Overview

The article delineates five fundamental steps for establishing a real estate investment company. These steps encompass:

- Understanding the various types of investment firms

- Drafting a comprehensive business plan

- Selecting the appropriate business structure

- Securing financing

- Cultivating a professional network

Each step is bolstered by detailed explanations and pertinent examples, underscoring the critical role of market analysis, funding strategies, and networking in the successful launch and management of a real estate investment venture.

Introduction

In the dynamic realm of real estate investment, grasping the diverse types of investment companies is crucial for aspiring investors. These companies are instrumental in pooling resources to acquire, manage, and sell properties, each presenting unique strategies tailored to various financial objectives. As the landscape shifts, particularly in 2025, emerging trends reveal a growing inclination towards Real Estate Investment Trusts (REITs) and private equity firms, motivated by their potential for substantial returns.

With markets like New Jersey witnessing remarkable growth in industrial rents, the opportunities are abundant for those adept at navigating these complexities. This article explores the foundational elements of establishing a successful real estate investment company, from crafting a robust business plan to selecting the appropriate structure and securing financing, ultimately guiding investors on their path to wealth creation through real estate.

Understand the Basics of Real Estate Investment Companies

Property acquisition firms play a pivotal role in the real estate market, gathering capital from investors to buy, oversee, and trade properties. They exist in various forms, each catering to distinct financial strategies and objectives. Understanding these types is essential for effectively aligning your investment approach:

- Real Estate Investment Trusts (REITs): These firms specialize in owning, operating, or financing income-generating real estate. REITs provide individuals with an opportunity to earn a share of the income generated from commercial property ownership without the complexities of direct management.

- Private Equity Firms: These entities focus on raising funds from investors to acquire property assets, often employing value-add strategies to enhance asset value. Their methodology typically involves significant renovations or operational improvements aimed at maximizing returns.

- Property Management Firms: Tasked with managing properties on behalf of owners, these firms oversee tenant interactions, maintenance, and financial reporting, ensuring that properties remain well-maintained and profitable.

As we look ahead to 2025, the landscape of real estate firms is shifting, with a marked trend towards REITs and private equity companies due to their potential for high returns. For example, New Jersey has emerged as a frontrunner in industrial rent growth, boasting an impressive 9.8% year-over-year increase, which underscores the lucrative opportunities present in specific markets.

Moreover, the sustained interest in classic gateway markets, such as San Francisco and New York City, signals a strategic pivot towards established locations recognized as secure investments. This trend highlights the necessity of comprehending market dynamics when selecting the most suitable investment model.

As entrepreneur Jesse Jones insightfully remarks, "I have always liked property; farm land, pasture land, timber land, and city plots. I have had experience with all of them. I guess I just naturally like ‘the good Earth,’ the foundation of all our wealth." This perspective emphasizes the intrinsic value of property as a cornerstone of wealth generation.

By grasping these fundamentals, you can more effectively ascertain which type of property management firm aligns with your financial goals and strategies, ultimately guiding you toward starting a real estate investment company successfully.

Draft a Comprehensive Business Plan

Developing a thorough business strategy is essential for starting a real estate investment company that is prosperous. This plan should encompass several key components:

-

Executive Summary: Provide a concise overview of your business, including your mission statement and specific goals you aim to achieve.

-

Market Analysis: Conduct thorough research on the property market, focusing on current trends, target demographics, and competitive analysis. For instance, in 2025, 45% of respondents anticipate more competitive rates and increased accessibility if Fannie Mae and Freddie Mac are privatized, indicating a shift in market dynamics. Additionally, 36.25% of people believe that Trump's policies for inflation and tariffs will negatively impact market recovery in 2025, highlighting potential challenges. Furthermore, inventory shortages are driven by homeowners’ reluctance to sell in a high-interest-rate environment, as noted by Sharad Mehta, which is critical to understanding current supply issues. Finally, industrial property leasing activity has increased by 10.2% because of e-commerce, highlighting a notable trend in the market.

-

Funding Plan: Clearly define your funding approach, whether it involves residential properties, commercial properties, or a mix of both. Significantly, the appeal of Real Estate Investment Trusts (REITs) has made property financing more attainable, mirroring a wider trend in financial strategies. This change in how people engage with property acquisition should be a key consideration in your strategy.

-

Financial Projections: Include detailed financial forecasts, such as projected income, expenses, and cash flow for the initial years. This will help you understand the financial viability of your business.

-

Funding Requirements: Clearly state the capital needed to launch and sustain your business, along with potential sources of funding. This is crucial for drawing in financial backers and obtaining necessary resources.

-

Operational Plan: Describe the day-to-day operations of your business, including management structure and staffing needs. A clearly outlined operational strategy guarantees that your business operates seamlessly and effectively, which is crucial when starting a real estate investment company.

