Overview

The article titled "7 Best Commercial Real Estate Investment Strategies for 2025" presents a comprehensive overview of effective strategies for investing in commercial real estate in the upcoming year. It underscores the importance of understanding market trends, financing options, and conducting thorough market research to make informed investment decisions. These decisions must align with evolving consumer demands and economic conditions, ensuring a strategic approach to investment.

By focusing on key insights, the article captures the attention of investors looking to navigate the complexities of the market. It builds interest through relevant trends that highlight the significance of adapting to changes in consumer behavior and economic landscapes. The desire for actionable information is generated by emphasizing the need for a robust investment strategy that leverages these insights effectively.

Ultimately, the article calls readers to action, encouraging them to utilize these strategies in their investment planning. With a structured approach that combines authoritative insights and relatable examples, it serves as a valuable resource for those looking to enhance their commercial real estate investment portfolio in 2025.

Introduction

As the commercial real estate landscape evolves, investors encounter a multitude of strategies to navigate the market's complexities. With the year 2025 approaching, comprehending the most effective investment approaches becomes essential for maximizing returns and capitalizing on opportunities.

This article explores seven of the most impactful commercial real estate investment strategies that are poised to shape the industry's future.

How can investors leverage these strategies not only to survive but to thrive in an increasingly competitive environment?

Zero Flux: Daily Insights on Real Estate Investment Strategies

Zero Flux stands out as a specialized daily newsletter that meticulously compiles essential real estate industry trends and insights from over 100 diverse sources. By emphasizing factual information and avoiding subjective opinions, it serves as an invaluable resource for both industry professionals and enthusiasts. Subscribers benefit from a daily selection of 5-12 curated insights that cover crucial topics such as:

- Housing trends

- Investment opportunities

- The best commercial real estate investment demographic shifts

This data-driven approach empowers stakeholders to navigate the complexities of the industry effectively, enabling informed decisions that are critical in today’s dynamic real estate landscape. With a subscriber base exceeding 30,000, Zero Flux exemplifies best practices for real estate newsletters in 2025, underscoring the significance of clarity and precision in delivering market intelligence.

