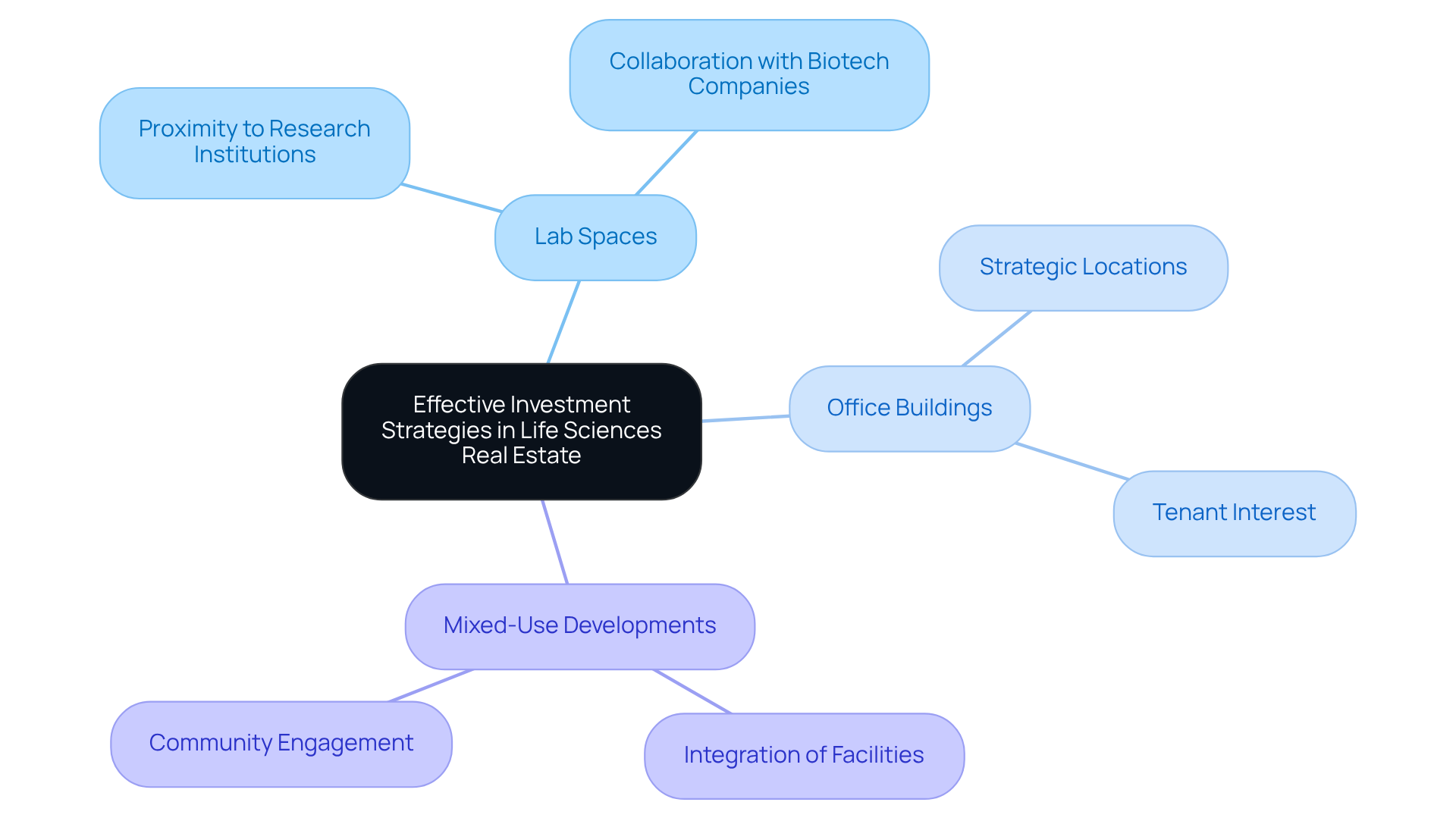

Effective Investment Strategies in Life Sciences Real Estate

To optimize returns in the life science real estate market report, investors must prioritize portfolio diversification by incorporating a variety of property types, including:

- Lab spaces

- Office buildings

- Mixed-use developments

Properties situated near research institutions and universities, particularly in the 'Golden Triangle' area, tend to attract greater tenant interest, positioning them as strategic investments. Furthermore, establishing collaborations with biotech companies can yield valuable insights into evolving space requirements, enabling investors to proactively adjust their strategies to meet industry demands.

