Overview

The article titled "7 Essential Commercial Real Estate Datasets for Investors" identifies crucial datasets that investors can utilize to make informed decisions in the commercial real estate market. It highlights various resources, including:

- ATTOM

- Moody's Analytics

- National Association of Realtors

These organizations emphasize their roles in providing comprehensive property data, economic insights, and market trends. These elements are vital for navigating investment opportunities and mitigating risks in a fluctuating market.

By leveraging these datasets, investors can gain a competitive edge, making decisions grounded in reliable information. The insights provided by these organizations not only enhance understanding of market dynamics but also inform strategic investment choices. In an environment where data-driven decisions are paramount, these resources serve as essential tools for success.

In conclusion, understanding and utilizing these datasets can significantly impact investment strategies, enabling investors to identify opportunities and manage risks effectively. As the commercial real estate landscape continues to evolve, staying informed through these critical resources is imperative for any savvy investor.

Introduction

In an era where data drives decision-making in the commercial real estate sector, investors encounter a multitude of information sources that can either illuminate or obscure their paths to success. The right datasets possess the potential to unlock insights into market trends, property valuations, and investment opportunities, ultimately shaping effective investment strategies. However, with an abundance of options available, how can investors discern which datasets are truly essential for navigating the complexities of the real estate landscape? This article delves into seven pivotal commercial real estate datasets that empower investors to make informed decisions in 2025 and beyond.

Zero Flux: Daily Insights on Real Estate Market Trends

Zero Flux stands as an essential daily newsletter, delivering critical realty trends and insights. By meticulously curating information from over 100 diverse sources, including premium content, it offers subscribers a comprehensive overview of the latest developments in the real estate sector. This dedication to factual accuracy establishes Zero Flux as an invaluable resource for both industry professionals and enthusiasts, empowering them to navigate challenges such as elevated mortgage rates and limited inventory.

With a subscriber base exceeding 30,000, the newsletter consistently garners positive feedback for its clarity and precision, reflecting the latest industry dynamics and trends crucial for adeptly maneuvering through the ever-evolving real estate landscape.

ATTOM: Comprehensive Property Data and Analytics

ATTOM offers a comprehensive array of property information and analytics, encompassing over 158 million U.S. properties. Their extensive services include property tax, deed, mortgage, foreclosure, and neighborhood data—essential elements for individuals aiming to assess conditions efficiently.

As Franklin D. Roosevelt aptly stated, "Real property cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world."

By leveraging ATTOM's vast commercial real estate datasets, individuals can uncover patterns and identify lucrative opportunities in the property market. For instance, access to detailed neighborhood information allows financiers to assess location appeal, while foreclosure data can unveil potential investment prospects.

Furthermore, the case study titled 'Building Wealth' illustrates how property investment can facilitate financial independence, underscoring the critical role of ATTOM's information in achieving such goals.

As the landscape of real property evolves, the importance of commercial real estate datasets becomes increasingly clear, empowering stakeholders to make informed decisions that align with current economic trends.

Additionally, Zero Flux addresses the challenge of information overload in the real estate sector by filtering through vast amounts of data, ensuring stakeholders receive only the most relevant insights.

Moody's Analytics: Economic and Real Estate Data Solutions

Moody's Analytics stands at the forefront of delivering economic and property data solutions, empowering stakeholders to grasp essential trends in the market. With a valuation of $31 billion, their insights span various sectors, notably commercial property, and are indispensable for making informed investment decisions.

By meticulously analyzing economic indicators such as:

- Interest rates

- Employment statistics

- Inflation trends

Moody's Analytics equips individuals with the knowledge necessary to navigate the complexities of the real property sector effectively. This data-driven methodology not only facilitates the identification of lucrative opportunities but also plays a crucial role in mitigating risks associated with market fluctuations.

