Overview

Emerging real estate markets present significant opportunities for investors. With a projected 2% increase in median home prices and a remarkable 90% reduction in foreclosure filings since 2010, these trends are hard to ignore. Understanding local dynamics, demographic shifts, and economic conditions is crucial for making informed investment decisions in this rapidly evolving landscape.

Investors must pay close attention to these insights. The data indicates a favorable environment for investment, but success hinges on a thorough grasp of the underlying factors driving these changes. Are you prepared to navigate the complexities of these markets?

In summary, the implications for your investment strategies are clear: leveraging these insights can lead to informed decisions that capitalize on emerging opportunities. Stay ahead of the curve by focusing on the nuances of each market and adapting your strategies accordingly.

Introduction

As the real estate landscape undergoes significant transformations, understanding emerging market trends is essential for both investors and professionals. Insights drawn from authoritative sources such as Zero Flux, Freddie Mac, and JLL paint a comprehensive picture of these evolving dynamics.

- Anticipated increases in home prices

- Shifts toward sustainable investments

- The intricacies of local markets like Boise highlight the nuances of buyer behavior and economic influences critical for navigating this complex terrain.

This article delves into the latest research and forecasts, equipping readers with the knowledge needed to identify lucrative opportunities and make informed decisions in a rapidly changing environment.

