Overview

This article provides essential insights into current real estate news that are vital for investors. Understanding trends such as:

- Mortgage rates

- Housing inventory

- Buyer demand

- Demographic shifts

is crucial, as these factors significantly influence investment strategies and market conditions. By grasping these trends, investors can better navigate the complexities of the market and make informed decisions. Ultimately, this knowledge empowers investors to align their strategies with the evolving landscape of real estate.

Introduction

In the ever-evolving landscape of real estate, understanding market dynamics is paramount for investors aiming to seize lucrative opportunities. Insights drawn from over 100 sources illuminate the latest trends in housing markets, mortgage rates, and buyer behavior. As economic conditions shift and demographic preferences evolve, investors must navigate a complex array of factors influencing property values and investment strategies.

This article delves into critical market insights, including the impact of rising mortgage rates and the significance of demographic trends, equipping investors with the knowledge needed to thrive in a competitive environment.

Zero Flux: Daily Insights on Real Estate Market Trends

Zero Flux delivers essential daily insights on real property trends by aggregating information from over 100 reliable sources. This newsletter is indispensable for investors who seek to stay informed about:

- Current real estate news

- Housing trends

- Investment opportunities

- Demographic shifts

By prioritizing factual information, Zero Flux empowers subscribers to adeptly navigate the intricacies of the real estate landscape, ensuring they are well-equipped to make informed investment decisions based on current real estate news.

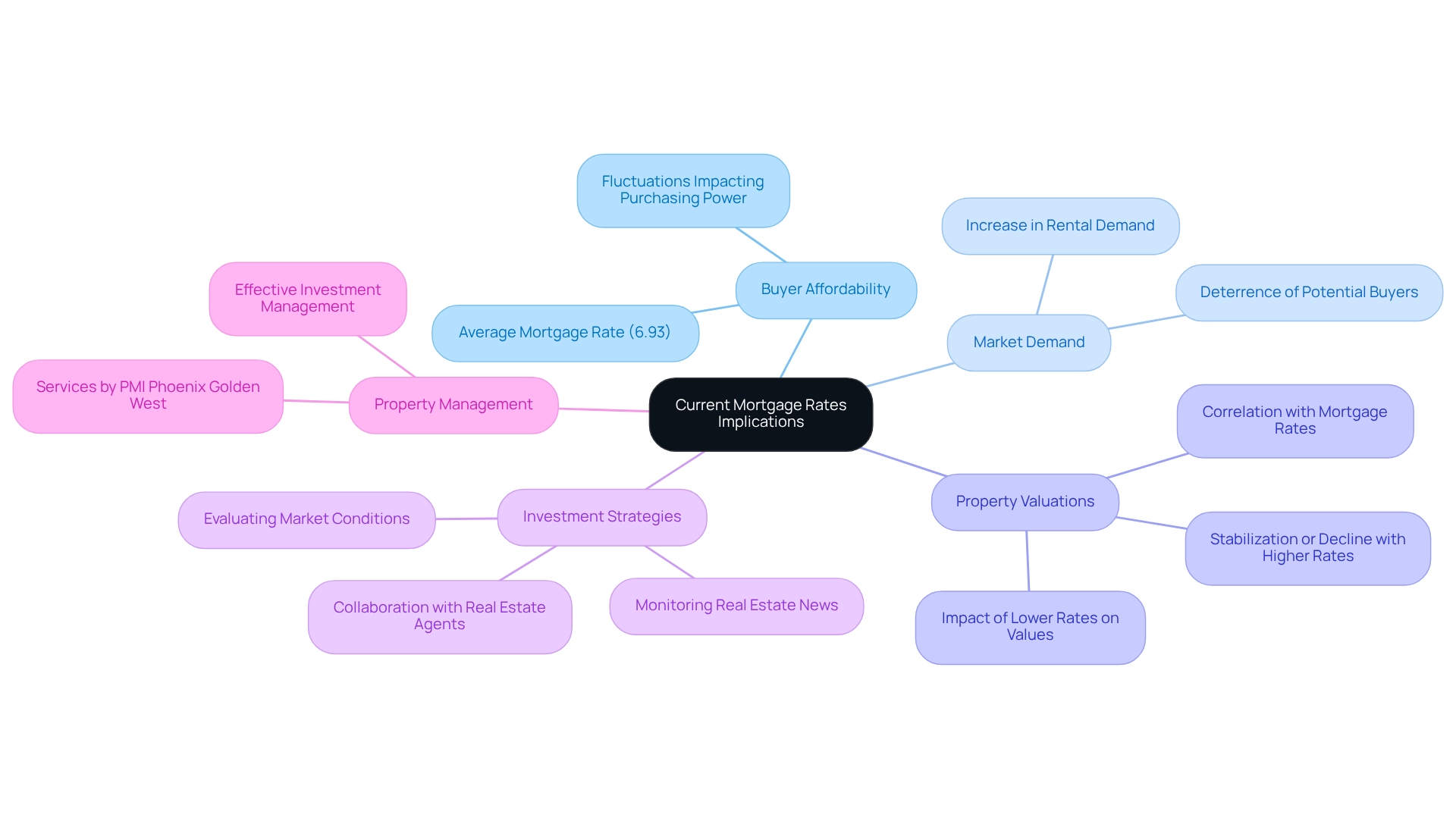

Current Mortgage Rates: Implications for Investment Decisions

As of June 2025, the average 30-year fixed mortgage rate stands at approximately 6.93%. This rate significantly influences buyer affordability and overall market demand. Investors must recognize that fluctuations in mortgage rates can directly impact their purchasing power and the appeal of rental properties. Higher mortgage rates often deter potential buyers, leading to an uptick in rental demand as individuals seek alternative housing solutions.

