Overview

The article titled "7 Essential Insights on Real Estate Notes for Sale" presents crucial information that investors must grasp regarding real estate notes and their market dynamics. It underscores the necessity of remaining informed through reputable sources such as Zero Flux, which diligently curates daily insights on market trends, consumer preferences, and investment strategies. This resource equips investors with the essential knowledge required to make informed decisions within a rapidly evolving real estate landscape.

Introduction

In the ever-evolving landscape of real estate, staying informed is paramount for investors eager to capitalize on emerging trends and opportunities. The intricacies of mortgage note investments and the legal nuances of property transactions necessitate a wealth of knowledge for making sound financial decisions. This article delves into various aspects of real estate investing, highlighting essential resources like Zero Flux, which curates daily insights, and exploring the advantages of self-directed IRAs for mortgage notes.

Moreover, it examines strategic approaches to buying and selling notes, the economic factors influencing property values, and the critical importance of legal compliance in transactions. By understanding these crucial elements, investors can effectively navigate the complexities of the market and enhance their potential for success. Are you ready to take your investment strategies to the next level?

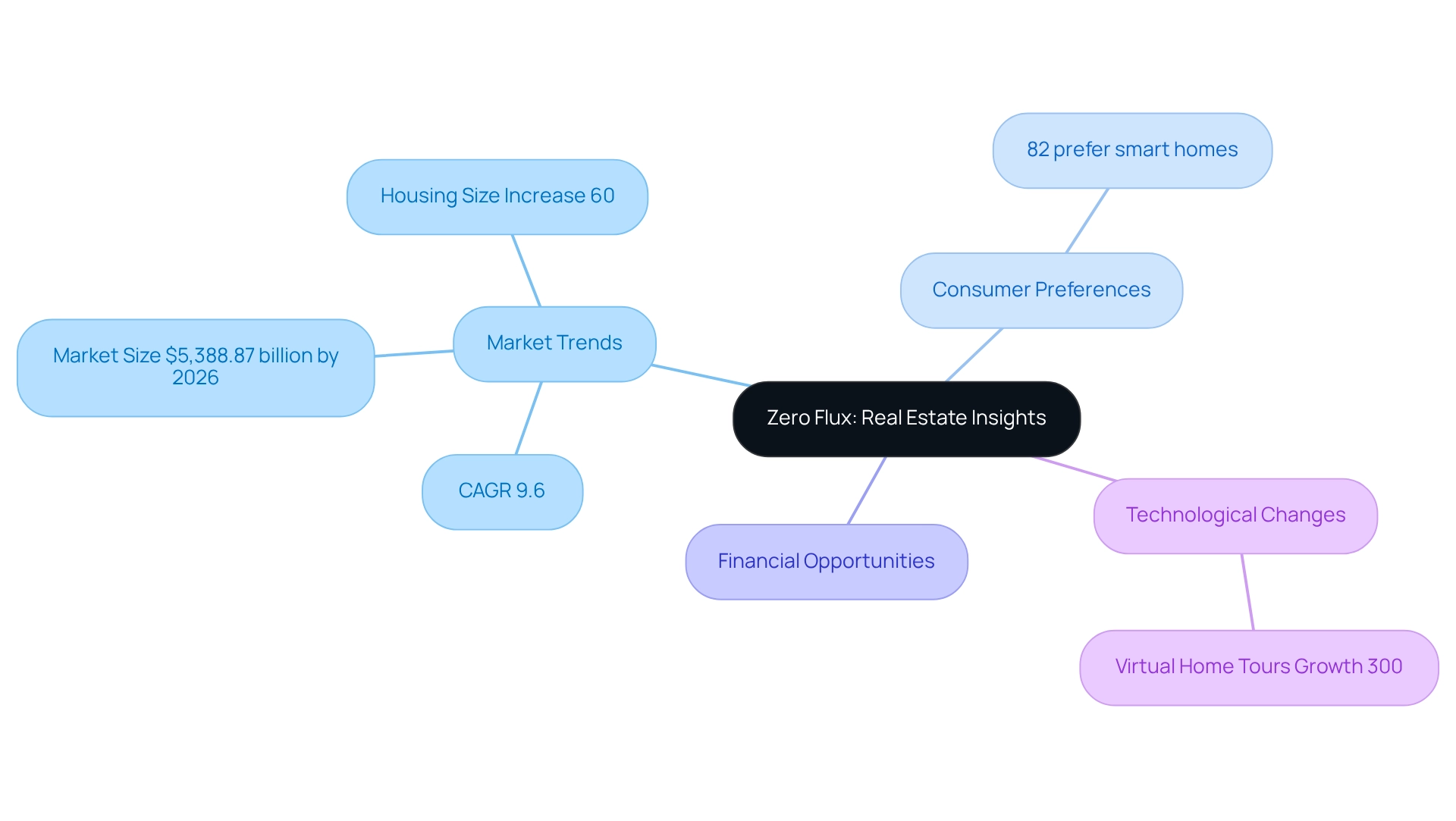

Zero Flux: Daily Insights on Real Estate Notes and Market Trends

Zero Flux delivers daily insights on real estate notes for sale and market trends by meticulously curating data from over 100 diverse sources. This specialized newsletter is dedicated to highlighting essential developments within the real estate sector, including information on real estate notes for sale, and offering subscribers a concise and factual overview of market dynamics. By sifting through extensive information, Zero Flux identifies the most pertinent trends, making it an indispensable resource for real estate professionals, investors, and those interested in real estate notes for sale. Each day, subscribers receive 5-12 thoughtfully chosen insights that cover essential topics such as housing market trends, financial opportunities, and demographic shifts, all presented in a clear and accessible format.

