Overview

The article delineates four essential practices for comprehending commercial real estate market news:

- Contextual analysis

- Credible sources

- Market trend analysis

- Synthesis of insights from diverse information

By scrutinizing macroeconomic indicators alongside local factors, leveraging reliable sources, analyzing market data, and integrating various insights, professionals can make informed decisions. This strategic approach enables them to adeptly navigate the complexities of the commercial real estate landscape.

Introduction

Navigating the commercial real estate market is akin to traversing a complex maze, where every turn can lead to either opportunity or risk. The dynamics of this sector are influenced by a myriad of factors, ranging from macroeconomic trends like interest rates and employment statistics to localized demographic shifts. Investors and professionals must equip themselves with the right tools to effectively interpret market news.

The challenge lies in discerning credible sources and synthesizing insights from diverse data streams—a task that can often feel overwhelming.

How can stakeholders ensure they are making informed decisions amidst a sea of information? What key practices can enhance their understanding of this ever-evolving landscape?

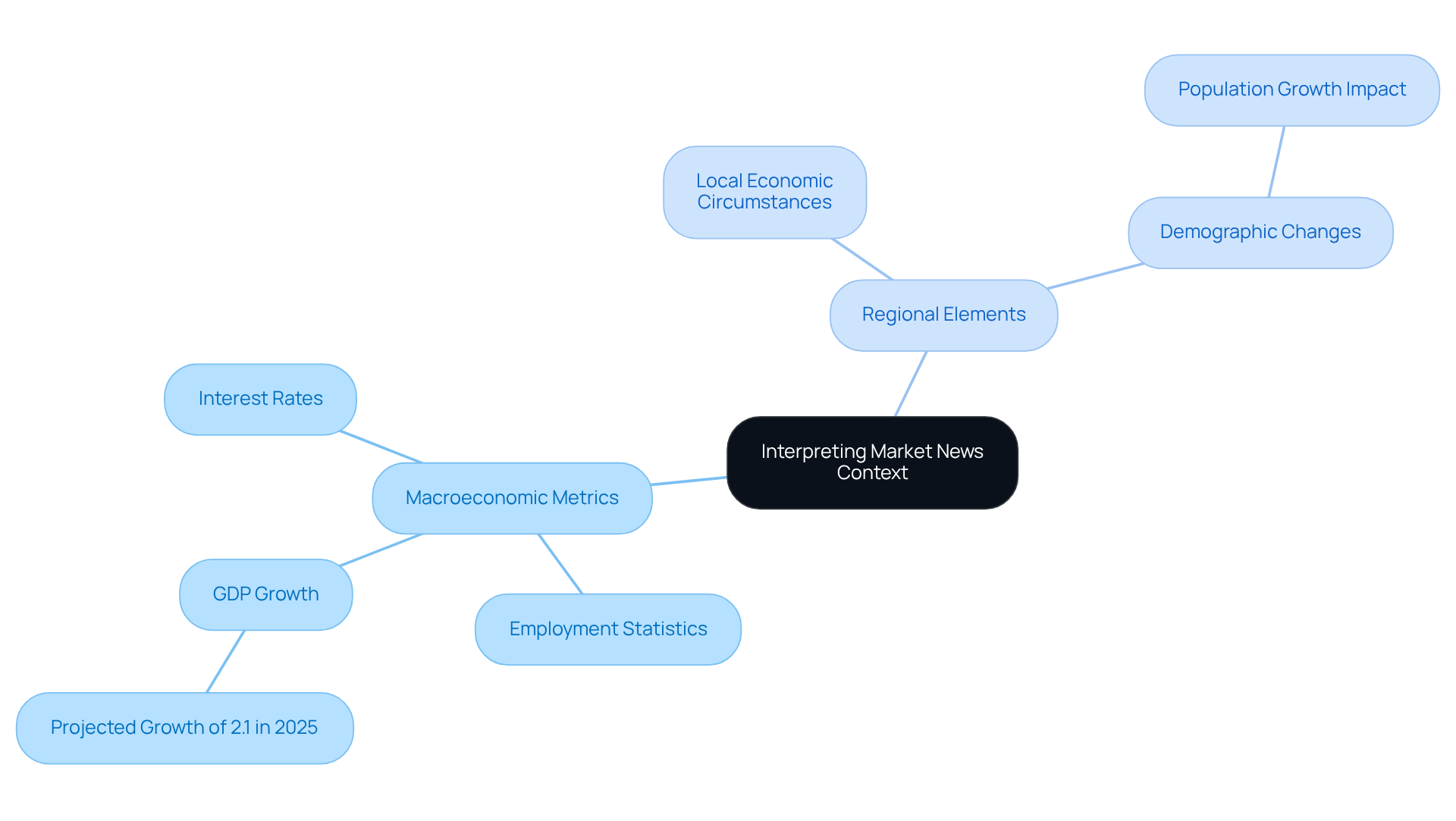

Establish Context for Market News Interpretation

To effectively interpret commercial real estate market news, it is essential to establish the broader context surrounding the information. This involves examining macroeconomic metrics such as:

- Interest rates

- Employment statistics

- GDP growth

These factors can significantly influence financial dynamics. For instance, a rise in interest rates may indicate a cooling housing sector, whereas a surge in employment could suggest increased demand for commercial properties. The U.S. economy is projected to expand at a moderate rate of 2.1% in 2025, which may further impact economic conditions. By understanding these relationships, investors and professionals can better assess the implications of specific news items and make more strategic decisions.

Furthermore, it is advantageous to consider regional elements, including:

- Local economic circumstances

- Demographic changes

These can affect industry trends. For example, a city experiencing population growth may witness heightened demand for commercial spaces, while another facing economic decline may struggle. Notably, Orange County boasts the lowest vacancy rate nationwide at 4.2%, underscoring the influence of local dynamics on performance. Additionally, the total dollar volume of commercial property transactions reached $647 billion in 2023, emphasizing the scale and significance of the sector.

Establishing this context not only aids in interpreting commercial real estate market news but also enhances the ability to effectively forecast future market movements. As highlighted by industry specialists, comprehending the interaction between macroeconomic indicators and regional elements provides stakeholders with the insights necessary to make informed, strategic choices in the evolving commercial property landscape.

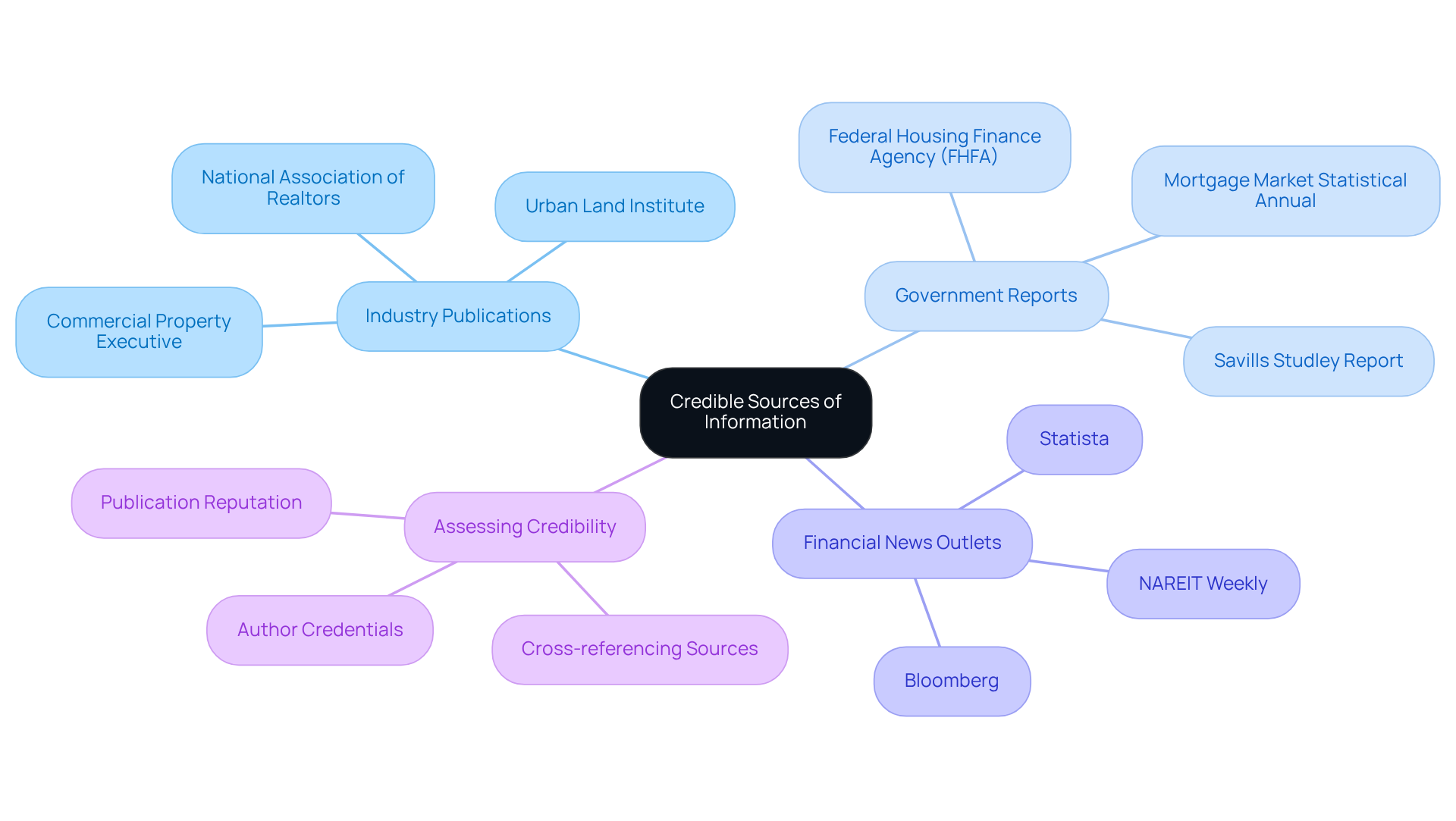

Identify Credible Sources of Information

Recognizing trustworthy information sources is crucial for understanding the commercial real estate market news. Focus on established industry publications, government reports, and reputable financial news outlets to stay informed about commercial real estate market news. These sources employ rigorous editorial standards and provide data-backed insights relevant to commercial real estate market news. For instance, reports from the National Association of Realtors or the Urban Land Institute, which is read by over 45,000 members, are generally trustworthy and offer valuable analyses of the economy. Home price growth is projected to be 2.7% in 2025, underscoring the importance of staying informed through credible sources.