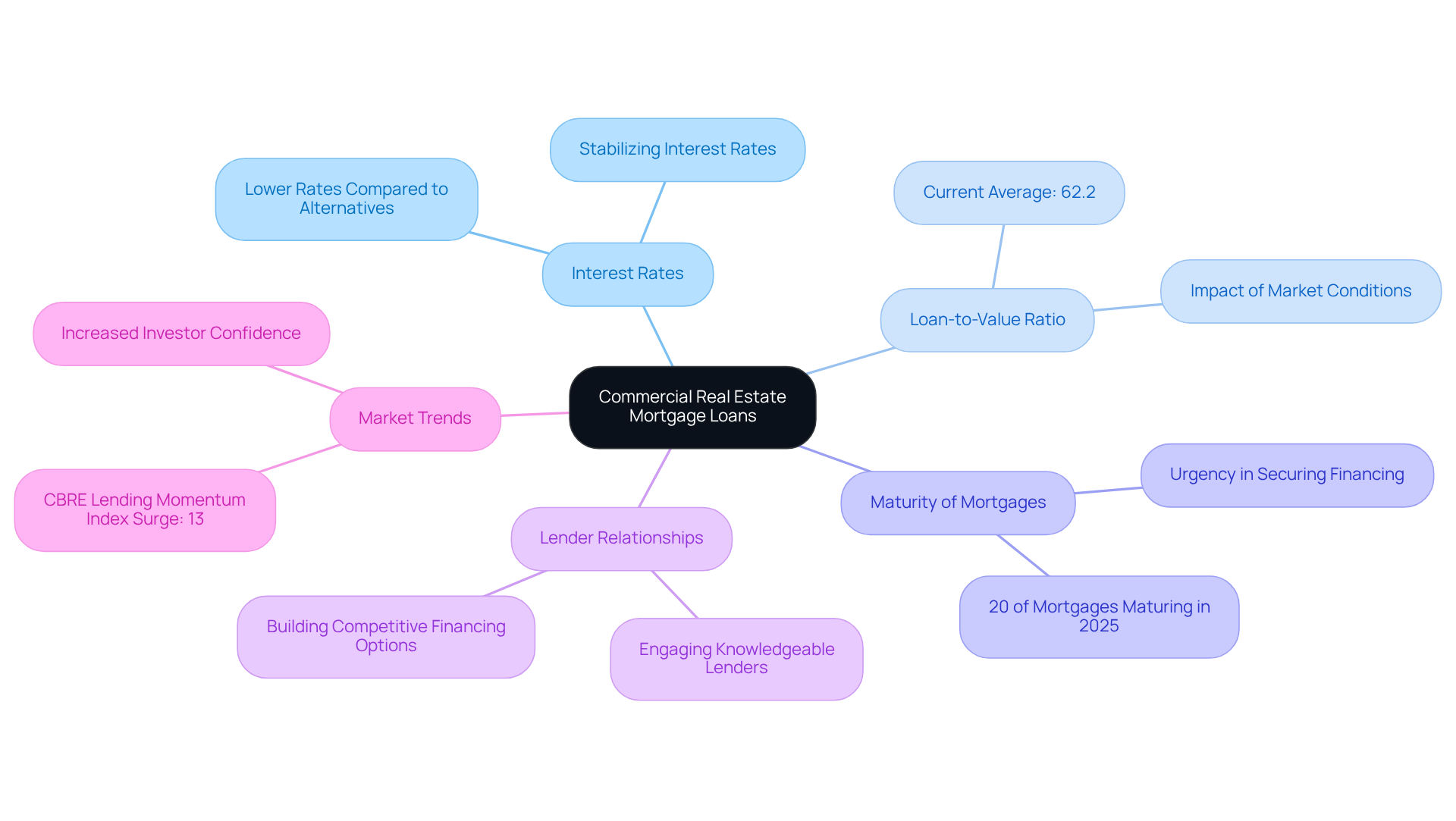

Commercial Real Estate Mortgage Loan: Secure Financing for Property Acquisition

Investors aiming to make the best commercial real estate investment find that commercial real estate mortgage loans are pivotal due to their generally lower interest rates compared to alternative financing options. As of 2025, the average loan-to-value ratio for commercial real estate has notably decreased to 62.2%, indicating a more cautious lending environment.

Importantly, 20% ($957 billion) of the $4.8 trillion in outstanding commercial mortgages is set to mature in 2025, underscoring the urgency of securing financing in the current market landscape. Investors must meticulously assess elements such as interest rates, repayment terms, and the overall financial health of the property when selecting the best commercial real estate investment.

Engaging with knowledgeable lenders can significantly streamline the complexities of commercial financing, ensuring that buyers secure optimal terms for their acquisitions. Furthermore, cultivating relationships with lenders can open doors to competitive financing options, crucial in a market where commercial real estate lending activity is on the upswing.

This is evidenced by the CBRE Lending Momentum Index, which experienced a remarkable surge of 13% quarter-over-quarter and 90% year-over-year in Q1 2025. By understanding these critical factors, individuals can make informed decisions that enhance their strategies for the best commercial real estate investment.

Working Capital Loan: Flexible Financing for Operational Needs

Working capital loans serve as essential financial instruments that enable businesses to manage operational expenses effectively, addressing costs such as payroll, inventory, and other short-term needs. Their defining feature is flexibility, allowing stakeholders to maintain liquidity while pursuing new investment opportunities. In the real estate sector, the average terms for working capital loans typically span from six months to three years, contingent upon the lender and the specific requirements of the business. Financial experts underscore the significance of flexible financing options, highlighting that lines of credit and short-term loans can furnish the necessary financial resources to navigate operational challenges.

