Overview

The article presents four essential real estate analytics tools designed to empower investors in making informed decisions through comprehensive market analysis and investment opportunity evaluation. It underscores the necessity of selecting tools tailored to specific investment needs. Notably, it highlights:

- Reonomy as a prime choice for commercial investors

- HouseCanary for those focused on residential properties

- CoreLogic for an all-encompassing market analysis

Each tool is supported by data-driven insights that significantly enhance decision-making capabilities within the real estate sector.

Introduction

Real estate investment presents a complex landscape where informed decisions can significantly impact success or failure. With the total value of U.S. properties soaring to nearly $50 trillion, the demand for precise data-driven insights has never been more critical. This article explores four essential real estate analytics tools that empower investors to navigate market fluctuations and uncover lucrative opportunities. However, with numerous options available, how can investors discern which tools will genuinely enhance their strategies and lead to profitable outcomes?

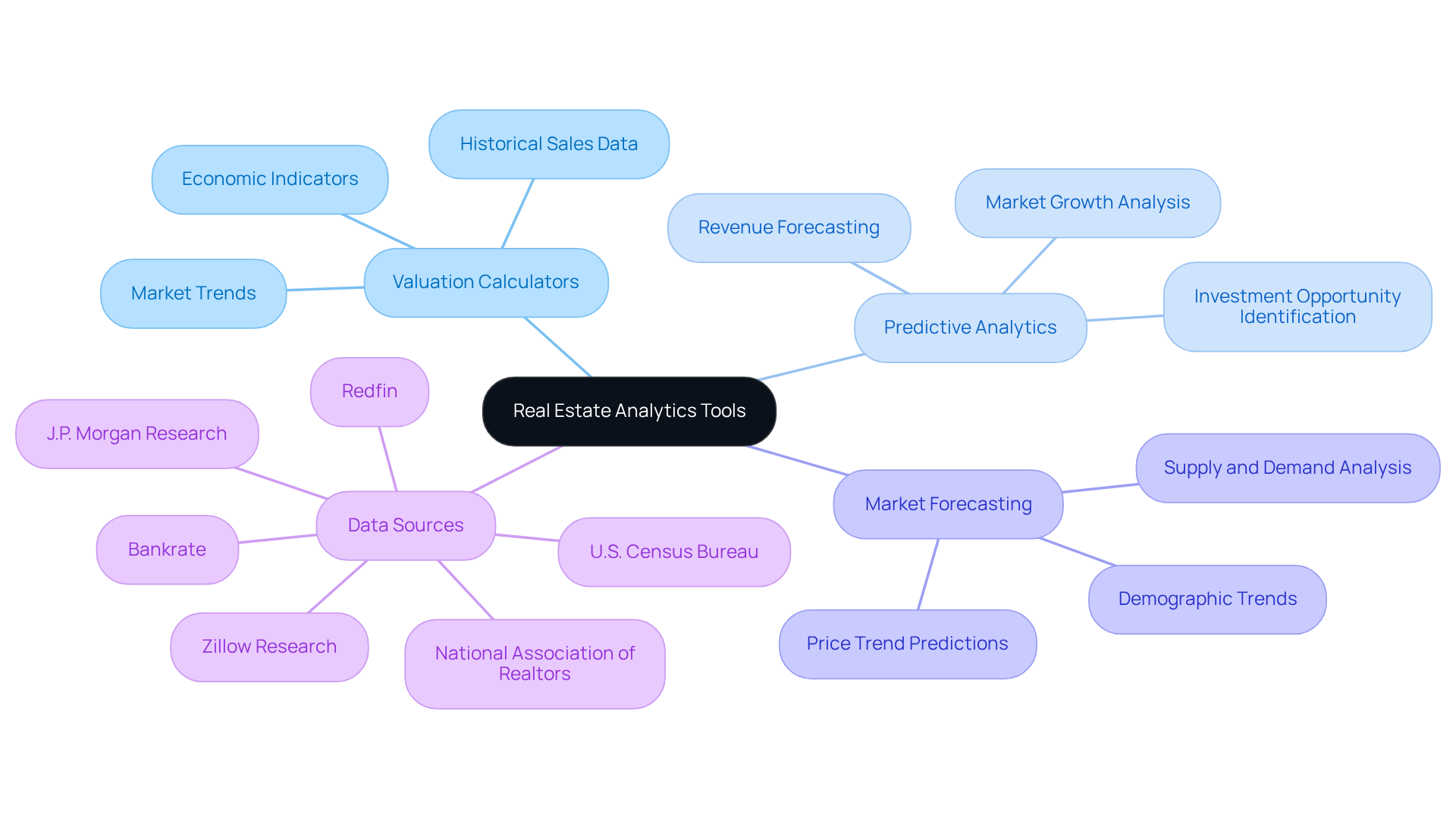

Understanding Real Estate Analytics Tools

Real estate analytics tools are essential software applications that evaluate information related to market conditions, investment opportunities, and demographic trends. By leveraging various data sources—such as historical sales data, market trends, and economic indicators—real estate analytics tools provide invaluable insights that empower investors to make informed decisions. Ranging from straightforward valuation calculators to sophisticated real estate analytics tools that offer predictive insights and market forecasting capabilities, these resources are vital for real estate professionals and investors seeking a competitive edge.

