Overview

This article presents a comprehensive guide to mastering commercial real estate investing. It emphasizes the critical importance of understanding market dynamics, assessing investment goals, and conducting thorough due diligence. By detailing essential steps such as:

- Analyzing potential properties

- Exploring financing options

- Implementing effective management practices

the article equips readers to navigate the complexities of the commercial real estate landscape successfully.

Introduction

Navigating the intricate world of commercial real estate (CRE) can be both exhilarating and daunting for investors. With a projected market size of approximately USD 1.66 trillion in 2024, the significance of CRE in the economy is undeniable. This sector encompasses a diverse array of properties, from office buildings to retail spaces, each presenting unique dynamics and investment opportunities. As investors seek to capitalize on this robust market, understanding the nuances of property types, financing options, and legal obligations becomes paramount.

This article delves into essential strategies for successful CRE investing, offering insights into:

- Assessing investment goals

- Identifying potential properties

- Maximizing returns

All while navigating the complexities of this ever-evolving landscape.

Define Commercial Real Estate and Its Importance

Commercial real estate (CRE) encompasses properties utilized exclusively for business purposes, including:

- office buildings

- retail spaces

- warehouses

- multifamily residences

Each category of CRE presents unique market dynamics and investment opportunities. For instance, office buildings are often influenced by employment rates, whereas retail spaces are shaped by consumer spending patterns. Understanding these nuances is essential for investors, as it empowers them to identify potential opportunities and effectively assess associated risks, particularly in the realm of commercial real estate investing for dummies.

In 2024, the U.S. commercial real estate market is projected to reach approximately USD 1.66 trillion, based on historical data from 2020 to 2024. This figure underscores the sector's significance within the economy. Notably, multifamily rental properties achieved an impressive occupancy rate of around 95% in 2022, indicating a robust demand for various CRE types.

However, a considerable financing challenge looms, with about $600 billion in loans maturing each year until 2028. This emphasizes the inherent risks tied to CRE investments. Additionally, the retail industry is adapting to evolving market conditions, maintaining the lowest vacancy rate among commercial properties despite a 12% decrease in foot traffic. This situation illustrates how market dynamics can significantly influence financial strategies; therefore, mastering the intricacies of commercial real estate investing for dummies is vital for investors aiming to navigate this complex environment effectively.

Assess Your Investment Goals and Financial Readiness

Establishing your financial objectives is essential in commercial property investing. Are you aiming for long-term appreciation, immediate cash flow, or a combination of both? Assess your financial situation by evaluating your available capital, credit score, and comfort level with debt. In 2025, the average capital accessible for commercial real estate funding has observed a significant rise, indicating a heightened interest in the sector. Notably, crowdfunding platforms collected almost twice the amount in 2023 compared to 2020.

Create a detailed budget that specifies your funding ability and possible expenses. This financial preparedness is crucial, as it not only affects the kinds of properties you can evaluate but also determines your overall approach to investing. The recent move towards crowdfunding has opened up access to property financing, enabling wider public involvement that can improve your funding choices.

Expert advice emphasizes the importance of a data-driven location analysis to minimize risks and maximize profitability. As Tomás Fonseca points out, "A location assessment supported by data reduces risk and enhances the opportunity for a lucrative property venture." This approach is particularly relevant given the current economic climate, where net operating income (NOI) for apartment owners has slowed significantly to 3% in Q3 2023, down from 25% in 2021. This decline underscores the difficulties encountered by apartment proprietors and highlights the necessity for a reassessment of funding strategies.

Additionally, understanding days on market and sales to listing ratios can provide insights into market trends for various housing types, potentially saving money in negotiations. By clearly evaluating your financial objectives and readiness, you can strategically align your assets with your financial capabilities, ensuring a more informed and effective approach to commercial real estate investing for dummies.

