Overview

The article presents ten pivotal trends that are set to shape the industrial real estate market in 2025. These trends encompass:

- Sustainability initiatives

- Technology integration

- E-commerce growth

- Urbanization

- Labor market dynamics

- Emerging markets

- Regulatory changes

- Supply chain resilience

Each trend not only highlights how businesses are adapting to economic shifts and technological advancements but also underscores the critical importance of strategic investment and operational efficiency. As the landscape of industrial real estate evolves, understanding these trends will be essential for informed investment decisions.

Introduction

In the rapidly evolving landscape of industrial real estate in 2025, several transformative trends are reshaping the industry. The surge in e-commerce is driving demand for fulfillment centers, while the critical integration of sustainability initiatives is becoming paramount. Stakeholders must navigate a complex web of challenges and opportunities.

As urbanization continues to influence property locations, labor market dynamics affect investment decisions, making it essential to understand these shifts for success. Moreover, emerging markets present new avenues for growth. Regulatory changes and supply chain resilience strategies further complicate the picture.

This comprehensive analysis delves into the key trends and insights defining the future of industrial real estate, equipping investors and industry professionals with the knowledge needed to thrive in this competitive environment.

Zero Flux: Daily Insights on Industrial Real Estate Trends

Zero Flux delivers daily insights specifically tailored for the industrial real estate market, meticulously curating information from over 100 diverse sources. This comprehensive strategy ensures that subscribers receive the most pertinent and timely data related to the industrial real estate market, empowering them to stay ahead of evolving industry trends and make informed decisions. The newsletter's unwavering commitment to factual reporting, free from subjective opinions, significantly bolsters its reliability, establishing it as an essential resource for professionals and investors in the industrial real estate market alike.

In 2025, the industrial real estate market is witnessing notable trends, including a wave of consolidation exemplified by Prologis's recent $23 billion acquisition of Duke Realty. This highlights the growing necessity for operational efficiencies and strategic portfolio enhancements. Additionally, recent statistics reveal that hotel occupancy rates stand at 63%, reflecting a slight decline of 2.8% from pre-pandemic levels. Such changes in economic dynamics present challenges that investors must adeptly navigate.

As Joshua J. Marine aptly stated, "Challenges are what make life interesting. Overcoming them is what makes life meaningful." This perspective resonates within the industrial real estate market, where a focus on daily insights is crucial. It enables stakeholders to swiftly adapt to changes and seize emerging opportunities. Effective property newsletters, such as Zero Flux, occupy a vital role in this landscape, providing essential insights that foster informed decision-making and strategic planning in the industrial real estate market.