For instance, a case study revealed that a property management company utilizing predictive data analysis achieved a remarkable 20% increase in year-over-year revenue by identifying high-growth regions for investment. This illustrates how real estate analytics tools can uncover profitable opportunities in a vast market, particularly significant given that the total value of U.S. properties reached $49.7 trillion in 2024. Industry leaders emphasize the importance of data-driven decision-making; as one expert stated, "when in doubt, follow the data—because the market never lies." This underscores the necessity of integrating real estate analytics tools into investment strategies to effectively navigate the complexities of the real estate landscape.

Comparison Criteria for Real Estate Analytics Tools

When evaluating real estate analytics tools, several key criteria should be prioritized:

-

Information Accuracy: The dependability of the information is essential. Tools that aggregate information from over 100 reputable sources typically provide more precise insights, reducing the risk of costly investment errors. In 2025, the significance of information precision is emphasized by the fact that companies lose around $5.2 million in revenue due to unutilized information. As Andrew Carnegie noted, "Ninety percent of all millionaires become so through owning real estate," highlighting the critical role of accurate data in successful investments.

-

User Interface: A user-friendly interface significantly enhances the user experience, allowing investors to navigate the application with ease and efficiency. A well-designed interface can streamline the decision-making process, making it easier to access vital information quickly. User feedback frequently highlights the significance of intuitive design in maximizing effectiveness.

-

Features and Functionality: Essential features to look for include property valuation, market trend analysis, predictive analytics, and customizable reporting options. For example, Mashvisor's heatmap feature offers valuable insights into cash on cash return and occupancy rates, enabling investors to make informed choices based on thorough data analysis.

-

Integration Capabilities: The capacity to connect with other software systems, such as CRM or financial modeling applications, enhances the utility of the resource. Seamless integration can enhance workflow efficiency and provide a more holistic view of investment opportunities.

-

Cost: Pricing structures can vary significantly among instruments. Grasping the cost-benefit ratio is crucial for making financially wise choices, ensuring that the selected resource aligns with the investor's budget and analytical requirements. As mentioned by real estate experts, the use of real estate analytics tools can result in substantial savings and enhanced investment results.

In-Depth Comparison of Leading Real Estate Analytics Tools

This comparative analysis presents three leading real estate analytics tools that are essential for investors seeking to enhance their strategies:

