Overview

This article delineates five essential steps for identifying real estate investment properties available for sale. It emphasizes the significance of:

- Understanding market dynamics

- Evaluating property characteristics

- Conducting financial analysis

- Utilizing platforms for listings

- Assessing investment viability

Each step is bolstered by insights into market trends, financial metrics, and tools that empower investors to make informed decisions. The importance of thorough research and strategic planning in real estate investment is underscored, guiding readers toward successful investment strategies.

Introduction

Navigating the world of real estate investment can appear daunting; however, it offers a wealth of opportunities for those eager to learn. With the potential for income generation and capital appreciation, grasping the foundational aspects of real estate is essential for aspiring investors. Identifying the types of properties that yield the best returns and mastering the intricacies of market research and financial analysis are critical steps in the investment process.

As trends shift and economic conditions fluctuate, being equipped with the right knowledge and tools can significantly impact success in this dynamic market. This article explores key strategies and resources that empower investors to make informed decisions and capitalize on the ever-evolving landscape of real estate.

Understand the Basics of Real Estate Investment

Acquiring real estate investment properties for sale entails securing assets with the intent of generating revenue or capital growth. To navigate this landscape effectively, understanding foundational concepts is essential:

- Types of Real Estate: Become acquainted with the three primary categories: residential, commercial, and industrial properties. Each category presents distinct opportunities and challenges that can significantly influence your financial decisions.

- Investment Strategies: Investigate various approaches, such as buy-and-hold, flipping, and rental income. Each strategy carries its unique risk profile and potential returns, making it imperative to align your choice with your financial objectives and prevailing economic conditions.

- Market Dynamics: Acknowledge how supply and demand affect property values and investment potential. Recent trends indicate that millennials are increasingly dominating the home-buying market, motivated by escalating rental costs and shifting political policies that may impact stability. Notably, 36.25% of individuals believe that Trump’s policies on inflation and tariffs will negatively influence economic recovery in 2025. As Lawrence Yun, Chief Economist, noted, 'Home buyers are gradually entering the sector.' While mortgage rates have remained relatively stable, an increase in inventory and choices is releasing pent-up housing demand.

Furthermore, the latest data from the NAR reveals median home values across over 3,100 counties, offering crucial insights into local market dynamics. Understanding these statistics is vital for making strategic financial decisions. Additionally, many buyers have expressed they would be less inclined to consider a listing lacking a floor plan, underscoring the importance of presentation in attracting potential investors to real estate investment properties for sale. By mastering these fundamental concepts, you will be well-equipped to identify lucrative financial opportunities in real estate investment properties for sale and make informed decisions in the ever-evolving real estate market.

Identify Key Characteristics of Profitable Properties

When evaluating potential real estate investment properties for sale, several key characteristics should be prioritized.

-

Location: Properties situated in desirable neighborhoods tend to appreciate more rapidly and attract high-quality tenants. In 2025, location remains a pivotal factor, with trends indicating that urban areas with access to amenities and good schools are particularly sought after. Statistics indicate that location greatly influences real estate value appreciation, making it crucial for investors to concentrate on this element.

-

Condition: The physical state of an asset is crucial. Well-maintained assets not only require less immediate investment but also tend to hold their value better over time. Investors should look for properties that have been updated or are in good repair to minimize renovation costs.

-

Cash Flow Potential: It's essential to calculate the expected rental income against all expenses to ensure a positive cash flow. Properties that can generate consistent income are more likely to provide profitable returns, especially in an environment where mortgage rates have recently risen to 6.8%, impacting affordability for many buyers. As highlighted in a recent case study, homebuyers are encouraged to concentrate on their financial circumstances instead of attempting to time the environment, as future mortgage rate adjustments will rely on inflation and economic conditions.

-

Industry Trends: Staying updated on local industry trends is essential. For instance, the global real estate market is projected to grow at a CAGR of 9.6%, indicating robust opportunities for investment. D.R. Horton, the nation’s largest homebuilder, remarked that this year’s spring selling season started slower than expected, as potential homebuyers have been more cautious due to continued affordability constraints and declining consumer confidence. Grasping these trends can assist investors in predicting changes in real estate values and demand.

By concentrating on these characteristics, investors can better identify real estate investment properties for sale that are likely to yield profitable returns, ensuring a strategic approach to their real estate investment.

