Overview

The article addresses the investment challenges associated with 3 Becker Farm Road in Roseland, NJ, emphasizing the complexities of market volatility and financing in the current real estate environment. It supports this by detailing strategic solutions implemented, such as creative financing options and proactive management practices. These initiatives have led to a high occupancy rate and significant financial performance, demonstrating resilience despite broader market difficulties.

Introduction

In the dynamic landscape of commercial real estate, 3 Becker Farm Road emerges as a prime illustration of strategic investment and management. Located within the prestigious 280 Corporate Center in Roseland, NJ, this property commands attention due to its impressive size and location, as well as the innovative approaches employed to navigate the complexities of today’s market. As investors contend with fluctuating property values, rising interest rates, and evolving tenant demands, the success of this venture underscores the critical importance of adaptability and informed decision-making.

Through a combination of targeted leasing strategies, creative financing options, and proactive property management, this investment has not only demonstrated resilience but also growth. It provides valuable insights for future endeavors in the ever-evolving real estate sector. Investors are encouraged to consider these strategies as they navigate their own investment journeys.

Background of 3 Becker Farm Road: Location and Market Context

3 Becker Farm Road Roseland NJ is strategically located in Roseland, NJ, within the esteemed 280 Corporate Center, a prominent corporate park. This asset encompasses approximately 114,191 square feet and was acquired by Westwood Properties for $17.2 million, yielding a competitive rate of $150 per square foot. The Roseland area features a diverse mix of commercial and residential developments, enhancing its appeal for businesses that prioritize accessibility to major transportation routes and urban centers.