As the real property landscape continues to evolve, a keen understanding of these economic indicators becomes increasingly vital for investors striving to optimize their portfolios and achieve sustainable growth. Furthermore, Zero Flux underscores the importance of information integrity by sourcing from a diverse array of reputable outlets, as evidenced by the positive feedback from its growing subscriber base.

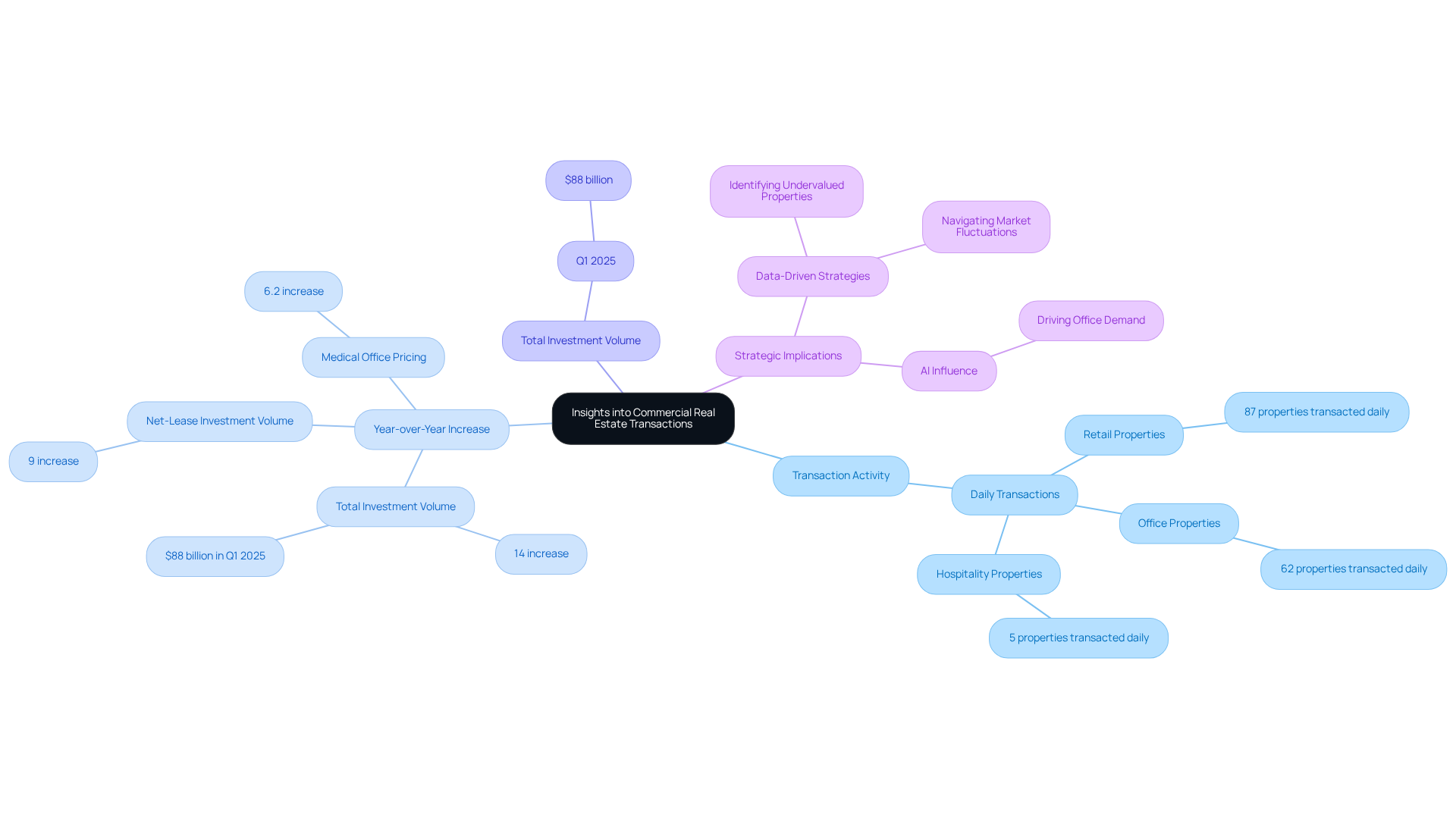

Real Capital Analytics: Insights into Commercial Real Estate Transactions

Real Capital Analytics offers critical insights into commercial real property transactions, encompassing detailed information on sales, pricing, and trends. With its robust commercial real estate datasets, stakeholders can monitor transaction activity and identify emerging opportunities in the commercial property landscape. Notably, in July 2025, the commercial real estate sector is witnessing significant trends, including a 14% year-over-year increase in total investment volume, which has reached $88 billion in Q1. This information is vital for stakeholders aiming to refine their strategies and capitalize on economic trends.

Profitable investments often stem from leveraging commercial real estate datasets. Case studies illustrate how individuals have utilized Real Capital Analytics to identify undervalued properties, thereby enhancing their portfolios. By adopting this data-driven approach, investors can adeptly navigate complexities such as market fluctuations and economic conditions. This ultimately leads to more informed and strategic investment decisions, empowering stakeholders to optimize their investment outcomes.

