Overview

The article delineates a four-step process for utilizing debt to build wealth in real estate, highlighting the critical role of leveraging borrowed funds to acquire properties and amplify investment returns. It articulates this by outlining strategies such as:

- Evaluating financial readiness

- Examining diverse debt options

- Formulating a strategic plan that aligns with investment objectives while taking into account market conditions and the risks associated with high leverage

By adopting these strategies, investors can effectively navigate the complexities of real estate investment and optimize their financial growth.

Introduction

Understanding the intricate relationship between debt and wealth creation in real estate can be a game-changer for investors. By leveraging borrowed funds, individuals can acquire more substantial assets than their initial capital would allow, opening doors to significant financial growth. However, this strategy is not without its risks.

How can investors effectively navigate the fine line between opportunity and potential pitfalls? Exploring the various types of debt available and assessing financial readiness are crucial steps in developing a successful approach to using debt as a tool for building wealth in real estate.

Understand the Role of Debt in Real Estate Wealth Building

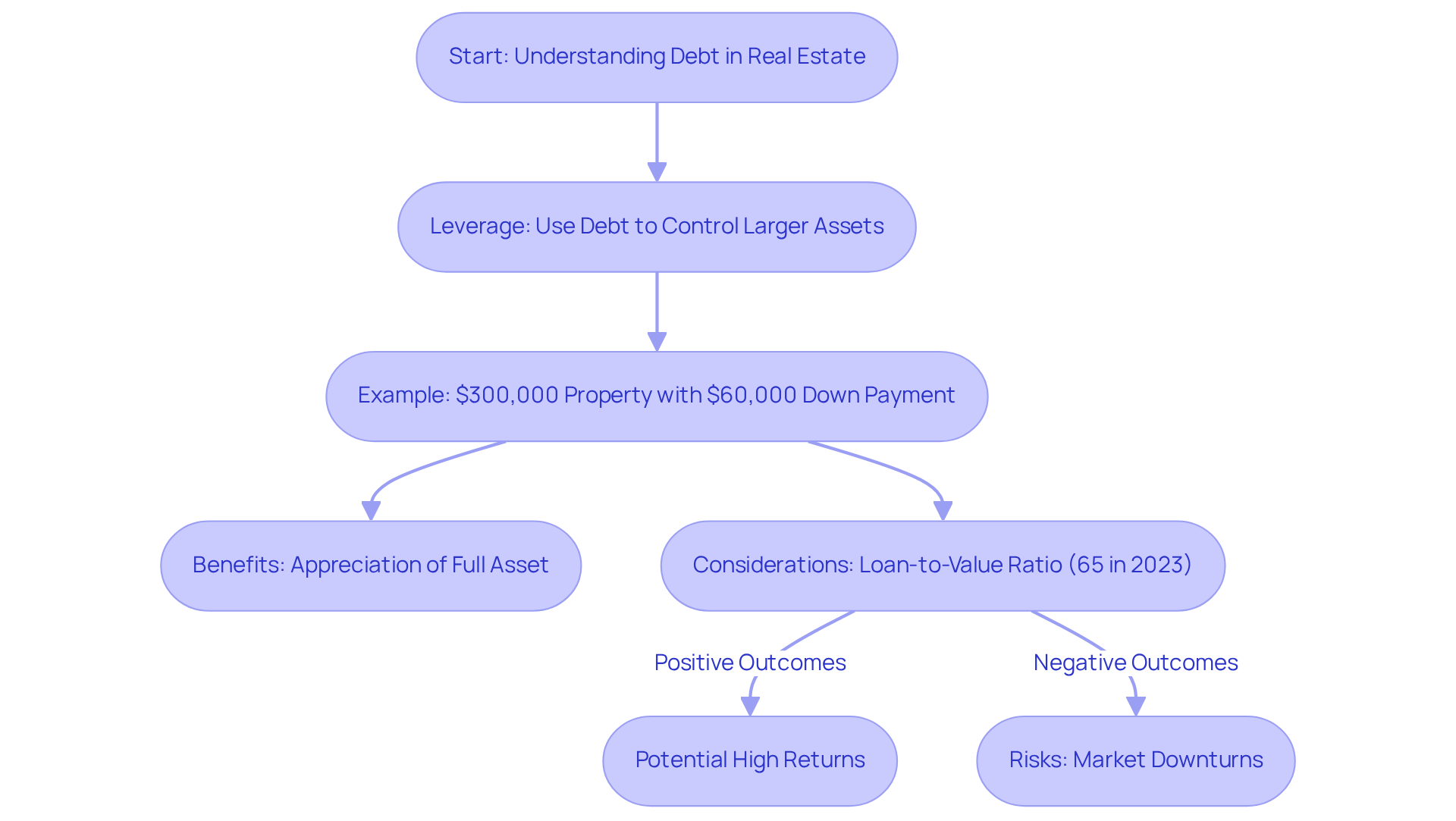

Understanding how to use debt to build wealth in real estate is crucial, as it plays a pivotal role in wealth creation within property investment, enabling investors to acquire assets without making a full initial payment. This strategy, known as leverage, demonstrates how to use debt to build wealth in real estate by allowing you to control a more substantial asset with a smaller capital outlay. For instance, consider purchasing a property valued at $300,000 with a $60,000 down payment and financing the remaining $240,000. This arrangement allows you to benefit from the appreciation of the entire property while only having invested a fraction of that amount. Such an approach can significantly amplify returns, especially in a rising market.

In 2023, the typical loan-to-value ratio for property ventures hovered around 65%, indicating that many investors are effectively leveraging their buying capacity. However, it is crucial to recognize that understanding how to use debt to build wealth in real estate can enhance returns, but it also introduces risks, particularly in scenarios where property values decline or cash flow from the asset fails to meet financial obligations. As Marc Turner underscores, high leverage can result in substantial losses during a market downturn. Therefore, understanding how to use debt to build wealth in real estate, along with conducting thorough due diligence, is essential for successfully navigating the complexities of the market.