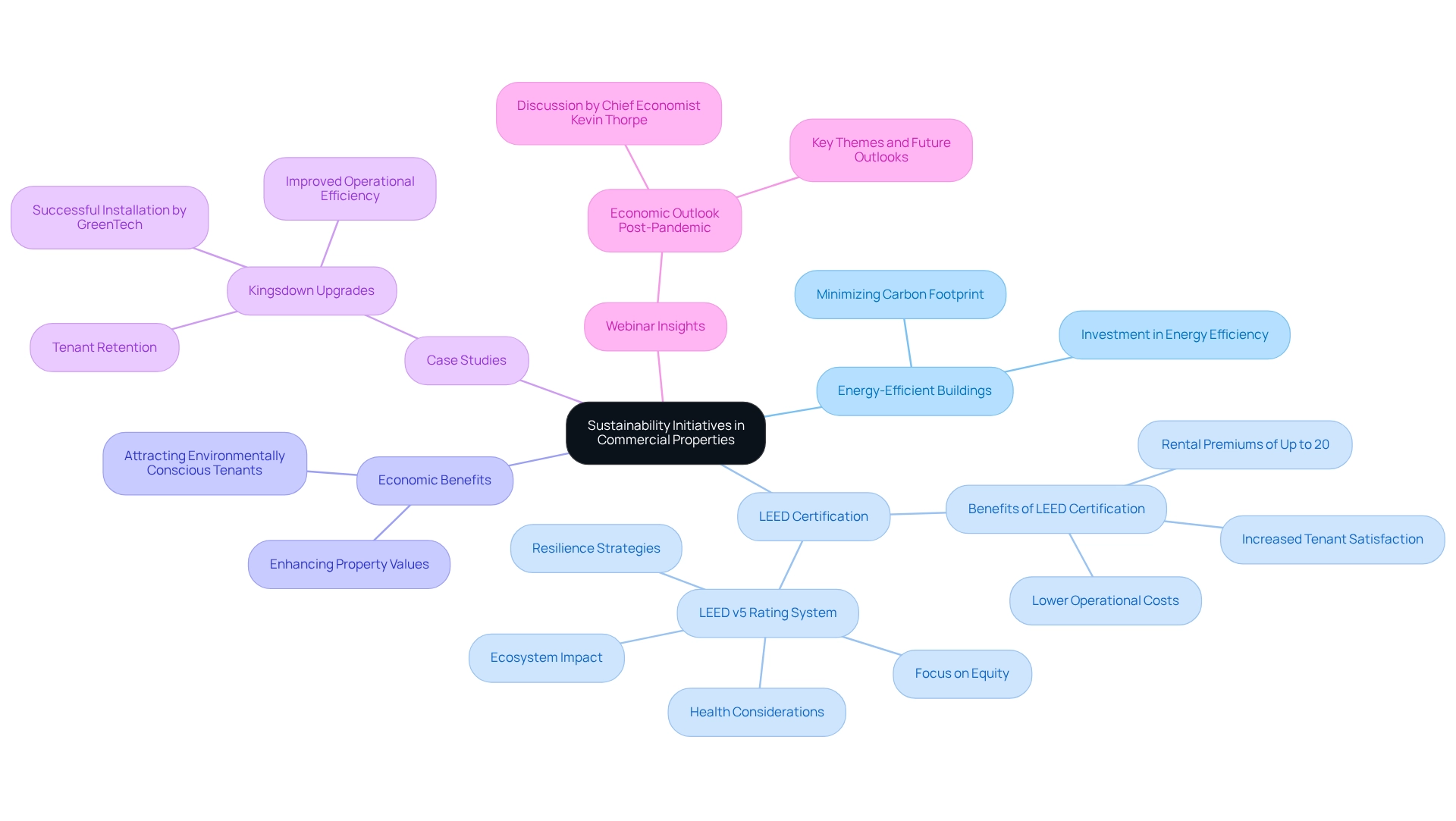

Sustainability Initiatives: Driving Change in Industrial Properties

In 2025, sustainability efforts are paramount in shaping commercial property development. Companies are increasingly investing in energy-efficient buildings and sustainable practices to minimize their carbon footprints. This strategic shift not only aligns with regulatory requirements but also attracts environmentally conscious tenants, thereby enhancing property values. Properties with LEED certification are particularly sought after, as they provide lower operational costs and increased tenant satisfaction. A recent analysis from the U.S. Green Building Council reveals that LEED-certified buildings can command rental premiums of up to 20% compared to their non-certified counterparts.

Moreover, successful case studies, such as the upgrades at Kingsdown following a prior installation by GreenTech, exemplify the tangible benefits of sustainability initiatives by showcasing improved operational efficiency and tenant retention. As the sector evolves, the integration of sustainability into commercial property is not merely a trend; it represents a vital transformation that ensures lasting value and resilience. Insights from a recent webinar featuring Chief Economist Kevin Thorpe further underscore the economic outlook for sustainability in commercial real estate, emphasizing the growing importance of these initiatives in navigating the post-pandemic landscape.

The U.S. Green Building Council's LEED v5 rating system addresses critical issues such as equity, health, ecosystems, and resilience, further highlighting the multifaceted advantages of adopting sustainable practices in commercial properties.

