Overview

To invest in real estate online successfully, one should adopt a structured approach encompassing:

- An understanding of investment types

- Conducting thorough market research

- Exploring suitable platforms

- Implementing effective management strategies

This article outlines these critical steps, emphasizing the significance of:

- Setting clear financial goals

- Analyzing market trends

- Diversifying investments

Such strategies are essential to maximize returns while mitigating the risks associated with online real estate investing.

Introduction

The rise of digital platforms has fundamentally transformed the landscape of real estate investing, making it more accessible than ever before. Investors now have the opportunity to explore a multitude of online avenues—from Real Estate Investment Trusts (REITs) to crowdfunding—facilitating greater diversification and significantly reduced entry costs.

However, navigating this complex environment raises critical questions:

- How can one effectively conduct market research?

- How can one select the right platforms?

- How can one manage these investments to maximize returns?

This guide outlines the essential steps to successfully invest in real estate online, empowering investors to harness the potential of this innovative market.

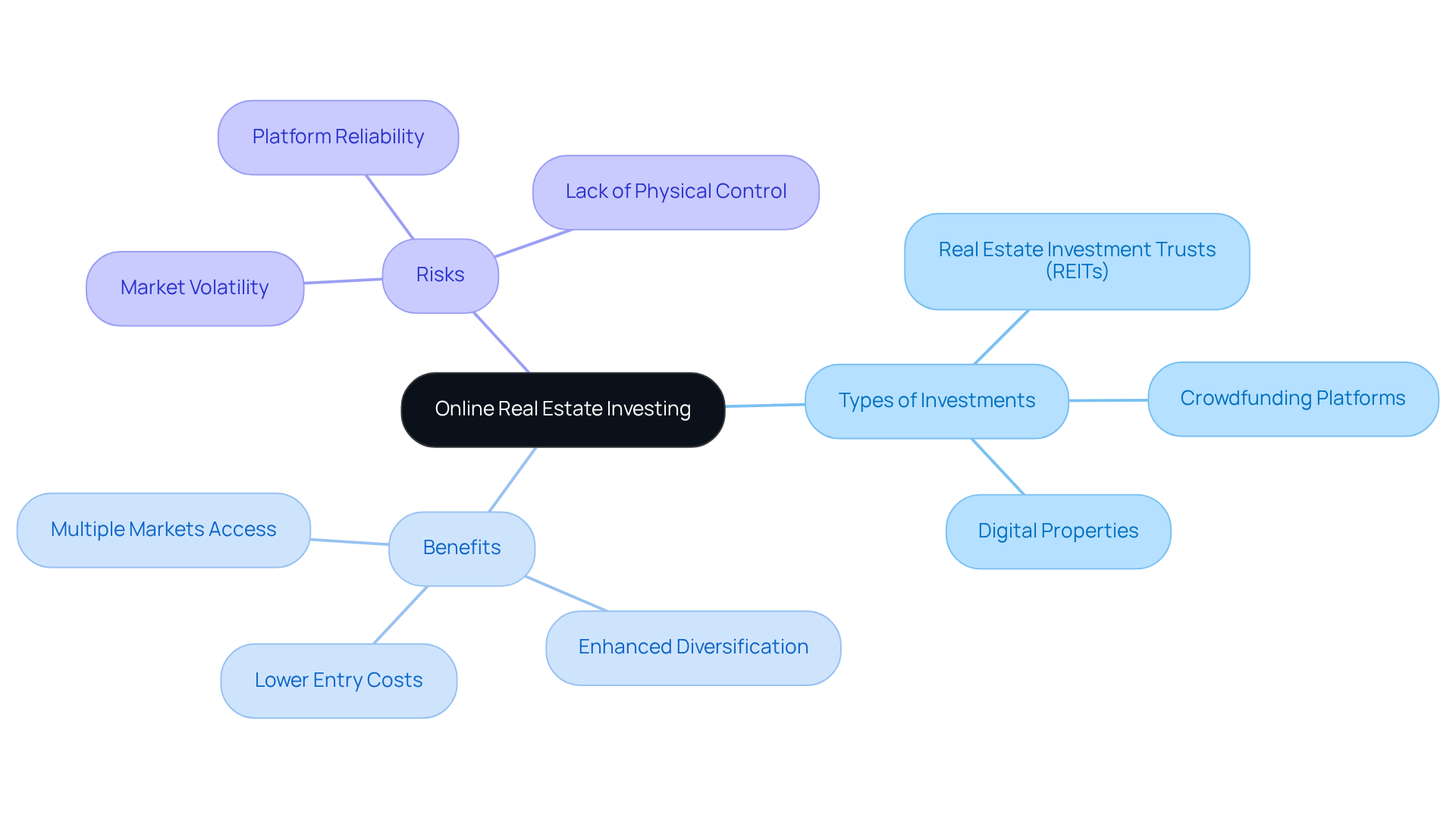

Understand Online Real Estate Investing

The process to invest real estate online involves acquiring property assets through digital platforms. This innovative approach empowers investors to tap into a multitude of financial opportunities without the need for direct asset ownership. To fully grasp this concept, consider the following key aspects:

- Types of Investments: Understand the various forms of online real estate investments, including Real Estate Investment Trusts (REITs), crowdfunding platforms, and digital properties. Each option presents unique opportunities for portfolio diversification.

