Overview

Investing successfully in mobile home parks requires a deep understanding of market dynamics, securing appropriate financing, and implementing effective management strategies. This article outlines essential steps for investors:

- Evaluate potential parks based on strategic factors such as location and occupancy rates.

- Explore various financing options that align with your investment goals.

- Establish clear management policies aimed at enhancing tenant satisfaction, which is crucial for ensuring long-term profitability.

By following these guidelines, investors can navigate the complexities of this sector with confidence.

Introduction

Investing in mobile home parks has emerged as a compelling strategy within the real estate market, offering unique advantages that attract savvy investors. The rising demand for affordable housing, coupled with the potential for stable cash flow, positions mobile home parks as a lucrative opportunity for those looking to diversify their investment portfolios. However, navigating this niche market requires a keen understanding of key metrics, effective management practices, and thorough due diligence.

How can investors capitalize on this growing sector while mitigating risks and ensuring long-term success?

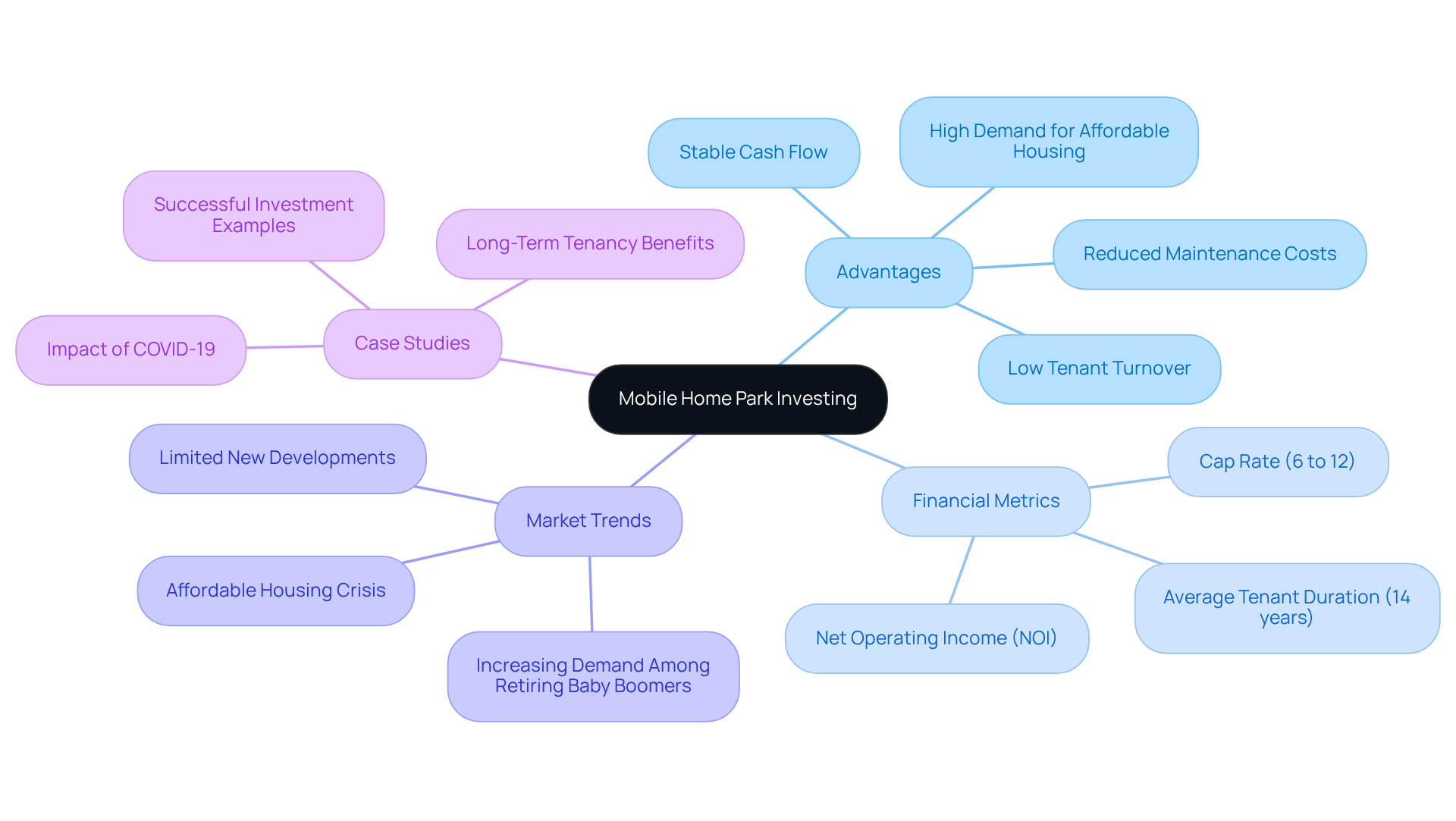

Understand the Basics of Mobile Home Park Investing

Investing in mobile home parks represents a strategic opportunity in the real estate market, focusing on acquiring land where trailers are situated. This approach allows investors to generate rental income from residents who own their trailers but lease the land. One of the significant advantages of this investment strategy is the notably reduced maintenance costs, as renters are responsible for their