Overview

This article delineates five essential steps for successfully renting commercial real estate:

- Understanding the basics

- Identifying suitable properties

- Evaluating financial considerations

- Negotiating agreements

- Conducting due diligence

Each step underscores the necessity of thorough research and strategic planning. For instance, assessing market trends and engaging with professionals are crucial to making informed decisions that align with business objectives in a dynamic real estate landscape. By following these steps, readers can navigate the complexities of the market with confidence.

Introduction

Navigating the world of commercial real estate can feel like traversing a complex maze; however, understanding its foundational elements is key to achieving success. Grasping essential terminology and property types, along with recognizing current market dynamics, creates a comprehensive knowledge base that empowers businesses to make informed decisions. The commercial landscape is continuously evolving, as evidenced by the contrasting performance of retail spaces versus industrial properties. Therefore, investors must remain attuned to trends that influence pricing and availability. As the market adapts to both local and global challenges—including geopolitical factors—the ability to identify suitable properties and negotiate favorable lease terms becomes increasingly critical. This article delves into the essential steps for effectively navigating the commercial real estate sector, equipping readers with the insights needed to thrive in this competitive arena.

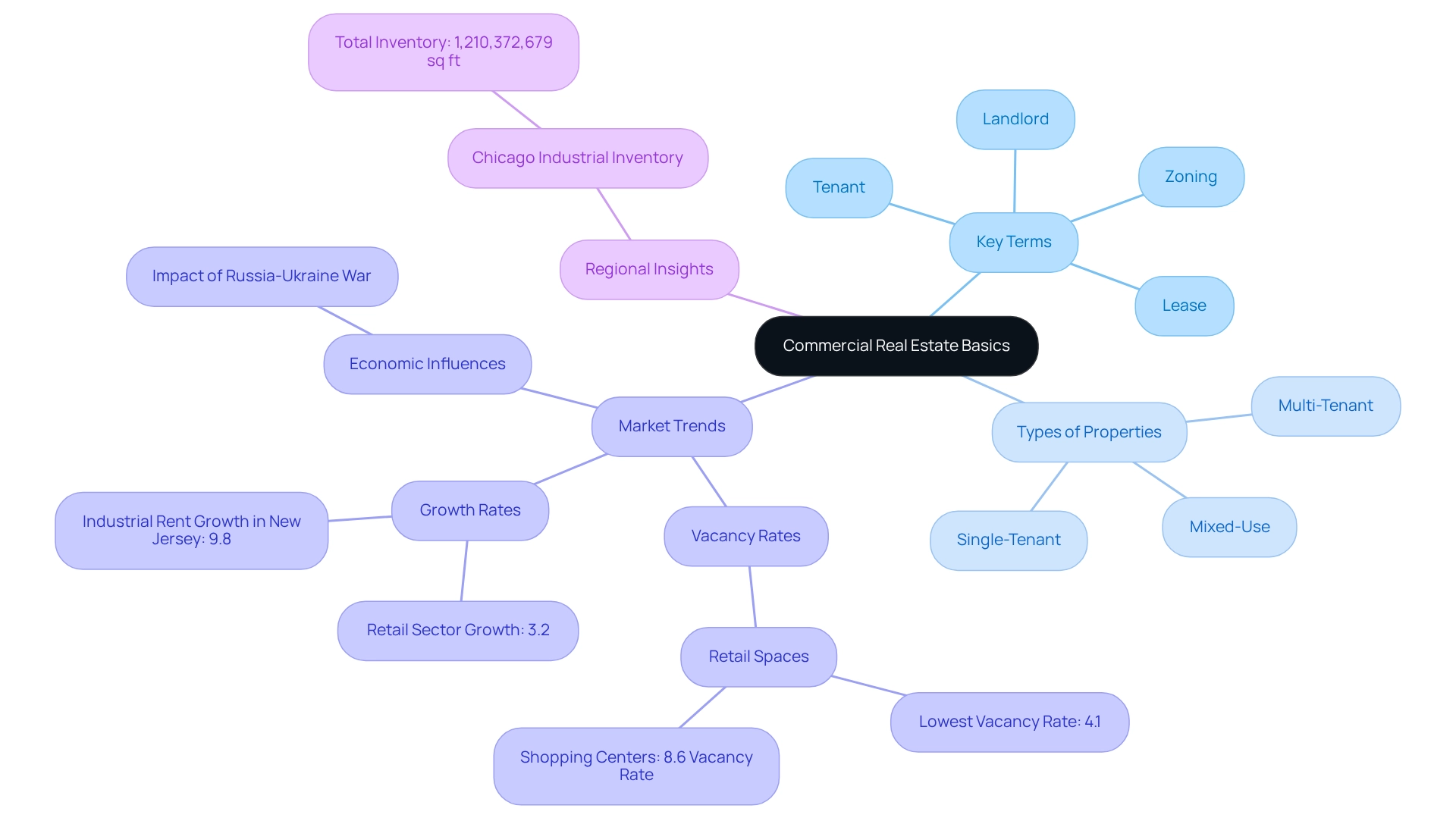

Understand Commercial Real Estate Basics

Commercial real estate (CRE) includes assets utilized for business purposes, such as office buildings, retail spaces, and industrial facilities, making it essential to rent commercial real estate for various business needs. A thorough understanding of essential terms such as 'lease', 'tenant', 'landlord', and 'zoning' is vital for effectively navigating this sector. By comprehending the various types of commercial properties—such as single-tenant, multi-tenant, and mixed-use—you can identify which options align most effectively with your business objectives, especially when considering how to rent commercial real estate, as current economic dynamics significantly influence rental costs and availability. For example, New Jersey has emerged as a leader in industrial rent growth, showcasing an impressive 9.8% year-over-year increase. In Chicago, the total industrial inventory stands at an astounding 1,210,372,679 square feet, reflecting the robust demand in this sector.

