Overview

This article provides a comprehensive comparison of four essential real estate investment analysis tools, emphasizing their unique features, strengths, and weaknesses to empower investors in making informed decisions. By meticulously evaluating tools such as PropStream, Zillow, and RealData against critical criteria—including user experience, data accuracy, and functionality—the article illustrates how the selection of the appropriate tool can significantly enhance investment strategies and improve overall financial outcomes. Investors are encouraged to consider these insights carefully, as the right analytical tool can serve as a cornerstone for successful investment ventures.

Introduction

In the dynamic world of real estate, making informed investment decisions is more crucial than ever. As market conditions shift and evolve, investors are increasingly turning to a variety of analysis tools designed to provide clarity and insight. From property analysis software that dissects cash flow and ROI to market research platforms that reveal local trends, these tools are essential for navigating the complexities of the industry.

Recent data suggests that a staggering 82% of real estate investors rely on some form of analytical tool, underscoring their significance in crafting effective investment strategies. However, with a plethora of options available, understanding which tools best align with specific goals and needs can be overwhelming.

This article delves into the various categories of real estate investment analysis tools, criteria for evaluating their effectiveness, and a comparative analysis of leading platforms, ultimately guiding investors toward making smarter, data-driven decisions in an ever-changing market.

Understanding Real Estate Investment Analysis Tools

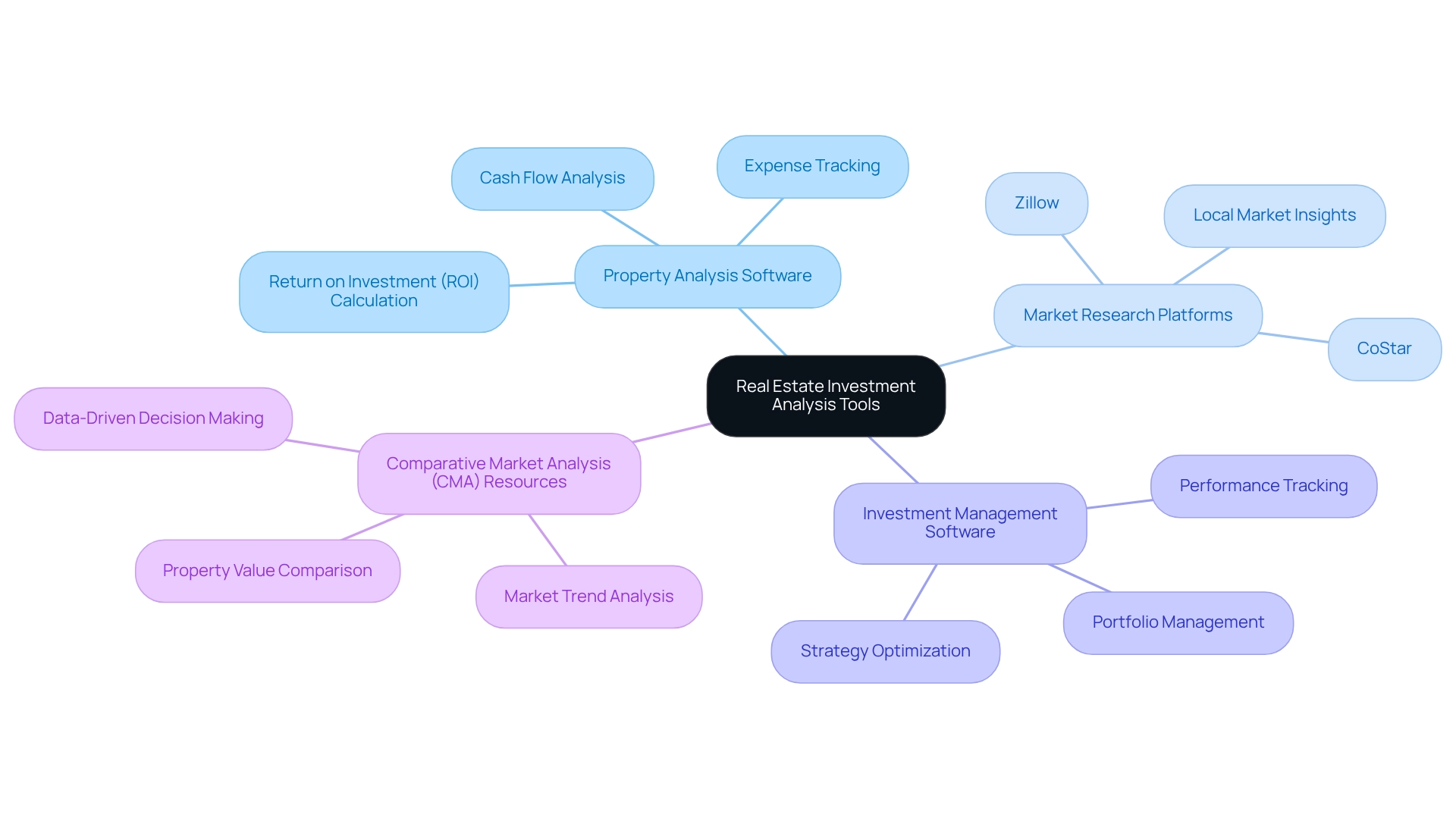

Real estate investment analysis tools are indispensable resources for individuals aiming to make informed decisions in a rapidly evolving market. These real estate investment analysis tools include everything from straightforward calculators to advanced software that integrates market data, financial metrics, and predictive analytics. Key categories include:

- Property Analysis Software: These applications empower investors to assess potential properties by analyzing cash flow, expenses, and return on investment (ROI). With 82% of real estate stakeholders leveraging real estate investment analysis tools, the effectiveness of these tools is clear.

- Market Research Platforms: Tools such as CoStar and Zillow offer insights into local market dynamics, property values, and emerging trends, aiding stakeholders in staying ahead of the curve.

- Investment Management Software: These platforms streamline portfolio management, performance tracking, and strategy optimization, ensuring individuals can effectively adapt to market fluctuations.

- Comparative Market Analysis (CMA) Resources: CMA resources assist individuals in assessing property values by comparing similar properties in the area, providing a data-driven foundation for decision-making.

The importance of real estate investment analysis tools cannot be overstated, as they enable individuals to navigate the complexities of the real estate landscape. Current trends indicate a growing reliance on sophisticated evaluation software, with industry leaders emphasizing the need for flexibility and adaptability in real estate investment analysis tools. As financier Kevin O’Leary asserts, informed decision-making is crucial in the dynamic real estate market, steering stakeholders towards more strategic approaches. Furthermore, as real estate developer Akira Mori states, "In my experience, in the real-estate business, past success stories are generally not applicable to new situations. We must continually reinvent ourselves, responding to changing times with innovative new business models." This underscores the necessity for flexibility in utilizing financial assessment resources. By understanding these categories, investors can select the appropriate real estate investment analysis tools that align with their financial strategies and objectives, ultimately enhancing their decision-making process.