own property upkeep. Consequently, this arrangement leads to a stable cash flow, with manufactured housing communities boasting an average tenant duration of 14 years and an annual turnover rate of only 5%, compared to 40% in traditional apartment complexes. Notably, Sun Communities reports an annual tenant move-out rate of less than 1%, underscoring the stability of this asset class.

The demand for affordable housing continues to rise, particularly among retiring baby boomers, positioning trailer communities as a sustainable financial choice. Investors must familiarize themselves with essential concepts such as:

- 'cap rate,' which typically ranges from 6% to 12%

- 'net operating income (NOI),' a key indicator of asset profitability

Understanding these metrics is crucial for navigating the residential lot funding landscape effectively.

Successful investment case studies highlight the potential for substantial returns. For instance, one investor acquired a 100-space trailer community for $1.1 million in 2013 and later sold portions for a total of $2.2 million, illustrating the appreciation potential within this sector. Moreover, trailer communities present a unique opportunity to capitalize on limited competition due to the scarcity of new constructions, with only about ten new sites developed annually in the U.S.

In summary, investing in mobile home parks offers an attractive combination of lower expenses, consistent occupancy rates, and a growing market for affordable housing. This makes it a compelling option for investors seeking reliable returns. Additionally, prospective investors should conduct thorough due diligence, reviewing financial statements and understanding local market conditions to make well-informed financial decisions.

