Overview

This article presents four essential strategies for effectively navigating the commercial real estate (CRE) industry news:

- Understanding the industry landscape is paramount, as it lays the foundation for informed decision-making.

- Identifying credible information sources is crucial; these sources serve as the backbone of reliable insights.

- Analyzing news for strategic insights allows investors to uncover opportunities and risks within the market.

- Staying updated on market trends ensures that one remains agile in a dynamic CRE environment.

Each strategy is supported by a thorough analysis of current market conditions, recommendations for reliable sources, and the necessity of continuous information assessment, all of which empower readers to make informed decisions in this ever-evolving sector.

Introduction

In the rapidly evolving world of commercial real estate (CRE), grasping the intricacies of the market is essential for professionals aiming to thrive. Various sectors—office, retail, industrial, and multifamily properties—each present unique challenges and opportunities, making it imperative to stay informed.

As economic indicators fluctuate and demographic trends shift, the ability to analyze credible information sources and adapt to market changes can significantly impact investment success.

This article explores the current landscape of CRE, offering insights on navigating its complexities, identifying reliable data, and transforming news into strategic insights. These insights empower real estate professionals to seize emerging opportunities and mitigate risks.

Understand the Commercial Real Estate Landscape

To effectively navigate the commercial real estate industry news, professionals must first understand its current state. Recognizing the various sectors within CRE—such as office, retail, industrial, and multifamily properties—is essential. Each sector possesses unique characteristics and economic drivers. For instance, the office sector is currently experiencing a stabilization phase post-pandemic, while industrial properties are benefiting from the growth of e-commerce.

Understanding demographic shifts, such as urbanization and remote work trends, can provide valuable insights into future demand. Staying informed about commercial real estate industry news, including economic indicators such as interest rates and employment rates, is crucial, as these factors significantly impact investment opportunities and overall performance. Furthermore, the upcoming commercial real estate industry news regarding debt challenges in the U.S. for 2025 must be considered, as they pose substantial risks to investors.

Recent statistics indicate that retail foot traffic has dropped by 12% compared to the previous year; however, the sector has still achieved a 3.2% growth, propelled by stringent conditions and limited supply. This underscores the resilience of certain segments within the CRE sector despite ongoing challenges. Case studies reveal that regional performance varies significantly, with leading areas for investment including:

- Austin

- Dallas

- Nashville

- Atlanta

- Phoenix

Notably, Orange County boasts the lowest vacancy rate at 4.2%, highlighting the importance of localized economic analysis.

As Sharad Mehta, Editor, states, "Technology and sustainability will drive the industry’s evolution going forward." By synthesizing data from multiple credible sources, professionals can develop a comprehensive view of the commercial real estate industry news, which enables informed decision-making.

