Overview

To successfully invest $30,000 in real estate, it is essential to grasp the fundamentals of investment.

- Begin by defining a clear strategy that aligns with your financial goals.

- Conduct thorough market research to identify promising opportunities and understand prevailing trends.

- Effective property management is crucial; it ensures that your investment performs optimally over time.

- Furthermore, regularly reviewing your investment portfolio allows for timely adjustments based on market conditions and personal objectives.

- A well-informed approach, which includes assessing your risk tolerance and staying attuned to market trends, is vital for maximizing returns and adeptly navigating the complexities of real estate investment.

Introduction

Investing in real estate represents a transformative journey, particularly when embarking with a budget of $30,000. This investment opens the door to numerous opportunities, ranging from rental properties to real estate investment trusts (REITs), each presenting distinct advantages and challenges. Yet, the journey to successful investment is laden with complexities, prompting the essential question: how can one adeptly navigate the intricacies of the market to maximize returns while minimizing risks? This guide explores vital strategies and insights designed to empower investors, enabling them to make informed decisions and excel in the competitive landscape of real estate.

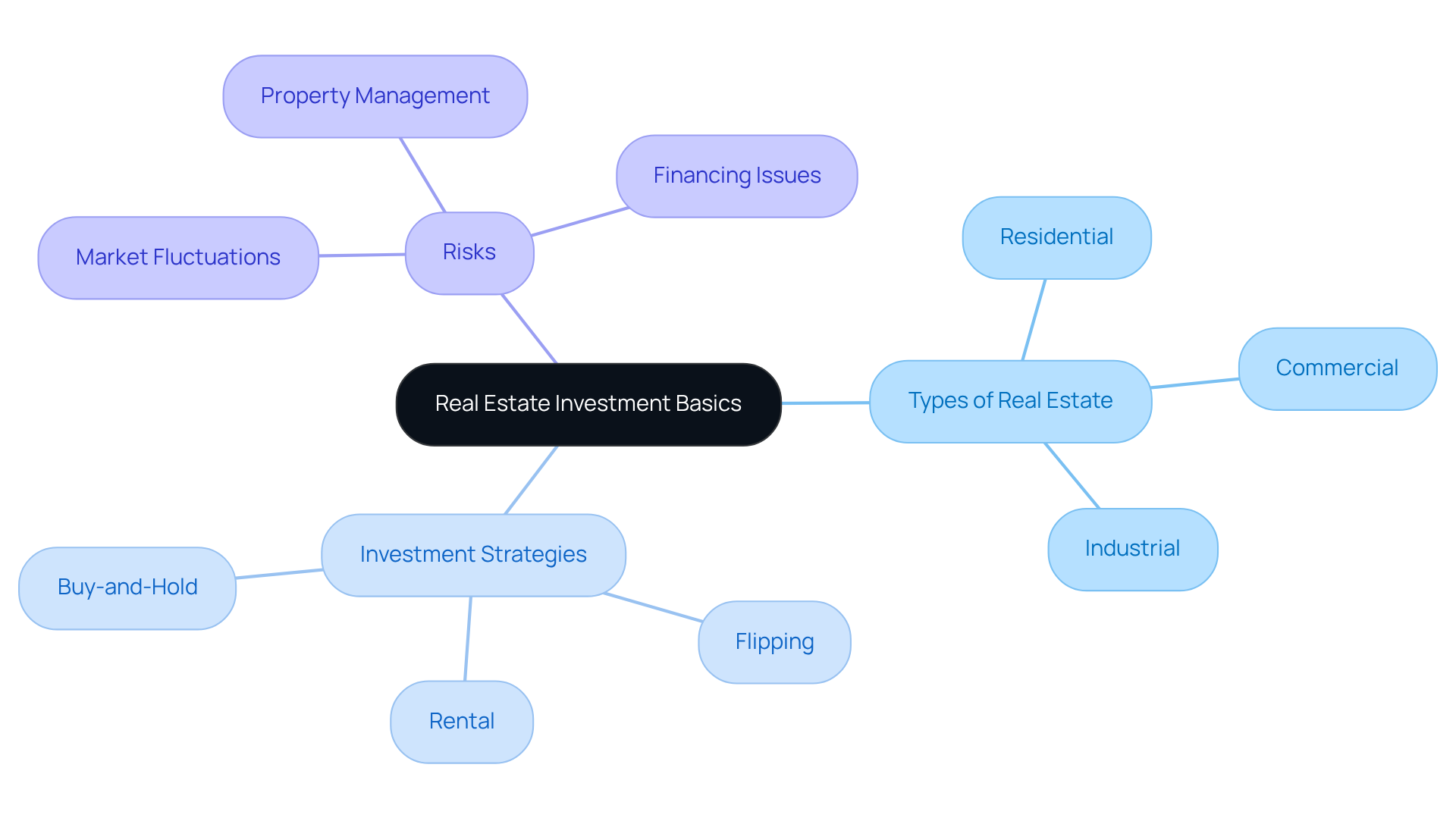

Understand Real Estate Investment Basics

