Overview

The article titled "7 Insights from Pamela Michaels on Real Estate Investment Trends" presents an authoritative examination of pivotal trends and insights pertinent to real estate investment. Although the content is not provided, the title indicates that it will delve into significant observations articulated by Pamela Michaels, which are essential for investors aiming to comprehend current market dynamics and make informed decisions.

By highlighting these key insights, the article seeks to capture the attention of its audience, drawing them in with compelling market observations. Each insight is likely backed by relevant data, fostering interest and encouraging readers to consider how these trends may influence their investment strategies. As the insights unfold, the desire for actionable information grows, prompting readers to reflect on their own investment approaches.

Ultimately, this article serves as a guide for investors, summarizing the implications of these insights and urging them to leverage this knowledge in their decision-making processes. By synthesizing Pamela Michaels' expertise, the article aims to empower readers with the confidence to navigate the complexities of real estate investment effectively.

Introduction

The real estate landscape is in a state of constant evolution, influenced by a myriad of factors such as market dynamics, demographic shifts, and global influences. Investors who wish to navigate this complex terrain must remain vigilant, staying ahead of emerging trends and insights to make informed decisions. This article explores seven key insights from Pamela Michaels, shedding light on critical investment strategies and market indicators that can empower investors to thrive in 2025 and beyond.

How can a deeper understanding of these trends transform investment approaches and lead to greater success in a fluctuating market?

Zero Flux: Essential Daily Insights for Real Estate Investors

Zero Flux serves as an indispensable resource for property investors, delivering essential daily insights sourced from over 100 diverse channels. By prioritizing data-driven information free from subjective opinions, the newsletter guarantees that subscribers obtain a clear and factual overview of the latest market trends.

With a rapidly expanding subscriber base exceeding 30,000, Zero Flux addresses the challenge of information overload in the property sector by providing a daily selection of 5-12 curated insights. This approach solidifies its status as a vital tool for industry professionals and enthusiasts alike.

Housing Market Trends: Key Indicators for Investment Decisions

Key indicators such as housing inventory levels, price trends, and interest rates play a pivotal role in shaping property investment choices. A decline in housing supply typically results in heightened competition among buyers, driving prices upward and creating a favorable environment for sellers.

For instance, in 2025, the average home price in the U.S. is projected to mirror these dynamics, with significant increases anticipated in regions with low inventory, as illustrated by data spanning from March 2018 to December 2022.

On the other hand, elevated interest rates can dampen buyer enthusiasm, leading to slower sales and potentially diminishing property values. This relationship is evident in case studies analyzing the impact of interest rates on property sectors, where high interest rates were associated with decreased demand and falling prices, particularly in sectors experiencing economic downturns.

Investors should vigilantly monitor these indicators using analytics platforms to assess economic health and pinpoint optimal entry points for their investments. By doing so, they can ensure they remain informed and agile in a rapidly evolving market.