-

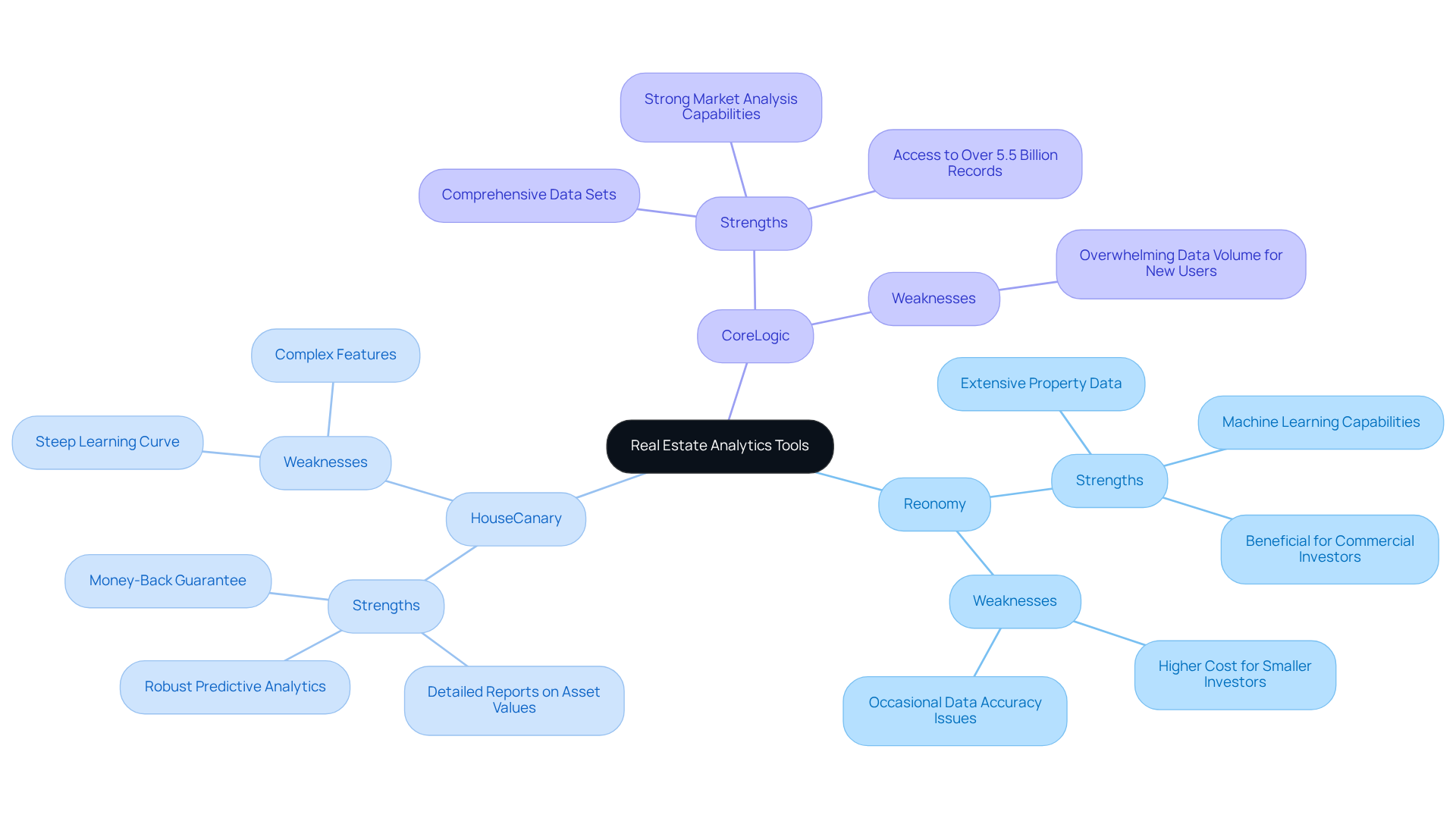

Reonomy:

- Strengths: Reonomy delivers extensive property data, encompassing ownership details and transaction history. Its machine learning capabilities significantly enhance prospecting by pinpointing potential opportunities, making it particularly beneficial for commercial real estate investors.

- Weaknesses: However, the higher cost associated with Reonomy may not be justifiable for smaller investors. Additionally, occasional data accuracy issues in real estate analytics tools could potentially impact decision-making.

-

HouseCanary:

- Strengths: HouseCanary stands out with its robust predictive analytics and valuation models, positioning it as an ideal choice for residential investors. Users appreciate its detailed reports, which cover current and anticipated asset values, and the money-back guarantee for dissatisfied users further boosts its appeal.

- Weaknesses: On the downside, some users have reported a steep learning curve due to its complex features, necessitating additional time and training for effective navigation.

-

CoreLogic:

- Strengths: CoreLogic is renowned for its comprehensive data sets and strong market analysis capabilities, providing crucial insights for informed decision-making in real estate investments. With access to over 5.5 billion property records, users are equipped with a wealth of information.

- Weaknesses: Conversely, the sheer volume of data can be overwhelming for new users, potentially hindering their ability to extract actionable insights swiftly.

This comparison underscores the distinctive characteristics of each real estate analytics tool, empowering investors to select based on their unique requirements and investment approaches.

