Overview

This article presents a comprehensive four-step process for transitioning from stocks to real estate via a 1031 exchange, a strategy that enables investors to defer capital gains taxes by reinvesting in like-kind properties.

- Engaging a Qualified Intermediary is crucial; they facilitate the exchange and ensure compliance with IRS regulations.

- Selling the relinquished asset is paramount, as this action initiates the exchange process.

- Following the sale, investors must identify replacement properties within specified timeframes—typically 45 days—to maintain the tax-deferral benefits.

- Completing the purchase of the identified properties is essential for maximizing tax efficiency and enhancing investment potential in real estate.

By understanding and executing these steps, investors can strategically navigate the transition and optimize their investment outcomes.

Introduction

Navigating the transition from stocks to real estate presents a daunting yet rewarding opportunity for investors aiming to optimize their portfolios. The 1031 exchange emerges as a powerful tool, enabling individuals to defer capital gains taxes while reinvesting in like-kind properties. Yet, the complexities of this process prompt critical questions:

- How can investors effectively leverage this strategy to enhance their wealth?

- What key considerations must be taken into account to ensure a successful transition?

This guide explores the essential steps and strategies for executing a seamless 1031 exchange, empowering investors to make informed decisions and capitalize on lucrative real estate opportunities.

Understand the Basics of 1031 Exchanges

A 1031 exchange, commonly referred to as a like-kind exchange, empowers investors to defer capital gains taxes on the sale of a real estate asset by reinvesting the proceeds into another comparable asset. Governed by Internal Revenue Code Section 1031, this tax-deferral strategy requires that both the relinquished asset (the one being sold) and the replacement asset (the one being acquired) be held for business or economic purposes. Consider the following key points:

- Like-Kind Property: The properties exchanged must share the same nature or character, although they need not be identical. This flexibility opens up a broad spectrum of investment options, with approximately 40% of like-kind exchanges involving rental housing.

- Tax Deferral: Engaging in a 1031 exchange allows investors to postpone capital gains taxes, significantly enhancing the capital available for reinvestment. This advantage is particularly notable given that many state governments impose an additional 3-10% tax on capital gains, with rates soaring as high as 13.3% in California, while federal rates range from 15-20%. The primary benefit of a 1031 Exchange for property investors lies in improved tax efficiency, which translates to increased purchasing power and the flexibility needed to accumulate wealth.

- Time Constraints: Investors are required to identify a replacement asset within 45 days and finalize the exchange within 180 days following the sale of the relinquished asset. Adhering to these timelines is essential for preserving the tax benefits.

Understanding these fundamentals is vital for effectively navigating the complexities of a 1031 exchange stocks to real estate investments. The strategic application of 1031 exchanges not only amplifies purchasing power but also cultivates greater flexibility in wealth-building, making them an indispensable tool for astute investors. Moreover, Section 1031 has facilitated approximately 976,000 jobs and generates tax revenue that is nearly ten times greater than the anticipated revenue from restricting these exchanges, highlighting their significance for economic vitality.

