Overview

The article outlines four essential steps to uncover lucrative real estate deals:

- Understanding the market and defining investment criteria

- Leveraging networking and technology

- Evaluating properties and analyzing financials

- Negotiating offers while securing financing

Each step is bolstered by specific strategies and data, including the analysis of local economic indicators and the utilization of online platforms. Collectively, these elements enhance an investor's ability to identify and capitalize on promising real estate opportunities.

Introduction

Navigating the real estate market can often resemble searching for a needle in a haystack, particularly when it comes to uncovering lucrative investment opportunities. Given the fluctuating economic indicators and an ever-evolving landscape, understanding how to identify promising real estate deals is essential for investors aiming to maximize their returns.

What strategies can one employ to not only pinpoint these hidden gems but also secure them in a competitive environment? This guide outlines four crucial steps designed to empower investors to effectively locate and capitalize on promising real estate deals.

- Research Market Trends

- Build a Network of Contacts

- Analyze Property Values

- Be Prepared to Act Quickly

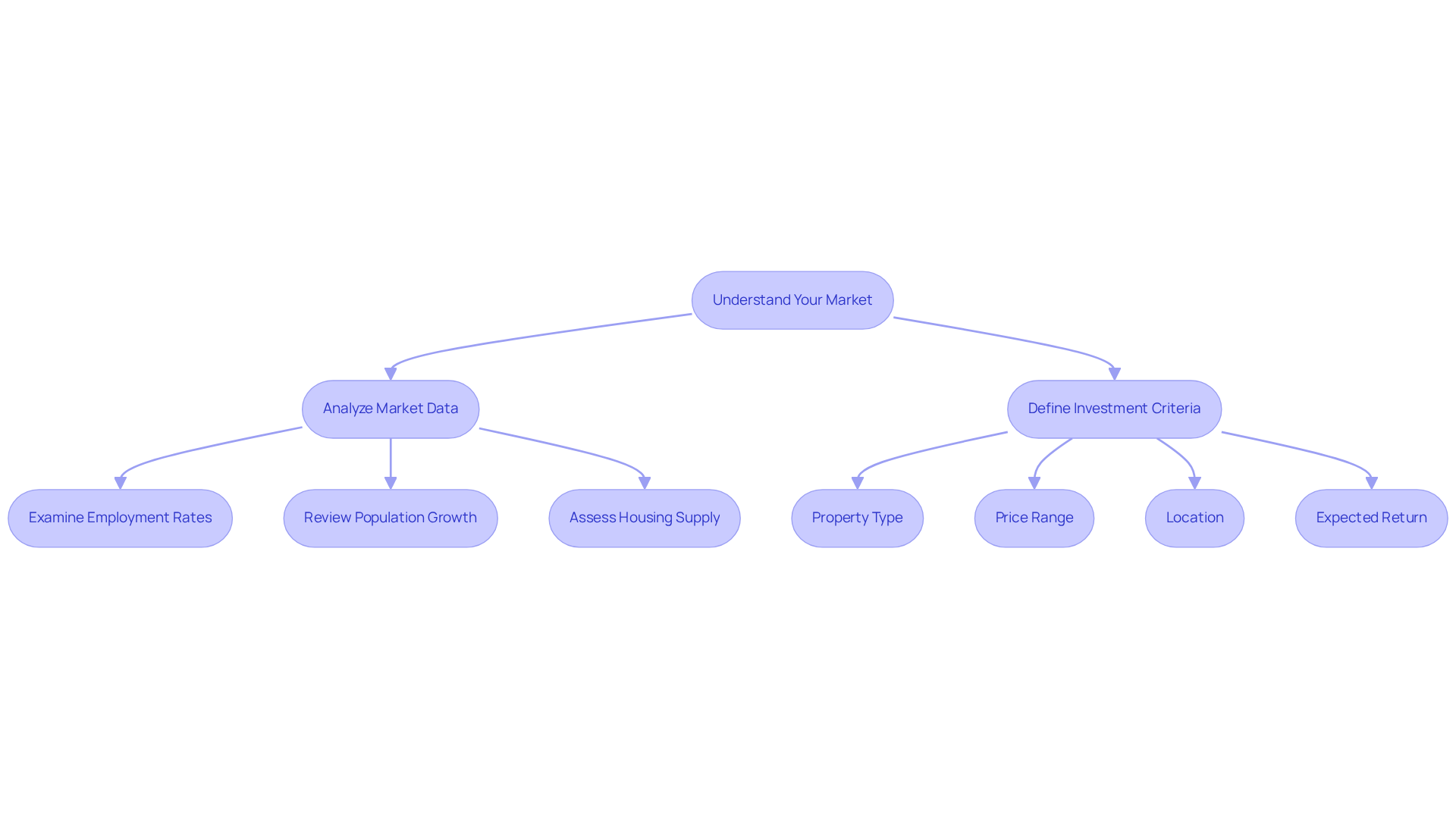

Understand Your Market and Define Your Criteria

To effectively recognize profitable property opportunities, begin with a thorough examination of your target audience. This involves analyzing local economic indicators, such as employment rates, which have demonstrated a year-over-year job increase of 1.3% in Texas. Furthermore, consider population growth statistics; for instance, Austin's population surged by 2.4% in 2024, a rate three times faster than the national average. Understanding these dynamics is crucial, as they directly influence housing supply and demand trends. Notably, the Southwest region currently boasts 23% more homes than in 2019, contributing to a more favorable buying environment. Significantly, Austin has 91% more homes available than in 2019, further enhancing buyer choices within the industry.

