Overview

The article delineates four essential steps for conducting effective commercial real estate market research:

- Defining research objectives

- Gathering and analyzing economic and demographic data

- Evaluating supply and demand

- Synthesizing findings to formulate actionable recommendations

Each step is vital, as it provides a structured approach to understanding market dynamics and identifying investment opportunities. This process is supported by rigorous data analysis and insights into current trends and competitive landscapes, ultimately empowering readers to make informed investment decisions.

Introduction

In the competitive realm of commercial real estate, grasping the market landscape is essential for making informed investment decisions. This comprehensive guide explores the critical steps of conducting effective market research, beginning with the definition of clear objectives and extending to the analysis of economic and demographic data.

By meticulously evaluating supply and demand dynamics alongside the competitive landscape, investors can uncover valuable insights that will shape their strategies. Moreover, synthesizing findings and formulating actionable recommendations empowers stakeholders to navigate the complexities of the market, ensuring they remain ahead in an ever-evolving industry.

With the right approach, the potential for success in commercial real estate investments transcends mere possibility—it becomes a strategic imperative.

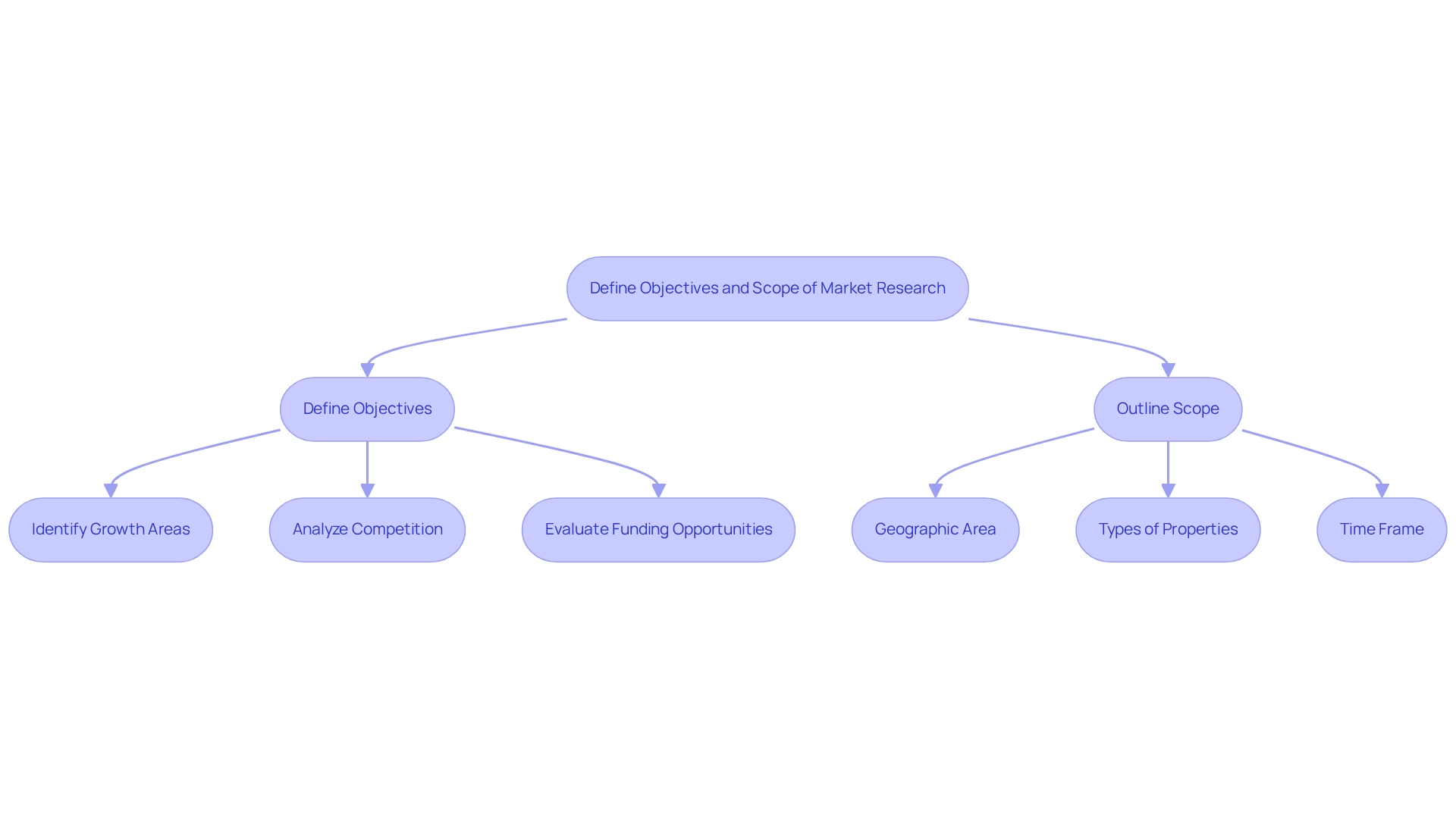

Define Objectives and Scope of Market Research

To commence your commercial real estate research, it is essential to clearly define your objectives. Consider the specific questions you aim to answer. For instance, are you looking to:

- Identify growth areas

- Analyze competition

- Evaluate potential funding opportunities

Once your questions are established, outline the scope of your research. This step involves determining:

- The geographic area of focus

- The types of properties of interest

- The time frame for your analysis

A well-defined scope will effectively guide your data collection and analysis efforts, ensuring a thorough and insightful research process.