Recommendations Based on Your Real Estate Analytics Needs

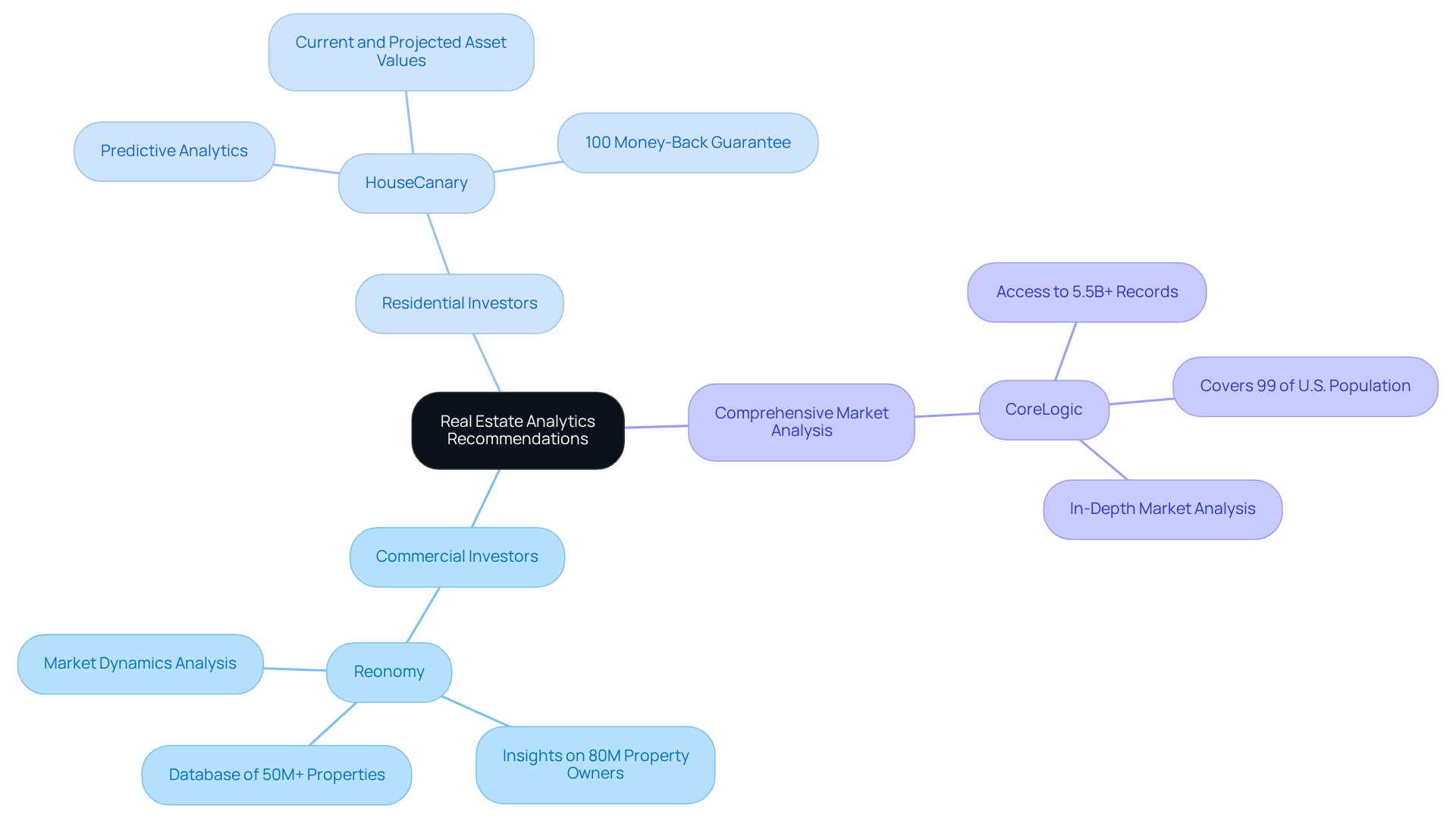

When selecting real estate analytics tools, aligning your choice with your investment goals is paramount. Here are tailored recommendations based on your focus:

-

For Commercial Investors: Reonomy emerges as a leader, boasting an extensive database that provides insights into over 50 million commercial properties and 80 million property owners across the U.S. This platform proves invaluable for grasping market dynamics and pinpointing lucrative opportunities in commercial transactions. Real estate analytics tools leverage historical sales data alongside current market conditions to deliver precise valuations, solidifying Reonomy as an essential asset.

-

For Residential Investors: HouseCanary presents an exceptional option for those seeking predictive analytics and precise real estate valuations. It offers comprehensive reports that include current and projected asset values, confidence scores, and market trends, empowering investors to make informed decisions. Notably, HouseCanary backs its service with a 100% money-back guarantee if the report is not delivered within 24 hours, enhancing its attractiveness.

-

For Comprehensive Market Analysis: CoreLogic is the go-to resource for investors requiring in-depth market analysis. With access to over 5.5 billion records of property and mortgage information, it encompasses more than 99% of the U.S. population, making it a robust tool for understanding market conditions and trends. This extensive coverage significantly boosts its reliability for investors.

Ultimately, the most suitable resource for your needs hinges on your specific investment strategy, budget, and the level of data analysis you require. As Andrew Chen, founder of Explo, aptly stated, "In a world where every decision matters, real estate analysis isn’t just a tool—it’s an essential strategy for long-term success." By leveraging real estate analytics tools, you can significantly enhance your decision-making process, paving the way for more successful investment outcomes.

Conclusion

Real estate analytics tools are indispensable in the decision-making process for investors, providing crucial insights into market conditions, investment opportunities, and demographic trends. By leveraging these tools, investors can confidently navigate the complexities of the real estate landscape, leading to more informed and strategic investment choices.

Key aspects such as the accuracy of information, user interface, features, integration capabilities, and cost are essential criteria for evaluating these tools. A comparative analysis of leading platforms—Reonomy, HouseCanary, and CoreLogic—illustrates how each tool addresses different investment needs, whether for commercial or residential purposes, while offering insights into their respective strengths and weaknesses.

In an ever-changing real estate market, utilizing analytics tools is not just advantageous; it is vital for long-term success. Investors should align their tool selection with specific investment strategies and goals. By adopting data-driven decision-making, the potential for improved investment outcomes and minimized risks can be significantly realized, paving the way for a more prosperous future in real estate investment.