Overview

The article titled "10 Key Insights on the Commercial Real Estate Market Outlook 2025" provides an in-depth analysis of anticipated trends and influential factors shaping the commercial real estate market in the upcoming years. It asserts that the market will be significantly impacted by economic recovery in the post-pandemic era, technological advancements, and evolving consumer preferences. Notably, there is a strong emphasis on sustainability and adaptability, which are crucial for capitalizing on emerging opportunities.

As we delve deeper, it becomes evident that understanding these dynamics is essential for investors. The article outlines how economic recovery will drive demand, while technological innovations will transform operational efficiencies. Furthermore, changing consumer preferences, particularly a shift towards sustainable practices, will redefine market strategies. These insights are not merely observations; they are actionable intelligence that can guide investment decisions effectively.

In conclusion, the implications of these trends are profound. Investors must adapt to the evolving landscape by integrating sustainability into their strategies and leveraging technology to enhance their competitive edge. By staying informed and responsive to these key insights, stakeholders can position themselves advantageously in the commercial real estate market as it evolves towards 2025.

Introduction

The commercial real estate landscape stands poised for transformation as it navigates the complexities of a post-pandemic world. Significant shifts in consumer preferences, technological advancements, and economic recovery present stakeholders with both challenges and opportunities that could redefine their strategies.

How can investors and property professionals effectively adapt to these evolving trends and ensure their success in a competitive market? This article delves into ten key insights that illuminate the commercial real estate market outlook for 2025, offering a roadmap for informed decision-making in an ever-changing environment.

Zero Flux: Daily Insights on Commercial Real Estate Trends

Zero Flux delivers essential daily insights into business property trends, meticulously curating information from over 100 diverse sources. This newsletter emphasizes critical developments, such as the notable shifts in office space demand and emerging investment opportunities. For example, the national office vacancy rate soared to a record high of 13.9% in 2024, while national office rent growth is anticipated to remain below 1% in the coming years. By offering concise overviews of industry trends, Zero Flux empowers property professionals to make swift, informed decisions, ensuring they stay competitive in an ever-evolving landscape.

With a robust subscriber base exceeding 30,000, the impact of these daily insights is profound, equipping subscribers with the knowledge needed to navigate complexities and capitalize on opportunities within the business property sector. As industry expert Vidit Saxena emphasizes, grasping metrics such as NOI and cap rates is crucial for assessing property profitability and market conditions. This underscores the significance of the insights provided by Zero Flux, reinforcing the necessity for property professionals to stay informed and strategically engaged.

