Overview

The primary insights emerging from US commercial real estate news for 2025 suggest a significant growth trajectory for the sector. This growth is anticipated to be fueled by:

- Heightened demand for industrial spaces

- The adaptive reuse of existing buildings

- The seamless integration of technology in property management

Notably, the rise of e-commerce is driving the necessity for more warehouses, while the shift towards sustainable and flexible work environments underscores the evolving landscape of commercial real estate. Furthermore, leveraging advanced technologies is becoming crucial for enhancing operational efficiency and tenant satisfaction.

These trends not only highlight the dynamic nature of the market but also present actionable insights for investors looking to navigate this promising sector.

Introduction

As the landscape of the US commercial real estate market evolves, numerous factors are shaping its trajectory towards 2025 and beyond. The burgeoning demand for industrial spaces, fueled by e-commerce growth, is one significant element. Additionally, the transformative impact of hybrid work models is redefining office requirements, indicating that the industry is undergoing substantial shifts.

- Retail spaces are embracing experiential shopping,

- Sustainability is becoming a cornerstone of development practices.

- Furthermore, demographic changes led by Millennials and Gen Z are influencing housing preferences, prompting a reevaluation of urban living.

- With technology integration driving operational efficiencies, the commercial real estate sector is poised for a dynamic future.

This article delves into these critical trends, providing insights that empower stakeholders to navigate the complexities of this ever-changing market.

Zero Flux: Essential Insights on US Commercial Real Estate Trends

Zero Flux is committed to delivering timely and relevant insights into US commercial real estate news in the property sector. By consolidating information from over 100 diverse sources, including premium content, it provides subscribers with a comprehensive overview of economic dynamics. This commitment to objective reporting, free from subjective opinions, empowers industry professionals to make informed decisions based on the latest trends and developments.

As we look ahead to April 2025, the US commercial real estate news indicates that the sector is anticipated to grow from USD 1.70 trillion to USD 1.94 trillion by 2030, reflecting a compound annual growth rate (CAGR) of 2.61%. This expansion is driven by various sectors adapting to evolving business demands, particularly in the industrial and hospitality fields, which are rebounding from the challenges posed by the COVID-19 pandemic.

Recent statistics reveal notable trends, such as New Jersey exhibiting the fastest industrial rent growth at 9.8% year-over-year. Furthermore, as noted by Sharad Mehta, Editor, "Orange County boasts the lowest vacancy rate nationwide at 4.2%," underscoring the competitive landscape in key regions.

A compelling case study from Sweden illustrates the increasing attractiveness of industrial properties, with the country reporting investments of 4.3 billion EUR in its industrial and logistics property sector. This trend signifies a broader movement towards industrial properties as a viable investment option, a pattern also reflected in the US market as investors seek similar growth opportunities.

As macroeconomic factors, including low interest rates and demographic shifts towards urban centers, continue to influence the market, these elements are crucial for understanding the dynamics discussed in US commercial real estate news. Zero Flux remains an indispensable resource for property professionals navigating these complexities. The newsletter's emphasis on data integrity and thorough analysis ensures that subscribers are well-prepared to comprehend and leverage current trends in US commercial real estate news.