Criteria for Evaluating Analysis Tools

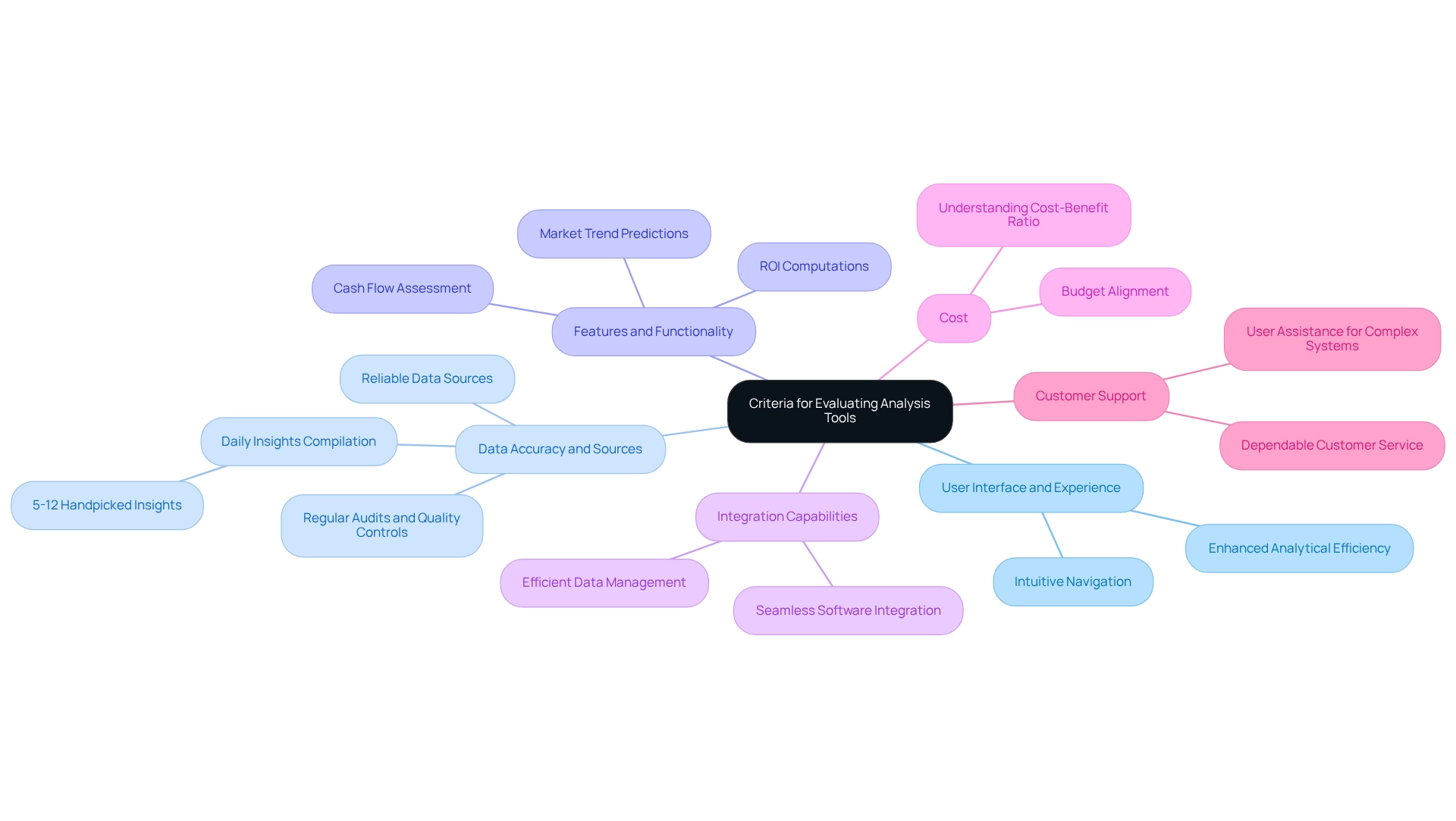

When assessing real estate investment analysis tools, several critical criteria come into play:

- User Interface and Experience: A well-designed, user-friendly interface is essential for enhancing analytical efficiency. Tools that prioritize intuitive navigation can significantly reduce the learning curve for users.

- Data Accuracy and Sources: The reliability of data is crucial; systems that gather information from various trustworthy sources ensure that users are making decisions based on precise and current information. Maintaining data accuracy is not merely a best practice; it is essential to effective financial strategies. Regular audits and quality controls are vital for sustaining this accuracy. As highlighted by Zero Flux, which compiles 5-12 handpicked real estate insights daily, the need for reliable real estate investment analysis tools that provide similar insights is crucial for informed decision-making.

- Features and Functionality: Key attributes like cash flow assessment, ROI computations, and market trend predictions are vital for thorough financial evaluations. Tools that offer robust functionalities can provide deeper insights into potential opportunities.

- Integration Capabilities: The ability to seamlessly integrate with other software platforms can streamline the investment process, allowing for more efficient data management and analysis.

- Cost: Pricing models can vary significantly, making it essential for investors to understand the cost-benefit ratio. Assessing the financial implications of each instrument aids in making informed choices that align with budget limitations.

- Customer Support: Dependable customer service is a crucial element, especially for intricate systems that may require user assistance. Effective assistance can improve user experience and guarantee that stakeholders can maximize the resource's potential.

As Winston Churchill noted, "Land monopoly is not only monopoly, but it is by far the greatest of monopolies; it is a perpetual monopoly, and it is the mother of all other forms of monopoly." This highlights the importance of precise data in real estate evaluation. By evaluating these standards, stakeholders can choose the most appropriate real estate investment analysis tools that not only meet their requirements but also enhance their overall financial strategy. Furthermore, maintaining data accuracy through quality controls and conducting regular audits, as demonstrated in case studies, is essential for upholding the integrity of data management practices.

