Overview

This article outlines four essential steps for investing in Platform 16 San Jose real estate. It emphasizes the importance of:

- Understanding the investment landscape

- Conducting thorough market research and financial analysis

- Securing appropriate financing

- Effectively managing the investment

Each step is supported by specific strategies and data, such as the significance of location and market trends. These elements highlight the area's potential for growth and profitability, guiding investors in making informed decisions. By following these steps, investors can navigate the complexities of the real estate market with confidence and clarity.

Introduction

The San Jose real estate market is currently experiencing a transformative phase, with significant developments such as Platform 16 set to redefine investment opportunities. This expansive project, strategically situated near tech hubs and essential transit links, presents a promising landscape for investors seeking lucrative returns.

Yet, navigating the complexities of this market raises crucial questions:

- What factors should investors prioritize to ensure their success in this competitive environment?

- Delving into these elements can unlock the potential of Platform 16 and facilitate informed investment decisions.

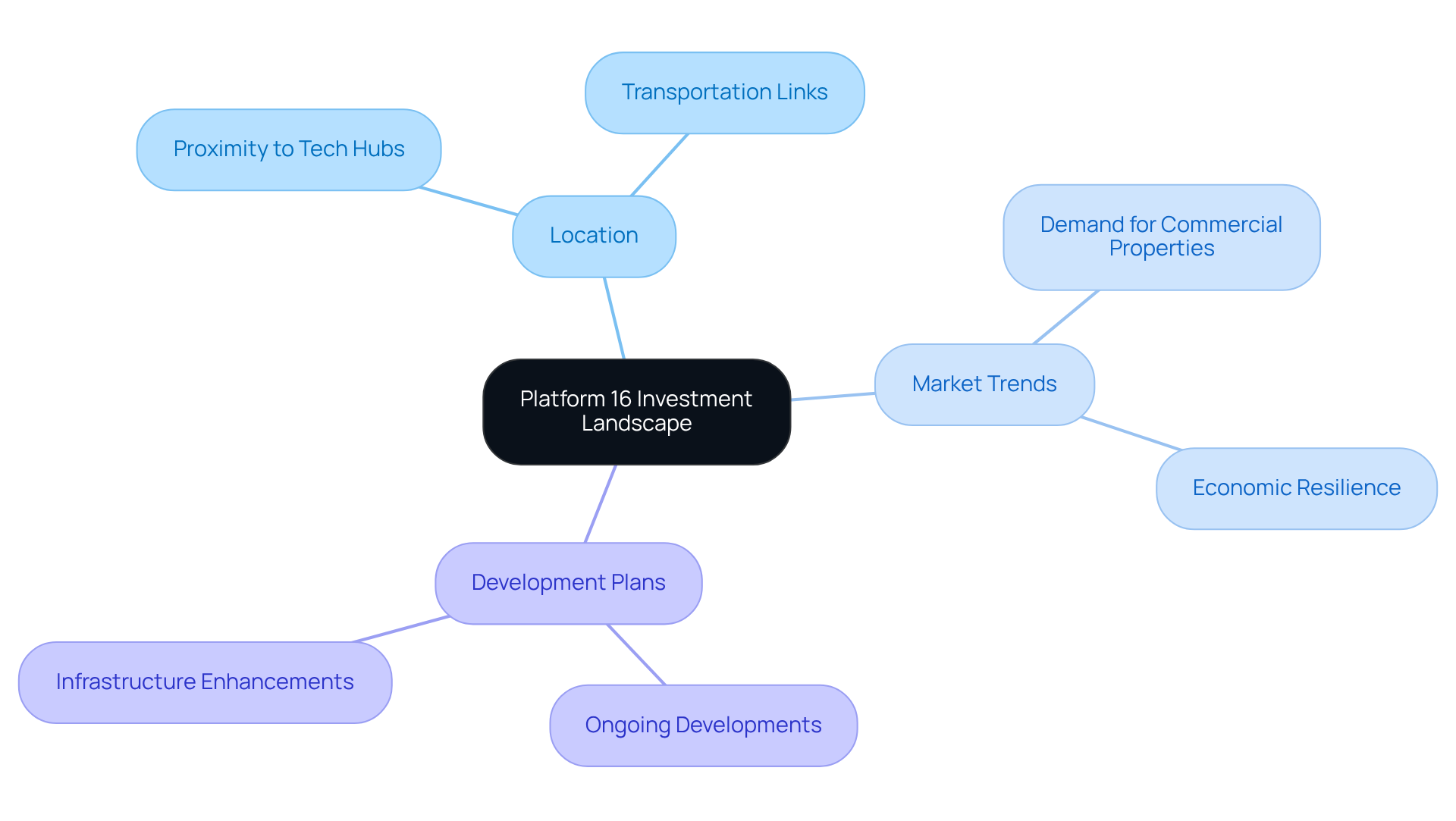

Understand the Platform 16 Investment Landscape

Platform 16 San Jose represents a pivotal real estate project in downtown San Jose, encompassing a vast 1.1 million square foot campus across three buildings. Its strategic positioning next to the forthcoming Google transit village and Diridon Station markedly enhances its appeal as a premier investment opportunity. Investors should contemplate several essential factors:

- Location: The proximity to major tech hubs and critical transportation links serves as a primary driver of demand for office space in San Jose. With the tech industry continuing to flourish, the need for accessible commercial properties is expected to rise. As of Q1 2025, the median home price in San Francisco stands at approximately $1.35 million, underscoring the area's robust demand for real estate.