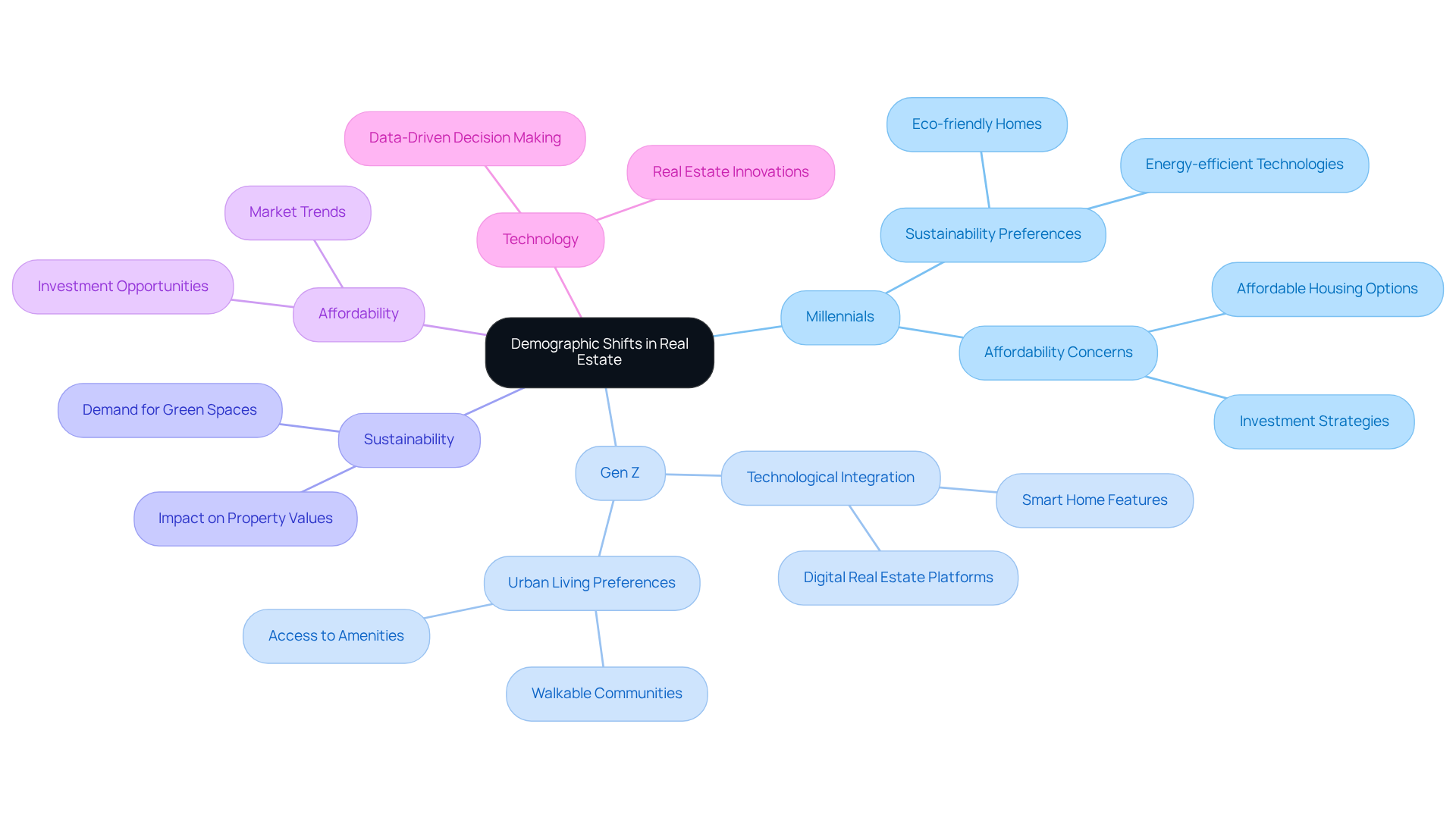

Demographic Shifts: The Impact of Millennials and Gen Z on Real Estate

Millennials and Gen Z are emerging as pivotal forces in the real estate sector, reshaping investment trends with their distinct preferences. These generations prioritize sustainability, affordability, and technological integration, significantly influencing demand for eco-friendly homes and urban living environments. Recent studies indicate that properties featuring sustainable designs and energy-efficient technologies are increasingly favored, with a notable rise in eco-friendly home purchases among younger buyers.

For example, studies on urban transformation in Heliopolis emphasize how demographic shifts are influencing alterations in property values and urban development. This indicates that stakeholders should adjust their strategies to these changing preferences. This shift not only reflects their values but also suggests that aligning investment strategies with these preferences can enhance occupancy rates and elevate property values.

As urbanization continues to attract younger populations, stakeholders should closely monitor these trends, recognizing that demographic shifts are not merely statistical changes but vital indicators of future market dynamics. Furthermore, grasping the urban policies and economic elements influencing change in neighborhoods can offer stakeholders practical insights to maneuver through this shifting environment.

