Overview

Data analytics is revolutionizing investment strategies in commercial real estate by delivering essential insights into market dynamics, enhancing property valuation, and facilitating informed decision-making. Leveraging data-driven approaches significantly improves financial performance; companies utilizing analytics are far more likely to achieve profitability. This underscores the vital role of data in navigating the complexities of the real estate market. As investors, understanding these dynamics is crucial for making strategic decisions that can lead to substantial returns.

Introduction

Data analytics is revolutionizing the commercial real estate landscape, fundamentally altering how investors approach their strategies in an increasingly complex market. By harnessing insights from a multitude of data sources, professionals are equipped to make informed decisions that enhance asset performance and drive profitability. As the reliance on data grows, however, so does the challenge of navigating its intricacies.

What are the key ways that data analytics can redefine investment strategies? How can investors leverage this powerful tool to stay ahead of the curve? These questions underscore the necessity for investors to adapt and thrive in this dynamic environment.

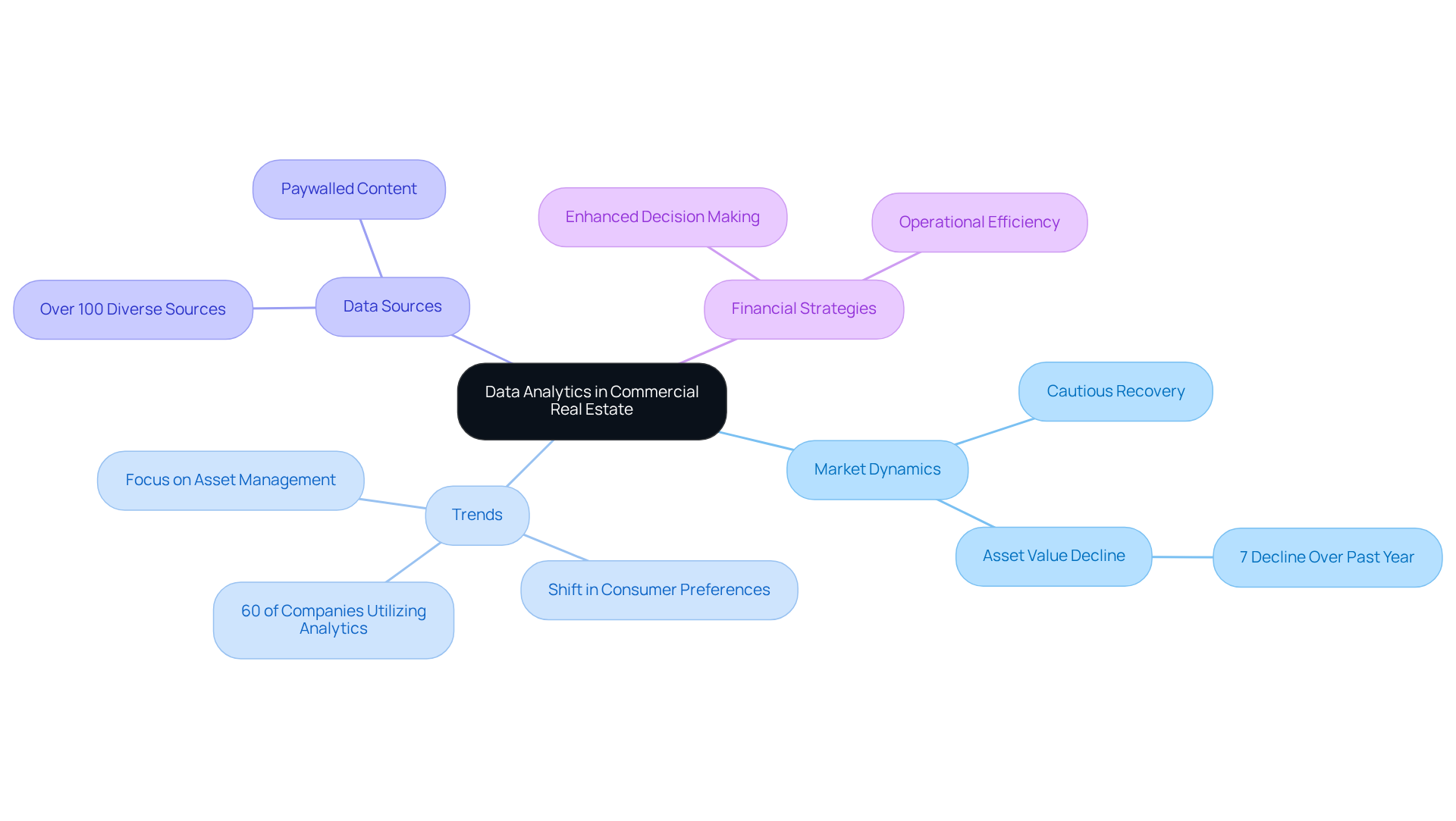

Zero Flux: Essential Insights on Data Analytics in Commercial Real Estate

Zero Flux is committed to delivering essential insights into the role of information analysis within the commercial property sector. By meticulously curating data from over 100 diverse sources, including paywalled content, it provides a comprehensive overview of market dynamics. This data-driven approach, utilizing data analytics in commercial real estate, empowers property experts and investors to stay informed about the latest trends, enabling them to make knowledgeable decisions that significantly enhance their financial strategies.

