Overview

The article titled "10 Key Trends Shaping Latin American Real Estate in 2025" identifies significant trends influencing the real estate market in Latin America as it approaches 2025. Key trends encompass:

- The rise of sustainable development

- Urbanization

- Remote work

- Technology integration

- Foreign investment

- Regulatory changes

- Demographic shifts

- Economic recovery

- The urgent need for affordable housing

These factors are reshaping housing demand and investment strategies in the region, underscoring the dynamic nature of the market.

As we delve into these trends, it becomes clear that sustainable development is not merely a preference but a necessity. Urbanization continues to accelerate, with more people flocking to cities, thereby increasing the demand for housing. The shift towards remote work is also altering the landscape, as individuals seek homes that accommodate their new lifestyles.

Furthermore, technology integration is revolutionizing how properties are marketed and sold, while foreign investment remains a crucial driver of growth. Regulatory changes and demographic shifts are equally pivotal, influencing market dynamics and investment opportunities. Economic recovery post-pandemic is fostering a renewed interest in real estate, yet the pressing need for affordable housing remains a challenge that must be addressed.

In conclusion, these trends collectively reshape the real estate landscape in Latin America, presenting both challenges and opportunities for investors. Understanding these key insights is essential for making informed investment decisions in the evolving market.

Introduction

The Latin American real estate landscape is experiencing a transformative shift, fueled by a convergence of trends that are set to redefine investment strategies and housing demands. As the region gears up for 2025, pivotal factors such as urbanization, sustainable development, and the rise of remote work are not merely influencing market dynamics; they are also creating lucrative opportunities for investors and developers alike.

However, amidst these promising developments, a critical question emerges: how will stakeholders navigate the evolving challenges of affordability and regulatory changes while seizing the burgeoning market potential?

This exploration examines ten pivotal trends shaping the future of Latin American real estate, providing insights that could inform strategic decision-making in this dynamic sector.

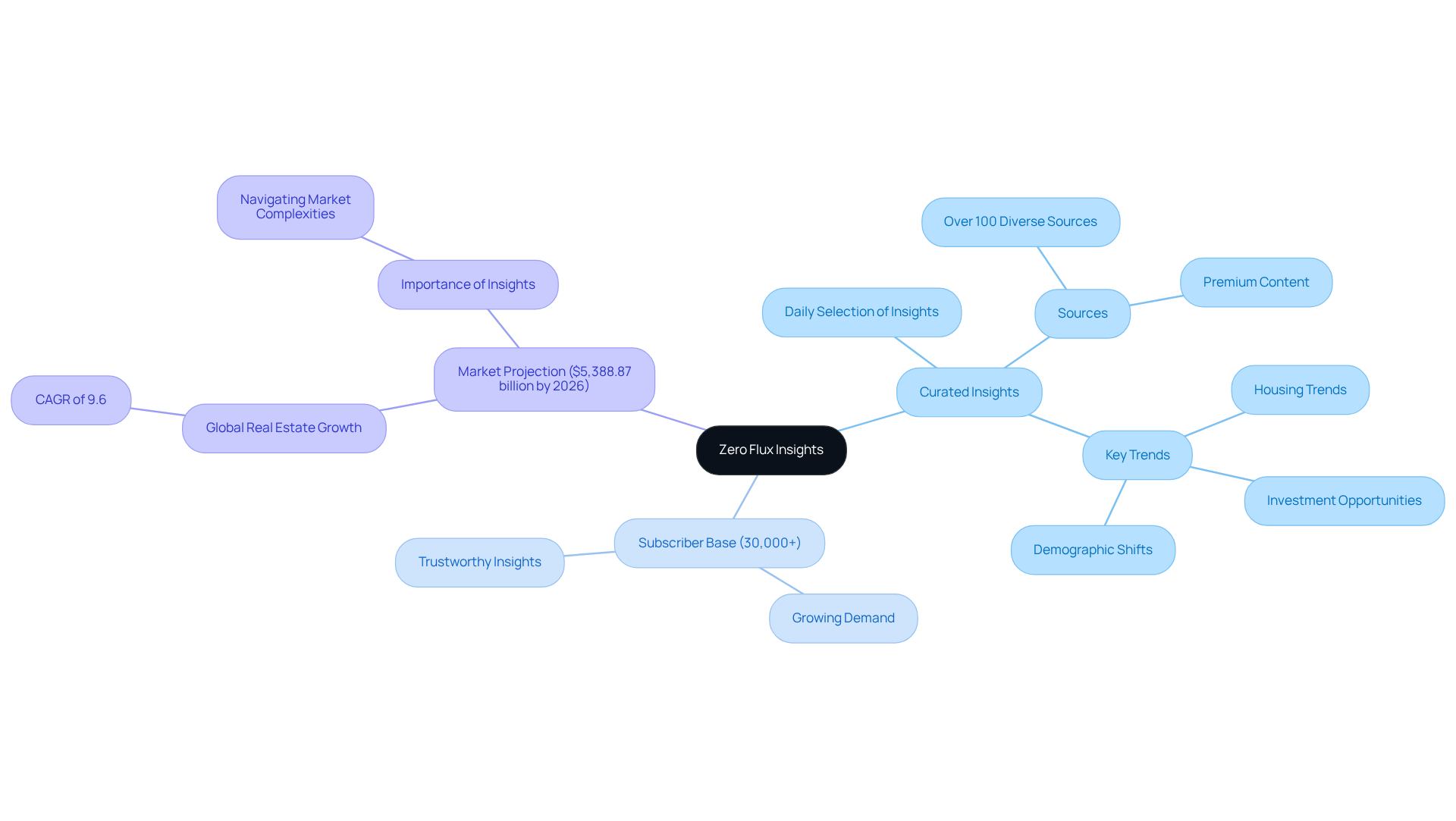

Zero Flux: Daily Insights on Latin American Real Estate Trends

Zero Flux serves as an essential resource for property professionals and investors in the Latin American real estate market, delivering a daily selection of 5-12 curated insights from over 100 diverse sources, including premium content. This meticulous curation simplifies the information-collecting process for subscribers and ensures access to the most relevant and timely updates on housing trends, investment opportunities, and demographic shifts. With a steadfast commitment to data integrity and factual reporting, Zero Flux has established itself as a trusted authority in the property sector, proving indispensable for those navigating the complexities of the industry.