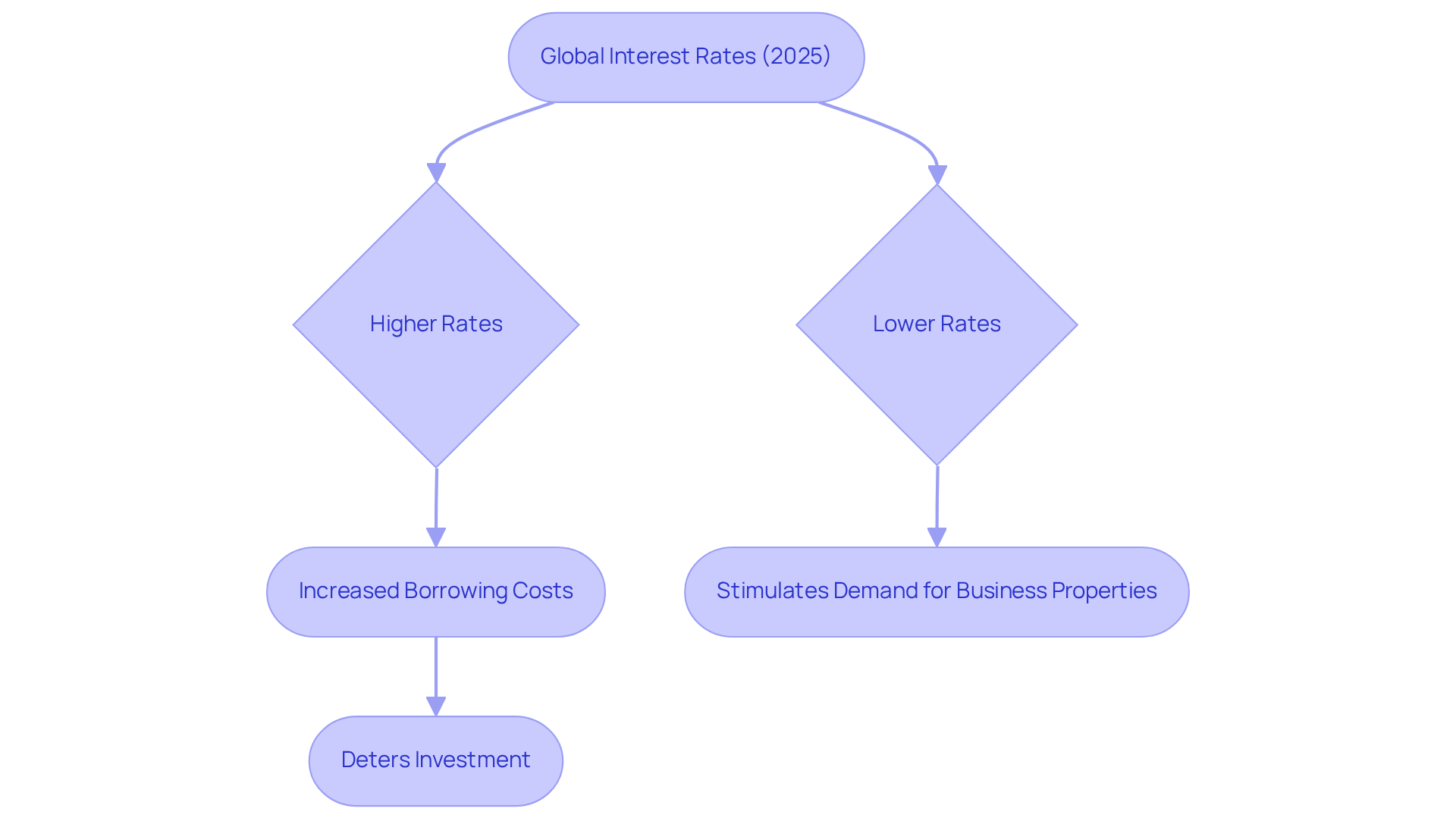

Deloitte: The Impact of Global Interest Rates on Commercial Real Estate

Deloitte forecasts that global interest rates will remain unstable in 2025, a factor that will significantly impact business properties. Higher interest rates are likely to increase borrowing costs, potentially deterring investment in new projects. Conversely, lower rates could stimulate demand for business properties. Investors must closely monitor these trends to adapt their strategies effectively. By capitalizing on favorable conditions, they can position themselves advantageously in the evolving market landscape.

Forbes: Key Trends in Office Spaces and Tech Sector Growth

The demand for flexible office spaces is surging, largely fueled by the tech sector's expansion and the increasing adoption of hybrid work models. As companies adapt to fluctuating employee numbers, they are prioritizing adaptable work environments that can accommodate diverse needs. Research indicates that 41% of tenants plan to enhance their use of flexible spaces in their post-pandemic strategies, reflecting a significant shift in workplace preferences. According to the commercial real estate market outlook 2025, investors should focus on properties that offer flexible leasing options and amenities tailored to tech firms, as these features are likely to drive higher returns in the coming years.

Successful case studies illustrate this trend: landlords who have embraced flexible workspace solutions, particularly in prime locations, are witnessing increased occupancy and income. For instance, management agreements between landlords and flexible space operators are becoming more common, allowing for shared revenue and reduced risk compared to traditional subleasing models. This approach not only aligns incentives but also enables landlords to adapt to changing tenant demands effectively.

Moreover, the tech sector's demand for office space has risen from 12% to nearly 20% of total U.S. demand in the past year, underscoring the importance of investing in quality office environments. As hybrid work models become more popular, with 63% of employees favoring a mix of in-office and remote work, the business property landscape is changing. Landlords who can manage these changes and integrate adaptable workspace solutions will be well-placed to take advantage of new opportunities highlighted in the commercial real estate market outlook 2025.

JPMorgan: Challenges and Opportunities in Commercial Real Estate

JPMorgan emphasizes that while the business property market faces challenges such as rising construction costs and regulatory hurdles, it also presents significant opportunities. Notably, sectors like logistics and healthcare are witnessing robust growth, fueled by the rise of e-commerce and the demands of an aging population. Investors should strategically focus on these sectors to mitigate risks and capitalize on emerging trends, ensuring their investment strategies align with current market dynamics.

