Overview

The article delineates four essential steps crucial for successfully investing in real estate online. These steps encompass:

- Understanding online investing

- Conducting market research

- Exploring various investment methods

- Selecting appropriate platforms to execute investment strategies

Each step is meticulously supported by detailed explanations of investment types, market trends, and strategic planning. This underscores the importance of thorough research and informed decision-making in navigating the complexities of online real estate investing. By adhering to these guidelines, investors can enhance their strategies and achieve greater success in the real estate market.

Introduction

Online real estate investing is revolutionizing property ownership, rendering it more accessible and appealing to a wider audience. Innovative platforms enable individuals to invest with lower capital and diverse options—from REITs to crowdfunding—presenting a remarkable opportunity for wealth creation. However, as the market evolves, potential investors encounter critical challenges in navigating risks and selecting the right strategies.

What steps can one take to successfully invest in real estate online and capitalize on this burgeoning market?

Understand Online Real Estate Investing

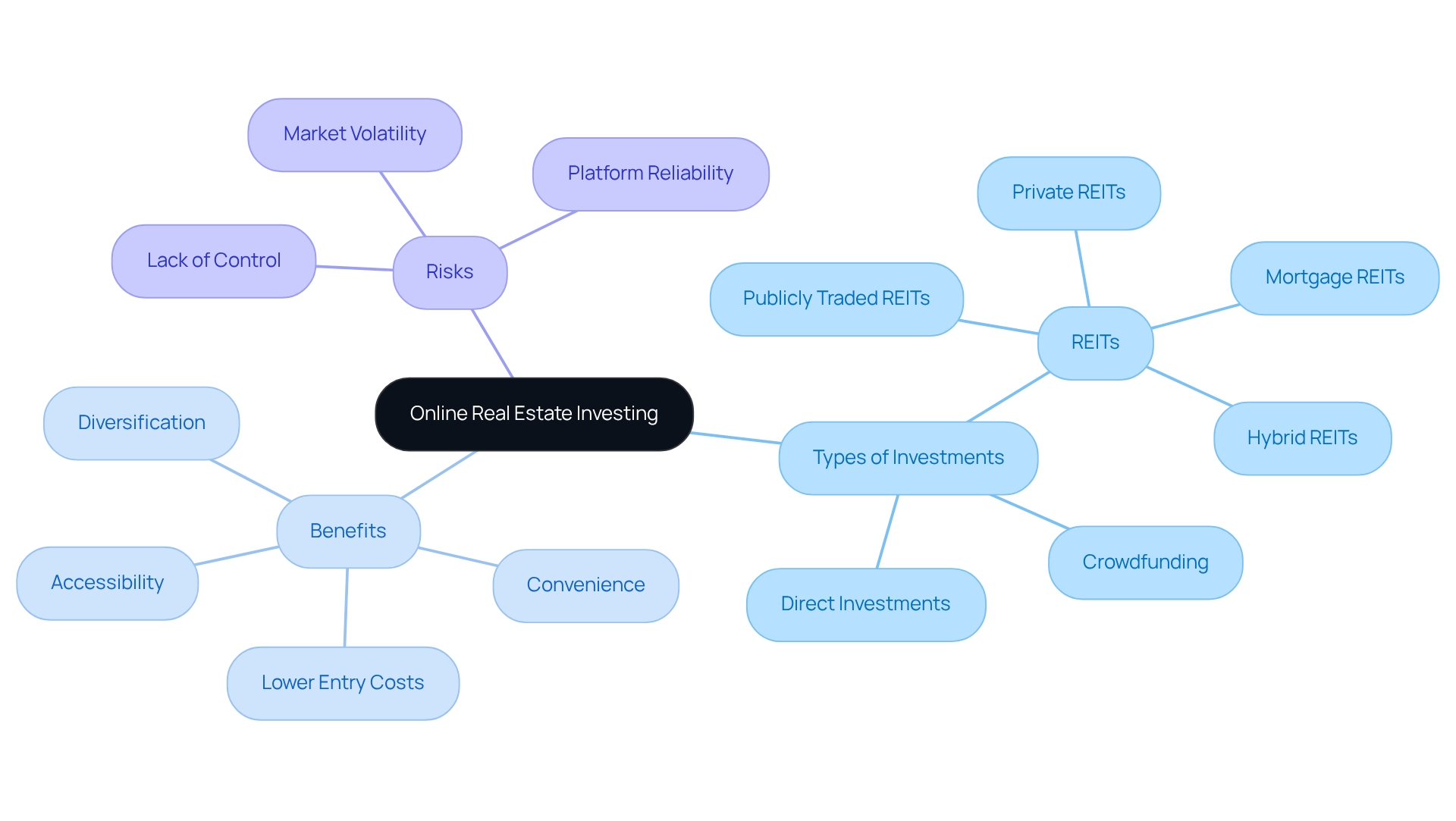

Online property investing has emerged as a revolutionary method to real estate invest online or finance properties through digital platforms. This approach has gained traction due to its accessibility and the potential for reduced capital requirements compared to traditional property ventures. Key aspects to consider include:

-