Effective asset management often hinges on the strategic use of working capital loans, empowering stakeholders to meet urgent cash flow demands without jeopardizing long-term growth. By leveraging these loans, real estate professionals can enhance operational efficiency and capitalize on the best commercial real estate investment opportunities available in a competitive market. This strategic approach not only addresses immediate financial needs but also positions businesses for sustained success.

Leasehold Improvement Loan: Enhance Property Value for Better Returns

Leasehold improvement loans are specifically designed to finance renovations and upgrades to rental units, providing a strategic avenue for investors. By enhancing the asset's value, these loans enable investors to attract higher-quality tenants and secure better rental rates. Covering a wide range of improvements—from cosmetic upgrades to structural modifications—these loans present significant opportunities.

Investors must carefully assess the potential return on investment for each enhancement, ensuring that the associated costs align with their overarching financial objectives. This thoughtful evaluation not only maximizes the effectiveness of the improvements but also solidifies the investor's position in a competitive market.

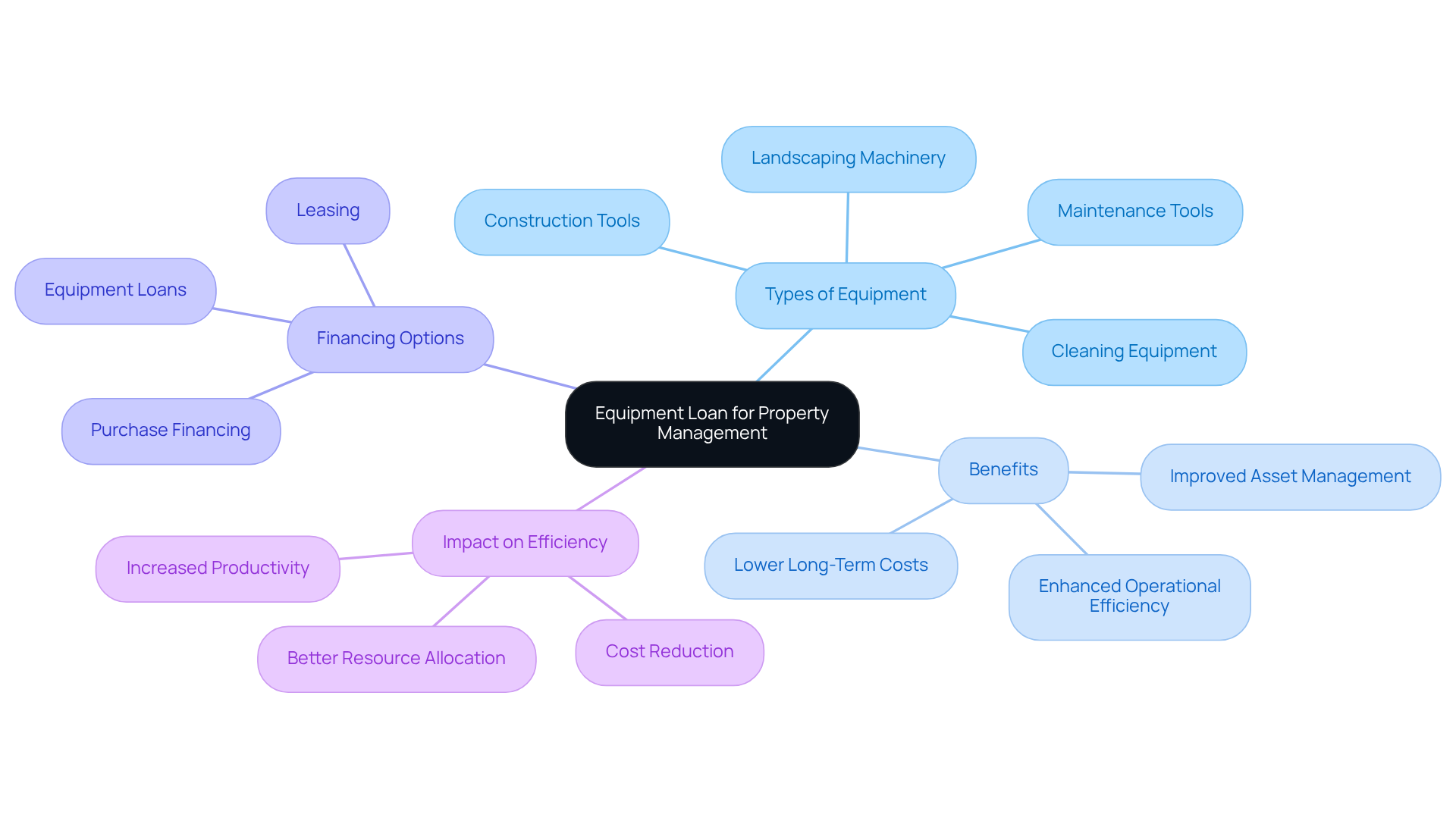

Equipment Loan: Invest in Essential Tools for Property Management

Equipment loans provide essential funding for acquiring the tools and machinery necessary for effective asset management. This encompasses a wide range of equipment, from landscaping machinery to maintenance tools. By strategically investing in the right equipment, property managers can significantly enhance operational efficiency and lower long-term costs. Investors must carefully assess their equipment needs and explore various financing options to secure the necessary tools without compromising their cash flow.

Demand Loan: Quick Access to Capital for Immediate Needs

Demand loans are pivotal for investors seeking rapid access to capital, addressing immediate financial needs within the commercial real estate sector. These loans can be drawn upon as necessary, providing the flexibility to respond to unexpected expenses or seize timely investment opportunities.

As of mid-2025, average interest levels for demand loans in real estate range between 5% and 15%, influenced by asset class and loan structure. Investors must carefully examine the terms and conditions associated with demand loans, including interest charges and repayment obligations, to effectively manage cash flow while leveraging this financing option.

Financial advisors stress that quick access to capital is essential for capitalizing on immediate investment needs, especially in a market marked by rising interest rates and tighter lending standards. By understanding the dynamics of demand loans, individuals can strategically position themselves to capitalize on profitable opportunities as they arise.