As the real estate landscape evolves, staying informed through trustworthy sources is crucial for making sound financial decisions. Significantly, the worldwide real estate market is expected to reach $5,388.87 billion by 2026, expanding at a CAGR of 9.6%, highlighting considerable growth opportunities for stakeholders. Furthermore, the average American house size has increased by 60% from 1973 to 2018, reflecting changing consumer preferences.

Moreover, virtual home tours have surged by over 300% since 2020, indicating a shift in how properties are marketed and viewed by potential buyers. Understanding consumer behavior is essential, as evidenced by a case study showing that 82% of homebuyers prefer homes with smart technology features. This insight emphasizes the importance of aligning offerings with buyer expectations.

Additionally, market research and analysis are critical for informed financial decisions, reinforcing the necessity of the insights provided by Zero Flux. As the real estate market continues to evolve, leveraging these insights will be vital for success.

The Entrust Group: Self-Directed IRAs for Mortgage Note Investments

Self-directed IRAs have emerged as a vital asset for real estate stakeholders, especially in the context of real estate notes for sale and loan agreements. This funding option not only allows for portfolio diversification but also offers significant tax benefits, enabling individuals to bolster their retirement savings while actively participating in real estate markets. By utilizing a self-directed IRA, individuals can directly acquire loan documents, thus gaining enhanced control over their financial strategies.

As we look toward 2025, the landscape for self-directed IRAs is evolving, with statistics revealing that a considerable number of individuals are capitalizing on these accounts to augment their portfolios. For instance, many financiers are tapping into unsecured credit lines ranging from $100,000 to $250,000, which can be strategically deployed for property investment. These credit lines provide the essential funds needed to secure loan agreements, allowing stakeholders to seize lucrative opportunities in the market.

Financial advisors emphasize the tax advantages linked to investing in mortgage notes through self-directed IRAs. According to a financial advisor, "Investing through a self-directed IRA not only allows for tax-deferred growth but also presents the potential for tax-free withdrawals in retirement, making it an attractive option for informed individuals." Effective strategies often include leveraging debt to finance acquisitions, enabling stakeholders to cover a substantial portion of their purchase expenses and potentially finance up to 100% of their expenditures.

Case studies illustrate the efficacy of self-directed IRAs in real estate endeavors. For example, one investor employed debt to secure multiple loan agreements, resulting in a 30% increase in passive income over two years. Investors who have embraced this method report improved portfolio performance and heightened passive income streams. As Warren Buffett aptly remarked, "We don’t have to be smarter than the rest. We have to be more disciplined than the rest," highlighting the significance of strategic investment decisions in achieving financial success.

In summary, self-directed IRAs present an appealing opportunity for individuals aiming to invest in real estate notes for sale, combining flexibility, control, and substantial tax benefits that can lead to greater profits with reduced effort. This guide promises valuable insights for maximizing returns with minimal work, making it an indispensable resource for investors seeking to enhance their financial outcomes.