As of 2025, the newsletter's subscriber base continues to expand, reflecting the increasing demand for trustworthy insights in a rapidly changing environment. The global property sector is projected to reach $5,388.87 billion by 2026, making the insights offered by Zero Flux even more crucial. With over 30,000 subscribers, the newsletter's popularity underscores its vital role in assisting investors in making informed decisions. Industry specialists emphasize, "Curated market insights are invaluable for navigating today's intricate property landscape," highlighting the significance of Zero Flux in this dynamic setting.

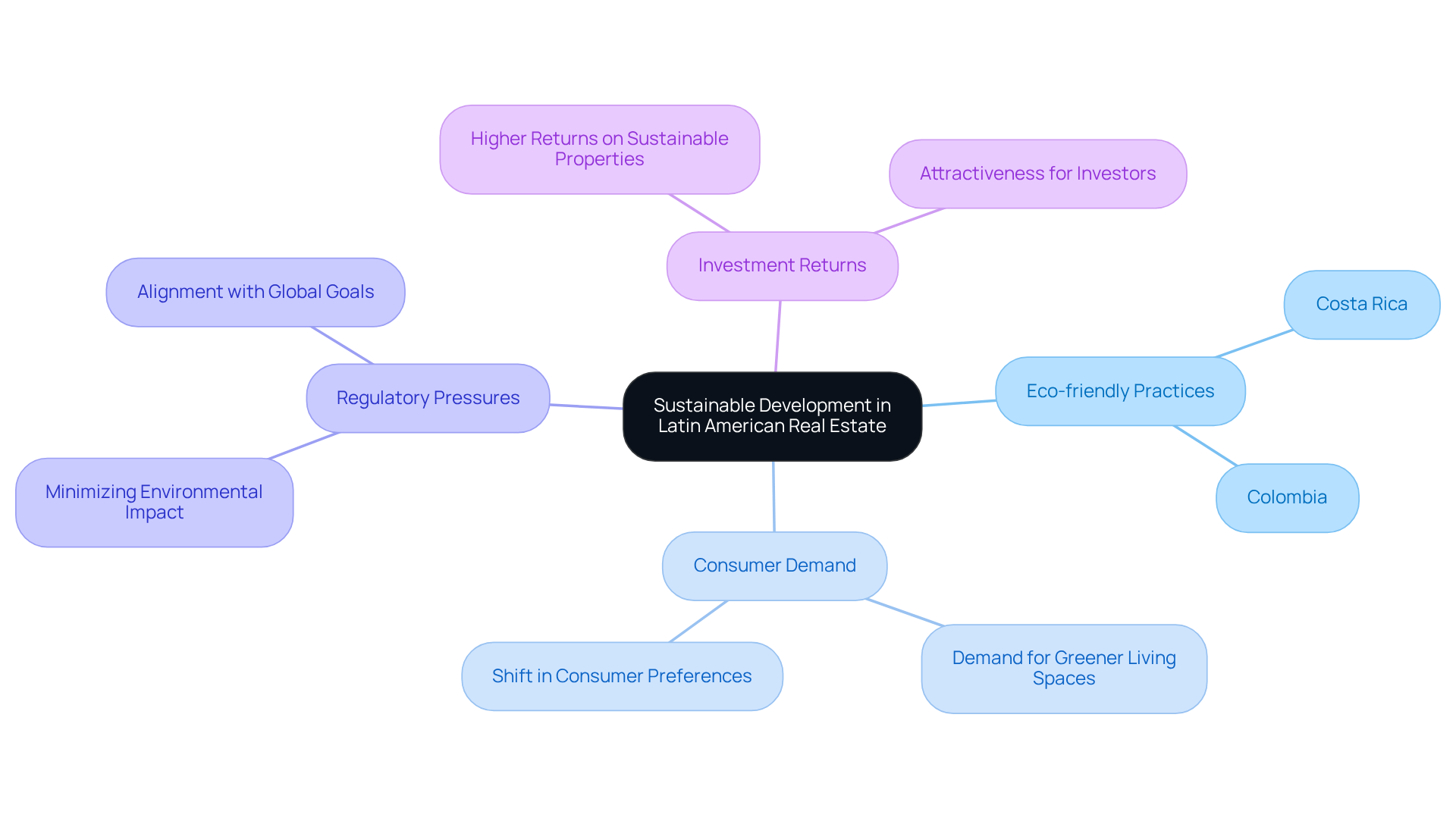

Sustainable Development: Driving Real Estate Investments in Latin America

Sustainable development is increasingly shaping investments in Latin American real estate. With a heightened focus on eco-friendly practices, developers are now prioritizing projects that align with sustainability criteria. This transformative shift is propelled by consumer demand for greener living spaces and regulatory pressures aimed at minimizing environmental impact. Consequently, investments in sustainable properties are projected to yield higher returns, rendering them appealing options for investors eager to align with global sustainability goals.

Notably, nations such as Costa Rica and Colombia are leading the charge in integrating sustainable practices into their property sectors, making Latin American real estate attractive to both domestic and international investments. Current statistics reveal a robust growth trajectory for eco-friendly real estate investments in the region, underscoring the critical importance of aligning with global sustainability objectives.