- Benefits: Online investing significantly lowers entry costs, enhances diversification, and allows investors to engage in multiple markets without geographical constraints, broadening their investment horizons.

- Risks: It is crucial to remain aware of potential risks, such as market volatility, platform reliability, and the inherent lack of physical control over properties, which can impact investment outcomes.

By comprehending these elements, you will establish a solid foundation for your financial journey as you invest real estate online.

Conduct Market Research and Create an Investment Plan

To effectively invest in real estate online, consider these essential steps:

-

Identify Your Goals: Clearly define your financial objectives—whether generating passive income, achieving capital appreciation, or diversifying your portfolio. Understanding your objectives will guide your financial choices.

-

Research the Market: Leverage online resources, market reports, and real estate analytics tools to gather extensive data on current trends, asset values, and demographic shifts. For instance, the average home value in the U.S. was $367,711 over the past year, with home-price appreciation predicted to slow to an average growth of 2 percent for 2025. Additionally, the housing affordability index stands at 98.1, highlighting challenging conditions for buyers. This data is crucial for making informed financial decisions.

-

Analyze Competitors: Examine successful investors and platforms to gain insights into their strategies. Identify gaps in the market that you can exploit. For example, with 34% of builders cutting home prices in May 2025 and 61% offering sales incentives to buyers, understanding how competitors navigate these changes can provide a competitive edge.

-

Create a Detailed Financial Plan: Develop a comprehensive strategy that outlines your target assets, budget, and anticipated returns. This strategy serves as your guide, assisting you in navigating the complexities of the property market. Effective financial strategies often include market research techniques that align with current trends, such as the rising value of homes with eco-friendly attributes, which can enhance value by up to 4%.

By following these steps, you can position yourself for success in the evolving landscape of investing in real estate online.

