Overview

This article delineates five essential steps for achieving success in online real estate investment. These steps encompass:

- Understanding the fundamentals of real estate

- Establishing an online investment platform

- Conducting thorough market research

- Planning finances meticulously

- Managing investments effectively

Each step is fortified by practical strategies, such as:

- Leveraging technology

- Exploring diverse funding options

- Adapting to market fluctuations

Collectively, these strategies enhance the investor's capacity to navigate the complexities of the real estate market and make informed decisions.

Introduction

Navigating the world of real estate investment is both exhilarating and daunting, particularly for newcomers eager to build wealth through property. Understanding foundational concepts—from various property types to effective investment strategies—is essential for making informed decisions.

As the real estate market evolves rapidly, investors must adapt to trends such as smart technology integration and changing consumer preferences. This comprehensive guide delves into the core elements of real estate investment, offering insights on:

- Setting up an online investment platform

- Conducting market research

- Planning finances

- Managing investments effectively

By equipping oneself with the right knowledge and tools, aspiring investors can confidently embark on their journey toward financial success in the dynamic realm of real estate.

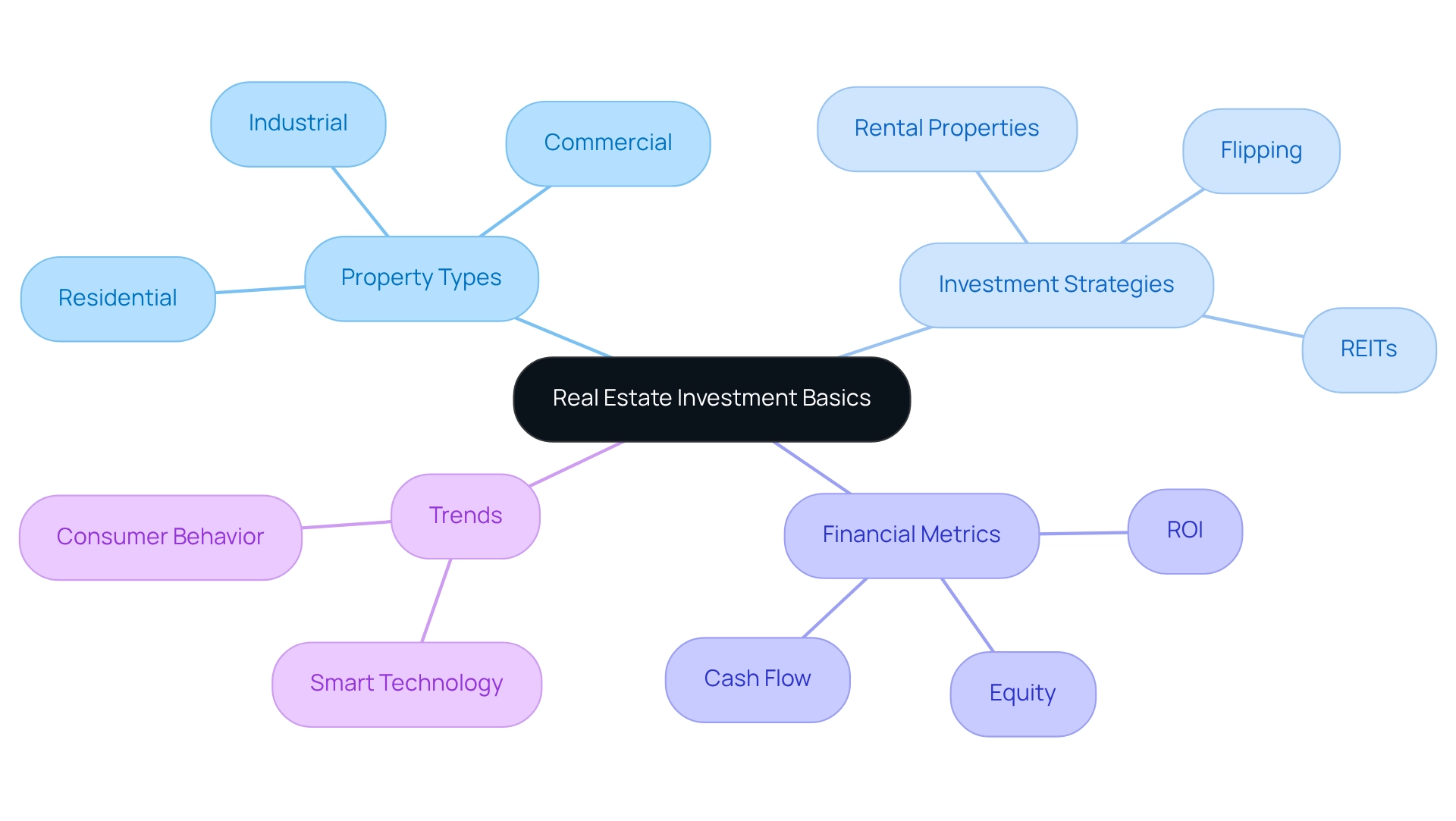

Understand the Basics of Real Estate Investment

To embark on your property acquisition journey, it is crucial to grasp fundamental concepts, including various property categories—residential, commercial, and industrial—and effective acquisition strategies such as buy-and-hold, flipping, and rental properties. Understanding key financial terms like cash flow, equity, and return on investment (ROI) is vital for assessing potential investments. Resources like Investopedia and BiggerPockets offer extensive glossaries and articles that can help you build a solid foundation in real estate.

Property Types: Distinguishing between residential, commercial, and industrial properties is essential, as each type possesses unique characteristics and market dynamics. Notably, San Francisco remains the most expensive city for tenants globally, with the average rent for a one-bedroom apartment nearing $3,500 each month. This reality underscores the importance of understanding local economic conditions.

Investment Strategies: Delve into various strategies, including rental properties, house flipping, and property trusts (REITs), to discover what aligns with your objectives. The commercial real estate sector in the U.S. generated an impressive $1.2 trillion in revenue in 2022, indicating robust potential for financial opportunities, especially with anticipated improvements in affordability and sector stabilization.

Financial Metrics: Mastering the calculations for cash flow and ROI is crucial for effectively evaluating the viability of your assets.

Recent trends reveal a growing preference for properties equipped with smart technology, with 82% of homebuyers prioritizing such features. This shift highlights the importance of understanding consumer behavior in shaping market demand and its impact on financial decisions. As you contemplate your financial journey, remember that true wealth encompasses the freedom to live life according to your preferences. Engaging in introductory courses on platforms like Udemy or Coursera can further enhance your understanding of these essential property fundamentals. Additionally, staying informed about how technology and sustainability are influencing the development of the commercial real estate sector will be vital for your future financial strategies.