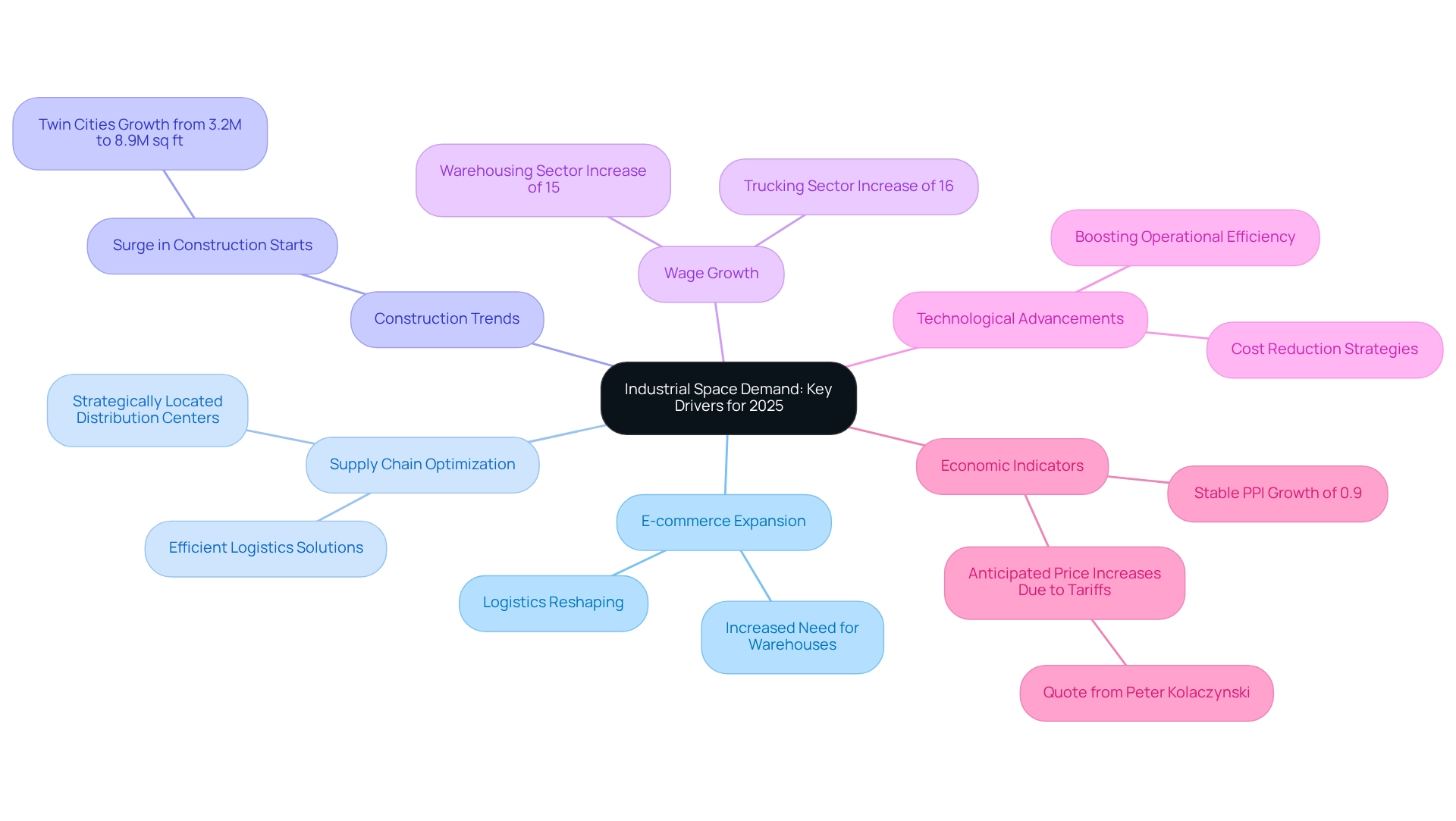

Industrial Space Demand: Key Drivers for 2025

In 2025, the demand for industrial areas is poised for significant growth, driven by several critical factors. The relentless expansion of e-commerce is reshaping logistics, creating a pressing need for strategically located warehouses and distribution centers. As companies increasingly prioritize supply chain optimization, the demand for efficient logistics solutions becomes paramount. Notably, the Twin Cities have witnessed a remarkable surge in construction starts, soaring from 3.2 million to 8.9 million square feet, which underscores the escalating demand for industrial facilities.

Moreover, the resurgence of manufacturing in the U.S. is playing a pivotal role in this trend, as businesses strive to enhance domestic production capabilities. A recent study highlighted substantial wage growth in the trucking and warehousing sectors, with increases of 16% and 15% respectively in Q1, reflecting a robust labor environment that supports industrial operations. Furthermore, technological advancements and automation are propelling demand, enabling companies to boost operational efficiency and reduce costs. As industry leaders anticipate potential price hikes due to tariffs, the urgency for companies to secure industrial locations intensifies. Additionally, the Producer Price Index (PPI) increased only 0.9% year-over-year in March, indicating a stable economic environment that could influence industrial demand.

For investors seeking deeper insights, a comprehensive April 2025 report on U.S. commercial real estate news and economic recovery fundamentals is available, providing valuable context for informed decision-making. Overall, the convergence of these factors positions industrial real estate as a highly attractive investment opportunity in 2025.

Office Space Demand: Adapting to Hybrid Work Models

The emergence of hybrid work models is fundamentally transforming the demand for conventional office environments. Organizations are progressively supporting adaptable work settings that accommodate both in-office and remote staff, resulting in a significant change in office area needs. This trend has led to an increasing need for smaller, versatile office environments designed to promote collaboration and innovation.

Property developers and investors must adjust to these changes by planning new office projects that align with the evolving needs of businesses. As IDC highlights, global spending on digital transformation technologies is projected to reach $3.4 trillion by 2025, underscoring the urgency for companies to invest in the right hybrid work solutions. Furthermore, statistics reveal that remote and hybrid employees report being 22% happier than those in traditional office settings, emphasizing the importance of creating workspaces that enhance employee satisfaction.

However, a significant percentage of employees in hybrid workplaces report feeling burned out, with 49% indicating some level of burnout and 21% experiencing high levels. This highlights the necessity for flexible office designs that promote employee well-being. Additionally, employers need to adopt the right hybrid work software to facilitate the transition and support these new work models. To stay competitive, stakeholders in the commercial real estate sector must prioritize these adaptable office designs and consider the implications of hybrid work on future area demand, as highlighted in recent US commercial real estate news.