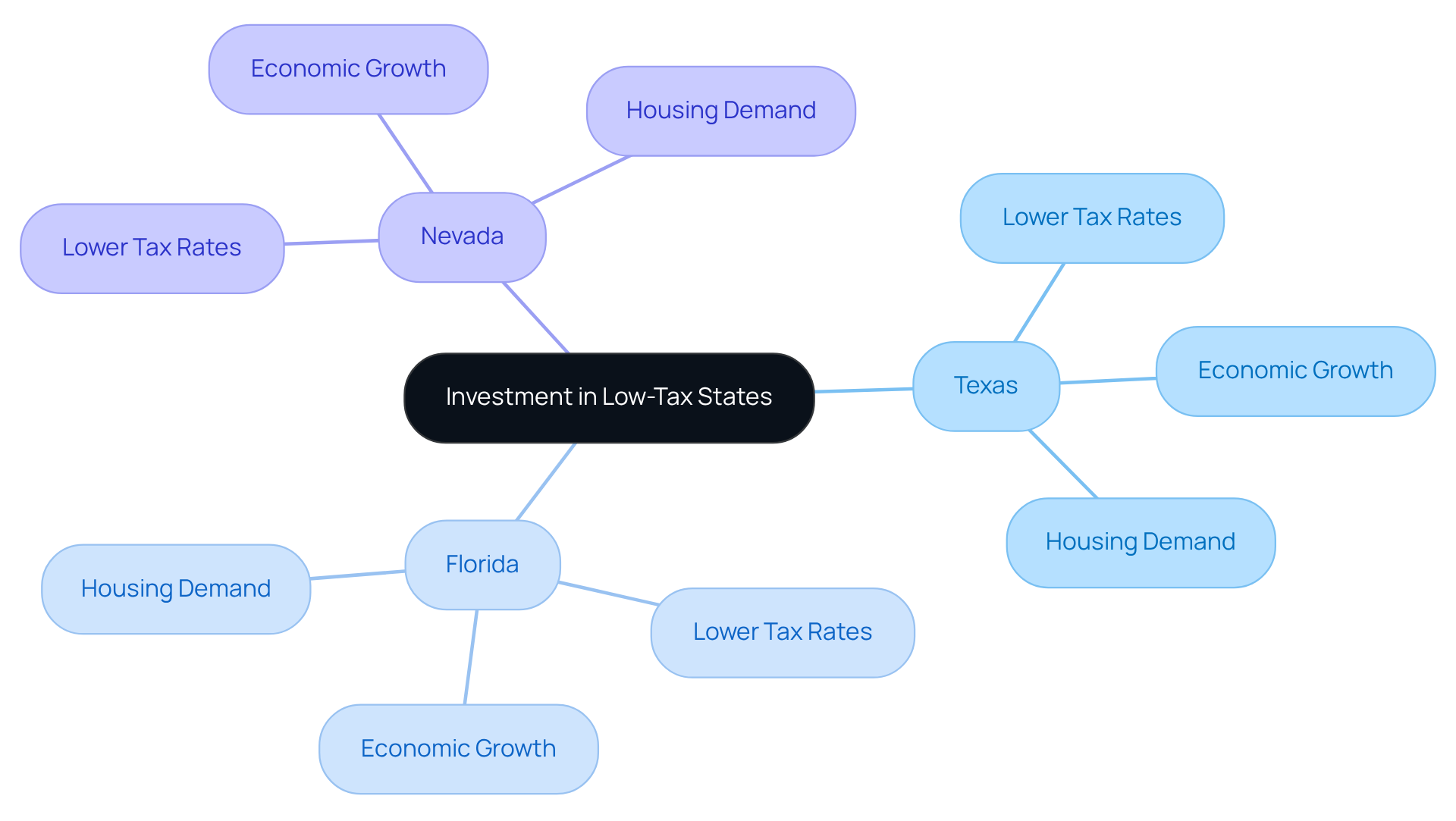

Investment Opportunities: Exploring Low-Tax States for Real Estate

Investors should consider the lucrative opportunities presented by low-tax states such as Texas, Florida, and Nevada. These regions boast favorable tax policies that can significantly enhance overall returns. As a result, they attract both businesses and residents, leading to a surge in housing demand. By investing in these areas, property purchasers stand to benefit from reduced tax rates and a more favorable regulatory landscape, ultimately boosting their profit margins.

In these states, the combination of lower taxes and a thriving economy creates a compelling environment for real estate investment. The influx of new residents and businesses contributes to a robust housing market, increasing the potential for appreciation in property values. This trend not only fosters a sense of community but also positions investors to capitalize on the rising demand for housing.

Thus, the strategic decision to invest in low-tax states can yield substantial advantages. By leveraging these favorable conditions, investors can enhance their financial outcomes while contributing to the growth of vibrant communities. Take action now to explore these opportunities and secure your position in the flourishing real estate market.

