Overview

This article provides a comprehensive overview of how to effectively utilize debt in real estate acquisitions, underscoring the significance of strategic borrowing as a means to leverage capital and amplify investment returns. It presents various debt options available in the market, along with essential financial metrics for evaluating investment viability.

Practical steps for securing financing are outlined, reinforcing the notion that a balanced approach to debt management is crucial for achieving long-term success in real estate investing.

Introduction

Understanding the strategic role of debt in real estate investment is crucial for unlocking significant financial opportunities. By leveraging borrowed capital, investors can acquire properties that might otherwise remain unattainable, amplifying potential returns and diversifying their portfolios. However, the path to effective debt utilization is complex.

How can investors navigate the inherent risks while maximizing their gains? This guide explores essential steps and strategies for using debt wisely in real estate, offering insights that can transform financial aspirations into tangible success.

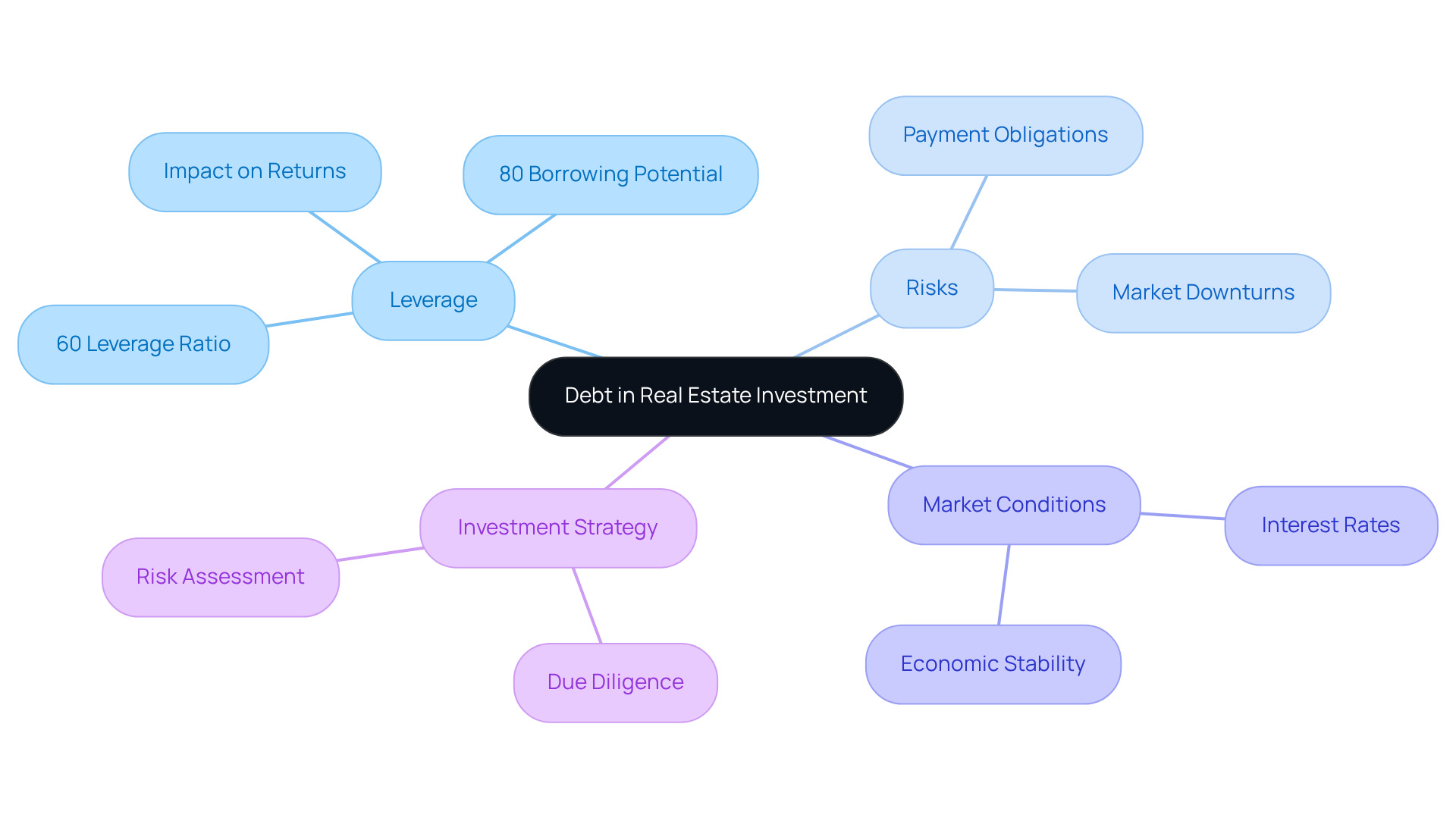

Understand the Role of Debt in Real Estate Investment

Understanding how to use debt to buy real estate is essential, as it stands as a fundamental pillar in real estate financing, empowering investors to leverage their capital with precision. When employed strategically, borrowing can substantially enhance returns on capital and illustrate how to use debt to buy real estate, enabling the acquisition of properties that may otherwise be financially unattainable. For instance, investors can achieve a leverage ratio of 60% by investing $40,000 of their own funds while borrowing $60,000, thereby allowing them to control larger assets with a smaller initial outlay. In many cases, investors can borrow up to 80% of the purchase price, further broadening their investment horizons.

Understanding essential concepts such as how to use debt to buy real estate, leverage, interest rates, and repayment terms is paramount. Leverage refers to the total financial obligation on a property relative to its market value, with standard leverage ratios in the market typically ranging from 50% to 90%, contingent on the type of property and prevailing market conditions. While leveraging can magnify potential profits, it also introduces inherent risks, including the obligation to adhere to regular payment schedules irrespective of property performance. For instance, during the 2008-2009 downturn, numerous investors encountered significant challenges due to high leverage ratios, often exceeding 85-90%, which rendered them vulnerable as property values plummeted.

Consequently, a balanced approach to borrowing is essential for long-term success in property investing. Investors must engage in thorough due diligence, evaluating both the potential for appreciation and the stability of income streams from properties. As Ian Formigle emphasizes, understanding how to use debt to buy real estate and the advantages and disadvantages of leverage is critical, as it influences the risk and reward dynamics of property investments. Moreover, market conditions such as interest rates can impact leverage strategies, making it imperative for investors to adapt their approaches accordingly. By meticulously assessing how to use debt to buy real estate, investors can position themselves to optimize returns while mitigating risks associated with financing.