National Association of Realtors: Housing Market Statistics and Reports

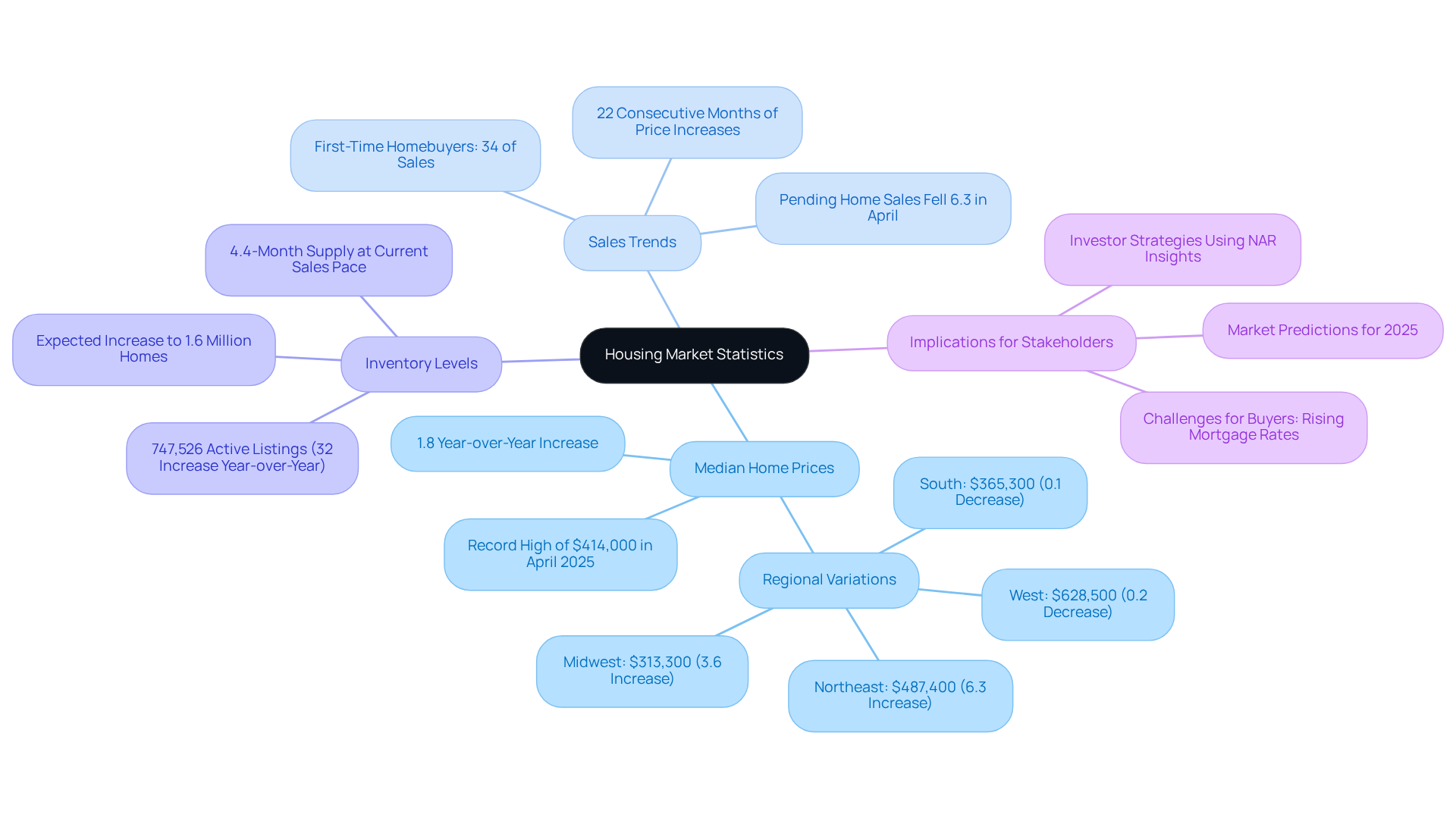

The National Association of Realtors (NAR) serves as a vital resource for stakeholders, delivering a comprehensive array of housing data and reports essential for informed decision-making. This information encompasses critical elements such as sales trends, pricing variations, and inventory levels, providing a nuanced understanding of industry dynamics. As of April 2025, NAR reports indicate a sustained rise in median home prices, showcasing a 1.8 percent increase year-over-year—an important metric for individuals assessing property value trends.

Investors have adeptly leveraged NAR insights for property acquisitions, utilizing detailed reports to identify emerging regions and lucrative investment opportunities. For example, many finance professionals have tapped into NAR's data to uncover favorable buying conditions and forecast potential returns based on historical trends. As the housing sector evolves, the implications of NAR reports grow increasingly significant, particularly in a landscape where inventory remains below balanced levels, underscoring the necessity of strategic insights to navigate challenges.

Moreover, NAR's ongoing analysis of sales trends for 2025 highlights the hurdles faced by buyers, including rising mortgage rates and fluctuating demand. According to Lawrence Yun, Chief Economist at NAR, "The outcome of the housing sector in the upcoming months will be influenced partly by the trend of mortgage rates, along with the well-being of the wider economy." By staying informed through NAR's reports, individuals can better position themselves to capitalize on economic shifts, ensuring they make well-informed decisions that align with prevailing economic conditions.

American Community Survey: Key Demographic Data for Real Estate

The American Community Survey (ACS) serves as an indispensable resource for real estate stakeholders, offering comprehensive demographic insights that shape investment strategies. By revealing critical information about population trends, housing characteristics, and economic factors, the ACS empowers stakeholders to pinpoint emerging markets and assess the needs of potential buyers.