Explore Different Types of Debt for Real Estate Investments

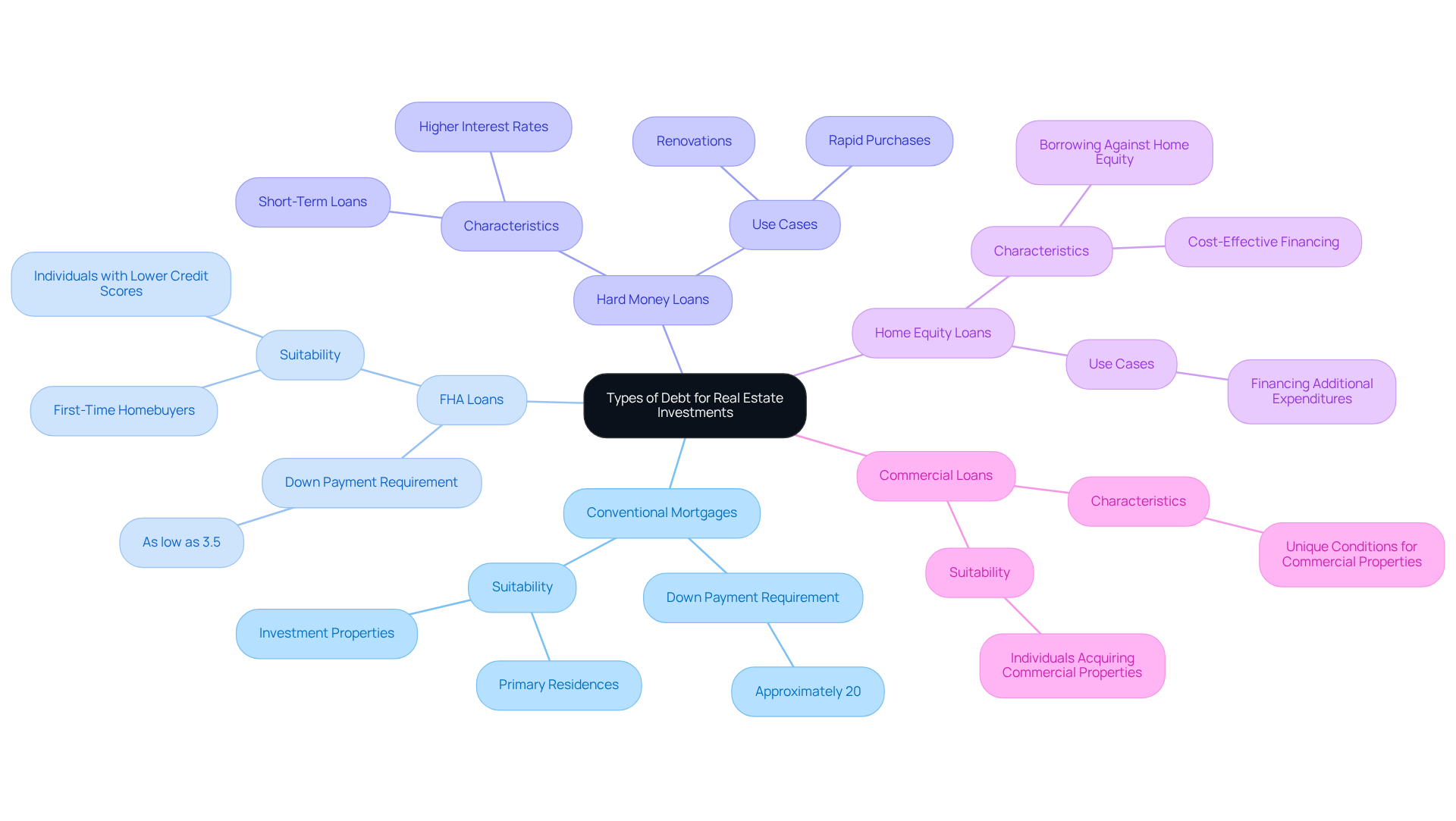

When exploring how to use debt to build wealth in real estate, it is essential to understand the various types of debt options available, each tailored to meet distinct needs and funding strategies. The most common types include:

-

Conventional Mortgages: These traditional loans, typically offered by banks and credit unions, necessitate a down payment of approximately 20%. They are suitable for both primary residences and investment properties, making them a favored choice among seasoned investors.

-

FHA Loans: Backed by the Federal Housing Administration, FHA loans permit lower down payments, sometimes as low as 3.5%. This feature renders them particularly appealing for first-time homebuyers or individuals with lower credit scores, providing a reachable entry point into property investing.

-

Hard Money Loans: These short-term loans are secured by real estate and are frequently utilized by investors for rapid purchases or renovations. While they carry higher interest rates, they can be advantageous for flipping properties or capitalizing on time-sensitive opportunities.

-

Home Equity Loans: For current property owners, borrowing against home equity can serve as a cost-effective method to finance additional expenditures. This option enables investors to leverage their existing assets to access funds for new ventures.

-

Commercial Loans: Designed for individuals acquiring commercial properties, these loans offer conditions that diverge from residential loans, catering to the unique requirements of business financing.

By understanding these alternatives, investors can select the most suitable type of liability that aligns with their financial strategy and situation, ultimately enhancing their prospects for success in how to use debt to build wealth in real estate.