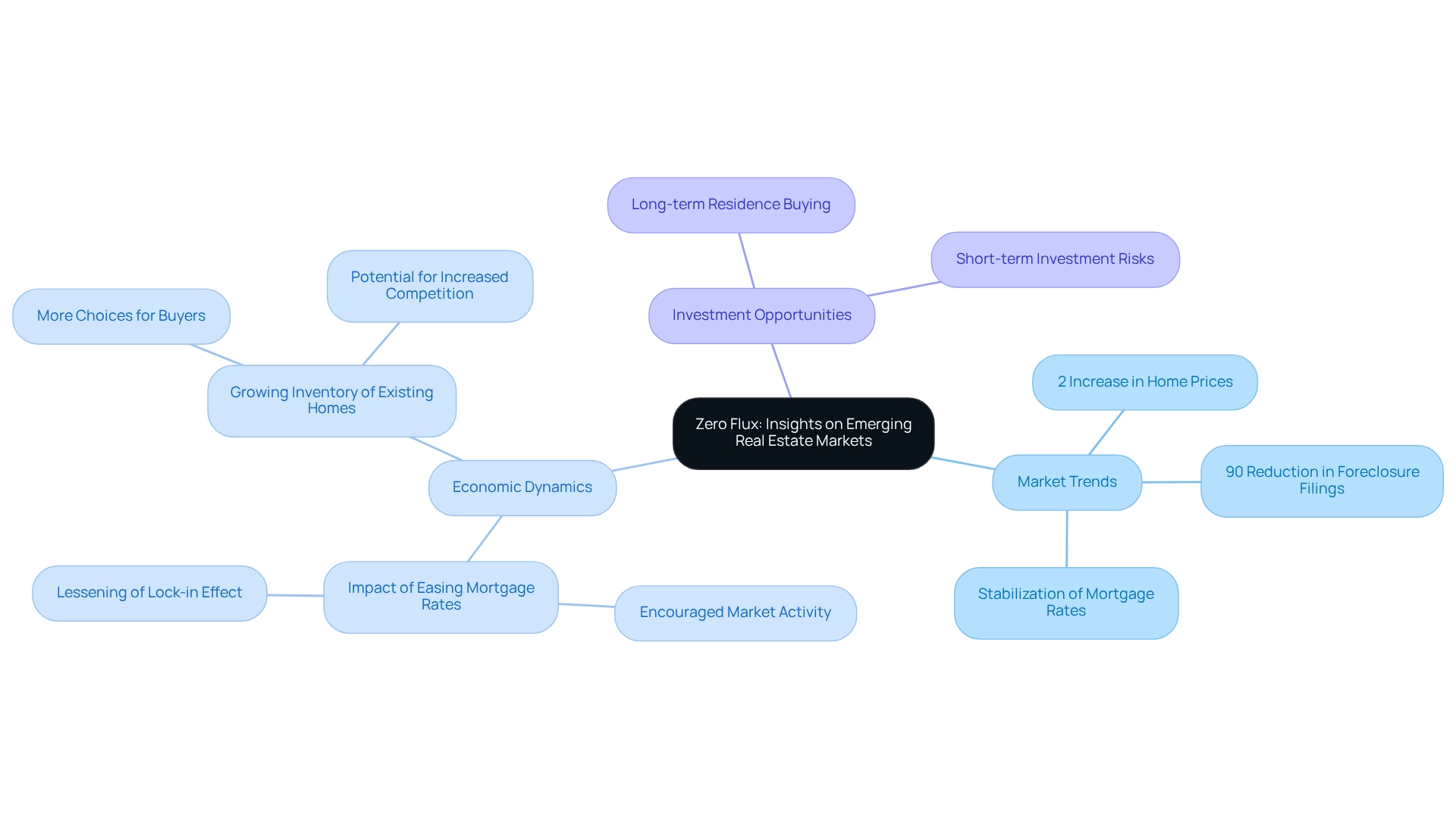

Zero Flux: Daily Insights on Emerging Real Estate Markets

Zero Flux delivers daily insights into emerging real estate markets by meticulously selecting information from over 100 diverse sources, including those behind paywalls. This extensive sourcing guarantees that subscribers acquire a comprehensive understanding of economic dynamics, empowering them to identify lucrative investment opportunities and effectively track demographic shifts.

With an unwavering commitment to factual reporting devoid of opinions, Zero Flux stands as an indispensable resource for real estate professionals and investors navigating emerging real estate markets. As the real estate landscape transforms, the newsletter underscores key trends, including:

- The anticipated 2% year-over-year increase in median home prices for 2025.

- The remarkable reduction in foreclosure filings, which have plummeted by nearly 90% since 2010.

Moreover, the decline in mortgage rates is expected to foster a more stable environment, encouraging renewed activity among buyers and sellers. Experts suggest that while rates may not revert to traditionally low levels, this stabilization will promote greater participation in the sector, as the 'lock-in effect' that has tethered homeowners to low rates is likely to wane.

Additionally, the rising inventory of existing homes presents buyers with more choices at improved prices, potentially leading to heightened competition and opportunities for investors. By focusing on data integrity and delivering insights that reflect the latest industry dynamics, Zero Flux equips its subscribers to make informed decisions in a complex and rapidly evolving sector.

As noted by the New York Post, accurately valuing properties and emphasizing move-in readiness can attract motivated buyers, underscoring the importance of strategic decision-making in this shifting environment.

Freddie Mac: Economic and Housing Market Outlook Reports

Freddie Mac's Economic and Housing Market Outlook Reports provide critical insights into the U.S. housing landscape, projecting a moderate increase in home prices for 2025. This anticipated growth is expected to occur within a stable mortgage rate environment, significantly influencing buyer behavior and financial strategies. With approximately 25 million job transitions occurring each year, the dynamics of the housing sector will be shaped by fluctuations in employment and economic conditions. These variations can lead to heightened demand for housing in specific regions. Therefore, investors should closely monitor these reports, as they offer essential information to align portfolios with the changing economic landscape.

Significantly, Freddie Mac emphasizes that "although home prices will increase, it’s going to be at a slower pace," highlighting the necessity for strategic planning in financial decisions. Additionally, the case study titled "Who Will Benefit in the 2025 Housing Market?" indicates that slight increases in housing supply are expected, which may favor sellers. Potential buyers are advised to concentrate on their financial readiness and maintain good credit for future refinancing opportunities. Monitoring Freddie Mac's forecasts will be crucial for navigating the complexities of real estate financing in 2025.

International Journal of Housing Markets and Analysis: Research on Market Trends

The International Journal of Housing Trends and Analysis offers vital research that delves into various facets of housing, encompassing pricing trends, funding patterns, and the ramifications of demographic changes. Recent studies reveal that the Midwest, South, and West regions have witnessed significant increases in transaction volumes, with the South at the forefront of this growth. This trend highlights the necessity of comprehending regional dynamics when evaluating investment opportunities.

Furthermore, the wealth effect—where homeowners with substantial equity contribute to home price escalation—indicates that while prices may continue to rise, affordability challenges will remain for new buyers. This duality underscores the imperative for investors to remain vigilant regarding economic conditions and demographic factors that influence housing demand.

Expert insights indicate that demographic transformations, such as aging populations and urban migration, play a crucial role in driving housing demand. Investors who grasp these trends can position themselves advantageously in emerging economies. As Gary Ashton, founder of The Ashton Real Estate Group of RE/MAX Advantage, articulates, "Sellers need to have the most up-to-date pricing intel on comparable homes selling in their market." Staying abreast of the latest research not only affords individuals a competitive edge but also enhances their ability to make informed decisions in a rapidly changing environment.

Moreover, it is critical for stakeholders to consider the recent restatement of data points by Realtor.com, which underscores the importance of leveraging the most current information for financial decisions. Additionally, acquiring real estate as a temporary asset entails heightened risk, particularly in the lead-up to an economic downturn, necessitating that individuals deliberate on their choices with care.