Technology Integration: Enhancing Efficiency in Industrial Operations

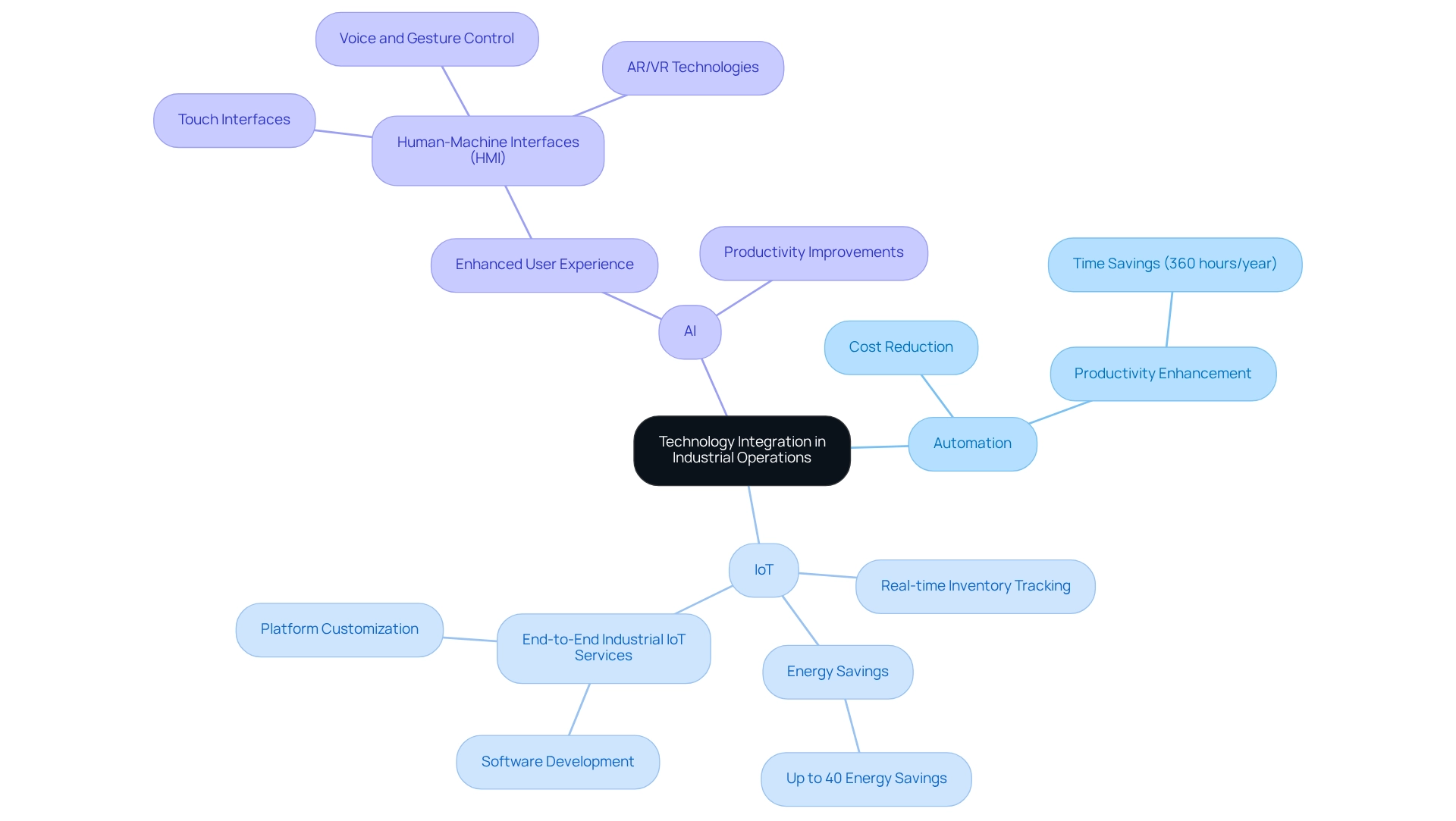

In 2025, technology integration is fundamentally transforming manufacturing operations. The adoption of automation, IoT, and AI is streamlining processes, reducing labor costs, and significantly enhancing productivity. For instance, smart warehouses equipped with real-time inventory tracking systems and supported by end-to-end industrial IoT services—including software development and platform customization—are minimizing operational inefficiencies. This allows companies to respond swiftly to market demands. Businesses leveraging these technologies are not only boosting their profitability but also establishing themselves as frontrunners in a highly competitive landscape.