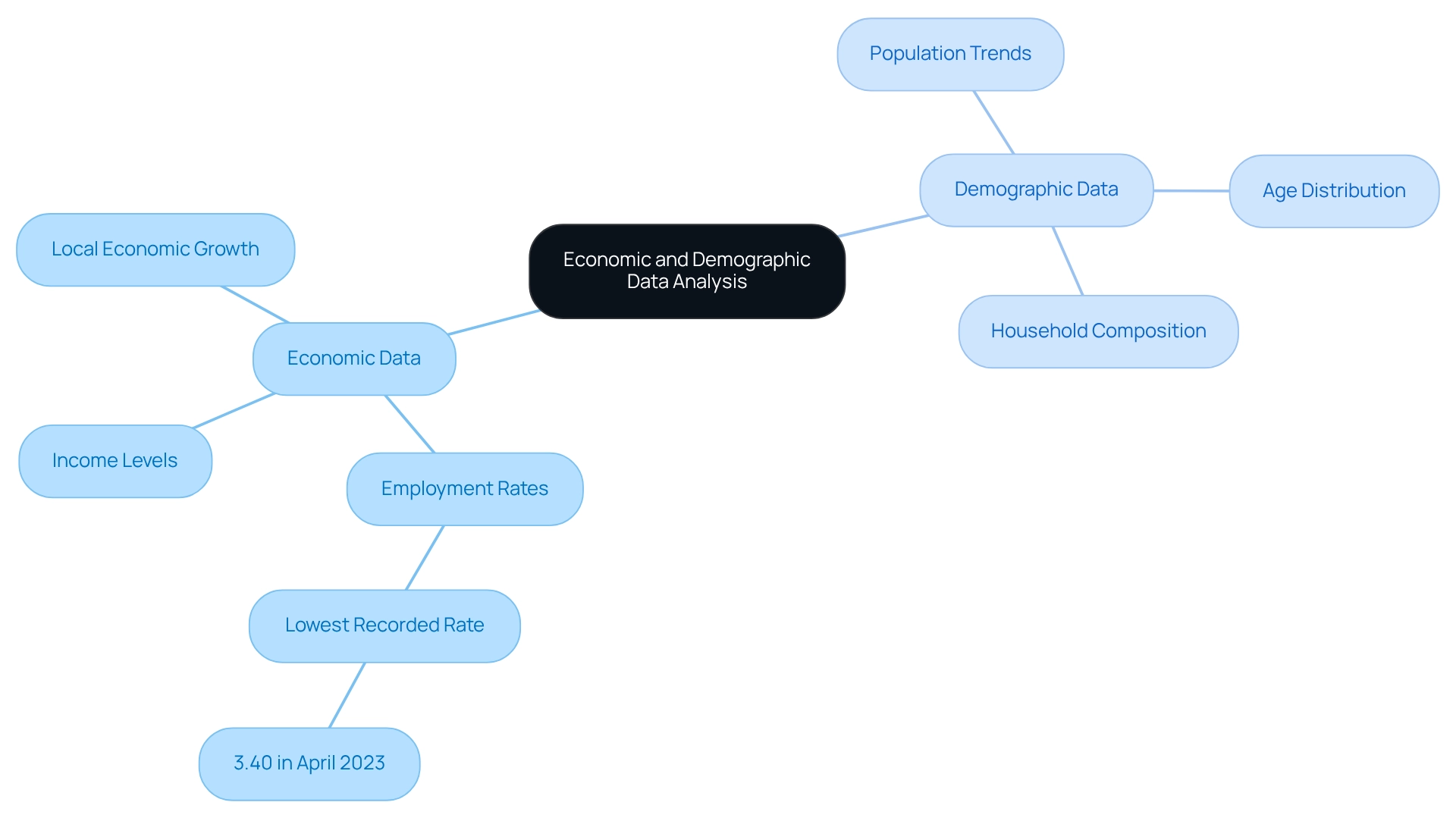

Gather and Analyze Economic and Demographic Data

Begin by gathering economic data pertinent to your target audience. This includes metrics such as employment rates, income levels, and local economic growth indicators. For instance, the lowest documented unemployment rate recently was 3.40% in April 2023, emphasizing a positive economic climate for funding. Utilize resources such as government databases, economic reports, and thorough property studies to gather this information. As Sarah Lee noted, "By embracing a multifaceted approach—one that integrates data, historical perspective, and policy innovation—we can ensure that the ever-changing landscape of employment is met with informed and adaptive strategies."

Next, focus on gathering demographic data, emphasizing population trends, age distribution, and household composition. Tools like census data and local demographic reports can provide valuable insights. It is essential to recognize the complexities involved in measuring unemployment, as discussed in the case study titled "Challenges in Measuring Unemployment." Understanding these challenges is crucial for accurately interpreting economic indicators.

Analyze this data to identify patterns and correlations that may indicate potential demand for commercial real estate market research in your area. Recognizing demographic shifts can guide financial strategies, as certain age groups may drive demand for specific types of commercial spaces. By combining economic and demographic insights through commercial real estate market research, you cultivate a strong understanding of the investment terrain, allowing for informed decision-making in your property investments.