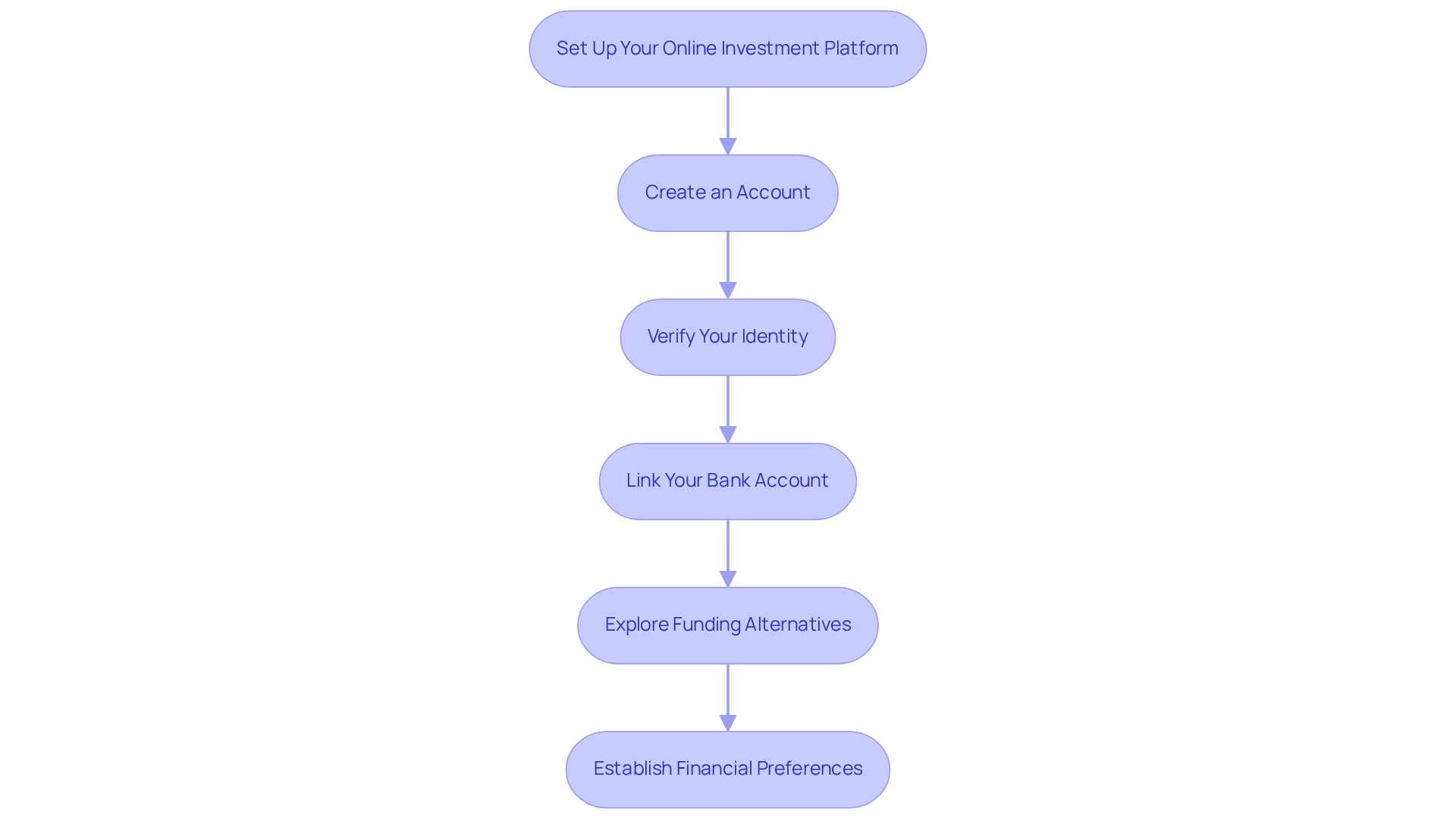

Set Up Your Online Investment Platform

To establish your online funding platform, start by researching reputable options such as Fundrise, RealtyMogul, and Crowdstreet. These platforms cater to various funding strategies, including crowdfunding, REITs, and direct property acquisitions, allowing you to align your selection with your financial goals. Once you have chosen a platform, follow these steps:

- Create an Account: Register by providing the necessary personal information.

- Verify Your Identity: Complete any required identity verification processes to meet regulatory standards.

- Link Your Bank Account: Connect your bank account to enable funding for your financial ventures.

- Explore Funding Alternatives: Familiarize yourself with the various financial opportunities and tools offered on the platform.

- Establish Financial Preferences: Customize your financial preferences based on your risk tolerance and monetary objectives.

The online property funding sector is experiencing significant growth in real estate investment online, with platforms like Fundrise attracting over 1 million users and RealtyMogul featuring approximately 200,000 users, demonstrating the increasing interest in digital funding options. By 2025, the global real estate sector is projected to expand at a compound annual growth rate (CAGR) of 9.6%, underscoring the potential for profitable opportunities. Successful investors emphasize the importance of selecting platforms for real estate investment online that not only offer robust options but also provide a seamless user experience, ensuring that your financial journey is both effective and satisfying. As Warren Buffet wisely stated, "Investing is placing capital in productive assets where ideally these assets should have the ability in inflationary times to deliver output that will retain its purchasing power value." This highlights the critical nature of choosing the right investment platforms, especially in an environment at the intersection of challenges and opportunities.

