Overview

The five essential steps for conducting a successful real estate comparative market analysis (CMA) are as follows:

- Gathering property information

- Selecting comparable properties

- Adjusting for property differences

- Compiling the findings

- Presenting the CMA report

Each of these steps plays a crucial role in ensuring a comprehensive evaluation of property values. Through systematic data collection, comparison, and clear communication of insights, these steps ultimately enhance decision-making for clients navigating the real estate market. This structured approach not only provides clarity but also empowers clients with the knowledge they need to make informed investment choices.

Introduction

In the competitive realm of real estate, understanding property values is crucial for success. Comparative Market Analysis (CMA) stands as a pivotal tool in this process. By meticulously comparing a specific property to similar homes recently sold in the area, real estate professionals can derive accurate market valuations that inform pricing strategies and investment decisions.

This article delves into the intricacies of conducting a CMA, including:

- Gathering essential property information

- Selecting appropriate comparables

- Making necessary adjustments

With insights into current market trends and effective presentation techniques, readers will discover how to leverage this structured approach to enhance their real estate practices and achieve favorable outcomes for their clients.

Define Comparative Market Analysis (CMA)

A real estate comparative market analysis (CMA) is an essential tool used by real estate professionals to assess the value of a specific asset by comparing it to similar assets that have recently sold in the same area. This analysis encompasses various factors, including location, size, condition, and unique characteristics of the assets under review. By systematically gathering and analyzing information from multiple sources, agents can derive a data-driven assessment of a property's worth. This process is vital for establishing competitive listing prices and making informed purchasing decisions.

The importance of conducting a comprehensive real estate comparative market analysis cannot be overstated. It acts as a fundamental component in justifying pricing strategies to clients, enabling agents to effectively convey the reasoning behind their pricing recommendations. As industry expert Sharad Mehta emphasizes, 'Adopting the practice of performing a comprehensive real estate comparative market analysis is crucial for anyone involved in real estate.' Additionally, being equipped to address inquiries regarding adjustments bolsters the credibility of the agent's advice.

In 2025, the relevance of real estate comparative market analysis continues to grow, as real estate professionals increasingly rely on active and pending listings to understand current market dynamics and their impact on property values. This dependence on data-driven insights is mirrored in the success stories of agents who have adeptly utilized real estate comparative market analysis (CMA) to enhance decision-making in real estate transactions. It is crucial to recognize that leveraging these listings necessitates professional expertise to accurately interpret their implications for home values. By adhering to a structured approach for real estate comparative market analysis, agents can ensure precise valuations of properties, ultimately leading to more successful outcomes for their clients. This structured methodology will be further elaborated upon in the following sections.