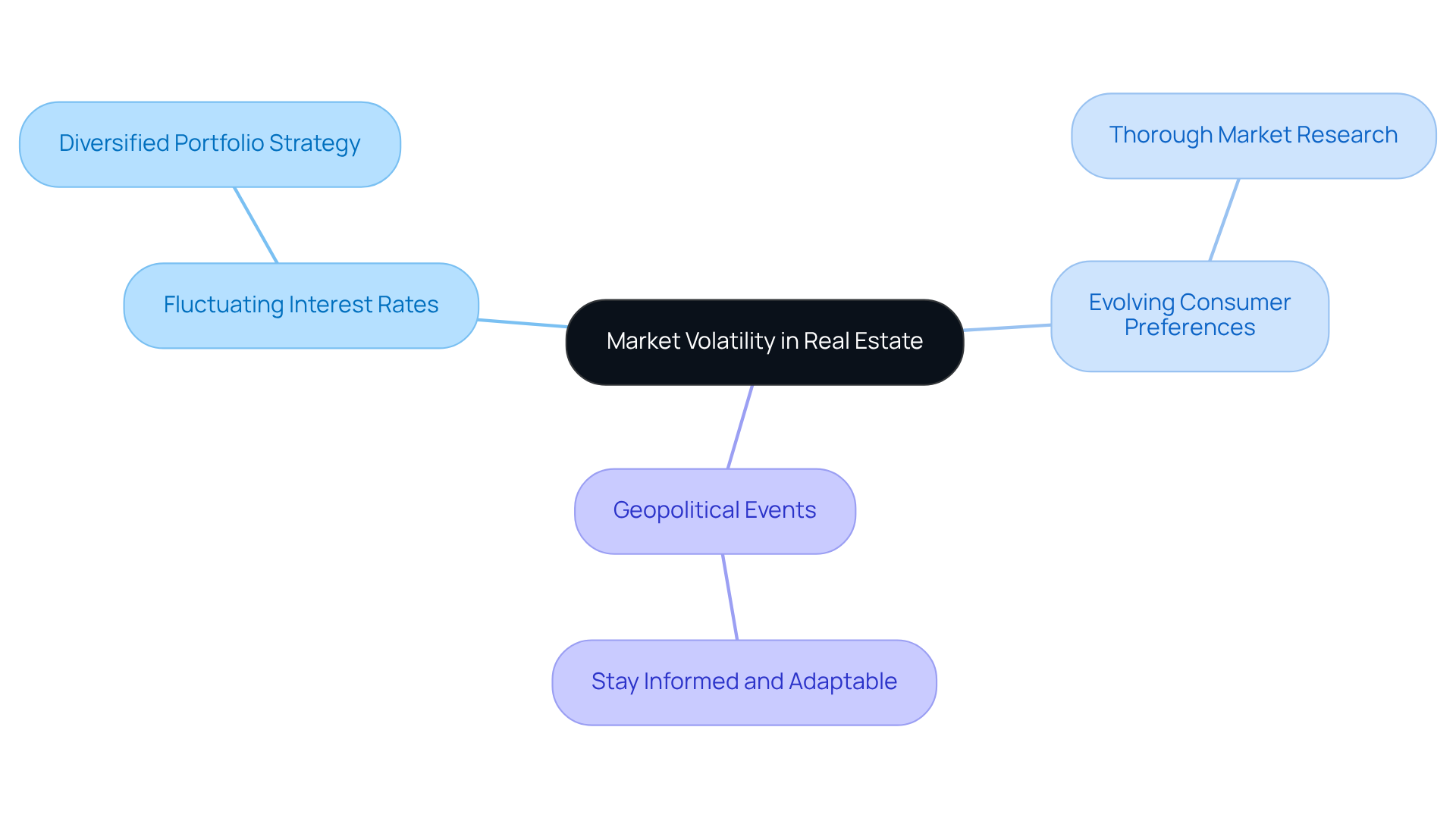

Market Volatility: Navigating Risks in Real Estate Investments

Market volatility presents notable challenges for property investors, particularly in unpredictable economic climates. Fluctuating interest rates, evolving consumer preferences, and geopolitical events significantly influence property values and rental income.

To navigate these complexities, investors must embrace a diversified portfolio strategy. Conducting thorough market research is essential for identifying resilient investment opportunities capable of withstanding economic fluctuations.

By staying informed and adaptable, investors can position themselves to thrive in a dynamic market landscape.

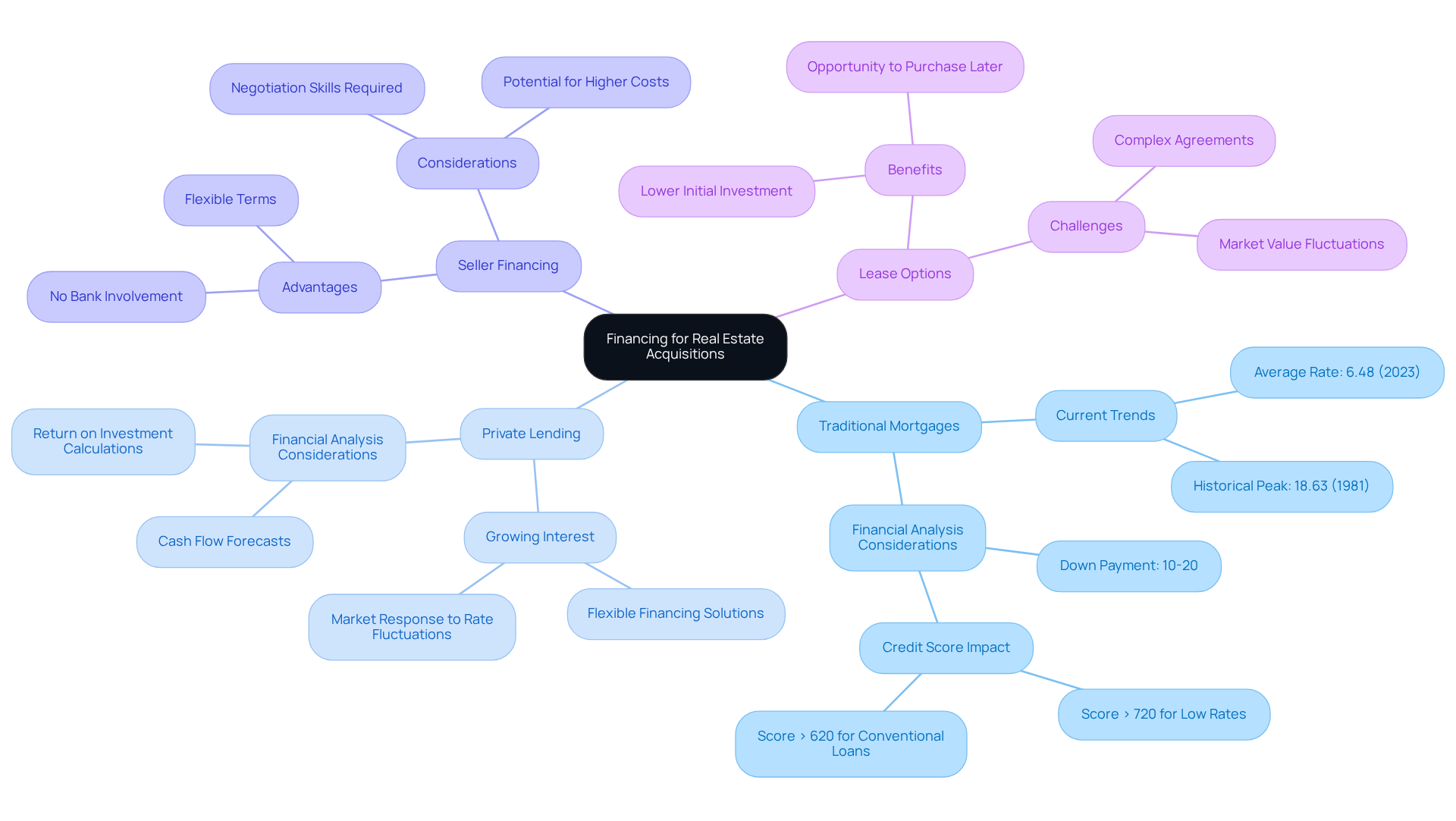

Financial Analysis: Securing Financing for Real Estate Acquisitions

Securing financing stands as a pivotal step in the real estate acquisition process. Investors must consider a variety of financing options, including:

- Traditional mortgages

- Private lending

- Innovative strategies such as seller financing

- Lease options

Trends for 2025 indicate a growing interest in private lending, driven by the need for flexible financing solutions amidst fluctuating mortgage rates, which reached 7.03% in December 2023 and have hovered around 6.5% in 2025. Additionally, the average 30-year mortgage rate was 6.48% in early 2023, providing essential historical context for these changes.

Conducting a comprehensive financial analysis is essential. This analysis encompasses cash flow forecasts and return on investment calculations, enabling stakeholders to make informed choices and present persuasive arguments to lenders. Understanding the subtleties of financing, including the significance of credit scores—where a score above 720 can create opportunities for low-interest-rate loans—can greatly enhance an individual's capacity to secure advantageous terms. Furthermore, considering the Federal Reserve's rate hikes since March 2022 and the fact that putting down 10-20% may qualify borrowers for conventional loans with lower costs, navigating the competitive landscape of real estate acquisitions becomes increasingly strategic.

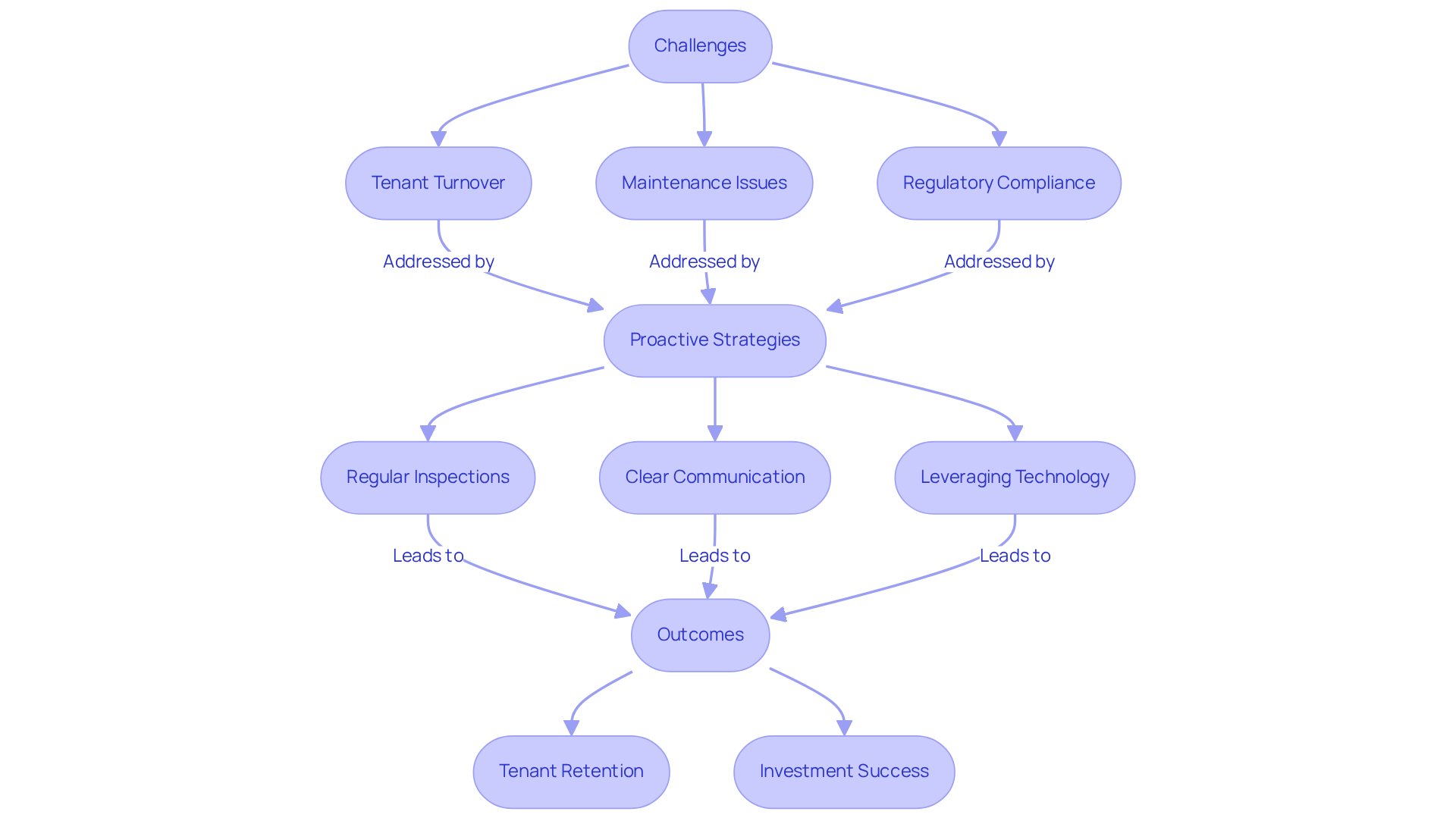

Property Management: Overcoming Challenges for Investment Success

Property management presents a variety of challenges, particularly tenant turnover, maintenance issues, and regulatory compliance. To effectively navigate these complexities, individuals must adopt proactive management strategies. Regular property inspections can identify potential issues before they escalate, while clear communication fosters trust and transparency with tenants. Additionally, leveraging technology—such as automated lease management systems—can streamline operations and enhance efficiency.