Notably, recent trends indicate that approximately 30% of biological industry sales in 2022-2023 involved joint venture purchasers, underscoring the significance of cooperation in this sector. As the biological property sector emerges as a new asset category, the life science real estate market report indicates that embracing these effective investment methods will empower investors to enhance their portfolios and capitalize on the expanding opportunities within this dynamic industry.

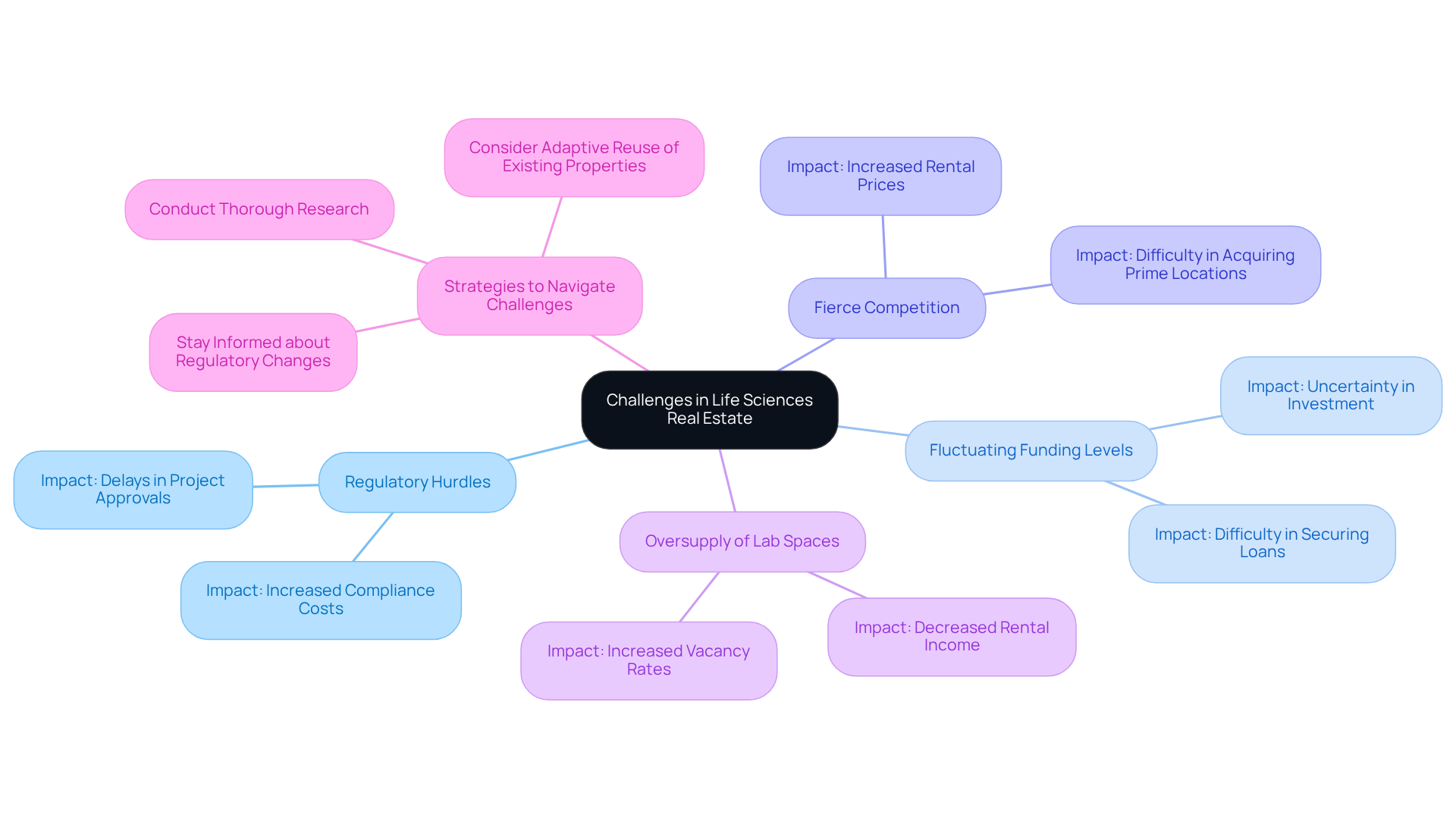

Navigating Challenges in the Life Sciences Real Estate Market

Investors in the life science real estate market report face a myriad of challenges that demand attention.

