Overview

The article delineates a four-step process for effectively selling real estate notes:

- Understanding the notes

- Evaluating them

- Selling them

- Navigating potential challenges

This structured approach is bolstered by comprehensive guidance on:

- Assessing the value of mortgage agreements

- Preparing detailed sale packages

- Addressing common obstacles such as low bids and legal complexities

Such insights equip sellers with the essential tools for achieving success in the market.

Introduction

Navigating the world of real estate notes is both rewarding and complex, as these financial instruments play a crucial role in property transactions. Investors can gain significant insights by understanding the nuances between performing and non-performing notes, particularly as the market shifts toward a higher percentage of stable agreements.

However, with opportunities come challenges. How can one effectively sell these notes while overcoming obstacles such as low bids and legal intricacies?

This guide unveils four essential steps to streamline the selling process and maximize returns in an evolving real estate landscape.

Understand Real Estate Notes

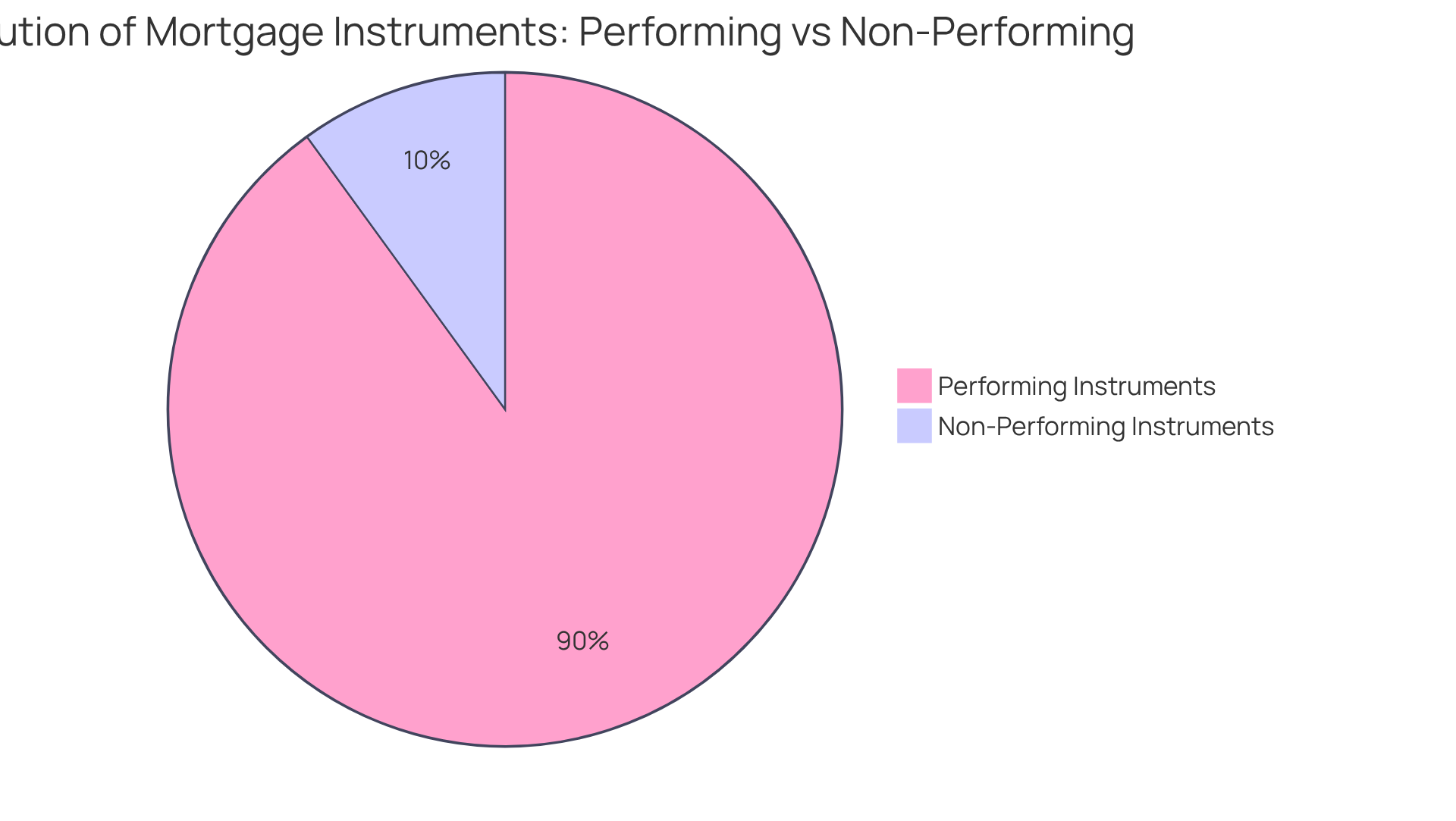

Real estate documents, commonly referred to as mortgage agreements, serve as legal instruments that delineate the terms of a loan secured by real property. They encapsulate a borrower's commitment to repay a specified amount over a defined period, typically inclusive of interest. Understanding the distinction between performing and non-performing instruments is crucial for investors.

- Performing instruments are characterized by consistent payments made by the borrower, indicating a stable investment.

- Conversely, non-performing assets are those in default, posing a higher risk but potentially offering greater rewards if managed effectively.

Recent trends indicate that by 2025, the landscape for mortgage agreements is evolving, with approximately 90% of documents expected to be performing. This statistic reflects a robust lending environment. Familiarizing yourself with these concepts not only aids in evaluating the worth and marketability of your materials but also equips you to make informed investment decisions in a dynamic real estate market. Are you prepared to leverage these insights for your investment strategies?