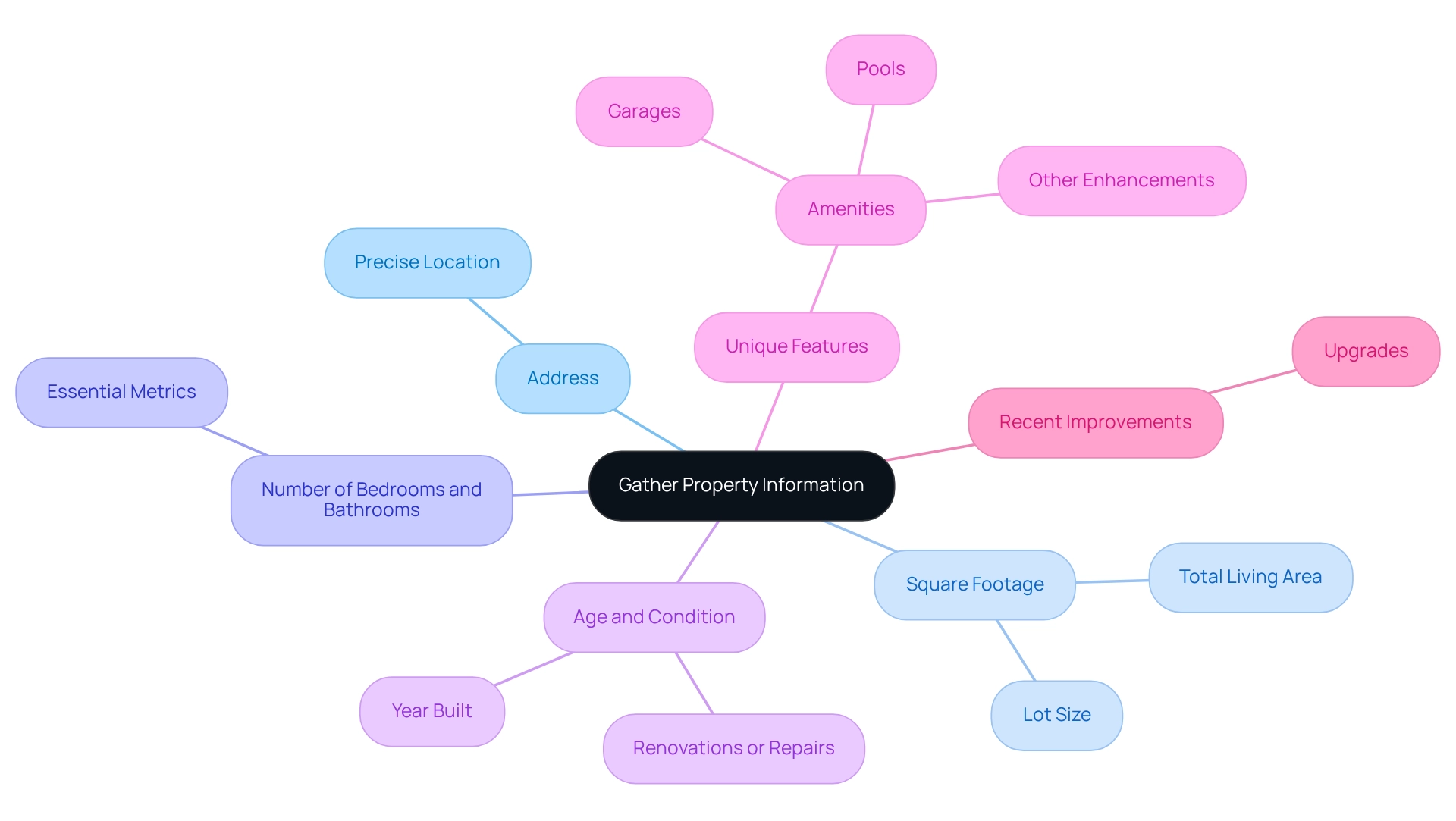

Gather Property Information

To initiate the Comparative Market Analysis (CMA) process, it is imperative to gather comprehensive details about the subject asset. Key data points to consider include:

- Address: The precise location of the asset.

- Square Footage: Both the total living area and the lot size are vital for accurate comparisons.

- Number of Bedrooms and Bathrooms: These fundamental metrics are essential for evaluating similar assets.

- Age and Condition: Documenting the year built and noting any renovations or repairs that may influence value is crucial.

- Unique Features: Consider amenities such as pools, garages, or other enhancements that could affect marketability.

- Recent Improvements: Highlight any upgrades that enhance the asset's appeal and value.

This information can be gathered through various channels, including public records, listings, and direct observation. Utilizing the Multiple Listing Service (MLS) database proves particularly beneficial, as it serves as a key resource for obtaining the most current 'sold' data, ensuring accuracy in your analysis. By adhering to these best practices, you can create a robust CMA that supports informed real estate decisions. Furthermore, emerging trends in home valuation, such as enhanced data collection methods, can further assist in gathering real estate information for CMAs, thereby improving the accuracy and efficiency of your analysis. By meticulously documenting unique features and recent improvements, you ensure a comprehensive overview that is vital for precise asset valuation.