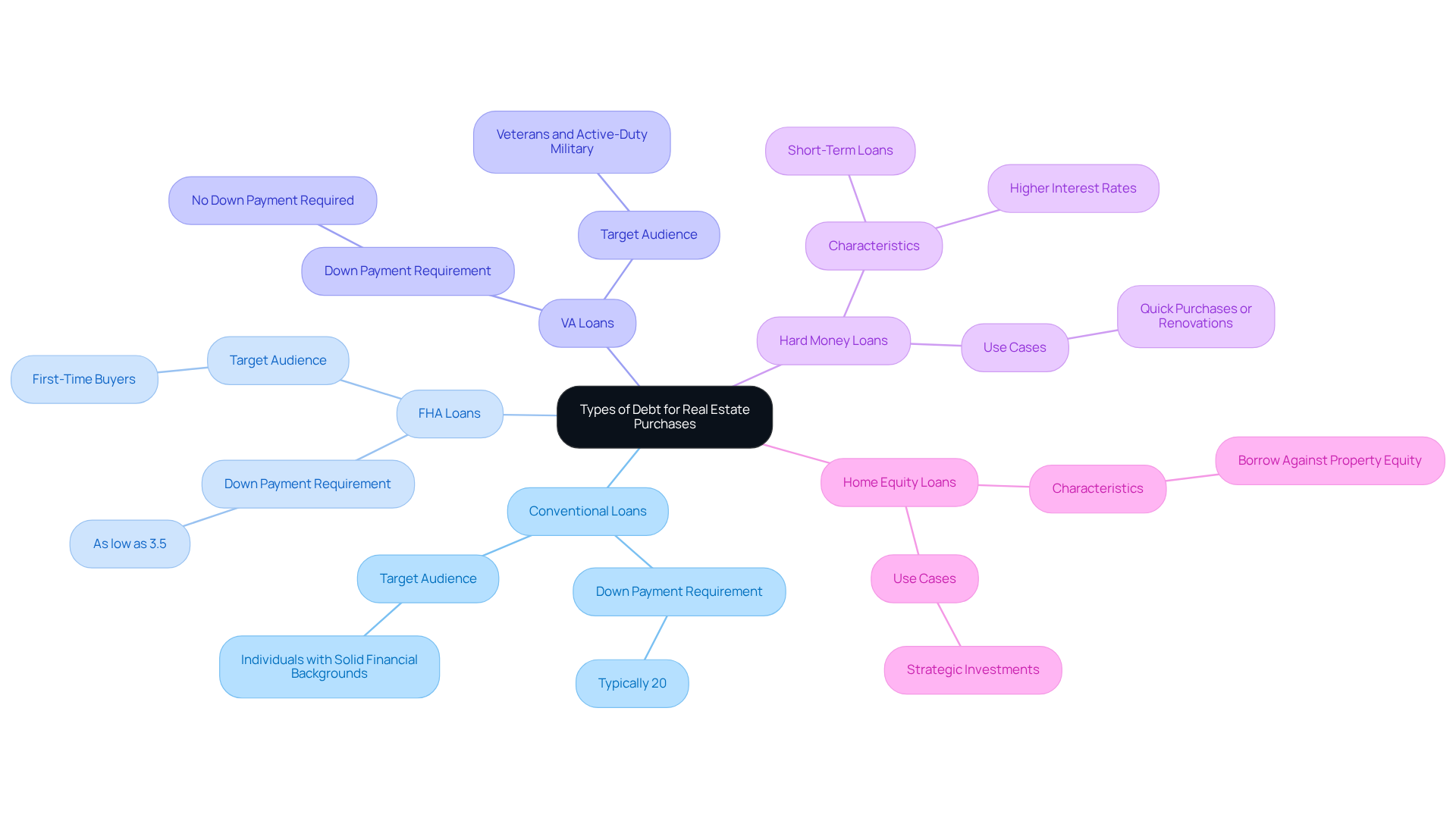

Explore Different Types of Debt for Real Estate Purchases

For investors aiming to make informed decisions, understanding how to use debt to buy real estate is crucial. Each option possesses unique characteristics that cater to different financial needs and goals.

- Conventional Loans: These traditional mortgages, offered by banks and credit unions, typically require a down payment of 20%. They are a reliable choice for those with solid financial backgrounds.

- FHA Loans: Insured by the Federal Housing Administration, these loans allow for lower down payments, sometimes as low as 3.5%, making them ideal for first-time buyers who may not have substantial savings.

- VA Loans: Exclusively available to veterans and active-duty military personnel, these loans often require no down payment and come with favorable terms, providing significant financial advantages.

- Hard Money Loans: These short-term loans, secured by real estate, are often utilized for quick purchases or renovations. However, they come with higher interest rates, which investors must weigh against their immediate financial needs.

- Home Equity Loans: By enabling homeowners to borrow against the equity in their property, these loans provide funds for further expenditures, allowing for strategic investments.

Comprehending these options aids investors in selecting the appropriate type of debt according to their monetary objectives and risk tolerance, particularly in understanding how to use debt to buy real estate. This knowledge empowers them to navigate the real estate landscape effectively.