Furthermore, the retail sector is adapting to shifting economic conditions, exhibiting a notable performance variance across different types of real estate. Retail spaces currently boast the lowest vacancy rate at 4.1%, while shopping centers face challenges with an 8.6% vacancy rate. Despite a 12% decline in foot traffic year-over-year, the sector has achieved a growth rate of 3.2%, highlighting the resilience of specific retail formats. As Sharad Mehta notes, the real estate sector provides critical insights into economic health and investment trends, making it imperative to grasp these fundamentals.

Moreover, while the effects of the Russia-Ukraine war are assessed at a country-specific level, they may influence market dynamics and should be recognized when evaluating the CRE landscape.

Armed with this foundational knowledge, including insights from the case study on retail sector adaptation, you can navigate the complexities of the leasing process with greater confidence and make informed decisions that align with current trends. Additionally, understanding average rental costs to rent commercial real estate by category in 2025 will provide a more comprehensive view of existing trends, aiding investors in making knowledgeable choices.

Identify Suitable Commercial Properties

Begin by thoroughly assessing your business requirements, which should encompass location, size, budget constraints, and the decision to rent commercial real estate. Utilize trustworthy online platforms and local listings to explore how to rent commercial real estate, paying close attention to crucial factors such as foot traffic, accessibility, and proximity to competitors. In 2025, average foot traffic data reveals a significant decrease of 12% year-over-year; however, the retail sector has achieved a 3.2% growth due to stringent economic conditions and limited supply, underscoring the importance of strategic location selection. Notably, the overall industrial inventory in Chicago stands at 1,210,372,679 square feet, providing substantial context for the extent of available business spaces.

Engaging with a real estate agent who specializes in your desired region is essential, as they can offer valuable insights into current trends and assist in your search to rent commercial real estate that aligns with your criteria. For example, the retail sector maintains the lowest vacancy rate among commercial real estate sectors at 4.1%, despite the challenges faced by malls, which exhibit an 8.6% vacancy rate. This emphasizes the necessity of understanding market dynamics when selecting a real estate asset. As Grant Cardone aptly states, "People don’t buy homes. They purchase dreams," highlighting the emotional aspect of real estate selection.

Finally, arrange space viewings to assess the physical area and its suitability for your operations. This hands-on evaluation is critical to ensure that the property meets your business needs and aligns with your strategic goals. Moreover, consider utilizing platforms like LoopNet and CoStar, which are among the premier online resources to rent commercial real estate. Staying informed about current business real estate market trends as of April 2025 will further enhance your decision-making process.

