Overview

This article details five essential steps for mastering real estate data analytics software.

- It emphasizes the need to understand the software's functionalities, which is crucial for effective utilization.

- Next, identifying investment needs allows for tailored solutions that align with specific goals.

- Evaluating features is the third step, ensuring that the selected software meets the necessary criteria for performance.

- Following this, comparing different options empowers investors to make informed choices.

- Finally, implementing the chosen software effectively is vital for maximizing its benefits.

Each step highlights the significance of data-driven strategies in property management, demonstrating how proficiency in these tools can lead to informed investment decisions and enhanced operational efficiency in a competitive market.

Introduction

In the dynamic landscape of real estate, the integration of data analytics software has emerged as a game-changer for investors and professionals alike. This innovative technology streamlines the process of collecting and interpreting vast amounts of data, equipping users with the insights necessary to navigate market complexities and make informed investment choices. As the industry evolves, understanding how to harness these tools effectively becomes imperative for success.

From identifying investment needs to evaluating software features and implementing chosen solutions, this article delves into the essential steps that real estate investors must take to leverage data analytics in their strategies. By doing so, they ensure they remain competitive in an increasingly data-driven environment.

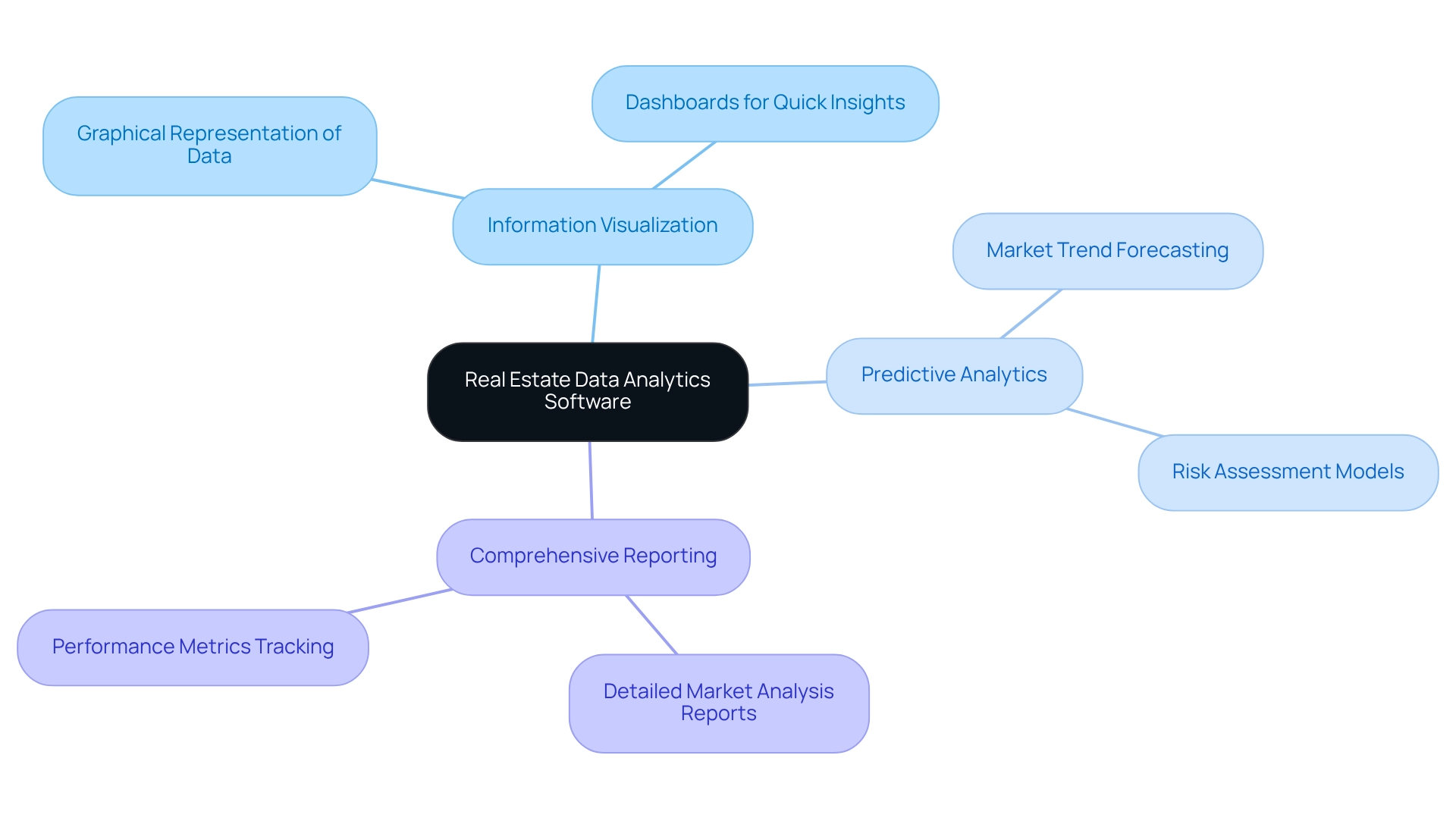

Understand Real Estate Data Analytics Software

Real estate data analytics software plays a vital role in the contemporary market by gathering, examining, and interpreting extensive datasets. This technology empowers users to identify emerging trends, forecast market movements, and make informed investment decisions. Key functionalities of these tools include:

- Information visualization

- Predictive analytics

- Comprehensive reporting capabilities

By mastering these features, investors can effectively utilize the potential of information to improve their property strategies.

The significance of data-driven approaches in property management cannot be exaggerated, as they offer a competitive advantage in an increasingly intricate market. As the industry evolves, adopting business analytics will become essential for success. For instance, Zero Flux, a specialized daily newsletter, has successfully curated insights from over 100 sources, demonstrating the effectiveness of data-driven approaches. With more than 30,000 subscribers, it acts as an essential resource for property professionals navigating market complexities, assisting them in making informed investment choices based on selected information.