By tackling these elements, you will create a strong business plan that not only acts as a guide for your real estate firm but also prepares you to handle the intricacies of the market proficiently. Successful investors emphasize the importance of a solid market analysis, as evidenced by case studies highlighting high-value transactions in luxury markets, such as New York, where properties have sold for as much as $38 million. This emphasizes the necessity for a thorough comprehension of market trends to guide your financial choices.

Choose the Right Business Structure

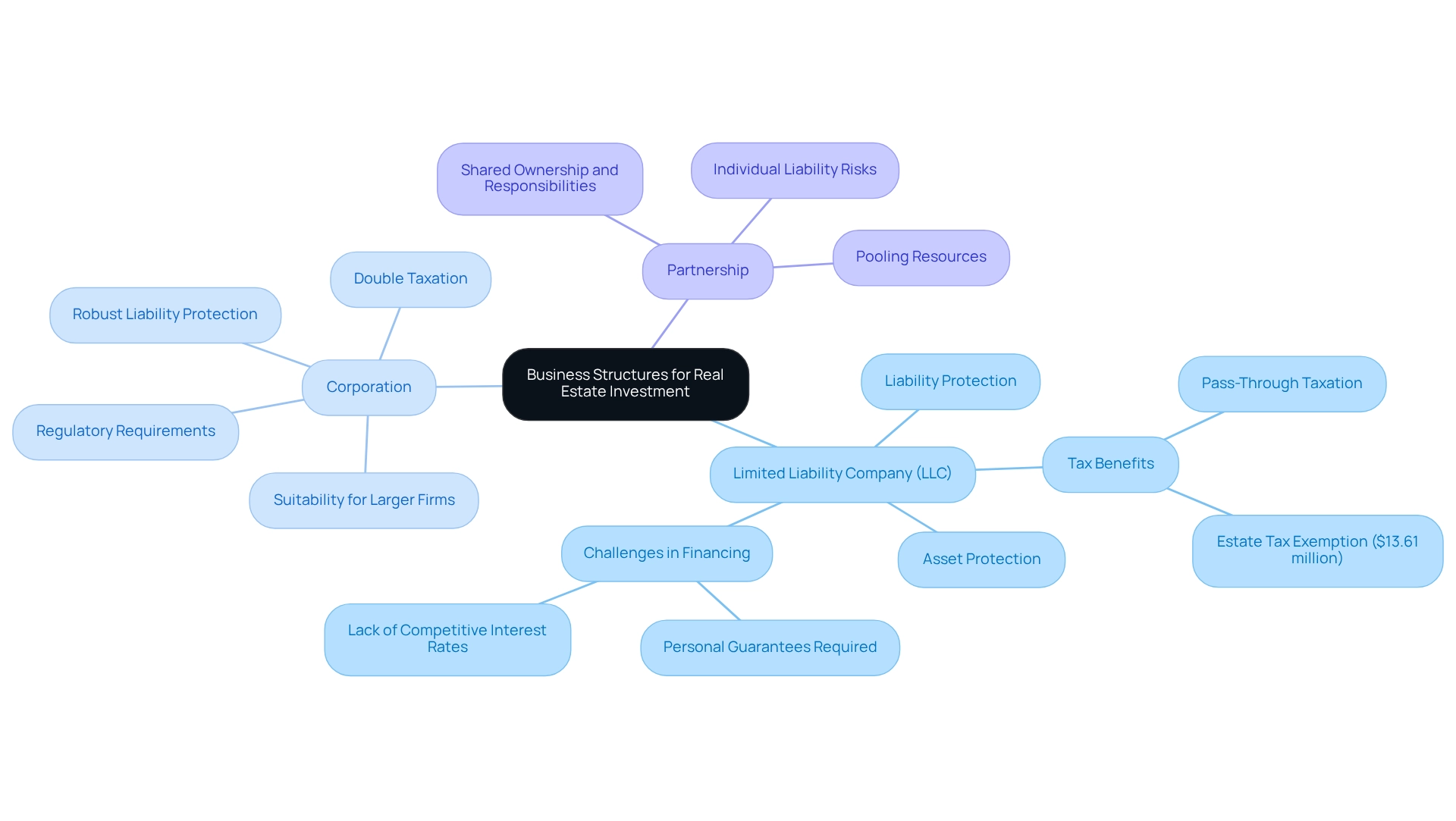

When starting a real estate investment company, selecting the appropriate business structure is crucial for sustained success and security. Here are the primary options:

- Limited Liability Company (LLC): The LLC stands out as a favored choice among property stakeholders, primarily due to its personal liability protection and tax benefits. It facilitates pass-through taxation, meaning profits are taxed at the individual level rather than the corporate level, which can yield significant tax savings. Furthermore, an LLC serves to shield personal assets from business liabilities, making it a preferred structure for many. Legal professionals underscore that establishing an LLC can enhance asset protection and limit liability, positioning it as a strategic choice for managing rental properties.