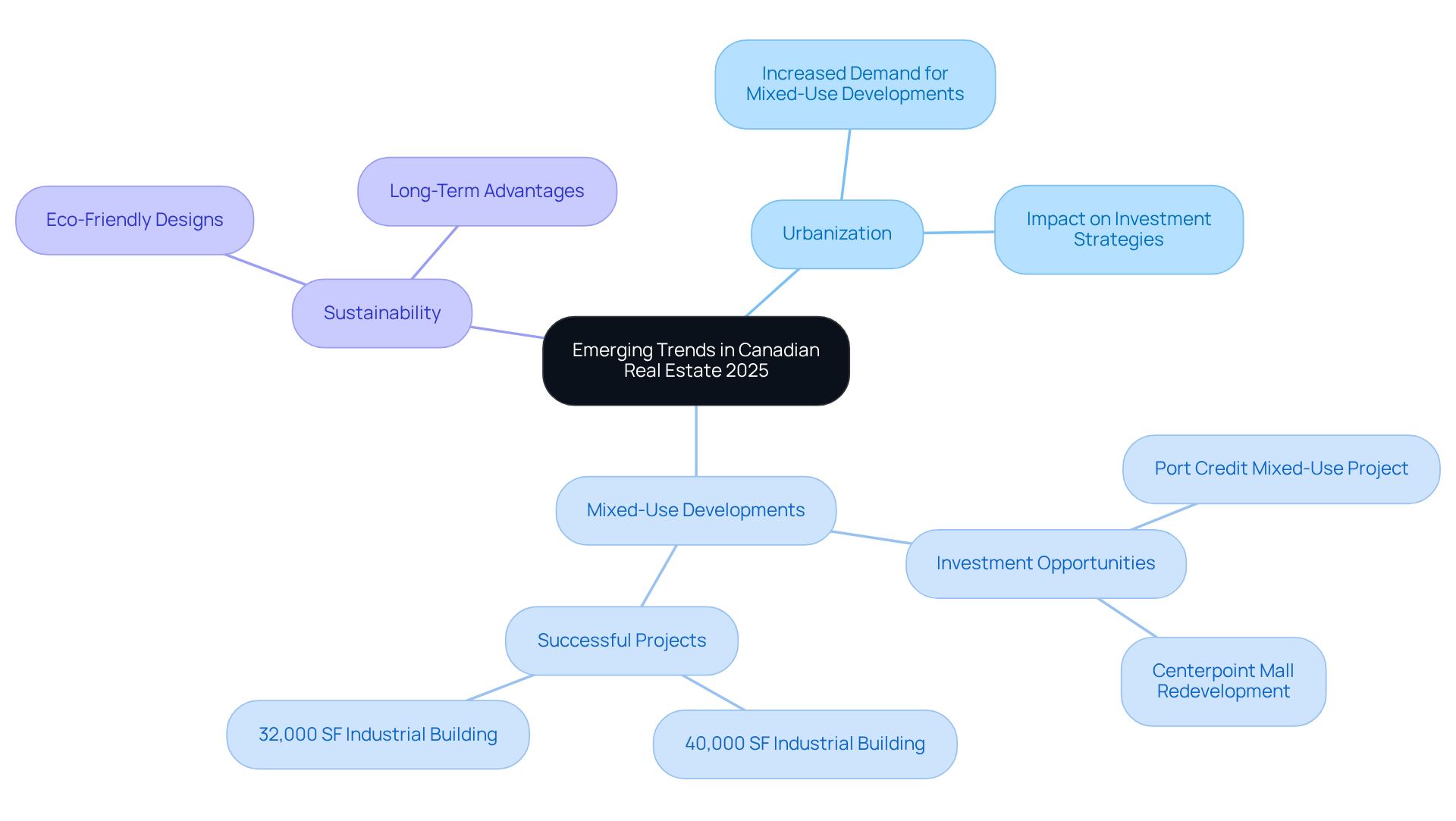

PwC: Emerging Trends in Canadian Real Estate for 2025

Emerging trends in Canadian property for 2025 underscore a significant emphasis on urbanization and sustainability. As urban areas expand, the demand for mixed-use developments—integrating residential, retail, and recreational spaces—continues to surge. This shift not only addresses the evolving needs of urban populations but also unveils lucrative investment opportunities. Successful projects, such as the 9,000 square foot mixed-use building in Port Credit, exemplify how resolving design inconsistencies can lead to timely and budget-friendly completions. This reinforces the critical importance of collaboration among architects and construction managers.

Investors should concentrate on properties that align with these trends, as urbanization is reshaping the business property landscape. The incorporation of sustainable practices in mixed-use developments is becoming increasingly essential, with a heightened focus on eco-friendly designs and materials. As illustrated by PCM's experience, adapting to these demands can result in successful outcomes, ensuring projects are delivered on time and within budget.

In the commercial real estate market outlook 2025, the emphasis on sustainability in mixed-use developments will be paramount, as stakeholders acknowledge the long-term advantages of environmentally conscious designs. This approach not only enhances the appeal of properties but also contributes to the overall well-being of urban communities, which is essential for investors considering the commercial real estate market outlook 2025.