Utilize a variety of resources, including local government reports, real estate websites, and analytical tools, to gather pertinent data. Once you have a comprehensive grasp of the market conditions, it is essential to define your criteria for investing. This should encompass elements such as:

- Property type—whether residential or commercial

- Price range

- Location

- Your expected return on capital

Documenting these criteria will aid in maintaining focus during your search and ensure alignment with your investment goals. By following these steps, you can learn how to find good real estate deals and navigate the intricacies of the real estate market more effectively.

Leverage Networking and Technology to Source Deals

Networking is a crucial strategy for understanding how to find good real estate deals. Engaging in local real estate events, participating in online discussions, and cultivating relationships with agents, brokers, and fellow investors can provide insights on how to find good real estate deals and unlock exclusive opportunities. Loren Howard, founder of Prime Plus Mortgages, emphasizes this by stating, "Networking not only allows you to connect with potential clients but also establishes a foundation of trust."

In 2025, harnessing technology is equally vital; using platforms such as Zillow, Realtor.com, and specialized investment sites can teach you how to find good real estate deals and streamline the identification of potential opportunities. These platforms aggregate listings and data, helping investors learn how to find good real estate deals by setting alerts for properties that align with their criteria, ensuring they remain informed about new opportunities as they arise.

As noted by Sharad Mehta, Editor, "96% of buyers start their home search online," underscoring the importance of a robust digital presence. The integration of technology in real estate deal sourcing demonstrates how to find good real estate deals by boosting efficiency and enhancing the chances of securing advantageous deals in a competitive market.