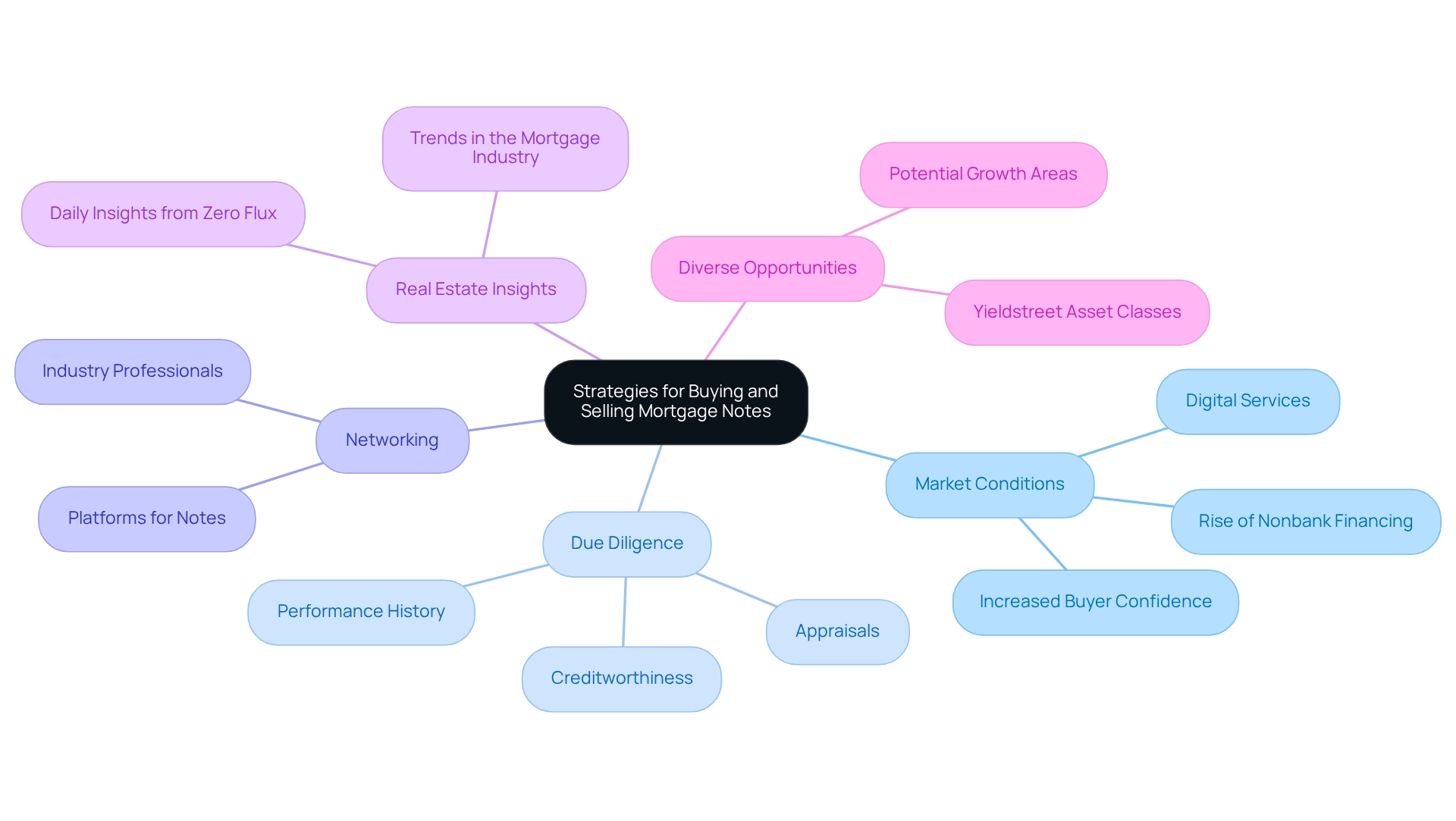

FasterCapital: Strategies for Buying and Selling Mortgage Notes

Efficient approaches to purchasing and selling loan agreements hinge on several crucial factors, particularly in light of current market conditions. As of May 2025, the lending sector is undergoing significant transformations, including a rise in nonbank financing and digital services, which are enhancing customer experiences and potentially boosting buyer confidence. According to Zero Flux, their newsletter curates 5-12 handpicked real estate insights daily, underscoring the necessity of staying informed in this rapidly evolving market. Investors must prioritize thorough due diligence, evaluating borrower creditworthiness, property appraisals, and the performance history of the agreement. Understanding the specific terms of the loan is essential for making informed decisions.

Networking with industry professionals can unlock valuable insights and opportunities. Engaging with platforms that specialize in real estate notes for sale can further streamline the buying and selling process. As highlighted in the case study 'Trends in the Home Loan Industry,' the current disruptions in the lending sector present opportunities for increased buyer confidence and potential growth. Moreover, Yieldstreet offers opportunities across various asset classes, providing diverse avenues for those interested in mortgage notes. By leveraging these strategies, individuals can effectively navigate the complexities of the market, positioning themselves for successful transactions and maximizing returns in this dynamic landscape. Remember, "Every accomplishment starts with the decision to try," emphasizing the importance of taking informed steps in your financial journey.