Sustainability: The Shift Towards Climate Resilience in Real Estate

The commercial property landscape is undergoing a significant transformation as the focus on climate resilience gains prominence. Investors are prioritizing properties that adopt sustainable practices, such as energy-efficient designs and the integration of renewable energy sources. This trend not only aligns with evolving regulatory requirements but also attracts environmentally conscious tenants, thereby enhancing long-term asset value. For example, LEED-certified multifamily properties demonstrated a 2.7% sales premium from 2012 to 2021, underscoring the financial benefits of sustainability in property investments.

Moreover, LEED-certified properties achieved a 21.4% higher average sales price per square foot compared to their non-LEED-certified counterparts, further emphasizing the importance of sustainable practices. As the demand for climate-resilient properties escalates, the potential for stranded assets due to climate risks could soar to $7.5 trillion, highlighting the urgency for investors to adapt their strategies. Additionally, the projected $9.2 trillion in annual investment required globally to facilitate the net-zero transition illustrates the broader economic implications of climate resilience in the property sector.

By focusing on sustainability, property stakeholders can mitigate risks associated with climate change while positioning themselves advantageously in a market increasingly shaped by environmental factors.

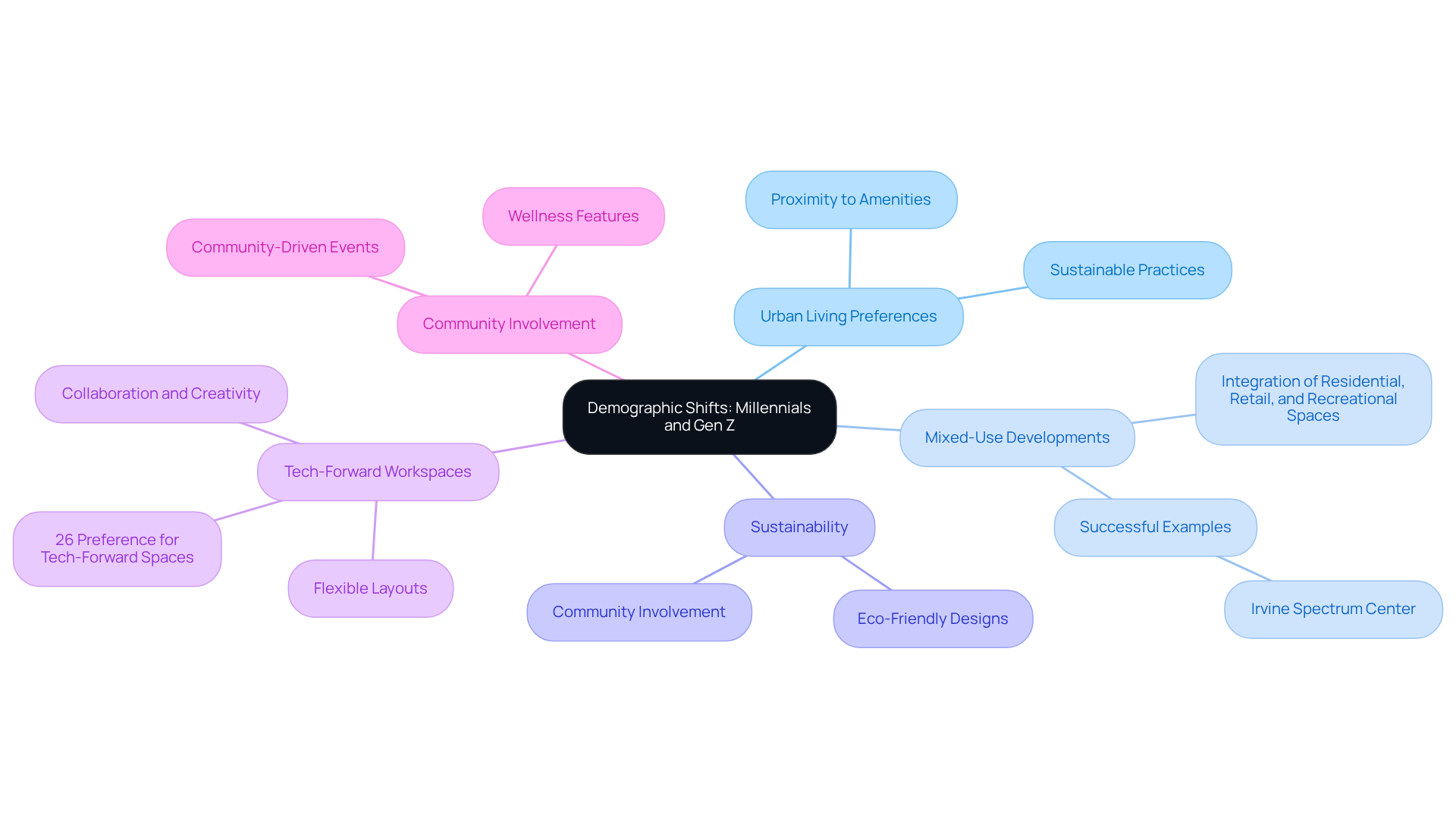

Demographic Shifts: The Migration of Millennials and Gen Z

The migration trends of Millennials and Generation Z are significantly transforming the landscape of business property. These generations increasingly favor urban living, placing a high value on proximity to amenities and sustainable practices. As they enter the workforce and seek housing, investors must concentrate on properties that align with their preferences, particularly mixed-use developments that integrate residential, retail, and recreational spaces.

Notably, 26% of employees express a preference for tech-forward office environments, underscoring the rising demand for flexible layouts that promote collaboration and creativity. Successful mixed-use developments, such as the Irvine Spectrum Center, exemplify this trend by incorporating outdoor spaces, community-driven events, and wellness features, making them appealing destinations for younger residents.

Furthermore, as Generation Z gains greater financial autonomy, their influence on business property will continue to grow, necessitating a shift towards locations that embody their principles of sustainability and community involvement. Understanding these demographic changes is crucial for investors aiming to navigate the evolving economic landscape effectively.