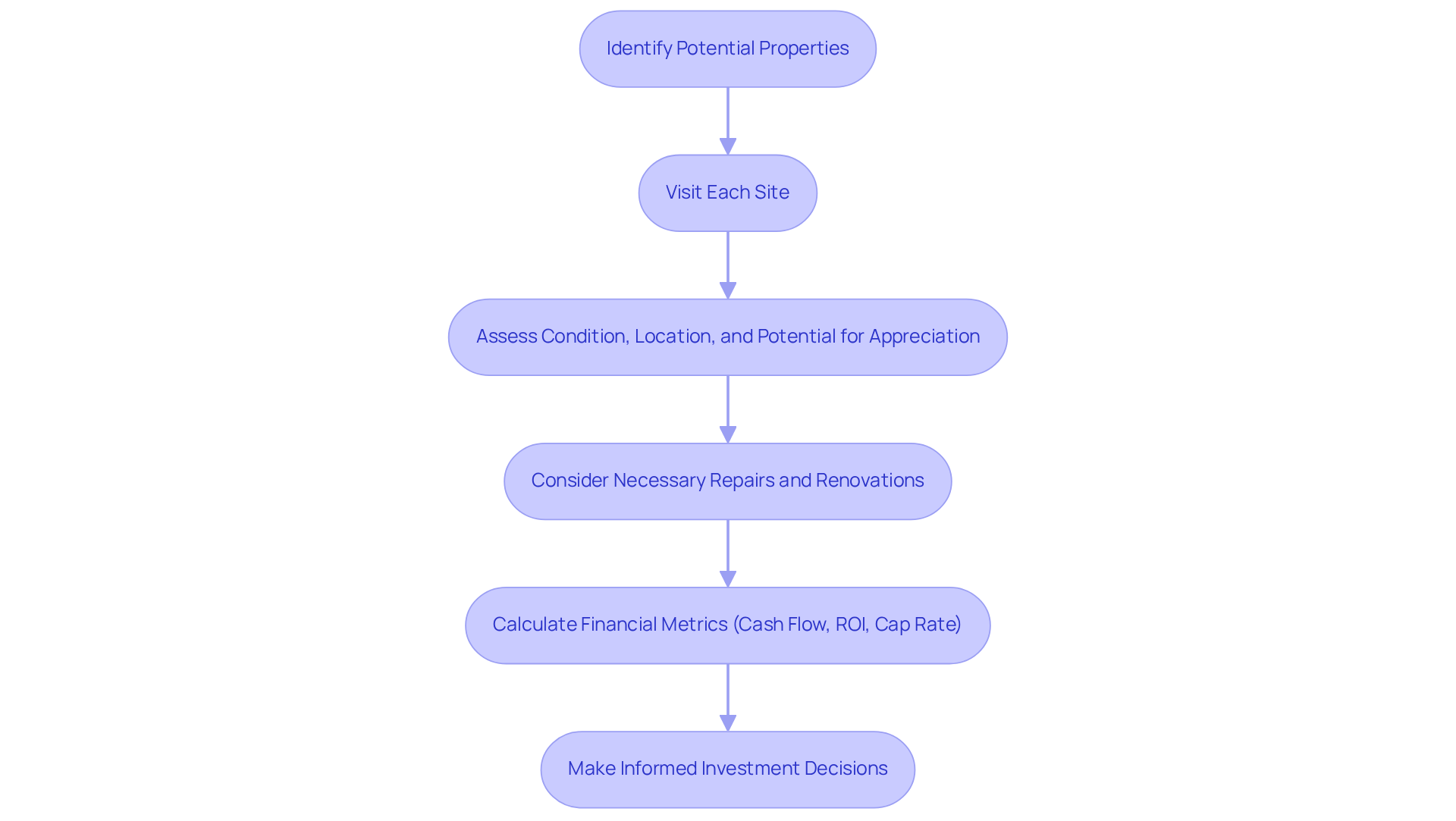

Evaluate Properties and Analyze Financials

After identifying potential properties, it is essential to conduct a comprehensive evaluation. Begin by visiting each site to assess its condition, location, and potential for appreciation. Consider the necessary repairs or renovations closely, as these factors can significantly influence your property's profitability. In July 2025, average repair expenses for rental properties are noted to vary significantly based on location and property type, making it crucial to factor these costs into your financial evaluations.

Next, delve into the financials by calculating essential metrics such as cash flow, return on investment (ROI), and capitalization rate (cap rate). Utilizing spreadsheets or financial analysis software can streamline this process, allowing for effective organization and comparison of various properties. Successful case studies reveal that investors who rigorously apply these financial analysis metrics often achieve superior returns. This reinforces the value of a disciplined approach to evaluating real estate opportunities.

This thorough examination will enable you to understand how to find good real estate deals that align with your investment standards and financial goals, ultimately guiding you toward successful investment choices.