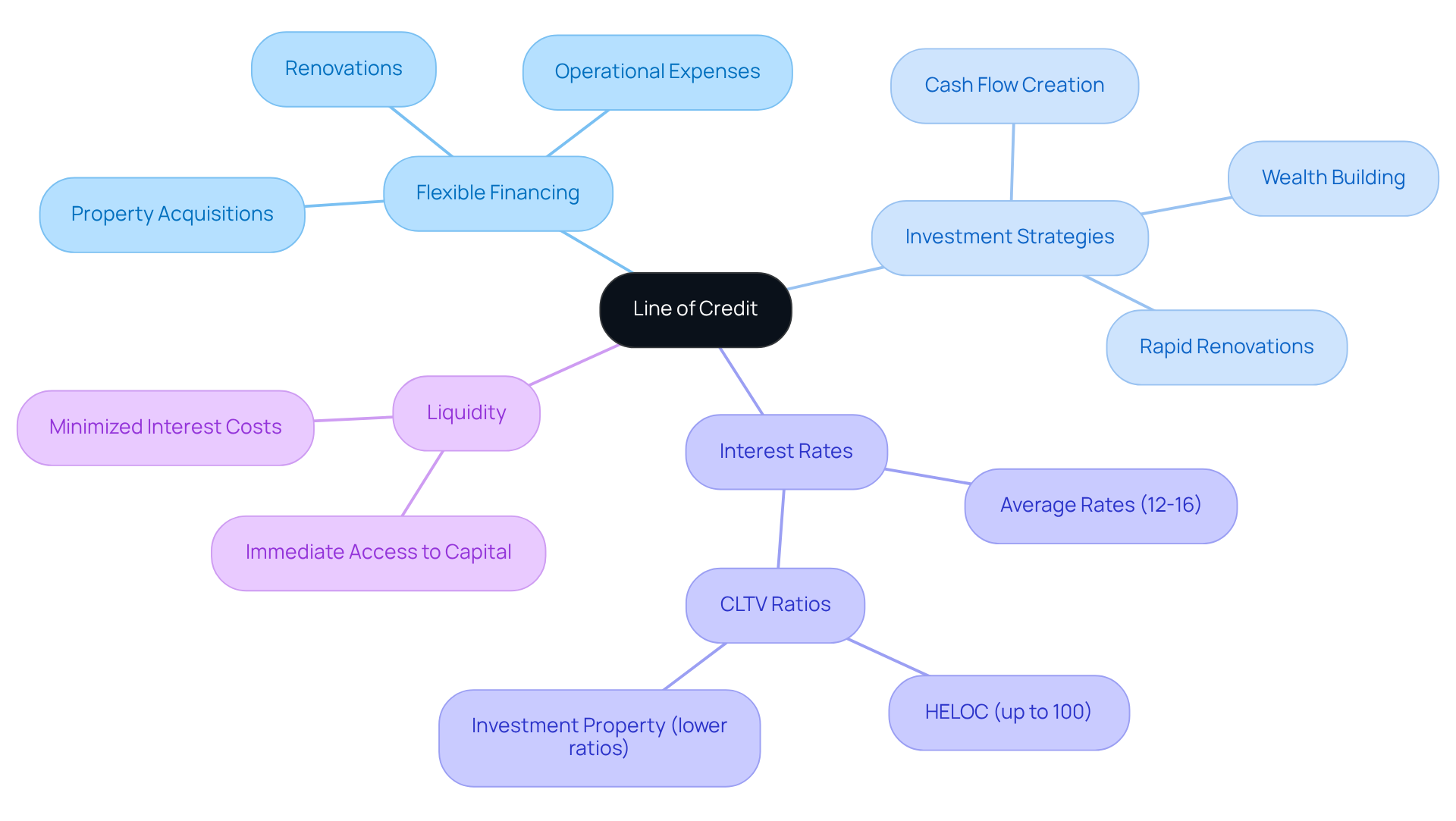

Line of Credit: Flexible Financing for Diverse Investment Strategies

A line of credit offers individuals versatile financing options that can be utilized for various purposes, including property acquisitions, renovations, and operational expenses. This financing structure allows borrowers to draw only what they need, effectively minimizing interest costs. In 2025, average interest rates for lines of credit in real estate typically range from 12% to 16%, contingent upon the lender and the borrower's creditworthiness. Some lenders may even extend to a combined loan-to-value ratio (CLTV) of 100% for a Home Equity Line of Credit (HELOC), providing additional flexibility.

Establishing a line of credit not only enhances investment strategies but also ensures liquidity within portfolios, enabling individuals to swiftly capitalize on the best commercial real estate investment options. Financial experts emphasize that leveraging a line of credit can significantly improve a person's ability to finance deals, as it provides immediate access to capital without the lengthy approval processes associated with traditional loans.

Successful investment strategies frequently incorporate lines of credit, allowing for rapid renovations or acquisitions that can lead to the best commercial real estate investment by creating forced appreciation and increased cash flow. As Austin Dean, a financial advisor, articulates, "Real estate offers multiple ways to build wealth: lending, flipping, syndications, and creating cash flow, which is crucial for financial independence."

By evaluating their financial needs and considering a line of credit, individuals can position themselves for greater success in the dynamic real estate market.

Cap Rates Explained: Assessing Property Value and Investment Potential

Cap rates, or capitalization metrics, serve as a crucial measure for evaluating the worth of income-generating assets. By dividing a real estate's net operating income (NOI) by its current valuation, investors gain a clear perspective on potential returns. For instance, an asset with a stabilized NOI of $100,000 and a market value of $1,111,111 yields a cap percentage of approximately 9%. Generally, a lower capitalization figure indicates a higher real estate valuation, while a higher figure suggests greater return potential.