Looking forward to 2025, trends in real estate data analytics software indicate a growing emphasis on advanced features that enhance user experience and decision-making. Statistics indicate that organizations utilizing analytics tools experience substantial enhancements in operational efficiency and investment results. For instance, DigitalDefynd has assisted more than 4 million contented learners, emphasizing the wider acceptance and efficiency of analytics tools in the sector. Industry leaders stress that in this new era, information may exceed conventional applications in significance, highlighting the need for property investors to adopt these technologies. Tim O'Reilly's assertion that "we’re entering a new world in which data may be more important than software" reinforces the critical need for investors to adopt data analytics in their strategies.

Identify Your Investment Needs

To effectively recognize your investment requirements in property, begin by clearly defining your investment objectives. Are you concentrating on residential properties, commercial properties, or investigating possibilities in emerging markets? Comprehending your goals is essential, as it influences your strategy towards data analysis and program selection.

Consider critical elements such as your typical budget for property investments in 2025, which is expected to be influenced by market trends and personal financial circumstances. While specific projections may vary, it is essential to remain aware of the economic landscape. For instance, with only 29.7% of Millennial renters currently able to afford home purchases, many are seeking alternative investment avenues. This demographic shift underscores the importance of aligning your investment strategy with current market realities, particularly in light of technological advancements and sustainability trends that are shaping the industry.

Additionally, define your desired return on investment (ROI) and the types of properties that interest you. This clarity will guide you in selecting real estate data analytics software that offers the necessary features tailored to your specific needs. Expert advice suggests that successful investors prioritize energy-efficient features and smart home technologies, reflecting a growing trend towards sustainability in property investments.

Incorporating insights from case studies, such as the crowdfunding revolution that raised nearly $20 billion in 2023, can also inform your strategy. This democratization of investment enables individuals to engage in property ventures that were previously unreachable, highlighting the necessity to adjust your investment objectives to take advantage of new opportunities. By understanding how crowdfunding can create opportunities for various investment choices, you can more effectively align your strategies with the changing market environment. By methodically detailing your investment objectives and taking these aspects into account, you will be better prepared to manage the intricacies of the property market and apply analytics proficiently.