Statistics indicate that business leaders estimate a potential time saving of 360 hours per year through task automation, underscoring the efficiency gains achievable through these innovations. These time savings translate into operational improvements, enabling companies to allocate resources more effectively and focus on strategic initiatives. Furthermore, the integration of smart air quality and occupancy sensors can lead to energy savings of up to 40% in facilities, highlighting the dual benefits of cost reduction and sustainability.

A notable case study on human-machine interfaces (HMI) in the Industry 4.0 era reveals how advanced touch interfaces, voice and gesture control, and AR/VR technologies are revolutionizing interactions within manufacturing environments. This evolution not only enhances user experience but also fosters productivity improvements, which are essential for the property sector as it adjusts to these technological advancements. As companies continue to adopt these innovations, the role of IoT and AI in enhancing operational efficiency becomes increasingly vital in the industrial real estate market, positioning them for success in this evolving sector. To capitalize on these trends, investors in the industrial real estate market should consider investing in properties that incorporate these technologies, as they are likely to yield higher returns and attract tenants seeking modern, efficient spaces.

E-Commerce Growth: Fueling Demand for Industrial Spaces

The surge in e-commerce is a pivotal element driving space demand in the industrial real estate market in 2025. As online sales continue to rise, businesses increasingly require expansive fulfillment centers and last-mile delivery hubs in the industrial real estate market to meet consumer expectations for rapid shipping. E-commerce is projected to account for nearly 40% of new warehouse demand in the industrial real estate market, prompting developers to prioritize properties that are strategically located to improve logistical efficiency. This trend is underscored by the fact that 83% of organizations are investing in friend-shoring to establish supply networks with politically and economically aligned partners, further emphasizing the necessity for adaptable and accessible commercial spaces.

Moreover, the average revenue per user (ARPU) in e-commerce is expected to reach approximately $1.17k by 2028, illustrating the sector's robust growth trajectory. Consequently, the demand for fulfillment centers in the industrial real estate market is anticipated to escalate, with logistics experts advocating for innovative solutions to meet the evolving needs of this market. John Andrews, Co-Founder and CEO, asserts, "These statistics highlight the transformative trends shaping the future of digital commerce." The integration of social media into e-commerce, which reached $945.92 billion in 2023 and is projected to grow at a CAGR of approximately 30%, further exemplifies the increasing importance of digital platforms in driving sales and, consequently, the demand for commercial real estate.

Successful case studies of fulfillment centers and last-mile delivery hubs illustrate how businesses are adapting to this dynamic landscape, showcasing innovative logistics approaches essential for meeting consumer demands.