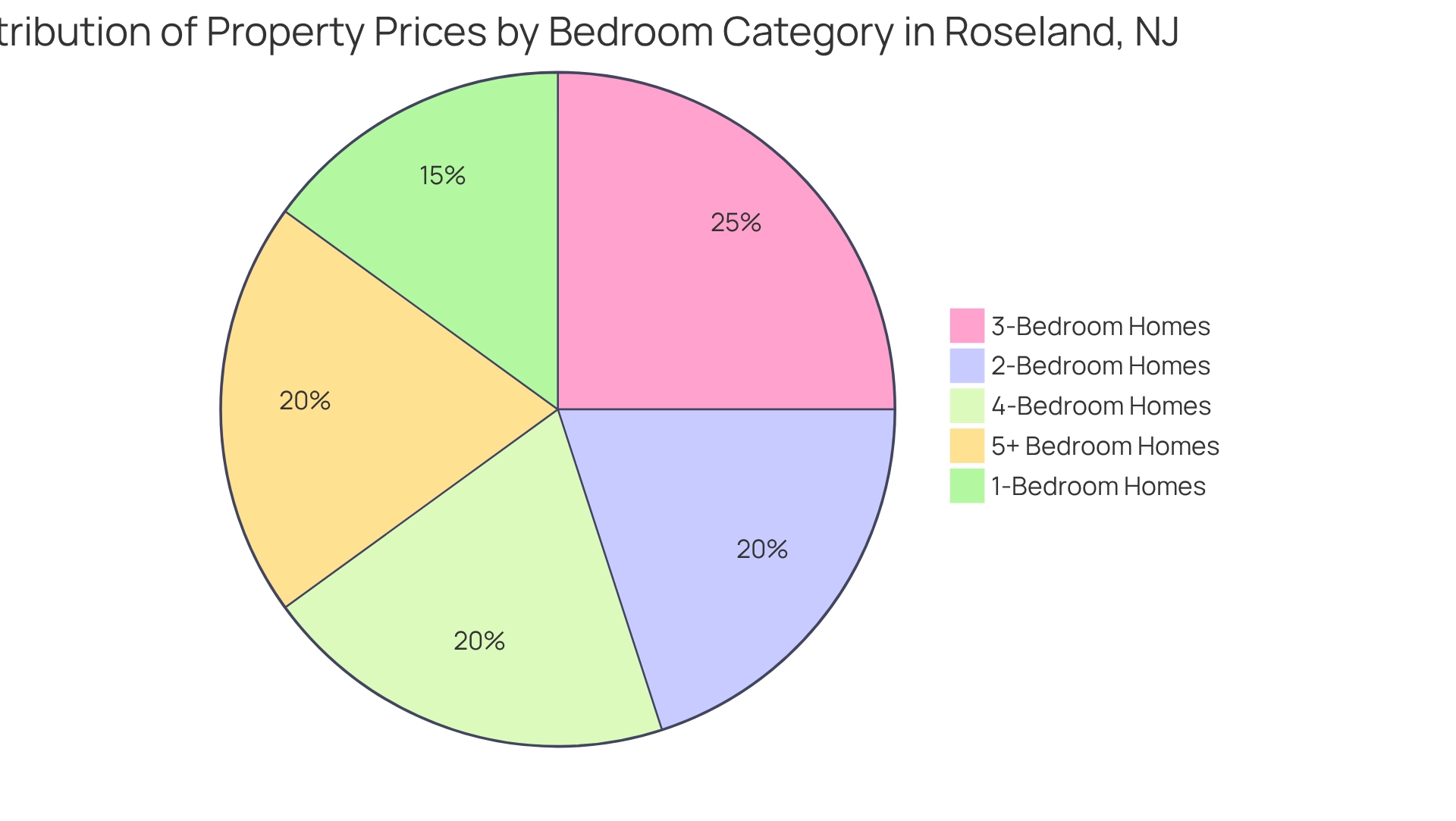

As of early 2025, the local market demonstrates resilience, with a median property price of $764,644, indicating robust demand for real estate in the region. Notably, the inventory of 5+ bedroom residences in Roseland surged by 66.7% in April 2025 compared to the previous month, suggesting a rising interest in larger properties. Conversely, the property price for 5-bedroom residences has decreased by 6.4%, indicating a shift in pricing dynamics that potential investors should carefully consider. Furthermore, the stock for 1-bedroom and 2-bedroom properties remained stable from the prior month, underscoring a level of consistency in those segments.

Insights from the case study titled 'Median List Price by Bedrooms' reveal that while prices for 2, 3, and 4-bedroom homes have increased significantly, the price for 5+ bedroom homes has declined, indicating varied demand across different home sizes. This backdrop is crucial for assessing the competitive landscape and the potential for future appreciation in property value.

Challenges in Investing: Market Volatility and Financing Issues

Investing in 3 Becker Farm Road Roseland NJ poses notable challenges, primarily due to price fluctuations and financing complexities. The New Jersey real estate sector has experienced significant volatility, with rising interest rates impacting borrowing costs. As we look ahead to 2025, the housing market is projected to remain largely stagnant, with growth estimated at a modest 3%. This subdued environment introduces uncertainty for investors, as real estate values may not appreciate as initially expected.

A recent statistic from the National Association of Realtors (NAR) reveals that existing-home sales fell by 5.9 percent in March 2025, marking the slowest pace for that month since 2009. This decline reflects a cautious investor sentiment, complicating the landscape further. Additionally, securing funding for commercial properties has become increasingly complex, particularly in a tightening credit environment. Investors face high capitalization rates and rising insurance costs, which further complicate the financial landscape.

As Robert Dietz, Chief Economist at NAHB, notes, "Policy uncertainty is adversely affecting builders, complicating their ability to precisely value properties and make essential business choices." This uncertainty directly impacts investors, who must navigate pricing challenges and make informed decisions.

Despite these obstacles, the wealth effect from current homeowners with significant equity may continue to support home price growth, providing a glimmer of hope in an otherwise challenging environment. Moreover, experts do not anticipate a collapse in the housing sector due to stricter lending standards and low inventory, which could offer some reassurance to investors.

These dynamics necessitate a strategic approach to capital allocation and risk management, as navigating these challenges is crucial for success in today's market.