- Regulatory hurdles

- Fluctuating funding levels

- Fierce competition for prime locations

These are just the beginning. Additionally, an oversupply of lab spaces in certain areas can lead to increased vacancy rates, which negatively impacts rental income.

To navigate these complexities, it is imperative for investors to:

- Conduct thorough research on the industry

- Stay informed about regulatory changes

- Consider the adaptive reuse of existing properties to meet evolving tenant requirements

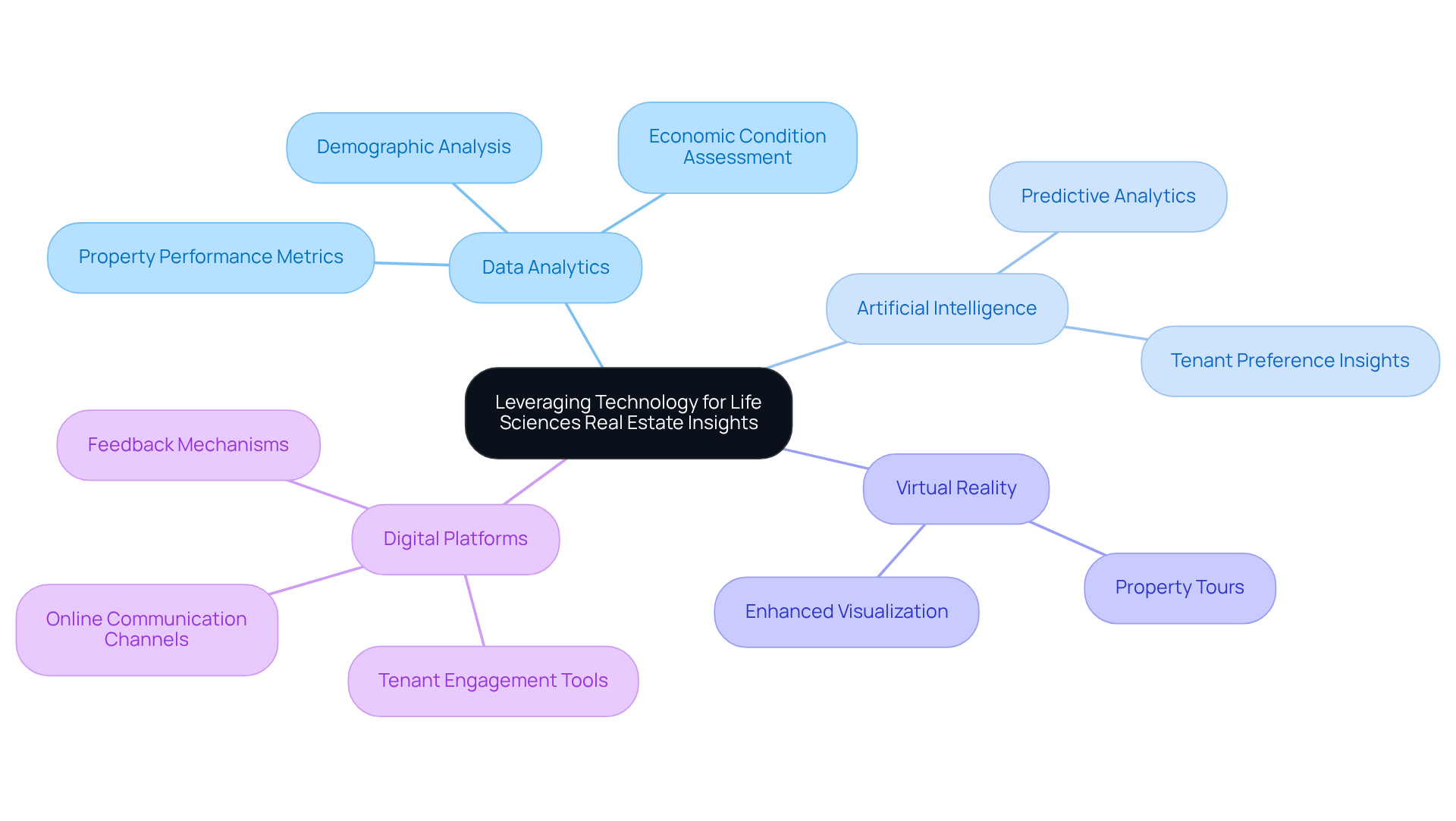

Leveraging Technology for Life Sciences Real Estate Insights

Investors must harness technology, such as data analytics and artificial intelligence, to gain profound insights into trends and tenant preferences. By employing instruments that assess demographic information, economic conditions, and property performance, investors can make informed decisions that significantly impact their portfolios. Furthermore, integrating virtual reality for property tours and utilizing digital platforms for tenant engagement not only enhances the investment experience but also fosters stronger relationships with tenants. These technological advancements are not just tools; they are essential strategies for modern investors aiming to stay ahead in a competitive market.