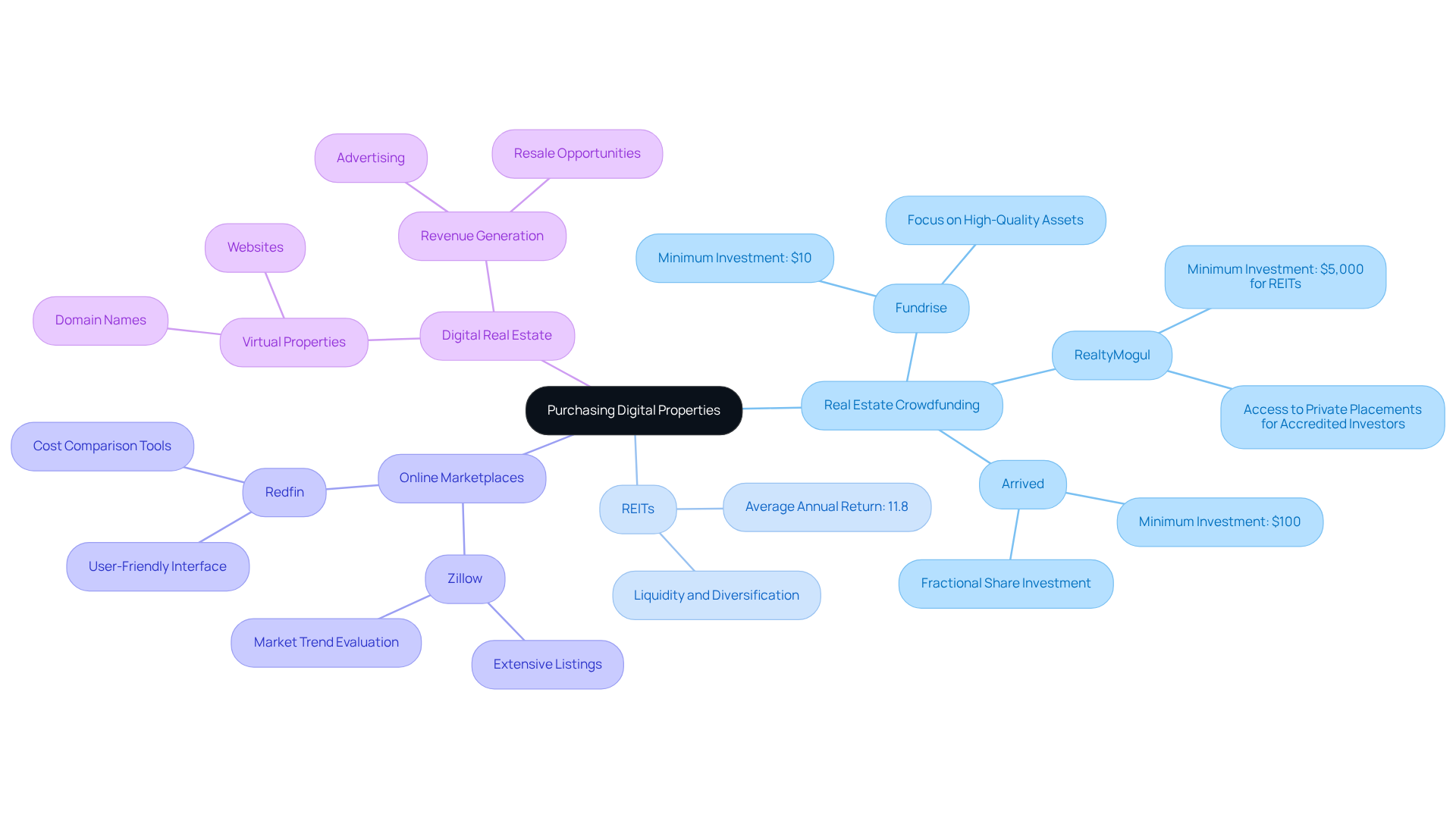

Explore Platforms and Methods for Purchasing Digital Properties

When considering how to invest in real estate online, several platforms and methods stand out.

-

Real Estate Crowdfunding Platforms: Platforms like Fundrise and RealtyMogul enable investors to pool resources for larger property acquisitions. Fundrise, for example, permits contributions beginning at only $10, making it attainable for many. These platforms often focus on high-quality assets and provide opportunities for both accredited and non-accredited investors.

-

REITs (Real Estate Investment Trusts): REITs are companies that own, operate, or finance income-generating real estate. They can be traded on stock exchanges, offering liquidity and diversification. In 2025, top-performing REITs are expected to continue delivering solid returns, with historical averages around 11.8% annually since 1972. Industry leaders emphasize the importance of including REITs in a diversified investment portfolio.

-

Online Marketplaces: Websites such as Zillow and Redfin offer extensive listings for real estate available for sale or rent. These platforms enable investors to examine different options, compare costs, and evaluate market trends, making them useful instruments to invest in real estate online.

-

Digital Real Estate: Investing in virtual properties, such as domain names or websites, presents unique opportunities. These assets can produce revenue through advertising or resale, attracting individuals seeking to broaden their financial portfolios beyond conventional properties.

When assessing these choices, consider elements such as fees, minimum contribution requirements, and potential returns to determine the best fit for your financial strategy.