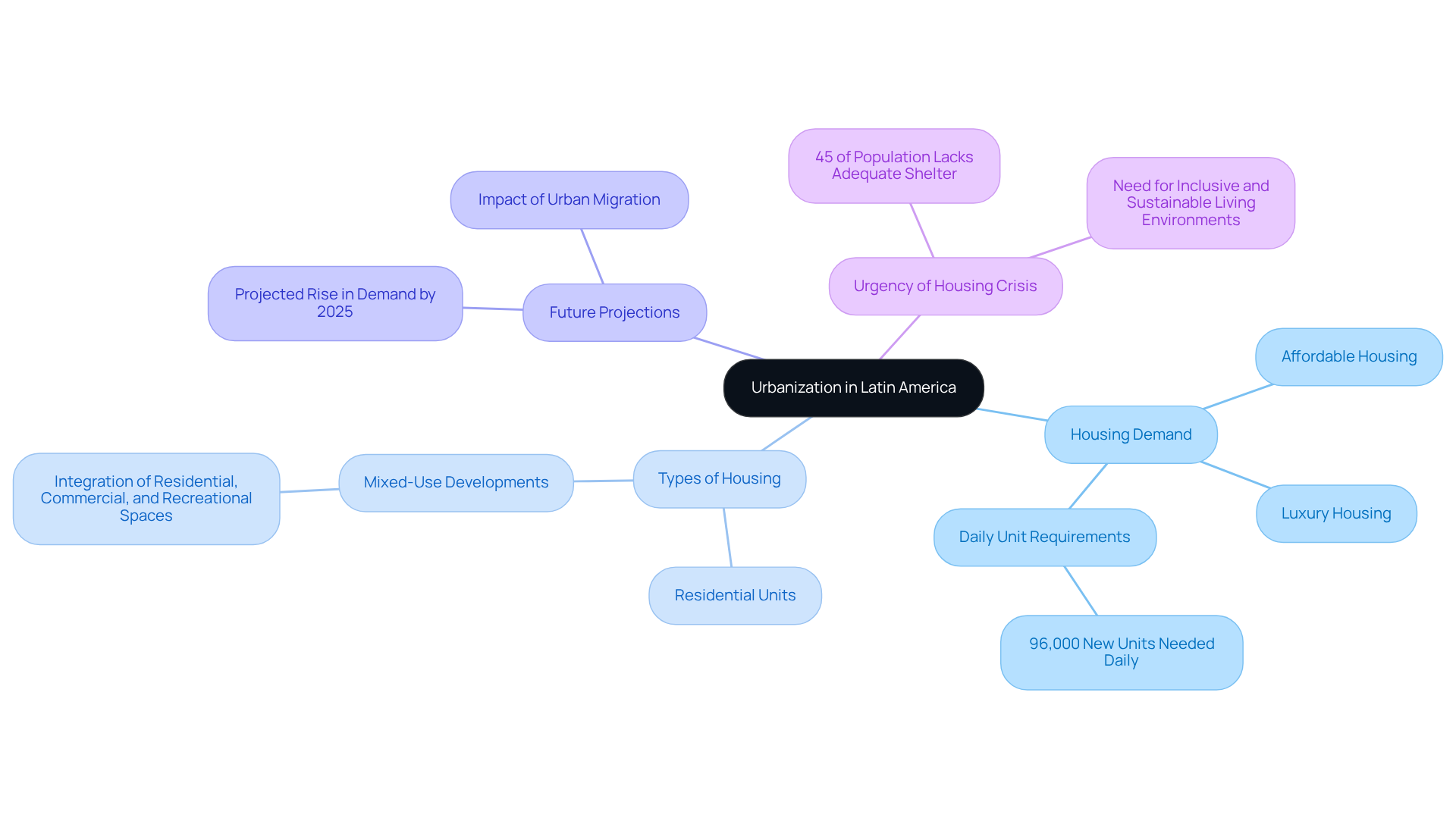

Urbanization: Transforming Housing Demand in Latin American Cities

Rapid urban growth in Latin America is reshaping the demand for accommodation, particularly in major cities like Mexico City, São Paulo, and Bogotá, which has significant implications for Latin American real estate. As populations migrate to urban areas in search of better opportunities, the need for housing is surging. This trend has led to an increase in the construction of both affordable and luxury residences, as developers strive to meet the diverse needs of urban dwellers. Furthermore, urbanization is spurring the development of mixed-use projects that seamlessly integrate residential, commercial, and recreational spaces, fostering vibrant communities that align with contemporary lifestyles.

By 2025, the demand for Latin American real estate in these cities is projected to witness a substantial rise. Statistics indicate that urban areas will require approximately 96,000 new residential units daily to accommodate their growing populations. This demand for Latin American real estate is further compounded by urban migration, which city planners highlight as a critical factor influencing residential dynamics in the region. Notably, 45% of the population in Latin America lacks adequate shelter, underscoring the urgency of addressing the accommodation crisis.

As cities continue to evolve, prioritizing the creation of inclusive and sustainable living environments becomes essential, ensuring that all residents can thrive amidst these bustling urban landscapes. Successful mixed-use developments, such as those observed in Medellín and Rio de Janeiro, exemplify how the integration of various spaces can enhance urban life while attracting both investors and residents. Additionally, the ongoing trends in the construction of affordable versus luxury housing reflect the varied needs of the population, making it imperative for stakeholders to adapt to these shifting dynamics.