- Market Trends: Current trends within the San Francisco real estate sector reveal a strong demand for commercial properties, propelled by an expanding workforce and shifting demographics. Analysts note that the region's economic resilience and job growth play vital roles in shaping the financial landscape. Recent data indicates that the San Francisco housing market remains a seller's domain, characterized by low supply and stable demand, further amplifying the potential of Platform 16.

- Development Plans: Staying abreast of ongoing and upcoming developments in the area is crucial, as these factors can significantly influence property values. For example, anticipated infrastructure enhancements and commercial investments in the vicinity are projected to stimulate demand and elevate the overall attractiveness of Platform 16 San Jose. A recent case study on the San Jose real estate market underscores the significance of such developments in driving property values upward.

By comprehensively understanding these elements, including current economic dynamics and expert insights, investors can make informed decisions regarding the viability of investing in Platform 16 San Jose, thereby positioning themselves strategically within a competitive landscape.

Conduct Market Research and Financial Analysis

To effectively conduct market research and financial analysis for Platform 16 San Jose, it is crucial to follow a systematic approach.

- Gather Data: Start by utilizing local real estate reports, economic forecasts, and demographic studies. This will provide a comprehensive understanding of the landscape. For instance, with San Francisco's median home price currently around $1.35 million and an income of $426,277 required to afford this median-priced residence, having precise data is essential given the affordability challenges in the sector.

- Analyze Comparable Properties: Next, examine similar properties in the area to assess pricing, occupancy rates, and rental yields. Notably, Downtown San Jose has a median home price of $1.05 million, making it essential to compare properties within this context to gauge potential returns. Furthermore, with 69% of sales taking place above the list price, the competitive nature of the industry must be taken into account.

- Evaluate Financial Metrics: It is equally important to calculate key financial metrics such as ROI, cash flow, and cap rates to determine the investment's profitability. Given the elevated price-to-rent ratios in San Jose, understanding these metrics will assist investors in navigating the complexities of the industry.

- Consider External Factors: Lastly, analyze economic indicators, interest rates, and local government policies that may influence the real estate sector. For example, with interest rates presently steady at approximately 6.84% and forecasts of a minor decrease in home values, these elements can substantially impact financial choices. Additionally, current inventory levels in San Jose exceed those of any June noted in the past five years, suggesting market dynamics that could affect funding strategies.

By systematically collecting and analyzing this information, investors can make informed, data-driven decisions regarding their involvement in Platform 16 San Jose.