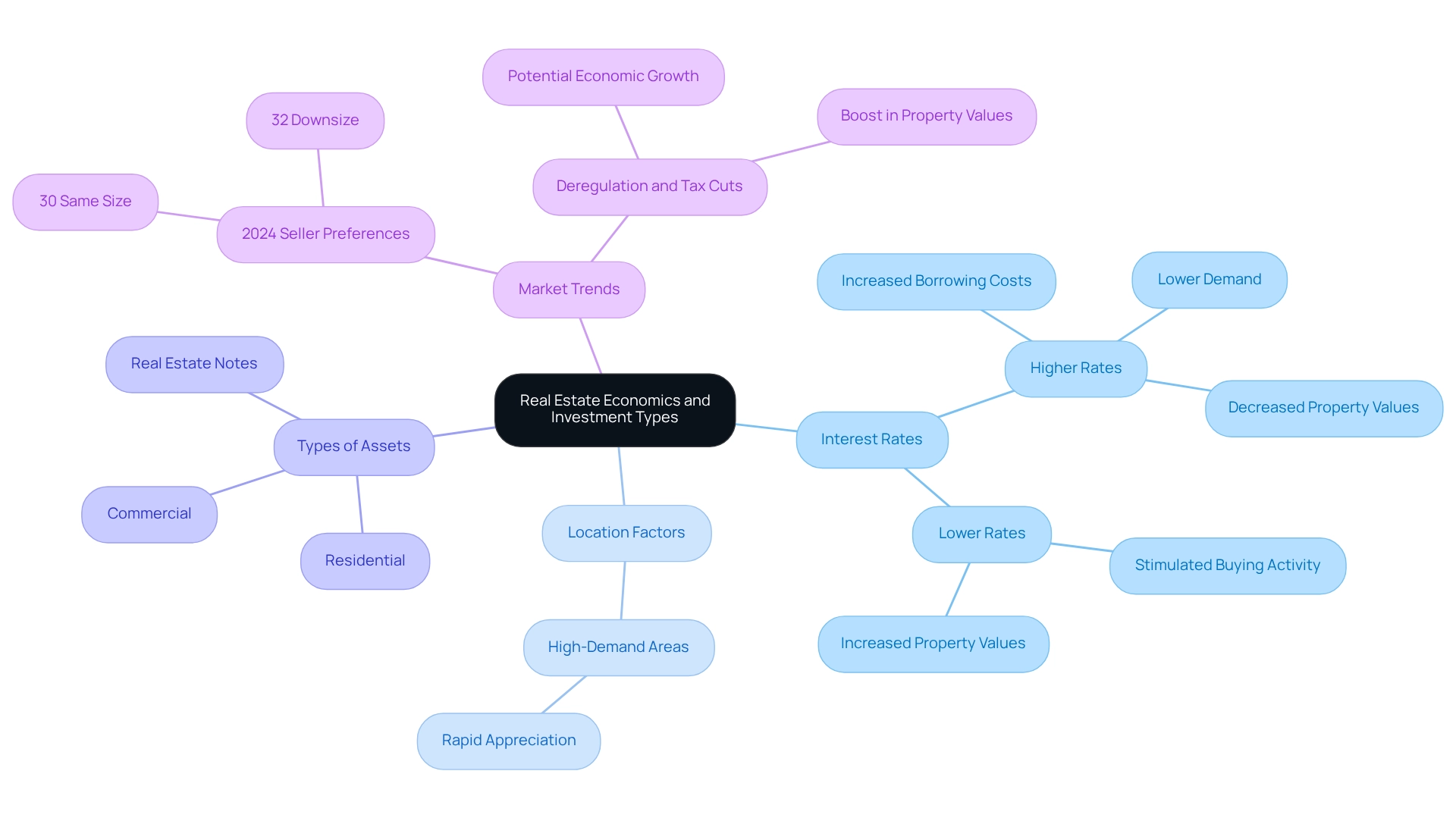

Investopedia: Understanding Real Estate Economics and Investment Types

A solid grasp of real estate economics is crucial for investors aiming to navigate the complexities of the market effectively. Comprehending the effect of interest rates on property values is especially important; as rates vary, they can directly affect financial choices and overall market dynamics. Rising interest rates typically lead to higher borrowing costs, dampening demand and subsequently lowering property values. Conversely, lower rates often stimulate buying activity, driving prices up.

Location remains a pivotal factor in the success of real estate ventures. Properties in high-demand areas tend to appreciate more rapidly, making them attractive options for investors. Different types of assets—including residential and commercial properties, as well as real estate notes for sale—provide unique opportunities and risks. In 2025, statistics suggest that the real estate market is diversifying, with a notable increase in interest in real estate notes for sale as a viable strategy.

Recent trends reveal that in 2024:

- 30% of home sellers opted for properties of the same size

- 32% chose to downsize

This shift indicates evolving buyer priorities, highlighting the necessity for stakeholders to adjust their strategies accordingly. Successful financial strategies in this evolving market often involve a keen understanding of these trends and the economic factors at play.

As deregulation and tax reductions potentially encourage economic expansion, property values may face upward pressure, generating new opportunities for astute individuals. According to Ben Adams, CEO and founder of Ten Capital Management, "deregulation and new tax cuts could provide stronger than anticipated GDP performance," underscoring the importance of these economic indicators. Furthermore, it's noteworthy that the highest 10% of real estate brokers receive up to $160,980, illustrating the potential profitability within the industry. By remaining knowledgeable about these economic indicators and grasping the nuances of real estate opportunities, individuals can make strategic choices that align with their financial objectives and capitalize on emerging market trends.

Tax Notes: Legal Insights on Real Estate Transactions

Tax Notes delivers crucial legal insights on real estate transactions, highlighting the necessity for stakeholders to comprehend the tax implications tied to mortgage notes. Recognizing potential tax liabilities, deductions, and reporting obligations is essential for effective investment management. Notably, recent changes in tax regulations for 2025 have introduced new elements that individuals must navigate to refine their strategies. Engaging with legal experts can clarify these evolving regulations, empowering individuals to enhance their overall performance.

Furthermore, effective tax strategies for mortgage note investors can significantly influence profitability. For instance, Tom's cost segregation study on his 50-unit apartment complex uncovered over $300,000 in short-life assets, facilitating substantial first-year write-offs. This exemplifies how strategic tax planning can yield considerable financial advantages. Additionally, Linda's oversight of a 16-unit building resulted in a $40,000 loss, underscoring the financial impact that tax considerations can have on real estate ventures.

Investors must also be cognizant of common tax liabilities associated with real estate investments in 2025, which may encompass capital gains taxes and property taxes. By staying informed and proactive, individuals can mitigate risks and capitalize on market opportunities. Legal insights from tax experts underscore the importance of optimizing tax strategies to maximize returns, making it imperative for individuals to remain vigilant and informed in this dynamic landscape. Moreover, there may be new funding opportunities in affordable housing if budget proposals are approved, potentially offering timely avenues for investors aiming to navigate the evolving market.

As Jesse Jones aptly stated, "I have always liked real estate; farm land, pasture land, timber land, and city property. I have had experience with all of them. I guess I just naturally like ‘the good Earth,’ the foundation of all our wealth." This perspective reinforces the fundamental aspects of real estate and the importance of informed decision-making. Ultimately, the case study on community involvement and improvement illustrates how real estate investment can bolster community development, contributing to economic growth and stability while enhancing residents' quality of life.