Conduct Market Research and Financial Analysis

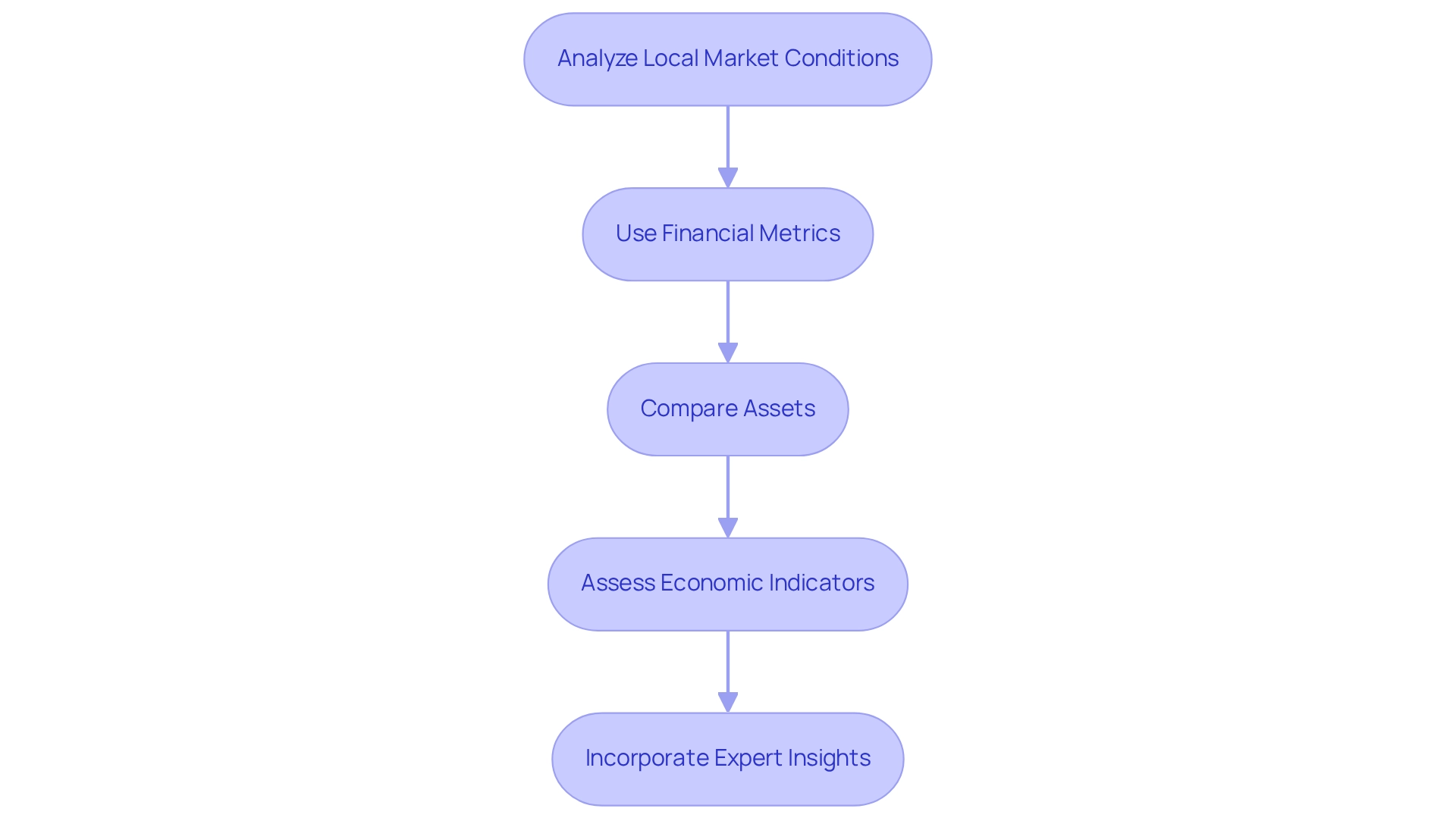

To conduct effective industry research and financial analysis, follow these steps:

-

Analyze Local Market Conditions: Begin by examining trends in property prices, rental rates, and vacancy rates in your target area. For instance, as of February 2025, homes in Iowa averaged just 22 days on the market, indicating a competitive environment. In contrast, Detroit's median home price stands at $99,900, reflecting a buyer's market with around 530 listings available.

-

Use Financial Metrics: Familiarize yourself with essential metrics such as Net Operating Income (NOI), Capitalization Rate (Cap Rate), and Cash-on-Cash Return. These indicators are crucial for assessing the profitability of potential investments. As of late April 2025, the average rate for a 30-year fixed mortgage was 6.86 percent, an important factor to consider when evaluating financing conditions.