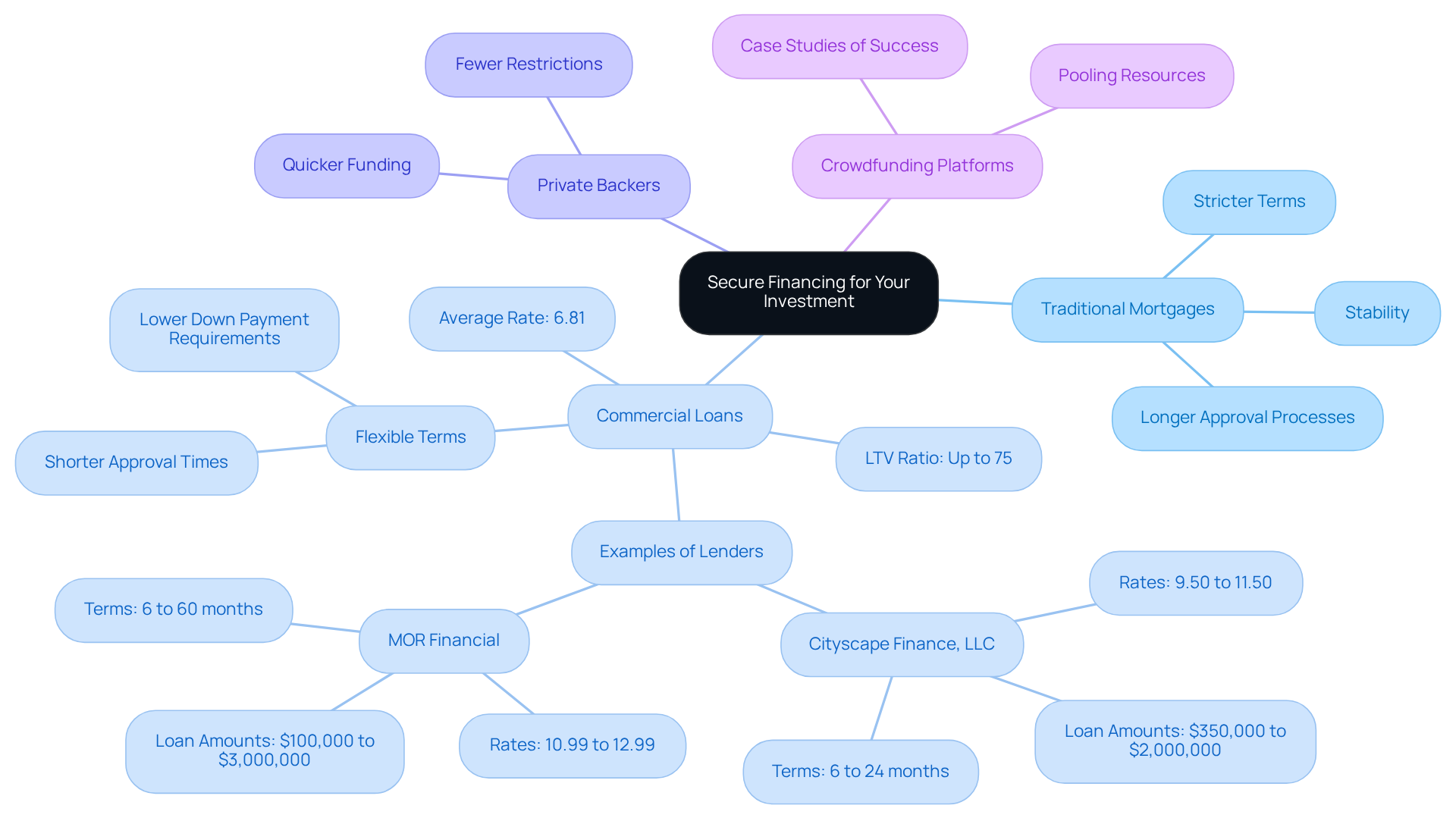

Secure Financing for Your Investment

To secure financing for your investment in Platform 16, consider the following options:

- Traditional Mortgages: Approach banks or credit unions for conventional loans, ensuring you meet their credit and income requirements. While these loans provide stability, they often come with stricter terms and longer approval processes.

- Commercial Loans: Explore commercial real estate loans specifically designed for property acquisition. As of June 2025, commercial mortgage rates in California average around 6.81%, with loan-to-value (LTV) ratios typically reaching up to 75%. These loans can offer more flexible terms compared to traditional mortgages, including shorter approval times and potentially lower down payment requirements. For instance, Cityscape Finance, LLC lends amounts ranging from $350,000 to $2,000,000 with terms of 6 to 24 months and rates between 9.50% and 11.50%.

- Private Backers: Consider collaborating with private backers or funding groups that can provide capital in exchange for equity. This approach can facilitate quicker funding and may impose fewer restrictions than conventional loans.

- Crowdfunding Platforms: Investigate real estate crowdfunding platforms that enable multiple investors to pool resources for larger projects. Successful crowdfunding case studies, such as those showcasing significant capital raises for developments, illustrate the potential for investors to engage in larger projects without shouldering the entire financial burden alone.

Assess each option based on current interest rates, repayment conditions, and your financial circumstances to identify the best fit for your financial strategy.