Remote Work: Influencing Property Preferences in Latin America

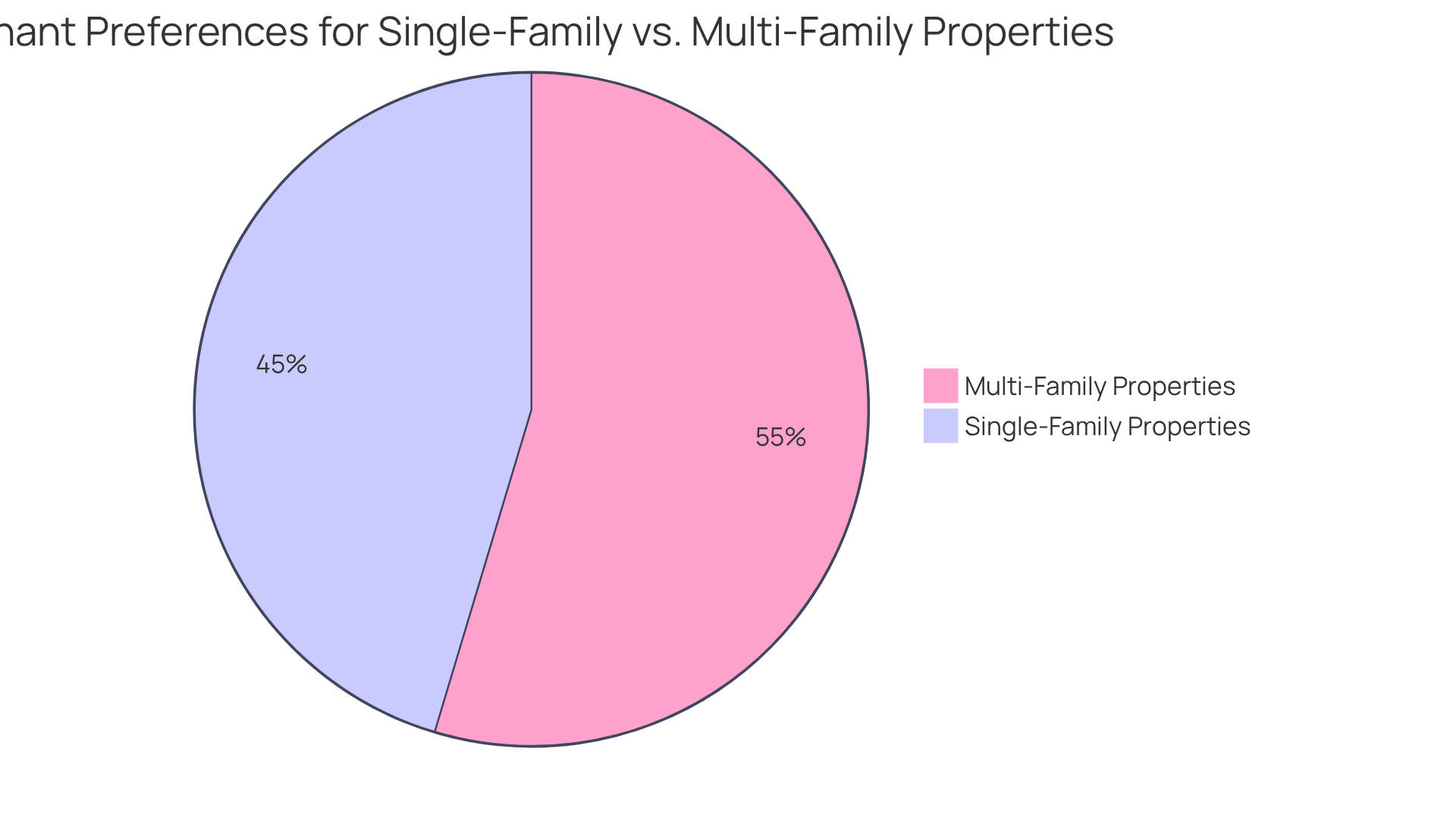

The rise of remote work is fundamentally reshaping preferences for Latin American real estate across the region. Professionals are now prioritizing homes that feature dedicated workspaces and reliable high-speed internet. This shift has led to a notable increase in demand for suburban and rural properties in the realm of Latin American real estate, as individuals seek environments that support both productivity and quality of life. In fact, approximately 45.36% of tenants have chosen single-family properties as their residence, underscoring this growing trend.

Developers are responding to this demand by reimagining property designs to include amenities that cater specifically to remote workers, such as home offices and communal workspaces. As a result, areas that were previously deemed less appealing in the context of Latin American real estate are now gaining traction, offering profitable investment opportunities for those looking to capitalize on this changing economic landscape. As one property developer remarked, "Modifying buildings to accommodate the requirements of remote workers is not merely a trend; it's an essential aspect of today's market."

By 2025, an estimated 32.6 million Americans will be working remotely, equating to about 22% of the workforce. This statistic further emphasizes the significant impact of remote work on housing demand and highlights the importance of adapting to these evolving preferences in real estate investments.