A recent case study highlights the correlation between mortgage rates and property valuations, indicating that lower rates typically drive up property values due to enhanced affordability. Conversely, rising rates can soften demand, resulting in stabilized or declining property valuations. This dynamic underscores the significance for stakeholders to closely observe current real estate news, especially regarding current mortgage trends, and evaluate their implications for investment strategies. Financial analysts stress that grasping these trends is vital for making informed choices in the changing real property environment of 2025, and Zero Flux provides a daily collection of 5-12 selected insights, including current real estate news, ensuring that investors have access to the most pertinent information.

As entrepreneur Armstrong Williams expresses, 'Now, one thing I advise everyone is to learn about property.' Real property offers the highest returns, the greatest values, and the least risk. Additionally, investors may consider utilizing property management services, such as those offered by PMI Phoenix Golden West, to effectively manage their investments in a fluctuating mortgage rate environment. Collaborating with a reliable real estate agent is also advised to navigate the intricacies of the current landscape.

Housing Inventory Trends: Analyzing Supply and Demand

In April 2025, housing inventory surged by 30.6% year-over-year, marking the 18th consecutive month of growth. As noted by Realtor.com, "The count of active listings spiked 30.6% annually in April." This trend indicates a shift towards a more balanced environment that could alleviate the upward pressure on home prices. For stakeholders, this rise in supply presents a crucial opportunity according to current real estate news; as inventory increases, the likelihood of improved purchasing conditions and competitive pricing becomes increasingly apparent. It is imperative for stakeholders to remain vigilant regarding these inventory trends, as they are reflected in current real estate news and directly influence economic dynamics and investment strategies.

To afford a median-priced home in April, households required an annual income of approximately $114,000, reflecting a significant increase of nearly $47,000 (70.1%) since 2019. Despite this rise, the required income has stabilized over the past year, with mortgage rates and median prices remaining relatively flat. This stability, combined with the rising inventory, suggests that sellers are recalibrating their expectations in response to affordability challenges and a softer buyer demand, resulting in an uptick in price reductions.

In high-demand areas such as the Sun Belt, price appreciation may continue to remain stable due to ongoing new construction. Conversely, regions in the Northeast and Midwest are likely to see prices hold firm or experience minor increases. As the landscape evolves, stakeholders should leverage these insights to navigate the complexities of the real property sector effectively.