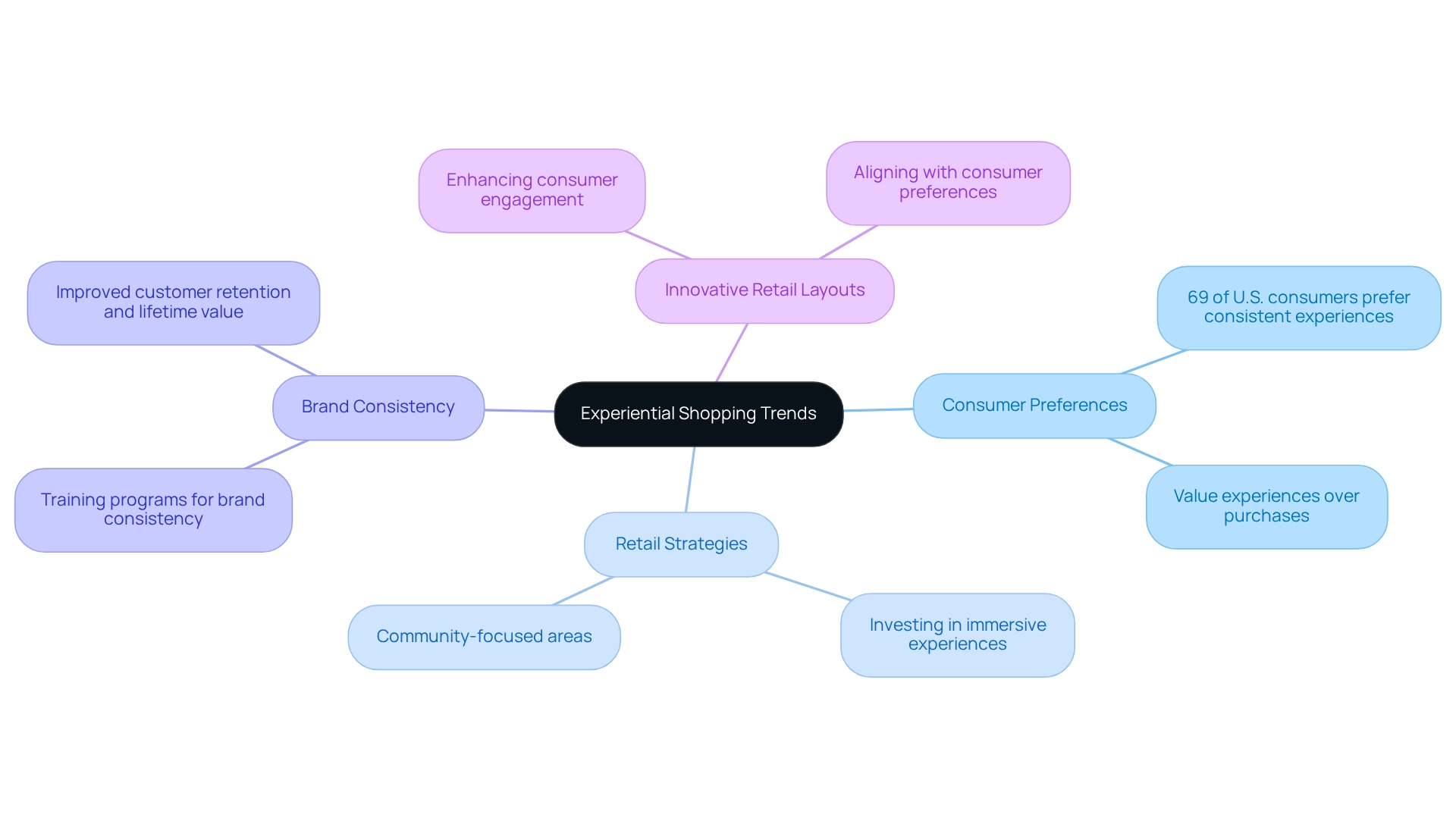

Retail Space Trends: The Shift Towards Experiential Shopping

In 2025, retail areas are increasingly prioritizing experiential shopping environments that engage consumers beyond conventional transactions. Retailers are investing in immersive experiences, interactive displays, and community-focused areas to attract foot traffic. This shift is largely driven by changing consumer expectations, particularly among younger generations who value experiences over mere purchases. Notably, 69% of U.S. consumers prefer brands that deliver consistent experiences across various platforms, underscoring the need for retail real estate to adapt to these trends to remain competitive.

As Leon Nicholas, Vice President of Retail Insights & Solutions at Smurfit Westrock, states, "Functional products are winning out over discretionary items," highlighting the importance of aligning retail offerings with consumer preferences. Innovations in retail layout design are essential, as they not only enhance consumer engagement but also align with this growing demand. Furthermore, training programs that promote brand consistency are crucial; a consistent customer experience is highly valued by consumers, leading to improved retention and lifetime value.

As retailers change their environments to satisfy these expectations, the emphasis on crafting unforgettable shopping experiences will be essential for success in the changing landscape. Additionally, utilizing customer feedback solutions, such as those offered by TruRating, can help measure the effectiveness of retail strategies, further enhancing consumer engagement.