- Corporation: While corporations provide robust liability protection, they are accompanied by more stringent regulatory requirements and the potential for double taxation on profits. This structure may be suitable for larger financial firms or those intending to raise capital through stock issuance.

- Partnership: Partnerships allow for shared ownership and responsibilities, which can be advantageous for pooling resources. However, partners may face individual liability for the business's obligations, which can pose a significant risk.

In 2025, data indicate that LLCs are gaining traction for property investments, with a substantial portion of individuals opting for this framework due to its adaptability and protective features. Additionally, the inheritance tax exemption of $13.61 million plays a critical role for stakeholders organizing their LLCs, as the net assets of an LLC are subject to inheritance tax at the member level. This highlights the importance of effective property planning when starting a real estate investment company, as investors should also recognize that securing loans through starting a real estate investment company can present considerable challenges. Banks frequently require personal guarantees from members and may not offer competitive interest rates, complicating financing compared to other structures. Consulting with a legal professional is advisable for those starting a real estate investment company to determine the most appropriate structure based on factors such as the number of investors, desired liability protection, and tax implications. This expert guidance can ensure that your property venture is positioned for success from the outset.

Secure Financing for Your Investments

To effectively finance your real estate investments, consider the following options:

- Traditional Bank Loans: Often the primary choice for many individuals, these loans typically offer competitive interest rates and favorable terms. As of 2025, the average interest rate for traditional bank loans is around 4.5%, making them a viable option for long-term financing.

- Hard Money Loans: These short-term loans, secured by property, are frequently utilized for quick purchases or renovations. Recent statistics show a 25% increase in the use of hard money loans in 2025, highlighting their appeal for those requiring immediate capital.

- Private Backers: Collaborating with private backers can provide essential funding while distributing the risks and rewards associated with the investment. This strategy allows for more flexible terms compared to conventional financing methods.

- Crowdfunding: Online platforms enable you to gather resources from various backers to finance property projects. Successful crowdfunding examples, such as a recent project that raised $1 million for a multi-family development, illustrate the effectiveness of this model, granting investors access to capital that may otherwise be out of reach.

- Government Programs: Investigate local and federal initiatives that offer financial support or incentives for property acquisitions. These programs can significantly broaden your funding options and reduce overall costs.

As Akira Mori, a seasoned real estate developer, states, "In my experience, in the real estate business, past success stories are generally not applicable to new situations. We must continually reinvent ourselves, responding to changing times with innovative new business models."

Thoroughly evaluate each financing alternative to determine which aligns best with your funding strategy and financial objectives. As the market evolves, staying informed about current trends and expert insights on financing will empower you to make informed financial decisions.