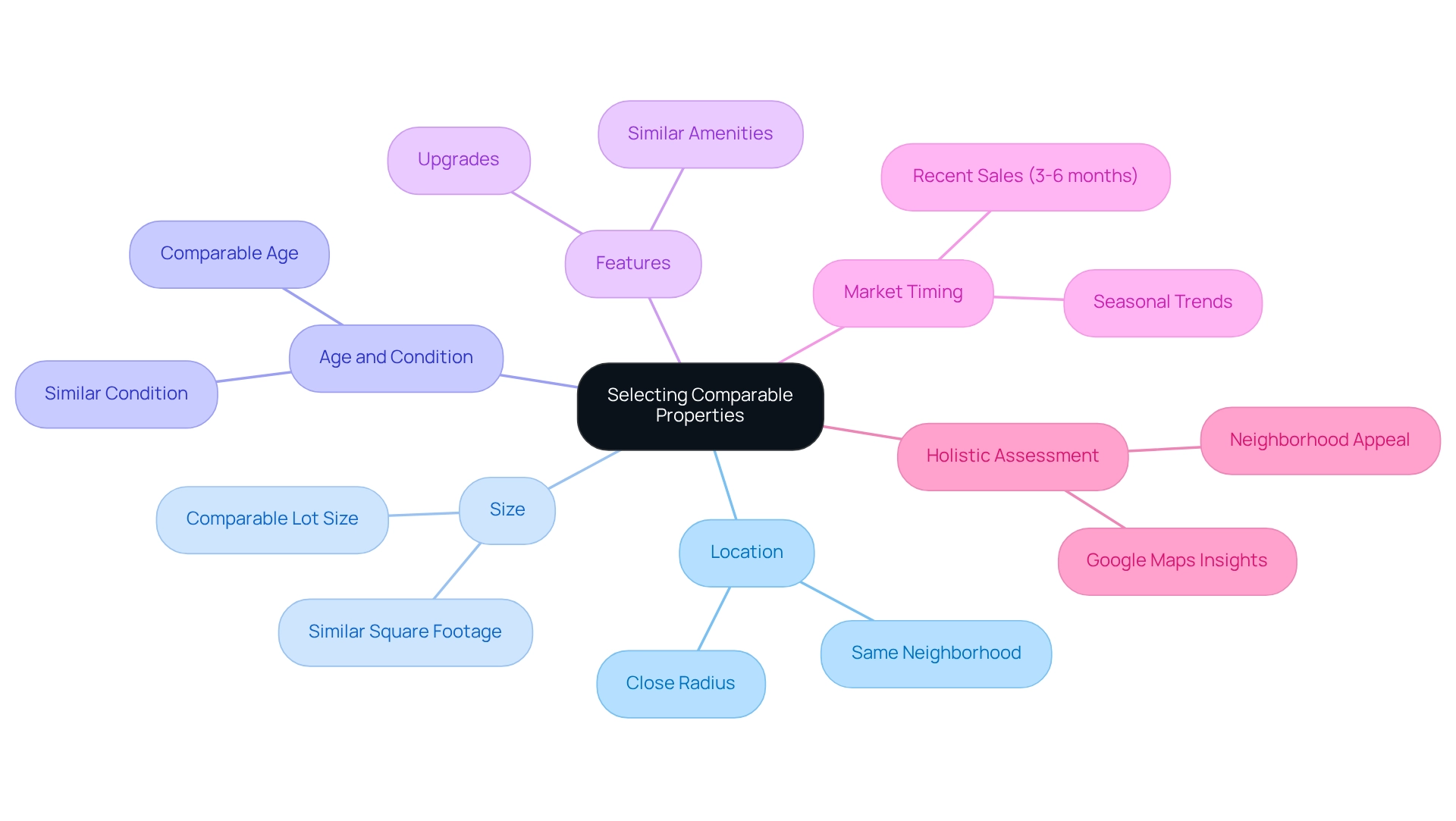

Select Comparable Properties

Selecting comparable assets, or 'comps', is a critical step in conducting a Comparative Market Analysis (CMA). The objective is to pinpoint homes that closely resemble the subject property based on several key criteria:

- Location: Prioritize properties ideally located within the same neighborhood or a close radius to ensure relevance.

- Size: Seek homes with similar square footage and lot size to maintain comparability.

- Age and Condition: Opt for assets of similar age and in comparable condition to accurately reflect value.

- Features: Take into account homes with similar amenities and upgrades, as these can significantly influence pricing.

To ensure the data reflects current market conditions, aim to select at least three to five comps that have sold within the last three to six months. This timeframe is essential, as real estate activity often fluctuates with the seasons; for example, winter sales typically lag behind those in spring or summer, impacting the availability and pricing of comps. Understanding these seasonal patterns can aid investors in selecting the most suitable assets.

Leverage local Multiple Listing Services (MLS) and real estate databases to uncover these assets. Furthermore, a comprehensive approach can enhance your analysis; exploring the locations or utilizing resources like Google Maps Street View can provide insights into neighborhood appeal and amenities. As highlighted in the case study titled 'Assessing Neighborhood Factors,' this method assists in identifying potential advantages or disadvantages that could affect real estate value, leading to a more informed pricing strategy.