Evaluate Financial Considerations and Lease Terms

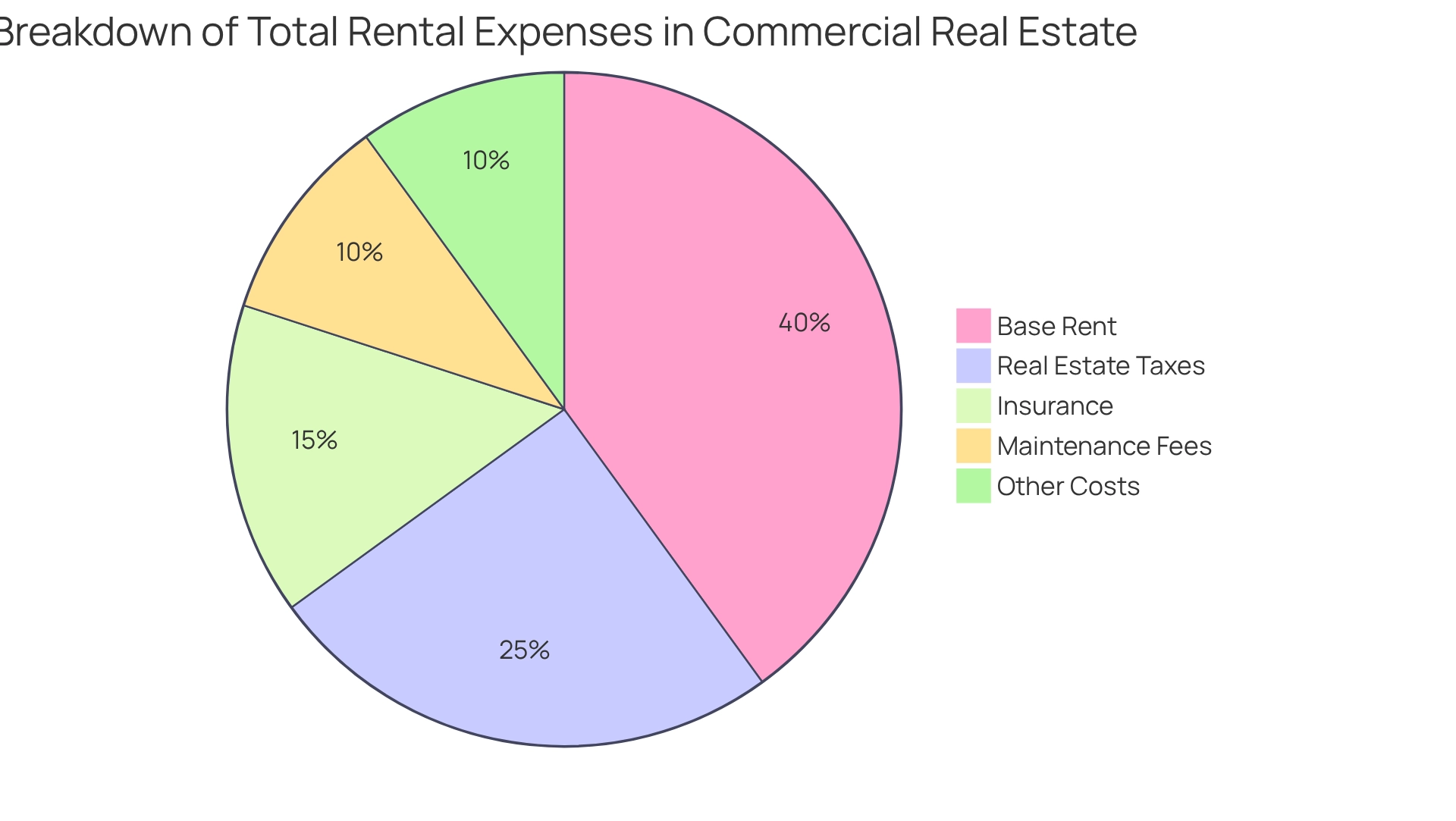

When evaluating the overall costs associated with renting commercial real estate, it is imperative to consider several factors beyond the base rent. This includes real estate taxes, insurance, and maintenance fees, all of which can significantly affect your total financial commitment. Understanding the different types of rental agreements—such as gross, net, and modified gross arrangements—is essential, as each type delineates unique financial responsibilities that can influence your budget.

