Overview

Choosing the right real estate analytics platform involves four critical steps:

- Defining objectives

- Considering asset strategies

- Evaluating target markets

- Prioritizing features according to your goals

By aligning your platform selection with specific investment objectives, you can significantly enhance your decision-making capabilities while reducing financial risks. This strategic approach not only streamlines the selection process but also empowers you to make informed choices that align with your investment aspirations.

Introduction

Selecting the appropriate real estate analytics platform can significantly impact investors seeking to optimize their returns. With numerous options on the market, it is essential to comprehend the key features and align them with specific investment objectives to ensure success. The real challenge, however, lies in navigating the intricacies of different platforms and confirming that the chosen tool not only fulfills analytical requirements but also delivers dependable data.

What steps are essential for making an informed choice that enhances decision-making and fosters financial growth in the competitive real estate landscape?

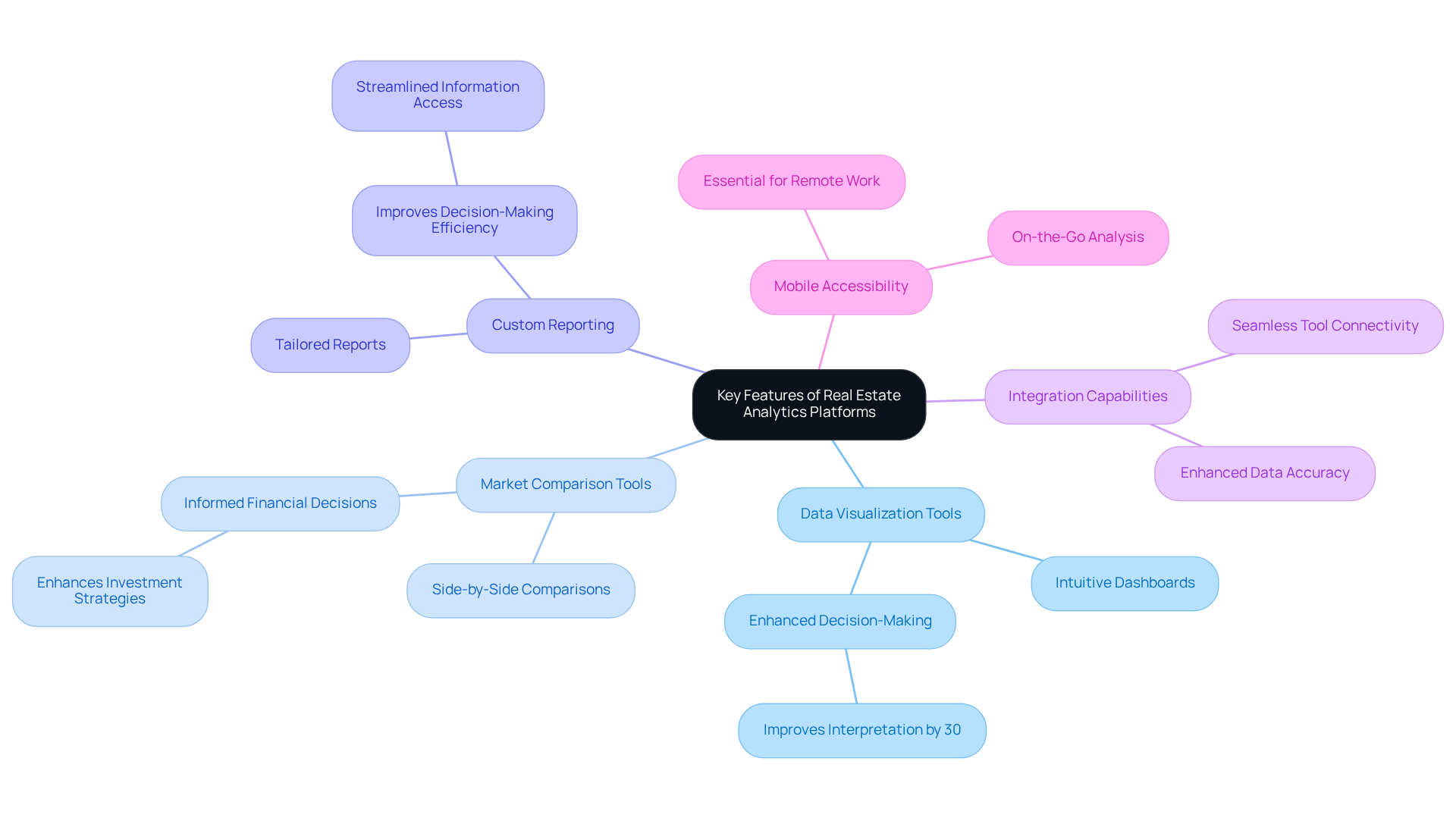

Identify Key Features of Real Estate Analytics Platforms

When selecting a real estate analytics platform, it is crucial to identify key features that will effectively meet your analytical needs. Consider the following essential features:

- Data Visualization Tools: Choose platforms that offer intuitive dashboards and visual representations of data. Research indicates that effective data visualization can enhance decision-making by up to 30%, simplifying the interpretation of trends and insights while making complex data more accessible.

- Market Comparison Tools: Ensure the platform enables side-by-side comparisons of various markets or properties. This functionality is vital for informed financial decisions, as it provides a clearer understanding of relative performance. Industry experts note, "the ability to compare markets directly can significantly enhance investment strategies."

- Custom Reporting: The capability to generate tailored reports that address your specific requirements can greatly improve decision-making efficiency and save valuable time. A case study on the MarketSphere implementation for JLL demonstrated how custom reporting features streamlined their information access and enhanced overall decision-making.

- Integration Capabilities: Confirm whether the system can seamlessly connect with other tools you use, such as CRM systems or financial modeling software. This interoperability can streamline your workflow and enhance data accuracy, as highlighted in various industry analyses.