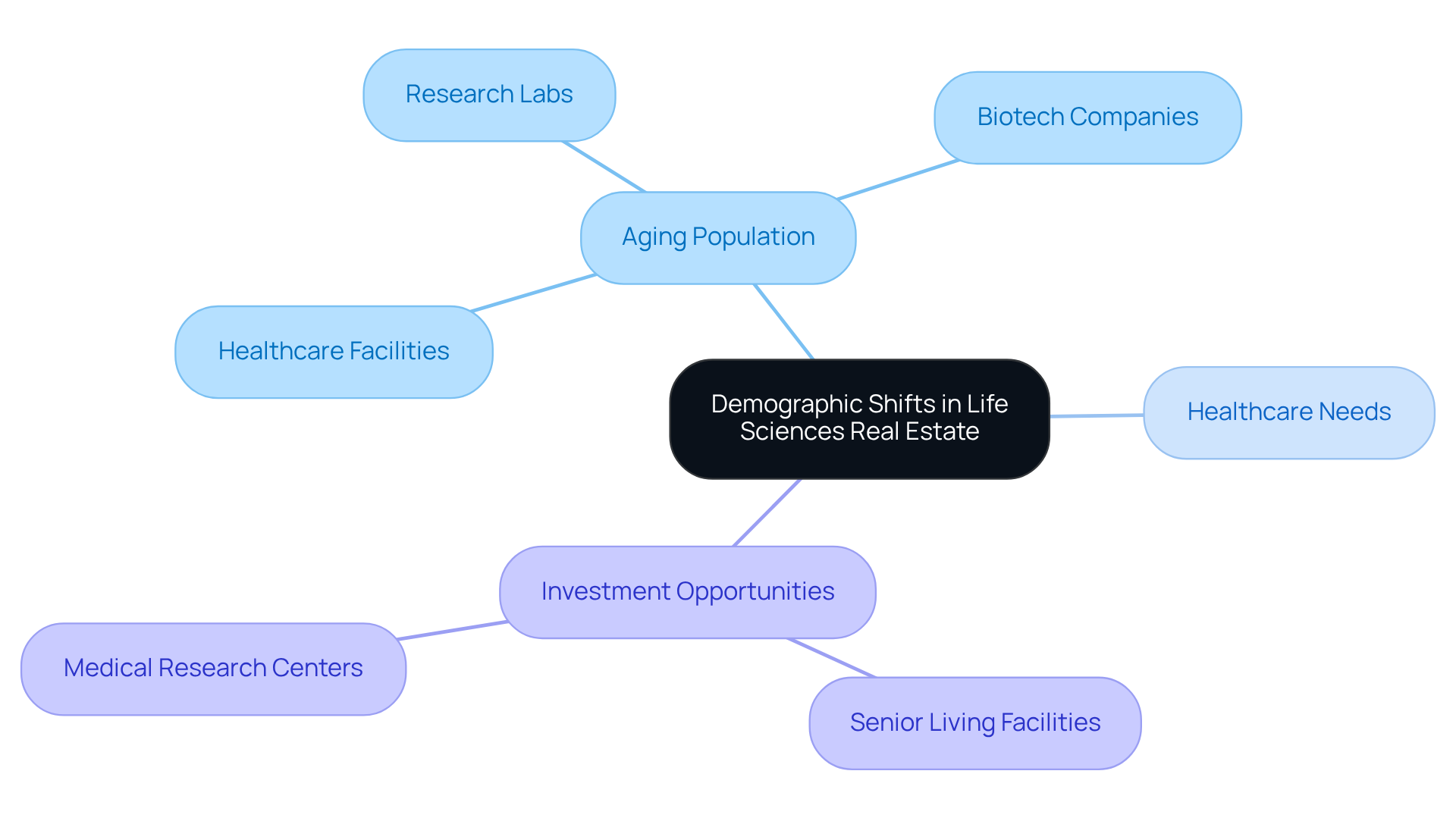

Demographic Shifts Affecting Life Sciences Real Estate

The aging population and rising healthcare needs represent significant demographic changes that are reshaping the real estate sector, which is highlighted in the life science real estate market report, particularly in relation to biological studies. As the population ages, the life science real estate market report indicates that the demand for healthcare facilities, research labs, and biotech companies focused on age-related diseases is increasing. This trend presents a compelling opportunity for investors to consider properties that meet these evolving needs, as detailed in the life science real estate market report.

According to the life science real estate market report, senior living facilities and medical research centers are prime examples of investments that can capitalize on this demographic shift. By aligning investment strategies with these insights, investors can position themselves advantageously in a changing market.