Buyer Demand Insights: Assessing Market Health

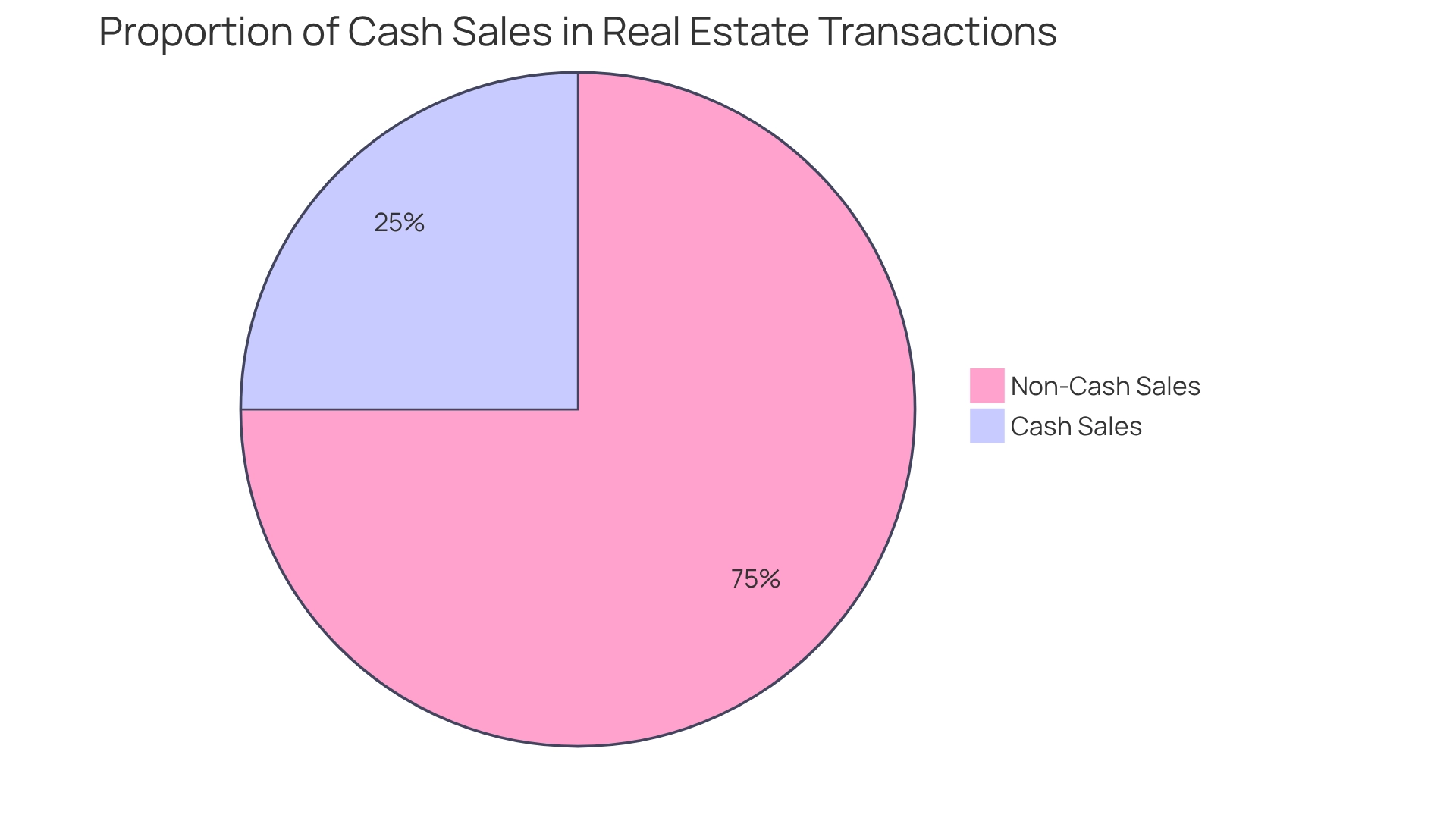

According to current real estate news, buyer demand in the sector remains subdued, as evidenced by a 2% decline in existing home sales year-over-year as of April 2025. This trend suggests a potential cooling of the sector, which may create favorable conditions for investors seeking to negotiate better deals. Notably, the median home price in the West stands at $628,500, reflecting a slight decrease of 0.2% from April 2024. Such trends indicate that sellers are adjusting their expectations in response to affordability challenges and weaker buyer demand in certain markets.

In April, cash sales accounted for 25% of transactions, a decline from 26% in March. This shift underscores a change in buyer financing strategies, which could significantly influence overall transaction dynamics. As the industry evolves, it is crucial to observe consumer sentiment and sales patterns alongside current real estate news for making informed financial decisions. Investors should meticulously evaluate these developments, as the decline in home sales may impact their strategies and future opportunities. To capitalize on the current economic landscape, investors are encouraged to explore negotiation strategies and maintain flexibility in their financial approaches.

Economic Shifts: Understanding Their Impact on Real Estate

Economic growth is anticipated to persist in 2025, albeit at a moderated rate. Key factors such as inflation and interest rates are poised to significantly influence the current real estate news. Investors must closely track economic indicators, as fluctuations can directly impact property values and the overall feasibility of their portfolios. While national trends suggest growth, localized economic conditions may differ, underscoring the necessity for a customized strategy. Notably, the South has experienced lower year-over-year price increases compared to other regions, emphasizing the importance of understanding regional dynamics.

Moreover, the current competitive environment showcases a blend of buyer's and seller's conditions across various metropolitan areas, complicating investment choices. As Joy Aumann, a licensed realtor and founder of LUXURYSOCALREALTY.com, observes, buyers are increasingly prioritizing energy-efficient features, such as solar panels and smart home automation, reflecting a shift in market demands. This trend underscores the changing preferences of purchasers, making it essential for stakeholders to consider these features in their strategies.

In light of these dynamics, understanding the interplay between inflation rates and property values is crucial. Historical data suggests that rising inflation can lead to increased interest rates, which typically exert downward pressure on property prices. Consequently, stakeholders should remain vigilant and adapt their strategies in response to the current real estate news, ensuring they are well-prepared to seize new opportunities in the real estate sector. With over 30,000 subscribers, Zero Flux provides valuable insights that can assist investors in navigating these complexities. Furthermore, the case study titled 'Forecasting Real Estate Values and Trends' illustrates the significance of examining historical data alongside current economic conditions to tailor investment strategies effectively.