Build a Professional Network and Market Your Company

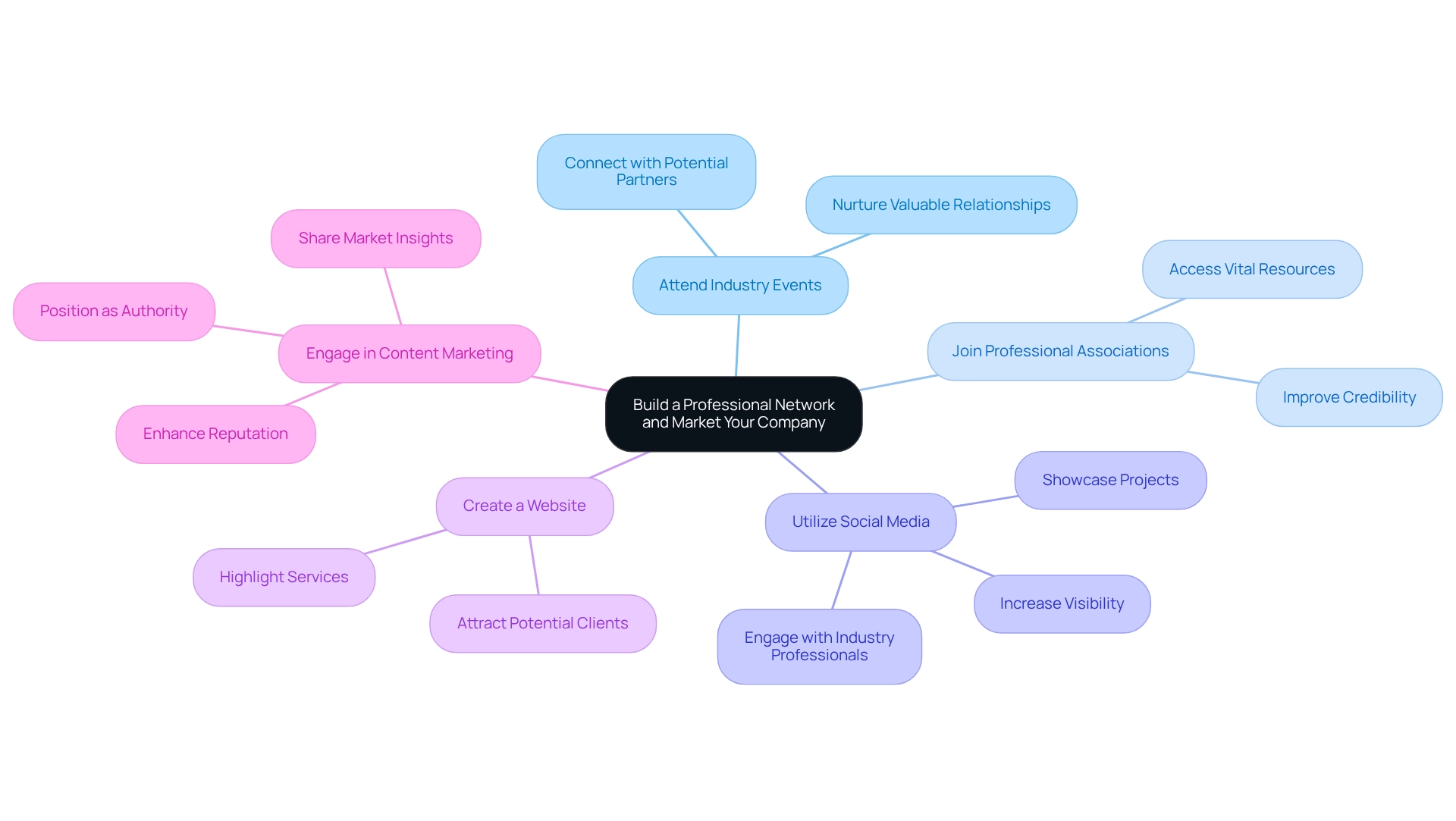

To effectively build your professional network and market your real estate investment company, consider the following strategies:

- Attend Industry Events: Participate in property conferences, seminars, and networking gatherings to connect with potential partners and investors, nurturing valuable relationships.

- Join Professional Associations: Membership in property associations provides access to vital resources, training, and networking opportunities that can improve your credibility and reach.

- Utilize Social Media: Harness platforms like LinkedIn, Facebook, and Instagram to connect with industry professionals and showcase your projects related to starting a real estate investment company. In 2025, social media marketing is increasingly vital for visibility. Statistics indicate that professionals who actively engage in networking see a marked increase in opportunities and partnerships. The expected ROI for email marketing is $40 for every dollar spent, highlighting the effectiveness of digital outreach.

- Create a Website: Develop a professional website that highlights your services, investment opportunities, and success stories, serving as a central hub to attract potential clients and establish your brand.

- Engage in Content Marketing: Share valuable insights and market trends through blogs, newsletters, or webinars to position yourself as an authority in the field, enhancing your reputation and attracting interest. For instance, realtors using CRM systems experience a 41% increase in lead conversions, demonstrating the importance of technology in managing client relationships.

Additionally, consider utilizing driving for dollars apps as modern tools for lead generation, which can streamline your outreach efforts. Implementing these strategies will not only expand your network but also significantly boost your company's visibility when starting a real estate investment company in the competitive market. In 2025, effective networking is crucial, with statistics indicating that professionals who actively engage in networking see a marked increase in opportunities and partnerships.

Conclusion

Navigating the world of real estate investment necessitates a solid foundation and strategic foresight. Understanding various types of investment companies, including REITs and private equity firms, is crucial for aligning investment approaches with personal financial goals. Insights into the evolving real estate landscape, particularly the significant growth in industrial rents, underscore the importance of market knowledge in making informed decisions.

Crafting a comprehensive business plan is another critical step in establishing a successful real estate investment company. By incorporating elements such as market analysis, investment strategies, and financial projections, investors can create a roadmap that guides their ventures and prepares them for potential challenges. Choosing the right business structure—be it an LLC, corporation, or partnership—further solidifies the foundation for long-term success, ensuring that investors are well-protected while optimizing tax benefits.

Securing appropriate financing is paramount in bringing investment plans to fruition. With options ranging from traditional bank loans to innovative crowdfunding models, investors must evaluate each choice carefully to align with their specific needs and strategies. Building a robust professional network and effectively marketing the company are equally important, as these efforts enhance visibility and foster valuable connections within the industry.

In conclusion, success in real estate investment hinges on a thorough understanding of the market, a well-structured business plan, appropriate financing, and effective networking. By embracing these principles, aspiring investors can confidently navigate the complexities of the real estate landscape, positioning themselves for wealth creation and long-term growth. The opportunities are abundant; taking informed action today can lead to a prosperous tomorrow in the realm of real estate.