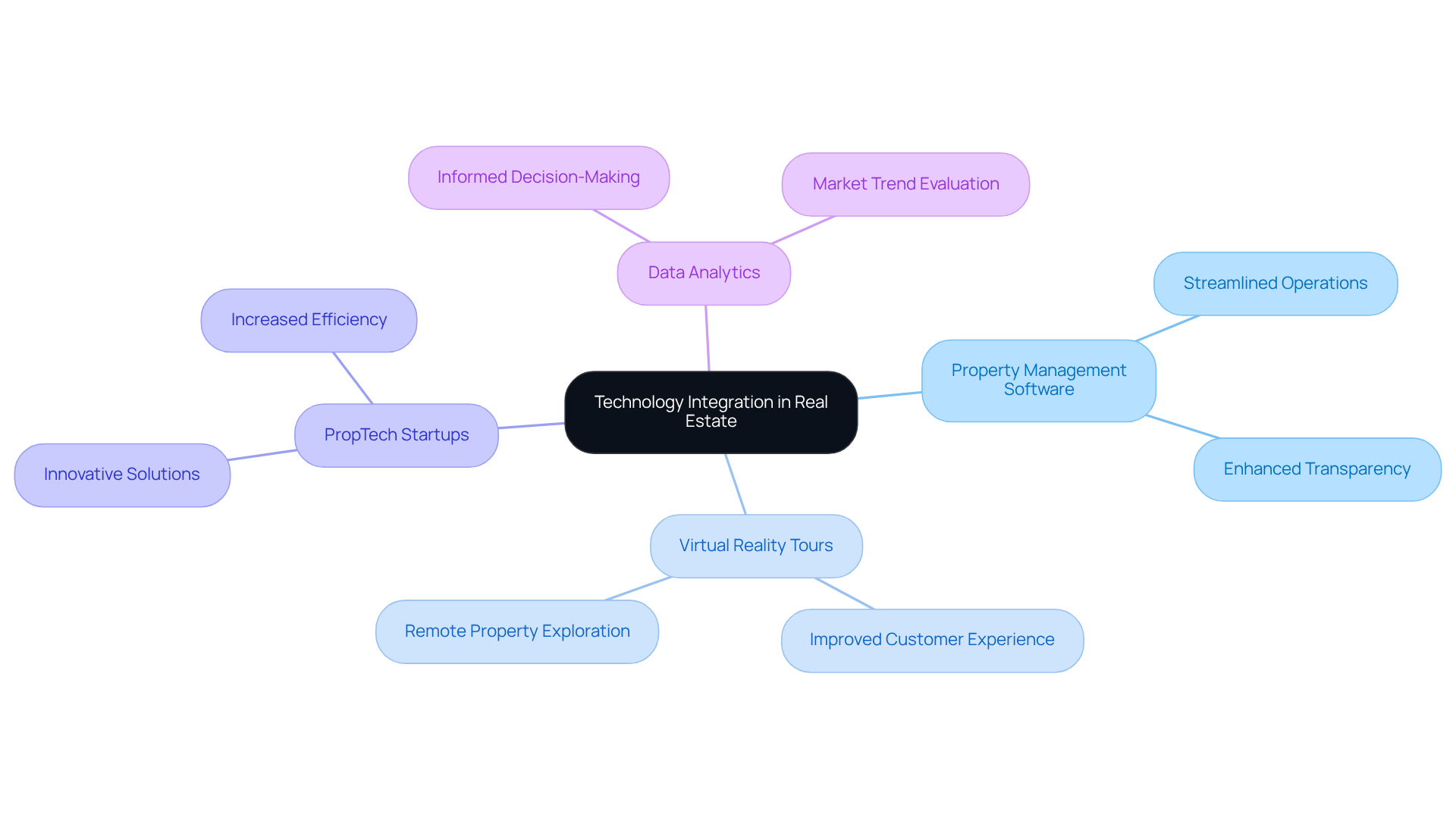

Technology Integration: Enhancing Real Estate Management in Latin America

The incorporation of technology in property management is revolutionizing the landscape of Latin American real estate. With the advent of property management software and virtual reality tours, technology is not only streamlining operations but also enhancing the customer experience. PropTech startups are emerging as key players, offering innovative solutions that significantly improve efficiency and transparency in transactions.

Furthermore, investors are increasingly leveraging data analytics to make informed decisions, evaluate market trends, and optimize their portfolios. As technology continues to advance, its impact on shaping the future of Latin American real estate in the region will be profound.

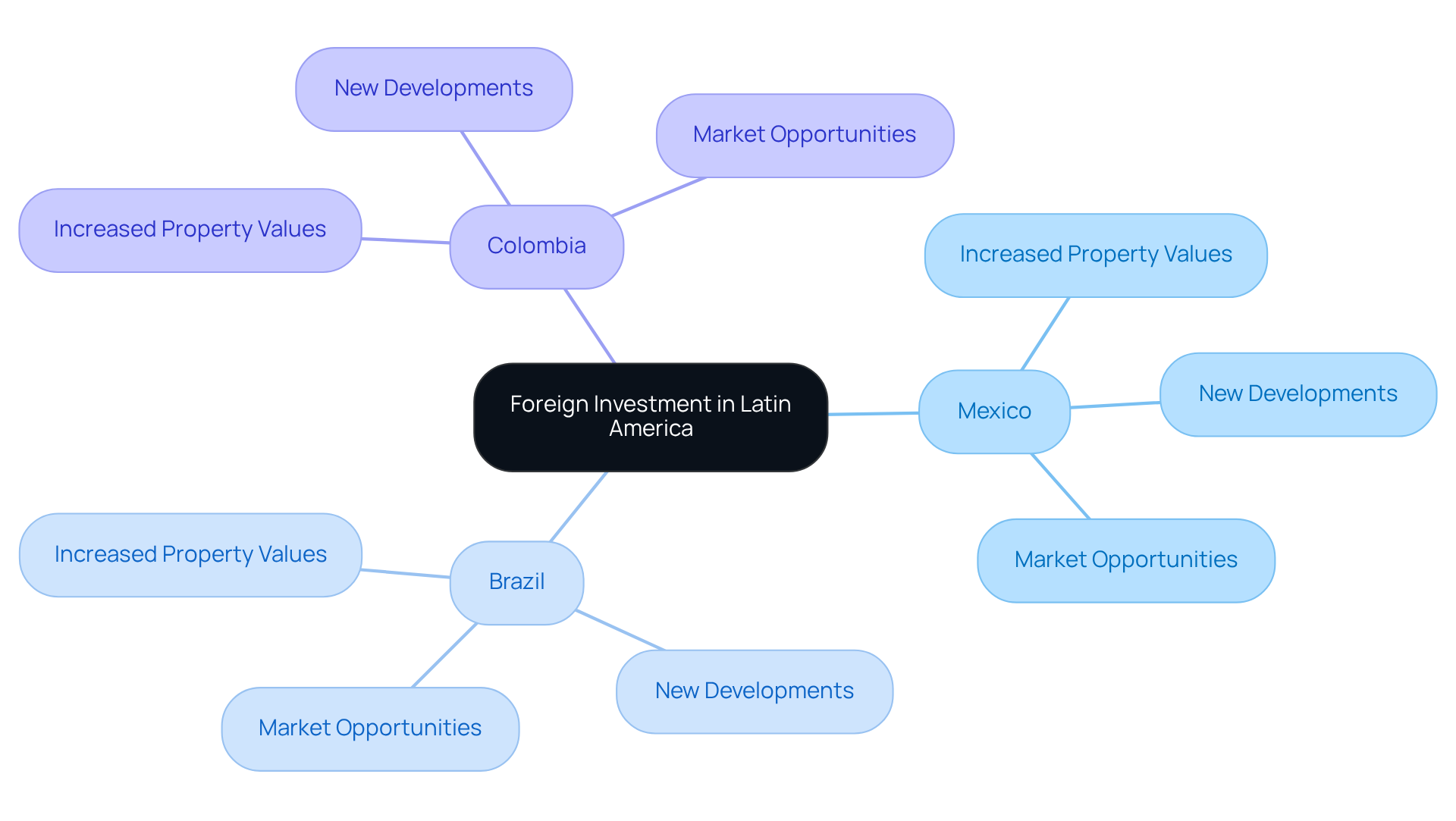

Foreign Investment: Boosting Latin American Real Estate Markets

Foreign investment is significantly enhancing the Latin American real estate sectors. Countries like Mexico, Brazil, and Colombia are attracting considerable capital from global financiers seeking high yields in developing markets. This influx of foreign capital is not only driving up property values but also stimulating new developments, especially in urban centers.