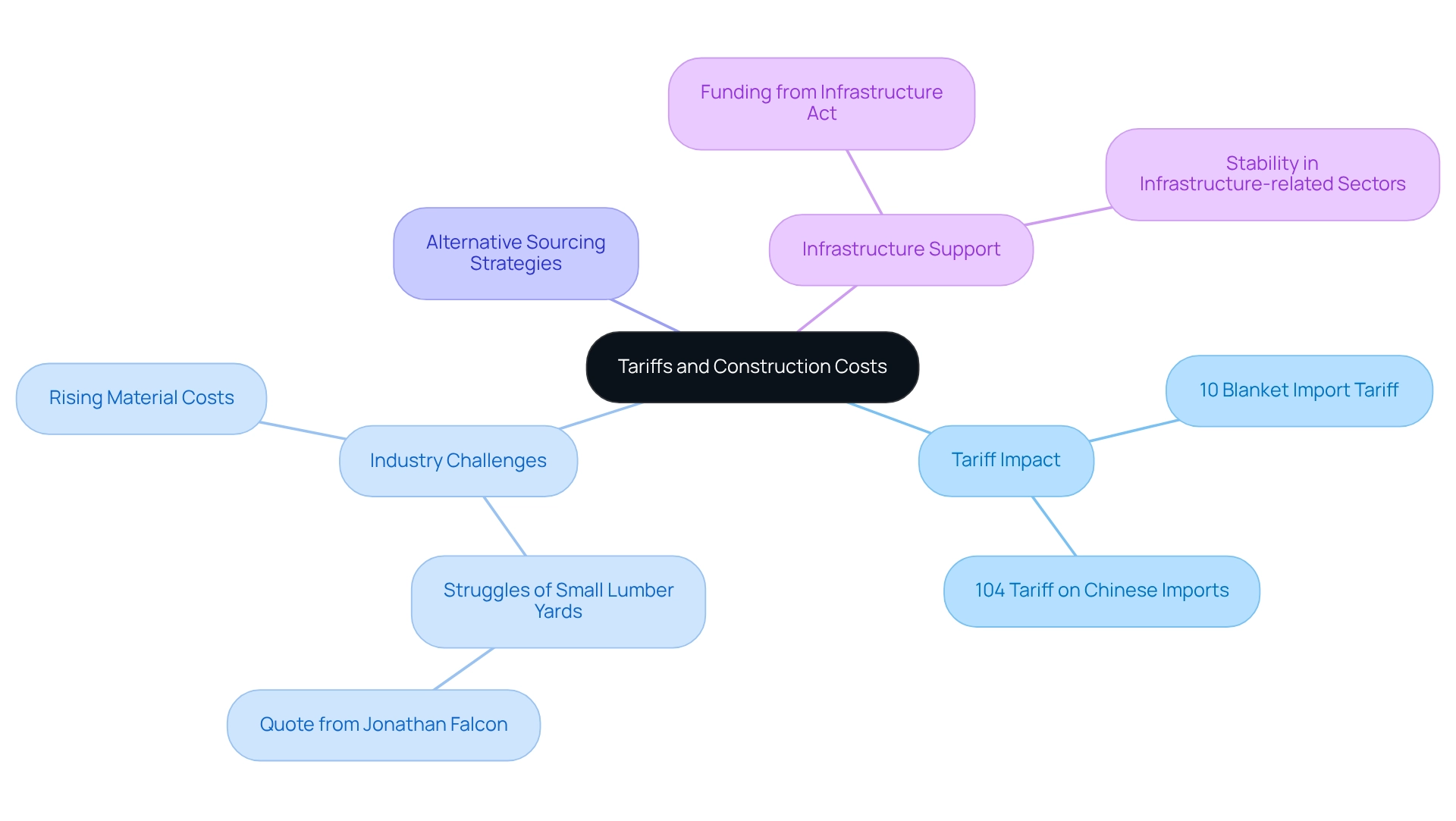

Tariffs and Construction Costs: Navigating Market Challenges

In 2025, the construction industry faces significant challenges due to increased tariffs on imported materials. These tariffs, which include a 10% blanket import tariff and an astonishing 104% tariff on Chinese imports, are expected to raise costs for builders, directly impacting project budgets and timelines.

As Jonathan Falcon, co-owner of Slutsky Lumber, remarked, "This is just like another thing that’s going to be harder for small lumber yards to handle than the big guys and just sort of keep driving businesses like us to not make it."

To effectively navigate these hurdles, developers must implement alternative sourcing strategies to mitigate the impact of rising material costs. Furthermore, traditional HVAC shipments have declined by 11% year-over-year, highlighting broader industry trends influenced by these tariffs.

However, infrastructure-related sectors are projected to remain stable, bolstered by funding from the Infrastructure Act through 2026, providing a counterbalance to the challenges posed by tariffs. Staying informed about tariff changes and understanding their effects on the industry will be essential for successful project execution.

As the landscape evolves, proactive measures and informed decision-making will be vital for maintaining project viability in this challenging environment.