Execute a 1031 Exchange: Step-by-Step Process

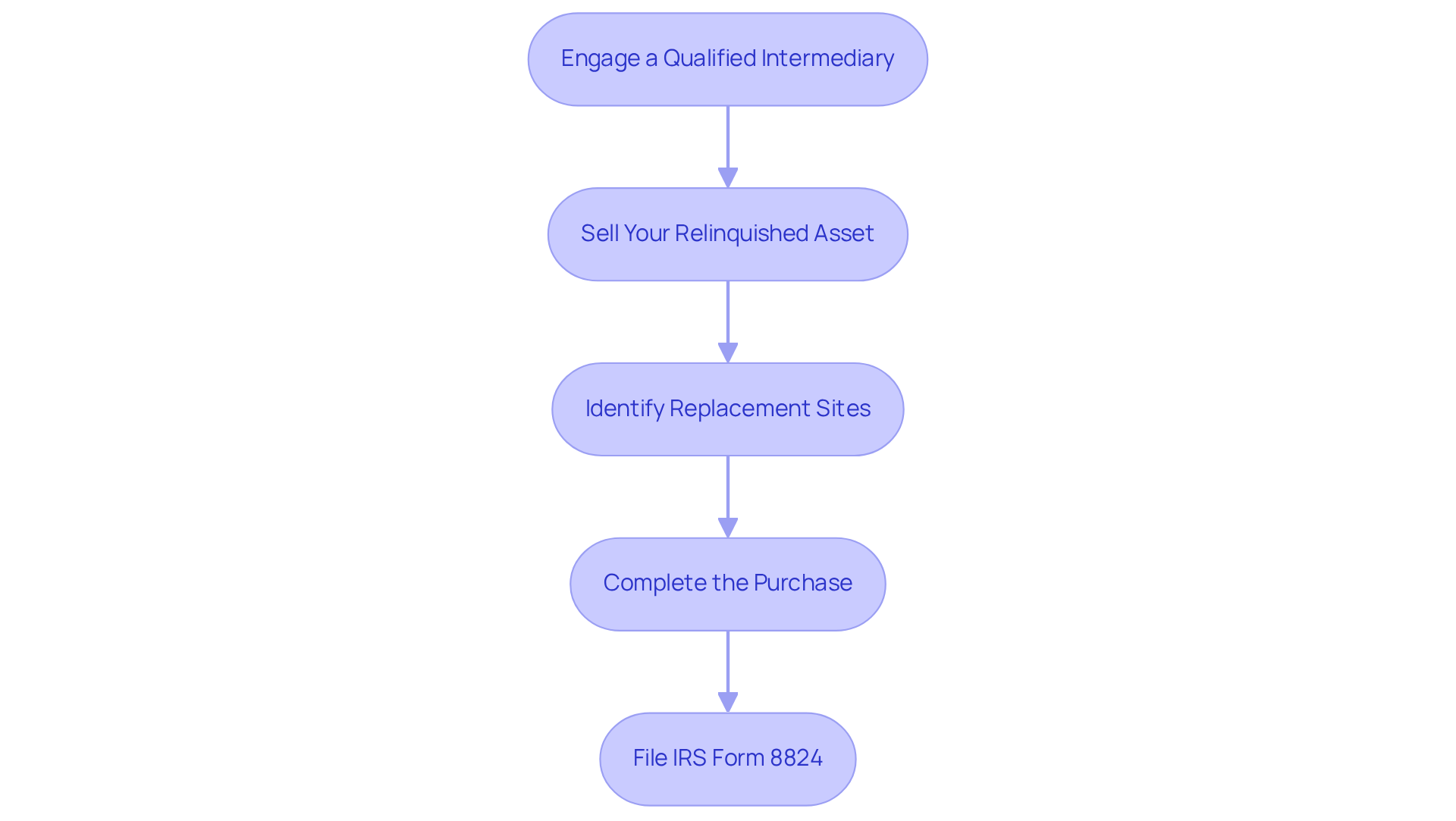

To successfully execute a 1031 exchange, it is essential to adhere to the following steps:

-

Engage a Qualified Intermediary (QI): A QI is crucial for facilitating the exchange. They will retain the proceeds from the sale of your relinquished asset and ensure compliance with IRS regulations. Approximately 90% of investors utilize qualified intermediaries for their 1031 exchanges, underscoring their importance in the process. As housing economist Edwin Deutsch notes, "The role of a qualified intermediary is vital in ensuring that investors navigate the complexities of the 1031 exchange effectively."

-

Sell Your Relinquished Asset: Once you secure a buyer, finalize the sale of your investment asset. Ensure that the sale contract explicitly states it is part of a 1031 exchange to maintain compliance.

-

Identify Replacement Sites: Within 45 days of selling your relinquished asset, you must identify potential replacement sites. You can designate up to three assets regardless of their worth or any number of assets as long as their total value does not exceed 200% of the relinquished asset's worth.

-

Complete the Purchase: You have 180 days from the sale of your relinquished asset to finalize the acquisition of your identified replacement asset. Ensure that all transactions are documented and that the QI is involved in the closing process to facilitate a smooth transition.

-

File IRS Form 8824: After completing the exchange, file Form 8824 with your tax return to report the transaction and defer the capital gains tax.