Before learning how to invest 30k in real estate, it is essential to understand the fundamentals of real estate investment. Start by familiarizing yourself with the various types of real estate, including residential, commercial, and industrial spaces. Each category presents unique opportunities and challenges; residential units are often the most accessible for new investors, while commercial assets can yield higher returns but typically require more capital and expertise.

Consider exploring different investment strategies such as buy-and-hold, flipping, and rental assets. The buy-and-hold strategy involves acquiring real estate to lease, generating steady cash flow over time. Conversely, flipping focuses on purchasing undervalued properties, renovating them, and selling them for a profit within a short period. Understanding these strategies will help align your financial approach with your investment goals.

It is also vital to recognize the risks associated with property investments. Market fluctuations can affect property values, while property management challenges may arise, particularly with rental properties. Financing issues, including securing loans or managing cash flow, can also present significant obstacles. Notably, property is often seen as a hedge against inflation, as its values typically rise during inflationary periods. By building a solid foundation of knowledge in these areas, you will be better equipped to navigate the complexities of property investment and learn how to invest 30k in real estate, enabling you to make informed decisions as you embark on your investment journey.

As Robert Kiyosaki states, 'property investing, even on a very small scale, is a method of generating cash flow and wealth.' For further insights and data-driven information, consider subscribing to the Zero Flux newsletter, which aggregates crucial property market trends and insights from over 100 sources, keeping you informed about the latest developments in the sector.