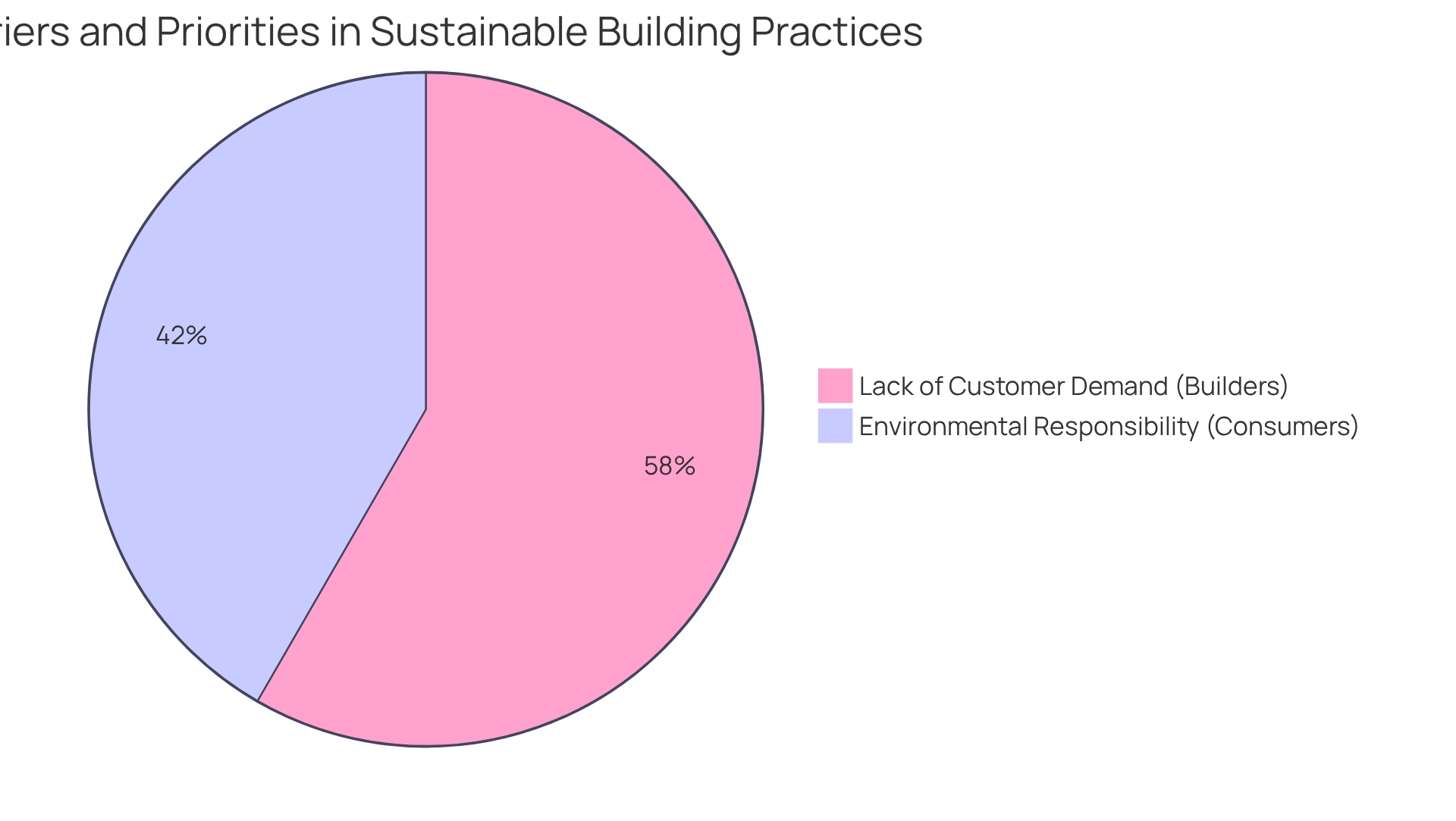

Sustainable Building Practices: The Future of Commercial Real Estate

As we progress through 2025, sustainable building practices have become increasingly vital in the commercial real estate sector. Developers are prioritizing eco-friendly materials and energy-efficient designs, understanding that these approaches not only mitigate environmental impact but also enhance the long-term value of their properties. Notably, 77% of builders have identified 'Lack of Customer Demand' as the primary barrier to green building, highlighting the urgent need for market-driven solutions. Furthermore, the average time spent on manual life cycle assessments is a staggering 450 hours, underscoring the necessity for streamlined processes in sustainable construction.

With sustainability emerging as a key differentiator, investors and developers who embrace these practices are likely to see heightened demand from tenants and buyers who prioritize green building certifications and energy-efficient features. Significantly, 55% of consumers indicate that environmental responsibility is very or extremely important when selecting a brand, further emphasizing the industry's shift towards sustainability. A prime example of this trend is the International Finance Corporation's recent initiative in Indonesia, which introduced the country's first sustainability-linked loan, illustrating the movement towards sustainable property development in developing regions.

This momentum is expected to resonate across the US and UK, where eco-friendly commercial properties are increasingly sought after, reflecting a broader commitment to sustainable practices in the industry. Moreover, the Asia Pacific region presents profitable opportunities for companies in the green building sector, indicating that the demand for sustainable practices is not confined to Western regions.

Demographic Shifts: Millennials and Gen Z's Impact on Real Estate

Millennials and Gen Z are set to significantly influence the real estate sector in 2025, driven by their distinct preferences for urban living, sustainability, and technology integration. As these generations increasingly enter the housing market, their demand for walkable communities and modern amenities will reshape property types and investment strategies. A recent survey conducted in December 2024 revealed that 60% of potential homebuyers are seeking homes with additional room, reflecting a growing desire for flexibility in living arrangements. This trend is especially pronounced among younger generations, who prioritize proximity to urban areas and access to coworking environments, a shift accelerated by the rise of remote employment.

Real estate professionals must adapt to these evolving preferences by focusing on developments that align with the lifestyle choices of Millennials and Gen Z. Properties that feature flexible living spaces, energy-efficient designs, and smart home technologies are likely to attract these buyers. Furthermore, statistics indicate that a considerable portion of younger buyers are making below-average down payments, which may affect their purchasing power and the types of properties they consider. For example, closing costs for homebuyers in the U.S. average approximately $7,300, with Washington, D.C. surpassing $30,000, presenting financial challenges that younger buyers must navigate.

Experts anticipate that as the economy stabilizes, there will be fewer foreclosure auctions in 2025, further influencing economic dynamics. This trend is crucial for younger buyers who may be more sensitive to economic fluctuations. The emphasis on urban living and community-oriented developments will not only cater to the preferences of younger generations but also enhance overall market resilience. Case studies illustrate how successful urban living developments are already drawing Millennials and Gen Z, underscoring the importance of aligning real estate offerings with the values and needs of these influential demographics. As Sarah Wolak, a mortgage reporter, notes, "Of the pool of respondents who plan on purchasing a home within the next year, 60% said they’re looking for a home with greater room, a 17% increase from a year ago," highlighting the shifting priorities in housing preferences. Additionally, the case study titled 'Remote Work's Impact on Housing Demand' demonstrates how the proliferation of remote work is transforming housing preferences, with buyers increasingly seeking homes that accommodate home office areas and proximity to coworking sites.