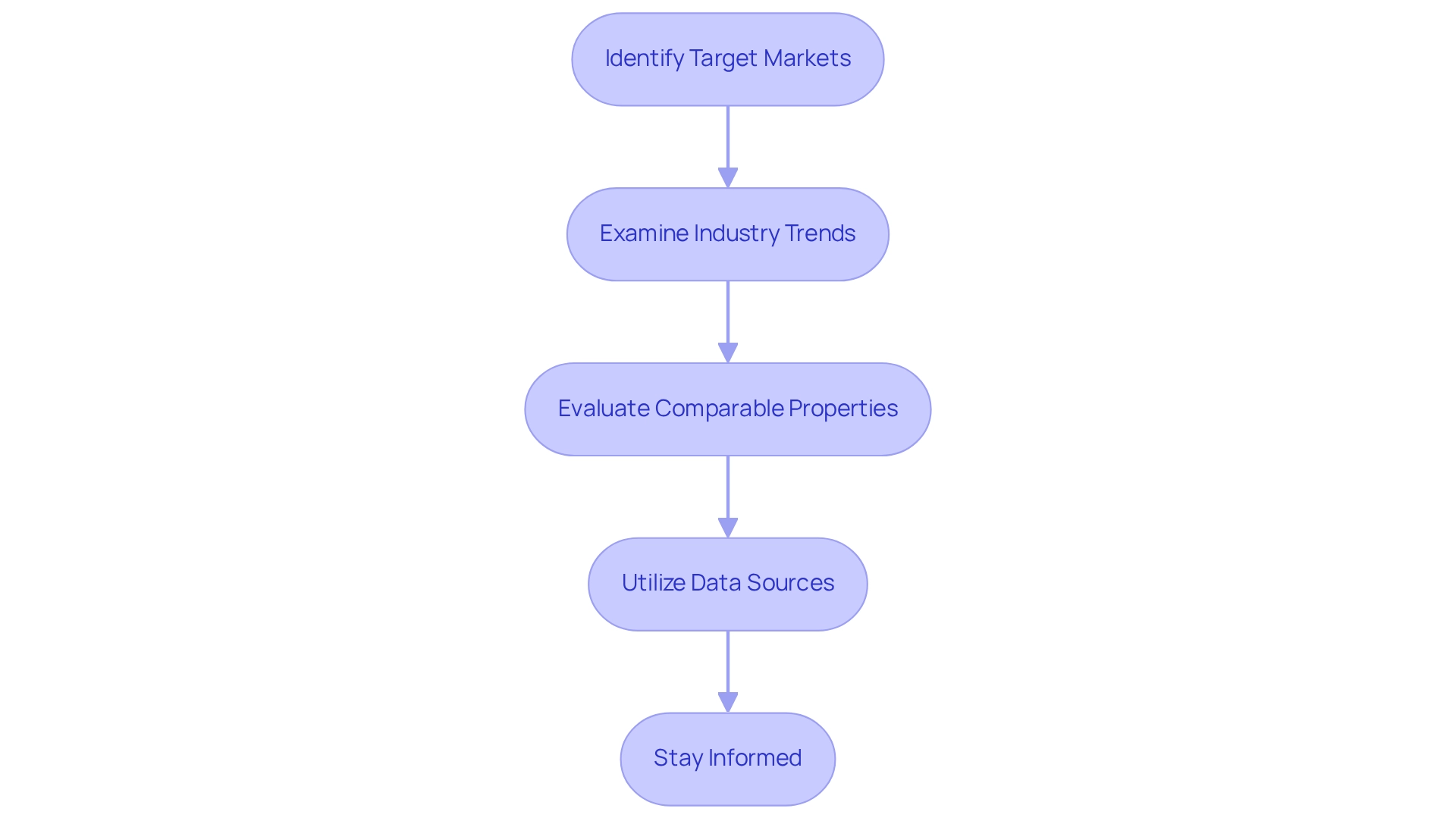

Conduct Market Research and Analyze Opportunities

Carrying out comprehensive industry research involves several essential steps:

-

Identify Target Markets: Focus on regions displaying strong economic indicators, such as job growth and population increases. For example, areas with a 5% increase in job opportunities often correlate with rising housing demand. Additionally, it is noteworthy that 5% of residences are sold through property auctions, indicating activity in specific neighborhoods.

-

Examine Industry Trends: Utilize platforms like Zillow and Redfin to track property values, rental rates, and overall demand. Current trends reveal that approximately 15% of homes sold feature advanced home automation systems, reflecting modern buyer preferences. CoreLogic highlights that smart home systems are increasingly becoming essential for contemporary buyers, making it crucial to incorporate these preferences into your analysis.

-

Evaluate Comparable Properties: Assess similar properties in the vicinity to determine pricing and potential returns. This comparative analysis is vital for understanding the competitive landscape, especially in desirable areas such as master-planned communities, which have demonstrated strong sales performance.