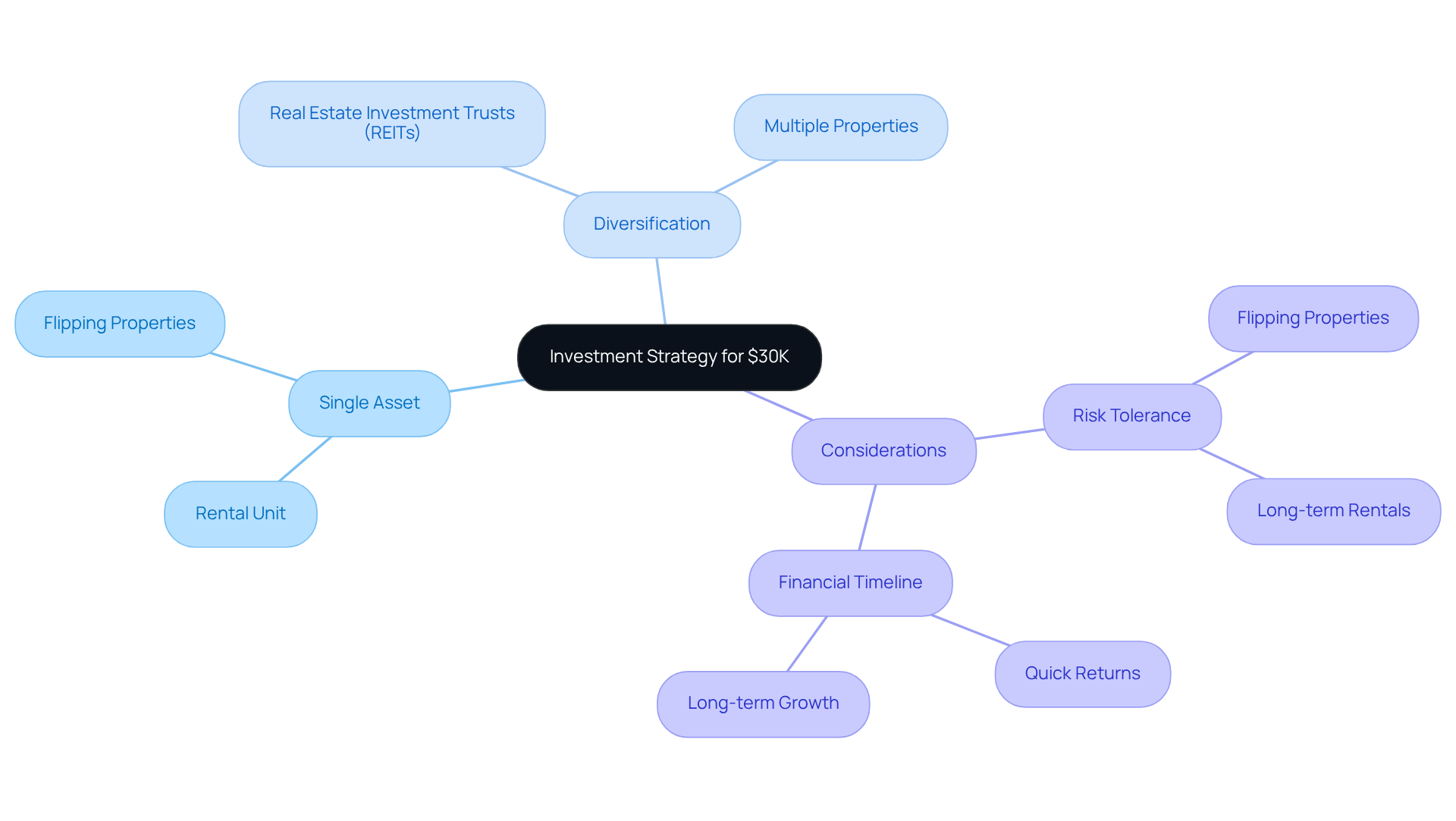

Determine Your Investment Strategy for $30K

With a budget of $30,000, it is crucial to define how to invest 30k in real estate effectively. When thinking about how to invest 30k in real estate, consider whether you prefer to invest your funds into a single asset, such as a rental unit, or if you would rather diversify across various holdings or real estate investment trusts (REITs).

Assess your risk tolerance:

- Are you prepared to handle the potential volatility of flipping properties?

- Do you lean towards the stability of long-term rentals?

Furthermore, reflect on your financial timeline:

- Are you in pursuit of quick returns?

- Are you looking for long-term growth?

By clarifying your financial strategy, you empower yourself to make focused and effective decisions regarding your assets.