Urbanization Impact: Shaping Industrial Property Locations

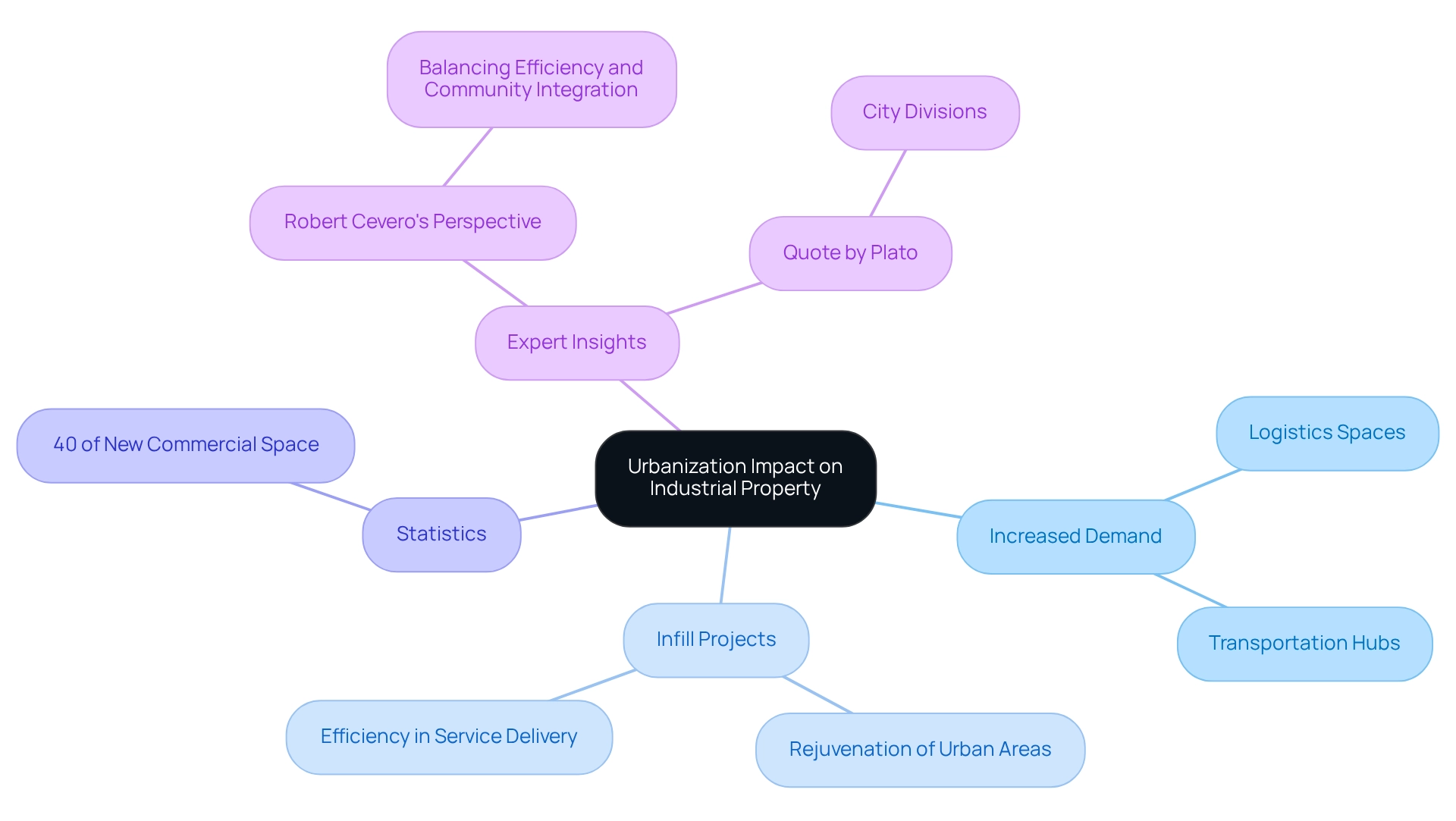

Urbanization is profoundly transforming the landscape of commercial properties in 2025. As populations increasingly gravitate towards urban centers, the demand for logistics and distribution spaces within the industrial real estate market is surging. This shift is driving developers to prioritize infill projects that leverage existing urban infrastructure, minimizing transportation costs while enhancing service delivery efficiency. In the industrial real estate market, properties situated near major transportation hubs are gaining significant value as businesses strive to streamline their supply chains.

Infill projects are especially vital in this context, enabling the rejuvenation of underused urban areas while fulfilling the increasing need for manufacturing space in the industrial real estate market. According to recent statistics, urban infill developments are expected to represent around 40% of new commercial space in the industrial real estate market within metropolitan areas by 2025.