Types of Investments: Familiarize yourself with various online investment options, including Real Estate Investment Trusts (REITs), crowdfunding platforms, and direct property investments. With over 225 publicly traded REITs available in the U.S., investors can easily access diversified portfolios of property assets. Notably, REITs are mandated to distribute at least 90% of their annual income as shareholder dividends, making them an appealing choice for income-seeking investors.

-

Benefits: Online investing presents several advantages, such as lower entry costs, which broaden accessibility for a wider audience. Moreover, it offers diversification opportunities, enabling investors to spread their risk across different properties and markets. The ability to manage assets from anywhere enhances convenience, particularly as 97% of home purchasers now real estate invest online, reflecting a significant shift towards digital engagement in real estate. Additionally, it's noteworthy that 90% of all millionaires achieve their wealth through property ownership, underscoring the wealth-creating potential of this financial avenue. The typical home value in the U.S. has increased by over 65% in the past five years, indicating substantial appreciation potential in property investments.

-

Risks: While online investing offers numerous benefits, it is crucial to acknowledge potential risks. Market volatility can affect investment returns, and the reliability of platforms may vary. Furthermore, investors might encounter challenges due to the lack of physical control over properties, complicating management and decision-making. Understanding these risks is vital for successfully navigating the evolving landscape of online property investing.

Grasping these components equips you with the knowledge necessary to adeptly navigate the shifting terrain of online property investing. As the industry continues to expand, with crowdfunding platforms raising nearly $20 billion in 2023, the opportunities for astute investors are rapidly multiplying.