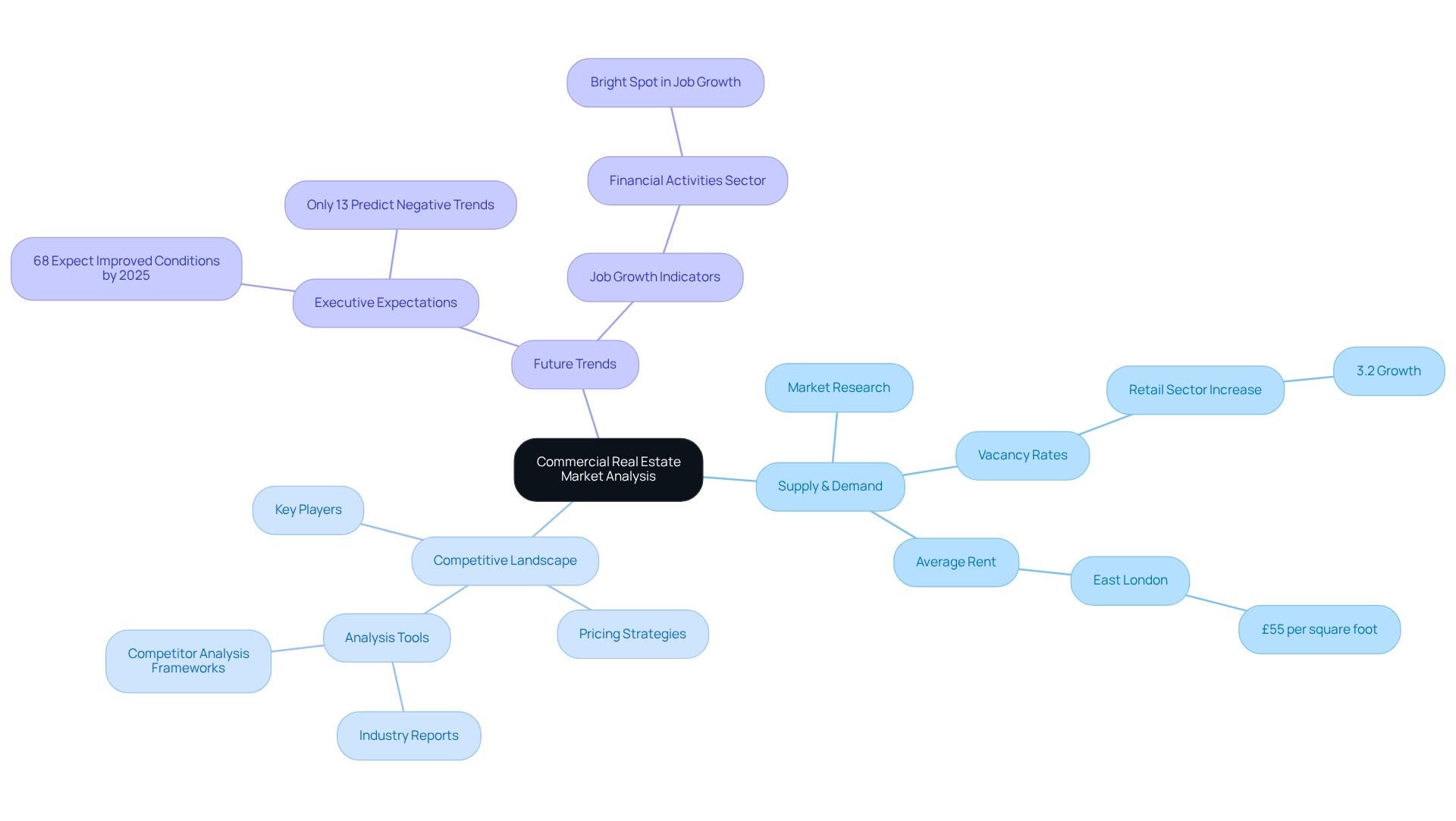

Evaluate Supply, Demand, and Competitive Landscape

To effectively assess supply and demand in your target sector, begin by conducting commercial real estate market research to evaluate the current inventory of properties available for lease or sale. Examine vacancy rates, which serve as vital indicators of economic health. For instance, the retail sector has recently experienced a 3.2% increase in vacancy rates due to strict conditions and limited supply. Understanding this context is essential for grasping demand dynamics.

Next, delve into recent sales data to further gauge demand trends. The average rent for commercial properties in East London, currently at £55 per square foot per year, exemplifies how regional variations can significantly impact demand and pricing strategies.

Following this, conduct a competitive landscape analysis by identifying key players in the industry, their property types, and pricing strategies. Instruments such as industry reports and competitor analysis frameworks can provide valuable insights into the competitive dynamics relevant to commercial real estate market research. Notably, 68% of commercial real estate executives surveyed expect enhanced conditions by 2025, with only 13% forecasting adverse trends. This statistic underscores the prevailing optimism in the industry, which can influence financial choices and strategic approaches.

Additionally, it is important to recognize that the Financial Activities sector has emerged as a bright spot in job growth among office-using sectors, further indicating positive demand trends. Understanding these supply and demand dynamics will enable you to identify gaps in the market, revealing potential opportunities for financial growth. By leveraging expert analysis and case studies on successful competitive landscape assessments, you can refine your strategic approach to commercial real estate market research for property ventures. Remember, as noted, 90% of millionaires attribute their wealth to real estate assets, emphasizing the significance of this sector.