The importance of information analysis in property cannot be overstated, especially as the sector navigates a landscape marked by shifting consumer preferences and economic uncertainties. By 2025, the integration of information analysis into financial strategies is expected to be vital, with over 60% of property companies already leveraging these tools to guide their financial decisions. This trend signifies a broader shift towards disciplined asset management and operational efficiency, as emphasized by industry leaders who assert that success now depends on current asset performance rather than speculative gains. As Calanog noted, "Asset management has never mattered more."

Recent data indicates that the commercial property market is witnessing a cautious recovery, with transaction volumes and origination levels significantly higher than in 2023. However, funding remains precarious, underscoring the necessity for robust information analysis to navigate this complex landscape. Additionally, the commercial property market is facing challenges, with asset values declining by 7% over the past year, making information accuracy and reliable insights more crucial than ever.

In this context, Zero Flux stands out as a premier source, utilizing information analysis to extract critical market insights that inform investment strategies. By eschewing subjective opinions and focusing on factual data, the newsletter provides its over 30,000 subscribers with the clarity required to excel in a competitive market. This dedication to data-driven insights not only boosts subscriber engagement but also positions Zero Flux as an essential resource for anyone involved in the real estate sector.

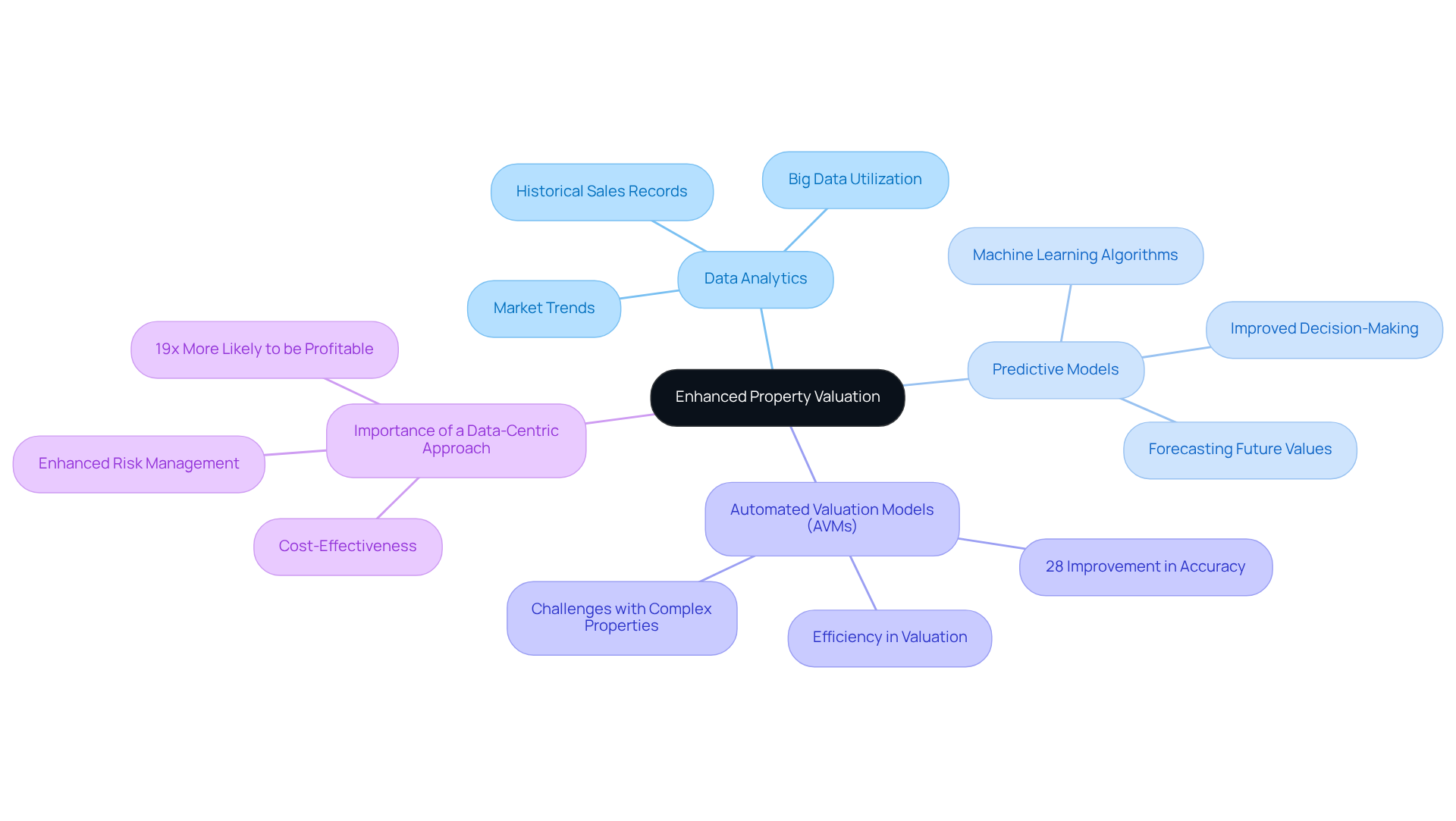

Enhanced Property Valuation: Leveraging Data Analytics for Accurate Assessments

Data analytics in commercial real estate significantly enhances property valuation by leveraging historical sales records, market trends, and economic indicators. By employing advanced algorithms, investors can achieve precise assessments that reduce the risk of overpaying for properties. For example, predictive models analyze comparable sales data to forecast future property values, empowering investors to base their decisions on solid evidence rather than mere intuition. Notably, companies that leverage data analytics in commercial real estate are 19 times more likely to be profitable than those that do not utilize data, highlighting the critical importance of a data-centric approach.