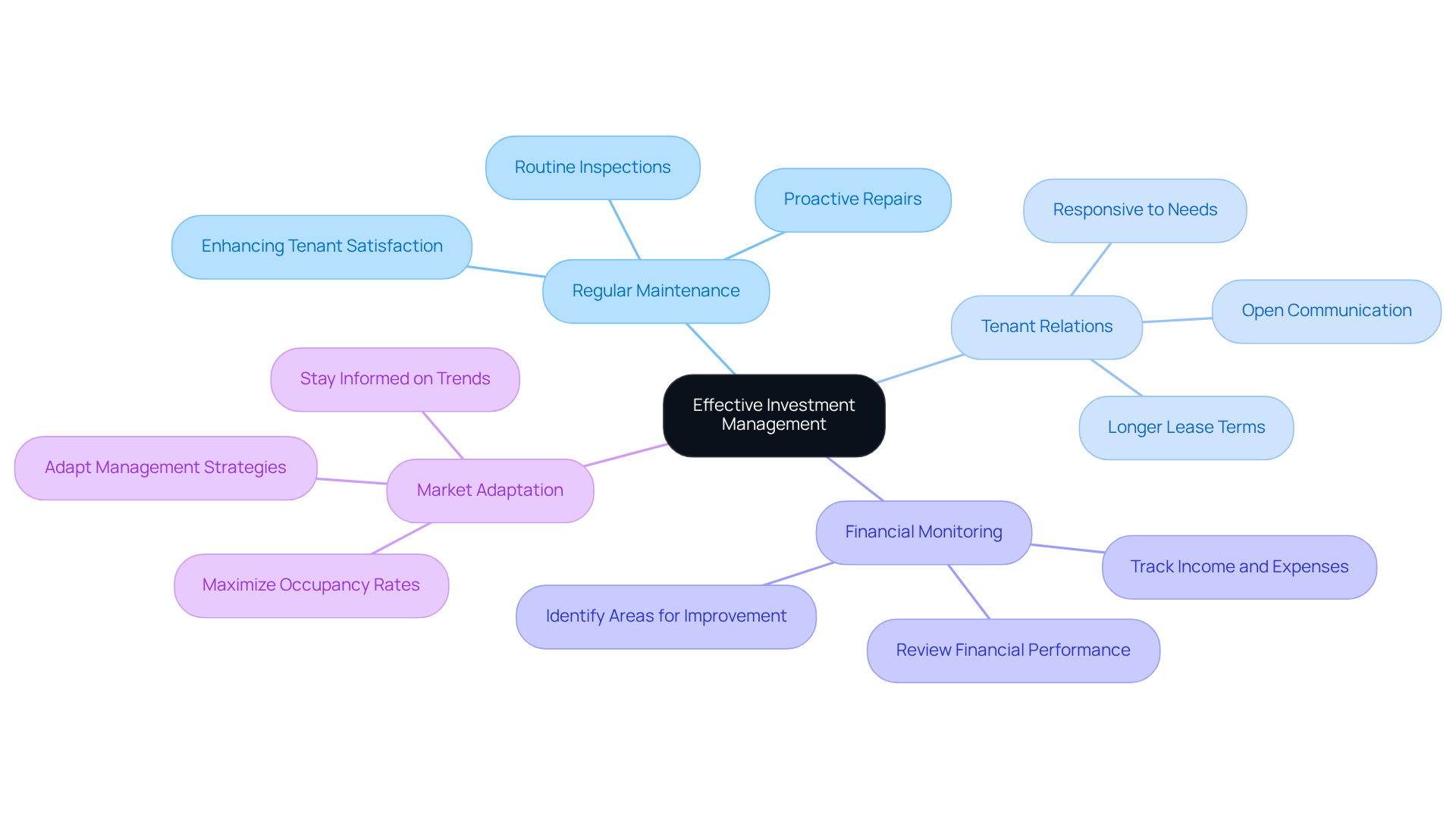

Manage Your Investment Effectively

To effectively manage your investment in Platform 16, it is essential to implement the following strategies:

- Regular Maintenance: Schedule routine inspections and maintenance to keep the property in optimal condition. This proactive approach not only enhances tenant satisfaction but also promotes retention, ultimately contributing to your investment’s stability.

- Tenant Relations: Foster positive relationships with tenants by maintaining open lines of communication and being responsive to their needs. This strategy can lead to longer lease terms, reducing turnover and associated costs.

- Financial Monitoring: Diligently track income and expenses, and regularly review financial performance against your initial projections. This practice allows you to identify areas for improvement and make informed decisions that can enhance profitability.

- Market Adaptation: Stay informed about market trends and be prepared to adapt your management strategies accordingly. By meeting changing demands, you can maximize occupancy rates and ensure the long-term viability of your investment.

By focusing on these critical management practices, investors can secure the long-term success and profitability of their investment in Platform 16 San Jose.

Conclusion

Investing in Platform 16 San Jose presents a distinctive opportunity within a vibrant real estate market marked by growth and innovation. This expansive project, strategically situated near vital transportation links and technology hubs, is set to draw considerable demand, rendering it an attractive option for discerning investors. Grasping the intricacies of this investment landscape is crucial for maximizing potential returns and securing long-term success.

Throughout the article, key arguments underscore the necessity of comprehensive market research, financial analysis, and effective management strategies. Investors are urged to evaluate:

- Location

- Current market trends

- Development plans

While also performing a thorough analysis of comparable properties and essential financial metrics. Moreover, obtaining suitable financing through various channels—such as traditional mortgages, commercial loans, or crowdfunding—can greatly influence the feasibility and profitability of the investment.

Ultimately, engaging with the San Jose real estate market, especially through projects like Platform 16, demands a proactive and informed approach. By leveraging insights into market conditions and embracing best practices for investment management, investors can adeptly navigate the complexities of this evolving landscape and seize the promising opportunities it offers. Taking action now can yield substantial rewards in the future, making it imperative for potential investors to remain informed and strategically engaged in this dynamic market.