Moreover, favorable exchange rates and recent economic reforms are positioning Latin America as an appealing destination for foreign investors in Latin American real estate. As the region continues to stabilize both politically and economically, the trend of foreign investment is anticipated to grow, thereby expanding market opportunities for savvy investors.

Regulatory Changes: Shaping Real Estate Transactions in Latin America

Regulatory changes are fundamentally reshaping property transactions within the realm of Latin American real estate. Governments are actively pursuing reforms aimed at enhancing transparency, safeguarding investors, and simplifying the purchasing process. These reforms often include:

- Updates to property laws

- Tax incentives for developers

- Regulations governing foreign ownership

For investors, staying informed about these developments is essential, as they can profoundly impact property values and investment strategies. The evolving regulatory landscape not only presents challenges but also unveils new opportunities for stakeholders in Latin American real estate. It is imperative to remain aware of the latest changes, particularly those anticipated in July 2025, to strategically navigate this dynamic environment.

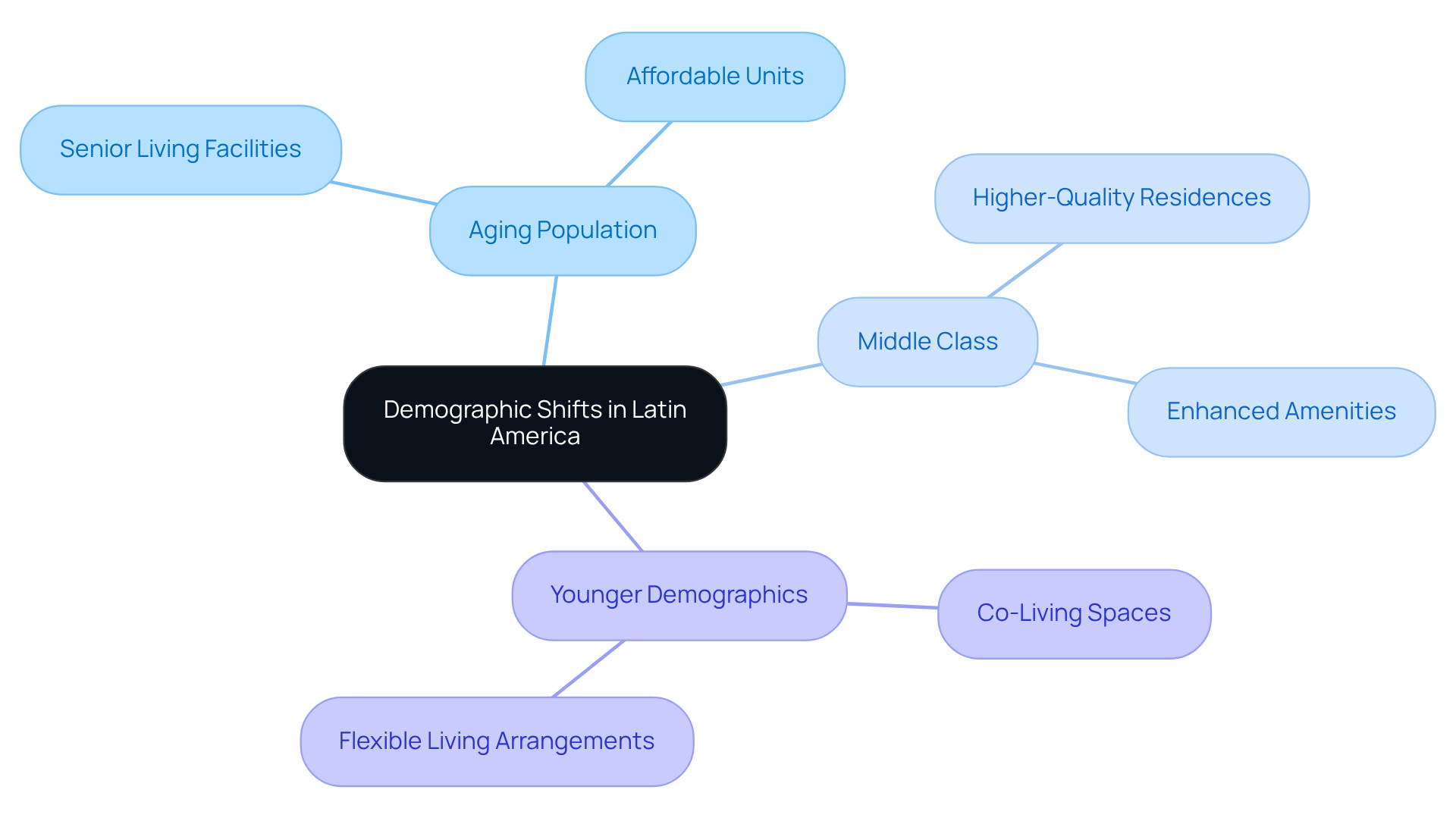

Demographic Shifts: Redefining Housing Needs in Latin America

Demographic changes in Latin America are significantly altering accommodation needs and preferences. With one-third of families lacking access to sufficient accommodation and a deficit estimated at over 43 million flats, the aging population is increasingly seeking diverse living arrangements, including affordable units, senior living facilities, and co-living spaces. As of July 2025, the demand for senior living options has surged, reflecting a broader trend where the middle class is driving the need for higher-quality residences and enhanced amenities. This shift is further compounded by the fact that living expenses in the region have increased between 1.5 and 3 times faster than incomes in recent years, making affordable options even more critical.