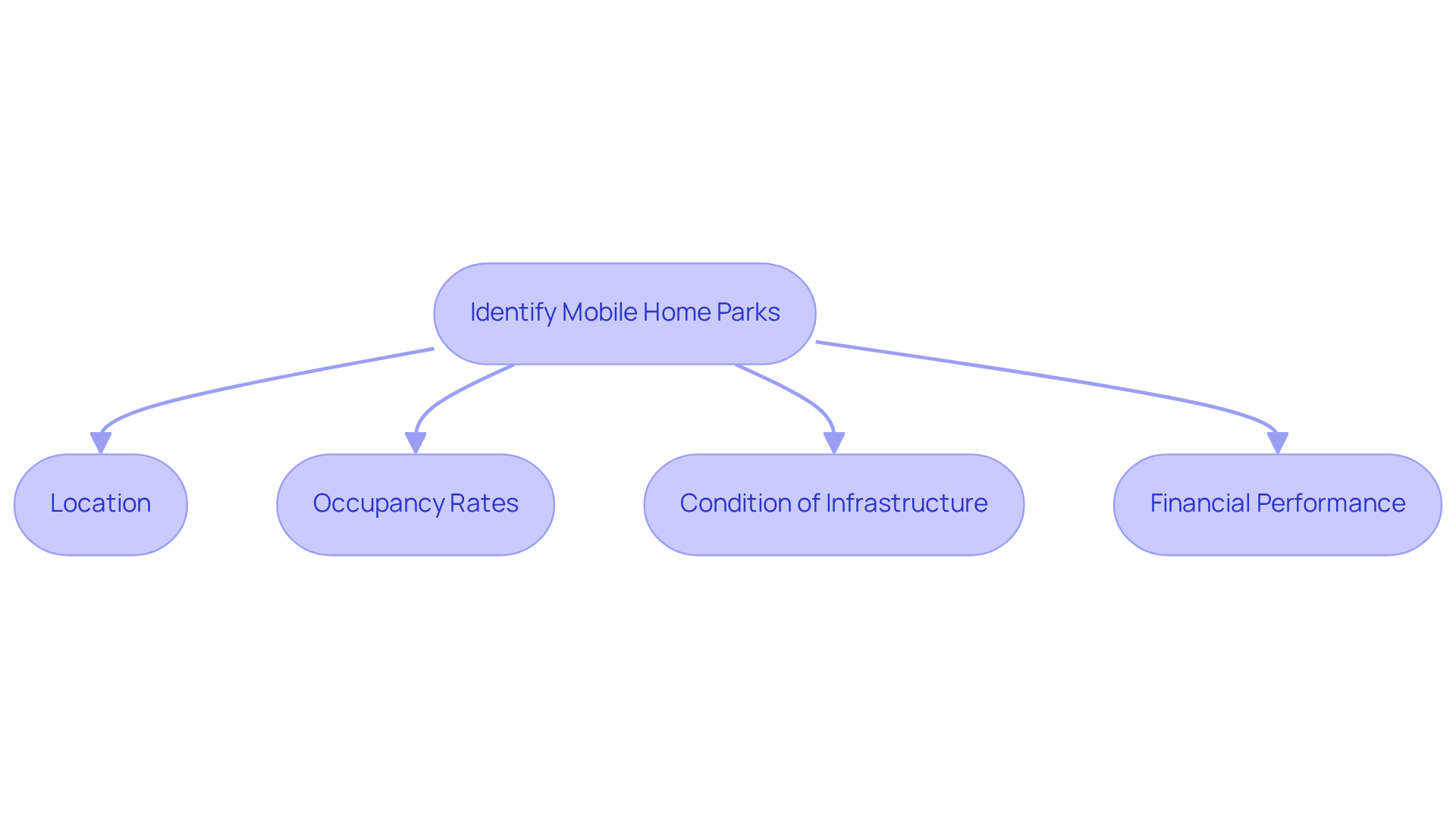

Identify and Evaluate Potential Mobile Home Parks

Begin your financial journey by investing in mobile home parks that are situated in high-demand areas for affordable housing. Harness online platforms, collaborate with local real estate agents, and leverage industry contacts to discover promising listings. When evaluating a park, consider these essential factors:

- Location: It is crucial to ensure that the park is in proximity to essential amenities and employment centers, as this greatly impacts demand.

- Occupancy Rates: High occupancy rates indicate robust demand and signal a stable investment. For example, Santa Clara County boasts an impressive occupancy rate of 100%, while Miami-Dade County also reports full occupancy.

- Condition of Infrastructure: Assess the state of roads, utilities, and community amenities to gauge potential future costs and tenant satisfaction.

- Financial Performance: Examine rent rolls and operating expenses closely. Employ metrics such as cap rate and net operating income (NOI) to evaluate profitability. The average site rent in Orange County, CA, is $1,383, whereas in Los Angeles County, it stands at $946. Conducting site visits will yield valuable insights into the property and its surrounding environment.

In 2025, capitalization rates for trailer communities are anticipated to remain competitive, underscoring the ongoing demand for budget-friendly housing options. Frank Rolfe highlights the significance of accurate data in market comprehension, asserting, "I believe you end up with around $300 per month" for average lot rents. By meticulously analyzing these factors, investors can strategically position themselves for success when investing in mobile home parks.