Expert recommendations underscore the necessity of a meticulous selection process. As industry expert Ilona Bray, J.D., states, "With the list of similar listings, the views of agents, a potential appraisal report, and your own thorough assessment of your home and others, you'll likely determine a probable value—or at least a range." By adhering to these guidelines, investors can adeptly navigate the complexities of real estate valuation through a real estate comparative market analysis and make well-informed decisions in the current economic landscape.

Adjust for Property Differences

After selecting comparable assets, the next crucial step in the real estate comparative market analysis is to adjust for variations between the subject asset and its comparables. Key factors to consider include:

- Square Footage: Adjustments should be made based on size discrepancies, typically calculated using a price per square foot method. This ensures that the assessment accurately reflects the true worth in relation to the scale of the assets.

- Condition: Evaluate the state of the subject asset compared to the comparables. If the subject asset is in excellent or poor condition, its worth should be adjusted accordingly to reflect these differences.

- Features: Unique characteristics can significantly impact worth. For instance, properties with features such as a swimming pool or a finished basement may justify an increase in value, while the absence of such attributes might necessitate a reduction.

- Market Conditions: Consider any changes in market conditions since the comparables were sold. Adjustments may be needed to account for trends that could influence asset prices, such as fluctuations in demand or economic factors.

As Robert Kiyosaki wisely remarked, 'Real estate investing, even on a very small scale, remains a proven method of creating an individual’s cash flow and wealth.' Understanding these adjustments is essential for investors aiming to enhance their financial portfolios by utilizing a real estate comparative market analysis. It is crucial to document these adjustments meticulously, as they provide a transparent basis for your final valuation in the context of a real estate comparative market analysis. This thorough approach not only bolsters the credibility of your real estate comparative market analysis but also positions you as a knowledgeable advisor, capable of simplifying complex financial aspects for clients. As George Choy reminds us, 'Property mistakes are like a bad haircut…they grow out in the end,' emphasizing the importance of careful adjustments in the real estate comparative market analysis process as a learning opportunity for investors. By applying these techniques, you can effectively navigate the intricacies of asset valuation and make informed investment choices, as illustrated in the case study titled 'The Financial Arithmetic of Real Estate,' which emphasizes how understanding financial aspects enhances trust and decision-making for clients.