In 2025, average total rental expenses for commercial spaces have shown marked fluctuations. The retail sector boasts a low vacancy rate of 4.1%, while shopping centers face challenges with an 8.6% vacancy rate. Notably, New Jersey has recorded the fastest industrial rent growth at 9.8% year-over-year, providing valuable context for investors eyeing industrial properties. Furthermore, Chicago has achieved one-third of its total sales volume for 2024 just two months into the year, although many assets are being sold at reduced prices, reflecting current market dynamics that could impact rental negotiations.

As you formulate your budget for when you rent commercial real estate, ensure it encompasses not only the base rent but also potential rent increases and renewal options that may arise during the lease term. Engaging with a financial consultant or property attorney can provide clarity on complex rental terms and empower you to negotiate more favorable conditions. Expert insights underscore the importance of fully understanding these financial elements to make informed decisions in the leasing landscape.

Additionally, with international investment in U.S. commercial properties surpassing $53 billion, recognizing these broader financial implications is crucial for strategic planning when you rent commercial real estate. In summary, a comprehensive understanding of rental categories and their associated expenses, coupled with prevailing trends, will equip you to navigate the complexities of how to rent commercial real estate more effectively.

Negotiate Rental Agreements Effectively

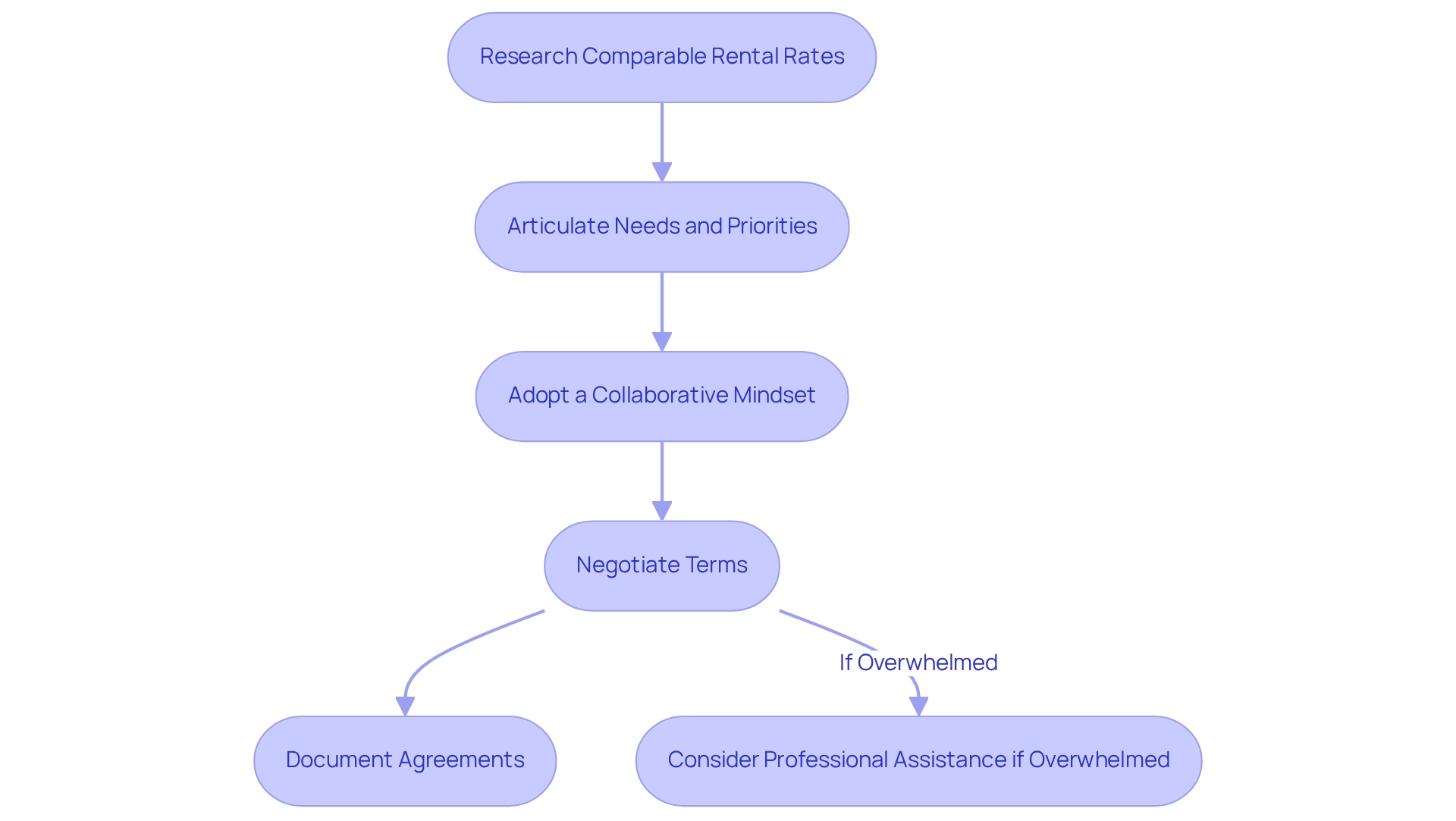

To negotiate rental agreements effectively, start by researching comparable rental rates to rent commercial real estate in your target area. This foundational step establishes a baseline for your discussions and equips you with data-driven insights. Notably, retail foot traffic has decreased by 12% year-over-year, yet the sector achieved a 3.2% growth, underscoring the necessity of informed negotiations in a dynamic environment. Clearly articulate your needs and priorities, including:

- Lease duration

- Desired rent-free periods

- Maintenance responsibilities

Adopting a collaborative mindset is crucial; aim for a win-win outcome that benefits both parties. For instance, in Chicago, where one-third of its 2024 total sales volume was realized within just two months, many assets are sold at discounted prices, indicating potential leverage in negotiations. While flexibility on certain terms is important, remain steadfast on critical issues that align with your investment goals. Document all agreements in writing to ensure clarity and prevent misunderstandings later on.

If the negotiation process feels overwhelming, consider enlisting the assistance of a professional negotiator or attorney to navigate the complexities. Furthermore, understanding the performance of top supermarkets in the U.S. for 2023 can provide broader context for the real estate market, aiding investors in their negotiations. Remember, thorough research and credible sourcing are essential, as demonstrated by Zero Flux's commitment to data integrity, which enhances the quality of insights available to you.