Assess Your Financial Readiness for Using Debt

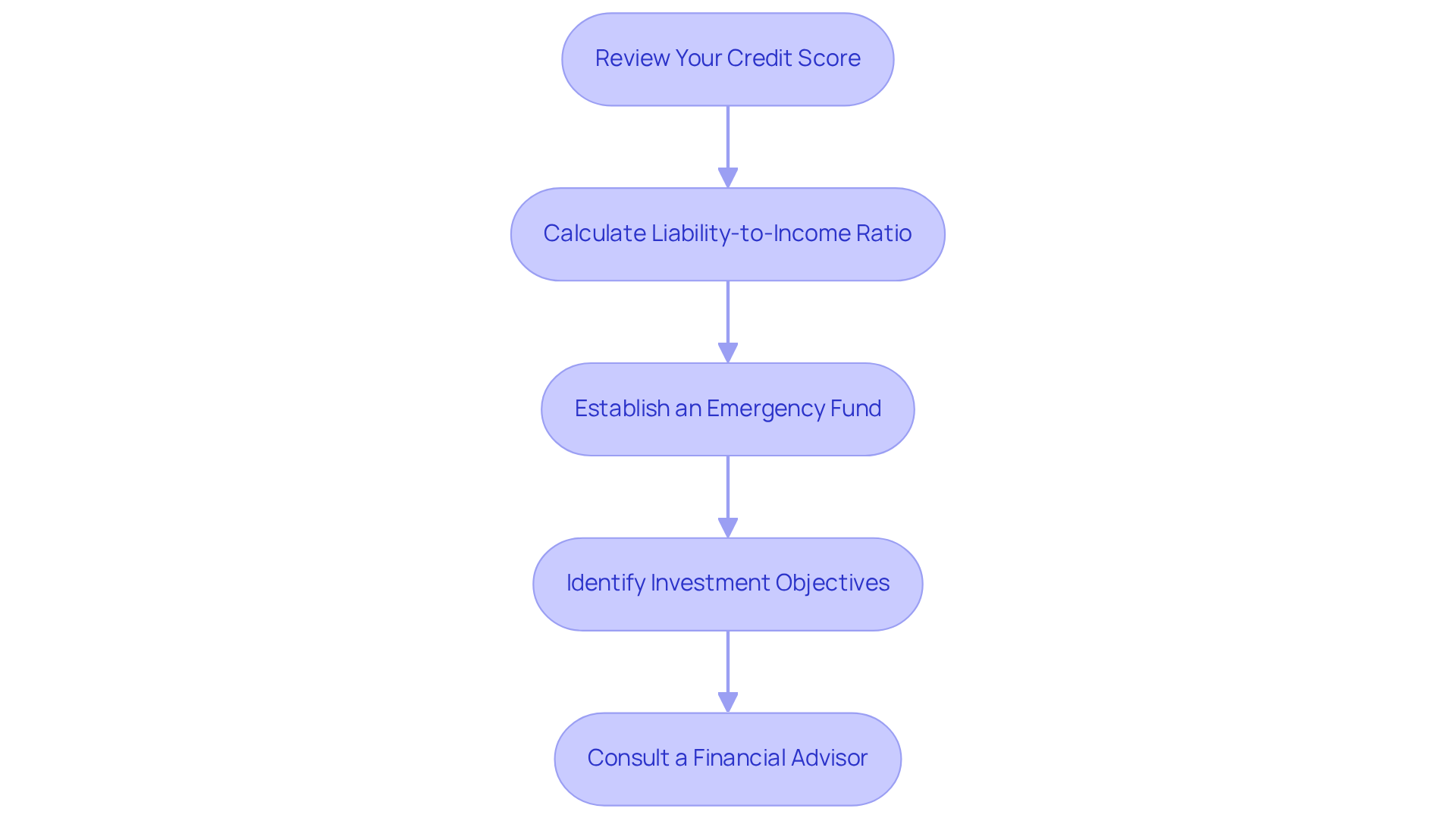

Before utilizing borrowed funds for real estate investments, assessing your financial readiness is essential. Start by reviewing your credit score. A higher credit score can lead to better loan terms and lower interest rates. Obtain your credit report and check for any discrepancies.

Next, calculate your liability-to-income ratio. This ratio assesses your monthly obligation payments against your gross monthly income. Lenders typically prefer a ratio below 36%. If your ratio is higher, consider reducing current obligations before taking on more.