Evaluate Your Mortgage Note

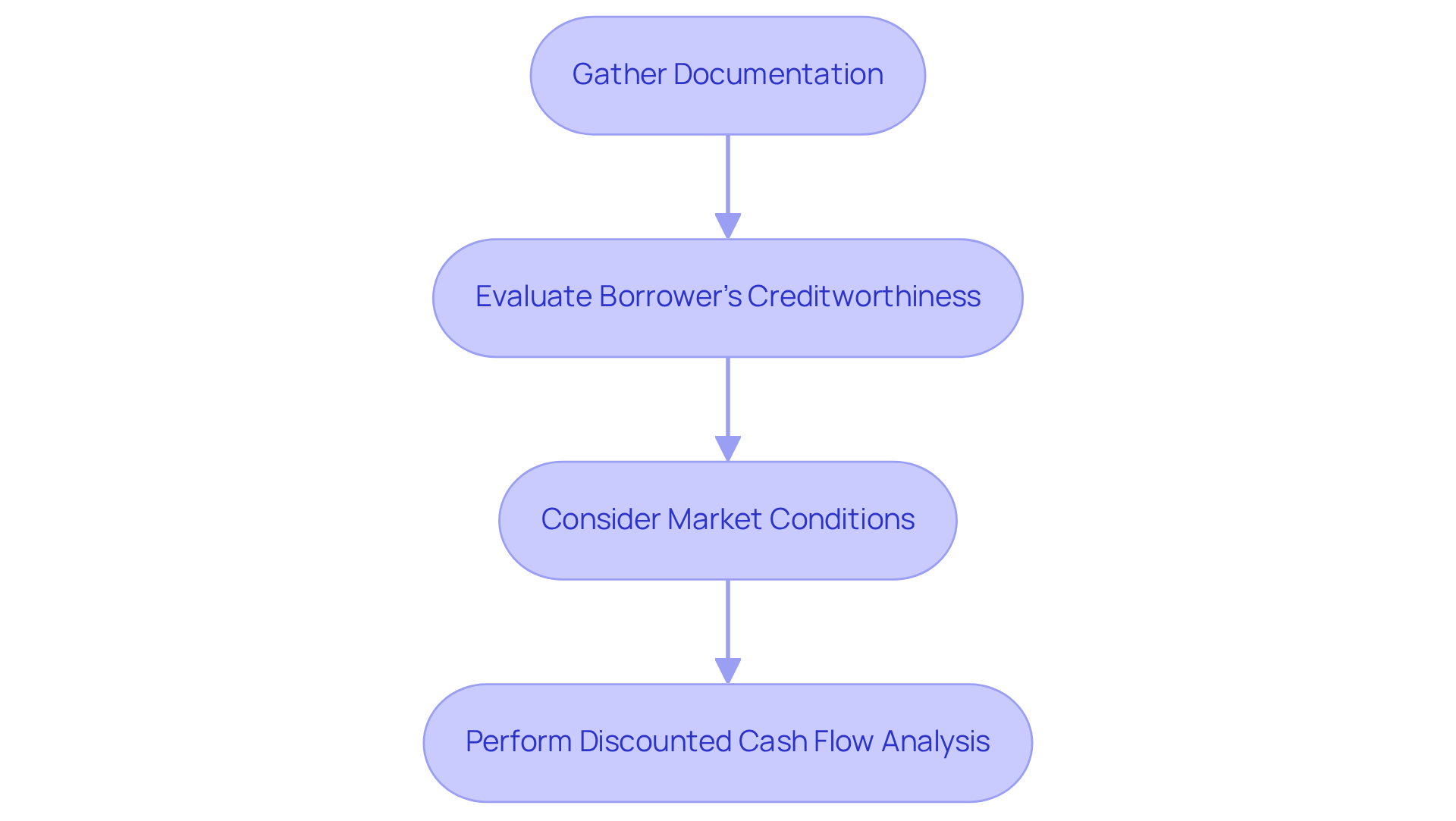

To effectively assess your mortgage agreement, start by gathering all essential documentation, including the original agreement, payment history, and any modifications made to the loan terms. Next, evaluate the borrower's creditworthiness by analyzing their payment history and credit score. Additionally, consider the current market conditions and interest rates, as these factors significantly impact the instrument's value. A common method for valuation is the discounted cash flow analysis, which estimates the present value of future cash flows from the instrument. This comprehensive evaluation will provide a clearer understanding of your document's value.