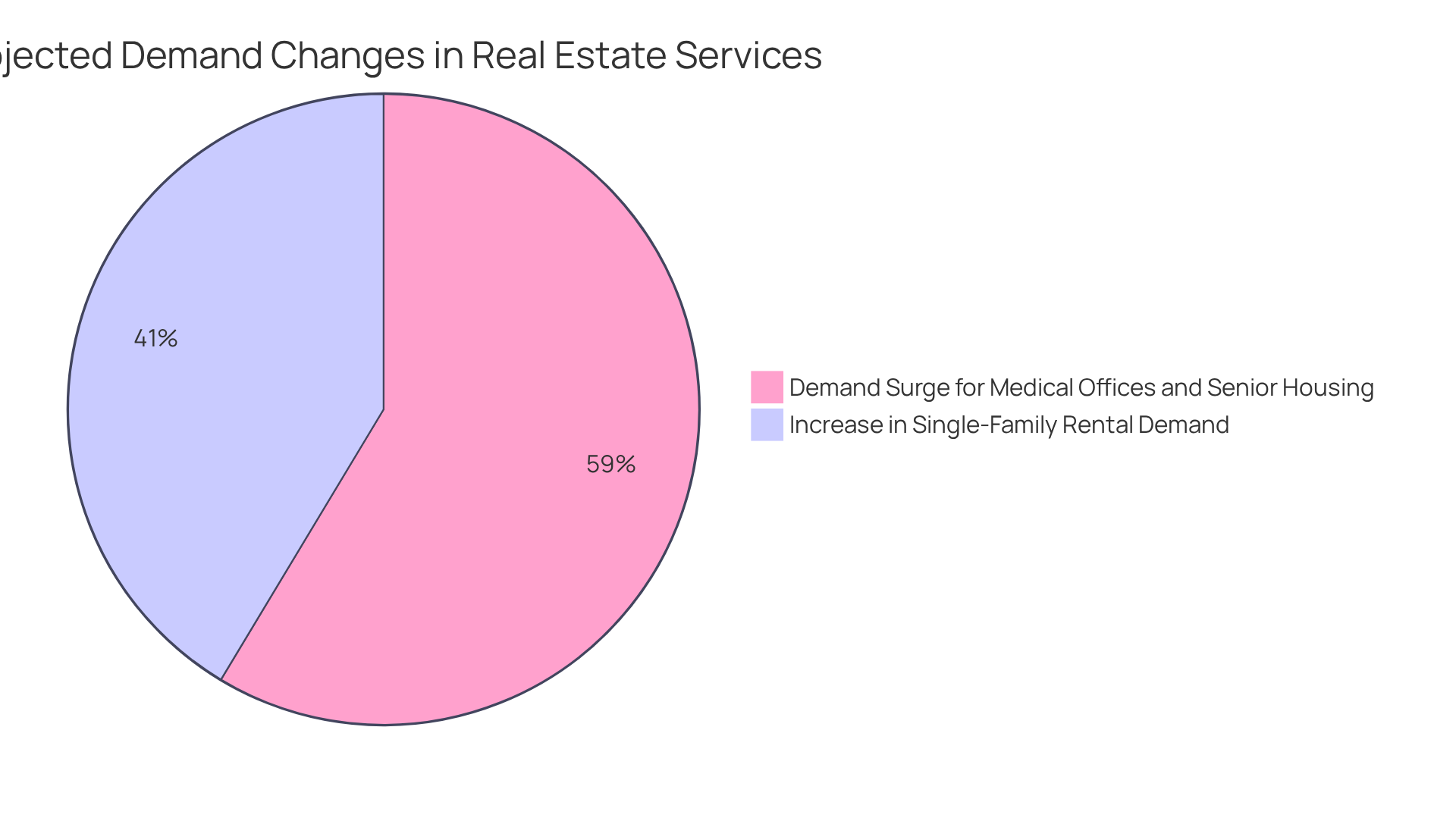

Notably, the population segment aged 65-74 is anticipated to experience a 34% surge in demand for medical offices, life sciences, and senior housing, largely fueled by the significant wealth transfer. This data enables stakeholders to effectively target these growing sectors.

Furthermore, understanding demographic shifts, such as the projected 24% increase in single-family rental demand among the 35-44 age group, equips stakeholders to make informed decisions that resonate with market dynamics.

The ACS not only highlights prevailing trends but also furnishes stakeholders with analytical tools essential for navigating the complexities of the real estate landscape, thereby ensuring strategic investment choices that leverage demographic insights.

Nonetheless, it is imperative to acknowledge potential challenges, including declines in certain age groups that may impact demand for specific housing types.