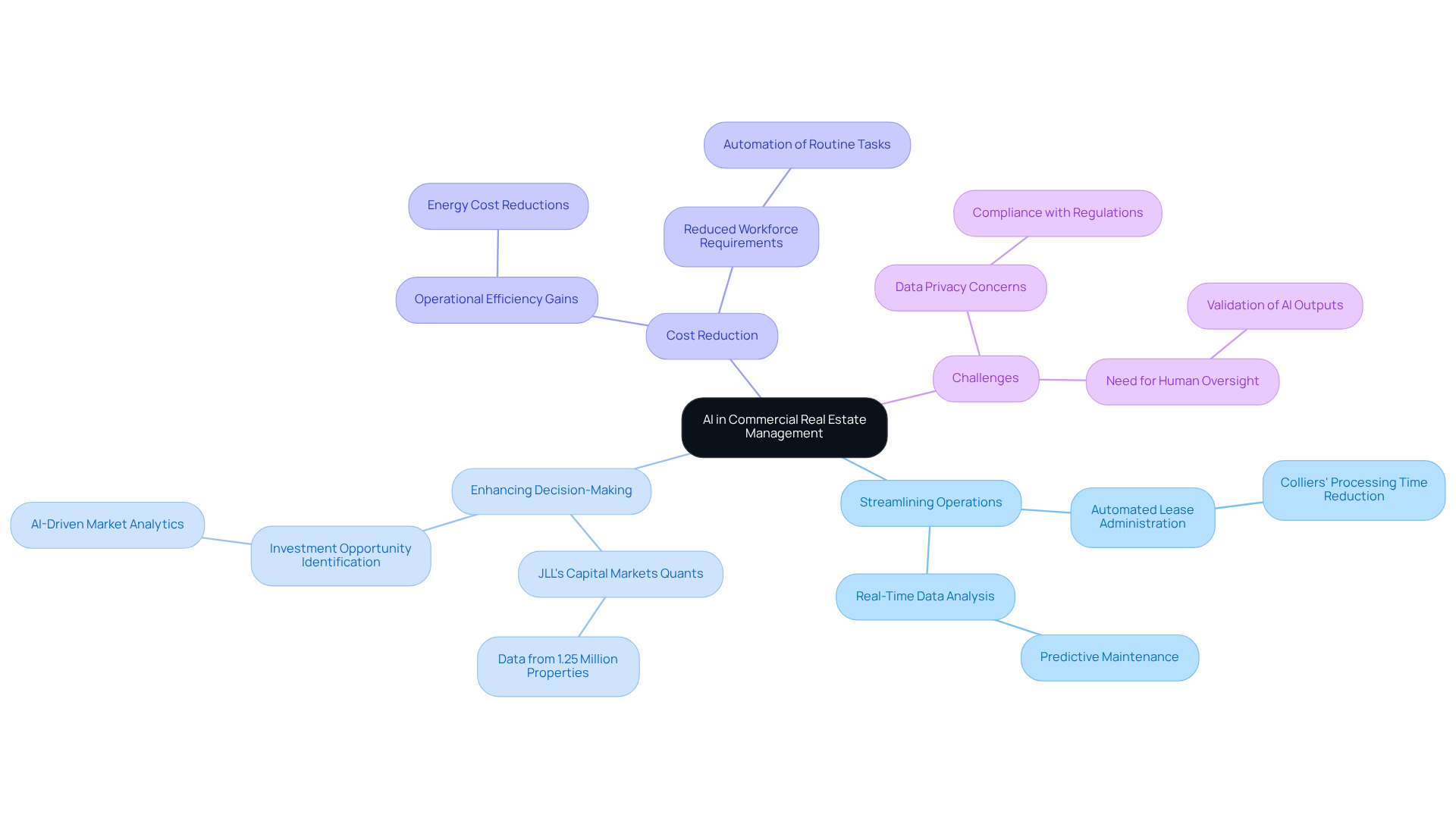

Artificial Intelligence: Transforming Commercial Real Estate Management

Artificial intelligence is revolutionizing commercial real estate management by streamlining operations and enhancing decision-making capabilities. AI tools analyze extensive datasets, predicting industry trends, optimizing pricing strategies, and enhancing tenant experiences. For instance, JLL's Capital Markets Quants platform employs AI to forecast industry changes by examining data from over 1.25 million properties exchanged worldwide in the last twenty years. This level of analysis empowers investors to identify lucrative opportunities and make informed decisions based on real-time insights.

Moreover, AI applications in property management significantly reduce operational costs and improve efficiency. Companies like Colliers have successfully integrated AI to automate lease administration, drastically cutting processing times from several days to mere minutes. Such implementations not only enhance productivity but also ensure accuracy in managing lease obligations, particularly in high-stakes environments.

As AI continues to evolve, its role in decision-making becomes increasingly critical. The International Monetary Fund estimates that 40% of all jobs worldwide involve tasks that can be enhanced or automated with AI, underscoring the technology's potential to transform the workforce in property management. By leveraging AI technologies, investors and property managers can gain a competitive advantage, effectively navigating the complexities of the industry. However, it is essential to address challenges such as data privacy concerns and the necessity for human oversight to ensure responsible AI adoption.