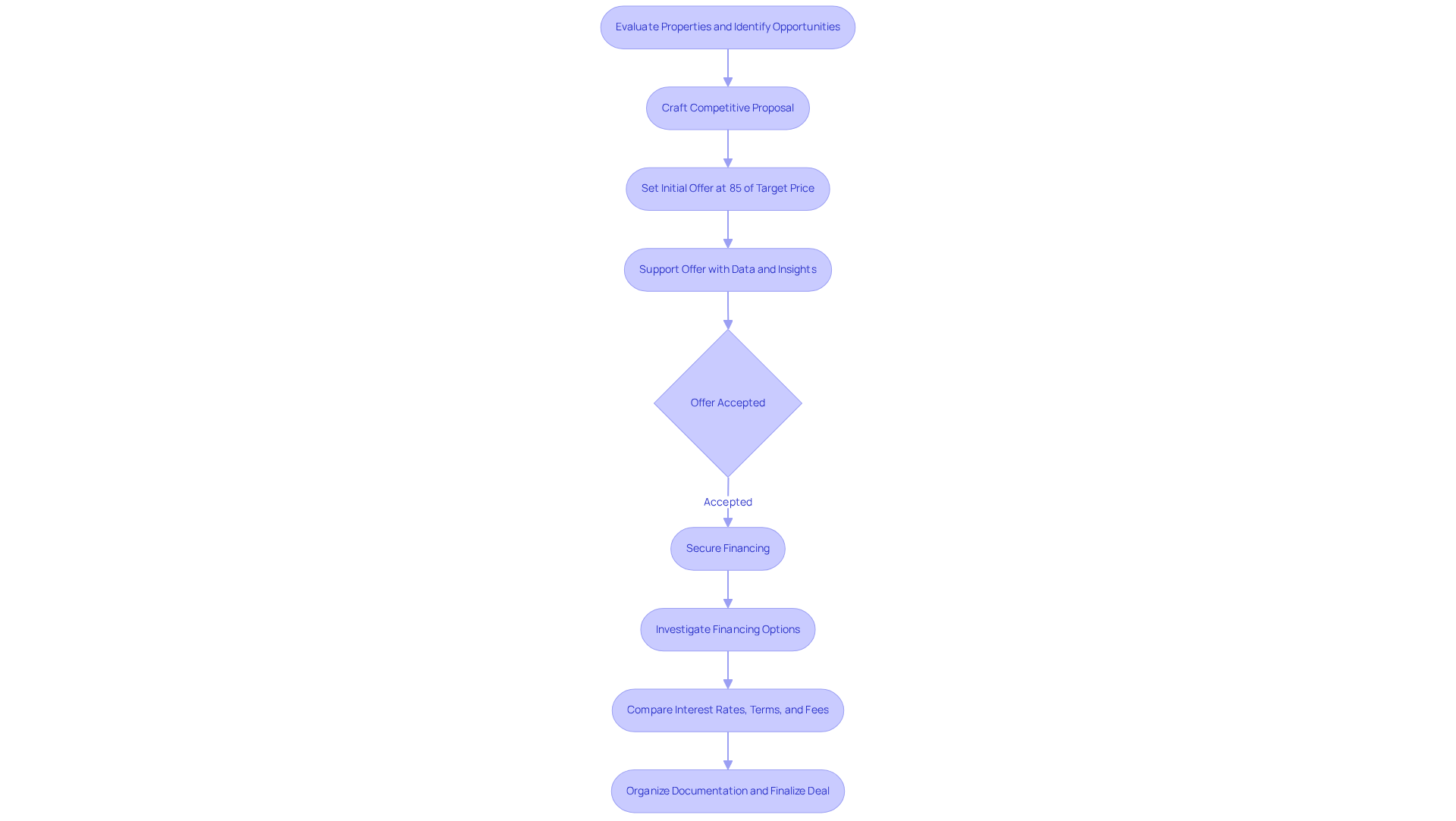

Negotiate Offers and Secure Financing

After evaluating properties and identifying promising opportunities, the next crucial step involves negotiating offers. Begin by crafting a competitive proposal that reflects your assessment and aligns with current economic conditions. Setting your initial offer at 85% of your target price is a strategic move that can help you secure a favorable deal. Support your offer with data and insights obtained during your research; this not only demonstrates due diligence but also strengthens your negotiating position. In 2025, average offer prices are typically around 92% of the market value, making this a relevant benchmark for your proposal.

Once your offer is accepted, securing financing becomes essential. Investigate various options, including traditional mortgages, private lenders, and real estate funding groups. Each financing avenue presents its own interest rates, terms, and fees, making it vital to compare these elements to find the most advantageous solution for your investment. For example, earnest money deposits generally range from 1-3% of the home's price, which can significantly influence your financing strategy.

It is imperative to ensure that all documentation is meticulously organized and that you fully comprehend the terms before finalizing the deal. This thorough preparation not only facilitates a smoother transaction but also positions you favorably within the competitive real estate landscape. As Andrew Finney aptly states, "Knowing if you're in a seller's market, a buyer's market, or somewhere in between is like having the playbook to the game.

Conclusion

Understanding how to find good real estate deals hinges on a strategic approach that encompasses market analysis, networking, property evaluation, and effective negotiation. By immersing in local market dynamics and defining clear investment criteria, investors can pinpoint opportunities that align with their financial goals. This foundational knowledge sets the stage for successful real estate ventures.

Key strategies include:

- Leveraging technology and networking to uncover exclusive deals

- Conducting thorough evaluations of potential properties

- Analyzing financial metrics

- Employing disciplined negotiation tactics

By following these strategies, investors can enhance their chances of securing advantageous terms. The importance of these steps cannot be overstated; they serve as a roadmap to navigate the complexities of the real estate market effectively.

In conclusion, the journey to finding profitable real estate investments requires a proactive mindset and a commitment to continuous learning. By applying the outlined strategies, investors can position themselves to capitalize on emerging opportunities and thrive in a competitive landscape. Embrace these steps, and take action to transform insights into successful real estate endeavors.