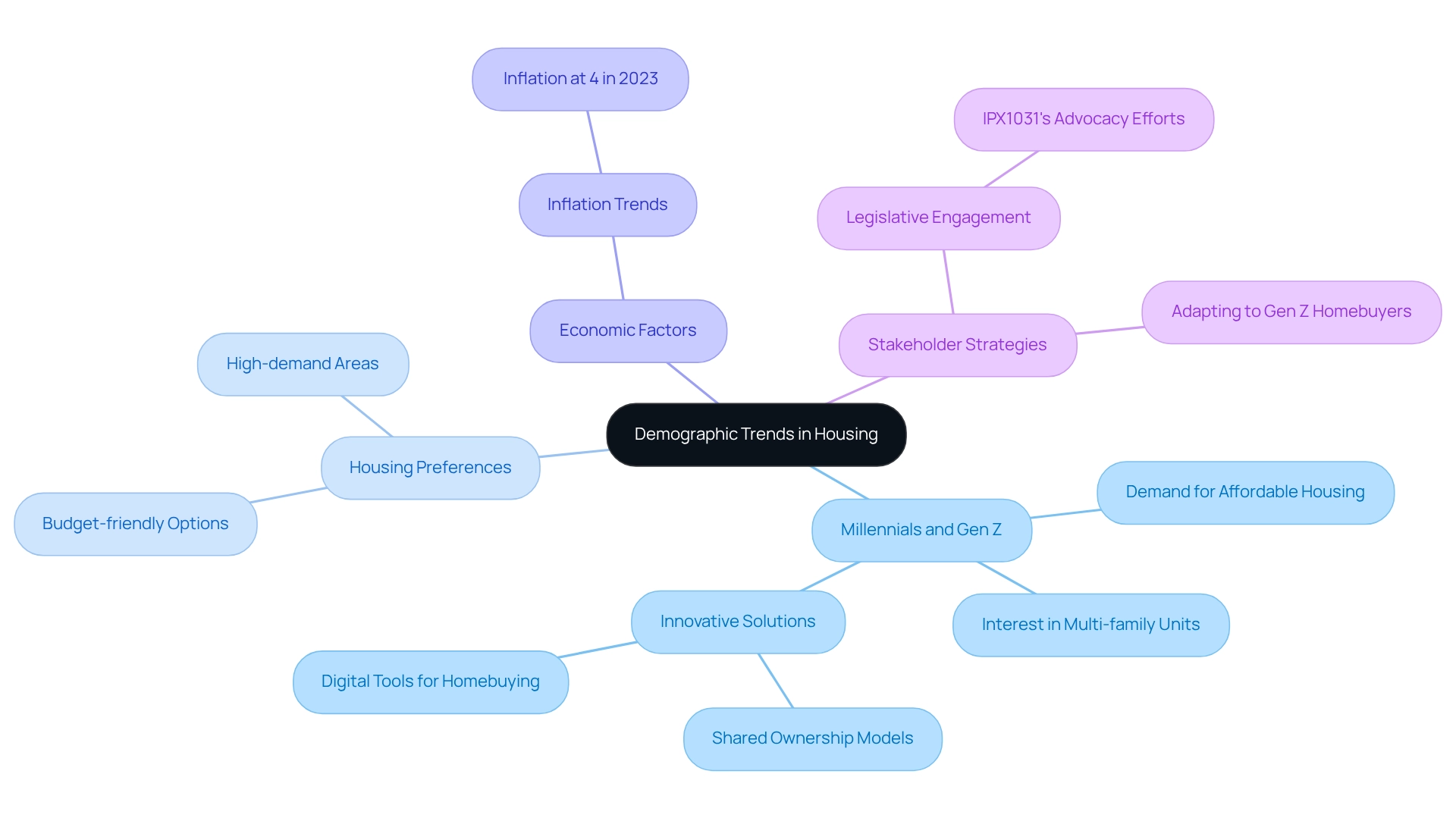

Demographic Trends: Identifying Growth Opportunities

In 2025, millennials and Gen Z are set to significantly influence the housing market, with a notable increase in demand for affordable housing options. Statistics indicate that these younger generations are increasingly seeking multi-family units and affordable single-family homes, as traditional pathways to homeownership become less accessible. This shift presents an excellent opportunity for stakeholders to focus on properties that align with the preferences of these demographics.

Real estate analysts emphasize that understanding the distinct needs and behaviors of millennials and Gen Z is crucial for achieving successful outcomes. As these groups prioritize affordability and innovative housing solutions, such as shared ownership models, stakeholders can strategically position themselves in high-demand areas. Herskovitz notes, "Gen Z and millennials may be priced out of the traditional path, but they’re building new ones — with digital tools, shared ownership models, and smarter investment thinking."

Furthermore, current real estate news underscores the ongoing demand for affordable housing, revealing that a significant portion of millennials and Gen Z are actively searching for budget-friendly options. With inflation decreasing to 4% in 2023, the economic climate is becoming more favorable for these demographics. By capitalizing on this trend, investors can not only meet industry demands but also seize profitable opportunities that cater to the evolving landscape of homeownership. Realty professionals are encouraged to adapt to the careful and systematic approach of Gen Z homebuyers, establishing themselves as preferred representatives in this competitive environment.

Finally, proactive legislative involvement by companies such as IPX1031 highlights the importance of understanding external factors that can impact investment strategies and opportunities in the housing sector.