Expert insights emphasize that urbanization trends are not solely about location; they also indicate a wider change in how commercial properties are woven into the urban fabric. As urban planner Robert Cevero notes, "Planning for accessible cities must balance the need for efficiency with the importance of community integration." Successful infill initiatives have shown the ability to create lively, mixed-use areas that fulfill both commercial functions and community needs. For instance, the revitalization of the former manufacturing district in San Francisco has transformed the area into a center for logistics and tech, showcasing the advantages of strategic urban planning.

As urban planners highlight the significance of these advancements, the industrial real estate market is positioned to adjust and thrive in this evolving environment.

Labor Market Trends: Influencing Industrial Real Estate Decisions

Labor force trends are pivotal in shaping commercial real estate decisions in 2025. As companies confront a shortage of skilled labor, there is a discernible shift toward properties situated in areas with a robust workforce. Workforce analysts assert that access to skilled labor is critical for operational efficiency and growth, making it a fundamental consideration for investors. Moreover, escalating wages in certain sectors are prompting businesses to reevaluate their operational costs, often leading them to consider relocation to regions with more favorable labor expenses. This trend underscores the necessity of aligning property investments with labor market dynamics to ensure long-term viability.

For example, successful industrial properties in regions with a plentiful skilled labor force have exhibited resilience and profitability, highlighting the significance of workforce availability in investment decisions. As Akira Mori, a distinguished real estate developer, articulates, "In my experience, in the real-estate business, past success stories are generally not applicable to new situations. We must continually reinvent ourselves, responding to changing times with innovative new business models." This perspective underscores the need for adaptability in response to evolving employment conditions.

Statistics indicate that by 2025, the availability of skilled labor in manufacturing sectors is expected to be constrained, particularly due to restrictive immigration policies that may further diminish the labor supply in the construction industry. Understanding these employment trends will be crucial for making informed decisions in the commercial property sector. Specific case studies, such as those highlighting successful economic developments in areas with a strong skilled labor pool, provide valuable insights for investors seeking to navigate these challenges effectively.

Emerging Markets: New Investment Opportunities in Industrial Real Estate

In 2025, the industrial real estate market in developing economies is becoming increasingly appealing for commercial property investments, especially in Southeast Asia and Latin America. These regions are witnessing robust economic growth, substantial infrastructure development, and favorable regulatory environments in the industrial real estate market, which are all drawing investor interest. For instance, the demand for manufacturing spaces in the industrial real estate market of Southeast Asia is projected to surge, driven by global firms aiming to diversify their supply chains. This trend is underscored by a projected compound annual growth rate (CAGR) of 6.6% for the industrial real estate market from 2025 to 2029, indicating significant growth potential.

Investment opportunities abound in these markets, with analysts highlighting Southeast Asia as a pivotal region in the industrial real estate market. The region's strategic location and expanding consumer base position it as an ideal choice for logistics and warehousing facilities in the industrial real estate market. Similarly, Latin America is experiencing a rise in demand for commercial spaces within the industrial real estate market, propelled by increasing trade volumes and urban development. However, as Nikoleta notes, "Cybercrime is growing exponentially; it’s a sign of the times," which emphasizes the necessity of considering security risks in these investments.

Successful case studies from these regions illustrate the potential for substantial returns within the industrial real estate market. For example, a firm plans to invest $100 million annually in India for warehouse development, demonstrating a targeted strategy to capitalize on the growth of these economies. Investors who strategically position themselves in the industrial real estate market can make informed decisions based on the latest trends and data. As the industrial real estate market evolves, individuals who take action now may reap significant benefits in the future.