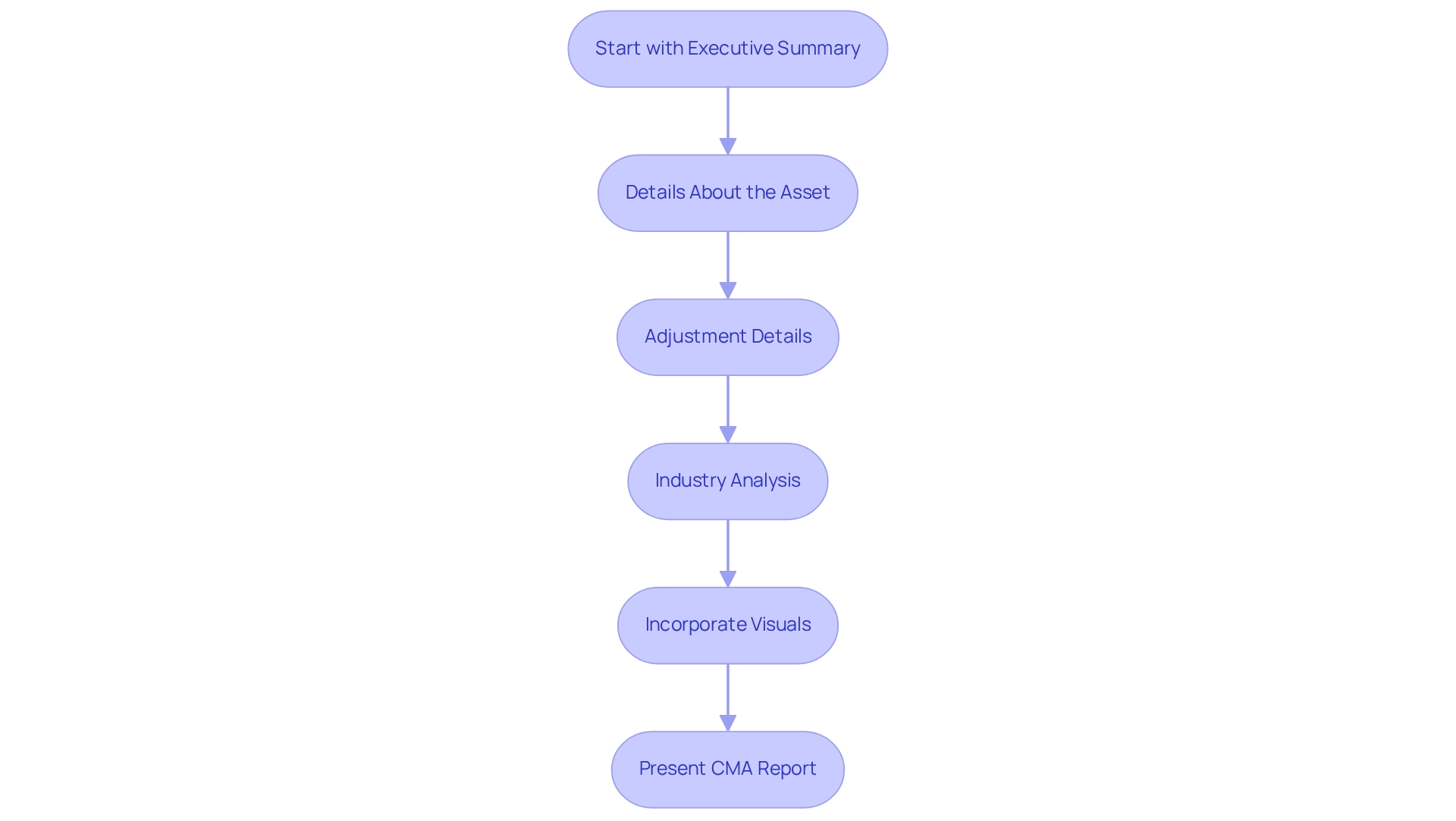

Compile and Present the CMA

To create an effective Comparative Market Analysis (CMA) report, begin by compiling your findings into a structured format that includes the following key elements:

- Executive Summary: Start with a concise overview of the CMA findings, summarizing the essential insights that will guide your clients.

- Details About the Asset: Provide comprehensive information regarding the subject asset alongside the chosen comparable assets (comps), ensuring clarity on the specifics that influence worth.

- Adjustment Details: Clearly articulate the adjustments made to the comps, explaining the rationale behind each adjustment to enhance understanding.

- Industry Analysis: Include insights into current trends that could impact property values, drawing on recent data to support your analysis. Staying informed about these trends is crucial, as highlighted by Zero Flux, which compiles 5-12 handpicked real estate insights daily.

- Visuals: Incorporate effective visuals such as graphs or charts that illustrate key data points, making complex information more accessible and engaging for your clients. Emphasizing the importance of visual data in real estate comparative market analysis presentations can significantly enhance client understanding.

Present the CMA in a polished, professional format that prioritizes readability and visual appeal. This report will not only serve as a critical tool for discussions about pricing strategies but also reinforce your credibility as a knowledgeable real estate professional by utilizing a real estate comparative market analysis. As noted, "Whether you’re helping a buyer make a competitive offer in a hot market or pricing a home to sell for top dollar, a strong CMA can be the one piece of your presentation that will sell your client on you and your brand." By utilizing effective presentation techniques, such as visually appealing slides and clear explanations, you can engage clients more effectively, even in virtual settings. This approach is particularly beneficial when addressing client questions about the CMA process, as illustrated in the case study on presenting CMA results to first-time home buyers, fostering trust and ensuring a positive experience.

Conclusion

Understanding and conducting a Comparative Market Analysis (CMA) is an essential skill for real estate professionals who seek to navigate the complexities of property valuation. By gathering comprehensive property information, selecting appropriate comparable properties, and making necessary adjustments, agents can derive accurate market valuations that serve as the foundation for informed pricing strategies and investment decisions.

The process begins with meticulous data collection, ensuring that every relevant detail about the subject property is accounted for. Selecting comparables that closely match the subject property in terms of location, size, condition, and features is crucial for an effective analysis. Thoughtful adjustments for any differences between the properties must be made to accurately reflect market conditions and the unique characteristics of the subject property.

Finally, compiling and presenting the CMA in a clear, structured format enhances the communication of findings to clients. A well-prepared CMA not only justifies pricing strategies but also reinforces the agent’s credibility and expertise. As the real estate landscape continues to evolve, mastering the CMA process is vital for achieving favorable outcomes and maintaining a competitive edge in the market. By leveraging these insights, real estate professionals can better serve their clients and make informed decisions that lead to successful transactions.