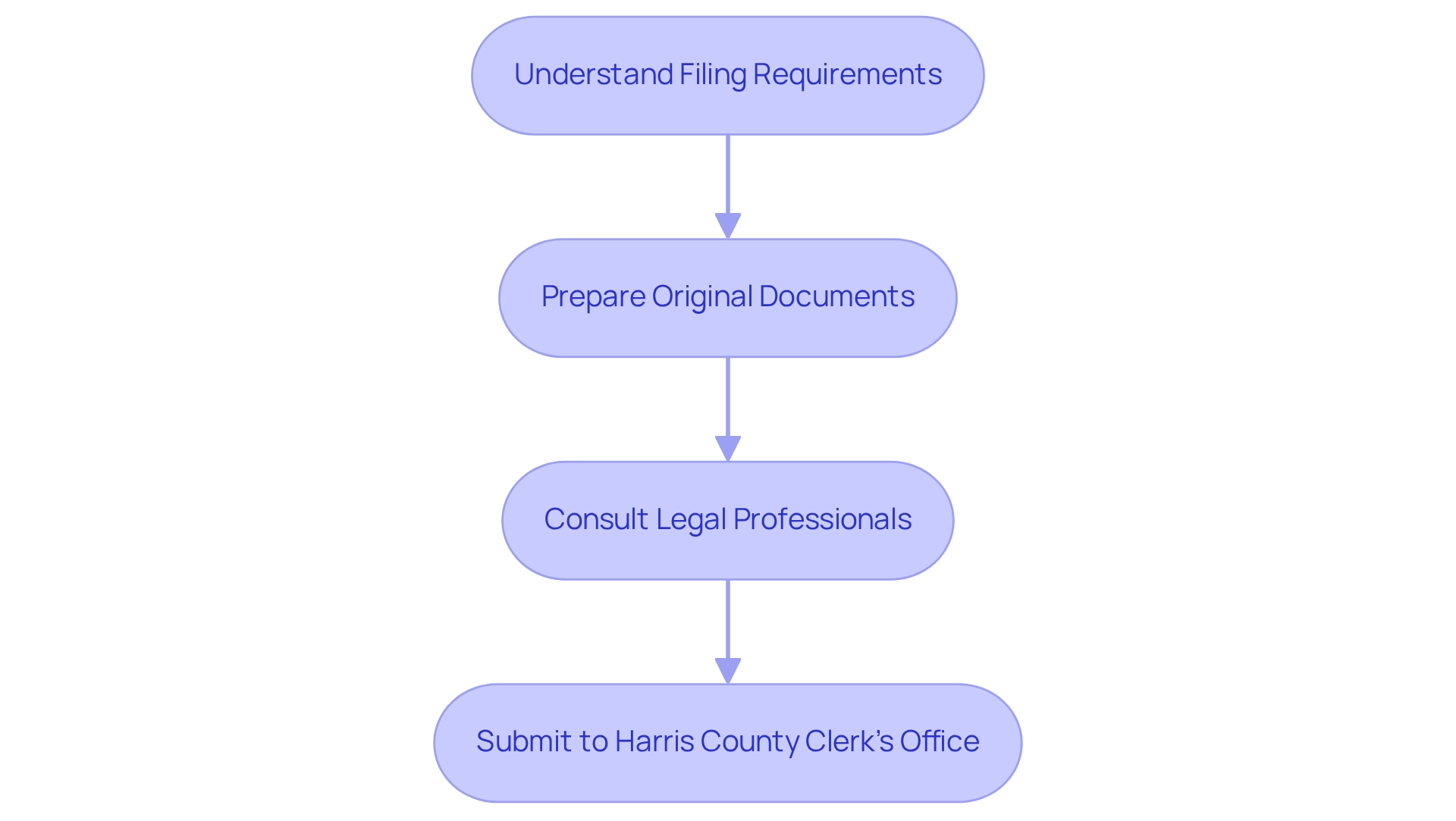

Harris County Clerk's Office: Filing Requirements for Real Property Documents

The Harris County Clerk's Office delineates the essential submission criteria for real estate documents, pivotal for individuals engaged in financial agreements. Accurate documentation is vital for establishing ownership and ensuring the legality of these transactions. Investors must present original documents, including deeds and mortgage agreements, along with any requisite forms to the Clerk's Office. Understanding these requirements is crucial, as it helps individuals avoid common legal pitfalls and guarantees that their transactions are documented accurately. In 2025, adherence to these filing protocols is more critical than ever, given the evolving landscape of real estate transactions in Harris County.

It is important to highlight that extrinsic evidence is admissible only if the deed is ambiguous on its face, underscoring the necessity for clarity in documentation. Furthermore, the measure of damages for breach of an implied covenant, in cases of total failure of title, is the consideration paid, with interest. This underscores the potential financial repercussions of inadequate documentation.

As Jesse Jones, an entrepreneur, aptly stated, "I have always liked real estate; farm land, pasture land, timber land, and city property. I have had experience with all of them. I guess I just naturally like ‘the good Earth,’ the foundation of all our wealth." This sentiment encapsulates the intrinsic value of real estate and the importance of proper documentation in safeguarding that value.

Moreover, individuals should stay informed about the latest updates from the Harris County Clerk's Office regarding real estate dealings in 2025 to ensure compliance with current practices. To facilitate adherence to filing requirements, individuals are encouraged to consult with legal professionals and utilize checklists to verify that all necessary documents are prepared and submitted correctly.

City of Milwaukee: Guidelines for Purchasing City-Owned Properties

The City of Milwaukee presents clear guidelines for acquiring city-owned properties, which can offer profitable opportunities. Prospective buyers are encouraged to engage with a licensed real estate agent and adhere to the city's structured purchasing process. This typically involves:

- Attending informational sessions

- Submitting the necessary applications

By familiarizing themselves with these guidelines, individuals can navigate the purchasing landscape more effectively, positioning themselves to acquire properties under favorable conditions.

Recent statistics reveal that approximately 30% of construction workers are immigrants, underscoring the diverse labor market that can influence real estate investments. Furthermore, as highlighted by Inman.com, there are nine methods to become a successful real estate agent, providing valuable insights for those navigating the purchasing process.

The March 2025 NAR Real Estate Forecast Summit, led by NAR Senior Economist Nadia Evangelou, emphasized essential predictions and trends that equip stakeholders with the insight needed to maneuver through the evolving real estate environment. City-owned properties frequently offer distinctive value propositions, making them an appealing choice for strategic funding. To enhance their financial potential, individuals should actively pursue these opportunities and reflect on broader market trends.

An actionable tip for prospective buyers is to network with local real estate professionals who can offer insights and guidance tailored to the Milwaukee market.