By meticulously following these steps, you can ensure a seamless transition while adhering to IRS regulations. Furthermore, examining successful funding strategies, such as the Austrian model for affordable rental housing, can offer insights into effective techniques for managing property holdings, especially regarding the transition of 1031 exchange stocks to real estate.

Evaluate Key Considerations for Transitioning to Real Estate

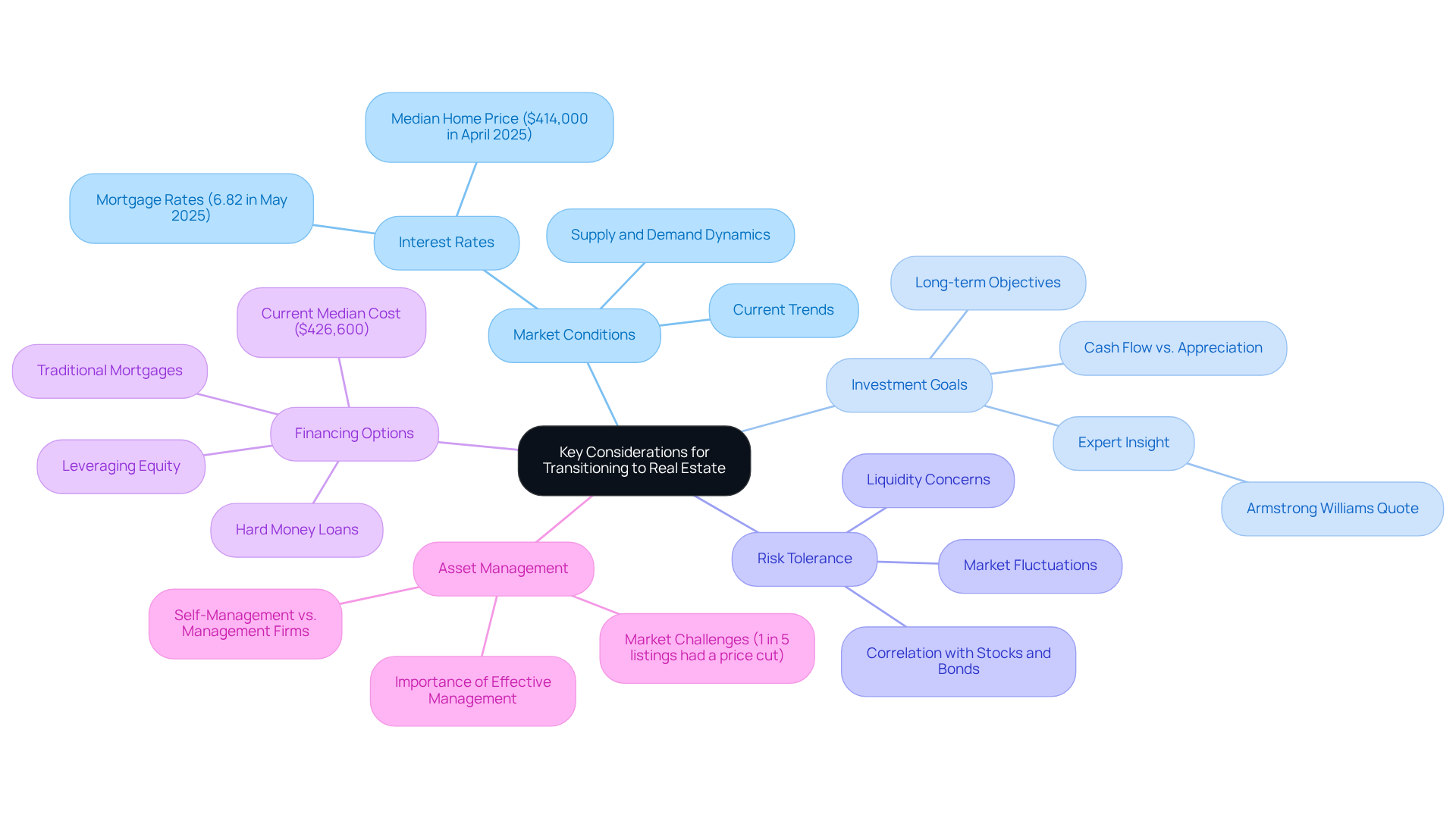

When transitioning from stocks to real estate, several key factors warrant careful consideration:

-

Market Conditions: Analyzing current real estate market trends is essential. This includes understanding supply and demand dynamics, interest rates, and economic indicators that influence property values. For instance, with mortgage rates averaging 6.82% in May 2025 and the median home price reaching a high of $414,000 in April 2025, prospective buyers face affordability challenges. It is crucial to grasp how these rates impact purchasing decisions.