Comparative Analysis of Top Real Estate Investment Tools

A comparative analysis of three leading real estate investment analysis tools reveals distinct strengths and weaknesses that cater to various investor needs:

- Tool Name: PropStream

Key Features: Property analysis, market trends, lead generation

Pros: Comprehensive data, user-friendly interface

Cons: Higher cost compared to basic tools - Tool Name: Zillow

Key Features: Market research, property valuation

Pros: Extensive database, free access

Cons: Limited analytical features - Tool Name: RealData

Key Features: Financial modeling, investment analysis

Pros: Robust financial metrics, customizable reports

Cons: Steeper learning curve for new users

PropStream is particularly suited for serious investors seeking detailed property analysis and market insights, making it a powerful tool for informed decision-making. In contrast, Zillow provides a broad overview of market conditions and property values, serving as an excellent starting point for novice investors. Meanwhile, RealData distinguishes itself for its financial modeling abilities by providing real estate investment analysis tools that assist users in maximizing their return on capital (ROI) through thorough analysis.

The U.S. housing market recently demonstrated resilience, with approximately 4.1 million home sales recorded, reflecting a modest growth of 0.8% from the previous year despite challenges such as high mortgage rates. This stability highlights the significance of employing efficient financial instruments, such as real estate investment analysis tools, to maneuver through the intricacies of the market. As the typical American home size has grown considerably over the decades, from 1,525 square feet in 1973 to 2,435 square feet in 2018, comprehending market trends through these resources becomes progressively essential for investors seeking to take advantage of changing opportunities. As Ada Louise Huxtable wisely remarked, "Real estate is the nearest equivalent to the mythical pot of gold," emphasizing the lasting worth of real estate resources.