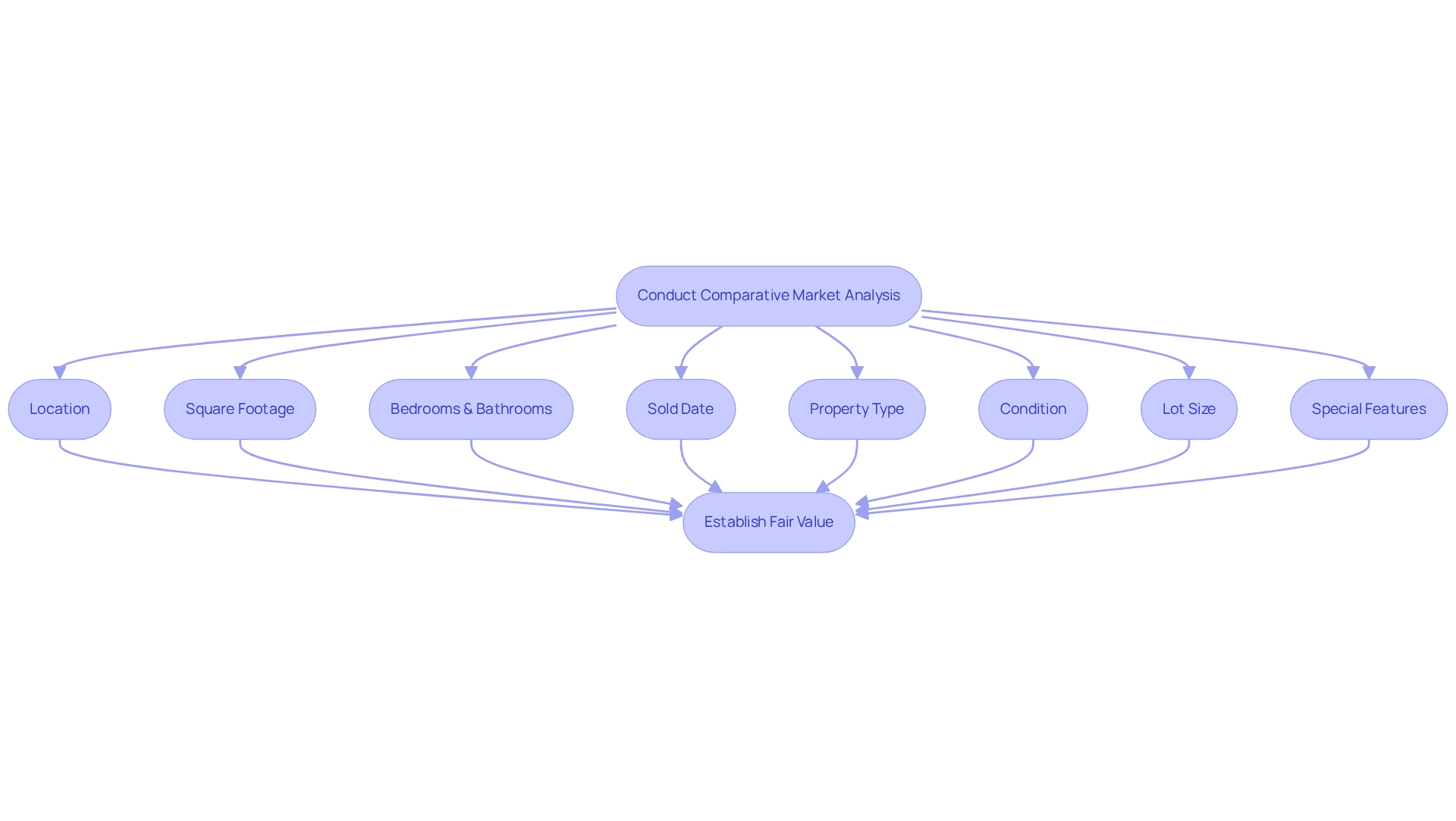

Comparative Market Analysis: Evaluating Property Values

A comparative property analysis (CMA) serves as an indispensable tool for real estate stakeholders, facilitating the evaluation of comparable properties within a designated area to ascertain a property's fair value. By scrutinizing pivotal factors such as:

- Location

- Square footage

- Number of bedrooms and bathrooms

- Sold date

- Property type

- Condition

- Lot size

- Special features

buyers can conduct a thorough assessment that underpins effective pricing strategies. This meticulous approach not only aids in establishing competitive pricing but also fosters trust between agents and sellers, demonstrating the agent's expertise in the market.

In 2025, leveraging CMAs is crucial for investors seeking to optimize their returns. Notably, the average proposal based on current CMA data is $431,640, underscoring the vital role of precise assessments in unlocking lucrative opportunities. Real estate professionals assert that a well-executed CMA can profoundly influence investment decisions, as it furnishes a factual basis for negotiations and mitigates the risk of overpaying for properties.

Best practices for conducting a CMA encompass gathering data from multiple credible sources and ensuring that the analysis reflects the latest market trends. Effective property appraisal techniques frequently rely on CMAs to empower individuals in making informed choices. As one property expert aptly noted, "It’s hard for sellers to resist going with the agent that tells them the highest possible selling price," emphasizing the necessity of a data-driven approach to counteract inflated valuations.

Ultimately, CMAs are vital for real estate investors, providing insights that bolster sound financial decisions and enhance overall industry comprehension.