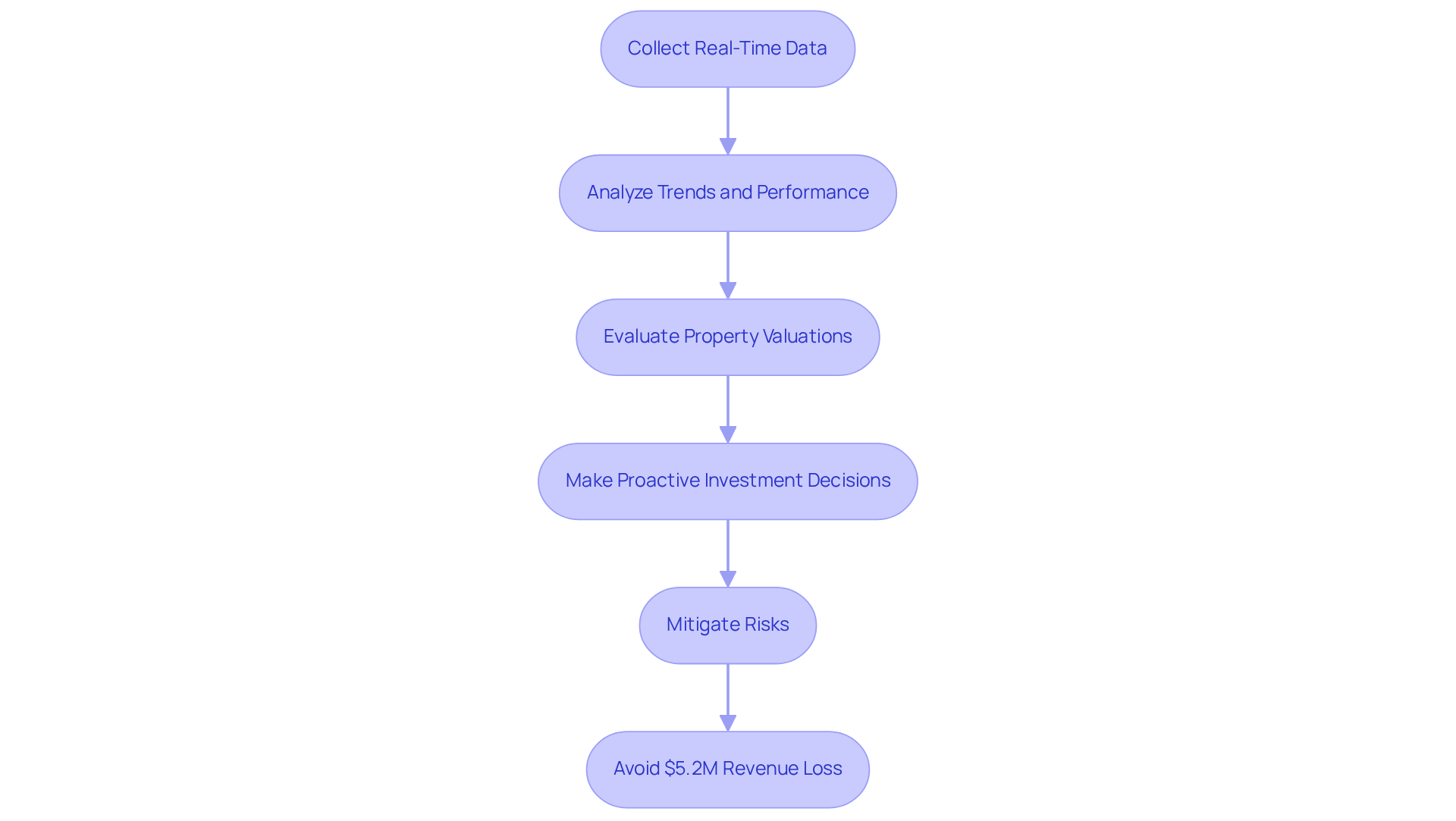

Utilizing Real-Time Data Analytics in Life Sciences Investments

Investors must harness real-time data analytics to effectively assess trends, tenant performance, and property valuations as outlined in the life science real estate market report. By employing advanced platforms that deliver up-to-date insights on leasing activity, demand trends, and economic indicators, investors can make proactive decisions that align with evolving market conditions. This strategic approach not only enhances investment performance but also significantly mitigates risks associated with economic fluctuations.

With the demand for data experts surging at an impressive rate of 36%, the life science real estate market report indicates that the ability to leverage real-time analytics is increasingly vital for navigating the complexities of biology-related property investments. As Thomas Redman notes, organizations must adeptly manage their 'data fires,' underscoring the critical role of data analytics tools and specialists in this dynamic landscape.

Furthermore, businesses are forfeiting $5.2 million in potential revenue due to untapped data, highlighting the financial repercussions of not effectively utilizing real-time data analytics.

