Overview

To achieve success in online real estate investment, four key strategies must be mastered:

- Understanding investment fundamentals

- Selecting effective platforms

- Managing risks

- Committing to continuous learning

Mastering these areas is crucial; for instance, evaluating property values and diversifying investments are essential skills that empower investors to navigate the complexities of online real estate. As a result, these strategies significantly enhance the chances of financial success.

Introduction

As the digital landscape reshapes the world of investing, online real estate stands out as a promising avenue for savvy investors aiming to diversify their portfolios. This innovative approach includes various strategies, from engaging with Real Estate Investment Trusts (REITs) to exploring crowdfunding opportunities.

Investors must navigate the complexities of market trends and legal implications. With growing optimism surrounding the future of commercial real estate, grasping the fundamentals of online real estate investment is crucial.

This article delves into essential aspects such as:

- Selecting effective platforms

- Managing risks

- The significance of continuous learning

These elements equip investors with the tools they need to thrive in this dynamic environment.

Understand Online Real Estate Investment Fundamentals

Real estate online investment utilizes digital platforms to facilitate the buying, selling, or management of properties. Understanding various asset categories, such as Real Estate Investment Trusts (REITs), crowdfunding, and direct property acquisitions, is fundamental. Investors must familiarize themselves with essential terms like cash flow, appreciation, and market analysis. Moreover, grasping the legal and financial implications of online transactions is critical. For instance, the ability to evaluate property values and potential returns can significantly impact financial success.

Current statistics reveal that 61% of global respondents anticipate improvements in hurdle rates over the next 12 to 18 months, indicating a more favorable environment for real estate online investment. This optimism is further supported by a notable decline in the number of respondents expecting deteriorating conditions for commercial real estate (CRE) fundamentals, highlighting a positive trend that could enhance confidence in real estate online investment opportunities.

Resources such as Investopedia and Harvard DCE provide valuable insights into these fundamentals, offering comprehensive explanations of REITs and crowdfunding mechanisms. These resources are crucial for individuals seeking to diversify their portfolios. By understanding these fundamental concepts, investors can establish a robust foundation for their online financial journey. As Ada Louise Huxtable aptly stated, "Real estate is the closest thing to the proverbial pot of gold," emphasizing the potential value of informed investing in this sector.