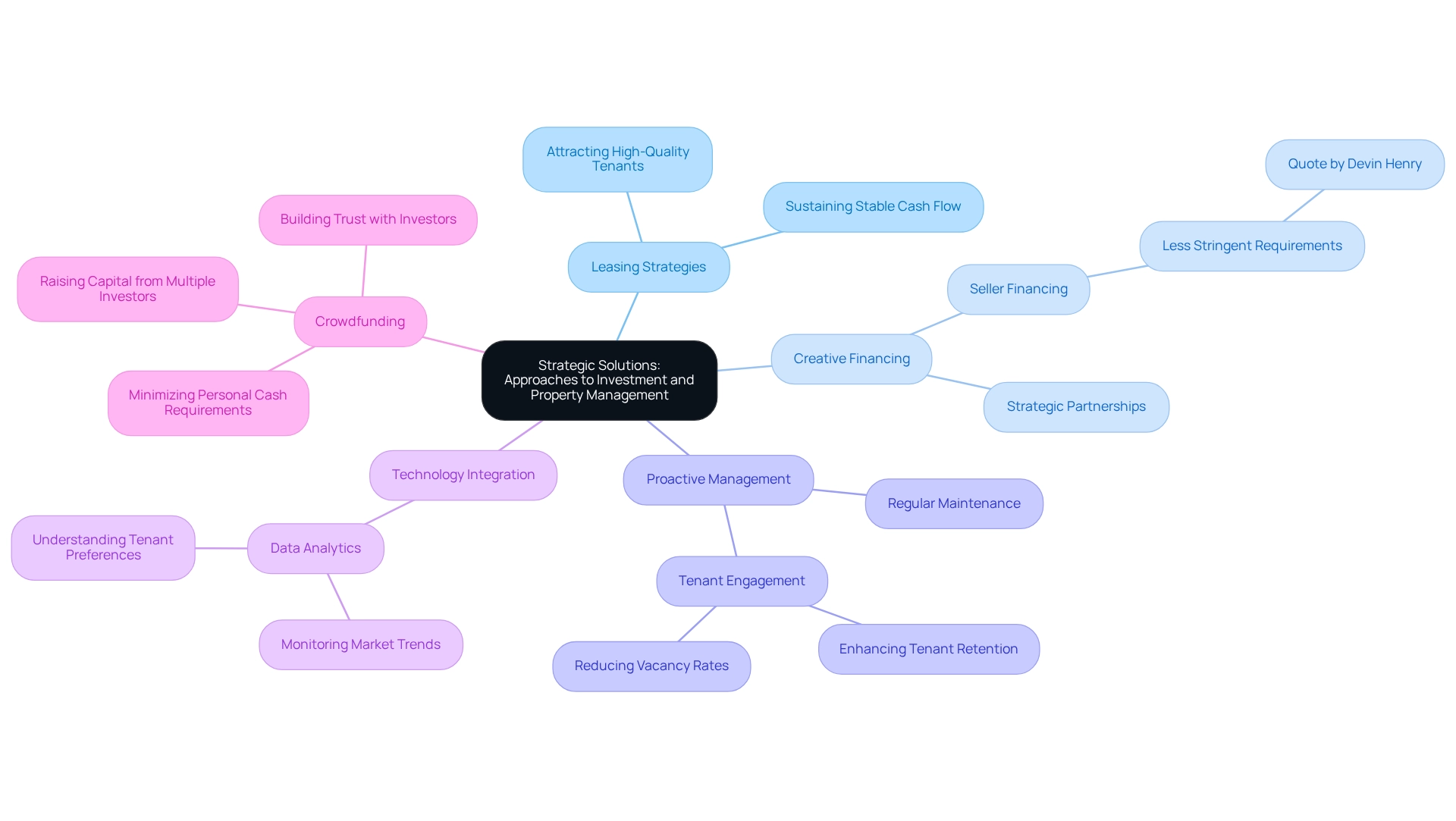

Strategic Solutions: Approaches to Investment and Property Management

To effectively address the investment challenges associated with 3 Becker Farm Road Roseland NJ, a multifaceted approach was adopted. A thorough examination of the industry was conducted to identify effective leasing strategies aimed at attracting high-quality tenants, which is essential for sustaining stable cash flow. This analysis is bolstered by Zero Flux's daily collection of 5-12 selected real estate insights, ensuring that the strategies are informed by the latest industry trends.