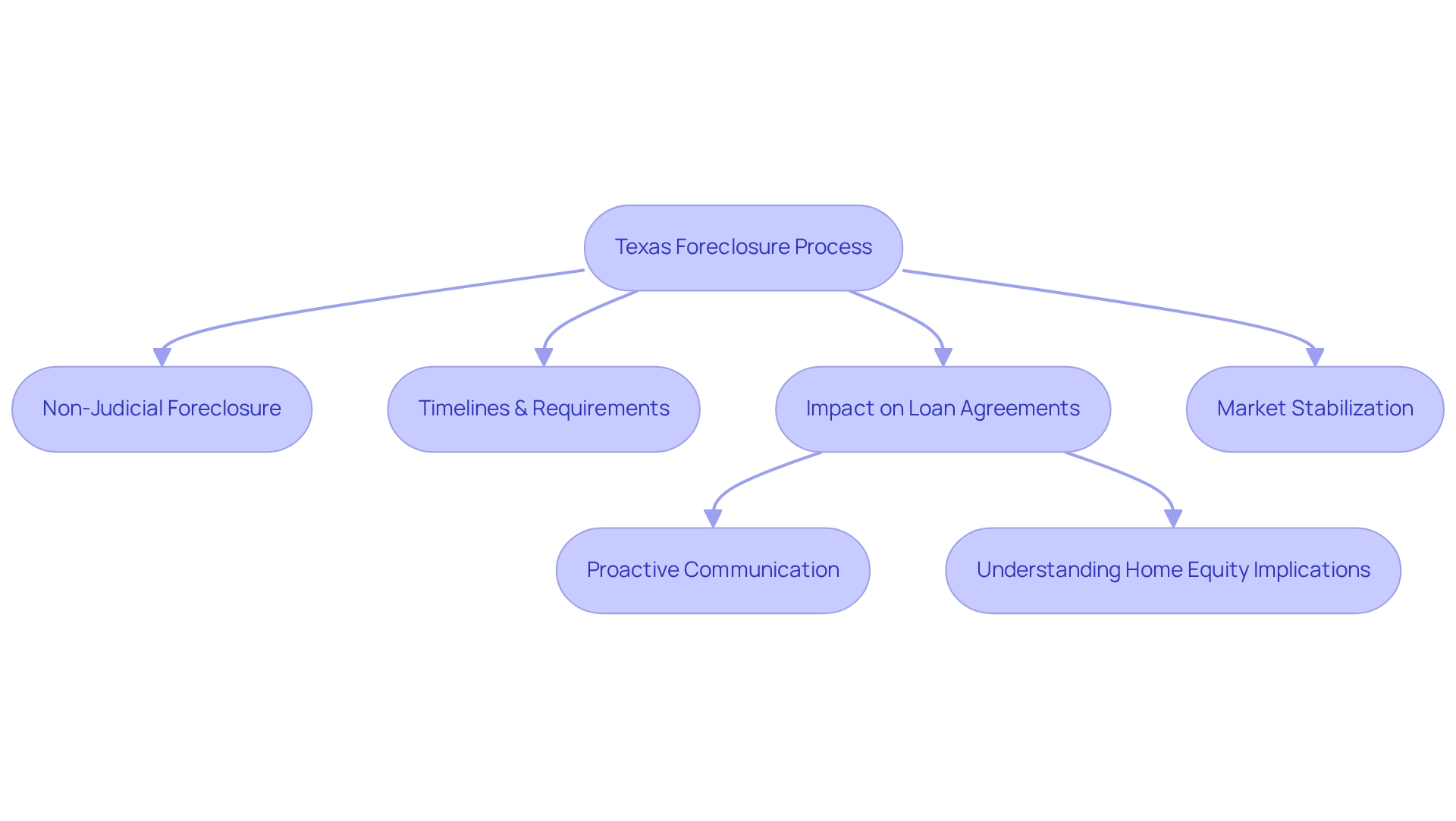

Texas Law: Understanding Foreclosure Processes and Their Impact on Mortgage Notes

Understanding the foreclosure procedure in Texas is crucial for investors in loan agreements, as it directly impacts the value and effectiveness of their investments. Texas employs a non-judicial foreclosure process, enabling lenders to act without court involvement, which streamlines the foreclosure timeline.

Investors must familiarize themselves with the specific timelines and legal requirements associated with Texas foreclosures. Notably, the percentage of severely delinquent loans in foreclosure in Texas has decreased from 0.53% in Q2 2023 to 0.43% in Q2 2024. This decline suggests a potential stabilization in the market, which could positively affect property values.

Legal experts emphasize that the impact of foreclosure on loan agreements can be significant. As industry professional Sharad Mehta notes, "Understanding how today’s foreclosure landscape compares to previous housing crises provides essential context for evaluating current market risks and opportunities." This insight is vital for Texas stakeholders navigating the complexities of the market.

Furthermore, case studies on foreclosure prevention and mitigation efforts demonstrate the effectiveness of strategies such as loan modifications and forbearance programs. In Q1 2023 alone, over 58,000 foreclosure prevention actions were recorded, assisting more than 6 million families in retaining their homes. These interventions can influence overall market dynamics and, consequently, the value of loan agreements in Texas.

As of May 2025, remaining informed about developments in the Texas foreclosure process is essential for all involved. Effective strategies for managing loan agreements during foreclosure include:

- Proactive communication with borrowers

- Understanding the implications of rising home equity levels

These strategies have been crucial in preventing a more severe foreclosure crisis. By staying informed and adaptable, individuals can better protect their portfolios and capitalize on emerging opportunities.