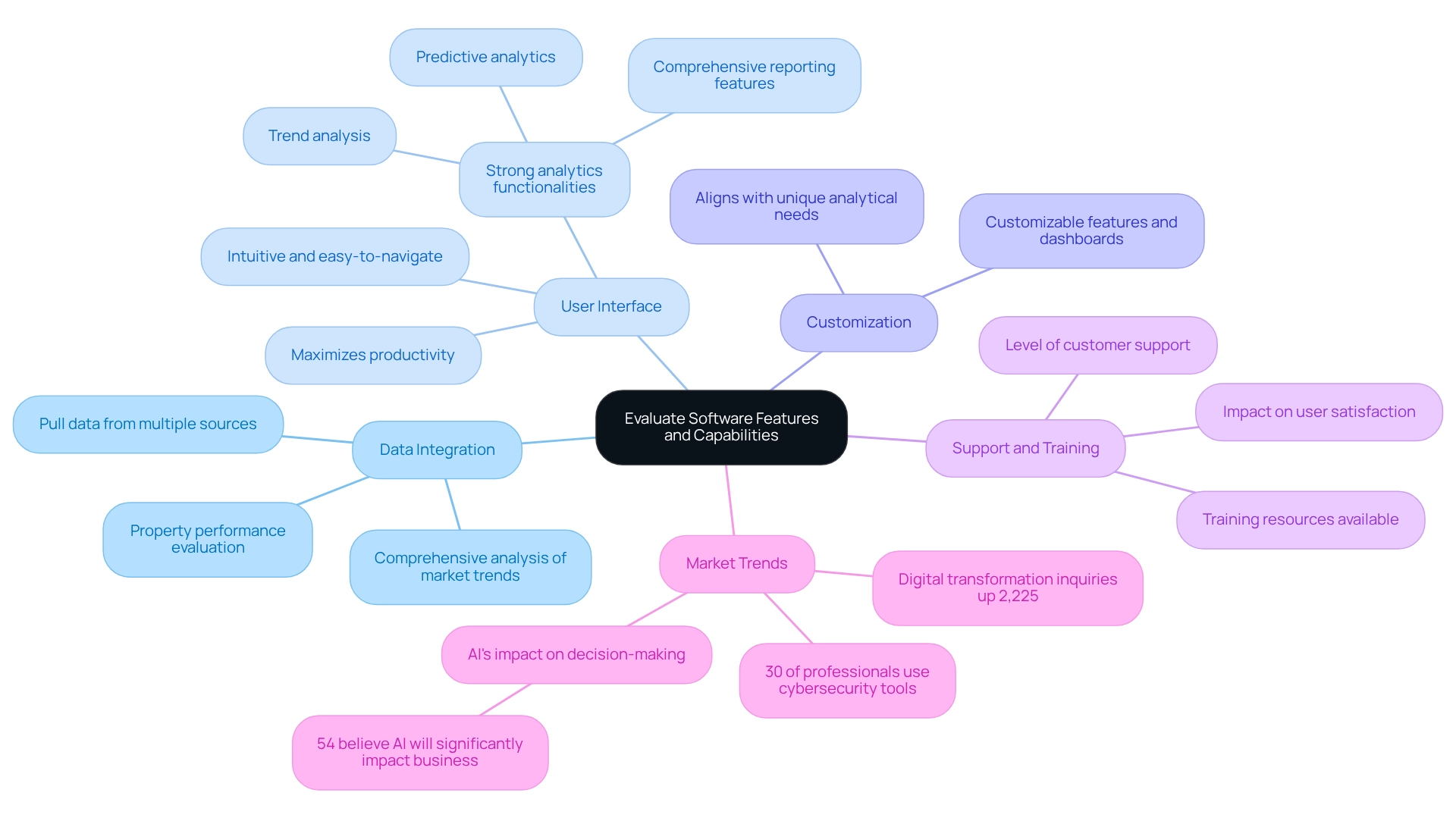

Evaluate Software Features and Capabilities

When evaluating real estate data analytics software, it is crucial to consider several key features that can significantly enhance your analytical capabilities:

- Data Integration: The ability to pull data from multiple sources is essential. Effective systems should seamlessly integrate various datasets, which allows real estate data analytics software to conduct a comprehensive analysis of market trends and property performance.

- User Interface: An intuitive and easy-to-navigate interface is vital for maximizing productivity. A well-designed user interface ensures that users can quickly access the tools and information they need without unnecessary complexity. Seek out applications that provide strong analytics functionalities, including predictive analytics, trend analysis, comprehensive reporting features, and real estate data analytics software. These tools empower users to make informed decisions based on data-driven insights.

- Customization: The application should permit customization to meet specific business needs. Customizing features and dashboards can improve usability and ensure that the application aligns with your unique analytical needs.