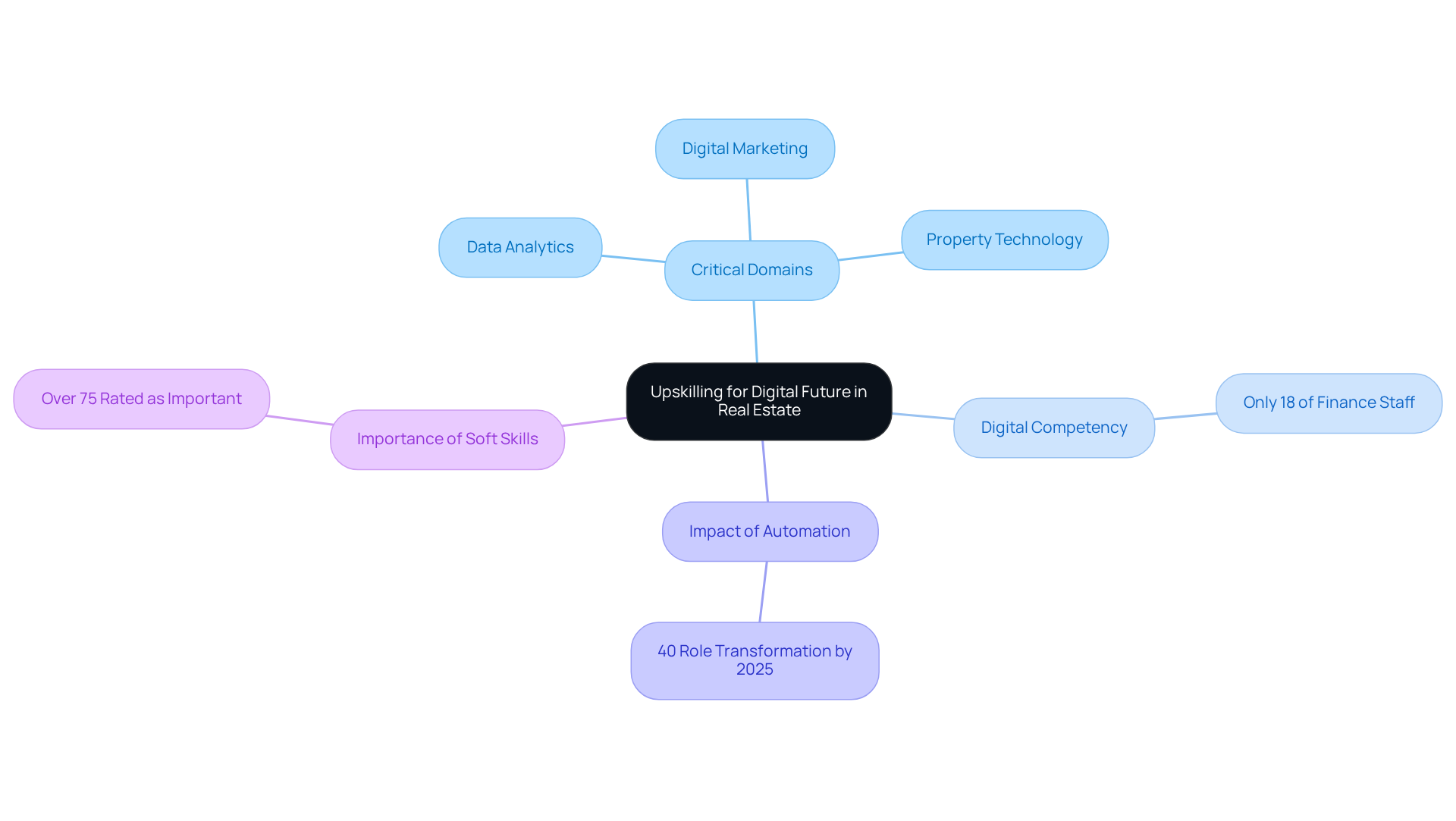

Upskilling: Preparing for a Digital Future in Real Estate

In the realm of digital transformation, upskilling stands as a fundamental pillar for property professionals striving to secure a competitive edge. Training in critical domains such as data analytics, digital marketing, and property technology is essential for navigating this dynamic landscape. Organizations must prioritize investments in comprehensive training programs that foster a culture of continuous learning, ensuring their workforce possesses the necessary skills to excel in a technology-driven environment.

With a mere 18% of finance staff exhibiting digital competency, the urgency for upskilling is unmistakable. Moreover, as automation and AI redefine roles within the industry—predictions indicate that 40% of finance roles will be newly created or significantly transformed by 2025—cultivating adaptability through targeted training will be crucial for success in the forthcoming years.

Additionally, over 75% of respondents rated soft skills as somewhat or very important, underscoring the necessity for a well-rounded skill set that encompasses both technical and interpersonal capabilities.