Identify and Analyze Potential Investment Properties

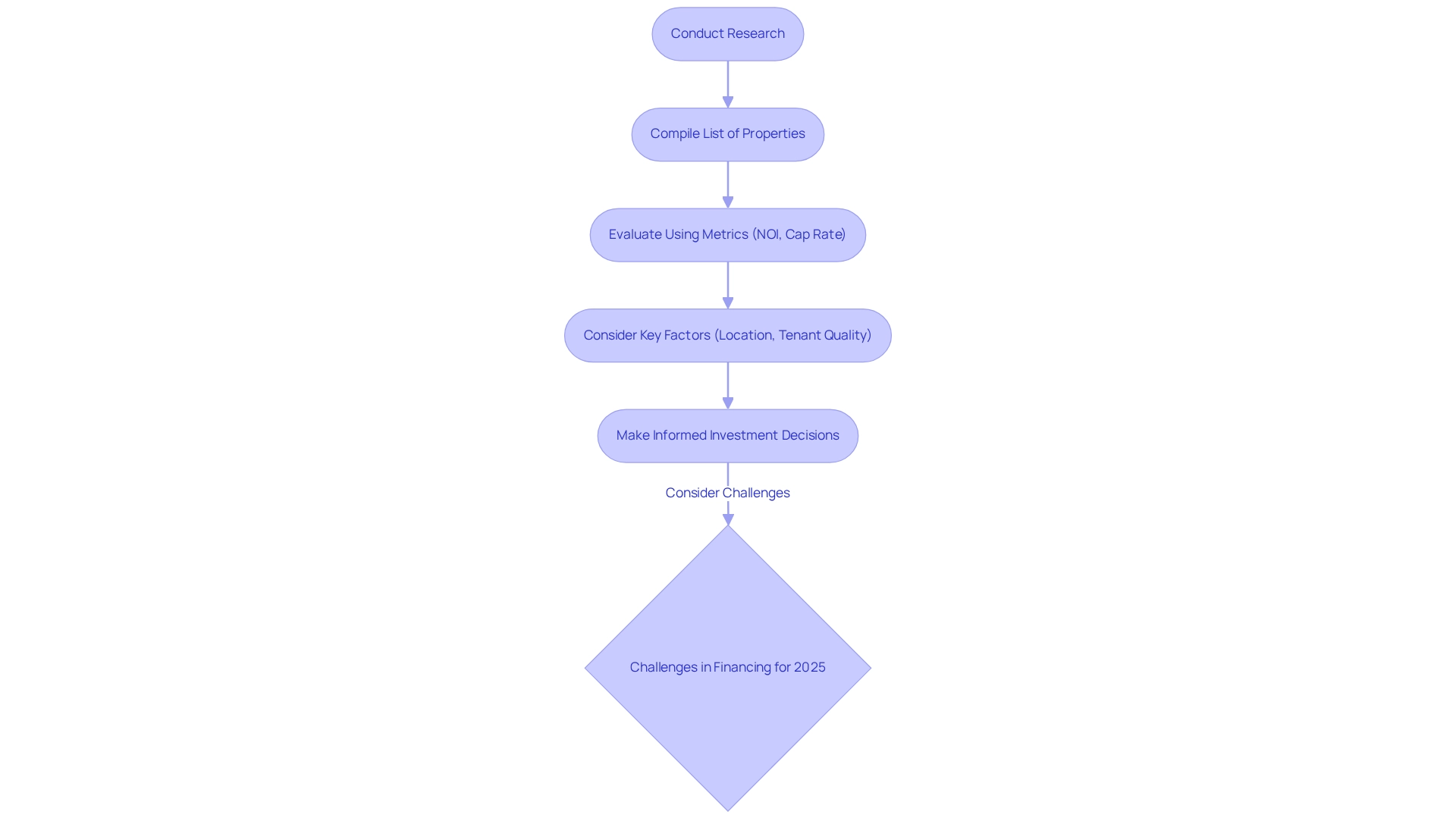

Begin your journey in commercial real estate investing for dummies by conducting thorough research on various options within your target market. Utilize online platforms, local listings, and professional networks to compile a comprehensive list of potential investments. Once you have identified these characteristics, execute a detailed evaluation using essential metrics such as Net Operating Income (NOI), Capitalization Rate (Cap Rate), and cash flow forecasts. For 2025, the average NOI for commercial real estate is projected to be approximately $500,000, reflecting current market conditions influenced by a 19% decline in the Net Lease sector over the past year.

When assessing assets, consider critical factors such as location, tenant quality, and lease terms. Notably, the retail sector has shown resilience, with retail spaces maintaining a low vacancy rate of 4.1%, whereas malls face challenges with an 8.6% vacancy rate. A recent case study illustrates that the retail sector is adapting to evolving market conditions, highlighting the varying vacancy rates among different types of retail spaces. This analysis will aid you in identifying properties that align with your criteria and exhibit potential for strong returns. Moreover, be aware of the anticipated challenges in commercial property financing for 2025, as these factors can significantly impact your financial strategy. By focusing on these metrics and trends, you can make informed decisions that enhance your investment approach in commercial real estate investing for dummies within the dynamic property landscape.

Explore Financing Options and Secure Funding

When contemplating funding choices for commercial property, it is crucial to assess conventional bank loans, SBA loans, and private financing. Each of these avenues presents distinct advantages and disadvantages, particularly regarding interest rates, terms, and qualification criteria. For instance, traditional bank loans typically offer competitive interest rates; however, they may require stringent credit assessments and collateral. In contrast, SBA loans are intended to assist small businesses and can offer lower down payments and extended repayment terms, making them a desirable choice for many investors.

In 2025, average interest rates for conventional bank loans in commercial property are expected to stay around 5.5%, mirroring current economic conditions. However, the landscape is shifting, with approximately $600 billion in commercial real estate loans maturing annually through 2028, which could impact financing availability and terms. This situation emphasizes the significance of strategic planning for investors managing potential risks linked to decreasing valuations. Furthermore, the stability of specific asset types is illustrated by the occupancy rate of multifamily rental properties, which was around 95% in 2022. This statistic strengthens the case for particular financing options, as stable occupancy rates frequently result in more secure returns. To improve your chances of obtaining favorable financing terms, prepare a comprehensive business plan that clearly outlines your funding strategy, projected income, and expenses. This preparation not only demonstrates your commitment but also provides lenders with the necessary information to assess your proposal effectively.