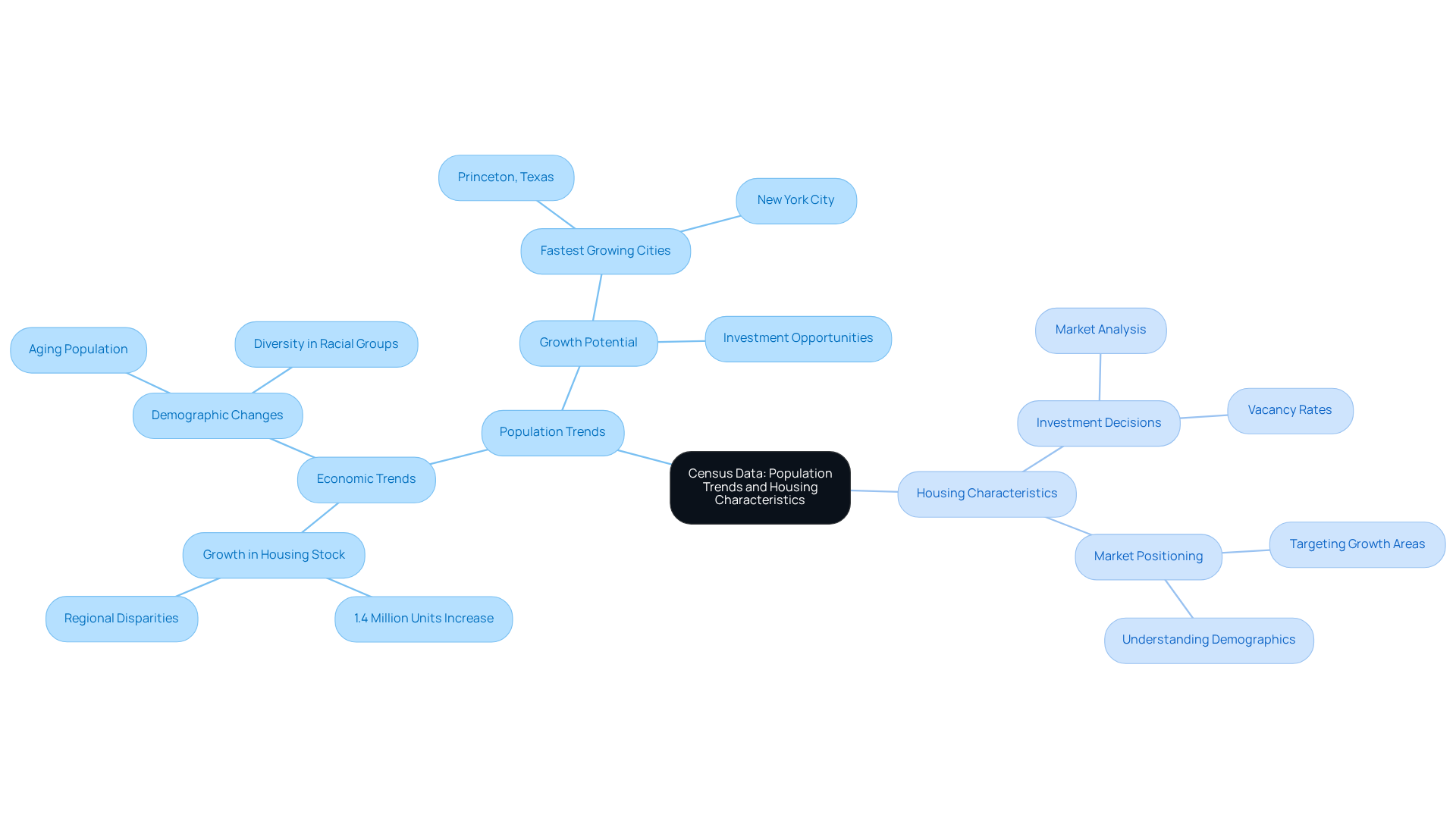

Census Data: Population Trends and Housing Characteristics

Census information provides a comprehensive overview of population trends and housing characteristics across the United States. This data, particularly commercial real estate datasets, is crucial for stakeholders who seek to understand economic trends and identify regions with growth potential. By analyzing commercial real estate datasets and census information, stakeholders can make informed decisions about where to focus their investment activities and how to position their properties within the market.