-

Utilize Data Sources: Leverage resources like the U.S. Census Bureau for demographic insights and local government websites for zoning and development plans. Insights from the case study on the research methodology of Verified Market Research underscore the importance of both qualitative and quantitative analysis in the property sector, aiding stakeholders in making informed decisions.

-

Stay Informed: Regularly subscribe to property newsletters, including Zero Flux, to receive daily insights on trends and opportunities. This practice helps investors remain updated on the latest advancements, including the increasing prevalence of smart home systems, which are becoming crucial elements for modern buyers in real estate investment online. By adhering to these steps, investors can effectively navigate the complexities of the property market and identify profitable opportunities.

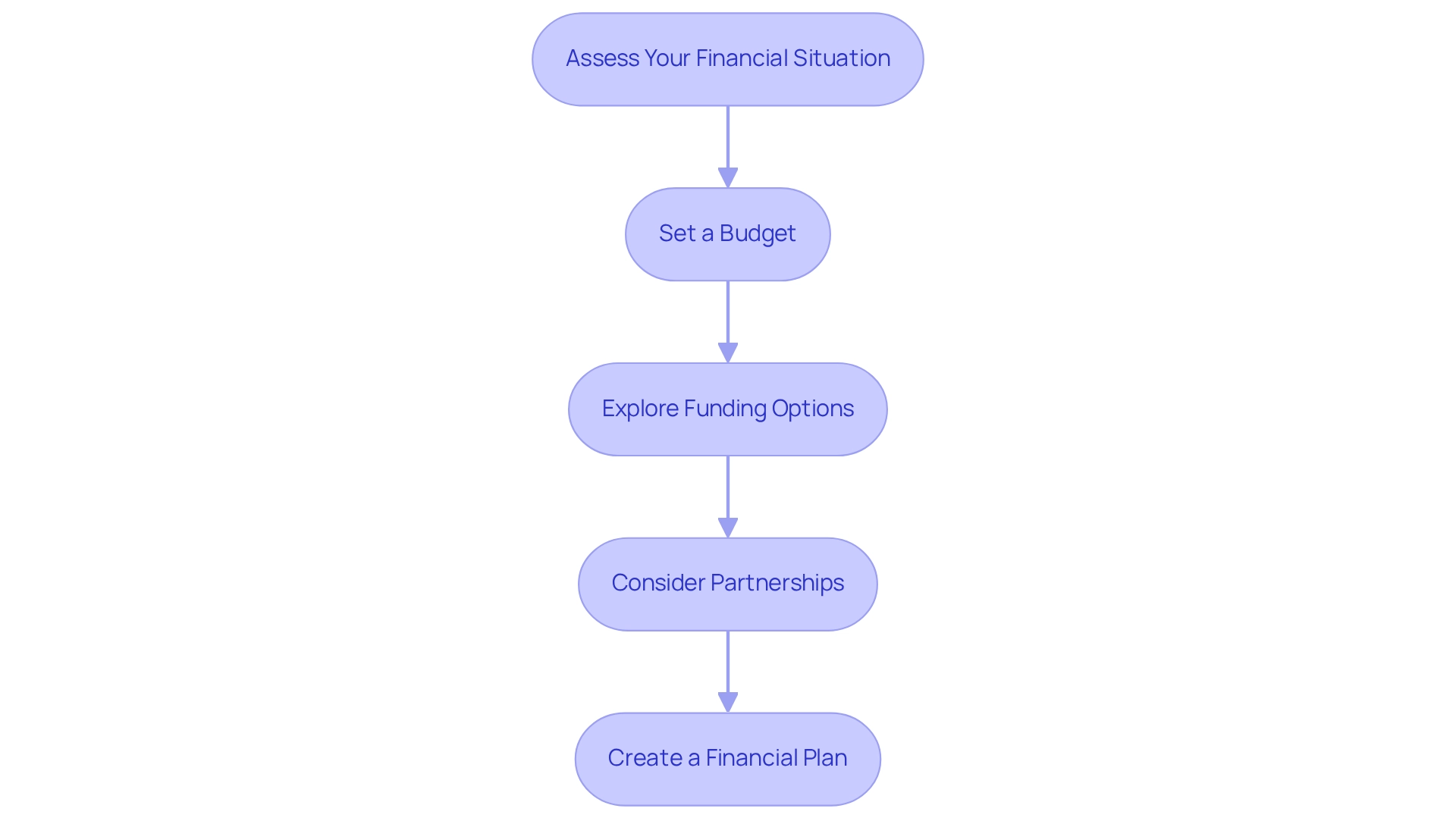

Plan Your Finances and Explore Funding Options

To effectively plan your finances for real estate investment, consider the following steps:

- Assess Your Financial Situation: Begin by calculating your net worth, income, and expenses. As Hal M. Bundrick, CFP®, states, "Net worth is what you own minus what you owe." This assessment provides a clear picture of your funding capacity and helps identify any financial gaps.