Successful residential projects are emerging that cater specifically to the aging population, addressing their unique needs while promoting community engagement. For instance, innovative projects are being designed to incorporate spaces for social interaction, which are essential for fostering a sense of belonging among seniors. Additionally, co-living spaces are gaining traction, appealing to younger demographics who prioritize flexibility and community living.

Sociologists emphasize that these changing housing preferences are not merely a response to economic factors but also reflect a cultural shift towards valuing community and accessibility. As urbanization continues to accelerate, investors must adapt to these evolving demographics by focusing on developments that align with the needs of a diverse population. The residential property sector in Latin American real estate is projected to reach $477.77 billion in 2024, emphasizing the industry's scale and opportunity for investment. Grasping these trends is essential for making well-informed investment choices in the dynamic Latin American real estate market.

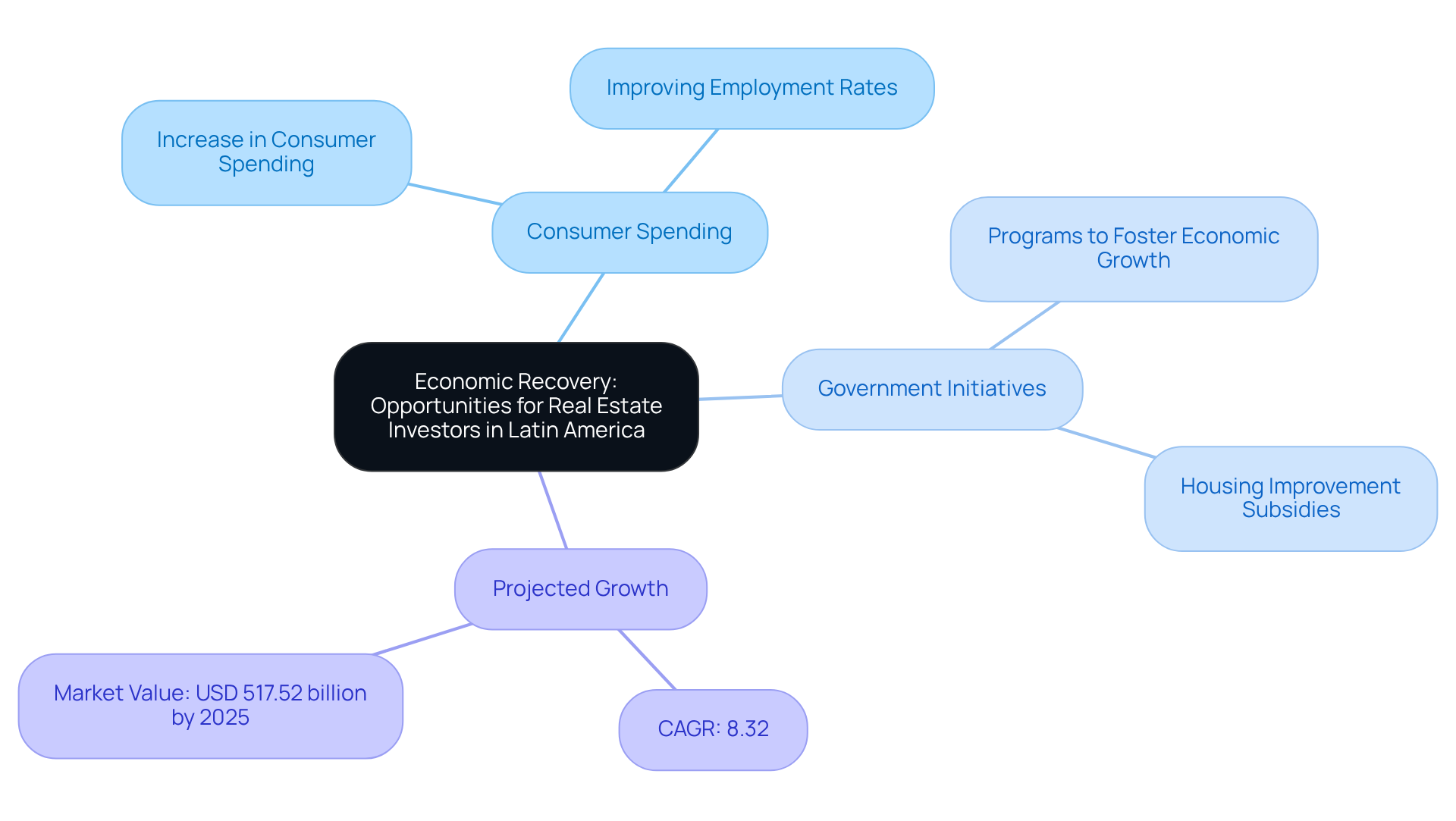

Economic Recovery: Opportunities for Real Estate Investors in Latin America

As Latin America navigates its economic recovery, the environment for Latin American real estate investors is becoming increasingly favorable. The resurgence in economic activity is anticipated to bolster demand for both residential and commercial properties, particularly in urban hubs. Key factors driving this trend include:

- An increase in consumer spending, expected to rise alongside improving employment rates.

- Government initiatives aimed at fostering economic growth.

This favorable investment climate is further supported by a projected compound annual growth rate (CAGR) of 8.32% for the residential real estate sector, which indicates a strong future for Latin American real estate, expected to reach USD 517.52 billion by 2025.

Investors who strategically position themselves in the revitalizing Latin American real estate market stand to gain from appreciating property values and heightened rental demand. With these compelling indicators, now is an opportune moment to explore new investment avenues. Consider the potential returns as you navigate your investment strategy in this promising landscape.