National Association of Homebuilders: Insights on Housing Market Conditions

The National Association of Homebuilders (NAHB) offers crucial insights into housing conditions, encompassing trends in construction, pricing, and buyer preferences. Their comprehensive reports empower stakeholders to comprehend the current state of the housing market and anticipate future shifts. By leveraging the NAHB's insights, individuals can strategically navigate decisions related to new construction and property acquisitions, ultimately enhancing their investment strategies. With these insights, investors are equipped to make informed choices that can significantly impact their success in the real estate sector.

HelloData.ai: Innovative Real Estate Data Processing Solutions

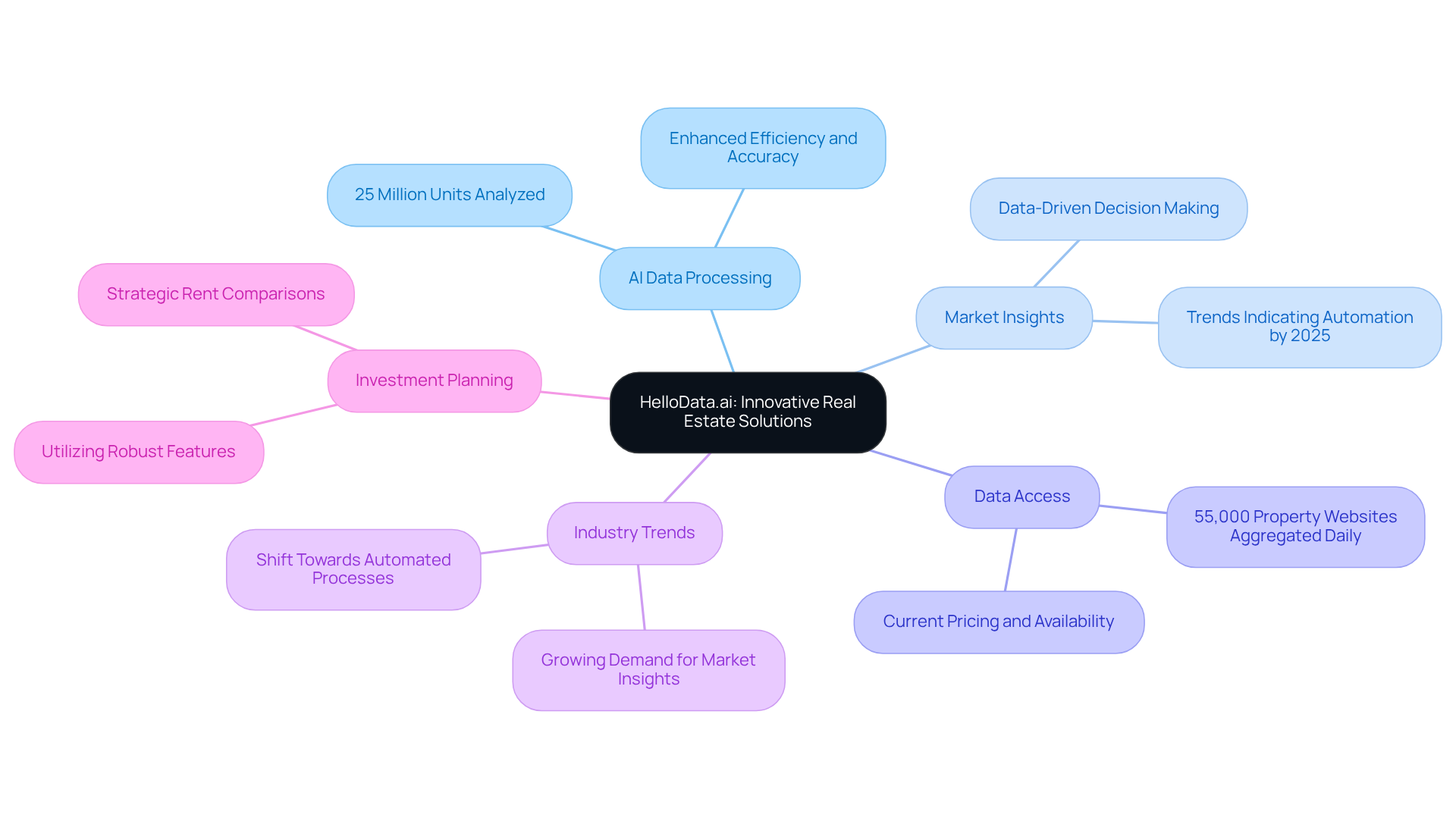

HelloData.ai is at the forefront of realty information processing, harnessing artificial intelligence to deliver comprehensive analyses of multifamily rent and expense comparisons. With access to current data on over 25 million units across the U.S., the platform empowers stakeholders to make swift, informed decisions. By leveraging advanced technology, HelloData.ai dramatically enhances the efficiency and accuracy of real estate information analysis, addressing the growing demand for precise market insights. The platform aggregates data from around 55,000 property websites daily, guaranteeing stakeholders have the latest pricing and availability information at their fingertips.

As the industry evolves, the integration of AI in data analysis is increasingly crucial, with trends indicating a shift towards more automated and data-driven decision-making processes by 2025. Joe Palmisano, who brings nearly thirty years of experience in business intelligence, underscores the importance of technology in property analysis. This enables investors utilizing HelloData.ai to capitalize on its robust features for effective rent comparisons and strategic investment planning.

CRE Finance Council: Insights into Commercial Real Estate Finance

The CRE Finance Council stands as a pivotal organization, delivering essential insights into commercial realty finance. Their extensive resources encompass various facets of financing, including current industry trends, investment opportunities, and effective risk management strategies.

As we approach 2025, the commercial real estate sector is confronted with significant challenges, notably the impending maturity of approximately $1 trillion in mortgages—predominantly five- or ten-year balloon mortgages that originated in a lower rate environment and now necessitate refinancing at rates exceeding 6%. In this context, the Council's commercial real estate datasets become increasingly vital.