- Set a Budget: Establish a budget that outlines how much you can allocate for real estate ventures. This budget should ensure your financial stability remains secure while allowing for potential growth in your asset portfolio. Notably, 82% of Americans are missing out on high-yield savings accounts, which could serve as a valuable tool for your financial strategy.

- Explore Funding Options: Investigate various financing methods available in 2025, such as traditional mortgages, hard money loans, and property crowdfunding. Crowdfunding platforms raised nearly $20 billion in global real estate funding in 2023, showcasing a growing trend that investors can utilize. Resources like NerdWallet and Investopedia provide comprehensive comparisons of these financing options, aiding in informed decision-making.

- Consider Partnerships: If capital constraints are a concern, consider forming partnerships with other investors. Pooling resources can enhance your purchasing power and diversify your portfolio, making it easier to manage larger projects.

- Create a Financial Plan: Develop a comprehensive financial strategy that outlines your funding objectives, potential funding sources, and anticipated returns. This plan should also address the financial challenges highlighted by the disparity between the median homebuyer income of $106,500 and the median household income of $80,610, underscoring the barriers many face in the housing market. As Suze Orman recommends, individuals contemplating financial opportunities should reevaluate their monetary circumstances to prevent significant financial errors.

By adhering to these steps, you can strategically position yourself for success in real estate investment online, ensuring that your financial foundation is robust and your strategies are well-informed.