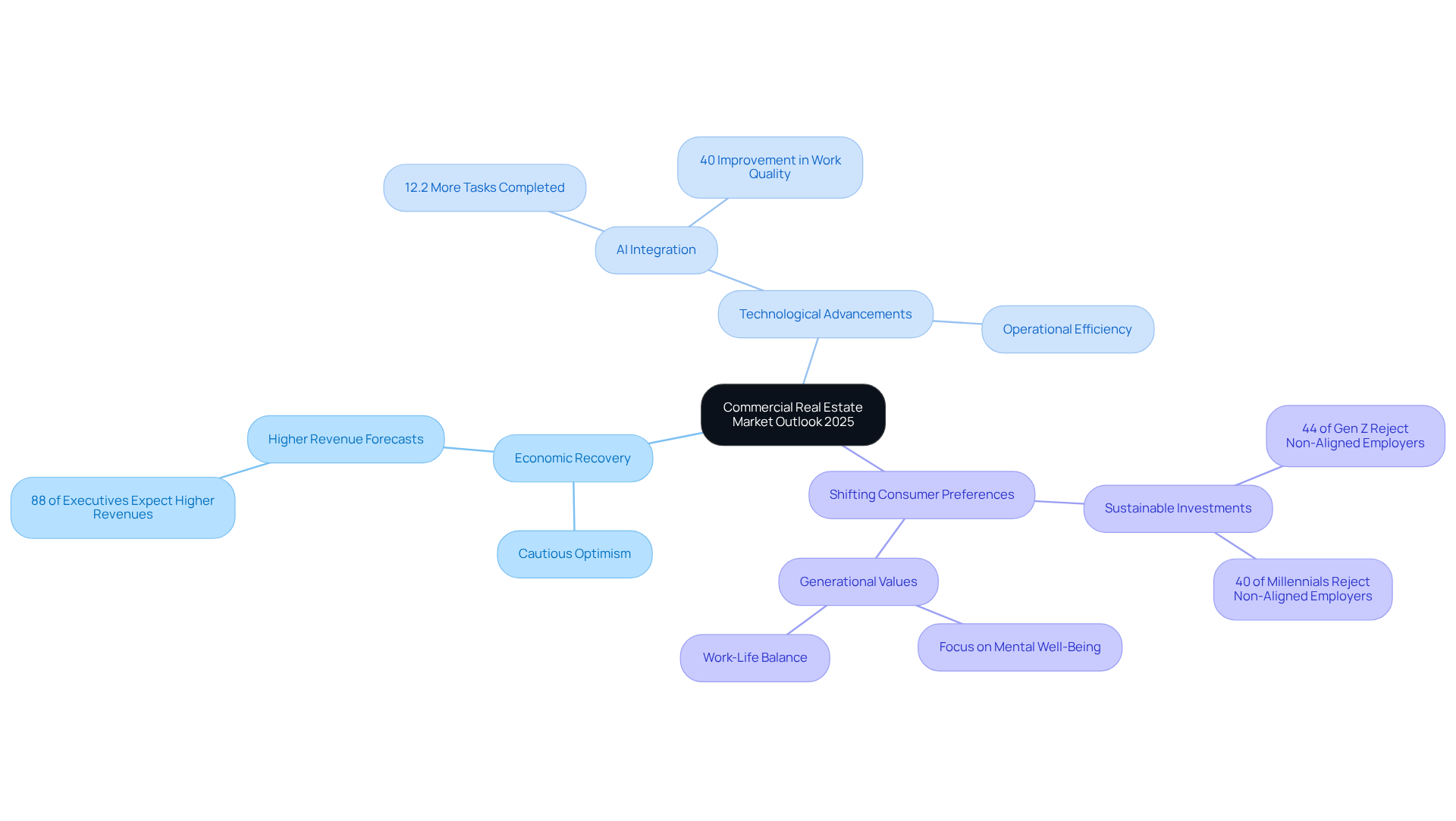

Market Outlook: Key Factors Shaping Commercial Real Estate in 2025

The commercial real estate market outlook 2025 is expected to be significantly influenced by the ongoing economic recovery post-pandemic, along with rapid technological advancements and shifting consumer preferences. As the economy rebounds, investors are poised to navigate a landscape marked by cautious optimism, with 88% of executives forecasting higher revenues—the highest projection in five years. This recovery transcends a mere return to pre-pandemic conditions; it signals an opportunity for strategic repositioning and investment in growth sectors, notably industrial properties and affordable housing.

Technological innovations are fundamentally reshaping the industry, as companies harness AI and digital tools to bolster operational efficiency and enhance decision-making. For instance, firms that have integrated AI report completing 12.2% more tasks while achieving a remarkable 40% improvement in work quality. This technological edge is crucial as competition intensifies, creating a clear divide between industry leaders and followers.

Furthermore, the influence of evolving consumer preferences is undeniable. Younger generations, particularly Gen Z and millennials, are propelling demand for sustainable and socially responsible investments. Notably, 44% of Gen Z and 40% of millennials express willingness to reject job offers from employers whose values do not align with their own. This shift compels property firms to adopt more sustainable practices and prioritize mental well-being and work-life balance in their offerings.