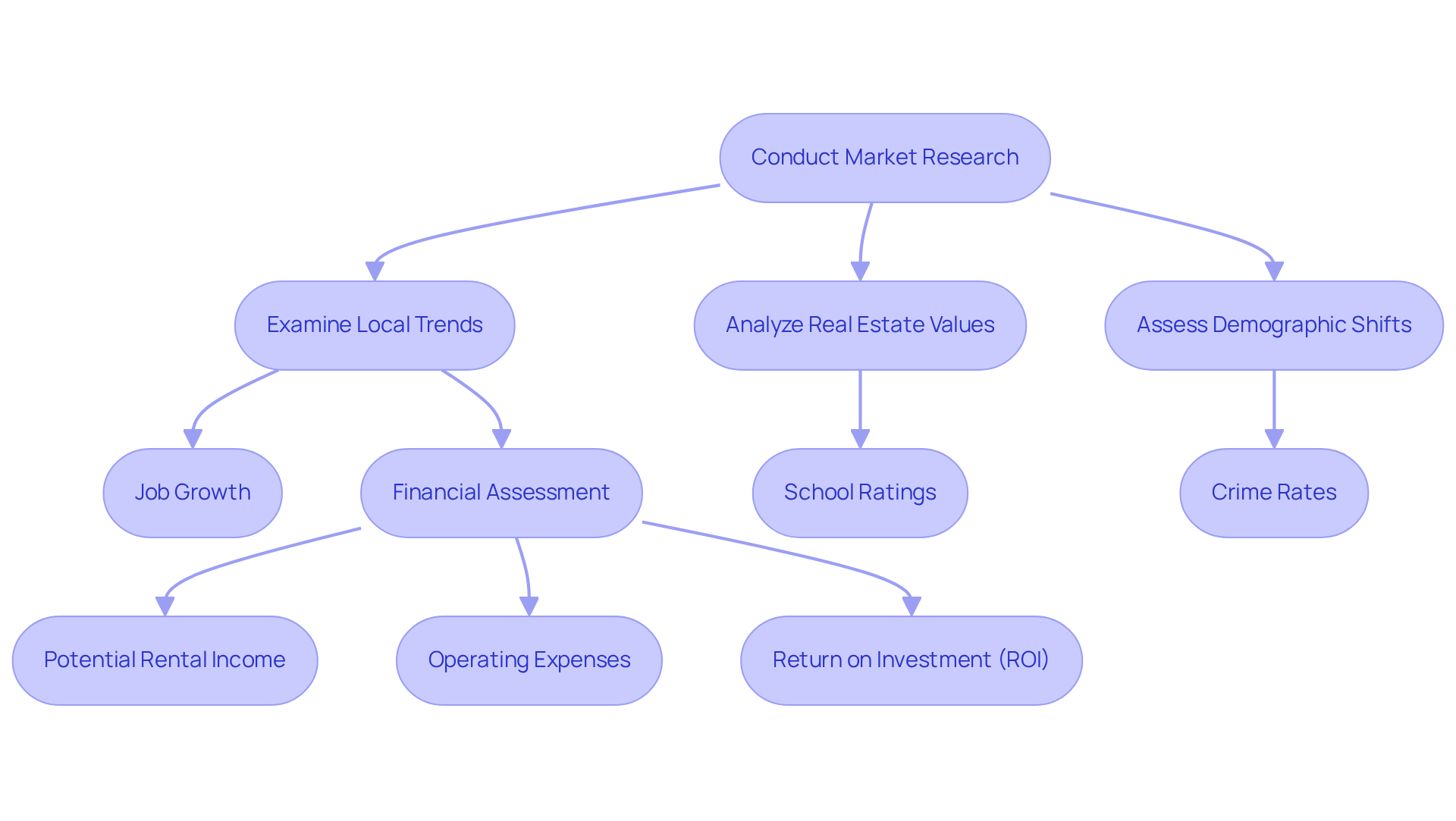

Conduct Market Research and Financial Analysis

Conducting effective market research is essential for successful property investments. Begin by examining local trends, real estate values, and demographic shifts. Utilize reputable online resources, including real estate websites and local market reports, to gather comprehensive data on neighborhoods of interest. Key factors to consider include:

- Job growth

- School ratings

- Crime rates

These elements can significantly influence real estate values and potential returns.

Once you have identified promising sectors for funding, explore a thorough financial assessment of particular assets. Calculate potential rental income, operating expenses, and return on capital (ROI) to evaluate whether the property aligns with your financial goals. For instance, the typical gross profit from home flipping in the U.S. has been monitored from 2008 to 2024 and is expected to be approximately $66,000, emphasizing the possible profitability of thoroughly researched ventures. Additionally, consider the broader context of housing affordability challenges, as 37% of millennials struggle with housing affordability. This data-driven approach not only empowers you to make informed decisions but also positions you to navigate the complexities of the real estate market effectively.