-

Compare Assets: Utilize comparable sales (comps) to assess asset values and potential returns. This approach enables effective industry assessment and helps pinpoint undervalued opportunities.

-

Assess Economic Indicators: Consider local economic factors, including job growth and demographic shifts, which can significantly influence property demand. Recent data indicates that inventory in the West increased by 40.3% and in the South by 31.1% in March 2025, suggesting a revival in these sectors. Furthermore, the continuing influence of tariffs and the new presidential administration introduces uncertainty to the housing sector, which should be included in your analysis.

-

Incorporate Expert Insights: Leverage perspectives from industry specialists to enhance your understanding of consumer sentiments. For instance, Les Sulgrove, a statewide housing analyst from Iowa REALTORS®, noted that a late September interest rate decrease by the Federal Reserve lifted buyer and seller sentiments throughout the peak autumn month.

By thoroughly examining the industry and analyzing financial data, you can make informed financial decisions that align with current trends and economic conditions.

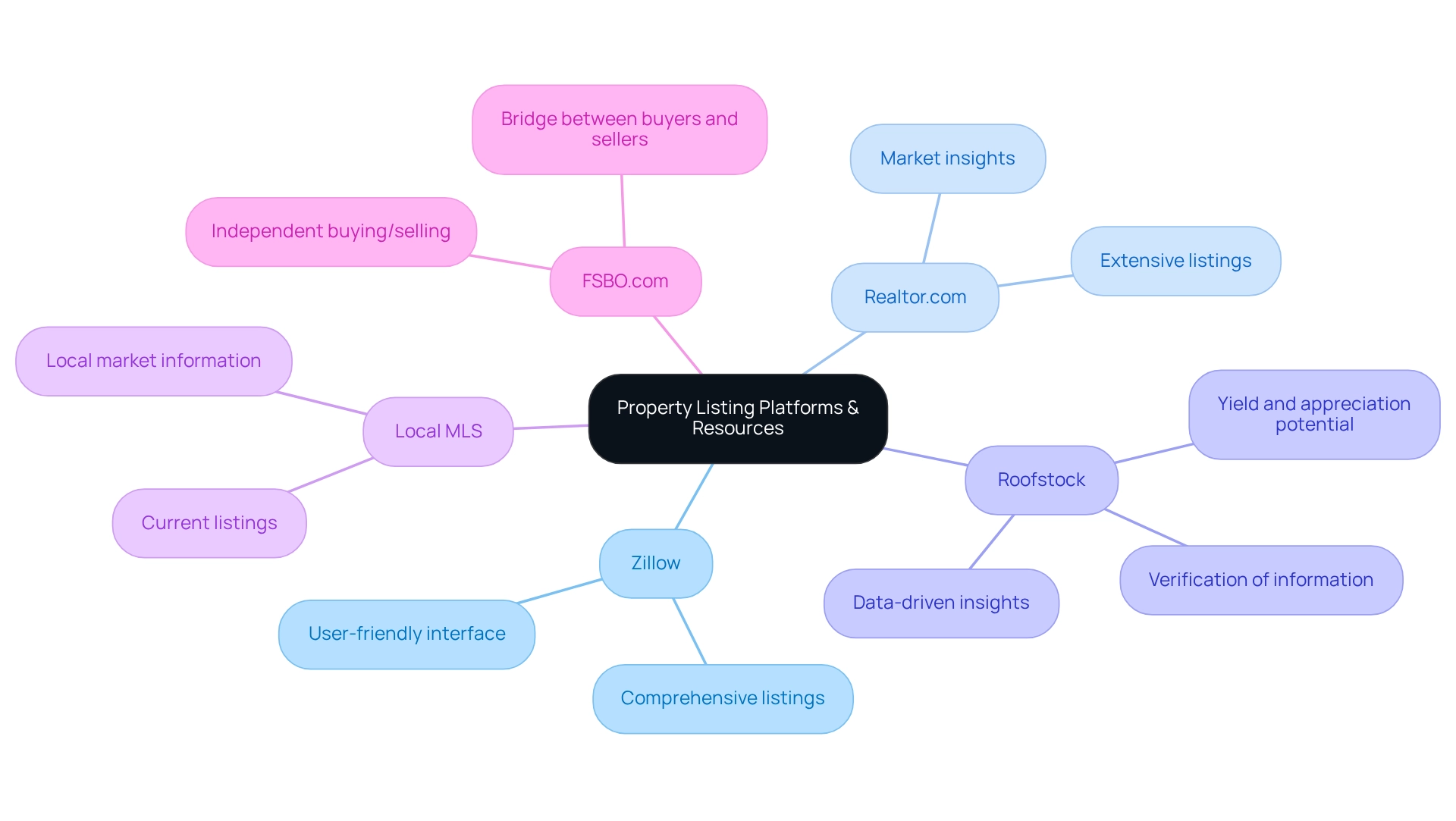

Explore Platforms and Resources for Property Listings

To effectively locate investment properties, consider utilizing the following platforms and resources:

- Zillow: This platform boasts a vast database of properties for sale, complete with filters specifically designed for investment properties. In 2025, Zillow continues to be a leading choice among investors due to its user-friendly interface and comprehensive listings.

- Realtor.com: Renowned for its extensive listings and market insights, Realtor.com simplifies the process of identifying possible investments. Its robust search features allow investors to narrow down options based on specific criteria.

- Roofstock: Focused on rental assets, Roofstock enables users to search by yield and appreciation potential, making it an excellent resource for investors looking to maximize returns. As noted by Jeff, an author on the Roofstock Blog, "Although Roofstock provides information it believes to be accurate, Roofstock makes no representations or warranties about the accuracy or completeness of the information contained on this blog." This highlights the importance of verifying data while using the platform. The platform's emphasis on data-driven insights enhances decision-making.

- Local MLS: Accessing your local Multiple Listing Service (MLS) provides the most current listings, ensuring you stay informed about new opportunities in your area.

- FSBO.com: Recognized as the best platform for consumers to buy and sell real estate independently without an agent, FSBO.com serves as a bridge between independent buyers and sellers. This can be particularly beneficial for investors seeking alternative purchasing methods.

By utilizing these resources, you can simplify your search for properties that match your financial objectives. Significantly, platforms such as Zillow and Realtor.com have been acknowledged for their efficiency in linking investors with viable listings, further reinforcing their status as essential tools in the real estate market. Additionally, as the case study titled "Future Outlook: Balancing Challenges and Opportunities" suggests, the real estate market is at a crossroads of challenges and opportunities, with potential for lowered mortgage rates and market stabilization. Stakeholders must navigate these dynamics to capitalize on emerging opportunities while mitigating risks.