In 2024, 54.6% of U.S. apartment renter households were retained when their leases expired, underscoring the effectiveness of these strategies in improving tenant retention. By directly addressing these challenges, investors can significantly enhance tenant satisfaction, leading to increased retention rates and ultimately greater investment success. As industry experts have noted, prioritizing tenant experience is crucial for long-term profitability in the evolving property market of 2025.

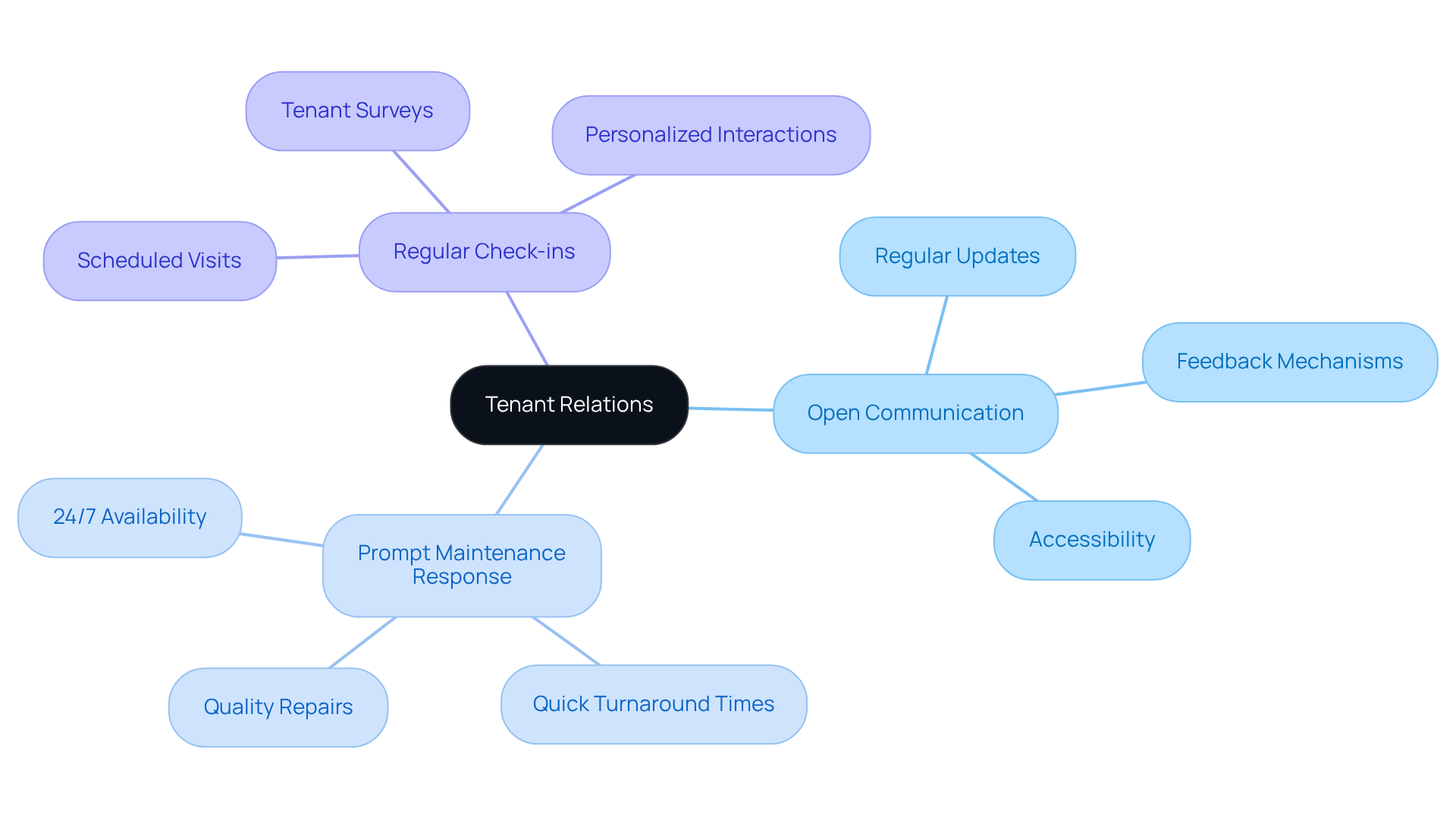

Tenant Relations: Building Strong Connections for Better Returns

Establishing strong relationships with tenants is essential for securing consistent rental income and reducing turnover. Investors must prioritize:

- Open communication

- Responding promptly to maintenance requests

- Conducting regular check-ins

to cultivate a positive tenant experience. By fostering a supportive environment, landlords can significantly enhance tenant satisfaction. This, in turn, leads to longer lease terms and improved property performance, ultimately benefiting investors' bottom lines.