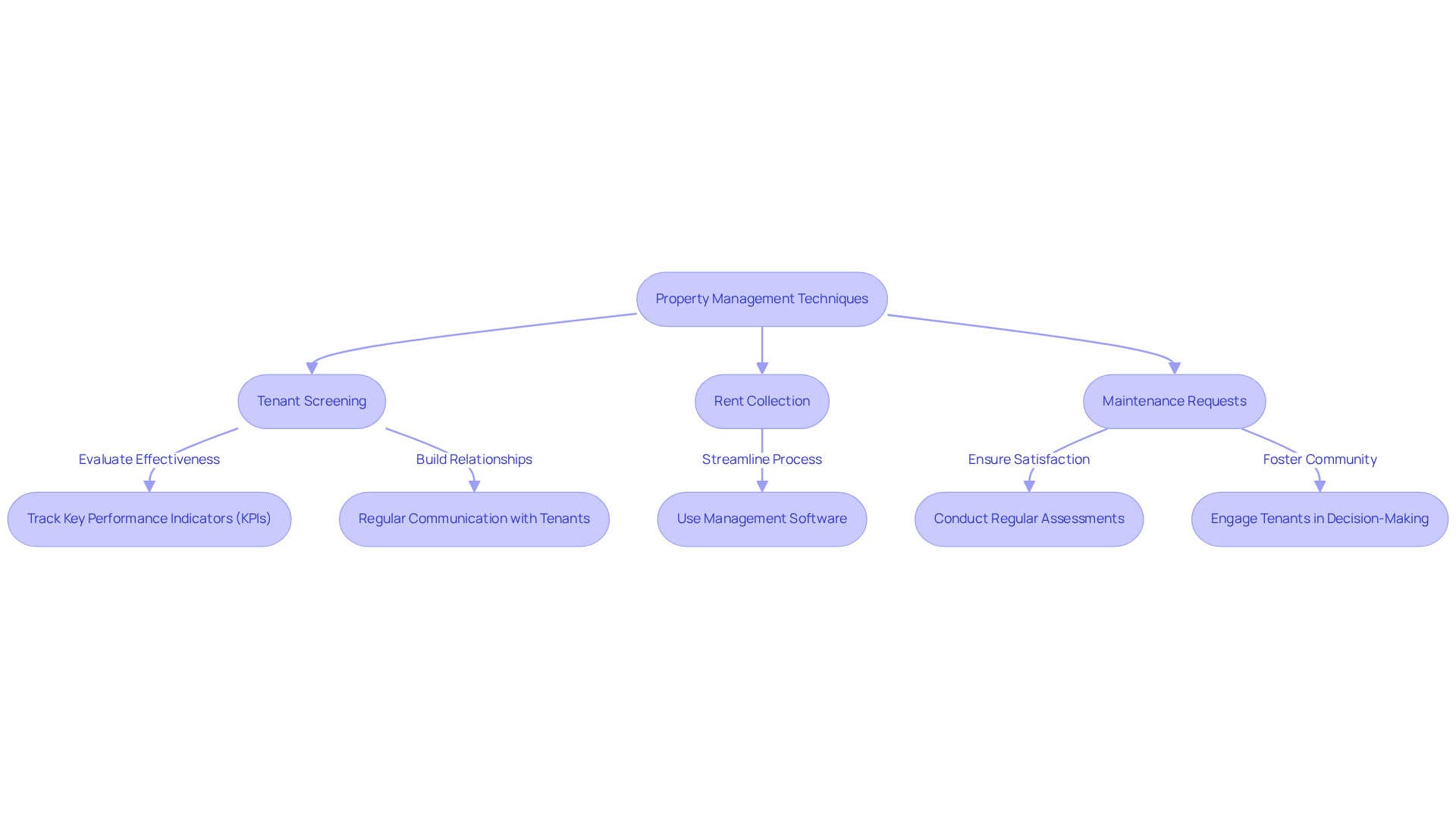

Implement Effective Property Management Techniques

Once you have invested in an asset, implementing effective management techniques is essential for maximizing your investment. If you are overseeing the real estate yourself, establish a robust system for:

- Tenant screening

- Rent collection

- Maintenance requests

Notably, around 70% of landlords are now using management software to streamline these processes, which can greatly accelerate rent collection and enhance tenant communication. If you choose to employ a management firm, perform extensive research to select one with a strong reputation and clear fee structures, typically ranging between 8-12% of monthly rent. Additionally, tracking key performance indicators (KPIs) such as occupancy rates and average repair times is crucial for evaluating the effectiveness of the management company.

Regular communication with tenants is crucial; it not only addresses their concerns promptly but also fosters a positive relationship that can lead to higher tenant retention rates. Engaging tenants in decision-making processes, such as maintenance schedules or community events, can significantly enhance their overall experience. As one rental management expert observed, "Interacting with your tenants is essential for fostering a positive living environment and guaranteeing their contentment." By prioritizing efficient asset management, you can enhance tenant satisfaction and secure a consistent income flow, ultimately aiding in the long-term success of your real estate holdings. Furthermore, management firms typically arrange routine assessments at least twice annually, which assists in preserving the condition of the assets and ensuring tenant contentment.