Affordable Housing: Addressing Shortages in Latin American Markets

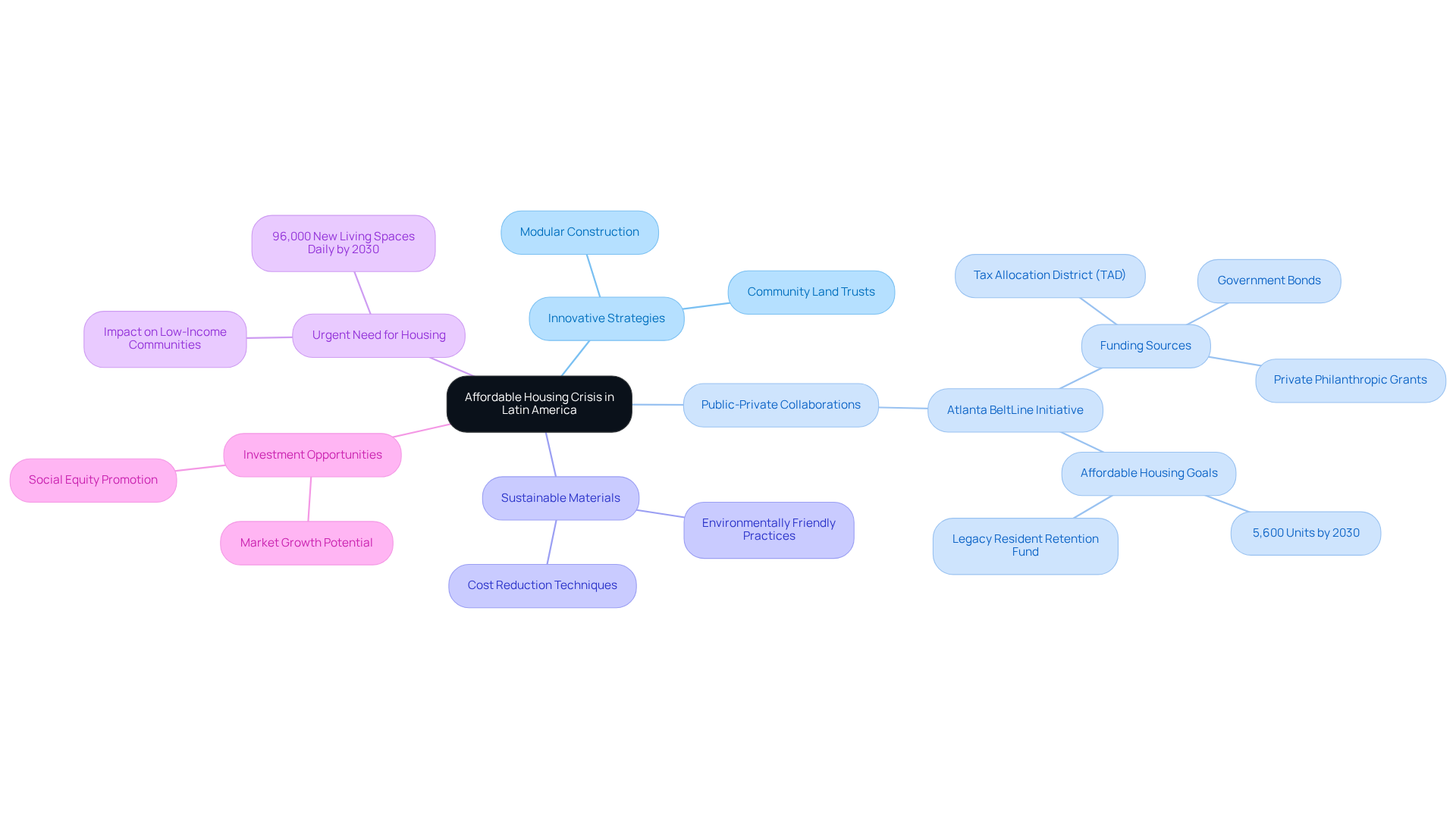

The crisis of affordable accommodation in Latin American real estate presents a considerable challenge, with millions lacking access to suitable living conditions. In response, governments and private developers are increasingly adopting innovative strategies to tackle this issue. Public-private collaborations have arisen as an essential method, facilitating joint efforts to finance and create affordable living projects. For example, the Atlanta BeltLine initiative illustrates effective teamwork in affordable shelter development, demonstrating how such collaborations can successfully meet community requirements.

Moreover, the use of sustainable building materials is gaining traction, promoting environmentally friendly construction practices that can reduce costs and enhance livability. Specialists in residential policy emphasize that innovative solutions, such as modular construction and community land trusts, can effectively address the shortage of accommodations while promoting social equity. According to UN-Habitat, there is an estimated need for 96,000 new living spaces daily by 2030, underscoring the urgency of the situation.

Inclusive residential policies are also being prioritized, ensuring that developments cater to diverse community needs. Investors focusing on affordable living in Latin American real estate not only enhance societal well-being but also engage in a rapidly expanding market segment poised for long-term growth. As demand for affordable housing escalates, the landscape is ripe with opportunities for impactful investments that align financial returns with community benefits.

Conclusion

The landscape of Latin American real estate is undergoing a significant transformation, driven by a multitude of trends that are reshaping investment opportunities and housing demands. As we approach 2025, it is evident that factors such as sustainable development, urbanization, remote work, and technology integration are not merely influencing the market; they are redefining it. Resources like Zero Flux highlight the necessity for investors and property professionals to stay informed and agile in this dynamic environment.

Key trends include:

- The growing emphasis on sustainability, which is attracting both domestic and foreign investments.

- The rapid urbanization that is increasing the demand for diverse housing options in major cities.

- The rise of remote work, altering property preferences and pushing developers to create spaces that cater to this new lifestyle.

- The integration of technology, enhancing property management and investment strategies.

- Demographic shifts that necessitate innovative housing solutions to address the needs of an evolving population.

As the real estate market in Latin America continues to recover and evolve, it presents a plethora of opportunities for investors and stakeholders. Engaging with these trends positions investors to capitalize on potential growth and aligns their strategies with the pressing needs of communities. Understanding and adapting to these changes is crucial, as they will ultimately shape the future of real estate in the region. Embracing this multifaceted approach will be key to thriving in the vibrant and challenging landscape of Latin American real estate in the years to come.