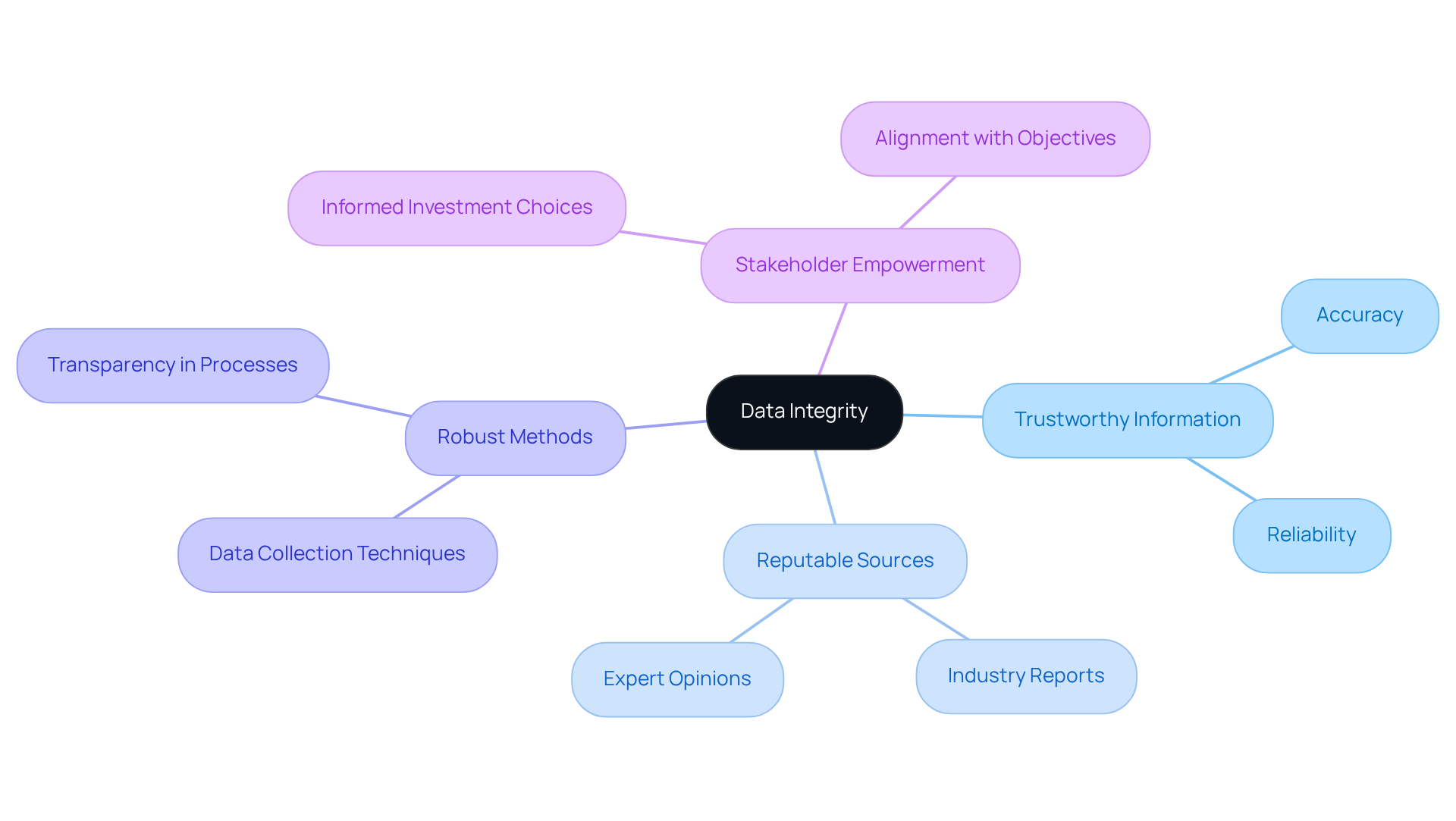

Data Integrity: The Foundation of Reliable Real Estate Insights

Data integrity stands as a cornerstone in the property sector, where precise and trustworthy information lays the groundwork for sound investment choices. Investors must leverage reputable sources and ensure that their data collection methods are both robust and transparent. By prioritizing data integrity, stakeholders not only enhance their analytical capabilities but also empower themselves to make informed decisions that align seamlessly with their investment objectives.