- Support and Training: Evaluate the level of customer support and training resources available. Comprehensive support can significantly impact user satisfaction and the overall effectiveness of the software.

In today's swiftly changing property market, where inquiries for 'digital transformation' have increased by 2,225% over the last ten years, the significance of analytics cannot be emphasized enough. By thoroughly evaluating these characteristics, you can choose an analytics solution that not only satisfies your requirements but also improves your capability to maneuver through the intricacies of the property market. With 30% of property professionals already employing cybersecurity tools for information backup and recovery, investing in trustworthy software with robust security features is more essential than ever to protect your information and enhance your analytical processes. Additionally, examining resources like articles and courses can offer aspiring analysts valuable insights and knowledge to enhance their expertise. The incorporation of AI tools is also changing decision-making processes in property, as emphasized in the case study "The Impact of Artificial Intelligence on Property," where 54% of professionals think AI will greatly affect their business in the upcoming years.

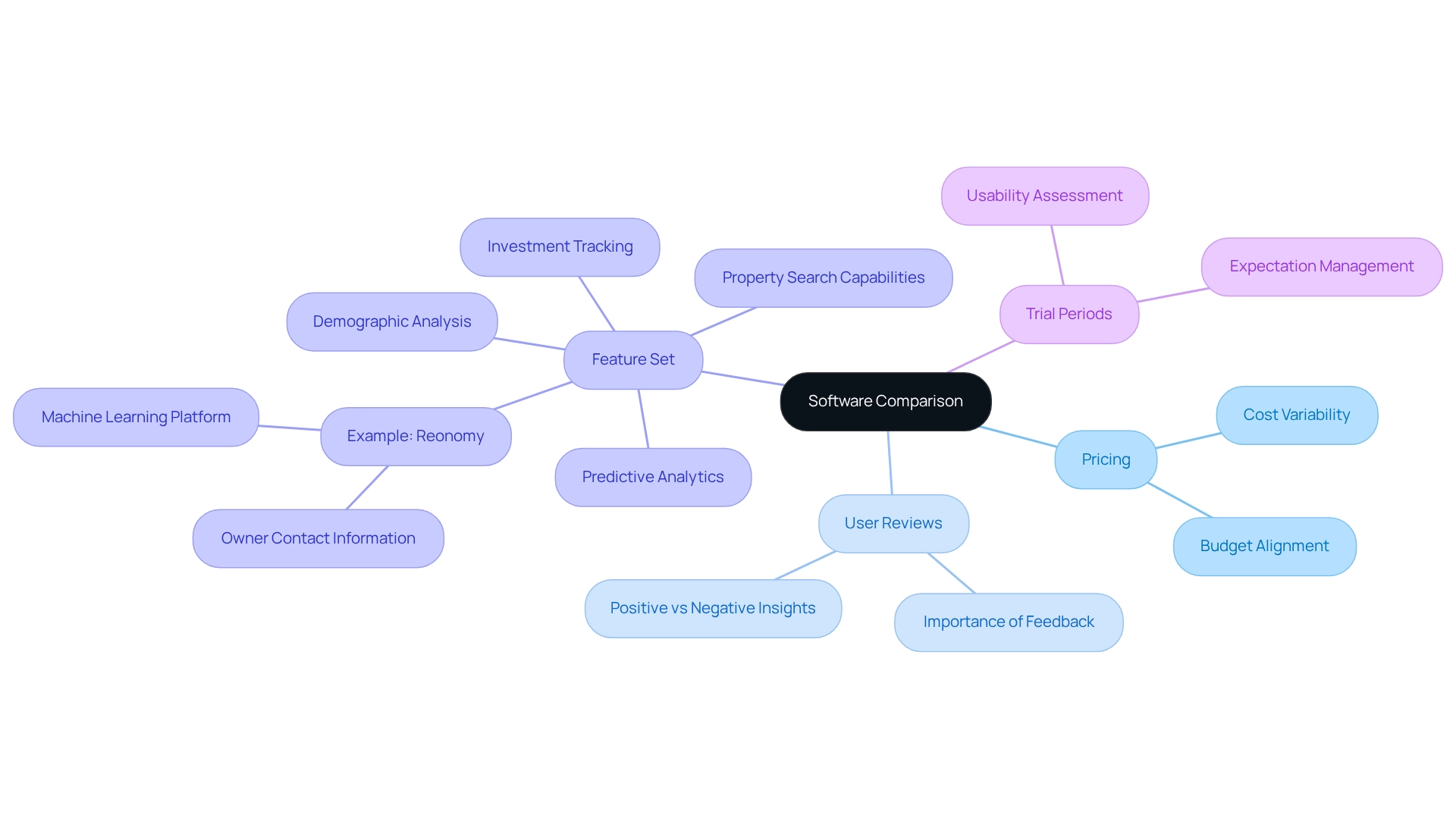

Compare Different Software Options

When evaluating real estate data analytics software, it is essential to conduct a thorough comparison based on several key factors.

-

Pricing: Understanding the costs associated with each software is crucial. In 2025, the average costs for property analytics applications vary significantly, with options ranging from economical subscription plans to high-end services that provide extensive features. This range allows users to select applications that align with their budget and requirements. Notably, the U.S. faces a shortfall of 4.5 million homes, underscoring the urgency for effective real estate data analytics software to make informed real estate decisions.

-

User Reviews: Current users provide invaluable insights into their experiences with various applications. Statistics indicate that user reviews are critical in selecting applications, with many prospective buyers relying on feedback to assess reliability and effectiveness. Positive reviews often highlight ease of use and robust functionality, while negative feedback can uncover potential pitfalls. A significant percentage of users report that they consider user reviews a primary factor in their decision-making process.

-

Feature Set: Evaluating how the characteristics of each program align with your specific requirements is essential. Some platforms excel in predictive analytics and property search capabilities, while others may focus on demographic analysis or investment tracking. A clear understanding of your needs will help you identify the most suitable application. For instance, Reonomy offers a machine learning platform for prospecting, providing predictive analytics and extensive owner contact information, which can be particularly beneficial for commercial real estate professionals.

-

Trial Periods: Numerous platform providers offer trial durations, enabling users to evaluate the system before making a commitment. This feature is particularly advantageous for assessing usability and ensuring that the application meets your expectations.

As Ada Louise Huxtable aptly stated, "Real property is the closest thing to the proverbial pot of gold." By systematically comparing these aspects, you can effectively narrow down your options to the real estate data analytics software that best fits your operational needs and improves your data-driven decision-making in the real estate market.