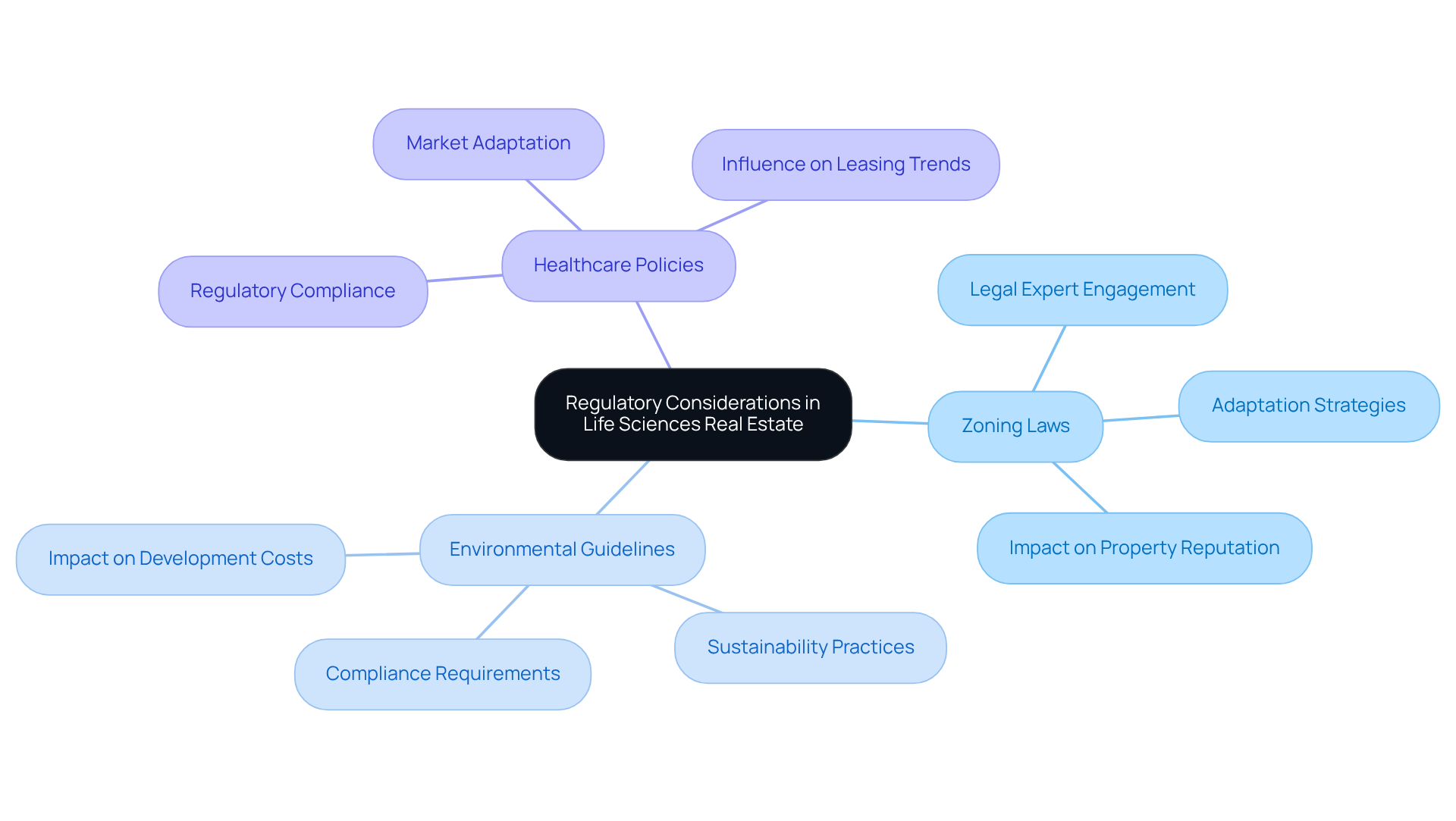

Regulatory Considerations in Life Sciences Real Estate

Investors in the biotechnology property sector must remain vigilant regarding regulatory modifications, particularly zoning laws, environmental guidelines, and healthcare policies. Engaging with legal experts and industry associations is essential for gaining insights into upcoming changes, enabling investors to adapt their strategies effectively. Adhering to these regulations not only safeguards investments but also bolsters the reputation of properties.

As the landscape evolves, understanding the impact of zoning regulations on biological sector properties becomes increasingly vital. Notably, a recent life science real estate market report indicates that approximately 45 million square feet of biotechnology space is projected to be available by the end of 2024. This underscores the necessity for investors to prioritize compliance, ensuring their properties align with the evolving standards and expectations of the sector.

Moreover, in a tenant-friendly environment where biotechnology firms are leasing less physical space compared to pre-pandemic levels, investors must navigate these dynamics cautiously to refine their investment strategies.

Key Players and Partnerships in Life Sciences Real Estate

The biological sector of property is characterized by a network of essential participants, including:

- Biotech companies

- Research organizations

- Property developers

By forming alliances with these organizations, investors can gain valuable insights into industry needs and emerging trends. Furthermore, collaborating with local governments and economic development agencies can significantly enhance investment opportunities. This alignment not only supports community goals but also opens doors to various funding initiatives, making it a strategic move for savvy investors.

Future Projections for Life Sciences Real Estate Market