Price-to-Rent Ratio: A Key Metric for Investment Strategy

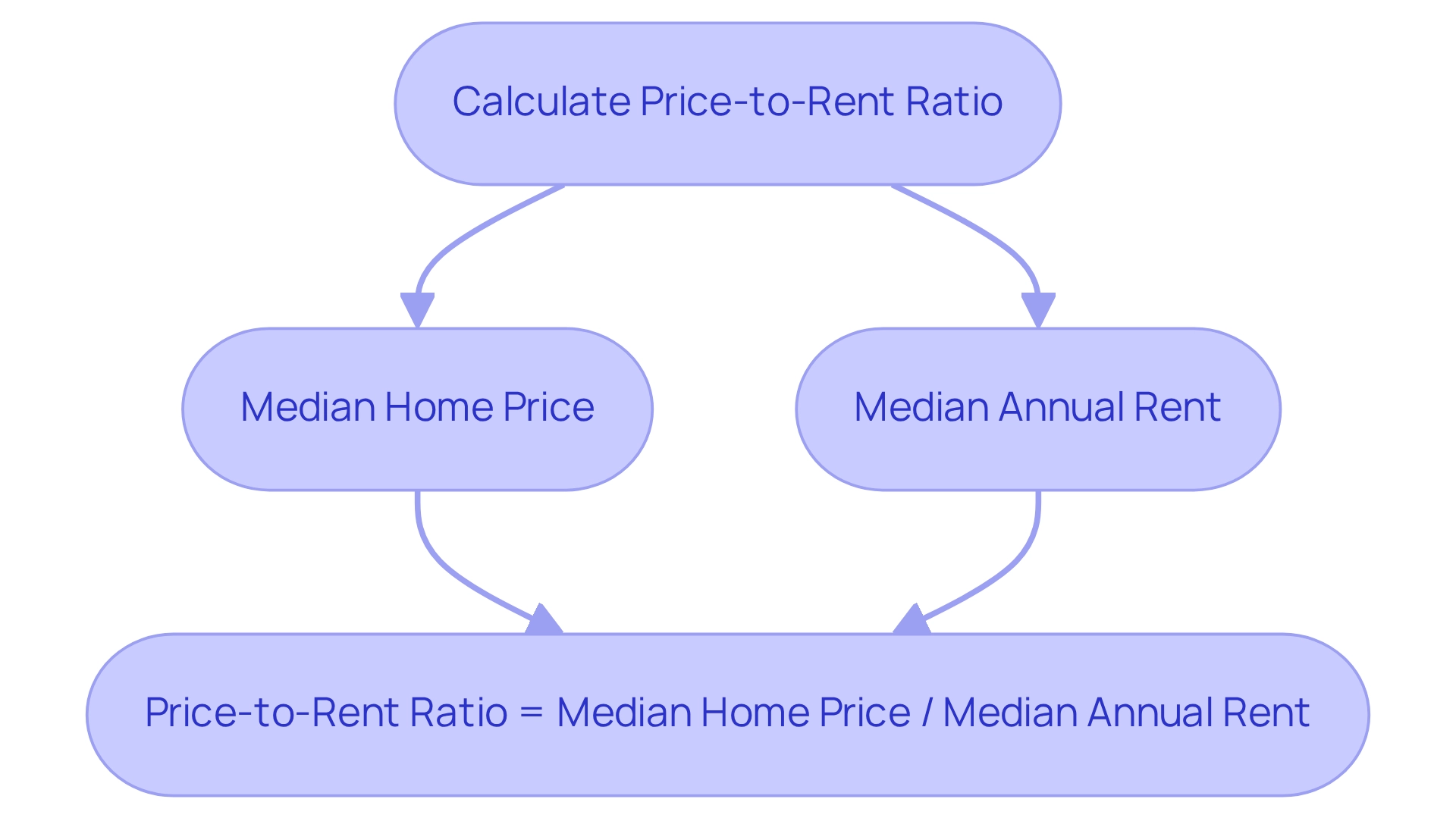

The price-to-rent ratio in the U.S. has risen significantly, suggesting that renting may be more affordable than buying in many markets. Investors must calculate this ratio when considering rental properties, as a lower ratio indicates a more favorable environment for acquiring properties. This crucial metric can guide strategic funding decisions.

As J. Scott Davis notes, 'Since the ratio is a fraction, it can become smaller by decreasing the numerator (home prices) or increasing the denominator (rents).'

Understanding how to determine the price-to-rent ratio—by dividing the median home price by the median annual rent—can profoundly impact financial strategies, particularly in light of the increasing ratios. Investors should also consider the implications of these rising ratios, as they can affect the overall attractiveness of rental investments.

By leveraging this key metric, real estate investors can make informed choices that align with their financial goals.