Manage Your Investments and Navigate Challenges

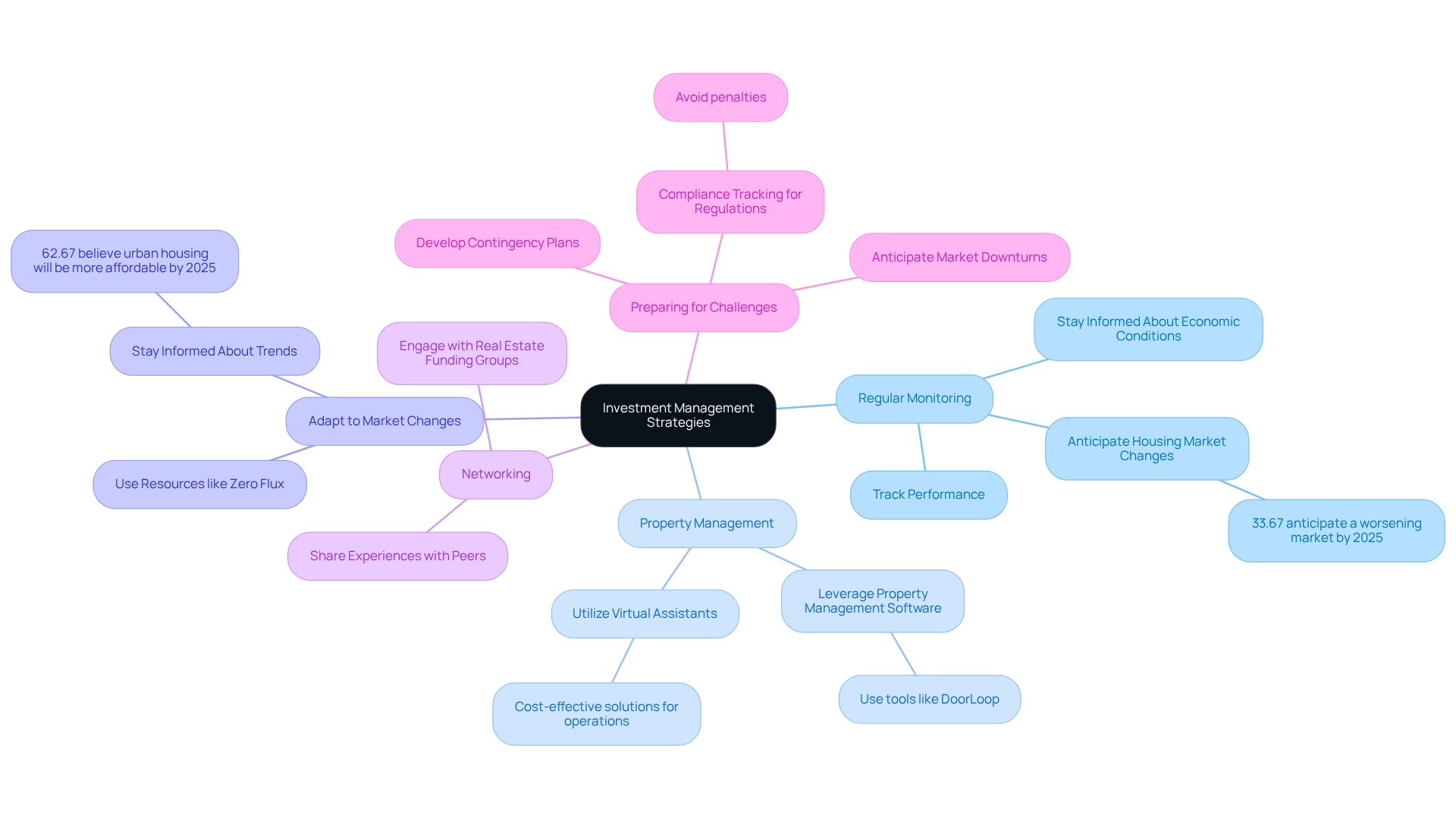

Managing your investments effectively requires a multifaceted approach.

Regular Monitoring: Consistently track your properties' performance and remain informed about economic conditions. This vigilance enables prompt decision-making, essential in a changing environment where 33.67% of investors anticipate a deteriorating housing landscape by 2025.

Property Management: For rental property owners, leveraging property management software can significantly streamline operations. Tools like DoorLoop enhance efficiency, allowing property managers to adapt and thrive in a competitive environment. Additionally, utilizing virtual assistants can provide cost-effective solutions for managing daily operations and tenant interactions.

Adapt to Market Changes: Stay informed about evolving market trends and be prepared to adjust your strategies. Resources like Zero Flux offer crucial insights that can steer your financial choices, ensuring you stay ahead of the curve. A recent survey revealed that 62.67% of participants believe urban housing will become more affordable by 2025, indicating a potential shift that could affect buyer behavior and purchasing strategies.

Network with Other Investors: Engaging with real estate funding groups or forums can be invaluable. Sharing experiences and strategies with peers fosters a collaborative environment that can lead to new opportunities and insights.

Prepare for Challenges: Anticipate potential challenges, including market downturns, tenant issues, and maintenance costs. Developing contingency plans is essential for proactive management, ensuring you can navigate obstacles effectively.

Moreover, compliance tracking for local short-term rental regulations is critical to avoid penalties, highlighting the importance of staying informed about legal requirements. Understanding average property management costs for rental properties is also vital, as it provides a clearer picture of the financial aspects of property management. As the property management landscape evolves, these insights and tools will be essential for effective investment management.

Conclusion

Understanding the complexities of real estate investment is paramount for aspiring investors seeking to build wealth. Grasping essential concepts such as property types, investment strategies, and financial metrics lays a solid foundation for informed decision-making. Establishing an online investment platform streamlines the investment process and opens doors to a wide array of opportunities tailored to diverse financial goals.

Conducting thorough market research is critical for identifying lucrative investments and staying attuned to consumer preferences, especially as trends evolve towards smart technology integration. Financial planning, including assessing personal finances and exploring funding options, ensures that investors can strategically navigate the market and capitalize on opportunities.

Effective management of investments is equally vital. It requires ongoing monitoring, adaptability to market changes, and an understanding of potential challenges. By fostering a network with other investors, one can gain valuable insights and support that enhance investment strategies.

Ultimately, success in real estate investment hinges on a commitment to continuous learning and adaptability. As the market continues to evolve, those equipped with knowledge and the right tools will find themselves well-positioned to thrive in this dynamic landscape, paving the way for financial success and the freedom that comes with it.