Furthermore, Automated Valuation Models (AVMs) can effectively manage large volumes of property valuations. One commercial property client reported a 28% improvement in portfolio valuation accuracy after implementing an AVM platform. However, it is essential to acknowledge that AVMs may encounter challenges in accurately valuing complex properties, underscoring the necessity for a balanced approach in property assessments. This data-focused methodology utilizes data analytics in commercial real estate to enhance valuation precision and enable investors to identify optimal opportunities and make strategic choices in a competitive market.

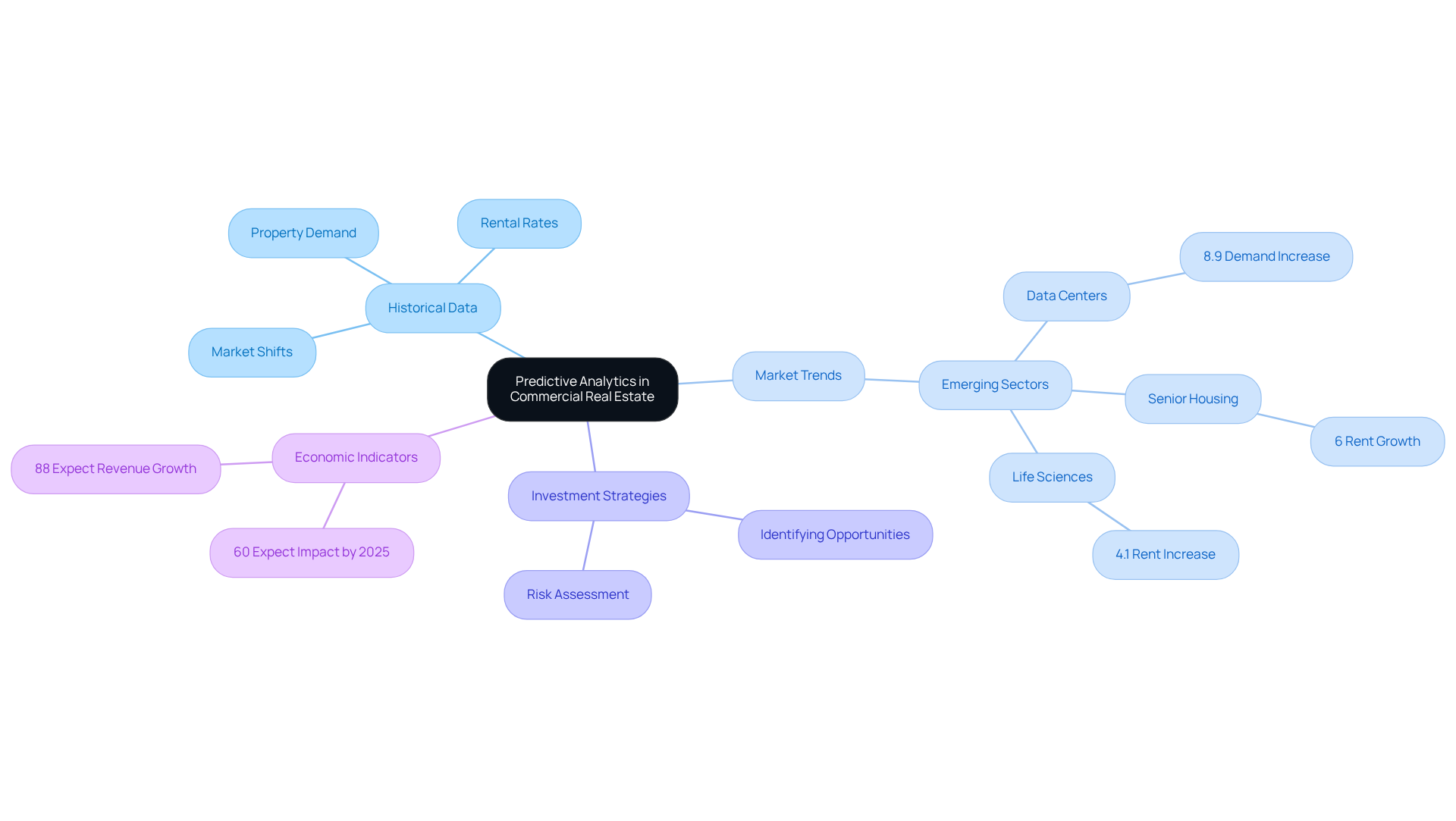

Predictive Analytics: Anticipating Market Trends in Commercial Real Estate

Predictive analysis, as a form of data analytics in commercial real estate, harnesses historical information and statistical algorithms to foresee future market trends, fundamentally transforming strategies in the property sector. Investors can effectively anticipate market shifts by meticulously analyzing patterns in property demand, rental rates, and economic indicators through data analytics in commercial real estate. A notable trend in a specific neighborhood, for example, can signal an impending rise in property values.

Investors who act swiftly to acquire properties in these areas stand to capitalize on the expected price increase, thereby maximizing their potential returns. This proactive strategy is increasingly essential, as 60% of commercial property experts anticipate that data analytics in commercial real estate will significantly influence the industry by 2025. Furthermore, 88% of commercial property executives expect their firms' revenues to grow in 2025, underscoring the enthusiasm surrounding the integration of predictive insights into funding strategies.