Conduct Market Research and Create an Investment Plan

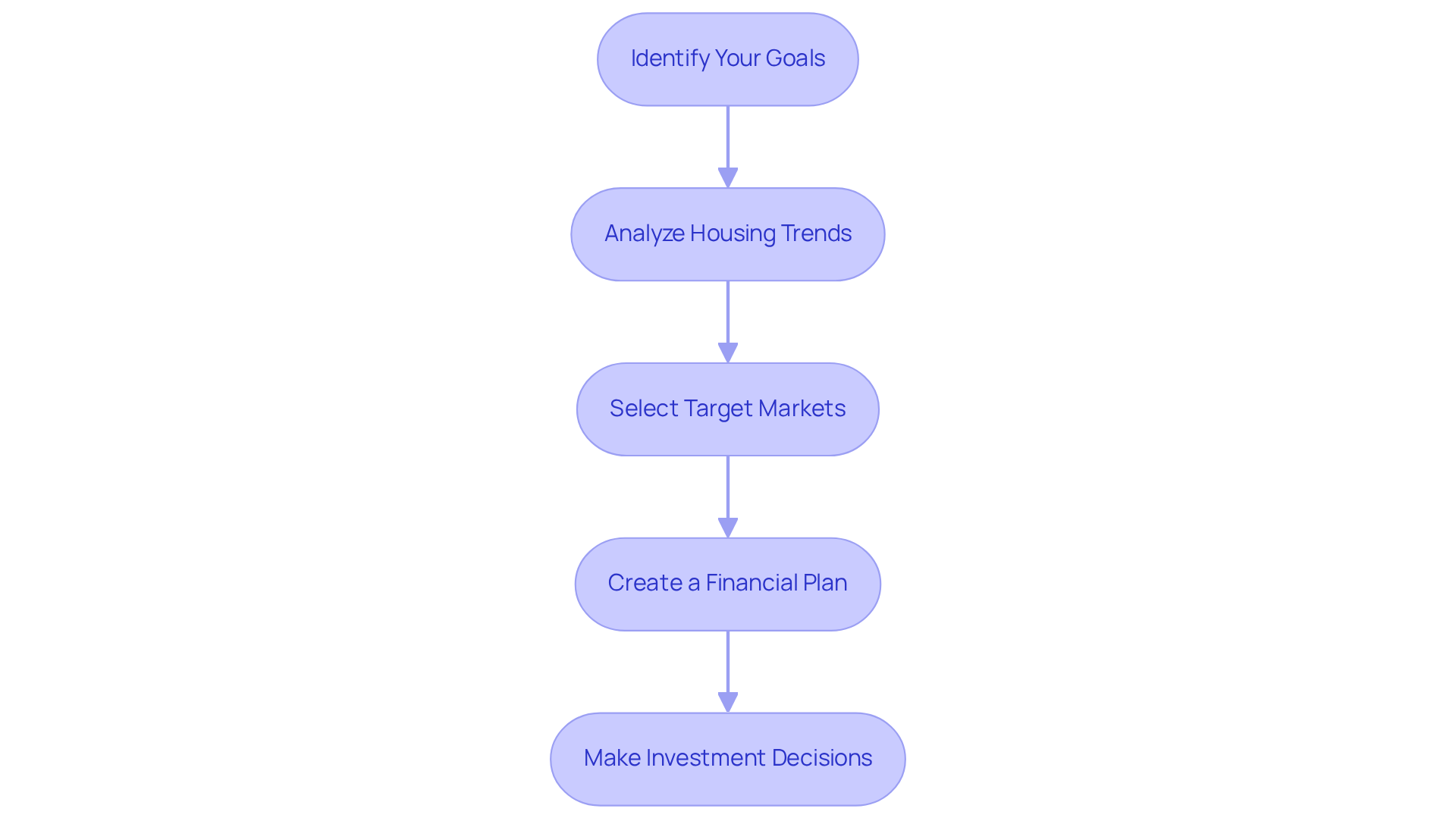

To effectively real estate invest online, it is essential to begin with thorough research of the property industry. Follow these vital steps:

- Identify Your Goals: Clearly define your financial objectives, whether they involve long-term appreciation, generating rental income, or achieving diversification within your portfolio.

- Analyze Housing Trends: Leverage resources like Zero Flux to access critical data on property trends, demographic shifts, and economic indicators that influence real estate dynamics. For instance, as of April 2025, the median home price reached a record high of $414,000, reflecting a 1.8% year-over-year increase, while inventory levels rose by 20.8% compared to the previous year.

- Select Target Markets: Focus on specific geographic regions that align with your financial objectives. Look for areas demonstrating growth potential and low vacancy rates—such as Wilmington, NC, with a vacancy rate of just 1.43%, indicating strong rental demand and a favorable environment for investors—and robust rental demand.

- Create a Financial Plan: Develop a comprehensive strategy that outlines the types of properties you wish to acquire, your budget, and your anticipated return on capital (ROI). This organized plan will serve as a guide for your decision-making process, assisting you in navigating the complexities of the current market where you can real estate invest online, as homes are going pending in an average of 19 days, implying a competitive environment that necessitates prompt acquisition actions. Additionally, consider the absorption rate in the multifamily sector, which has reached 557,121 units, indicating a healthy demand for rental properties. Furthermore, keep in mind the average 30-year mortgage rate of 6.94% as of May 28, 2025, which impacts financing options for your investments.