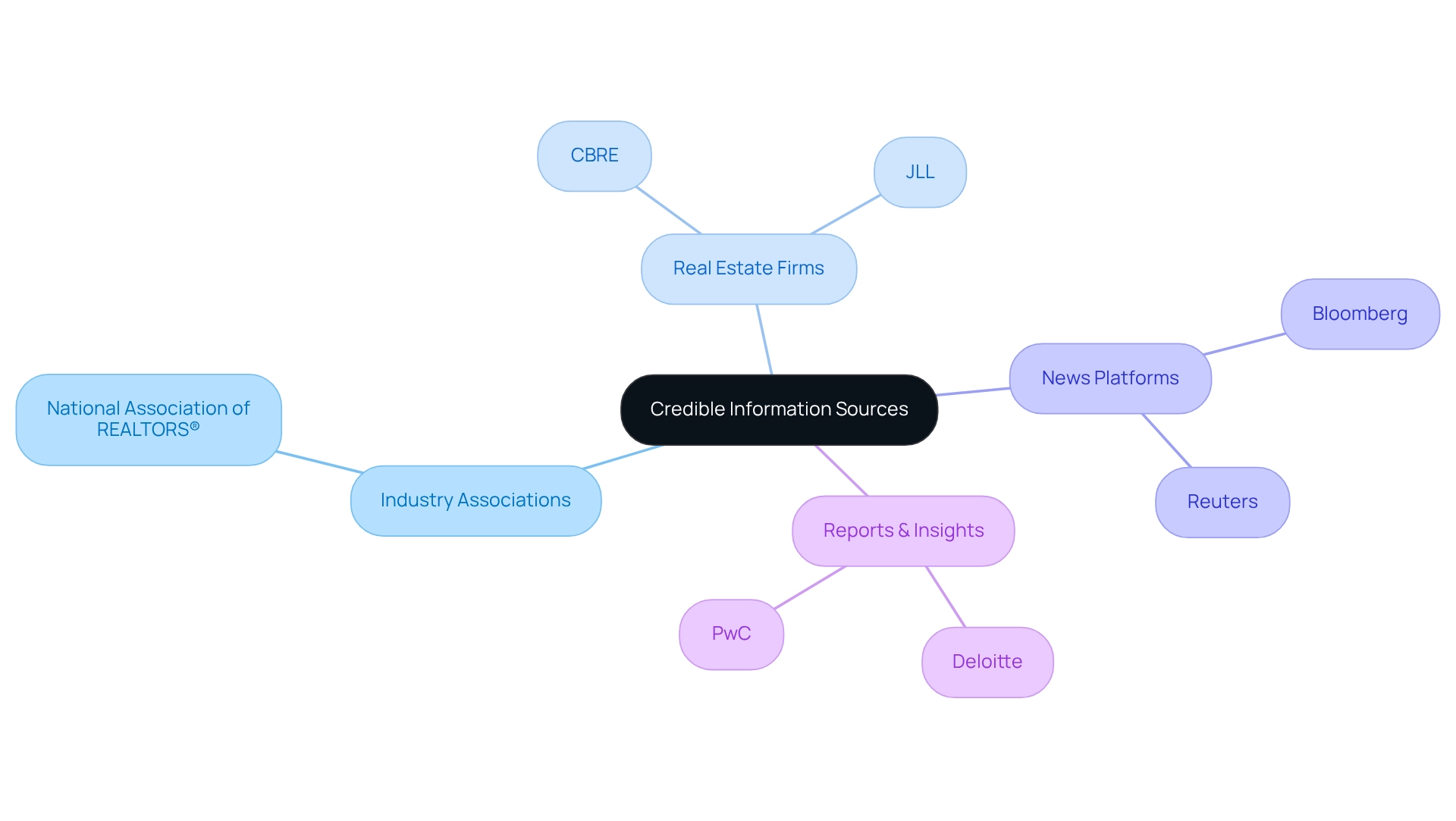

Identify Credible Information Sources

In the age of information overload, distinguishing credible sources from unreliable ones is paramount. Experts should focus on recognized publications in the commercial real estate industry news, such as:

- National Association of REALTORS®

- CBRE

- JLL

These sources provide detailed analyses and predictions. Additionally, subscribing to specialized newsletters like Zero Flux offers curated insights tailored to the commercial real estate industry news. Online platforms such as Bloomberg and Reuters deliver timely news and data about the commercial real estate industry. Interacting with industry reports from companies like Deloitte and PwC can yield valuable insights on trends and economic conditions. Deloitte emphasizes the significance of continuous performance evaluation and reassessment to adapt effectively to changes in the environment.

Furthermore, networking with industry peers and attending conferences enhances knowledge and provides access to firsthand insights. By utilizing these trustworthy sources, experts can ensure they are making decisions based on precise and pertinent information. For instance, the multifamily sector has demonstrated resilience, with an occupancy rate of approximately 95% in 2022—a statistic derived from credible sources. Moreover, institutional investors now own over 17% of rental properties in major U.S. cities, which highlights the necessity of staying informed through reliable commercial real estate industry news.

Navigating carbon markets for net-zero goals illustrates the importance of informed decision-making in sustainability efforts, emphasizing the need for due diligence in evaluating projects.