- Mobile Accessibility: A system that offers mobile access is advantageous for conducting analysis and making decisions on the go, ensuring you remain informed regardless of your location. With the rise of remote work, mobile accessibility has become increasingly essential for property professionals.

Focusing on these attributes will aid you in refining your choices to systems that align with your analytical requirements, ultimately enhancing your financial strategy through a real estate analytics platform.

Align Platform Selection with Investment Goals

Choosing the appropriate real estate analytics platform is essential for achieving your financial goals in real estate. To ensure your choice aligns with your objectives, consider these four critical steps:

-

Define Your Objectives: Begin by determining whether your focus is on identifying emerging markets, evaluating property values, or analyzing demographic trends. Clearly expressing your main goals will direct your choice of system.

-

Consider Your Asset Approach: Different asset strategies—such as buy-and-hold, flipping, or rental properties—necessitate distinct analytical tools. Ensure that the system you select supports your specific strategy to maximize effectiveness. According to a study from the National Association of Realtors, predictive models can improve accuracy by up to 20%, underscoring the importance of selecting the right tools.

-

Evaluate Your Target Market: If your resources are concentrated in a specific geographic region or property category, confirm that the system offers pertinent information and insights tailored for that market. This specificity can significantly enhance your decision-making process. For instance, the effective application of predictive analytics in the Indian property market illustrates how customized insights can lead to informed financial decisions.

-

Prioritize Features Based on Goals: If your aim is to uncover undervalued properties, prioritize systems that provide robust valuation models and comprehensive historical data analysis. As Mathieu van Roon, Portfolio Manager at Robeco, emphasizes, selecting the best mathematical optimization solving engine is vital for effective decision-making.

By aligning your investment objectives with a real estate analytics platform, you can enhance your decision-making capabilities and achieve successful results in your property endeavors. Notably, businesses utilizing analytics have demonstrated a reduction in financial risk by up to 30%, highlighting the critical importance of making informed decisions in your analytics tool selection.