By examining demographic trends and economic indicators, predictive analysis not only forecasts demand for specific property types but also aids in identifying promising investment opportunities and evaluating potential risks. This makes it an indispensable tool for navigating the complexities of the market.

Optimized Marketing Strategies: Utilizing Data Analytics for Effective Outreach

Data analytics empowers property experts to refine their marketing strategies by accurately identifying target demographics and tailoring messages accordingly. By meticulously analyzing customer behavior and preferences, agents can develop personalized marketing campaigns that resonate profoundly with potential clients. For example, segmenting audiences through data analysis facilitates more effective outreach, significantly increasing the likelihood of successful transactions.

Incorporating these insights not only enhances marketing effectiveness but also positions agents to respond proactively to market trends. As they leverage data-driven strategies, agents can anticipate client needs and preferences, fostering stronger connections and driving engagement. This approach ultimately leads to higher conversion rates and more satisfied clients, reinforcing the agent's reputation in a competitive market.

By embracing data analytics in commercial real estate, professionals can transform their marketing efforts, ensuring they remain relevant and impactful in an ever-evolving landscape. Therefore, it is imperative for agents to integrate these insights into their investment strategies to maximize their potential for success.

Improved Risk Management: Data-Driven Approaches to Minimize Investment Risks

Data-driven risk management is crucial for navigating the complexities of commercial real estate ventures, particularly through the use of data analytics in commercial real estate. By analyzing factors such as market volatility, tenant defaults, and economic downturns, investors can leverage predictive analytics to identify potential risks early and formulate effective mitigation strategies.

For instance, examining historical tenant behavior data allows landlords to anticipate and address issues proactively, fostering a more stable financial environment. This approach not only enhances risk evaluation but also boosts overall financial performance. In fact, predictive models have demonstrated a 5% higher return compared to traditional methods, underscoring their value in optimizing asset allocation and minimizing investment risks.

Moreover, predictive analysis can reduce fraud losses by up to 25%, illustrating its effectiveness in risk management. The incorporation of predictive data analysis can streamline research processes, saving analysts up to 20 hours a month, thereby enabling them to focus on strategic decision-making. However, 62% of organizations face challenges merging legacy systems with new predictive tools, emphasizing the need to overcome these obstacles to fully harness predictive insights.

As the real estate landscape continues to evolve, utilizing data analytics in commercial real estate will be vital for investors seeking to protect their portfolios against unforeseen challenges. Additionally, inadequate information quality costs the US economy approximately $3.1 trillion annually, highlighting the demand for high-quality information in predictive analysis. With 78% of financial institutions identifying information quality as their largest hurdle, addressing these challenges will be essential for effective risk management.