Looking ahead, the life science real estate market report indicates that it is poised to sustain its growth trajectory, propelled by advancements in biotechnology, escalating healthcare spending, and a pronounced focus on innovation.

Investors should be prepared for an uptick in demand for specialized lab spaces and facilities that foster research and development.

Furthermore, as the industry embraces digital transformation, properties outfitted with advanced technologies are likely to command higher rents and attract premium tenants.

Staying ahead of these trends is essential for investors seeking to capitalize on the evolving landscape.

Conclusion

The life science real estate market is poised for significant growth, propelled by a surge in demand for specialized laboratory and research facilities. As investors navigate this dynamic landscape, grasping the critical insights and trends outlined in the life science real estate market report becomes essential. The report underscores the necessity of leveraging data-driven strategies, technological advancements, and demographic shifts to make informed investment decisions that align with the sector's evolving needs.

Key insights from the report highlight the growing importance of collaboration with biotech companies and research institutions, along with the need to adapt to regulatory changes. Investors are urged to concentrate on regions with established biological research clusters and to harness real-time data analytics to optimize their strategies effectively. Furthermore, the focus on sustainability and advanced technologies in lab design reflects a broader trend that investors must embrace to remain competitive.

In conclusion, the life science real estate market offers a wealth of opportunities for astute investors. By staying informed about emerging trends, utilizing technology, and prioritizing strategic partnerships, investors can position themselves advantageously in this rapidly evolving sector. Embracing these insights not only enhances investment potential but also contributes to the advancement of healthcare and biotechnology, ultimately benefiting society as a whole.