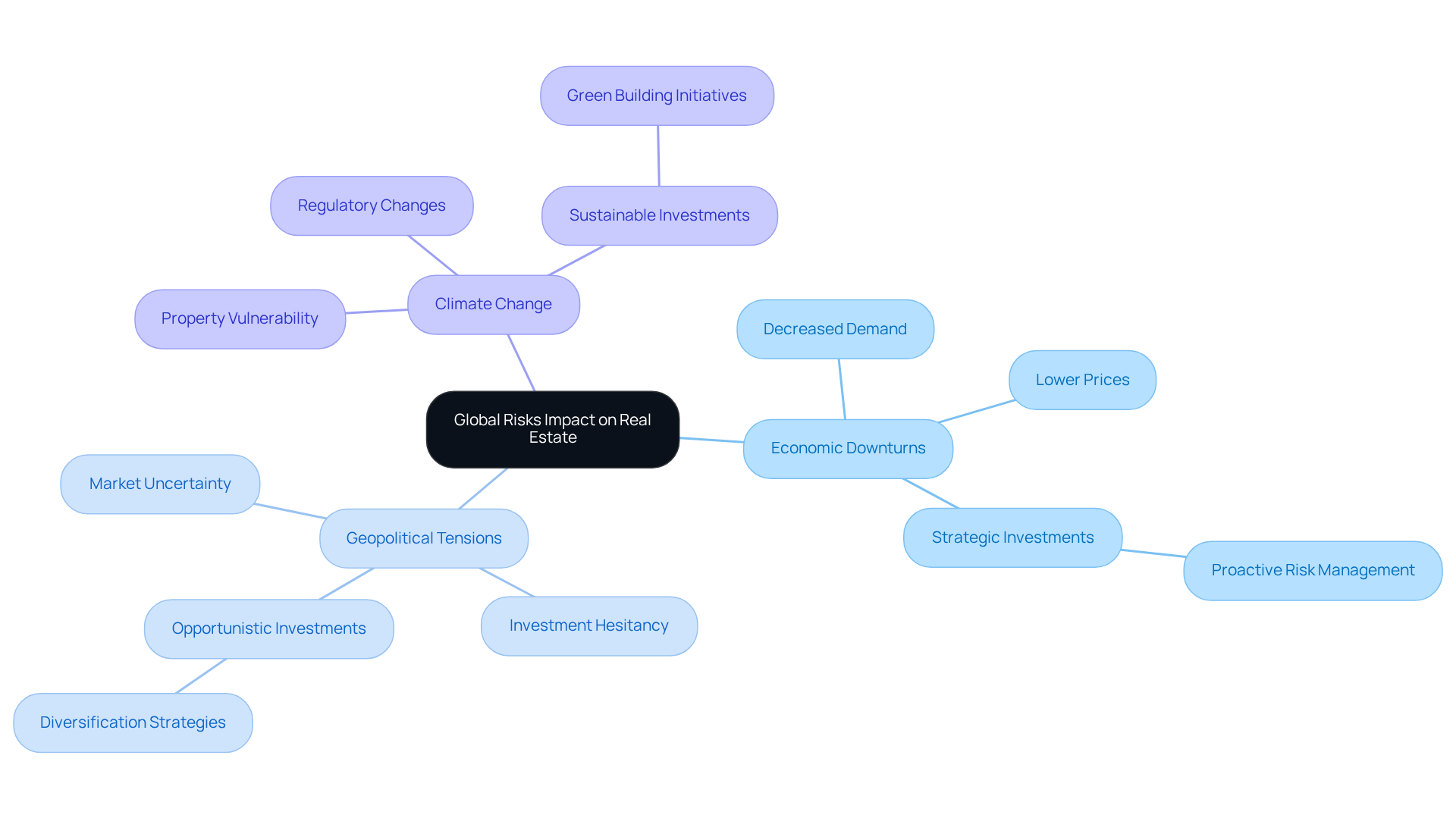

Global Risks: Understanding Their Impact on Local Real Estate Markets

Global risks—such as economic downturns, geopolitical tensions, and climate change—have the potential to significantly influence local property sectors. Investors must remain vigilant about these risks and consider their implications on property values and demand. By adopting a proactive approach to risk management, investors can navigate uncertainties more effectively. This positions them for long-term success within the real estate market.

Understanding these dynamics is crucial. As economic conditions fluctuate and geopolitical landscapes evolve, property values can be impacted in unforeseen ways. For instance, a sudden economic downturn may lead to decreased demand and lower property prices. Conversely, strategic investments during such downturns can yield substantial returns when the market rebounds.

In conclusion, staying informed about global risks is not just advisable; it is essential for making sound investment decisions. By integrating these insights into their strategies, investors can enhance their resilience and capitalize on opportunities in the ever-changing real estate landscape.

Conclusion

Understanding the current landscape of real estate investment is essential for making informed decisions in a constantly evolving market. The insights shared by Pamela Michaels highlight critical trends and strategies that investors must consider, from demographic shifts and housing market indicators to the importance of data integrity and proactive property management. By focusing on these areas, investors can better position themselves to capitalize on emerging opportunities and navigate potential challenges.

Key arguments presented in the article emphasize the significance of:

- Monitoring housing market trends

- Recognizing the influence of Millennials and Gen Z on property preferences

- Exploring investment opportunities in low-tax states

- Understanding market volatility

- Securing appropriate financing

These factors are crucial for long-term success in real estate. The article underscores that informed decision-making, grounded in reliable data and strategic analysis, is vital for thriving in today's investment climate.

Ultimately, embracing these insights not only equips investors with the tools needed to succeed but also fosters a deeper understanding of the broader economic landscape. As the real estate market continues to shift, staying informed and adaptable will be key. Investors are encouraged to leverage the insights and strategies discussed to enhance their investment outcomes, ensuring they remain competitive and resilient in the face of change.