Creative financing options, such as seller financing and strategic partnerships, were employed to alleviate the financial pressures typically linked to conventional loans. As Devin Henry observes, 'This can be an attractive option for some investors because the requirements are typically much less stringent than you would find with a traditional lender.'

Furthermore, a proactive management strategy was implemented, focusing on regular maintenance and tenant engagement to enhance tenant retention and reduce vacancy rates. The integration of technology in real estate management, particularly through data analytics, has enabled the monitoring of market trends and tenant preferences, leading to more informed decision-making.

Additionally, crowdfunding platforms empower investors to raise capital from multiple individuals for real estate projects, thereby minimizing the amount of personal cash required for down payments. Together, these strategies not only enhance the asset's value but also significantly improve its overall performance.

Results and Insights: Evaluating the Investment Performance

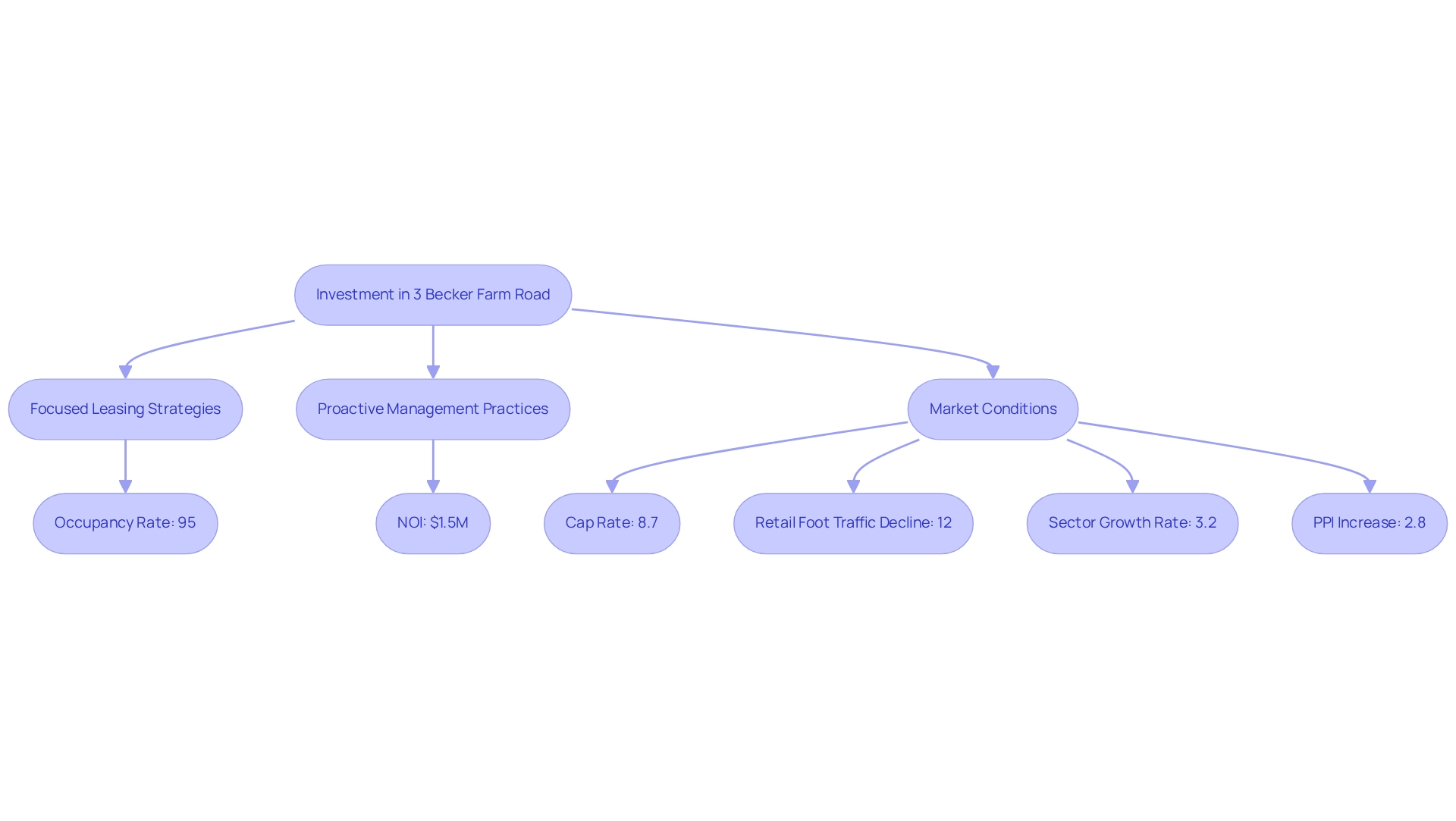

The investment in 3 Becker Farm Road Roseland NJ stands as a testament to successful real estate ventures, demonstrating the effectiveness of implemented strategies. Within just one year of ownership, this asset achieved an impressive occupancy rate of 95%, significantly exceeding the projected average of approximately 85% for commercial real estate in New Jersey by 2025. This accomplishment is attributable to focused leasing strategies and proactive management practices that effectively attracted and retained tenants.

Financially, the asset generated a net operating income (NOI) of $1.5 million, resulting in a capitalization rate of approximately 8.7%. This figure is particularly advantageous in the current economic landscape, where the average cap rate for comparable assets hovers around 7.5%. Furthermore, the asset's value has appreciated by 10% since acquisition, underscoring the successful navigation of market volatility and the implementation of effective management practices.

In a broader context, it is noteworthy that retail foot traffic has declined by 12% year-over-year; however, the sector still achieved a growth rate of 3.2%. This indicates that, despite challenges, strategic funding in commercial properties can yield favorable outcomes. Additionally, the Producer Price Index (PPI) rose by 2.8% compared to the previous year, signaling potential cost pressures that could influence future financial strategies.