Sell Your Real Estate Note

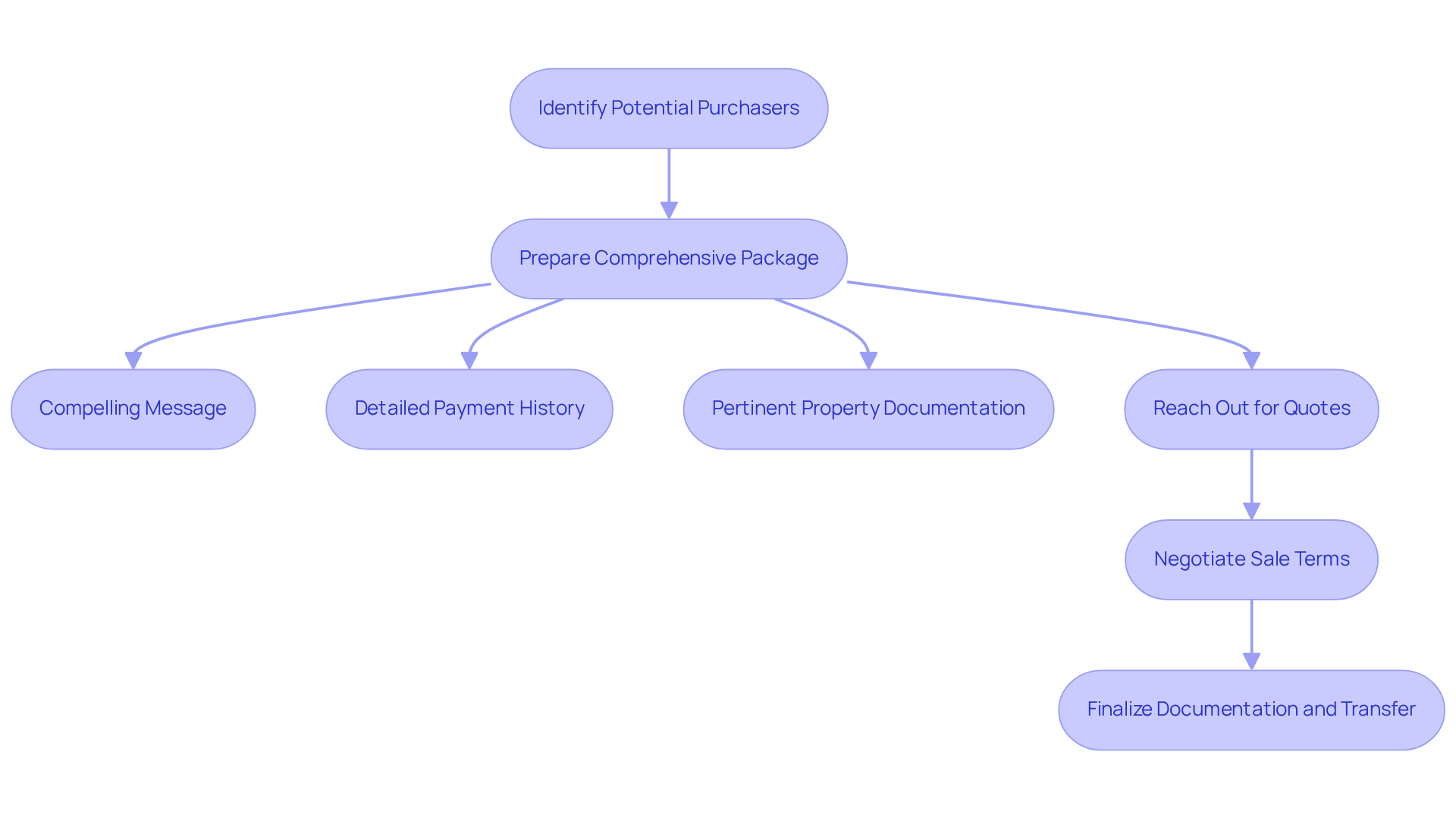

To successfully engage in selling real estate notes, start by identifying potential purchasers, which may include specialized purchasing firms or private investors. Prepare a comprehensive package that includes:

- A compelling message

- A detailed payment history

- Any pertinent property documentation

Involving multiple purchasers is crucial; reach out to obtain quotes and compare proposals to ensure you secure the best agreement. As highlighted in various case studies, including 'The Role of Confidence in Selling,' presenting your message with enthusiasm can foster trust and generate client interest.

Once you receive an acceptable offer, negotiate the sale terms, ensuring that all parties clearly understand the conditions involved. Finalizing the necessary documentation, including a purchase agreement, is the last step, followed by facilitating the transfer of the document to the purchaser.

This entire process typically lasts 15 to 30 days, influenced by factors such as customer responsiveness and documentation completeness. Remember, as Suze Orman emphasizes, owning a home is a cornerstone of wealth, making your property document a valuable asset. By following these steps and considering insights from successful investors, you can effectively navigate the process of selling real estate notes and maximize your returns.