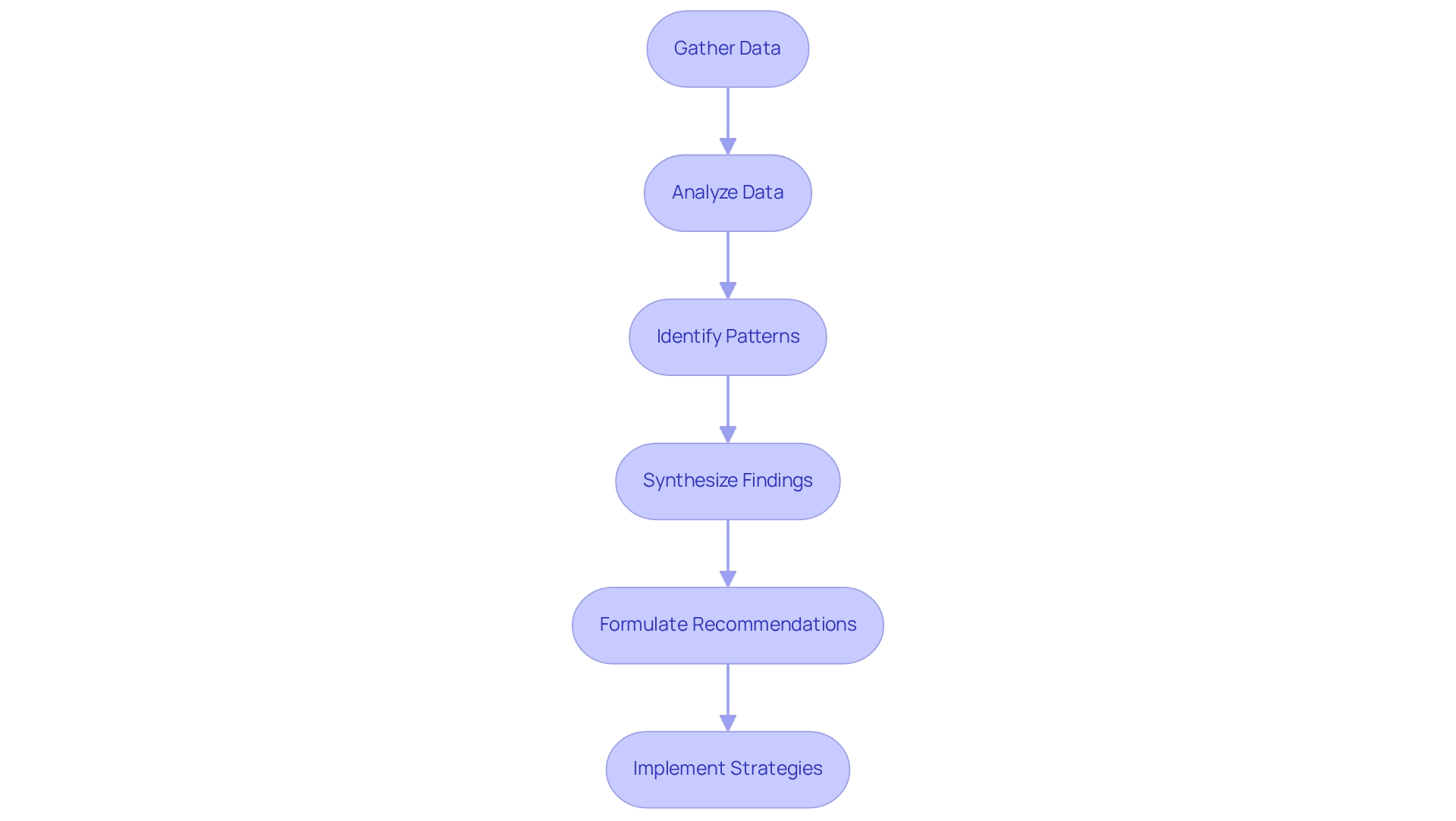

Synthesize Findings and Formulate Recommendations

Once you have gathered and analyzed your data, the next crucial step is to synthesize your findings. Identify patterns and insights that emerge from your commercial real estate market research, focusing on key trends, potential risks, and opportunities. For instance, with retail foot traffic declining by 12% year-over-year yet the sector achieving a 3.2% growth, it’s essential to highlight these contrasting dynamics in your summary report. This will enable you to identify areas of potential funding by conducting commercial real estate market research, such as emerging demand for retail space in specific locales.

As the quote states, "This makes it the ideal time to craft strategic plans and stay ahead of opportunities by conducting precise deal and market analyses." Formulating actionable recommendations based on these insights is vital. Ensure that your suggestions are clear, concise, and firmly grounded in the data collected. If your analysis shows a growing interest in life sciences properties, suggest focusing on opportunities in that sector, where average asking rents have experienced substantial growth. Furthermore, consider that average daily rates and revenue per available room have exceeded pre-pandemic standards, signifying a wider recovery in the commercial property sector.