Co-Working Spaces: Redefining Office Utilization

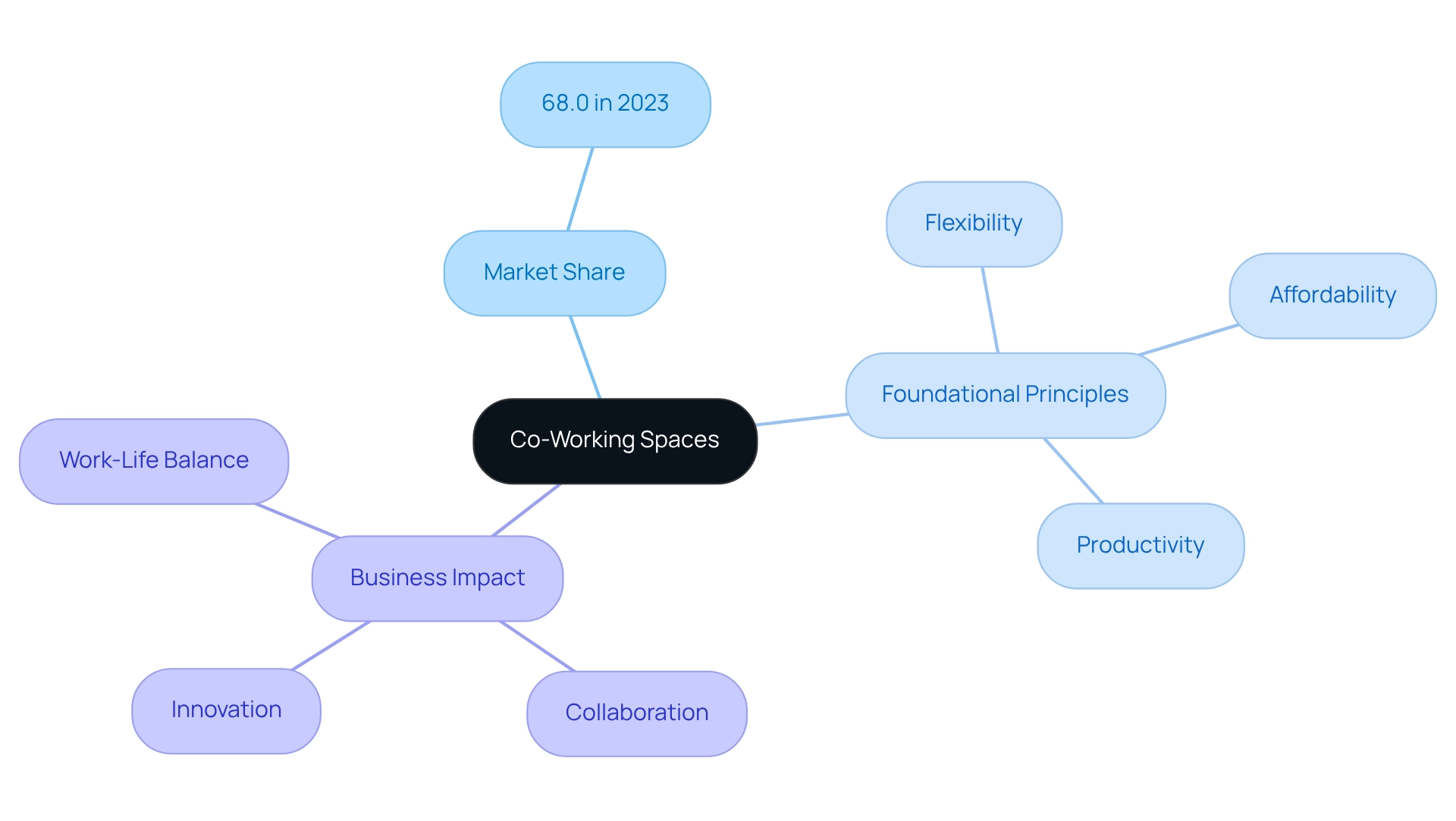

In 2025, co-working environments are fundamentally transforming office usage. These flexible spaces enable companies to dynamically modify their area requirements, fostering collaboration and innovation among a diverse range of tenants. As hybrid work models gain traction, the demand for co-working environments is poised to rise, presenting substantial opportunities for investors and developers to create adaptable office solutions tailored to modern business needs.

The U.S. co-working market, which commanded a significant 68.0% revenue share in 2023, exemplifies this trend. Successful co-working models, as detailed in the case study "Foundational Principles of Coworking," emphasize foundational principles such as:

- Flexibility

- Affordability

- Productivity

These principles not only enhance workplace satisfaction but also support a healthier work-life balance, ultimately revolutionizing traditional office concepts. Furthermore, partnerships within co-working environments often prove to be economical strategies that enhance revenue and generate new leads, reinforcing their attractiveness.

As the landscape continues to evolve, insights from real estate professionals underscore the necessity of these flexible solutions in meeting the demands of modern enterprises, showcasing specific examples of how businesses are leveraging co-working environments to thrive.