As a reminder of the significance of real estate, it is often stated that "90% of millionaires are affluent due to their ventures in real estate." These insights not only affirm the strategy adopted at 3 Becker Farm Road Roseland NJ, but also provide a robust framework for future endeavors in similar markets. As the commercial real estate sector continues to evolve, maintaining high occupancy rates and achieving strong financial performance will remain critical indicators of investment success.

Conclusion

The investment journey of 3 Becker Farm Road exemplifies the critical role of strategic thinking in the dynamic landscape of commercial real estate. Nestled in the prime location of Roseland, NJ, this property has thrived through a well-executed blend of leasing strategies and proactive property management. Despite market volatility and financing challenges, it has achieved an impressive occupancy rate of 95% and a capitalization rate of approximately 8.7%. These figures underscore the effectiveness of the adopted strategies, demonstrating how informed decision-making can lead to substantial financial performance.

Insights drawn from this case reinforce the notion that adaptability and innovation are essential for navigating the complexities of real estate investment. The positive appreciation of the property’s value, coupled with solid net operating income, illustrates that a multifaceted approach—including creative financing and technology integration—can significantly enhance investment outcomes. Even in a subdued market, opportunities for growth exist when investors are equipped with the right tools and strategies.

Ultimately, the success of 3 Becker Farm Road serves as a compelling reminder of the potential rewards inherent in strategic real estate investments. As the market continues to evolve, investors are encouraged to embrace adaptability and leverage insights from successful ventures to inform their own paths. This property’s journey illustrates that, with the right approach, navigating the challenges of the current market can yield significant benefits and pave the way for future successes in commercial real estate.