Establishing an emergency fund is crucial. Ensure you have savings set aside to cover unexpected expenses or periods of vacancy in rental properties. A good rule of thumb is to have at least three to six months' worth of expenses saved.

Identify your investment objectives clearly. Specify what you wish to accomplish with your property investments. Are you looking for long-term appreciation, cash flow, or a combination of both? This clarity will steer your financial strategy.

Finally, consult a financial advisor. If you're unsure about your financial readiness, seeking advice from a financial professional can provide personalized guidance based on your situation.

By carefully evaluating your financial preparedness, you can make knowledgeable choices about utilizing financing to generate wealth in property.

Develop a Strategic Plan for Leveraging Debt

To effectively utilize debt in your property ventures, it is crucial to understand how to use debt to build wealth in real estate by creating a strategic plan. Here are the key steps to guide you:

-

Set Clear Investment Objectives: Clearly define your goals, whether it’s generating passive income, flipping properties for profit, or building a long-term portfolio. In 2025, understanding the goals of real estate investors will be essential, as over 70% prioritize cash flow and appreciation potential.

-

Choose the Right Properties: Conduct thorough research to identify properties that align with your financial objectives. Focus on areas with strong growth potential and favorable market conditions. For instance, markets like Phoenix and Henderson are currently experiencing rapid rent increases, and single-family rental demand remains strong as households seek more space, making them attractive options for investors.

-

Calculate Your Financing Requirements: Evaluate how much debt you will need to fund your ventures. This includes considering down payments, closing costs, and renovation expenses. With the average down payment for rental properties around 27.4%, and noting that non-bank lenders now originate over 50% of mortgages, it’s essential to plan accordingly.

-

Create a Budget: Develop a detailed budget that outlines your anticipated income and expenses associated with the expenditure. This will help you understand your cash flow and ensure you can meet debt obligations. Given that the national median rent has reached $1,937, ensuring positive cash flow is more important than ever. Additionally, understanding local market nuances can significantly impact your budgeting strategy.

-

Monitor Market Trends: Stay informed about property market trends and economic signals that could influence your assets. For example, the current building cost index has risen by 0.8% quarterly, and housing starts are at 1.42 million annually, significantly below the estimated 1.6 to 1.8 million units needed. This could affect your renovation budgets and overall investment strategy.

-

Review and Adjust Your Plan Regularly: As you gain experience and the market evolves, revisit your strategic plan to make necessary adjustments. Flexibility is key to successful investing, especially in a market where 29% of buyers are paying above asking prices, indicating a competitive environment. Understanding the sales-to-new-listings ratio (SNLR) as a market indicator for timing home purchases can also enhance your strategic approach.

By following these steps, you can create a robust strategic plan that effectively demonstrates how to use debt to build wealth in real estate, positioning you for success in the dynamic market.

Conclusion

Understanding how to effectively use debt to build wealth in real estate is essential for any investor looking to maximize their returns. By leveraging borrowed funds, investors can control larger assets and benefit from property appreciation while investing only a fraction of the total value. However, this strategy requires a careful approach to mitigate risks associated with market fluctuations and financial obligations.

Key insights into the types of debt available for real estate investments reveal a range of options, from conventional mortgages to hard money loans. Each type serves distinct purposes and caters to different investor needs, underscoring the importance of aligning debt choices with individual financial strategies. Additionally, assessing financial readiness is crucial; this involves evaluating credit scores, calculating liability-to-income ratios, and establishing clear investment goals. These steps ensure that investors are well-prepared to navigate the complexities of real estate financing.

Ultimately, the journey of using debt to build wealth in real estate is not just about acquiring properties but also about strategic planning and continuous market monitoring. By setting clear objectives, understanding financing requirements, and adjusting plans as needed, investors can position themselves for long-term success. Embracing this approach not only enhances the potential for wealth creation but also empowers investors to make informed decisions in a competitive landscape.