Overview

Creating a robust real estate investment business plan begins with a clear vision. It is essential to establish key components, such as:

- Executive summary

- Financial projections

While incorporating best practices like:

- Setting SMART goals

- Leveraging data-driven insights

A well-structured business plan not only provides direction and clarity but also significantly enhances your ability to secure funding and effectively manage risks in a competitive market. By understanding these elements, investors can position themselves for success and navigate the complexities of real estate investment with confidence.

Introduction

In the dynamic world of real estate investing, a well-defined business plan is not merely beneficial—it is essential. As the market continues to evolve, investors must adeptly navigate a landscape filled with both opportunities and challenges. A comprehensive business plan acts as a roadmap, guiding investors through their long-term goals, investment strategies, and market analysis.

Successful investors recognize the significance of establishing a mission statement that encapsulates their vision and identifying key components that ensure clarity and focus. With the real estate market projected to grow significantly in the coming years, it is crucial to regularly adapt and refine this plan. This strategic approach is vital for maximizing returns and achieving sustainable success.

Define Your Real Estate Investment Business Plan

Defining your real estate investment business plan begins with a clear articulation of your vision. Consider the following questions:

- What are my long-term goals in real estate investing?

- What types of properties do I want to invest in (residential, commercial, etc.)?

- Who is my target audience?

Crafting a mission statement is crucial as it encapsulates your purpose and the value you aim to deliver. This statement should be succinct yet comprehensive enough to guide your decision-making throughout your financial journey. For instance, a mission statement could be:

'To build a sustainable portfolio of residential properties that provide quality housing while generating consistent cash flow and long-term appreciation.'

Creating a mission statement not only clarifies your objectives but also aligns your strategies with industry demands.

With 66.1% of families possessing their primary residence, comprehending the dynamics of homeownership can guide your financial decisions. Furthermore, since almost 47% of home purchasers begin their search online, utilizing digital resources can improve your outreach and efficiency. In May 2024, residences remained an average of 44 days on the market, emphasizing the significance of timing in your financial strategy. Incorporating these aspects into your approach will create a strong foundation for your real estate investment business, ensuring that you remain focused and adaptable in a market projected to grow at an annual rate of 2.69%, reaching approximately $727.80 trillion by 2029. Moreover, understanding the difference between income-generating properties—characterized as properties mainly aimed at producing revenue through rental contracts—and primary residences is crucial for aligning your focus.

Understand the Importance of a Business Plan

A business plan is essential for the real estate investment business for several compelling reasons. First, it establishes a clear direction, ensuring that you remain focused on your financial goals amidst fluctuations in the economy. Additionally, a routine review process keeps your goals aligned with market changes and client needs, further enhancing clarity.

Second, funding is a critical aspect. Investors and lenders usually require a proposal to assess the viability of your investment strategy, making it an essential element for obtaining financing. As Sean Heberling, a Toptal Management Consultant, observes, 'Angels and venture capitalists are interested in your strategy, and public companies must present strategies to convince underwriters and investors to acquire their securities.' This highlights the importance of a well-organized strategy in attracting potential investors.

Furthermore, risk management is crucial; a well-structured enterprise approach identifies potential risks and outlines strategies to mitigate them, enhancing your capability to navigate uncertainties in the market. Lastly, performance tracking is vital in the real estate investment business; by establishing benchmarks, a strategy allows you to assess your progress over time, facilitating modifications as necessary to remain aligned with your goals.

In essence, a strategy transcends being merely a document; it functions as a tactical instrument that can significantly influence your success in real estate investing. Notably, studies show that 40% of students who complete course writing related to ventures proceed to establish their own enterprises, underscoring the significance of this essential component in promoting entrepreneurial achievement.

Moreover, as the real estate technology sector is anticipated to expand from $10.54 billion in 2024 to $17.22 billion by 2029, possessing a strong strategy will be increasingly essential for adapting to changing market conditions and securing necessary financing.