Government Policies: Navigating Opportunities in Real Estate

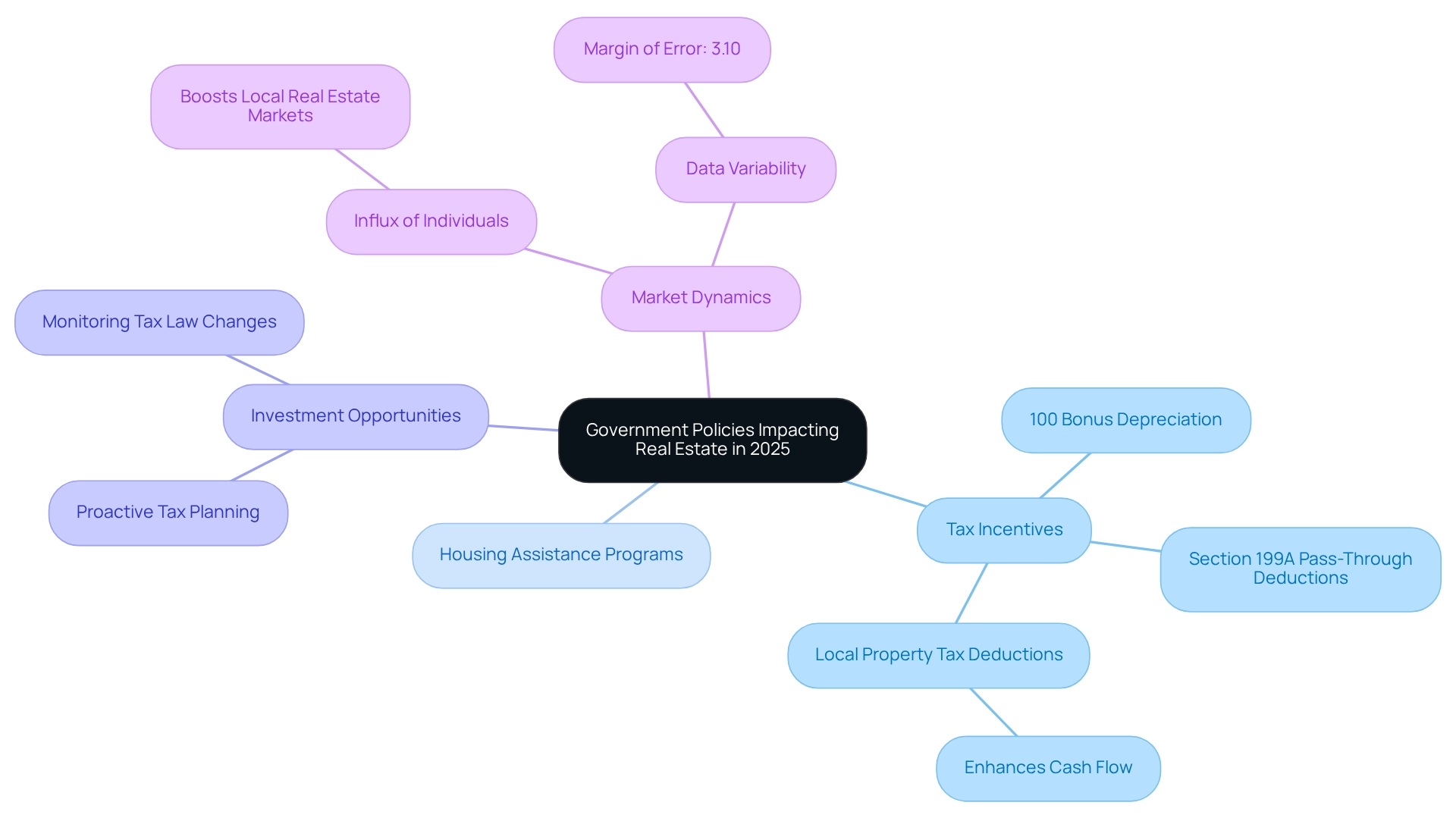

In 2025, government policies are poised to significantly impact the housing sector, particularly through anticipated changes to tax incentives and housing assistance programs. Investors must remain vigilant regarding these developments, as favorable policies can create lucrative investment opportunities and foster improved conditions for both buyers and renters. For instance, certain jurisdictions allow local property taxes to be deducted from business earnings, thereby enhancing cash flow for stakeholders.

The Tax Cuts and Jobs Act (TCJA) has introduced critical provisions, including 100% bonus depreciation and Section 199A pass-through deductions, which face expiration unless renewed. This uncertainty necessitates that businesses engage in proactive tax planning to optimize their positions amid potential shifts in tax designations. As the landscape evolves, the influx of individuals into specific regions can further bolster local property markets, making it essential for financiers to adapt their strategies accordingly.

Expert insights underscore that understanding these government policies is vital for navigating the complexities of property investments, as reflected in current real estate news for 2025. As one analyst aptly noted, "Being involved in real estate means staying alert for changes in tax regulations that could impact your financial strategies in 2025." This statement emphasizes the critical need to monitor tax law changes closely. Additionally, the margin of error for the national survey stands at 3.10%, indicating that while trends may appear promising, individuals should account for data variability when making decisions. By remaining informed and adaptable to these changes, investors can enhance their capacity to seize new opportunities within the real estate sector.