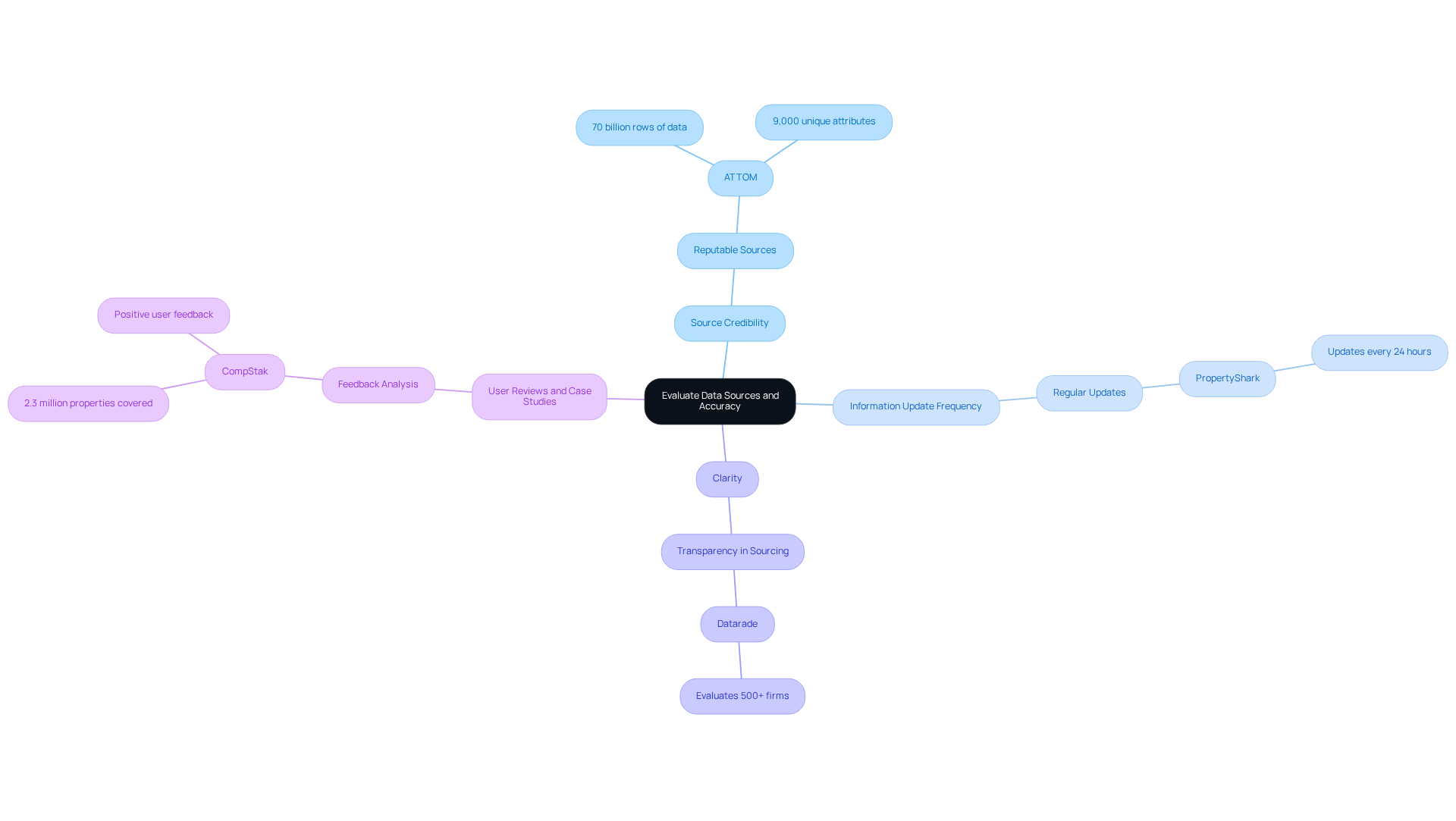

Evaluate Data Sources and Accuracy

Data quality is paramount when selecting a real estate analytics platform. To effectively evaluate data sources and their accuracy, consider the following aspects:

- Source Credibility: Investigate the origins of the platform's data. Reputable sources compile information from government databases, MLS listings, and reliable market reports, ensuring a solid foundation for analysis. For instance, ATTOM provides extensive real property information, boasting over 70 billion rows of transactional details and more than 9,000 unique attributes, thereby establishing itself as a dependable option for investors.

- Information Update Frequency: It is essential to ensure that the platform refreshes its information regularly. The real estate market can shift rapidly; outdated information can lead to misguided investment decisions. Platforms like PropertyShark, operational since 2003, update their sales information every 24 hours, offering timely insights.

- Clarity: Seek out systems that maintain transparency regarding their information sources and methods. This transparency allows you to assess the reliability of the insights provided. For example, Datarade offers a service for finding and evaluating information products from over 500 firms, highlighting the importance of transparent sourcing.

- User Reviews and Case Studies: Examine user feedback and case studies to understand how others have effectively utilized the system's information in their financial strategies. CompStak, for example, is recognized for its precise sales and lease comps, encompassing over 2.3 million properties, and has received favorable feedback for its efficiency in supporting financial decisions.

By thoroughly evaluating data sources and their accuracy, you can select a system that provides trustworthy insights, ultimately enhancing your investment strategies.

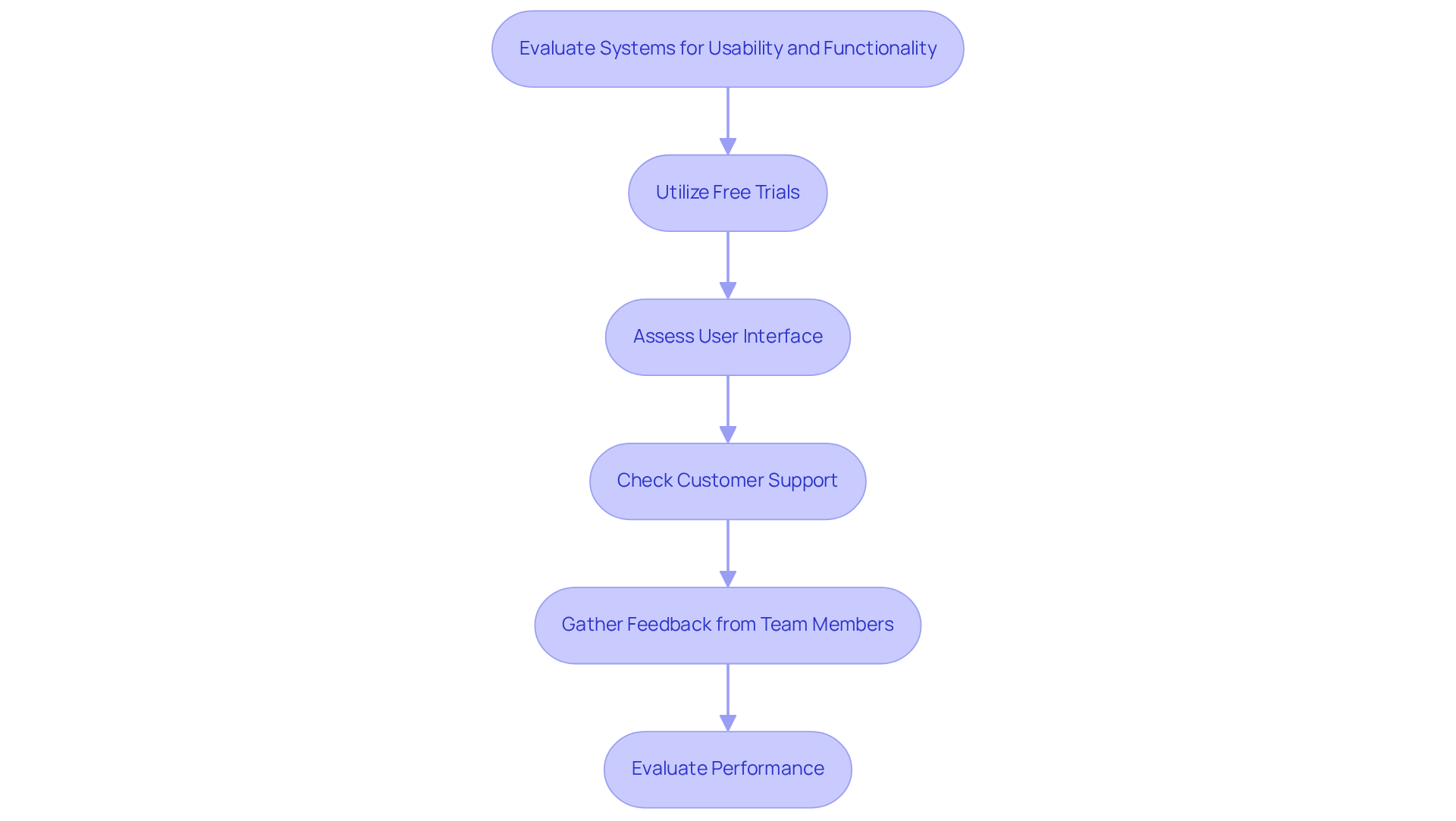

Test Platforms for Usability and Functionality

Once you have narrowed down your options, it’s time to evaluate the systems for usability and functionality. Here’s how to proceed:

- Utilize Free Trials: Numerous services provide free trials or demos. Take advantage of these to explore the interface and features without commitment.

- Assess User Interface: Evaluate how intuitive the system is. A user-friendly interface can significantly enhance your analytical efficiency. Remember, "A user-friendly interface can significantly boost your analytical efficiency, making it easier to navigate and extract insights."

- Check Customer Support: Investigate the level of customer support available. Responsive support can be crucial if you encounter issues or have questions.