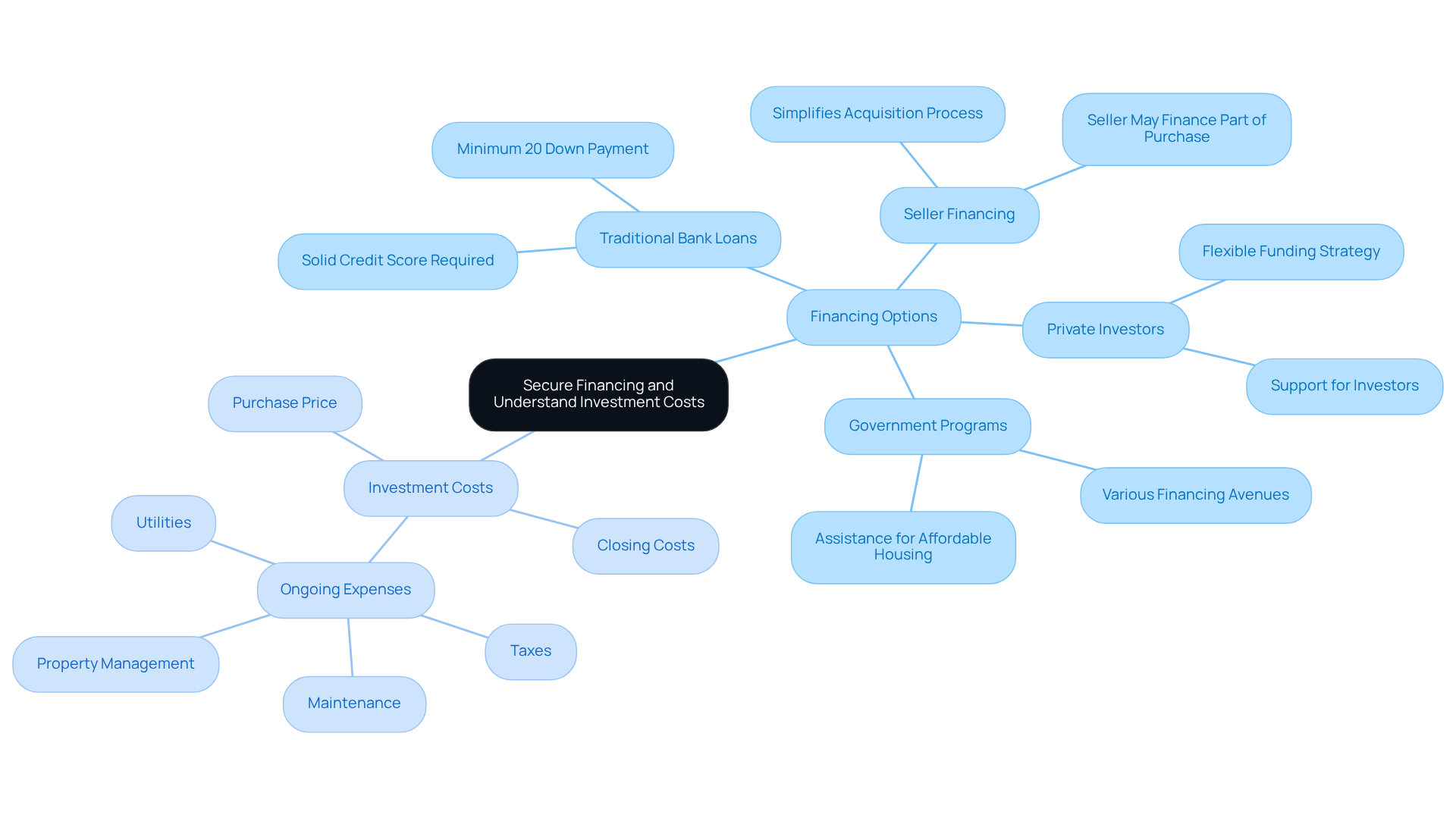

Secure Financing and Understand Investment Costs

Explore various financing options that can facilitate your investment in real estate. Traditional bank loans are a common choice, often requiring a solid credit score and a down payment. Alternatively, consider seller financing, where the seller may finance part of the purchase, thereby simplifying the acquisition process. Partnering with private investors can also be a viable funding strategy, offering flexibility and support. Additionally, government programs exist to assist with affordable housing financing, providing further avenues for potential investors.

Understanding the costs involved is crucial for successful investment. The purchase price represents the initial cost of the park, while closing costs encompass the fees associated with the transaction. Ongoing expenses, including maintenance, utilities, property management, and taxes, must also be factored into your financial planning. Creating a detailed budget will ensure that you can cover these costs while still achieving your desired return on investment.