In 2025, national average capitalization levels hover around 6%, with multi-family assets averaging about 6%. Class A assets are positioned at approximately 5.8%, whereas Class C units exceed 7.2% in smaller markets. The industrial sector presents an average capitalization of 6.9%, while office properties linger around 7.9%. These variations underscore the importance of analyzing cap yields alongside other financial indicators, such as the risk-free return, typically represented by U.S. Treasury bond returns.

Successful investment decisions hinge on a comprehensive understanding of capitalization values and their implications for identifying the best commercial real estate investment. For example, if an asset boasts a 5% acquisition capitalization and the risk-free percentage stands at 3%, the risk premium is 2%, signaling a balanced investment strategy. This risk premium may fluctuate based on factors like property age, tenant creditworthiness, and supply and demand. Real estate experts caution that reliance solely on capitalization figures can be misleading; thus, investors must consider regional dynamics and property-specific characteristics to make informed decisions. As the commercial real estate landscape evolves, understanding cap trends and calculations becomes essential for effectively navigating the best commercial real estate investment opportunities.

To enhance your investment strategy, consistently compare cap rates with similar assets in the same area to determine whether an asset is competitively priced.

Emerging Trends: Shaping the Future of Real Estate Investment Strategies

The real estate market is experiencing a significant transformation driven by emerging trends such as remote work, sustainability initiatives, and technological advancements. Investors must remain vigilant to these shifts to uncover new opportunities and effectively adapt their portfolios. For instance, structures that adopt eco-friendly construction methods are becoming increasingly attractive to renters. Notably, 60% of remote workers express a desire to continue working from home, leading to a substantial rise in demand for sustainable spaces. This shift in living preferences encourages buyers to consider properties that cater to the need for dedicated workspaces.

Furthermore, sustainability initiatives are not merely a trend but a necessity, aligning with the growing consumer preference for environmentally responsible living. The surge in remote work has also contributed to a remarkable increase in home prices, with an approximate rise of 15 percent. This underscores the importance of staying informed about these trends. By strategically positioning themselves in response to these dynamics, individuals can ensure their investments remain relevant and profitable in 2025.