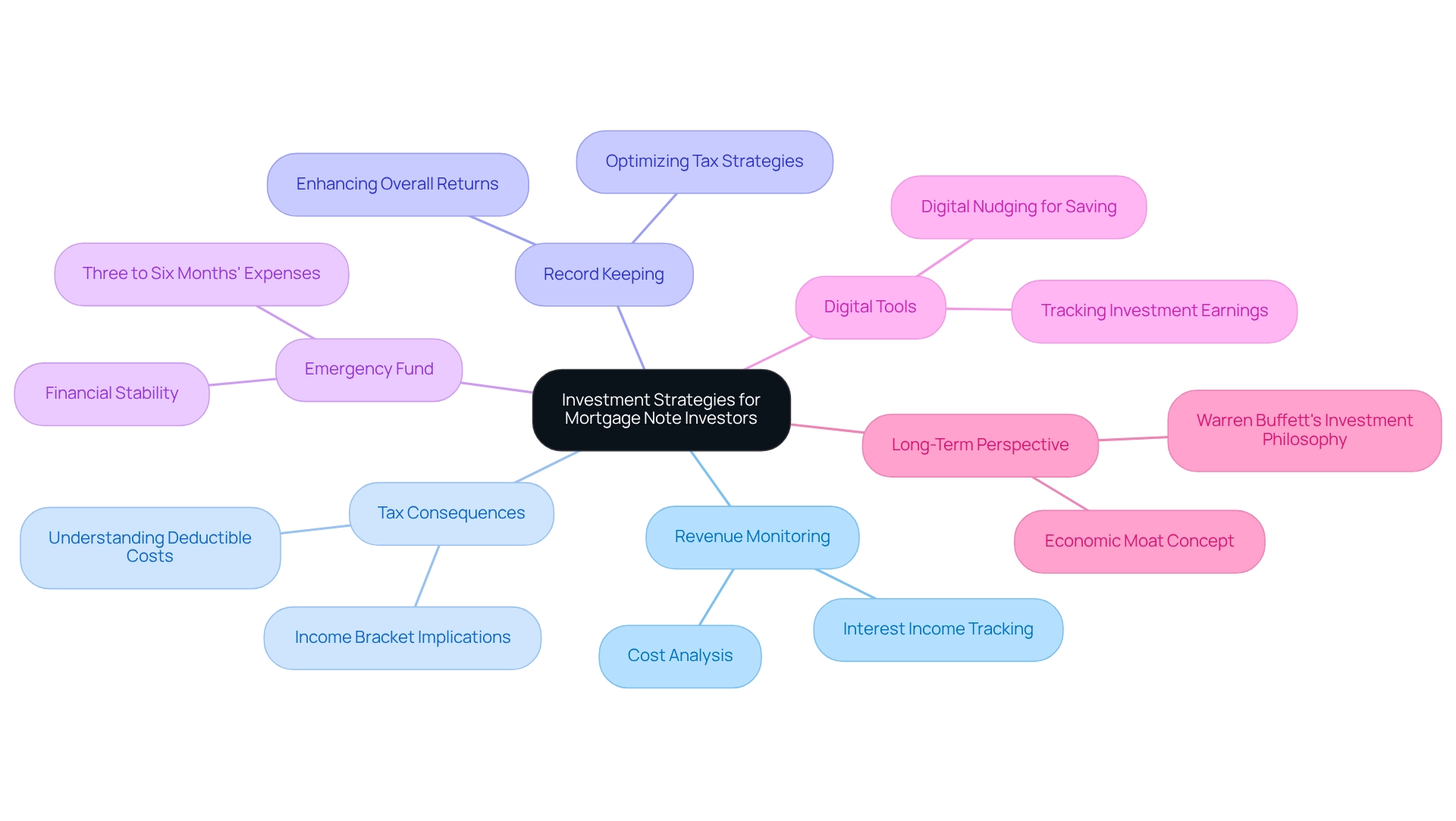

My Stock Options: Investment Income and Expense Insights for Mortgage Note Investors

Efficient administration of revenue and costs is essential for property loan holders seeking sustained achievement. Key strategies involve careful monitoring of interest income and understanding the tax consequences related to property loan assets. Investors must recognize that maintaining accurate records not only aids in optimizing tax strategies but also enhances overall returns. Notably, understanding deductible costs associated with loan agreements can significantly influence net earnings. Therefore, it is crucial to seek advice from financial consultants for personalized assistance.

In 2025, real estate debt holders must navigate changing tax consequences, which can vary depending on income brackets and asset structures. Staying informed about current insights on tax strategies is vital, as financial experts recommend that individuals set aside at least three to six months' worth of expenses for an emergency fund. This practice ensures financial stability amidst market fluctuations, particularly for loan agreement stakeholders, as it provides a cushion against unforeseen costs. Furthermore, utilizing digital tools for tracking investment earnings can simplify the process, allowing stakeholders to focus on strategic decision-making. Employing digital nudging promotes saving without relying solely on willpower, making it easier for individuals to manage their finances effectively. By adopting these practices, mortgage note holders can adeptly manage their financial landscape, preparing to capitalize on opportunities while mitigating risks.

As Warren Buffett wisely states, 'Our favorite holding period is forever,' underscoring the importance of a long-term perspective in financial strategies. Additionally, understanding the concept of an economic moat can help individuals establish competitive advantages in their investments, thereby improving their chances for success.