In 2025, commercial real estate market research indicates that key trends in funding include a focus on technology and sustainability, which are driving the industry's evolution. As proptech investment reached $13.5 billion, it underscores the necessity of integrating technological advancements into your investment strategies. By synthesizing findings effectively and crafting strategic recommendations, you position yourself to navigate the complexities of the market and capitalize on emerging opportunities.

Conclusion

Conducting thorough market research in commercial real estate is paramount for making informed investment decisions. By defining clear objectives and focusing on specific questions, investors can tailor their research to uncover critical insights. Gathering and analyzing economic and demographic data provides a solid foundation for understanding market dynamics, allowing investors to identify growth areas and assess potential risks.

Evaluating supply and demand, as well as the competitive landscape, further enhances this understanding. Recognizing trends such as vacancy rates and rental prices enables a nuanced approach to investment strategies. Moreover, awareness of industry sentiment can guide decision-making effectively. Synthesizing these findings into actionable recommendations ensures that investors are equipped to navigate the complexities of the market with confidence.

Ultimately, the strategic imperative in commercial real estate investment lies in leveraging comprehensive research to stay ahead in a rapidly evolving industry. By embracing a data-driven approach, investors can capitalize on emerging opportunities, ensuring long-term success in their endeavors. In this competitive landscape, informed decisions not only enhance individual portfolios but also contribute significantly to the broader growth of the real estate sector.