-

Investment Goals: Clearly defining your investment objectives is vital. Are you seeking cash flow, appreciation, or a blend of both? As Armstrong Williams observed, "real property provides the highest returns, the greatest values, and the least risk." Understanding your objectives will guide your asset selection and help you navigate the complexities of the market.

-

Risk Tolerance: Real property investments typically exhibit lower liquidity compared to stocks, and market fluctuations can significantly affect property values. Importantly, property usually shows a low correlation with stocks and bonds, which can mitigate certain risks. Evaluate your risk tolerance to ensure you are comfortable with the potential fluctuations inherent in property.

-

Financing Options: Explore various financing avenues available for real estate acquisitions, such as traditional mortgages, hard money loans, or leveraging equity from existing assets. With the current median cost for new residences at $426,600 and 34% of units experiencing a price drop, understanding your financing options is essential for making informed choices.

-

Asset Management: Consider whether you will manage the asset yourself or engage a management firm. Effective management is crucial for maintaining property value and ensuring a steady income stream, especially in a market where 1 in 5 listings had a price cut in 2024.

By assessing these factors, you can make strategic choices that align with your financial approach and navigate the transition of 1031 exchange stocks to real estate more effectively.

Identify Profitable Real Estate Investment Opportunities

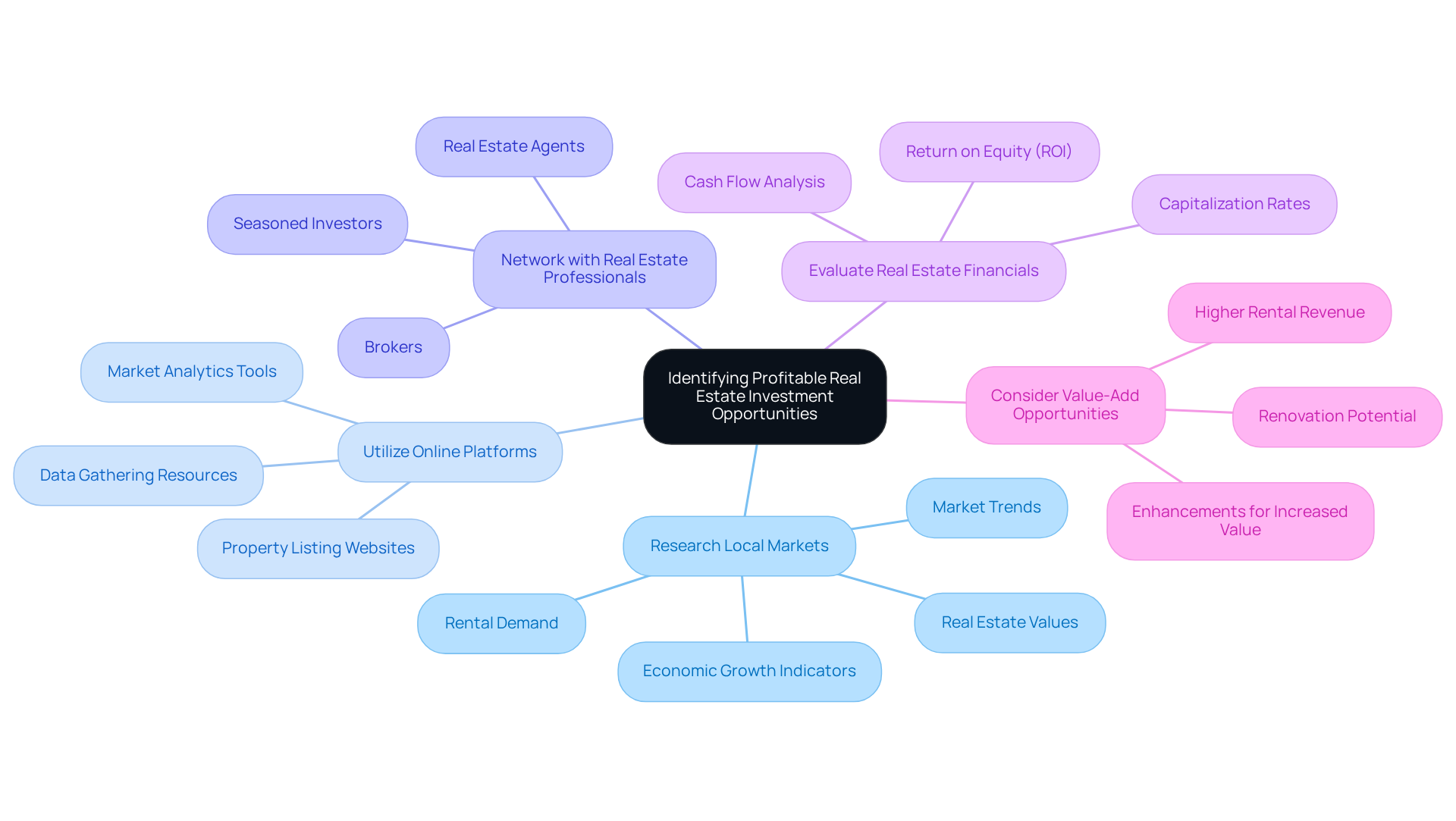

To identify profitable real estate investment opportunities, consider the following strategies:

-

Research Local Markets: Conduct thorough investigations of various neighborhoods and cities to grasp market trends, real estate values, and rental demand. Focus on areas exhibiting strong economic growth, job opportunities, and population increases, as these factors often correlate with higher investment potential. For instance, the national median home price reached $414,000 in April 2025, reflecting the competitive nature of the market where 29% of buyers paid more than the asking price.

-

Utilize Online Platforms: Take advantage of property listing websites and platforms that offer comprehensive data on sales, rental rates, and market analytics. Resources like Zillow, Realtor.com, and local MLS listings are essential tools for gathering insights into current market conditions.

-