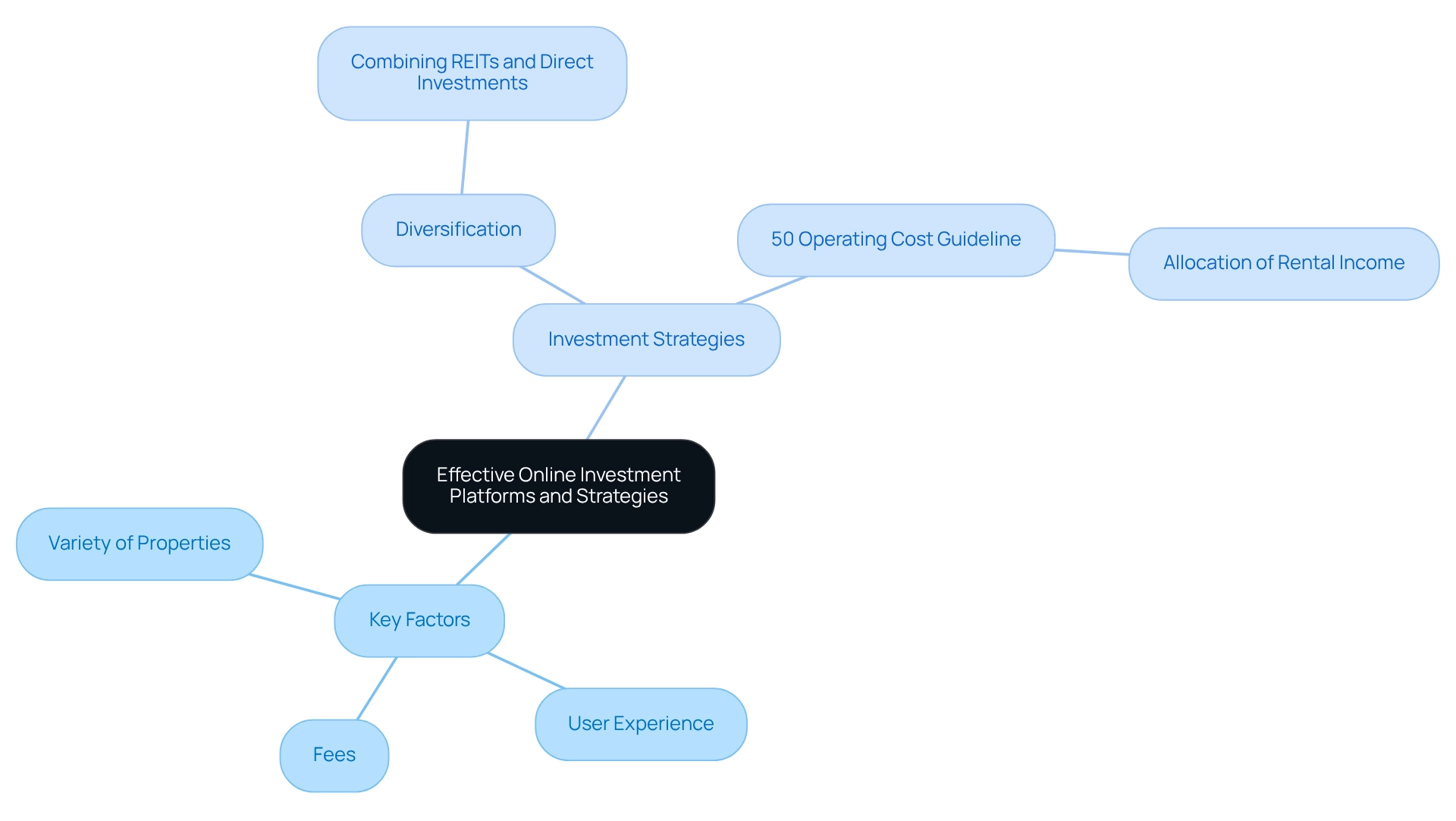

Select Effective Online Investment Platforms and Strategies

When selecting platforms for real estate online investment, it is essential to evaluate several key factors:

- Fees

- User experience

- The variety of properties available

Investors should implement strategies such as diversification, which involves distributing resources across different asset categories and geographic areas to effectively mitigate risks. For example, combining Real Estate Investment Trusts (REITs) with direct property investments can yield a balanced portfolio that maximizes potential returns while managing risk exposure.

Additionally, the 50% guideline suggests that half of a rental property's revenue should be allocated to operating costs, excluding mortgage payments, a crucial consideration for real estate investors. Comprehensive research through reviews and case studies can provide valuable insights into the performance and reliability of these platforms, aiding investors in making informed decisions.

To enhance credibility, it is advisable to consult expert opinions, such as those from Arielle O'Shea, who emphasizes the importance of adhering to strict guidelines for editorial integrity in financial strategies.