- Gather Feedback from Team Members: If you work with a team, involve them in the testing process to gather diverse perspectives on usability. Their insights can highlight strengths and weaknesses you might overlook.

- Evaluate Performance: Test the system’s speed and responsiveness, especially when managing large datasets, to ensure it meets your analytical needs. Usability testing results can be obtained quickly and at a reasonable cost, making it a cost-effective approach to enhance your analysis capabilities.

By thoroughly testing platforms for usability and functionality, you can confidently select a real estate analytics platform that enhances your real estate analysis capabilities. For instance, tools like UsabilityHub and Hotjar have proven effective in identifying usability issues and improving user experience, demonstrating the value of usability testing in real-world applications.

Conclusion

Selecting the right real estate analytics platform is a pivotal step in enhancing investment strategies and achieving financial goals. Understanding essential features, aligning platform selection with specific investment objectives, evaluating data sources for accuracy, and testing usability and functionality empower investors to make informed choices that significantly impact their success in the real estate market.

Key insights from this guide underscore the importance of:

- Data visualization tools

- Market comparison features

- Integration capabilities

These elements contribute to a streamlined decision-making process that is crucial for maximizing analytical effectiveness. Furthermore, aligning the chosen platform with individual investment strategies and market focus is vital, as it directly influences the quality of analysis. Rigorous evaluation of data sources and thorough testing of platform usability ensure that the selected tool meets the high standards required for reliable analysis.

Ultimately, choosing a real estate analytics platform transcends the mere selection of software; it is about empowering informed decision-making that can lead to reduced financial risks and improved investment outcomes. By prioritizing the right features and conducting comprehensive evaluations, real estate professionals can harness the full potential of analytics to uncover valuable insights and drive successful investments.