Moreover, consider the author's credentials and the publication's reputation. An article authored by an experienced property analyst or published in a reputable journal is likely to be more reliable than unverified online material. Additionally, cross-referencing information across multiple sources can help validate the accuracy of the data. As Jessica Lautz, Deputy Chief Economist at the National Association of Realtors, observes, "For home buyers who are taking on a mortgage to purchase a home, the conditions are becoming more favorable." By prioritizing credible sources, professionals can ensure they are making decisions based on sound information.

Analyze Market Trends and Data

To effectively analyze market trends and data, property professionals must adopt a systematic approach. Start by gathering essential data points, including vacancy statistics, rental prices, and transaction volumes. Utilizing tools such as Excel or specialized real estate software can significantly streamline the organization and visualization of this data.

Identifying patterns over time is paramount. A consistent decline in vacancy levels often indicates a strengthening market, while erratic rental costs may imply instability. As of 2025, the national average vacancy rate stands at 19.4%, with notable regional disparities; for instance, San Francisco's rate is considerably higher at 27.7%, whereas Dallas-Fort Worth's rate is recorded at 23.2%.

Furthermore, external factors such as economic indicators and demographic shifts play a crucial role in shaping these trends. Texas, for example, is experiencing a substantial influx of millennials, with over 46,200 relocating to the state in 2023, fundamentally altering the real estate landscape and creating new development opportunities. The DFW area, in particular, is witnessing a surge in demand for high-quality suburban office spaces, fueled by robust economic fundamentals and population growth. Currently, the average asking rent for office space in the DFW area is $32.15 per square foot.

As Dr. Horst Stipp, EVP of Research & Innovation at the Advertising Research Foundation, notes, "Effective tracking of vacancy rates and rental prices necessitates a blend of thorough data analysis and an understanding of industry dynamics." By conducting a comprehensive examination that encompasses these elements, property experts can make informed, data-driven decisions that reflect prevailing economic trends.