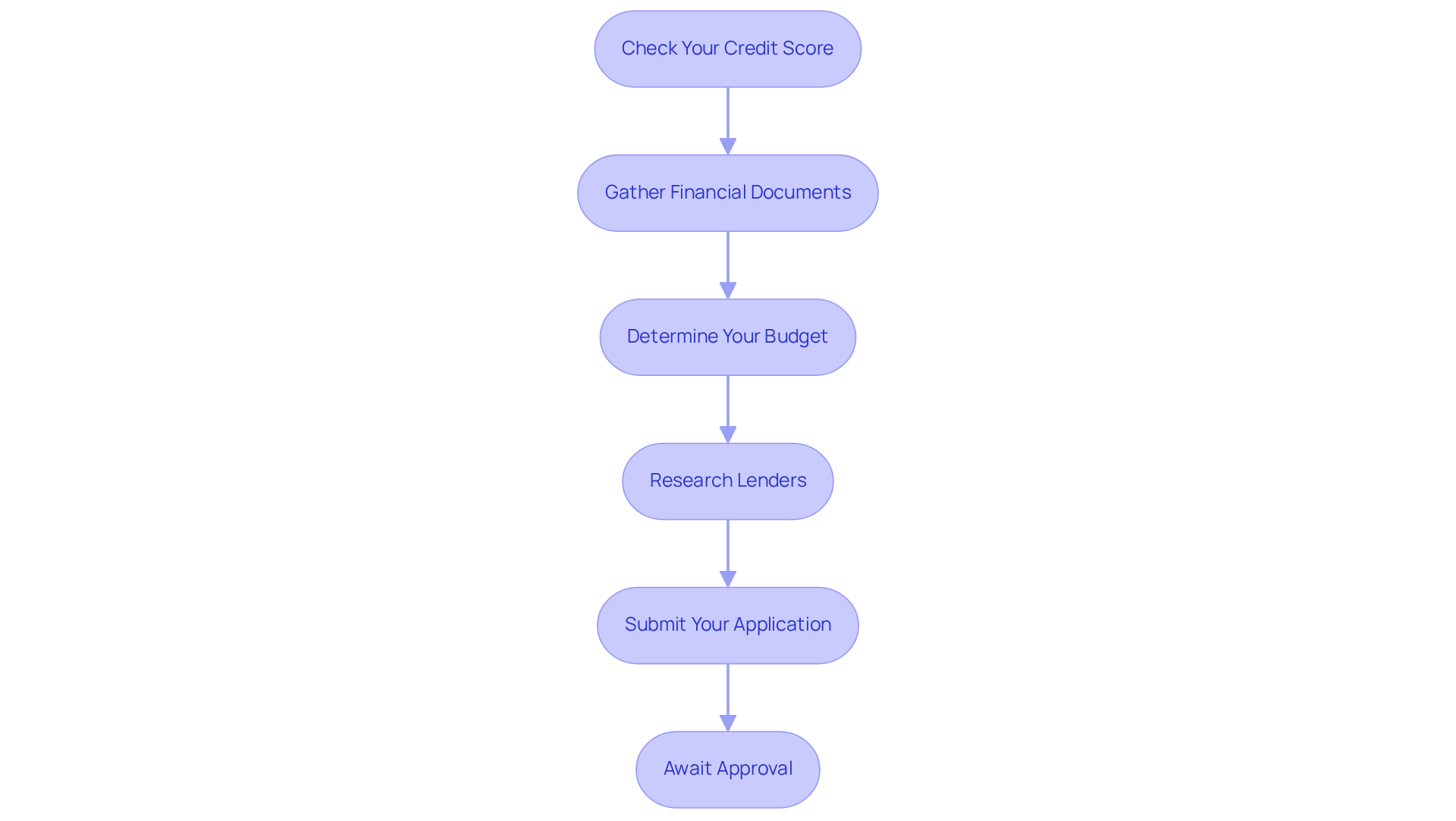

Apply for Financing: Steps to Secure Your Investment Loan

To secure your investment loan effectively, follow these essential steps:

-

Check Your Credit Score: Begin by reviewing your credit report and score. A score above 620 typically qualifies you for the lowest interest rates, while the average credit score in the U.S. is around 702. Improving your score can significantly enhance your loan terms.

-

Gather Financial Documents: Prepare the necessary documentation, including tax returns, bank statements, and proof of income. Lenders require these to evaluate your economic stability and capability to repay the loan, fostering trust in your application.

-

Determine Your Budget: Calculate how much you can afford to borrow based on your economic situation and investment objectives. This assessment should consider your current income, expenses, and any existing debts. Additionally, having 6-12 months of reserves to cover mortgage payments reassures lenders of your financial stability.

-

Research Lenders: Compare various lenders and their loan products to identify the best fit for your needs. Seek out lenders that provide competitive rates and advantageous terms, as this can greatly affect your overall expenses. Shopping around for lenders can help you find the best rates and terms available.

-

Submit Your Application: Complete the application process with your chosen lender, ensuring that all required documentation is provided. Accurate and up-to-date documents are crucial for a smooth approval process. Be sure to include current identification documents to avoid delays in the loan application process.

-

Await Approval: After submission, the lender will review your application and may request additional information. Be prepared to respond promptly to any inquiries to expedite the approval process.

By following these steps, you can simplify the financing process and improve your chances of learning how to use debt to buy real estate for your property ventures.