Explore Investment Methods: REITs, Crowdfunding, and More

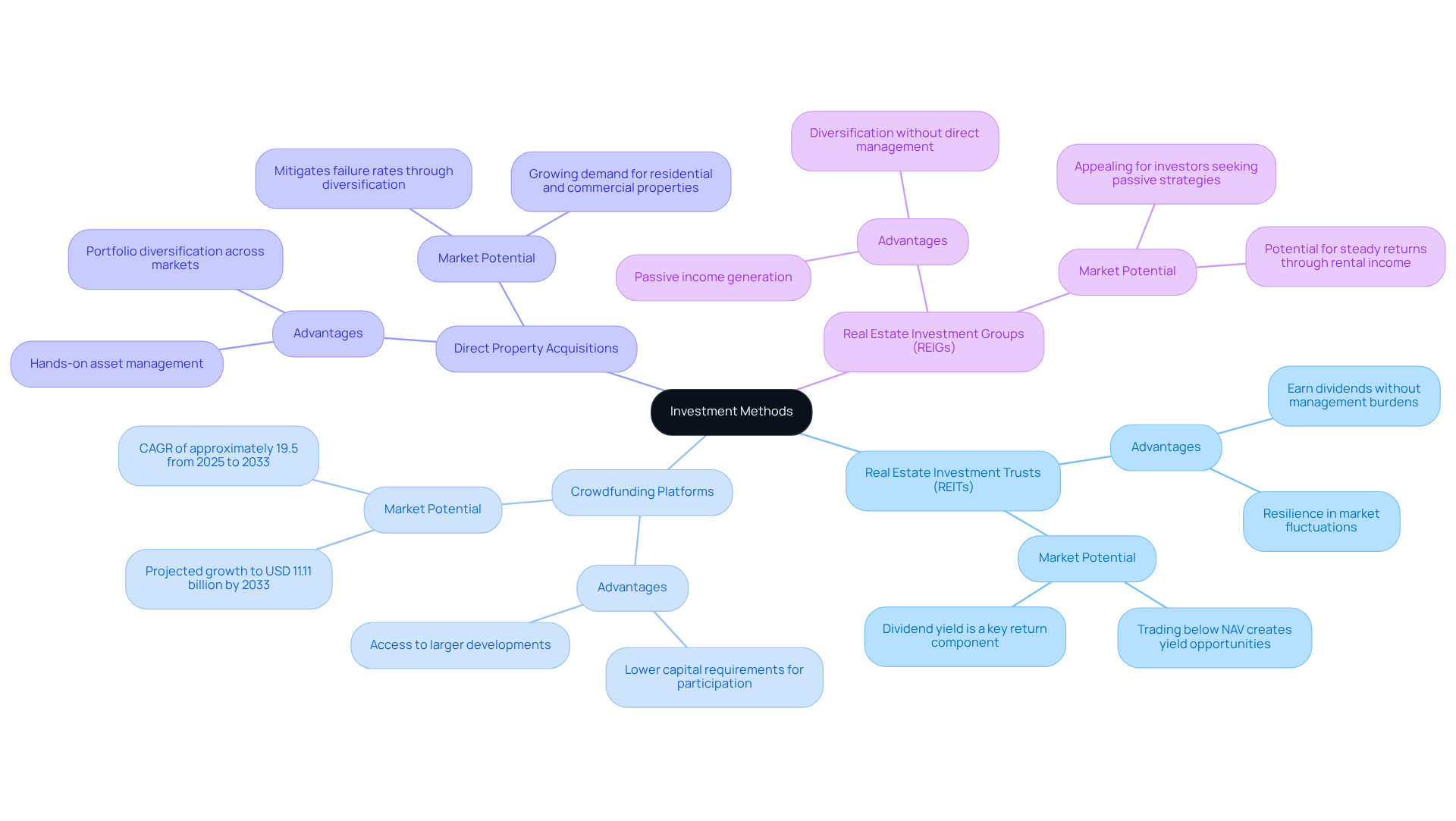

Investing in real estate online presents several methods, each characterized by distinct advantages:

-

Real Estate Investment Trusts (REITs): These companies own, operate, or finance income-producing properties, enabling investors to earn dividends without the burdens of property management. In 2025, REITs have shown remarkable resilience, with many trading below their Net Asset Value (NAV), creating opportunities for attractive dividend yields despite market fluctuations. Notably, dividend yield constitutes a critical element of a REIT's total return, drawing the attention of numerous investors.