Furthermore, the total liabilities of foreign-related institutions in the United States surged to $3,586.5 billion in June 2025, further reshaping the financial landscape. Investors can leverage these insights to navigate the complexities of financing, ensuring they make informed choices that align with the latest industry dynamics.

Understanding these trends not only aids in identifying lucrative investment opportunities but also equips individuals to manage risks effectively in a fluctuating market. As Warren Buffett wisely noted, 'The most important quality for an investor is temperament, not intellect,' highlighting the necessity for a balanced approach in today's challenging environment.

Conclusion

The importance of leveraging essential commercial real estate datasets is critical for investors seeking to excel in a competitive landscape. By tapping into various data sources, stakeholders can uncover vital insights into market trends, economic indicators, and demographic shifts that directly impact investment decisions. This holistic approach cultivates informed strategies aligned with current market dynamics, ultimately maximizing the potential for success in real estate ventures.

In exploring key datasets, several pivotal resources stand out, including:

- Zero Flux for daily market insights

- ATTOM for comprehensive property analytics

- Moody's Analytics for economic data solutions

Each platform presents unique advantages, from extensive property information to essential insights into transaction trends. Furthermore, organizations such as the National Association of Realtors and the American Community Survey offer invaluable information on housing market conditions and demographic trends, equipping investors with the knowledge necessary to make strategic decisions.

In a rapidly evolving real estate environment, the capacity to access and analyze diverse datasets is indispensable. Investors are urged to embrace these resources, as they not only illuminate current trends but also reveal emerging opportunities. By remaining informed and adaptable, stakeholders can adeptly navigate the complexities of the market and position themselves for long-term success. Engaging with these essential datasets empowers investors to make well-informed decisions that are aligned with the future trajectory of the commercial real estate sector.