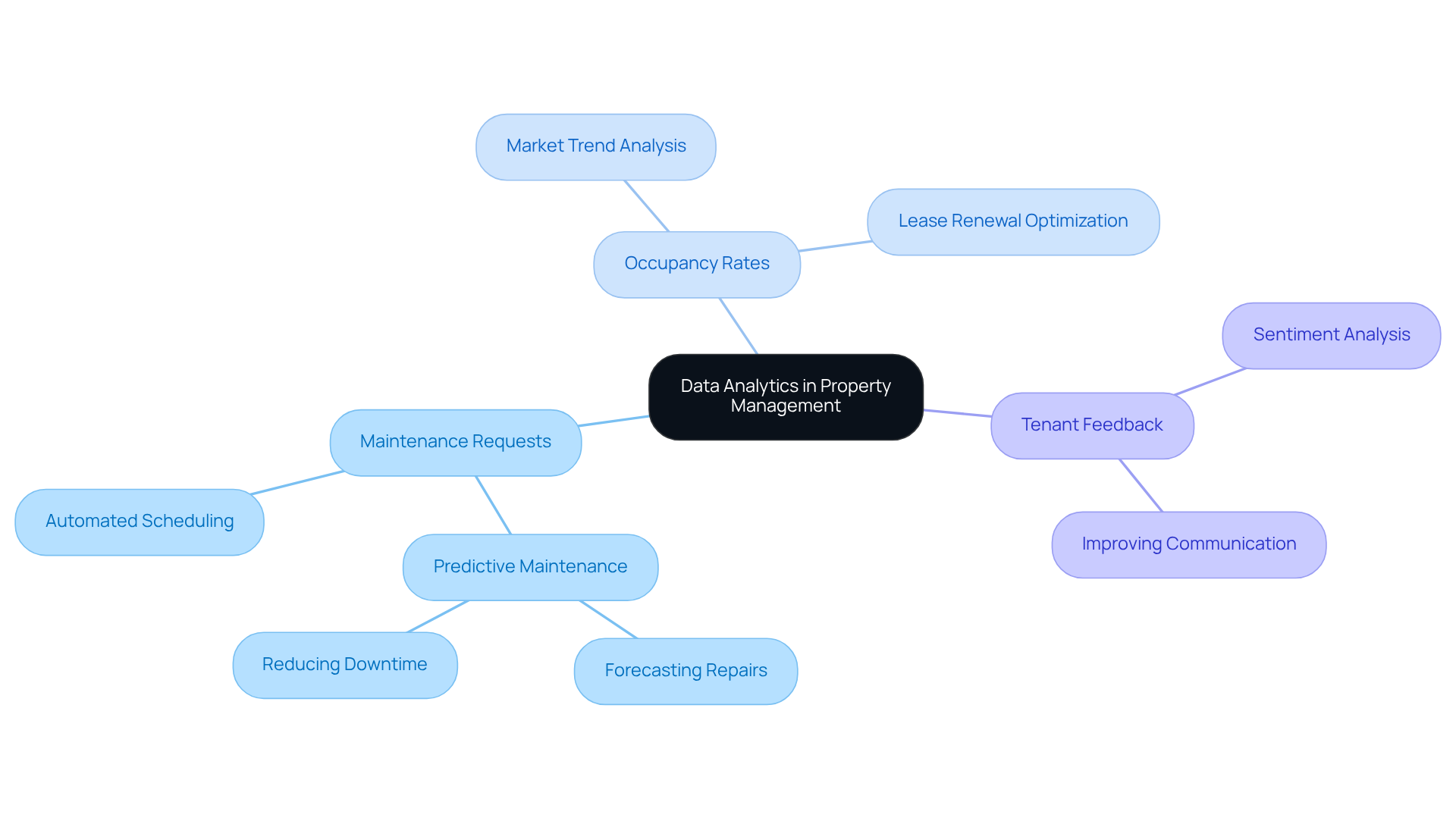

Streamlined Property Management: Enhancing Operations with Data Analytics

Data analytics in commercial real estate serves as a powerful catalyst for simplifying property management by automating routine tasks and providing critical insights into operational performance. By meticulously analyzing data analytics in commercial real estate, including:

- Maintenance requests

- Occupancy rates

- Tenant feedback

property managers can pinpoint areas ripe for improvement and optimize their operations effectively. For example, leveraging predictive maintenance data allows for accurate forecasting of when repairs are necessary, significantly reducing downtime and enhancing tenant satisfaction. This strategic approach not only streamlines processes but also fosters a more responsive management style, ultimately benefiting both property managers and tenants alike.

Enhanced Customer Experience: Using Data Analytics to Elevate Service Quality

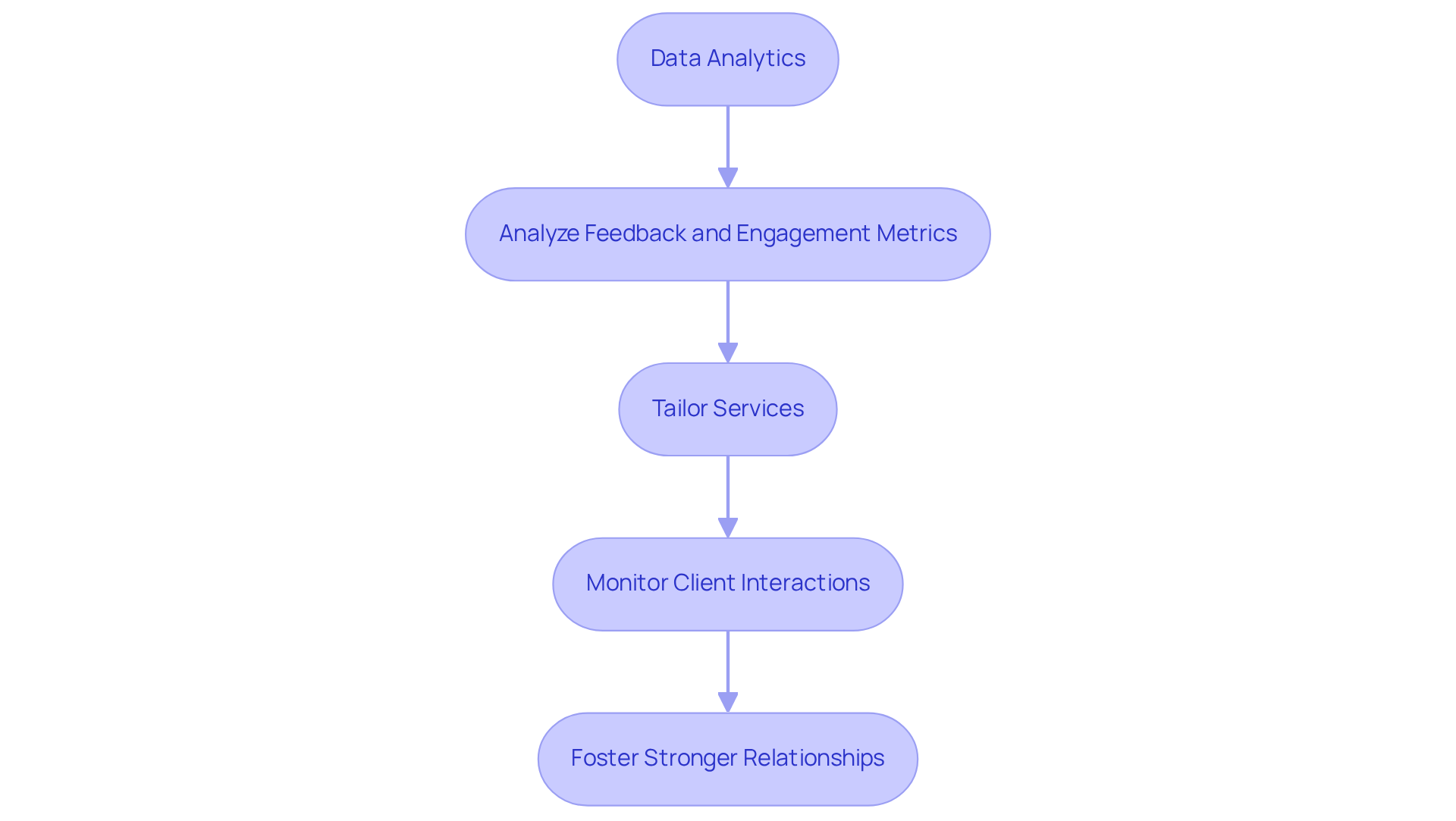

Data analytics significantly enhances customer experience by delivering critical insights into client preferences and behaviors. By meticulously analyzing feedback and engagement metrics, real estate professionals can effectively tailor their services to meet client needs.