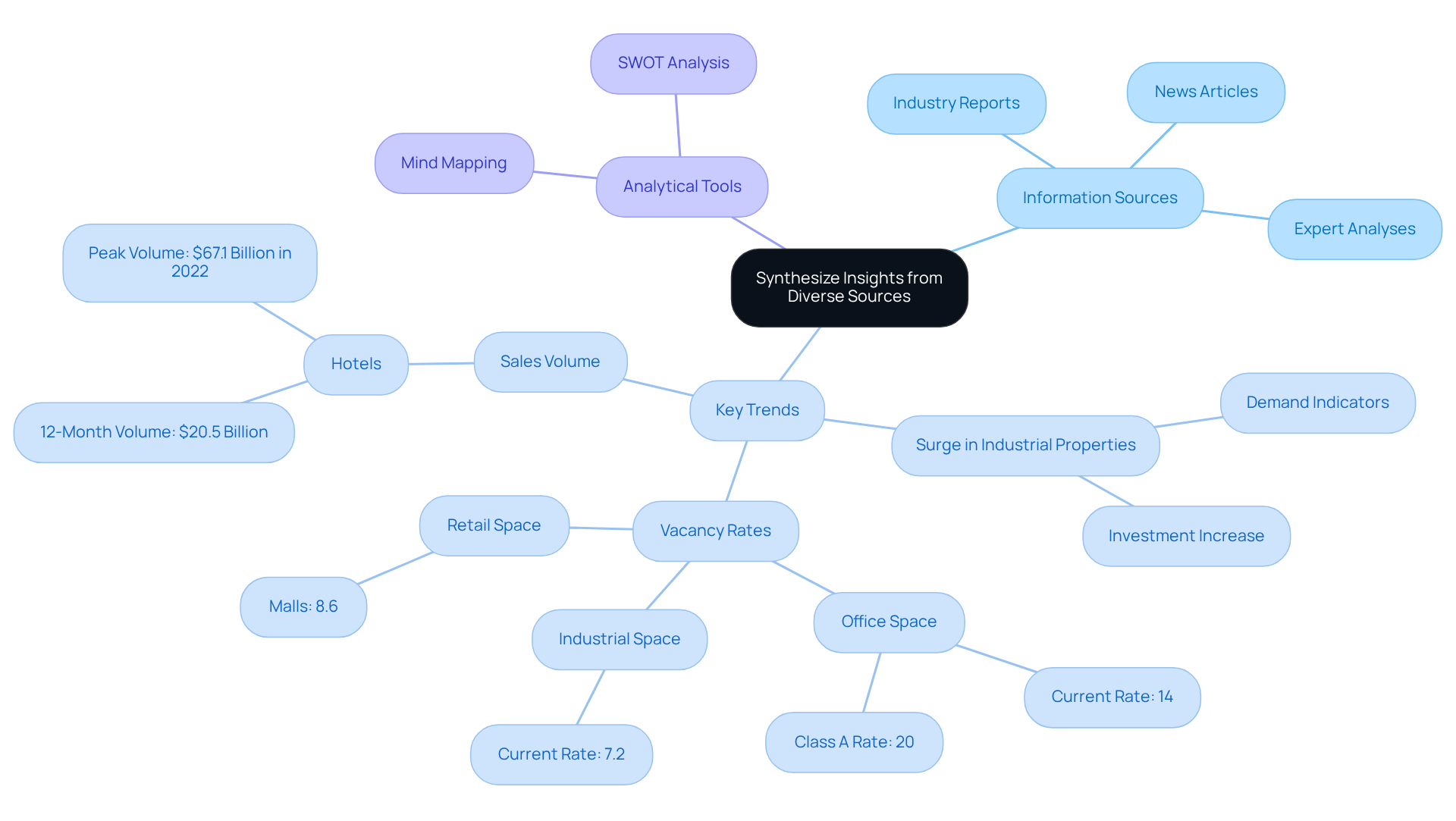

Synthesize Insights from Diverse Sources

Synthesizing insights from diverse sources is essential for a comprehensive understanding of the commercial real estate market news. Begin by gathering information from a variety of trustworthy sources, including industry reports, news articles, and expert analyses. For instance, the National Association of Realtors reports that the vacancy rate for office space is currently at 14%, with Class A office space at 20%. Identifying common themes and discrepancies among these sources can reveal key trends and potential areas of concern.

Consider this: if several reports indicate a surge in demand for industrial properties while one source points to possible supply chain challenges, it becomes crucial to evaluate these insights against one another. The 12-month sales volume for hotels was $20.5 billion as of April 2025, indicating a cautious recovery in that sector. This synthesis can be enhanced through analytical tools like mind mapping or SWOT analysis, which visually represent the relationships between different data points. By integrating insights from multiple sources, real estate professionals can formulate more effective strategies that address the complexities highlighted in commercial real estate market news, ultimately leading to informed decision-making.

Conclusion

Understanding commercial real estate market news is crucial for making informed investment decisions. By establishing a contextual framework that encompasses macroeconomic indicators and local dynamics, stakeholders can better interpret the implications of market developments. This approach not only aids in understanding current trends but also enhances forecasting capabilities, allowing for more strategic decision-making in a rapidly evolving landscape.

Key practices discussed include:

- The importance of identifying credible information sources

- Analyzing market trends systematically

- Synthesizing insights from diverse reports

Each of these elements plays a vital role in ensuring that real estate professionals are equipped with accurate data and comprehensive analyses. Recognizing the impact of economic metrics like interest rates and employment statistics, as well as local market conditions, can significantly influence investment strategies.

Ultimately, the significance of these practices cannot be overstated. As the commercial real estate market continues to evolve, adopting a multifaceted approach to understanding news and trends is essential. By leveraging reliable sources, analyzing data rigorously, and synthesizing insights from various perspectives, stakeholders can navigate the complexities of the market with confidence and clarity. Embracing these best practices will not only enhance market comprehension but also empower professionals to seize opportunities as they arise in the dynamic commercial real estate sector.