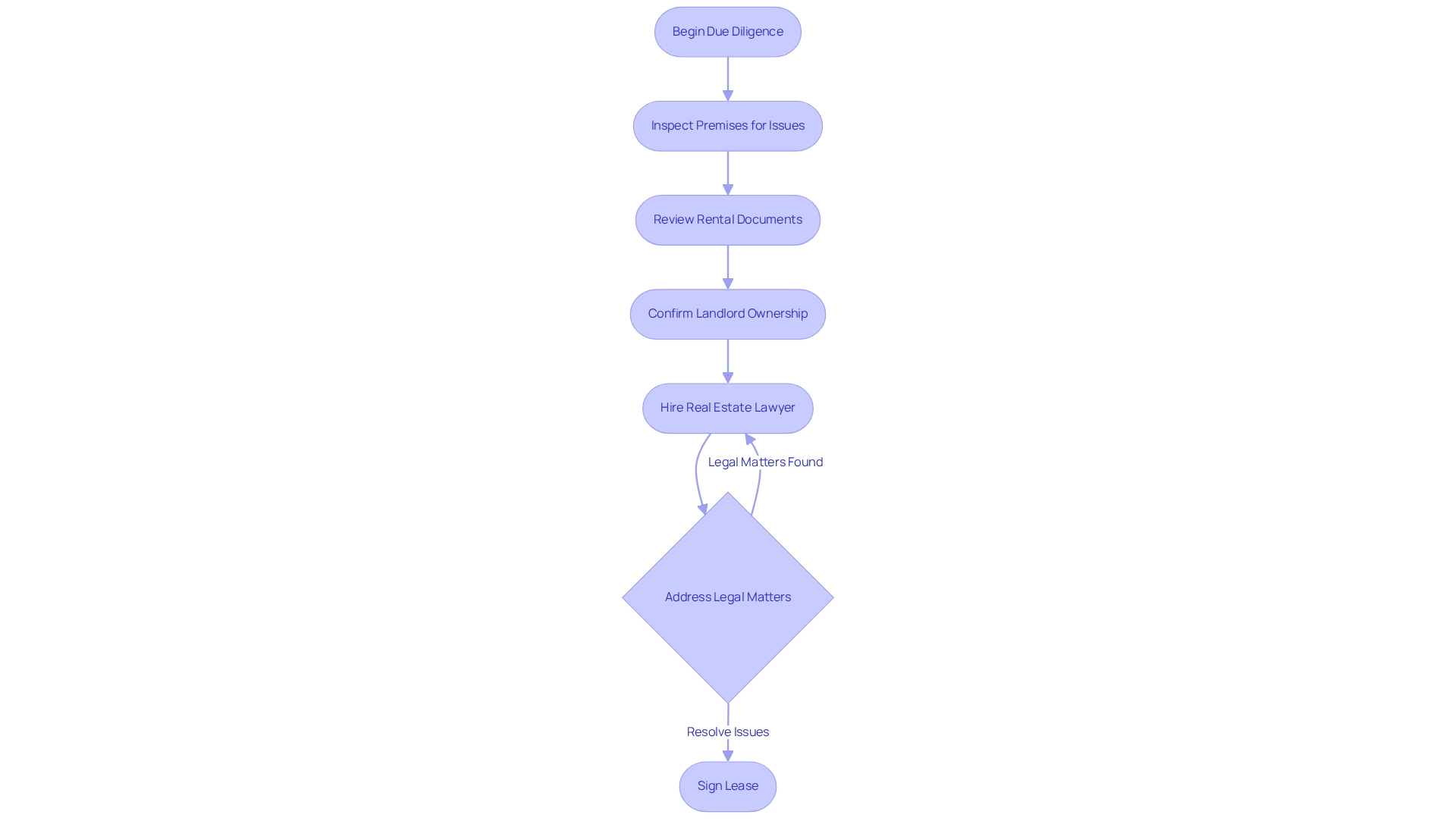

Conduct Due Diligence and Finalize the Rental

Before concluding a rental agreement, it is essential to perform a thorough examination of the premises to identify any maintenance problems or required repairs. Statistics indicate that around 30% of commercial real estate encounters inspection-related issues, which can result in expensive surprises after leasing. Pay close attention to rental documents, particularly terms regarding rent increases, maintenance obligations, and termination clauses, as these can significantly impact your investment.

Confirming the landlord's ownership is crucial; ensure there are no liens or legal problems related to the property that could affect your rental agreement. Hiring a real estate lawyer for a comprehensive examination of the agreement can provide extra reassurance and assist in resolving any issues that may arise. As AGrosheider notes, "Innovative companies like Blue222 are stepping up to modernize the industry," highlighting the importance of staying informed about current trends.

In 2025, frequent legal matters in commercial agreements involve unclear terms and insufficient disclosures, leading to potential conflicts. Understanding these nuances is paramount. For instance, the retail sector, despite facing a 12% decline in foot traffic year-over-year, achieved a 3.2% growth due to tight market conditions and limited supply. This demonstrates how due diligence can significantly influence investment decisions. Once you are satisfied with the inspection and legal review, sign the lease and ensure you receive a copy for your records. This meticulous approach to due diligence not only safeguards your interests but also positions you for success in the competitive commercial leasing landscape, especially when you aim to rent commercial real estate in emerging sectors like data centers and sustainable buildings that show strong growth.