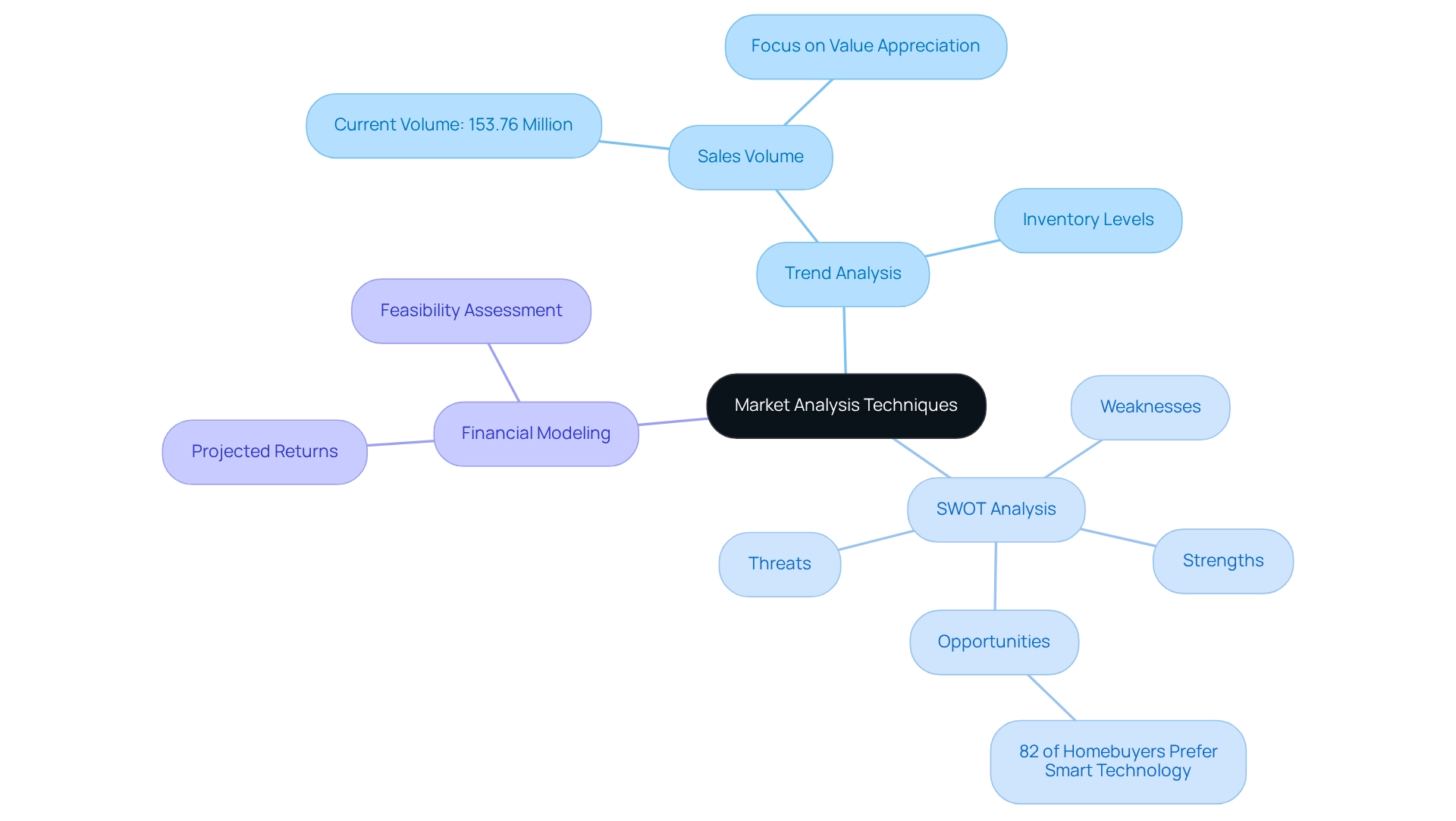

Market Analysis Techniques: Essential Tools for Investors

To navigate the intricacies of property ventures, individuals must employ a variety of analytical methods, including trend assessment, SWOT evaluation, and financial modeling. These tools are essential for identifying industry trends, evaluating risks, and making informed decisions that align with investment objectives, especially when considering current real estate news.

Trend analysis proves particularly advantageous, enabling stakeholders to track shifts in the sector over time and providing insights into sales volume and inventory levels. For example, the current real estate news shows that the U.S. residential real estate market currently exhibits a volume of 153.76 million, signifying robust activity. This substantial volume suggests that investors should focus on properties poised for value appreciation, particularly in regions experiencing rising demand.

SWOT analysis, which evaluates strengths, weaknesses, opportunities, and threats, is another critical approach. A case study on consumer behavior reveals that 82% of homebuyers prefer properties equipped with smart technology, underscoring a significant opportunity for stakeholders to align their offerings with buyer preferences. Additionally, 58% of purchasers prioritize location, emphasizing the importance of neighborhood characteristics in purchasing decisions. Investors should take these preferences into account when selecting properties to ensure they meet market demand.

Financial modeling complements these analyses by allowing investors to project potential returns and assess the feasibility of their investments. In a competitive landscape where many buyers are willing to pay above asking prices, grasping these dynamics is vital. Furthermore, as noted by Zero Flux, over 90% of home sales originate from existing properties, highlighting the necessity of concentrating on the existing home market. By integrating these methodologies, investors can refine their decision-making processes by staying informed through current real estate news, ensuring they capitalize on emerging trends and make strategic investments.

Conclusion

The real estate landscape is shaped by numerous factors that significantly influence investment decisions. Rising mortgage rates profoundly affect buyer affordability and market demand, which necessitates that investors remain vigilant and adapt their strategies accordingly. The correlation between mortgage rates and property valuations highlights the importance of monitoring these trends to make informed decisions in a fluctuating market.

Moreover, the increase in housing inventory presents both challenges and opportunities. As supply rises, investors can benefit from more favorable buying conditions and competitive pricing. This shift towards a more balanced market could alleviate upward pressure on home prices, enabling investors to negotiate better deals in a cooling market characterized by subdued buyer demand.

Demographic trends also play a critical role in shaping the real estate market. With millennials and Gen Z increasingly seeking affordable housing options, investors are encouraged to focus on properties that align with these preferences. Understanding the unique needs of these generations can lead to lucrative opportunities in an evolving landscape.

Additionally, the impact of government policies and economic shifts cannot be overlooked. Investors must stay informed about potential changes to tax incentives and housing assistance programs that may create new opportunities. By leveraging market analysis techniques and remaining attuned to current trends, investors can navigate the complexities of the real estate market effectively.

Ultimately, thriving in this competitive environment hinges on understanding the interplay between market dynamics and strategic investment approaches. By equipping themselves with knowledge and insights, investors can position themselves to seize opportunities and achieve success in the ever-evolving real estate landscape.