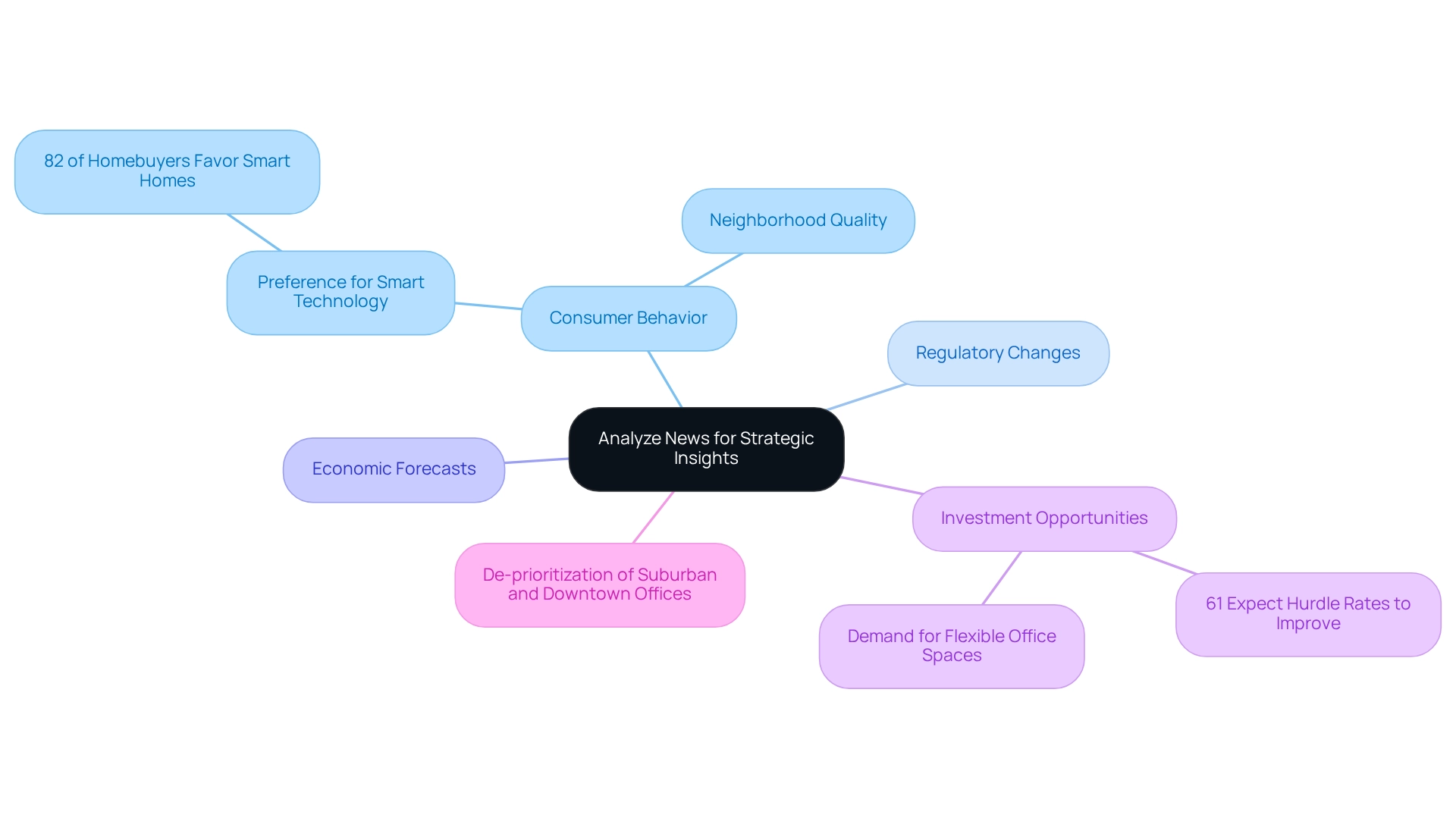

Analyze News for Strategic Insights

To effectively analyze commercial real estate industry news for strategic insights, experts must adopt a systematic approach. Begin by identifying key themes in the news, including shifts in consumer behavior, regulatory changes, or economic forecasts. A recent survey conducted in June and July of 2024 revealed that 61% of global respondents expect hurdle rates to improve over the next 12 to 18 months. This suggests a potential uptick in investment opportunities. If multiple sources report an increase in demand for flexible office spaces, it may indicate a shift in tenant preferences that could affect investment strategies.