-

Crowdfunding Platforms: These platforms allow individuals to real estate invest online by aggregating funds from various investors to finance property projects, enabling participation in larger developments with lower capital requirements. The global property crowdfunding sector is projected to experience significant growth, reaching approximately USD 11.11 billion by 2033, driven by the convenience of platforms that allow you to real estate invest online and the technology they offer. In 2024, the market size was valued at around USD 2.27 billion, underscoring the substantial growth trajectory.

-

Direct Property Acquisitions: Certain platforms enable users to real estate invest online in properties, whether through fractional ownership or by purchasing shares in specific real estate assets. This approach allows investors to take a more hands-on stance regarding their assets. By diversifying their portfolios across global markets, investors can mitigate failure rates and enhance their overall financial strategies, such as the option to real estate invest online.

-

Real Estate Investment Groups (REIGs): These organizations manage rental properties and offer a way for investors to real estate invest online by acquiring shares in the group, providing a passive approach to generating returns. REIGs can be particularly appealing for those seeking to diversify their portfolios without navigating the complexities of direct property management.

Evaluating the advantages and disadvantages of each approach is essential to determine which aligns best with your financial objectives. With the property crowdfunding sector projected to grow at a compound annual growth rate (CAGR) of approximately 19.5% from 2025 to 2033, now is an opportune time to explore these innovative financial avenues.

Select Platforms and Execute Your Investment Strategy

After researching investment methods and formulating a plan, the next crucial step is to select the right platforms and execute your strategy effectively:

-

Research platforms to identify trustworthy online platforms where you can real estate invest online. Assess key factors such as fees, minimum contribution requirements, user reviews, and the range of options available. In 2025, average fees for these platforms are expected to remain competitive, making it essential to compare costs. Significantly, the average home value in the US has risen by more than 65% in the past five years, highlighting the importance of making informed financial choices.

-

Create an Account: Register on your chosen platform and complete any necessary verification processes to ensure compliance with regulations.

-

Fund Your Account: Deposit the amount you plan to use, aligning with your predetermined funding strategy. Experts recommend starting with an amount you are comfortable risking, typically around 10% to 15% of your income.

-

Execute Your Strategy: Begin investing according to your plan. Consistently oversee your assets and be ready to modify your approach according to economic circumstances and results. As Warren Buffett advises, focus on finding undervalued opportunities rather than attempting to time the market.

By adhering to these steps, you can effectively navigate the real estate invest online landscape and work towards achieving your financial objectives.

Conclusion

Online real estate investing has revolutionized the way individuals engage in property investment, rendering it more accessible and financially viable for a wider audience. This innovative approach not only reduces entry costs but also presents diverse investment options, enabling investors to manage their assets conveniently from any location. Grasping the nuances of online investing, including the array of investment types available, is crucial for anyone eager to capitalize on this burgeoning trend.

Key insights highlighted here underscore the significance of comprehensive market research and the formulation of a robust investment plan aligned with personal financial objectives. By pinpointing target markets and scrutinizing housing trends, investors can make informed decisions that resonate with their goals. The examination of various investment methods, such as REITs and crowdfunding platforms, showcases the distinct advantages each presents, making it imperative to assess these options judiciously. Furthermore, selecting the appropriate platforms and executing a meticulously crafted strategy can substantially enhance the likelihood of success in this dynamic landscape.

Ultimately, embracing online real estate investing not only opens avenues for potential wealth creation but also empowers individuals to take charge of their financial destinies. As the market continues to evolve, remaining informed and adaptable will be essential for navigating challenges and seizing emerging opportunities. For those poised to embark on this journey, initiating research and planning can lead to rewarding investment experiences in the ever-expanding realm of real estate.