Network with Real Estate Professionals: Build connections with real estate agents, brokers, and seasoned investors who can share insights into off-market deals and emerging opportunities. Networking can reveal valuable collaborations and funding opportunities that may not be publicly accessible. As noted by industry experts, understanding local market trends is crucial for making informed decisions.

-

Evaluate Real Estate Financials: Assess potential assets by examining their financial performance. Key metrics such as cash flow, return on equity (ROI), and capitalization rates are essential for assessing profitability and making informed financial choices.

-

Consider Value-Add Opportunities: Identify assets that require renovations or enhancements. Value-add contributions can significantly enhance property worth and rental revenue, leading to a higher return on capital. As stated by Gary W. Keller, 'The finest asset on the planet is land,' highlighting the lasting worth of property holdings.

By employing these tactics, you can efficiently identify and take advantage of profitable property investment prospects, aiding a successful 1031 exchange stocks to real estate. Additionally, Zero Flux's commitment to filtering relevant trends can help you navigate the information overload often present in the real estate market.

Conclusion

Navigating the transition from stocks to real estate through a 1031 exchange presents a strategic pathway for investors eager to defer capital gains taxes and amplify their purchasing power. This process not only facilitates a seamless transition between asset classes but also unlocks greater investment opportunities within the real estate market.

Key steps in executing a successful 1031 exchange involve:

- Engaging a qualified intermediary

- Selling the relinquished asset

- Identifying replacement properties within the specified timeline

- Completing the purchase in compliance with IRS regulations

Furthermore, grasping market conditions, defining investment goals, assessing risk tolerance, and exploring financing options are critical considerations that can significantly influence the outcome of this transition.

Ultimately, the 1031 exchange acts as a powerful tool for investors seeking to leverage their stock investments into real estate, fostering wealth accumulation and financial growth. By conducting thorough research and strategic planning, investors can pinpoint profitable opportunities that align with their financial objectives, rendering the transition not just feasible but also advantageous in the long run. Embracing this approach can lead to a more diversified and resilient investment portfolio, essential for navigating the complexities of today’s market.