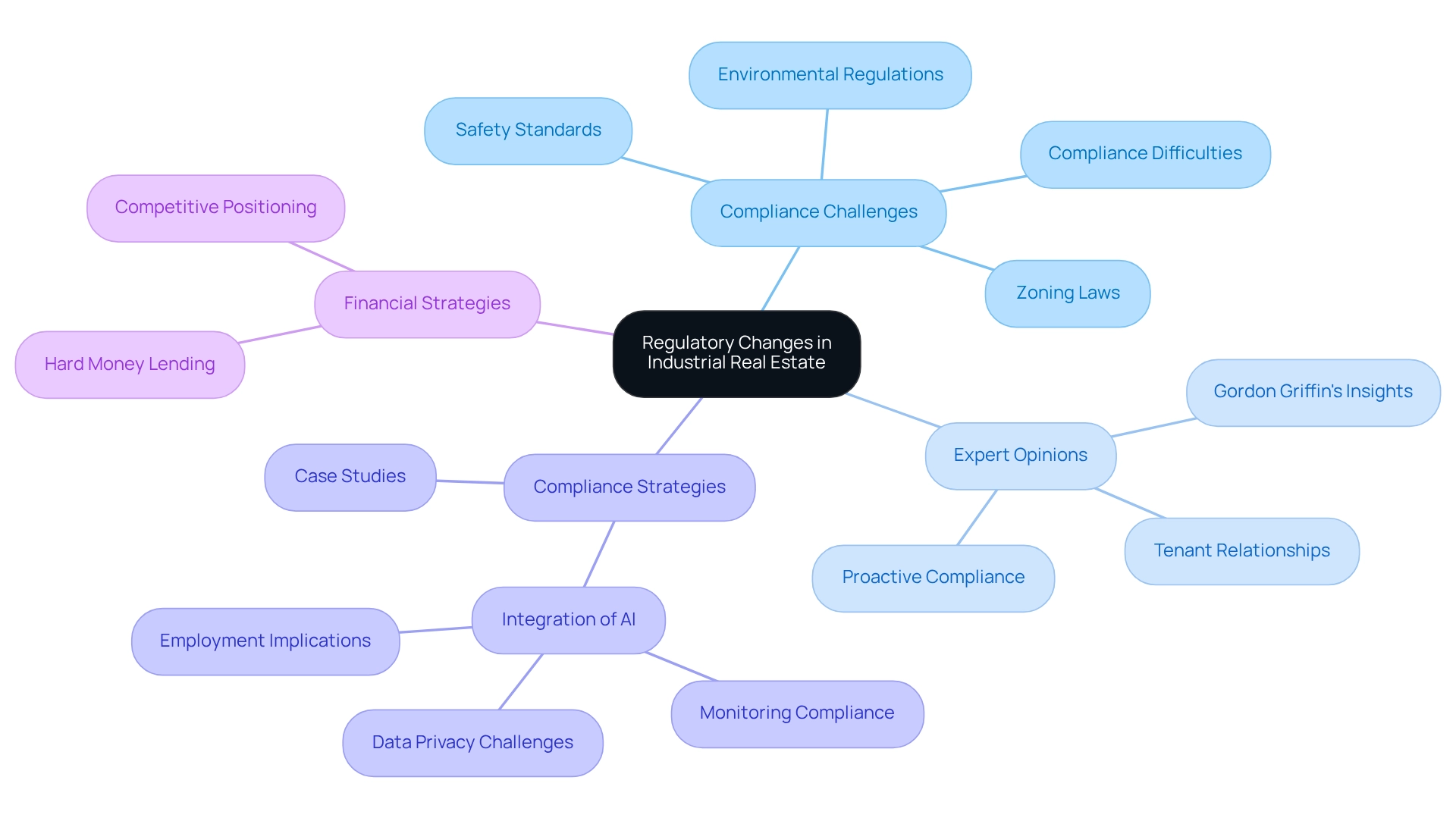

Regulatory Changes: Navigating Industrial Real Estate Compliance

In 2025, the industrial real estate market is experiencing a significant transformation driven by new regulatory frameworks. Environmental regulations, zoning laws, and updated safety standards are being introduced, compelling property owners and developers to adapt swiftly. Notably, a substantial percentage of property owners report difficulties in meeting the latest environmental standards, underscoring the increasing compliance challenges within the sector. This shift highlights the critical importance of staying informed about regulatory changes to avoid costly penalties and operational disruptions.