For example, leveraging information to monitor client interactions enables agents to identify opportunities for personalized follow-ups. This strategic approach not only fosters stronger relationships but also cultivates enhanced loyalty among clients.

Informed Investment Decisions: Data Analytics as a Tool for Strategic Planning

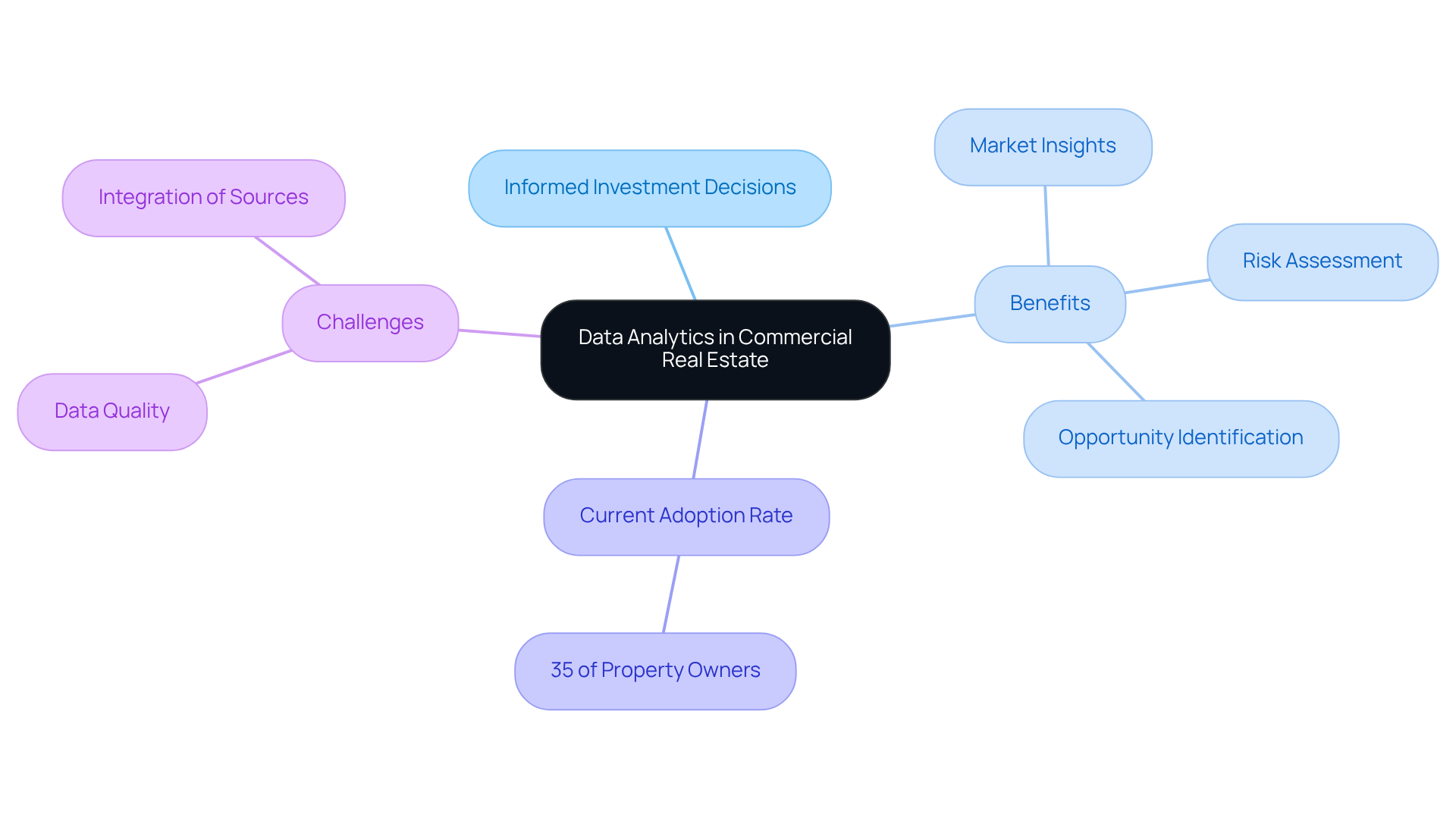

Data analytics in commercial real estate serves as a formidable tool for making informed investment decisions, offering comprehensive insights into market conditions, property performance, and economic trends. Investors can utilize data analytics in commercial real estate to evaluate potential acquisitions, assess risks, and pinpoint lucrative opportunities.

For instance, analyzing market data can reveal emerging neighborhoods with significant growth potential, empowering investors to make strategic decisions that align with their long-term objectives. Notably, only 35% of property owners have adopted suitable tools for data analytics in commercial real estate, highlighting the critical need for evidence-based strategies within the sector.

As Ali Kidwai underscores, accurate, timely, and reliable information is essential for effective decision-making through data analytics in commercial real estate investment. Furthermore, while data analytics in commercial real estate presents substantial benefits, challenges such as ensuring data quality and integrating various sources must be addressed to fully harness its potential.