Furthermore, professionals should assess the credibility of the information and consider the context in which it is presented. Comparing insights from various sources can help identify consensus trends or divergent opinions that warrant further investigation. For instance, consumer preferences are increasingly influencing property trends, with 82% of homebuyers favoring residences equipped with smart technology. This highlights the significance of contemporary amenities in attracting purchasers. As noted, 'These property sector statistics provide you with a significant edge over agents who are only here for a fast profit.'

Additionally, it is crucial to recognize that suburban and downtown offices have seen a de-prioritization in investment interest, which could influence strategic decisions according to commercial real estate industry news. Utilizing analytical tools and frameworks, such as SWOT analysis (Strengths, Weaknesses, Opportunities, Threats), can aid in evaluating the implications of news on specific investment opportunities. By converting news into strategic insights, individuals can position themselves to take advantage of emerging trends and mitigate potential risks, ensuring they remain competitive in the evolving commercial property landscape.

Stay Updated on Market Trends

To effectively stay informed about commercial real estate industry news, property professionals must establish a systematic routine for acquiring relevant information. This includes:

- Setting up notifications for significant commercial property terms

- Subscribing to industry newsletters

- Following prominent thought leaders on platforms such as LinkedIn to receive the latest commercial real estate industry news

Additionally, engaging in webinars and industry conferences can yield valuable insights into emerging trends and innovations as highlighted in commercial real estate industry news.

Employing data analytics tools is crucial for monitoring essential performance metrics, such as:

- Vacancy rates

- Rental prices

- Transaction volumes

Technology plays a pivotal role in gathering and analyzing property statistics, enabling experts to make data-informed choices. For instance, the National Association of Realtors (NAR) has developed metropolitan statistical area (MSA) profiles that provide detailed demographics and characteristics of home buyers across the U.S., along with median home values for over 3,100 counties. This information allows property experts to gain a deeper understanding of local conditions and buyer demographics, thereby enhancing their strategic planning and analysis.

Furthermore, participation in local property associations can provide access to regional economic reports and valuable networking opportunities. It is also essential to be mindful of common pitfalls, such as:

- Relying solely on one source of information

- Neglecting to verify data accuracy

By proactively seeking and analyzing market trends highlighted in commercial real estate industry news, professionals can remain agile and responsive to changes, positioning themselves to capitalize on emerging opportunities. Ultimately, staying informed not only enhances decision-making but also fosters a competitive edge in the dynamic real estate landscape.

Conclusion

The commercial real estate (CRE) landscape is multifaceted, demanding that professionals remain informed about its various sectors, including office, retail, industrial, and multifamily properties. Understanding market dynamics—such as demographic shifts and economic indicators—is crucial for identifying investment opportunities and mitigating risks. The resilience of certain segments, exemplified by the growth in industrial properties and the stabilization of the office sector, underscores the importance of localized market analysis and adapting to ongoing changes.

Identifying credible information sources is vital in an age where misinformation can easily proliferate. Established publications and industry reports provide invaluable insights, while networking and attending conferences enrich understanding and grant access to firsthand knowledge. By leveraging reliable data, professionals can make informed decisions that reflect current market conditions, such as impressive occupancy rates in the multifamily sector and the rising demand for smart technology in homes.

Analyzing news for strategic insights empowers professionals to pinpoint emerging trends and shifts in consumer behavior. By adopting a systematic approach to news analysis and utilizing tools like SWOT analysis, real estate professionals can transform information into actionable strategies that enhance competitiveness. Staying updated on market trends through structured routines and data analytics is essential for navigating the evolving CRE landscape.

Ultimately, success in commercial real estate hinges on the ability to synthesize information from various sources, adapt to market changes, and proactively respond to emerging opportunities. By embracing these practices, real estate professionals can not only thrive in the current environment but also position themselves for future success in a dynamic industry.