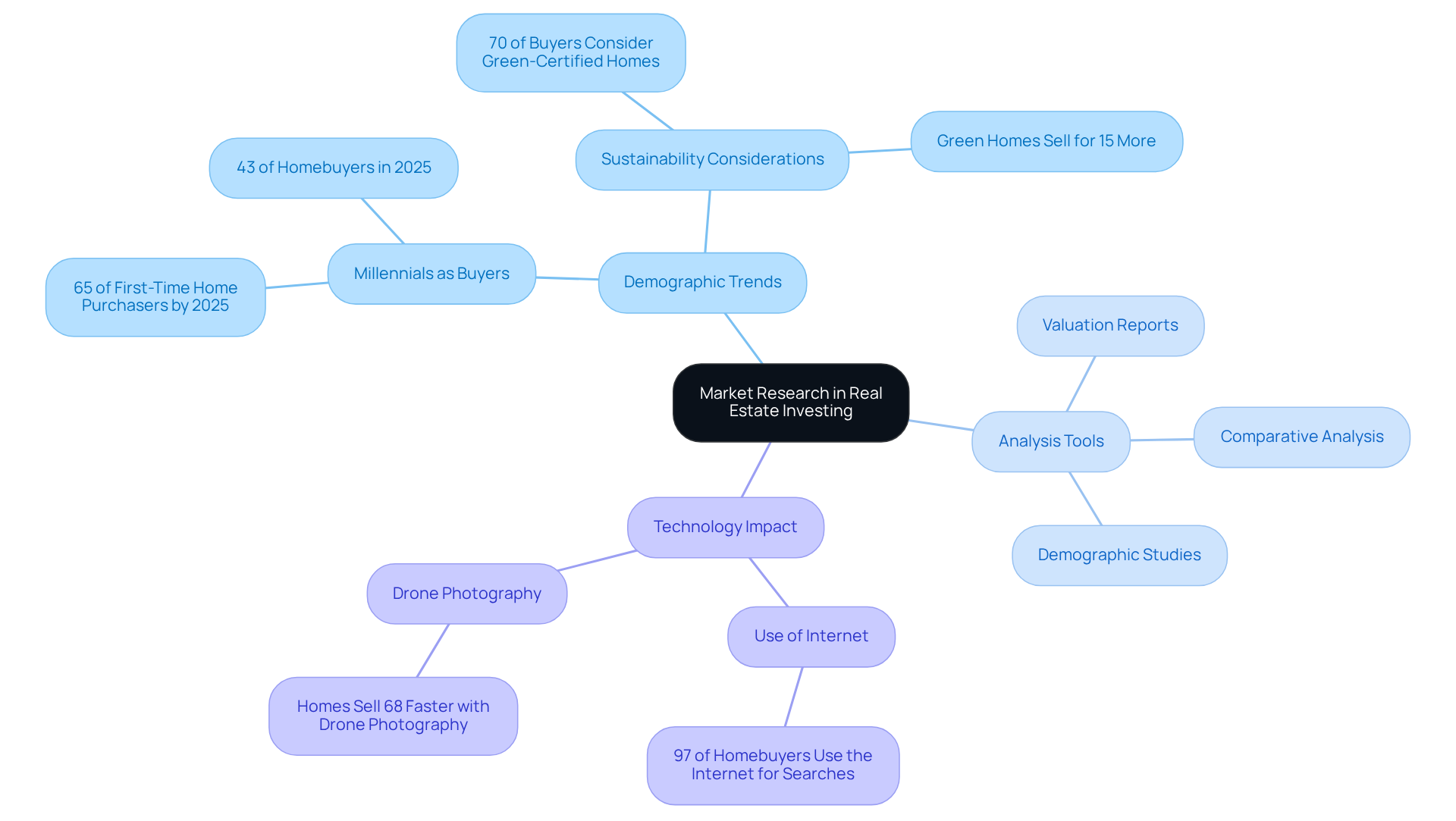

Market Research: Essential for Identifying Lucrative Investment Opportunities

Industry research is crucial for successful real estate investing. It empowers investors to uncover profitable opportunities through a thorough examination of local conditions, demographic shifts, and economic indicators. For instance, recognizing that millennials will represent 65% of first-time home purchasers in 2025 and account for 43% of buyers can significantly inform investment strategies aimed at attracting this demographic.

Instruments such as:

- comparative analysis

- valuation reports

- demographic studies

are vital for gaining insights into potential investments. Moreover, with over 97% of homebuyers utilizing the internet for real estate searches, leveraging digital platforms for analysis becomes imperative. Notably, homes featuring drone photography sell 68% faster, underscoring the pivotal role technology plays in property marketing.

By prioritizing comprehensive market research, investors can refine their strategies, minimize risks, and strategically position themselves in a competitive landscape. This proactive approach not only enhances their investment decisions but also fosters a deeper understanding of market dynamics, ultimately leading to greater success in real estate ventures.

Conclusion

In the evolving landscape of commercial real estate investment, understanding and implementing effective strategies is paramount for success in 2025. This article highlights various financing options, including commercial real estate mortgage loans, working capital loans, and lines of credit, which are essential for investors aiming to optimize their portfolios. Each of these financial instruments offers unique advantages, enabling investors to navigate market challenges while seizing lucrative opportunities.

Key insights discussed include:

- The importance of market research, which allows investors to identify emerging trends and demographic shifts that can influence investment decisions.

- The role of cap rates in assessing property values and the necessity of adapting to trends such as sustainability and remote work, which further underscore the multifaceted nature of real estate investment strategies.

By leveraging these insights, stakeholders can position themselves effectively within a competitive market.

Ultimately, the success of commercial real estate investments hinges on a proactive approach that combines thorough research, strategic financing, and an awareness of industry trends. Investors are encouraged to remain informed and adaptable, ensuring their strategies align with the dynamic nature of the real estate sector. By doing so, they can enhance their potential for profitable outcomes and secure their place in the future of commercial real estate investment.