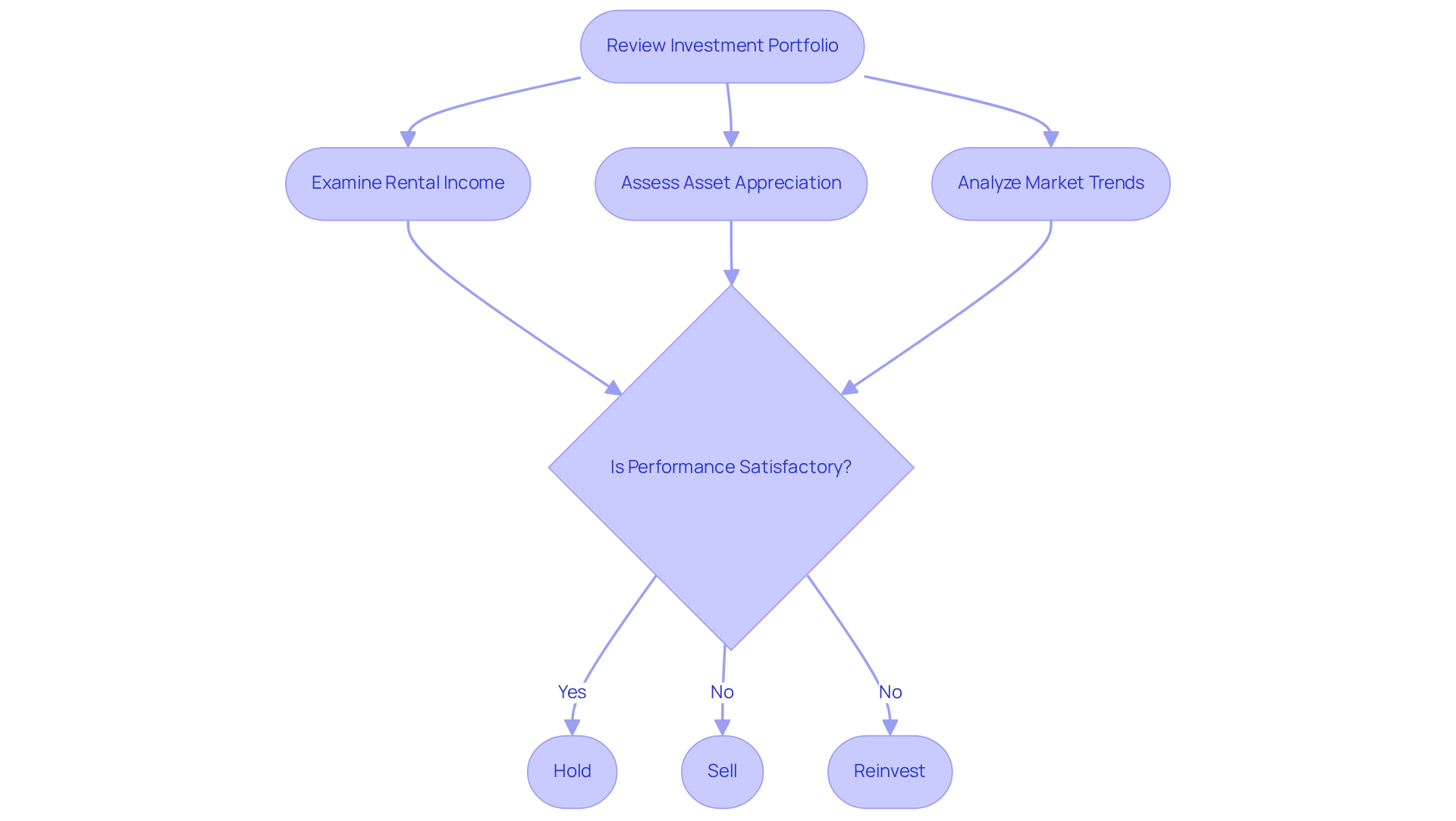

Review and Adjust Your Investment Portfolio Regularly

To ensure your investment remains aligned with your financial goals, it is crucial to review your portfolio regularly. Examine the performance of your assets by considering factors such as:

- Rental income

- Asset appreciation

- Market trends

For instance, did you know that the average rental income varies significantly across property types? Single-family homes often yield higher returns compared to multi-family units in certain markets. If specific assets are underperforming, you must consider whether to:

- Hold

- Sell

- Reinvest in more promising opportunities

Staying informed about changes in the real estate market is essential; for example, the projected growth rate of 3.34% from 2024 to 2029 can guide your strategic adjustments. Additionally, recognize that 24% of first-time home buyers face significant challenges, which can impact market dynamics. By actively managing your investment portfolio, you can maximize your returns and mitigate risks over time.

Conclusion

Investing $30,000 in real estate presents a unique opportunity to build wealth, necessitating a thoughtful approach to maximize potential returns. Understanding the fundamentals of real estate—from various property types to investment strategies—is crucial for making informed decisions. By defining a clear investment strategy, conducting thorough market research, and implementing effective property management techniques, investors can navigate the complexities of the real estate landscape with confidence.

Key insights emphasize the importance of:

- Assessing risk tolerance

- Analyzing market trends

- Regularly reviewing investment portfolios

Identifying the right investment strategy—be it buy-and-hold, flipping, or diversifying through REITs—sets the stage for success. Furthermore, effective management practices and ongoing portfolio evaluations ensure that investments remain aligned with financial goals and adapt to changing market conditions.

Ultimately, the journey of real estate investing transcends the initial capital; it embodies continuous learning and adaptation. By embracing these principles and staying informed about market dynamics, aspiring investors can transform their $30,000 into a fruitful venture in the real estate market. Taking action today can lead to significant financial growth tomorrow, underscoring the transformative potential of strategic real estate investments.