Identify Key Components of Your Business Plan

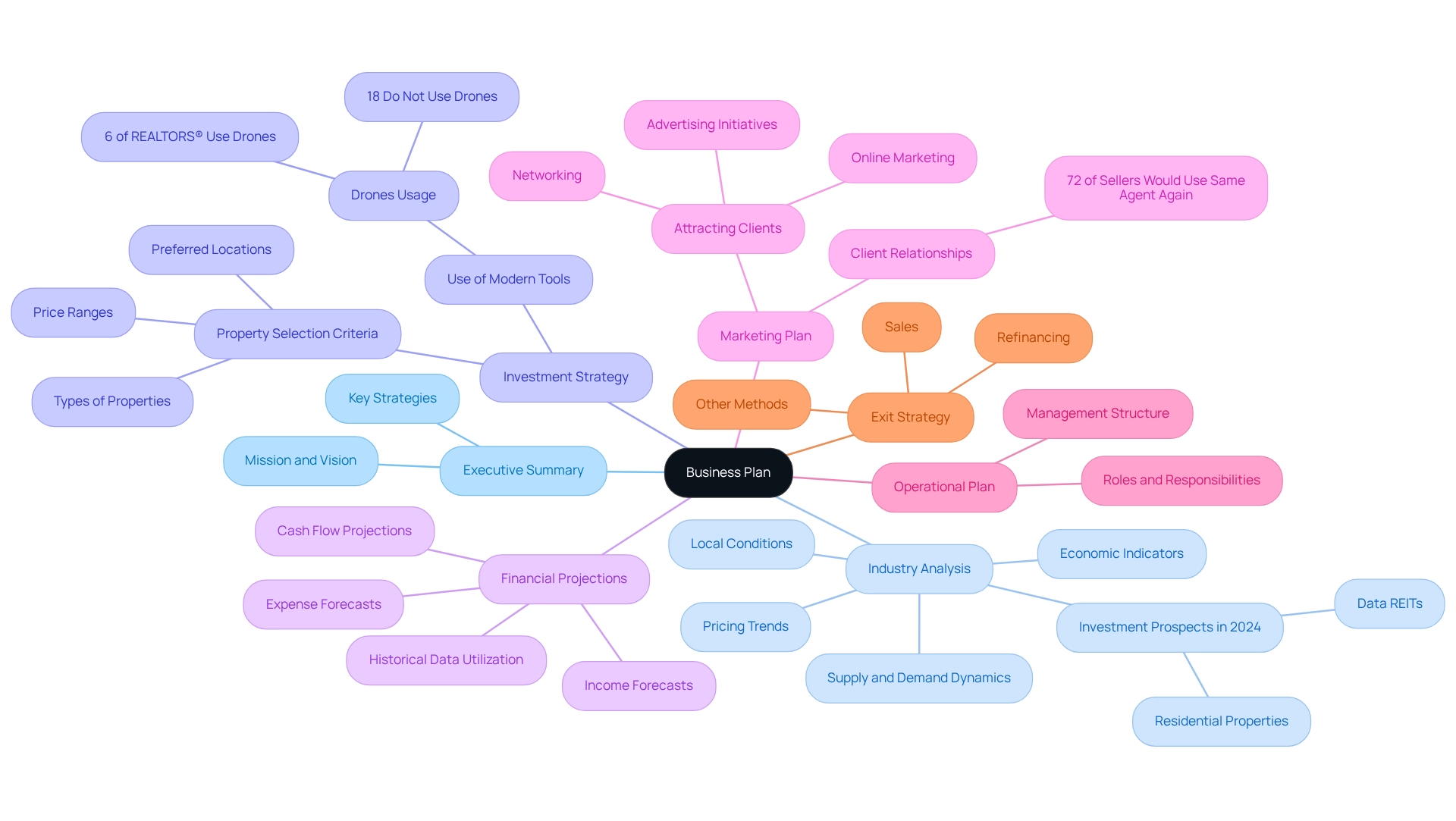

A robust business plan for real estate investment must encompass the following key components:

- Executive Summary: This section provides a concise overview of your business and investment strategy, setting the stage for your plan.

- Industry Analysis: Include insights into current real estate sector trends and demographic shifts. For instance, in 2022, 66.1% of families owned their primary residence, indicating a stable demand for housing. Furthermore, housing sector data suggests that values will continue to rise in 2025 to new highs, with this trend expected to persist through 2029 despite a decline in affordability. The case study titled 'Long-term Value Trends in Residential Real Estate' emphasizes that, despite a decline in value in late 2022 and 2023, the market recovered to historical peaks in 2024, underscoring the significance of comprehending these trends for financial strategies.

- Capital Strategy: Describe your funding approach, specifying the kinds of properties you plan to obtain and the techniques for acquisition.

- Financial Projections: Outline anticipated income, expenses, and profitability over time, which is essential for evaluating the feasibility of your assets.

- Marketing Plan: Develop strategies to attract potential buyers or tenants, ensuring your properties reach the right audience effectively.

- Operational Plan: Describe the daily operations and management framework essential for operating your financial business efficiently.

- Exit Strategy: Develop strategies for liquidating or transitioning your assets in your real estate investment business, which is essential for maximizing returns.

By clearly defining these components, you establish a comprehensive framework that not only guides your financial decisions but also positions you for success in the evolving real estate landscape.

Develop Each Section of Your Business Plan

To effectively develop each section of your real estate investment business plan, consider the following components:

- Executive Summary: Draft this section last to encapsulate your mission, vision, and key strategies succinctly.

- Industry Analysis: Conduct thorough research on local conditions, focusing on supply and demand dynamics, pricing trends, and relevant economic indicators. This analysis is essential, particularly as investment prospects in data REITs and residential properties in lower- and middle-income regions are expected in 2024, indicating a robust environment despite difficult circumstances.

- Investment Strategy: Clearly define your criteria for property selection, including preferred locations, price ranges, and types of properties. Consider incorporating modern tools, such as drones, which 6% of REALTORS® personally use, to enhance your property scouting and analysis.