Evaluate Properties for Investment Viability

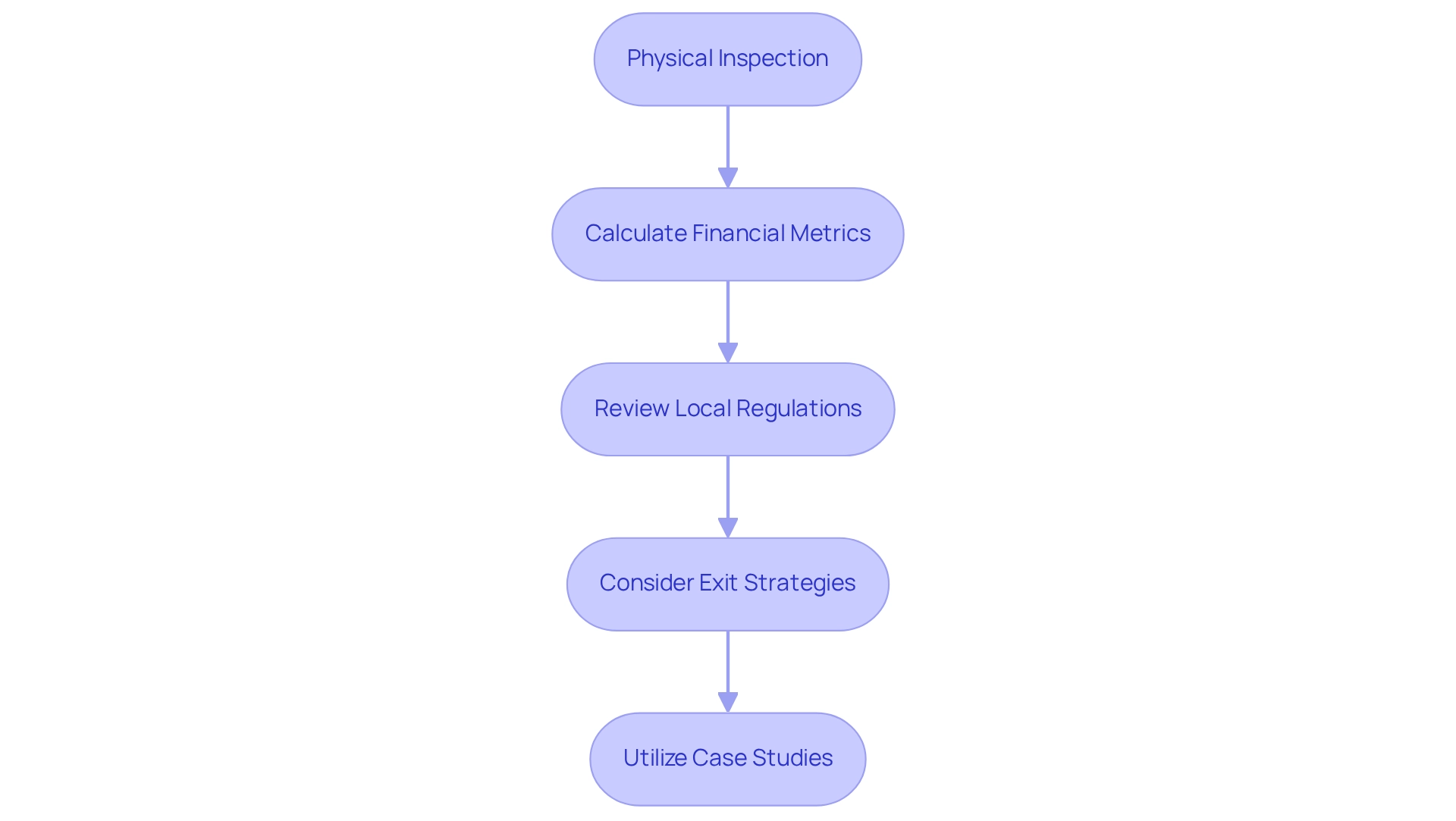

To effectively assess a real estate asset for financial potential, follow these essential steps:

-

Perform a Physical Inspection: Conduct a thorough assessment of the condition of the premises, focusing on structural integrity and identifying necessary repairs. This step is essential, as assets needing substantial repairs can greatly influence your returns' profitability. Statistics show that assets with thorough inspections tend to provide better long-term returns, underscoring the significance of this step.

-

Calculate Financial Metrics: Analyze key financial indicators such as expected cash flow and return on equity (ROE). For instance, the average ROI for real estate ventures in 2025 is anticipated to be approximately 9.5% for industrial properties. Moreover, considering the historical context, the 20-year ROI for a home in Maryland was 163% from 2000 to 2020, emphasizing the possible returns on real estate.

-

Review Local Regulations: Familiarize yourself with zoning laws and rental regulations that could affect your financial commitment. Understanding these regulations is vital to avoid legal complications and ensure compliance.

-

Consider Exit Strategies: Develop potential exit strategies, such as selling or renting the property, to maximize your returns. Referencing case studies, such as the identification of lucrative short-term rental areas for 2025, can provide insights into successful financial strategies and illustrate how these areas can inform your exit plans. Having a clear plan can help reduce risks associated with changes in the economy.

-

Utilize Case Studies: Refer to case studies on real estate assessment for funding, such as the identification of profitable short-term rental areas. These examples can offer insights into effective financial strategies and emphasize the significance of comprehensive assessments. As the global real estate market is projected to reach $5,388.87 billion by 2026, the importance of thorough evaluations of real estate investment properties for sale becomes even more apparent in a growing market. By conducting a comprehensive evaluation, you can make informed decisions about the viability of real estate investment properties for sale, ultimately enhancing your chances of success in the real estate market.

Conclusion

Understanding the fundamentals of real estate investment is imperative for anyone aiming to navigate this lucrative yet complex market. Familiarizing oneself with the various types of properties, investment strategies, and market dynamics positions potential investors to uncover profitable opportunities. Recognizing that factors such as location, condition, cash flow potential, and current market trends play a crucial role in property evaluation enables investors to make informed decisions that align with their financial objectives.

Effective market research and financial analysis are vital components of a successful investment strategy. Utilizing key financial metrics and staying abreast of local economic conditions provides valuable insights that enhance decision-making. Moreover, leveraging platforms and resources designed for property listings streamlines the search process and connects investors with viable opportunities, further enhancing their potential for success.

Ultimately, a thorough evaluation of properties, coupled with careful planning and strategic foresight, can lead to fruitful real estate investments. As the market continues to evolve, staying informed and adaptable empowers investors to navigate challenges and seize opportunities, ensuring a robust pathway to financial growth and stability in the world of real estate.