Expert opinions emphasize that companies proactively addressing these regulatory requirements not only mitigate risks but also enhance their reputations and operational efficiencies. As Gordon Griffin notes, "Lessors with expiring leases should prepare for extension requests and potential holdovers as tenant agencies come to terms with the new normal." This proactive approach can facilitate smoother transitions and foster better tenant relationships.

Furthermore, case studies illustrate effective compliance strategies employed by commercial property owners. For instance, the integration of advanced technologies, such as artificial intelligence, has proven beneficial in monitoring compliance and streamlining operations. This integration enables stakeholders to efficiently track adherence to regulations while addressing data privacy and employment implications associated with these technologies.

Additionally, hard money lending emerges as a viable strategy for investors seeking to remain competitive amidst these regulatory changes. As the regulatory landscape continues to evolve, understanding the impact of these alterations on the industrial real estate market is essential for investors. By implementing efficient compliance strategies and staying abreast of regulatory trends, property owners can position themselves advantageously in a competitive environment.

Supply Chain Resilience: Adapting Industrial Real Estate Strategies

In 2025, supply chain resilience has emerged as a pivotal concern for stakeholders within the industrial real estate market. Companies are actively reassessing their logistics strategies to mitigate risks arising from global disruptions. This transformation entails significant investments in flexible properties in the industrial real estate market, particularly multi-use facilities that can adapt to diverse operational requirements.

By embedding resilience into their strategies for the industrial real estate market, businesses not only enhance their capacity to navigate uncertainties but also secure a competitive edge in an increasingly volatile environment. Furthermore, 46% of customers have identified expensive delivery costs as a major challenge, accentuating the necessity for flexible properties in logistics.

Logistics specialists assert that agility and resilience are interdependent; an agile supply chain is inherently more robust, making the pursuit of adaptable commercial properties in the industrial real estate market essential for future success. Moreover, the growing integration of AI in supply chains is expected to enhance overall performance and efficiency, further reinforcing the need for flexible solutions in the industrial real estate market.

As stakeholders navigate this evolving landscape, the imperative to invest in resilient logistics strategies becomes increasingly clear.

Market Forecasts: Valuation Trends in Industrial Real Estate

Market predictions for 2025 indicate a stabilization in commercial property valuations following a phase of swift expansion. As supply and demand dynamics evolve, investors can anticipate a more balanced pricing landscape.

Significantly, real estate is viewed as a safeguard against inflation, since its values usually increase when inflation occurs, providing an additional level of stability to the sector.

Properties that adhere to modern efficiency standards and sustainability criteria are projected to achieve higher valuations, while older, less efficient buildings may experience declines.

To optimize returns, investors should prioritize properties that align with these emerging trends, as the industrial sector increasingly values sustainability and operational efficiency.

The Zero Flux newsletter serves as an indispensable tool for investors, providing essential insights to navigate these market dynamics effectively.

Conclusion

The industrial real estate landscape in 2025 is undergoing a significant transformation driven by several crucial trends that demand the attention of investors and industry professionals. E-commerce continues to fuel substantial demand for fulfillment centers, while sustainability initiatives are essential for enhancing property values and attracting eco-conscious tenants. The emphasis on energy-efficient buildings, particularly those with LEED certification, is increasingly vital.

Technological advancements, including automation, IoT, and AI, are streamlining operations and improving efficiency, making properties equipped with these features more appealing. Urbanization is reshaping property locations, with infill projects becoming indispensable as developers optimize urban infrastructure.

Labor market trends are also critical, as access to skilled labor significantly influences investment decisions. Investors must align their strategies with these dynamics to ensure long-term success. Furthermore, emerging markets in Southeast Asia and Latin America present attractive opportunities due to robust economic growth and infrastructure development.

Navigating regulatory changes and enhancing supply chain resilience are vital for stakeholders in the industrial real estate sector. Proactive compliance strategies will help mitigate risks and capitalize on market opportunities.

In conclusion, the future of industrial real estate is promising for those who remain informed and adapt strategically. By prioritizing sustainability, leveraging technology, and understanding market dynamics, investors can thrive in this evolving environment.