- Financial Projections: Develop detailed forecasts for income, expenses, and cash flow. Utilize historical data and present trends to support your projections, ensuring they align with realistic expectations. The resilience of the real estate investment business, even in challenging conditions, should inform your financial outlook.

- Marketing Plan: Outline your strategies for attracting potential clients. This may include online marketing, networking, and advertising initiatives tailored to your target audience. Emphasizing strong client relationships is vital, as evidenced by the National Association of REALTORS® finding that 72% of sellers would use the same agent again.

- Operational Plan: Establish a clear management structure, detailing roles and responsibilities within your team to ensure efficient operations.

- Exit Strategy: Clearly express your approach for exiting investments, whether through sales, refinancing, or other methods. This foresight is essential for maximizing returns.

Each section should be concise and supported by data to enhance credibility and facilitate informed decision-making.

Refine and Adapt Your Business Plan Regularly

To maintain the effectiveness of your business plan, consider these best practices:

- Schedule Regular Reviews: Implement quarterly or bi-annual reviews to evaluate your progress and make necessary adjustments. Frequent evaluations are essential. Lawrence Yun, NAR Chief Economist, highlights the necessity for flexibility in response to economic conditions. He notes, "Despite the modest monthly increase, contract signings remain well below historical levels. A meaningful decline in mortgage rates would help both demand and supply—demand by boosting affordability, and supply by lessening the power of the mortgage rate lock-in effect."

- Monitor Economic Trends: Stay informed about fluctuations in the real estate investment business that could affect your investment strategy. With the U.S. residential real estate investment business projected to reach $94.39 trillion by 2024, understanding these trends is vital for informed decision-making.

- Evaluate Performance: Regularly compare your actual performance against your projections. This practice enables you to recognize inconsistencies and enhance your strategies accordingly, ensuring alignment with industry realities.

- Solicit Feedback: Engage with mentors or peers to gather insights on your strategy and identify areas for enhancement. Collaborative discussions can provide fresh perspectives that enhance your approach. Attending events like the NAR Real Estate Forecast Summit can also provide valuable insights from economists on residential and commercial real estate trends.

- Be Open to Change: Adapt your strategies in response to emerging opportunities or challenges. The capacity to adapt is crucial in a market where almost 47% of home buyers begin their search online, emphasizing the significance of digital engagement in your strategy.

By regarding your enterprise strategy as a living document, you ensure it remains pertinent and efficient in navigating the complexities of the real estate investment business.

Incorporate Best Practices for a Successful Plan

To effectively incorporate best practices into your real estate investment business, consider the following steps:

- Set SMART Goals: Establish goals that are Specific, Measurable, Achievable, Relevant, and Time-bound. Research indicates that investors who set SMART goals are 30% more likely to achieve their objectives compared to those who do not (source needed). As Crate Admin, a Real Estate Marketing Agent, emphasizes, setting clear goals can significantly increase annual commission sales.

- Utilize Data-Driven Insights: Base your strategies on thorough industry research and data analysis. This approach not only enhances decision-making but also aligns with the trend of utilizing CRM systems to track performance and market shifts. Implementing a CRM system can streamline your processes and provide valuable insights into your investment strategies.

- Engage Stakeholders: Involve key stakeholders in the planning process to gather diverse perspectives and foster buy-in. This collaborative approach can lead to more innovative solutions and a stronger commitment to the plan.

- Keep It Concise: Strive for clarity and brevity in your writing. A well-organized strategy that is easy to digest enhances the likelihood of stakeholder engagement and understanding.

- Utilize Templates: Leverage project templates to ensure all essential components are addressed. Templates can streamline the planning process and help maintain focus on critical elements.

- Stay Committed: Regularly revisit your strategy and remain dedicated to your objectives, even when challenges arise. Regular assessment and modification of your strategies can greatly improve your likelihood of success in the real estate investment business.

By following these best practices, you can create a strong and efficient real estate investment business strategy that distinguishes itself in a competitive market. Additionally, consider how Zero Flux addresses the challenge of information overload in the real estate industry by filtering through vast amounts of data to highlight only the most relevant trends, which can aid in developing a successful investment plan.

Conclusion

A well-crafted real estate investment business plan serves as the cornerstone of success in an ever-evolving market. By clearly defining long-term goals, establishing a mission statement, and incorporating essential components such as market analysis, investment strategy, and financial projections, investors create a roadmap that not only guides their decisions but also adapts to changing market conditions.

Regularly refining and adapting this plan is crucial; it allows investors to stay aligned with market trends and performance metrics. The significance of setting SMART goals and utilizing data-driven insights cannot be overstated, as these practices significantly enhance the likelihood of achieving investment objectives. Furthermore, engaging stakeholders and maintaining clarity in the plan fosters commitment and collaboration, solidifying the foundation for success.

In summary, a comprehensive and adaptable business plan is not merely a formal document; it is an essential tool that empowers real estate investors to navigate challenges, seize opportunities, and ultimately maximize returns. As the market continues to grow and evolve, prioritizing the development and refinement of a strategic business plan will be vital for achieving sustainable success in real estate investing.