Calculate Key Financial Metrics: Assessing Debt Service Coverage Ratio and More

To effectively manage debt, investors must calculate key financial metrics that provide insights into their investment's financial health:

-

Debt Service Coverage Ratio (DSCR): This critical ratio assesses an investment's ability to meet its debt obligations. It is determined by dividing net operating income (NOI) by total financial obligations. A DSCR of 1.25 or higher is generally considered healthy, indicating that the property generates sufficient income to cover its debt payments. Conversely, a ratio around 1 suggests potential financial strain, highlighting the importance of maintaining a healthy DSCR for financial stability.

-

Loan-to-Value Ratio (LTV): This ratio compares the loan amount to the appraised value of the property. A lower LTV signifies reduced risk for lenders, often resulting in more favorable loan terms. In 2025, the average LTV for real estate ventures is approximately 75%, reflecting a cautious approach among investors. It's essential to recognize that higher-risk borrowers with a greater LTV generally obtain elevated interest rates, which can affect total expenses. Understanding LTV is crucial, as it directly influences borrowing limits and interest rates.

-

Cash Flow Analysis: Regularly assessing cash flow is vital to ensure that rental income exceeds all expenses, including debt payments. Positive cash flow is essential for sustaining investments and allows for reinvestment opportunities. Investors should strive for a steady positive cash flow to ensure economic stability. Furthermore, understanding how to use debt to buy real estate and the effects of property dealings on the service coverage ratio is essential for financial planning and analysis, as obtaining property can impact a firm's service coverage ratio, either by raising financial obligations or producing new income.

By diligently tracking these metrics, investors can make informed choices concerning their financial obligations and overall investment strategy, ultimately improving their chances of success in the real estate market.

Manage Your Debt: Strategies for Effective Financial Oversight

To manage your debt effectively, consider the following strategies:

- Create a Budget: Develop a comprehensive budget that details all income and expenses, including debt payments. This practice is crucial, as statistics show that 81% of individuals struggle with increasing costs, with 78% of women and 70% of men identifying rising costs as their biggest budgeting challenge. A clear budget is essential for tracking financial health.

- Prioritize Debt Payments: Focus on paying down high-interest debt first. This method not only lowers total interest expenses but also demonstrates how to use debt to buy real estate, which is essential for successful property investment.

- Refinance When Possible: Monitor interest rates closely and consider refinancing your loans to secure better terms. In 2025, average interest savings from refinancing real estate loans can significantly influence your economic situation, especially in a fluctuating market.

- Maintain an Emergency Fund: Set aside funds to cover unexpected expenses. This ensures that you can meet monetary responsibilities even during economic challenges, addressing the concern that 59% of individuals are anxious about unexpected expenses.

- Regularly Review Economic Performance: Conduct periodic assessments of your assets and liabilities to ensure they align with your monetary objectives. This practice is supported by case studies showing that investors who maintain discipline and focus on long-term objectives are more likely to achieve favorable outcomes. As Bankrate emphasizes, having a well-defined strategy for understanding how to use debt to buy real estate is crucial for navigating the complexities of real estate investment.

Implementing these strategies can empower investors to maintain control over their debt and enhance their overall financial stability.

Conclusion

Understanding how to effectively utilize debt in real estate investment is crucial for maximizing returns and achieving financial success. By leveraging borrowed funds, investors can access larger properties and diversify their portfolios; however, this strategy must be approached with caution. The balance between risk and reward is essential, as mismanagement of debt can lead to significant financial challenges.

Key insights from the article emphasize the importance of understanding various types of debt—such as conventional loans, FHA loans, and hard money loans—each catering to different financial needs and investment goals. Additionally, the steps for securing financing, including checking credit scores and researching lenders, are vital for ensuring a smooth acquisition process. Financial metrics like the Debt Service Coverage Ratio (DSCR) and Loan-to-Value Ratio (LTV) serve as critical tools for assessing the viability of investments and maintaining financial health.

Ultimately, effective debt management strategies are necessary for long-term success in real estate investing. By creating a budget, prioritizing debt payments, and regularly reviewing financial performance, investors can navigate the complexities of debt and enhance their overall financial stability. Embracing these principles not only empowers investors to make informed decisions but also underscores the significant role that debt plays in shaping investment opportunities within the real estate market.