Understanding Demographic Shifts: Data Analytics for Identifying New Opportunities

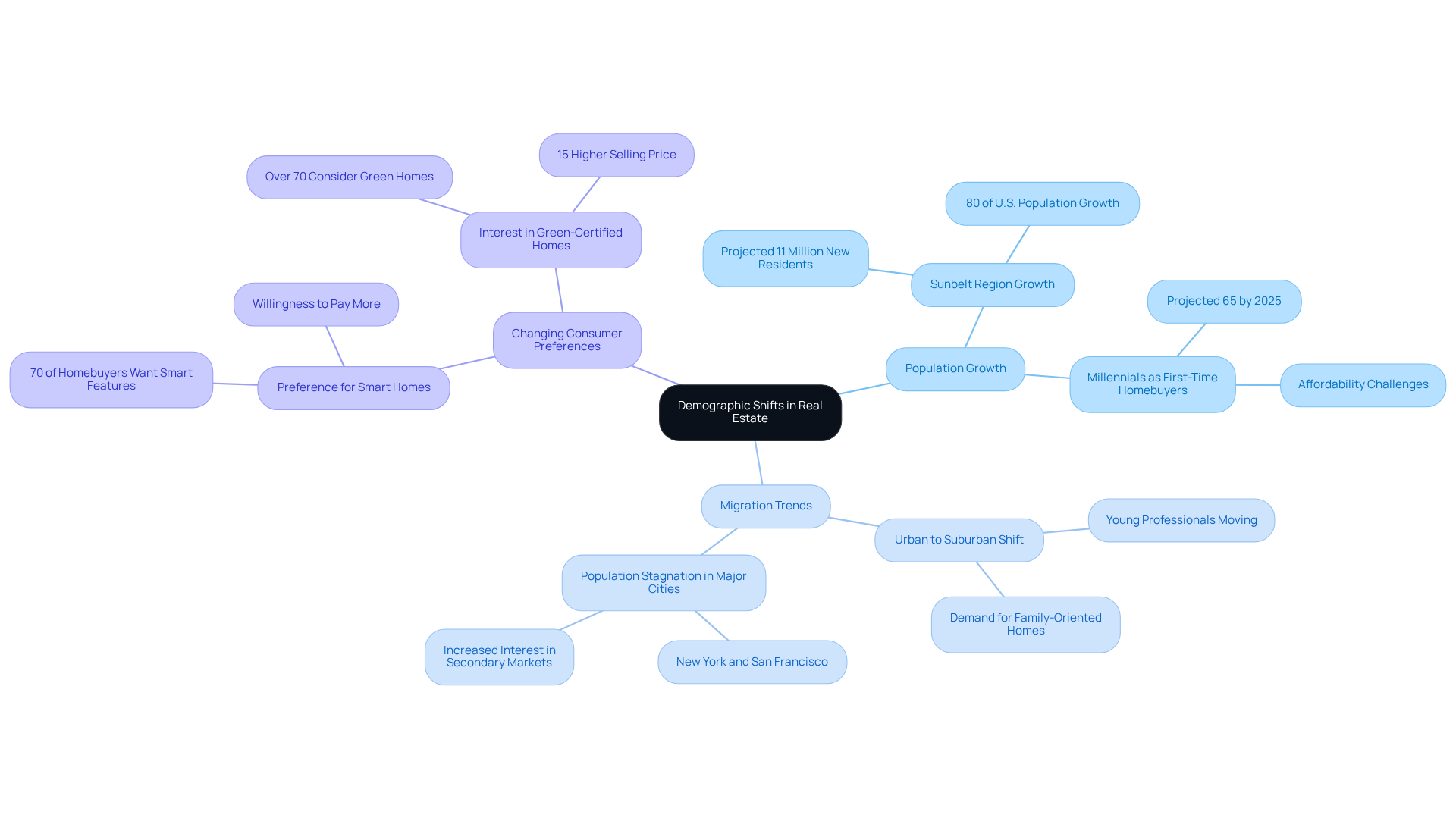

Data analytics in commercial real estate is pivotal for revealing insights related to demographic shifts, such as:

- Population growth

- Migration trends

- Changing consumer preferences

This information empowers real estate professionals to leverage data analytics in commercial real estate to pinpoint emerging markets and strategically adjust their financial approaches. For example, the notable influx of millennials and Gen Z into suburban regions is transforming the demand for family-oriented homes, leading developers to concentrate on properties that cater to these evolving needs. This trend is underscored by the fact that millennials are projected to comprise 65% of first-time homebuyers by 2025, despite grappling with affordability issues.

Furthermore, the Sunbelt region, which has accounted for 80% of total U.S. population growth over the past decade, is anticipated to expand by 11 million residents in the next ten years. This highlights significant investment potential in these high-demand areas. By leveraging demographic data, investors can utilize data analytics in commercial real estate to uncover new opportunities and align their portfolios with trends that promise sustainable growth and profitability.