Navigate Challenges in Selling

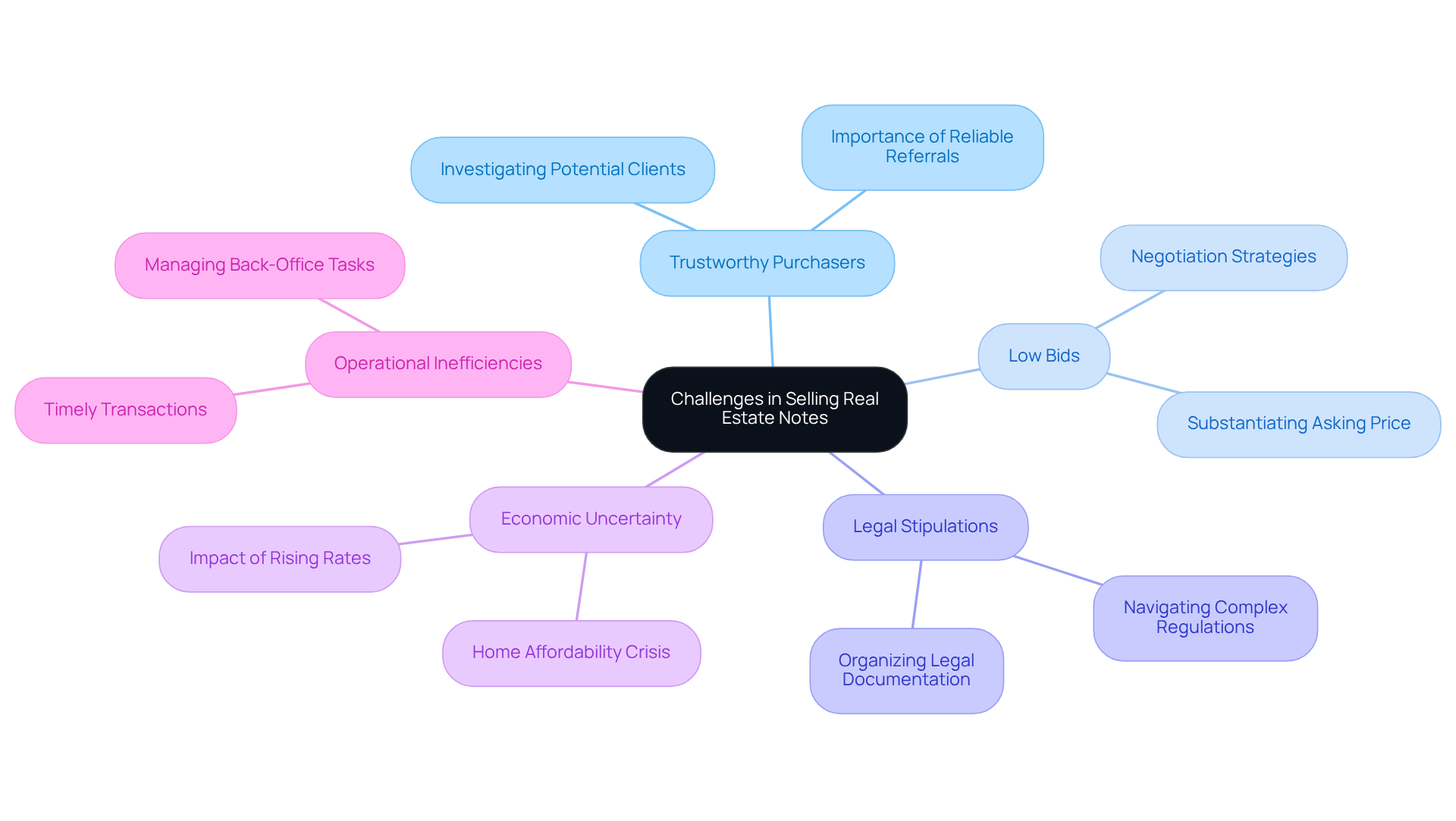

Selling real estate notes can present several challenges, such as the search for trustworthy purchasers, dealing with low bids, and navigating complex legal stipulations. Thoroughly investigating potential clients is crucial; approximately 74% of customers prefer lenders recommended by real estate agents, highlighting the importance of reliable referrals. In the current market, 54% of agents foresee a worsening home affordability crisis in 2025, which could lead to buyer hesitation.

When confronted with low offers, be ready to negotiate effectively by substantiating your asking price with a detailed assessment of the note's value. Furthermore, economic uncertainty may dampen buyer demand due to rising rates and home prices, making it essential to ensure that all legal documentation is meticulously organized to avoid delays during the closing process.

Operational inefficiencies can impede timely transactions, and with 51% of real estate agents believing that low housing inventory will challenge the market in 2025, being proactive is imperative. By anticipating these challenges and preparing strategically, you can significantly enhance your chances of success when selling real estate notes.

As industry experts note, "Understanding the market dynamics and being prepared to adapt your strategy is key to navigating these complexities.

Conclusion

Effectively selling real estate notes requires a strategic approach that can significantly enhance investment returns. By understanding the intricacies of mortgage agreements, evaluating the value of these notes, and navigating the selling process, investors can position themselves for success in a competitive market.

Key insights from this guide underscore the importance of:

- Distinguishing between performing and non-performing instruments

- Thoroughly assessing mortgage notes

- Preparing a compelling sales package

Additionally, awareness of potential challenges—such as:

- Identifying trustworthy buyers

- Managing legal complexities

is crucial for facilitating a smooth transaction.

Ultimately, the ability to adapt to market dynamics and proactively address challenges empowers investors to maximize their returns when selling real estate notes. Embracing these steps fosters informed decision-making and enhances confidence in navigating the complexities of real estate investments. By applying these strategies, investors can leverage their real estate notes as valuable assets, thereby contributing to long-term financial success.