Choosing the Right Tool for Your Investment Strategy

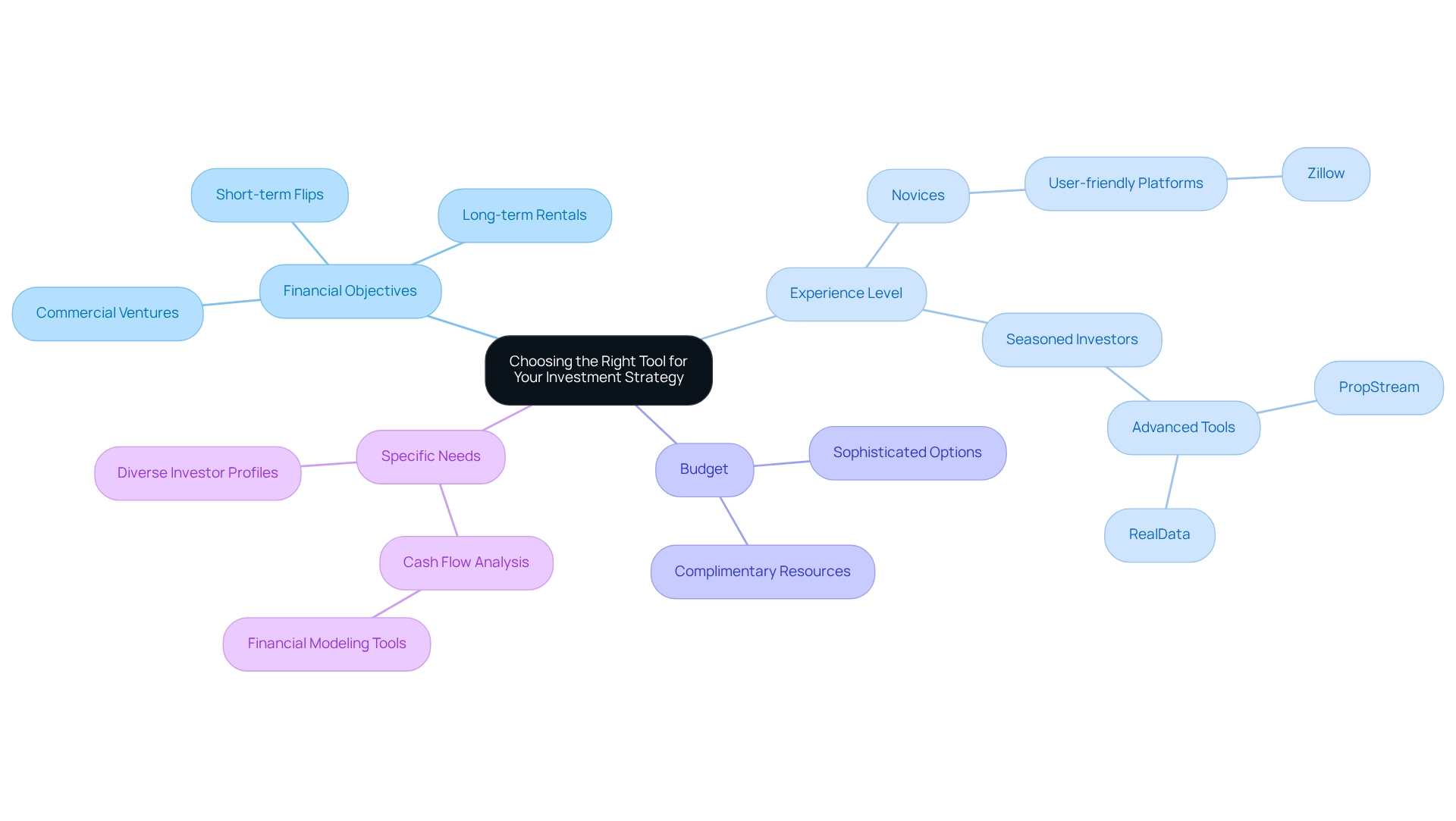

Selecting the appropriate real estate investment analysis tools is crucial for achieving your financial objectives. Key factors to consider include:

-

Financial Objectives: Clearly define your focus—whether it’s short-term flips, long-term rentals, or commercial ventures. The typical duration a residence remains on the market has decreased to 27 days, indicating a fast-paced environment that may benefit from using real estate investment analysis tools for quick assessments. Furthermore, understanding the financial goals of property stakeholders significantly influences equipment selection, as different strategies require distinct functionalities.

-

Experience Level: Your level of familiarity with real estate trading will impact your choice. Novices may find user-friendly platforms like Zillow advantageous, especially since approximately 47% of home purchasers start their property search online, underscoring the importance of accessible online resources. Conversely, seasoned participants might leverage advanced tools such as PropStream or RealData for deeper insights.

-

Budget: Evaluate the cost of the resource against your overall financial plan. Many individuals begin with complimentary resources for initial research; however, as their strategies evolve, they may allocate a budget for more sophisticated options. Notably, the typical budget for real estate financing resources varies widely among individuals, reflecting different levels of commitment and strategy.

-

Specific Needs: Identify your unique requirements. If cash flow analysis is critical, prioritize resources that excel in financial modeling and utilize real estate investment analysis tools to provide robust analytics. The changing landscape of real estate funding, particularly as the homeownership rate for Americans under 35 rises to 39%, emphasizes the need for real estate investment analysis tools that cater to diverse investor profiles. Ultimately, the ideal real estate investment analysis tools align with your funding