Unstructured Data Analytics: Unlocking Deeper Insights in Commercial Real Estate

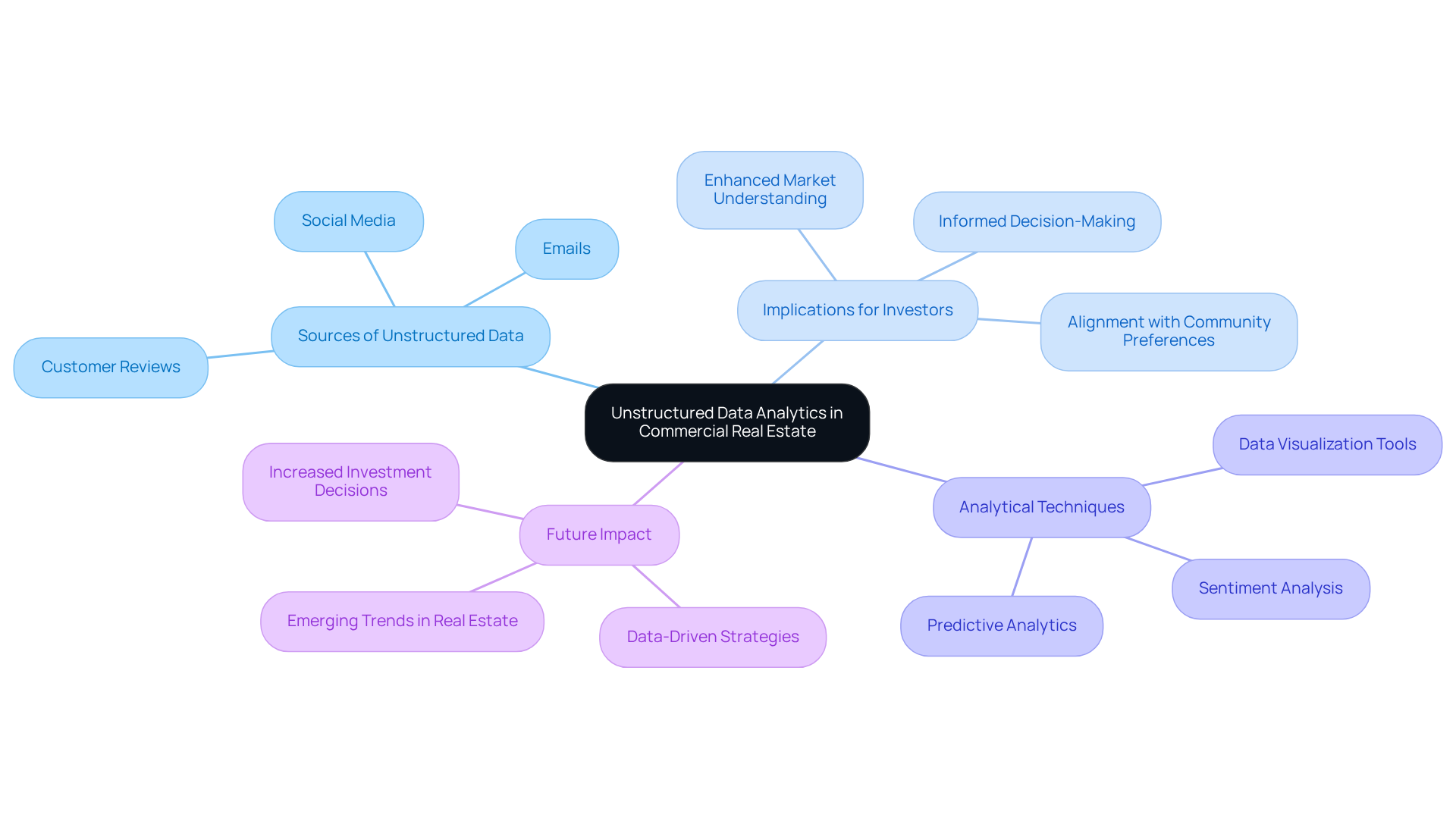

Unstructured information analytics encompasses the processing and examination of non-traditional sources, including social media, emails, and customer reviews. By employing advanced analytical techniques, property experts can extract insights that traditional information sources might overlook. For instance, analyzing social media sentiment can unveil community perceptions about neighborhoods, a crucial factor for investors contemplating property acquisitions. This method not only enhances comprehension of market dynamics but also informs strategic choices, ultimately leading to more successful financial endeavors.

Significantly, unstructured information constitutes 80% of all produced content, underscoring its importance in the property sector. Moreover, a Goldman Sachs report forecasts that data analytics will influence 85% of commercial real estate funding decisions by 2030, further emphasizing the growing significance of these insights. As sentiment analysis becomes increasingly vital to financial strategies, it empowers investors to align their portfolios with community preferences and emerging trends, thereby optimizing their decision-making processes.

To implement social media sentiment analysis effectively, investors should regularly monitor social media platforms for feedback and trends related to their target neighborhoods. This practice ensures that their investment strategies remain relevant and informed, ultimately enhancing their potential for success.

Conclusion

The transformative power of data analytics in commercial real estate is reshaping investment strategies and decision-making processes across the industry. By harnessing advanced data-driven insights, investors and property professionals can navigate the complexities of the market with greater precision, ultimately enhancing their financial outcomes.

Key elements such as:

- Enhanced property valuation

- Predictive analytics for market trends

- Optimized marketing strategies

- Improved risk management

illustrate how data analytics not only informs but also empowers stakeholders. This enables them to make informed choices that align with evolving market dynamics and consumer preferences. The emphasis on leveraging both structured and unstructured data underscores the necessity of adopting comprehensive analytical approaches to remain competitive.

As the commercial real estate landscape continues to evolve, embracing data analytics is imperative for success. By investing in robust analytical tools and methodologies, professionals can unlock new opportunities, mitigate risks, and enhance overall operational efficiency. The future of real estate investment is data-driven; those who adapt to these changes will undoubtedly thrive in this increasingly competitive environment.