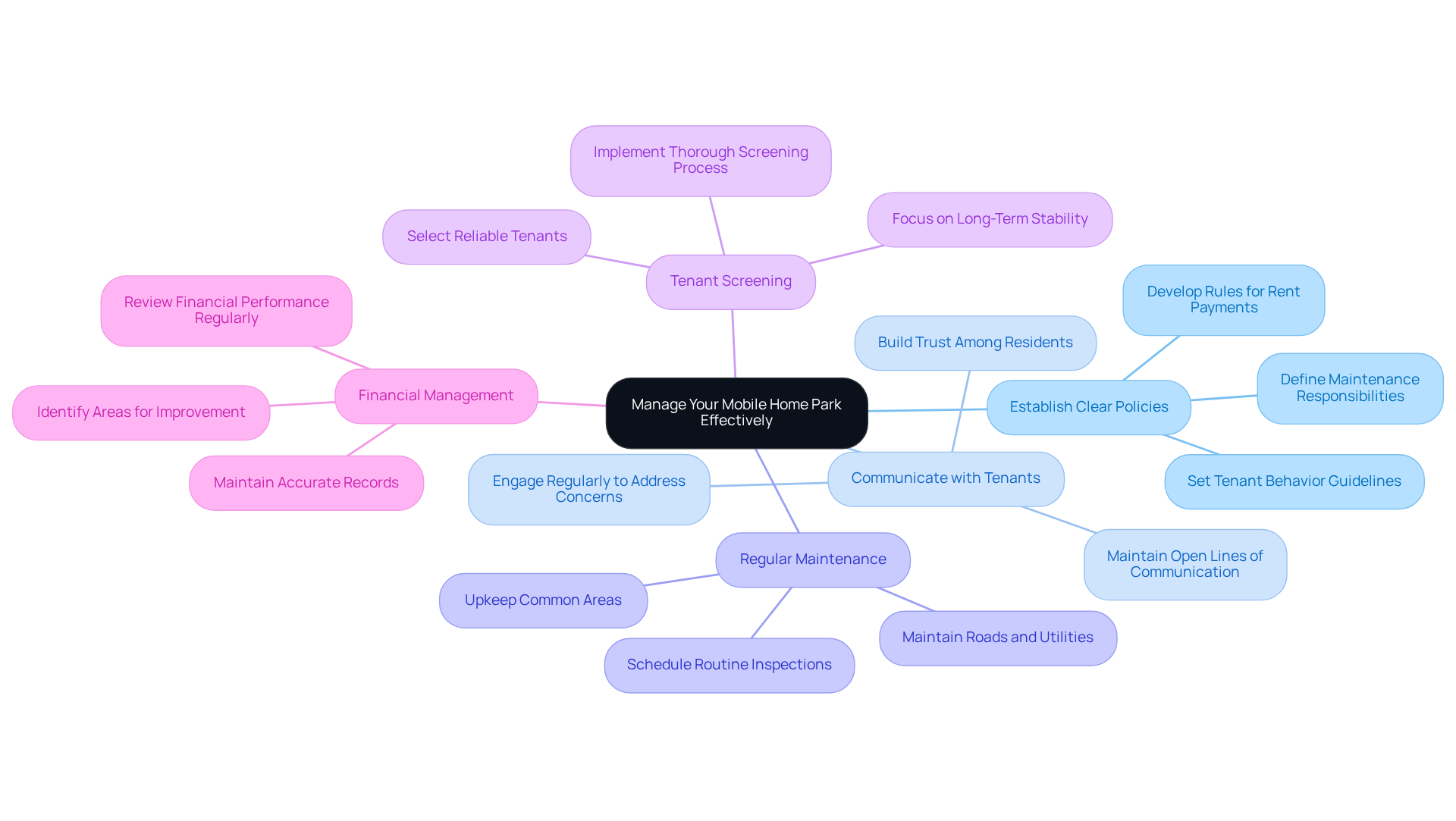

Manage Your Mobile Home Park Effectively

To manage your mobile home park effectively, consider the following key strategies:

-

Establish Clear Policies: Develop comprehensive rules regarding rent payments, maintenance responsibilities, and tenant behavior. This creates a structured living environment that benefits everyone involved.

-

Communicate with Tenants: Foster a positive community atmosphere by maintaining open lines of communication. Regular engagement not only addresses concerns promptly but also builds trust among residents, ultimately reducing turnover costs and enhancing community stability.

-

Regular Maintenance: Schedule routine inspections and maintenance to ensure the property remains in good condition. This includes the upkeep of roads, utilities, and common areas, which is crucial for tenant satisfaction and retention. Notably, well-run manufactured housing communities highlight the importance of investing in mobile home parks, as they boast the lowest maintenance costs among asset types.

-

Tenant Screening: Implement a thorough screening process to select reliable tenants. Mobile home parks typically experience a low turnover rate of around 5% annually, largely due to the high costs associated with moving mobile homes. Ensuring stable tenants can significantly enhance community stability.

-

Financial Management: Maintain accurate records of income and expenses while regularly reviewing financial performance to identify areas for improvement. This proactive approach in investing in mobile home parks helps mitigate risks and enhance profitability, ensuring the long-term success of your investment.

Conclusion

Investing in mobile home parks offers a distinctive opportunity within the real estate sector, characterized by lower maintenance costs and stable cash flow. This strategy not only addresses the growing demand for affordable housing but also enables investors to thrive in a market with limited competition due to the scarcity of new developments. Mastering the fundamentals of mobile home park investing—including key financial metrics and effective management practices—is essential for success in this niche market.

Throughout this article, we have explored vital insights, such as the necessity of assessing potential parks based on:

- location

- occupancy rates

- financial performance

The importance of securing suitable financing options and managing ongoing costs has been underscored, along with strategies for effective park management, including:

- tenant communication

- maintenance

Collectively, these elements form a robust investment strategy capable of yielding substantial returns.

As the demand for affordable housing continues to escalate, the potential for successful investments in mobile home parks remains formidable. Investors are urged to conduct thorough due diligence, leverage market data, and adopt best practices in management to optimize their investment outcomes. By taking these decisive steps, one can not only secure reliable returns but also make a positive contribution to the community by providing sustainable housing options.