As the industry evolves, investors must remain agile, recalibrating their strategies to capitalize on these emerging opportunities while remaining cognizant of potential risks, such as inflation and rising property insurance costs. The forthcoming year presents substantial potential for those adept at identifying and responding to subtle market changes, ensuring their investments align with the commercial real estate market outlook 2025 and resonate with the broader economic recovery and technological advancements shaping the landscape.

Conclusion

The commercial real estate market stands on the brink of significant transformation as it approaches 2025, propelled by a convergence of economic recovery, technological advancements, and shifting consumer preferences. Insights from industry experts underscore the urgent necessity for property professionals to recalibrate their strategies in response to these dynamic changes. Prioritizing flexibility, sustainability, and technological integration will be essential for stakeholders aiming to excel in this competitive landscape.

Key themes emerge from the discussions, notably:

- The influence of fluctuating interest rates on investment decisions

- The escalating demand for flexible office spaces

- The critical role of sustainability in property development

Furthermore, the migration patterns of younger generations and the incorporation of artificial intelligence into property management are redefining the industry. Investors must remain vigilant and adaptable, leveraging these insights to pinpoint opportunities while mitigating risks associated with market volatility and evolving consumer expectations.

Ultimately, the commercial real estate outlook for 2025 presents both challenges and opportunities. By emphasizing adaptability, sustainability, and technological innovation, stakeholders can align their strategies with the shifting market dynamics. Embracing these trends will not only enhance investment potential but also cultivate a more resilient and responsible real estate sector, vital for addressing the demands of a rapidly evolving economy.