Conclusion

Understanding the intricacies of commercial real estate is essential for success in this dynamic sector. Grasping fundamental concepts, such as property types and lease agreements, lays the groundwork for informed decision-making. In a continuously evolving market, investors must remain vigilant regarding trends that influence pricing and availability, particularly in the contrasting performances of retail and industrial properties.

Identifying suitable commercial properties requires a meticulous assessment of business needs, location, and market conditions. Engaging with knowledgeable brokers and utilizing reliable online platforms can streamline this process, ensuring that investors find properties that align with their strategic goals. Additionally, financial considerations play a pivotal role in the leasing process. Understanding lease types and the total cost of occupancy is crucial for crafting a budget that accommodates all potential expenses.

Effective negotiation of rental agreements is vital for securing favorable terms. By leveraging market data and articulating needs clearly, investors can navigate negotiations with confidence. Furthermore, conducting thorough due diligence before finalizing a rental agreement safeguards against unforeseen issues that could impact investments.

In conclusion, navigating the commercial real estate landscape requires a comprehensive approach that combines knowledge, strategic planning, and proactive engagement. By understanding foundational concepts, recognizing market dynamics, and diligently assessing properties and lease terms, businesses can position themselves for success in this competitive arena. As the commercial real estate market continues to adapt, staying informed and prepared will empower investors to make sound decisions that drive growth and profitability.