Adaptive Reuse: Transforming Existing Spaces for New Purposes

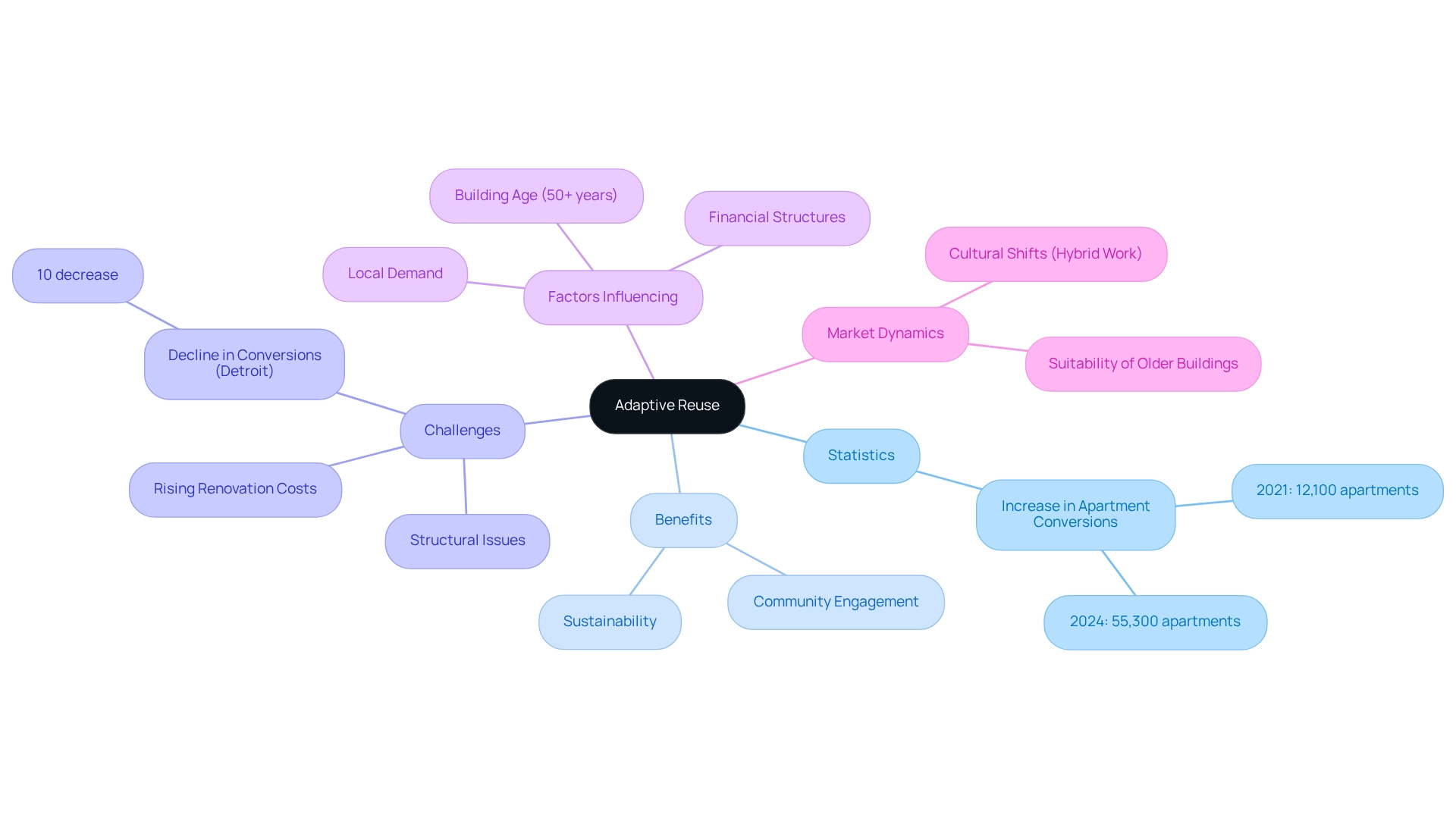

In 2025, adaptive reuse is increasingly recognized as a strategic method for developers aiming to convert existing structures into functional spaces that align with modern requirements. This trend not only preserves the architectural heritage of older buildings but also meets the rising demand for sustainable development practices. By repurposing underutilized properties, developers can cultivate vibrant environments that enhance community engagement and significantly reduce environmental footprints.

According to RentCafe, statistics reveal a remarkable increase in adaptive reuse projects, with the number of apartments transformed from old office buildings in the US soaring from 12,100 in 2021 to 55,300 by 2024. This shift underscores the potential for investors to tap into a profitable sector that emphasizes sustainability and innovation.

Moreover, the adaptive reuse landscape is shaped by various factors, including the age of buildings and local demand. Developers are encouraged to concentrate on structures that are at least 50 years old, as these often qualify for tax credits associated with historical property reuse. However, challenges remain; for instance, Detroit experienced a 10% decline in office-to-apartment transformations, influenced by rising renovation costs and structural issues, highlighting the complexities involved in such endeavors.

Cultural shifts, particularly the rise of hybrid work arrangements, have rendered certain traditional office environments obsolete, prompting a reassessment of their use. Successful transformations of existing buildings not only address current market demands but also contribute to urban revitalization. As industry experts emphasize, comprehending the dynamics of adaptive reuse is crucial for developers and policymakers alike, ensuring they can navigate this evolving landscape effectively.

The advantages of adaptive reuse extend beyond economic benefits; they also promote community development and environmental stewardship. By revitalizing existing structures, developers can create spaces that resonate with the public while addressing urgent sustainability goals. As this trend continues to gain momentum, it presents substantial opportunities for investors looking to leverage the potential of adaptive reuse projects in the commercial property sector. The adaptive reuse sector is influenced by various factors, including building age, financial structures, and local demand, making it essential for stakeholders to stay informed about these dynamics.