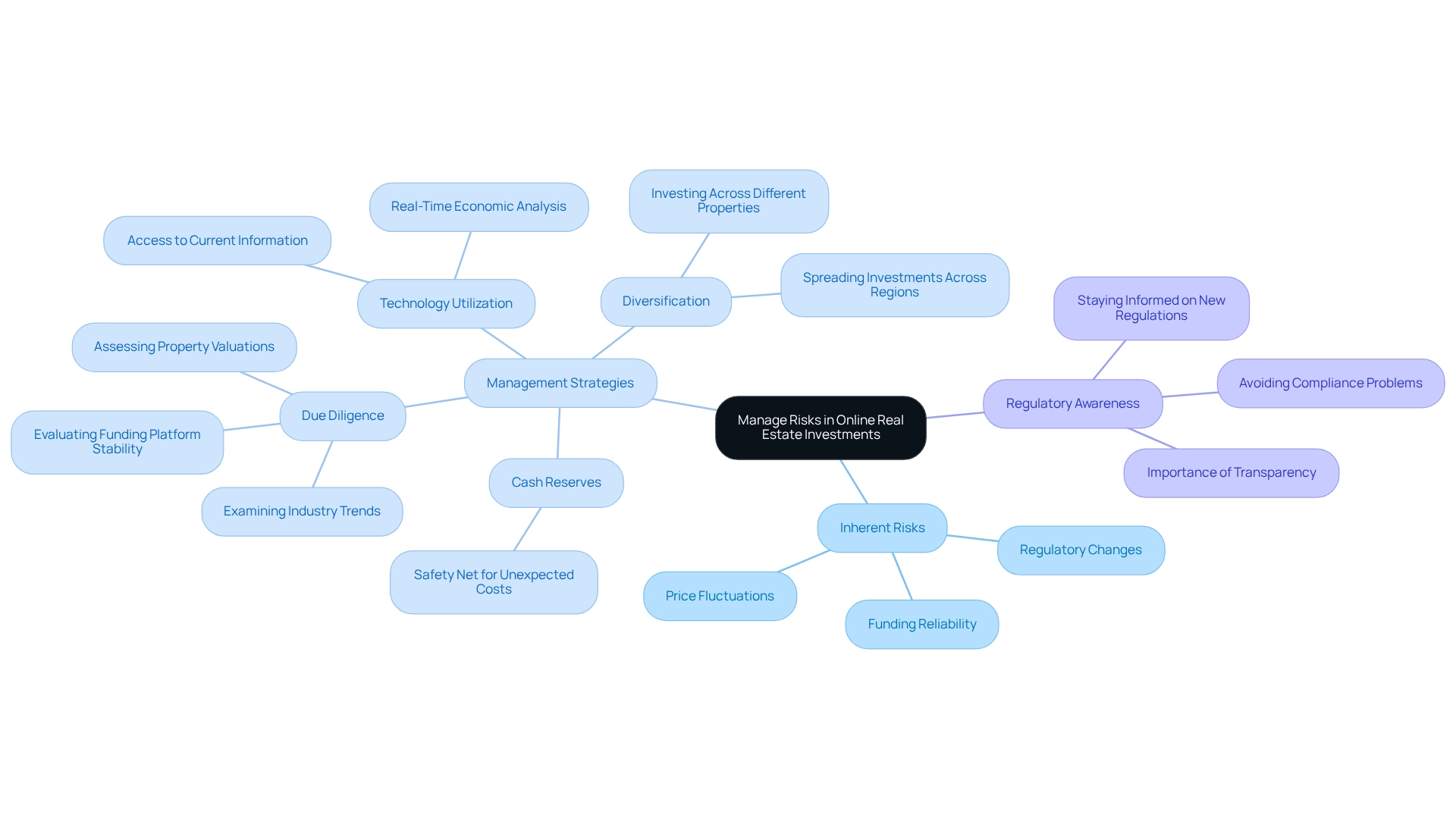

Manage Risks and Challenges in Online Real Estate Investments

Individuals involved in real estate online investment must navigate several inherent risks, including price fluctuations, regulatory changes, and the reliability of funding platforms. To effectively manage these risks, conducting thorough due diligence before making any financial decisions is crucial. This includes examining current industry trends, assessing property valuations, and evaluating the financial stability of the funding platform.

Implementing proactive strategies can significantly mitigate potential risks. For instance, allocating cash reserves for unexpected costs can offer a safety net during unstable economic conditions. Diversifying investments across different properties and regions can also help spread risk and enhance overall portfolio resilience. A study by Baldwin Insights emphasizes the importance of comprehending local economic circumstances, which can help individuals avoid typical pitfalls linked to particular regions. Specifically, the study found that individuals who are well-informed about local dynamics are less likely to encounter unexpected challenges.

Furthermore, utilizing technology for real-time analysis of the economy is crucial in today’s fast-paced environment. Access to current information enables stakeholders to make knowledgeable choices swiftly, adjusting to changes in the economy as they happen. As 61% of global respondents anticipate improvements in hurdle rates over the next 12 to 18 months, staying informed and agile is more important than ever.

Alongside these strategies, awareness of regulatory changes impacting real estate online investment is vital. Staying informed about new regulations can assist individuals in avoiding compliance problems that may emerge from changing industry environments. Recent changes in regulations have emphasized the importance of transparency and due diligence in online transactions. By understanding these dynamics and employing a long-term focus, investors can navigate the complexities of real estate online investment more effectively.

As Warren Buffett wisely stated, "Price is what you pay. Value is what you get." This viewpoint highlights the significance of evaluating the genuine worth of assets, especially in an unstable environment.

Commit to Continuous Learning and Market Analysis

Investors must prioritize continuous learning by actively engaging in workshops, webinars, and industry conferences to stay informed about evolving trends and investment strategies. Notably, statistics indicate that attendance at real property workshops and webinars has surged in 2025, underscoring their significance for professional growth. Subscribing to reputable realty newsletters, such as Zero Flux, offers a wealth of insights into industry dynamics, aiding investors in effectively navigating complexities.

Moreover, establishing a core business team comprising a lawyer and accountant is essential for property success, as it provides critical legal and financial guidance. Additionally, leveraging advanced tools for industry analysis—like property valuation software and demographic research platforms—can significantly enhance decision-making processes. For instance, Harvard DCE offers specialized courses in property analysis, equipping individuals with vital skills to critically assess opportunities.

The case study titled 'The Importance of Due Diligence in Ownership' highlights that thorough due diligence and realistic expectations are crucial when transitioning into property ownership. This illustrates how continuous learning can mitigate risks and maximize performance in property management. By committing to lifelong learning, investors not only adapt to market fluctuations but also improve their overall investment outcomes, ensuring they remain competitive in a rapidly evolving landscape. As Ken McElroy aptly states, 'Investing is not just about financial gains but also about enriching life experiences.

Conclusion

Understanding the fundamentals of online real estate investment is crucial for navigating this evolving landscape. Investors must familiarize themselves with various investment types, such as REITs and crowdfunding, while grasping essential concepts like cash flow and market analysis. With a positive outlook for commercial real estate, informed decision-making can lead to successful investment outcomes.

Selecting the right platforms and implementing effective strategies, such as diversification, can significantly enhance investment performance. Evaluating key factors like fees and user experience aids in choosing reliable platforms, while understanding operational expenses helps in managing rental properties effectively. Research and expert opinions further bolster the decision-making process, ensuring investors build a robust portfolio.

Risk management is paramount in online real estate investing. By conducting thorough due diligence and staying informed about market trends and regulatory changes, investors can mitigate risks associated with volatility and platform reliability. Proactive strategies, such as maintaining cash reserves and diversifying investments, provide additional safeguards against unforeseen challenges.

Finally, committing to continuous learning and market analysis is essential for long-term success. Engaging in workshops and utilizing advanced tools for property evaluation empowers investors to adapt to market fluctuations and refine their strategies. By prioritizing education and leveraging expert guidance, investors can enhance their decision-making processes, ensuring they thrive in the competitive world of online real estate. Embracing these principles not only fosters financial growth but also enriches the overall investment experience.