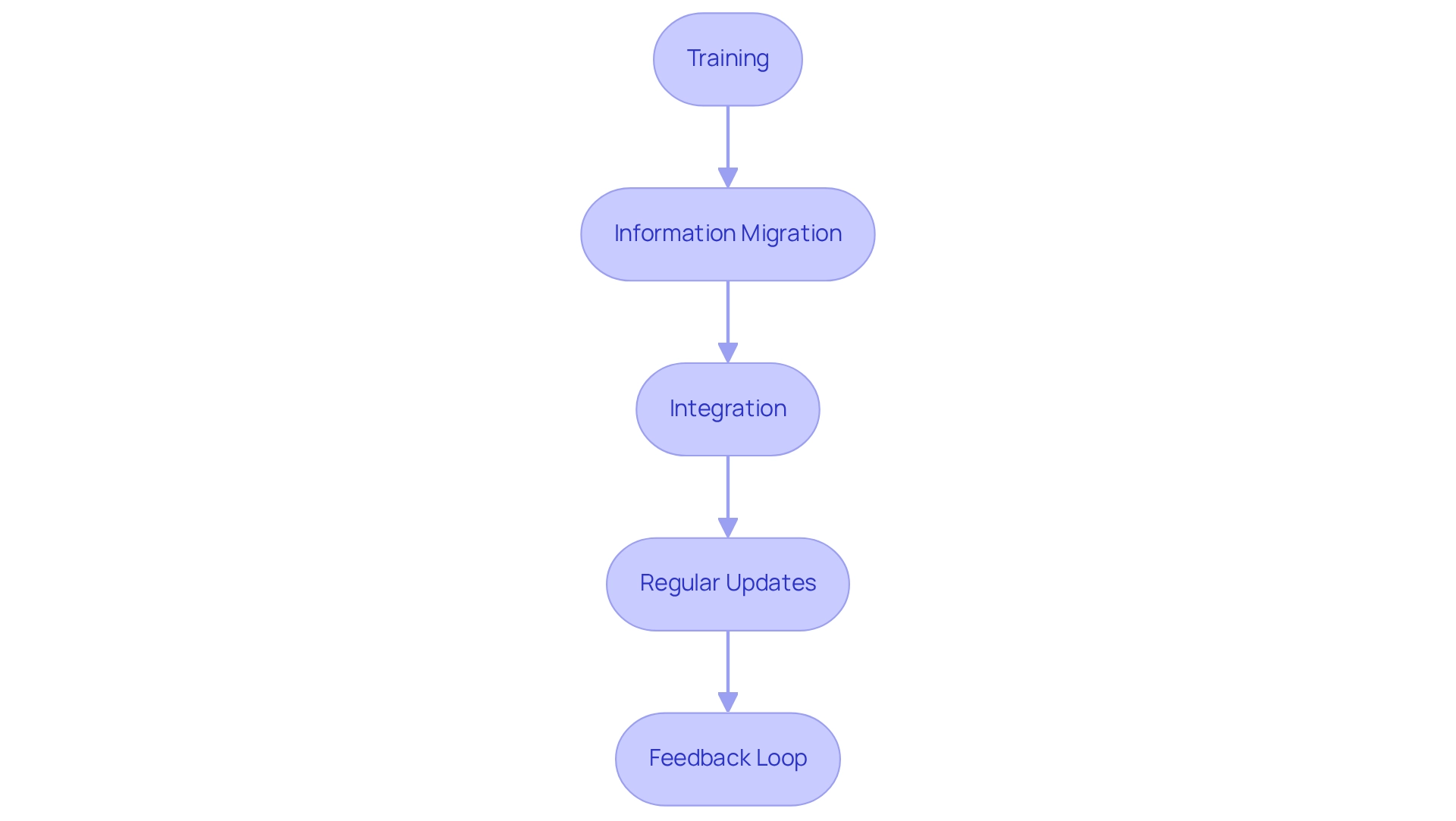

Implement the Chosen Software Effectively

To implement your chosen software effectively, consider the following best practices for 2025:

-

Training: Prioritize comprehensive training for yourself and your team. Effective training is essential, as studies show that 74% of engineers report that quality issues are first recognized by stakeholders. This highlights the need for a well-trained team that can recognize and address potential problems early.

-

Information Migration: Ensure a smooth transition by meticulously transferring all pertinent information into the new system. Successful information transfer is essential to prevent loss and maintain integrity, which is vital for accurate analytics.

-

Integration: Seamlessly connect the application with your existing tools. This integration promotes a unified workflow, enabling more effective information management and analysis.

-

Regular Updates: Keep your programs up to date to take advantage of new features and security enhancements. Regular updates not only improve functionality but also protect your data from vulnerabilities.

-

Feedback Loop: Establish a feedback mechanism to continuously refine how the application is utilized in your investment processes. This iterative method guarantees that the application develops with your requirements and improves overall efficiency.

Applying these best practices will enable you to utilize the application to its maximum potential, ultimately boosting your decision-making abilities in the property market. Additionally, case studies have shown that organizations providing adequate training and support significantly reduce human error risks during system transitions, emphasizing the importance of investing in training resources for real estate data analytics software.

Conclusion

The integration of data analytics software in real estate transcends mere trend status; it is rapidly becoming a fundamental requirement for success in a dynamic market. By grasping the capabilities of these tools, investors can uncover emerging trends and make data-driven decisions that significantly enhance their investment strategies. It is crucial to recognize the importance of aligning investment goals with market realities, especially as demographic shifts and technological advancements continue to reshape the landscape.

Evaluating software features such as data integration, user interface, and analytics tools is essential for selecting the right solution. This thoughtful assessment empowers investors to maximize their analytical capabilities and streamline decision-making processes. Furthermore, comparing various software options based on pricing, user reviews, and feature sets ensures that the chosen platform aligns with specific needs and budget constraints.

Ultimately, the effective implementation of data analytics software hinges on comprehensive training, seamless data migration, and continuous integration with existing tools. Establishing a feedback loop will further refine the software's use, ensuring it evolves in tandem with investment strategies. By embracing data analytics, real estate investors can navigate the complexities of the market with confidence, positioning themselves for success in an increasingly data-driven environment. The time to leverage these powerful tools is now; they hold the key to unlocking informed and strategic investment decisions.