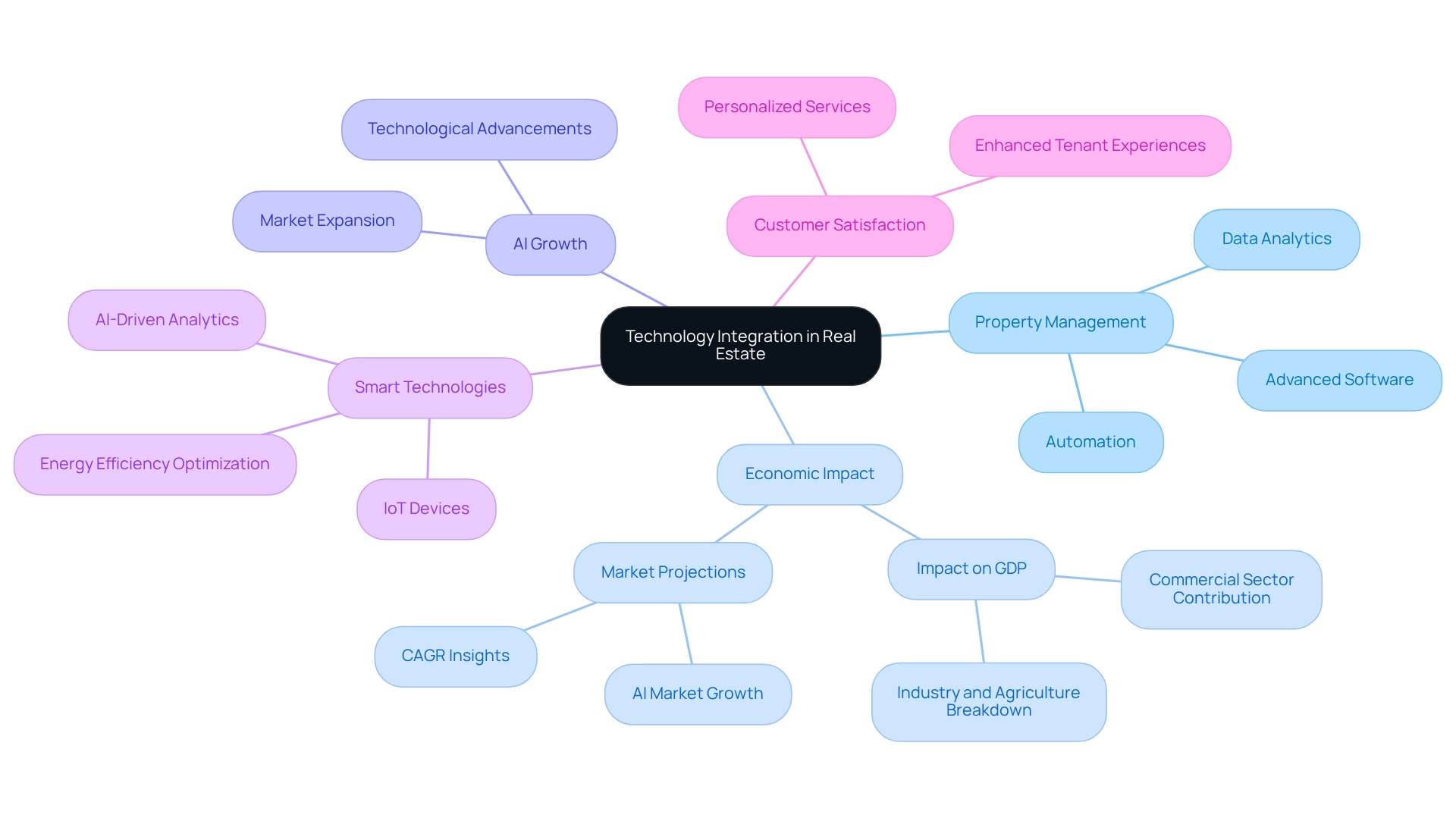

Technology Integration: Enhancing Real Estate Operations

In 2025, the integration of technology will be crucial in transforming property operations. Advanced property management software and sophisticated data analytics are streamlining processes and enhancing decision-making for both investors and developers. The emergence of smart building technologies, such as IoT devices and AI-driven analytics, empowers property owners to optimize energy efficiency and elevate tenant experiences, significantly increasing property values.

Notably, the commercial sector, constituting approximately 63% of global GDP, stands to gain immensely from these advancements. As JLL states, 'the commercial sector accounts for around 63% of global GDP, with Industry on 30% and Agriculture at about 7%,' underscoring the importance of these technologies in a vital economic sector.

The AI sector in property is projected to expand from $222.65 billion in 2024 to $303.06 billion in 2025, with a compound annual growth rate (CAGR) of 34.4% from 2025 to 2029, driven by advancements in analytics, chatbots, property valuation, and automation in property management. Staying informed about these technological trends is essential for success in the evolving landscape.

Successful implementations of smart building technologies are already reshaping property management, leading to more efficient operations and improved customer satisfaction. Insights from industry leaders highlight the necessity of embracing these innovations to remain competitive in the market.

Case studies on trends in AI for real estate automation illustrate how these advancements are transforming property management practices, further emphasizing the value of data-driven approaches in real estate operations.

Conclusion

The US commercial real estate market stands poised for transformation, adapting to a multitude of emerging trends that will shape its future through 2025 and beyond. The burgeoning demand for industrial spaces, propelled by the e-commerce boom and the revival of domestic manufacturing, underscores the sector's pivot towards logistics and supply chain optimization. This trend is further bolstered by the advent of hybrid work models, which are redefining traditional office space requirements and fostering flexible, collaborative environments.

In the retail sector, the shift towards experiential shopping mirrors evolving consumer preferences, particularly among younger generations who prioritize engagement over mere transactions. Likewise, the growing emphasis on sustainability in building practices is becoming increasingly essential, with eco-friendly developments capturing the interest of both tenants and investors. As Millennials and Gen Z continue to penetrate the housing market, their inclination towards urban living and modern amenities is reshaping residential real estate dynamics.

Additionally, the challenges posed by tariffs and escalating construction costs necessitate innovative strategies in project execution, while the adaptive reuse of existing spaces offers a sustainable solution for addressing market demands. The integration of technology in real estate operations is also paramount, enhancing efficiencies and improving tenant experiences.

In conclusion, stakeholders in the commercial real estate sector must remain vigilant and adaptable to these evolving trends. By embracing change and leveraging insights from data-driven analysis, real estate professionals can navigate the complexities of the market and capitalize on the opportunities that lie ahead. The future of commercial real estate is not merely about responding to current demands; it is also about anticipating shifts that will define the landscape in the years to come.