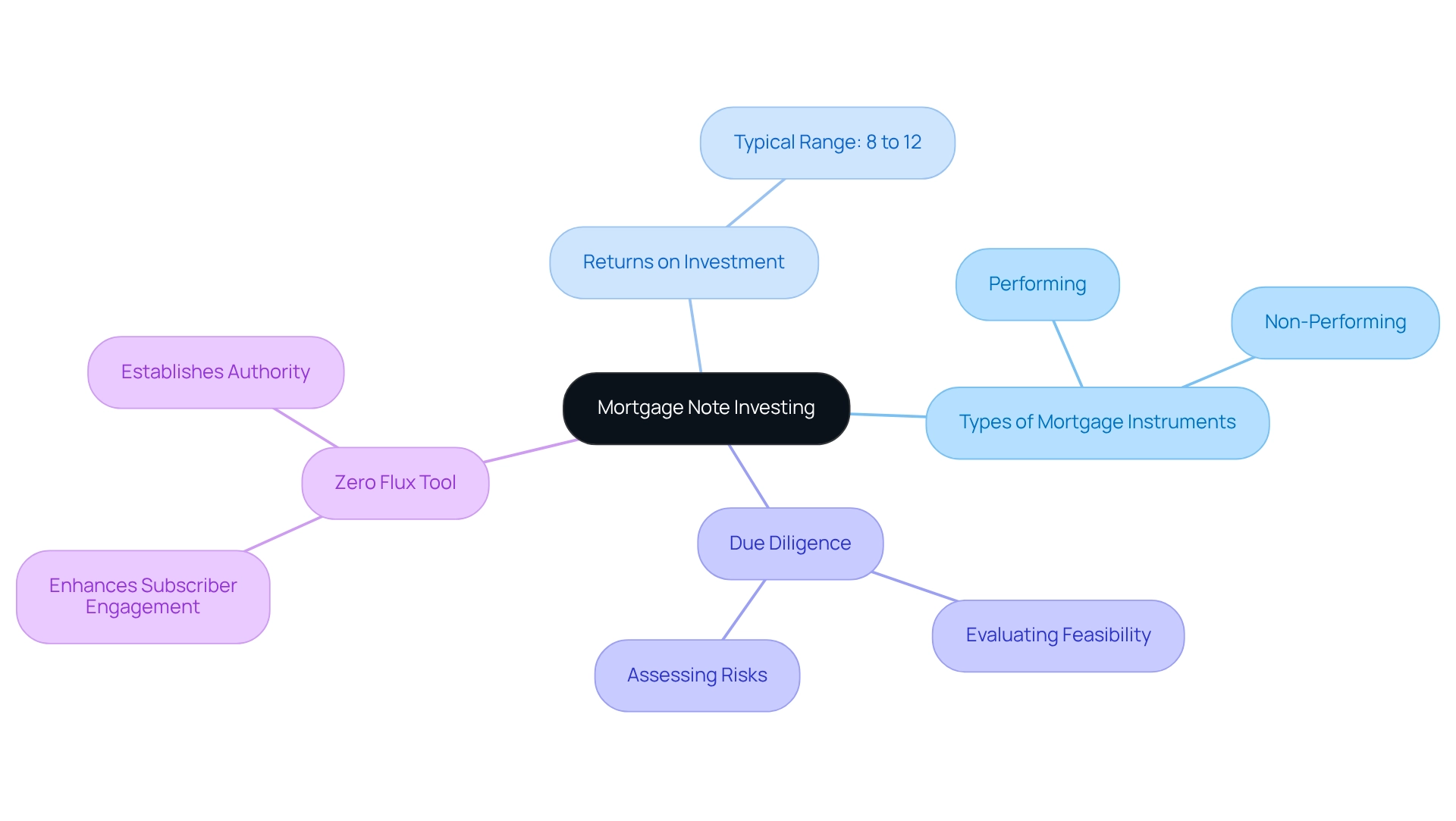

The Entrust Group: Key Components and Returns of Mortgage Note Investing

Mortgage bond investing encompasses several essential elements that participants must understand to navigate this market effectively. Key types of mortgage instruments include:

- Performing ones, which generate consistent income

- Non-performing ones, often available at a discount but associated with higher risks

Due diligence is crucial in this process, as it enables investors to evaluate the feasibility and potential of each document.

As Mark Twain famously remarked, "Buy land, they’re not making it anymore," emphasizing the enduring value of real estate investments. As of May 2025, typical returns on mortgage notes range from 8% to 12%, positioning them as an appealing option for those seeking passive income streams. Understanding these elements allows individuals to align their strategies with their financial goals, optimizing potential risk-adjusted returns. A clearly outlined strategy and the appropriate mindset are vital for assessing risks and achieving success in this financial sector. By focusing on these key elements, individuals can make informed choices that enhance their overall investment portfolio.

Moreover, Zero Flux serves as an indispensable tool for anyone involved in the real estate industry, providing essential insights that enhance subscriber engagement and establish authority in the market. By leveraging the quality content offered by Zero Flux, investors can navigate the complexities of mortgage note investing more effectively.

Conclusion

Staying informed and strategically engaged in the real estate market is crucial for investors aiming to maximize opportunities and navigate potential pitfalls. Insights from resources like Zero Flux underscore the importance of understanding market trends, particularly the growth of the global real estate sector and the evolving preferences of buyers. This knowledge empowers investors to make informed decisions, especially regarding mortgage note investments and the advantages of utilizing self-directed IRAs.

Moreover, mastering the complexities of buying and selling mortgage notes necessitates diligence and a thorough grasp of the legal and economic landscape. Investors must remain vigilant about market fluctuations, interest rates, and the intricacies of foreclosure processes to effectively manage their portfolios. As the market continues to evolve, leveraging strategic insights and networking with industry professionals can significantly enhance investment success.

Ultimately, real estate investment transcends merely capitalizing on current trends; it encompasses long-term planning and strategic decision-making. By embracing available resources and remaining vigilant about legal requirements and tax implications, investors can position themselves for sustained growth and profitability in a competitive landscape. The journey of real estate investing is one of continuous learning and adaptation, making it essential for investors to stay engaged and informed.