Additionally, consider alternative funding methods such as crowdfunding or partnerships. These options can diversify your funding strategy and reduce risks linked to conventional financing. For instance, crowdfunding platforms have gained popularity, enabling investors to combine resources for larger projects, while collaborations can utilize shared expertise and capital.

As a reminder of the potential of property ventures, it's worth noting that 90% of millionaires are affluent due to their financial activities in property. By comprehending the advantages and disadvantages of each funding choice and remaining updated on current trends in property financing, you can make better decisions that align with your investment objectives. Furthermore, the retail sector, despite experiencing a 12% decline in foot traffic year-over-year, achieved a 3.2% growth due to tight market conditions and limited supply, illustrating the importance of understanding market trends when considering financing options.

Conduct Due Diligence and Understand Legal Obligations

A comprehensive due diligence process is crucial for those engaging in commercial real estate investing for dummies. This involves meticulously reviewing property documents, inspecting the physical condition of the property, and evaluating potential legal issues, including zoning regulations and environmental concerns. Involving experts such as property lawyers and inspectors can greatly improve this process, guaranteeing that all elements are addressed thoroughly.

Understanding your legal responsibilities is essential. This includes familiarity with lease agreements, tenant rights, and any applicable local laws. Failure to grasp these responsibilities can lead to conflicts that may jeopardize your financial commitment. As the commercial property landscape evolves, the importance of legal adherence has become increasingly clear, with numerous investors recognizing the necessity for robust legal frameworks to tackle common challenges. For instance, climate risk assessment has been integrated into investment strategies by a significant majority (55%), underscoring the growing importance of environmental considerations in legal obligations.

Recent statistics emphasize the urgency of due diligence; with approximately $600 billion in loans maturing annually through 2028, strategic financial planning is critical. The commercial real estate investing for dummies may find that the sector is undergoing shifts, including a 12% year-over-year decline in retail foot traffic, yet still achieving a 3.2% overall growth. Furthermore, with Orange County boasting the lowest vacancy rate nationwide at 4.2% and New Jersey leading in industrial rent growth at 9.8% year-over-year, these dynamics highlight the necessity of a well-informed approach to commercial real estate investing for dummies, along with due diligence and legal obligations. Investors must be equipped to make sound decisions in a complex market.

Manage Your Investment and Maximize Returns

Acquiring a real estate asset necessitates prioritizing effective management practices to maximize returns. This involves regular maintenance, fostering strong tenant relations, and diligent financial oversight. A proactive maintenance strategy is essential; it can prevent minor issues from escalating into costly repairs, ensuring the premises remain in optimal condition. Furthermore, open communication with tenants is crucial; it not only enhances tenant satisfaction but also encourages longer lease terms, stabilizing income streams.

Regular reviews of financial performance metrics are vital for pinpointing areas needing improvement. For instance, understanding typical maintenance expenses for commercial assets—which can range from 10% to 15% of gross rental income—can aid in efficient budgeting and help avoid unforeseen costs. Additionally, consider value-add strategies such as renovations or repositioning the asset to boost its market appeal. In New Jersey, for example, industrial rent growth reached 9.8% year-over-year, highlighting the potential for increased rental income through strategic enhancements to real estate.

Moreover, the importance of tenant relations cannot be emphasized enough. A study indicates that nearly 80% of renters and owners use mobile devices for real estate searches, underscoring the necessity for management companies to establish mobile-friendly, user-responsive websites. This digital presence not only enhances tenant interaction but also positions the asset advantageously in a competitive market. Notably, 86% of property managers specialize in managing other people's properties, reinforcing the need for effective management practices. By embracing these best practices and concentrating on effective management strategies, investors can significantly enhance their commercial real estate investing for dummies and achieve sustainable growth.

Conclusion

Navigating the commercial real estate landscape necessitates a multifaceted approach that encompasses an understanding of property types, investment goals, and financing options. By defining investment objectives and assessing financial readiness, investors can align their strategies with their capabilities, facilitating informed decision-making. The significance of thorough research and due diligence cannot be overstated; these practices are vital for identifying viable properties and mitigating potential risks.

Moreover, comprehending legal obligations and fostering effective management practices are essential components of successful CRE investing. Engaging with professionals and implementing proactive management strategies can lead to enhanced tenant satisfaction and maximized returns. As market dynamics shift, remaining adaptable and informed about current trends will empower investors to seize opportunities and navigate challenges effectively.

Ultimately, the commercial real estate sector presents a wealth of opportunities for those prepared to engage with its complexities. By employing strategic insights and diligent management practices, investors can thrive in this robust market, contributing to their financial success and the overall vitality of the economy. With a projected market size of USD 1.66 trillion in 2024, now is the time to delve into the world of CRE and unlock its potential.