strategy, enhance your decision-making capabilities, and comfortably fit within your budget. For instance, in 2024, 53% of real estate experts recommended investing in hotel properties in West Palm Beach, indicating that tailored tools can profoundly influence investment success. By making informed choices, you can navigate the complexities of the real estate market more effectively.

Conclusion

The landscape of real estate investment is continually evolving, making the use of analysis tools indispensable for informed decision-making. This article highlights various categories of these tools, including:

- Property analysis software

- Market research platforms

- Investment management software

- Comparative market analysis tools

Each category serves a unique purpose, allowing investors to assess potential properties, understand market dynamics, and manage portfolios effectively. Notably, 82% of real estate investors utilize some form of analytical resource, underscoring their critical role in crafting successful investment strategies.

Evaluating the effectiveness of these tools is equally important. Key criteria such as:

- User interface

- Data accuracy

- Features and functionality

- Integration capabilities

- Cost

- Customer support

must be carefully considered. A well-rounded analysis ensures that investors select tools that not only meet their specific needs but also enhance their overall investment strategy. Insights from industry experts reinforce the necessity of adaptability and informed decision-making in an ever-changing market landscape.

Ultimately, choosing the right real estate investment analysis tool can significantly impact an investor's success. By aligning the selected tool with individual investment goals, experience level, budget, and specific needs, investors can navigate the complexities of the real estate market with greater confidence and efficiency. As the market continues to present both challenges and opportunities, leveraging the right analytical tools will empower investors to make data-driven decisions that propel their investment success in the long run.