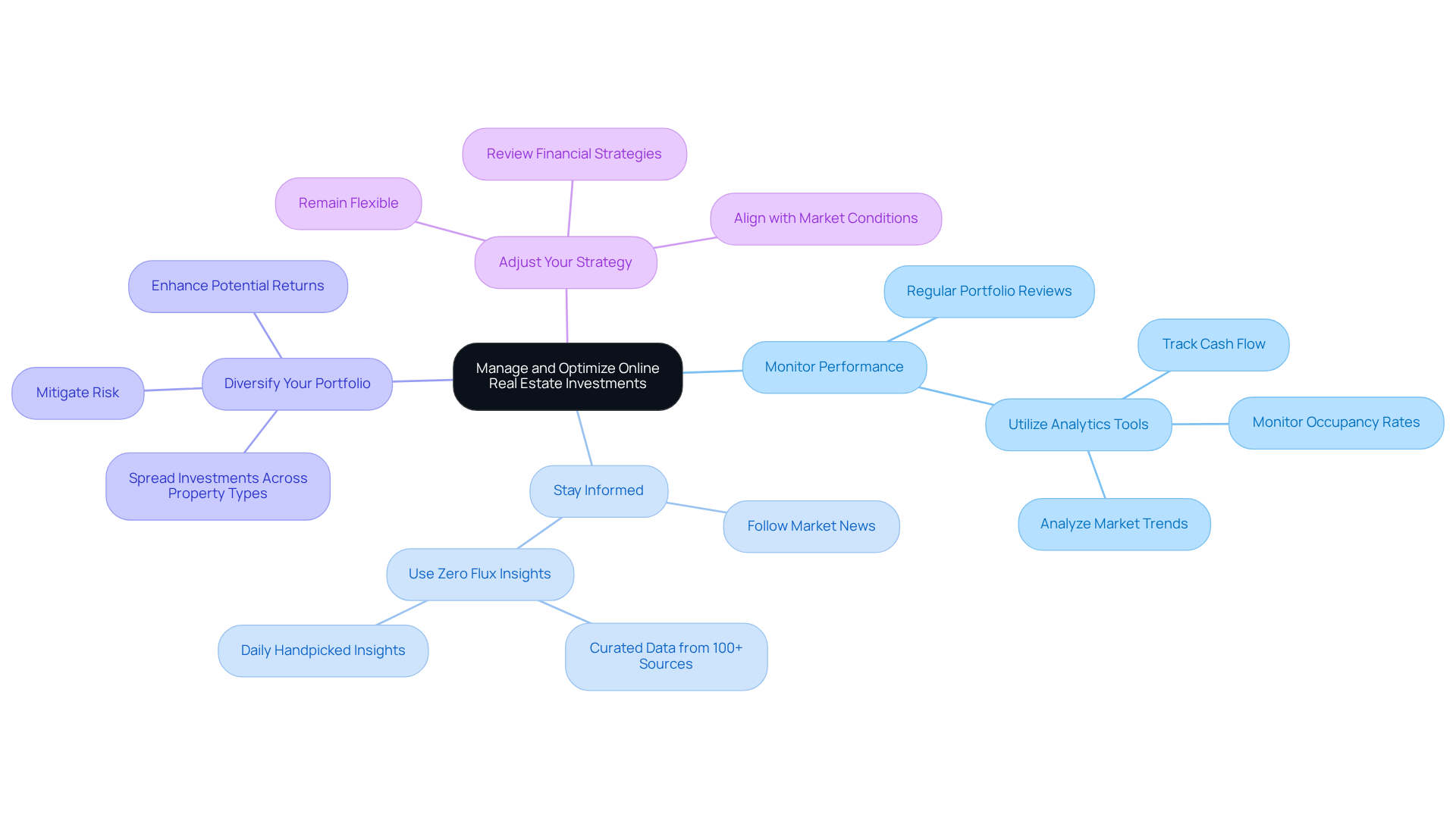

Manage and Optimize Your Online Real Estate Investments

To ensure your online real estate investments remain profitable, it is crucial to implement effective management strategies:

-

Monitor Performance: Regularly reviewing your investment portfolio is essential for assessing performance against your goals. Utilize analytics tools to track key metrics such as cash flow, occupancy rates, and market trends. These metrics are crucial for informed decision-making, allowing you to adjust your strategies as necessary.

-

Stay Informed: Keeping abreast of market news and trends through reliable sources like Zero Flux is vital. This platform curates insights from over 100 diverse outlets, enabling you to make informed choices regarding purchasing, selling, or retaining real estate. Zero Flux serves as an essential tool for anyone engaged in the property sector, assisting in sifting through vast amounts of data to highlight the most pertinent trends.

-

Diversify Your Portfolio: Spreading your investments across various property types and markets can mitigate risk and enhance potential returns. Real property typically shows a low correlation with stocks and bonds, making it an effective diversification strategy. As Armstrong Williams notes, "real estate provides the highest returns, the greatest values, and the least risk."

-

Adjust Your Strategy: Remaining flexible and willing to adapt your approach to financial allocation based on evolving market conditions and personal financial goals is critical. Consistently review your financial strategy to ensure it aligns with your goals and the current environment.

By actively managing and optimizing your investments, you can maximize returns and effectively navigate the complexities to invest real estate online.

Conclusion

Investing in real estate online represents a transformative opportunity for individuals aiming to diversify their portfolios and explore new financial avenues. By leveraging digital platforms, investors can navigate a landscape filled with various investment types, each presenting unique benefits and risks. Grasping these dynamics is essential for establishing a successful online investment strategy.

Key steps for effectively engaging in online real estate investing have been outlined throughout the article:

- Understanding the types of investments available, such as REITs and crowdfunding, is crucial.

- Conducting thorough market research and creating a detailed financial plan are also vital stages for informed decision-making.

- Exploring suitable platforms and methods for purchasing digital properties, along with implementing robust management strategies, significantly enhances the potential for success in this evolving market.

The significance of online real estate investing lies in its accessibility and the potential for substantial returns. As the market continues to evolve, remaining informed and adaptable will be imperative. Embracing the tools and strategies discussed empowers investors to optimize their portfolios and seize the opportunity to thrive in the digital real estate landscape. Taking the first step today could lead to a rewarding financial future.