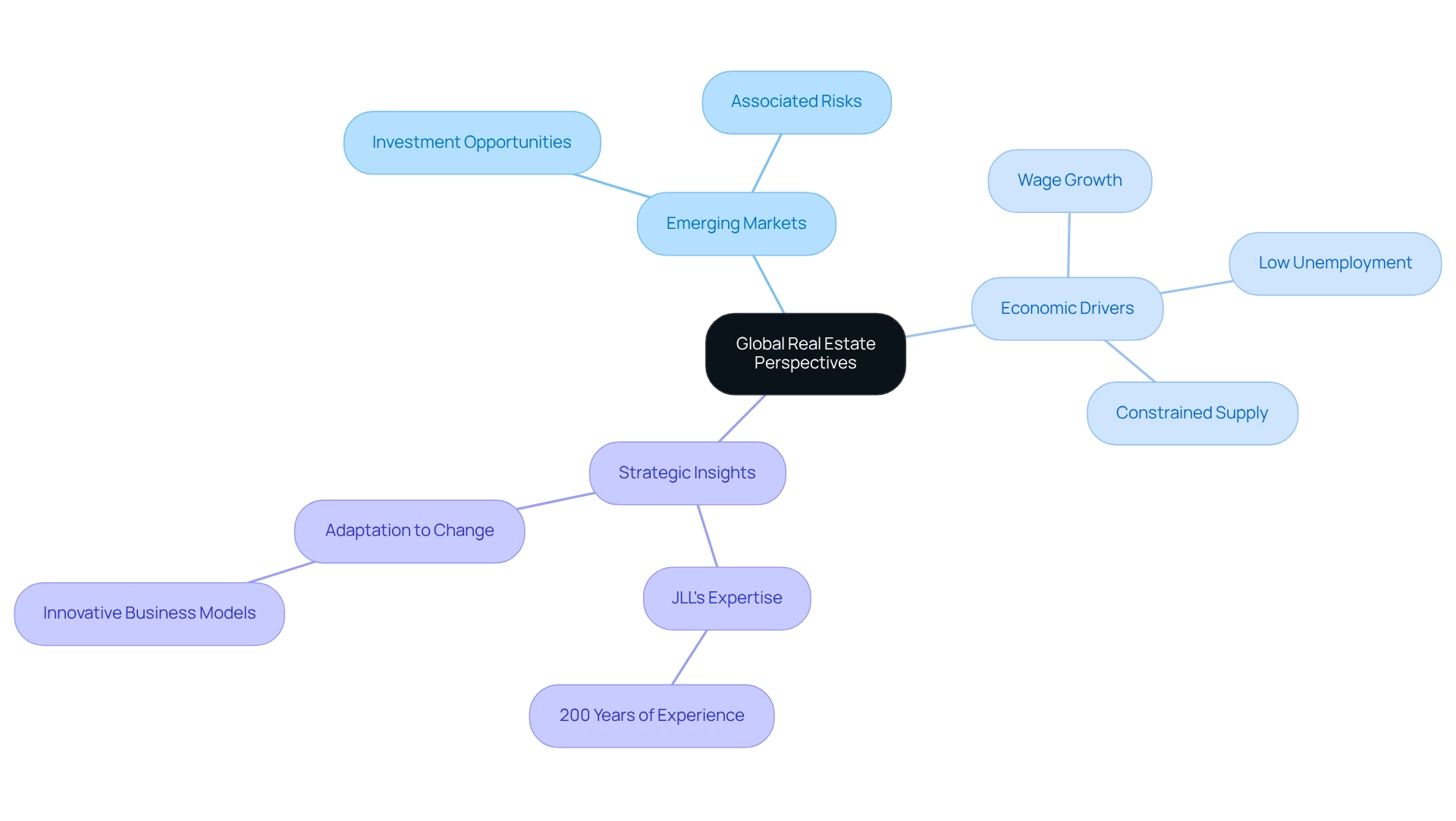

JLL: Global Real Estate Perspectives and Market Insights

JLL's Global Real Estate Perspectives report provides a thorough examination of trends across various regions, pinpointing significant investment opportunities and associated risks. For 2025, the report underscores a pivotal shift towards emerging real estate markets, as investors seek enhanced returns due to escalating expenses in primary sectors. Key economic drivers, including low unemployment, wage growth, and constrained new supply, further amplify the allure of these secondary regions.

Investors are encouraged to leverage JLL's expert insights when assessing potential investments in emerging real estate markets, as the data illuminates the evolving landscape of property investment. With over 200 years of experience as a leader in commercial property, JLL's insights stem from a deep understanding of industry dynamics.

Additionally, Akira Mori, a prominent property developer, emphasizes the importance of adapting to changing economic conditions, stating, "In my experience, in the property business, previous success stories are typically not relevant to new circumstances. We must continually reinvent ourselves, responding to changing times with innovative new business models."

This combination of strategic insights and expert viewpoints positions secondary sectors as a compelling focal point for those navigating the complexities of the property landscape in 2025.

MSCI Real Capital Analytics: Data on Transactions and Market Trends

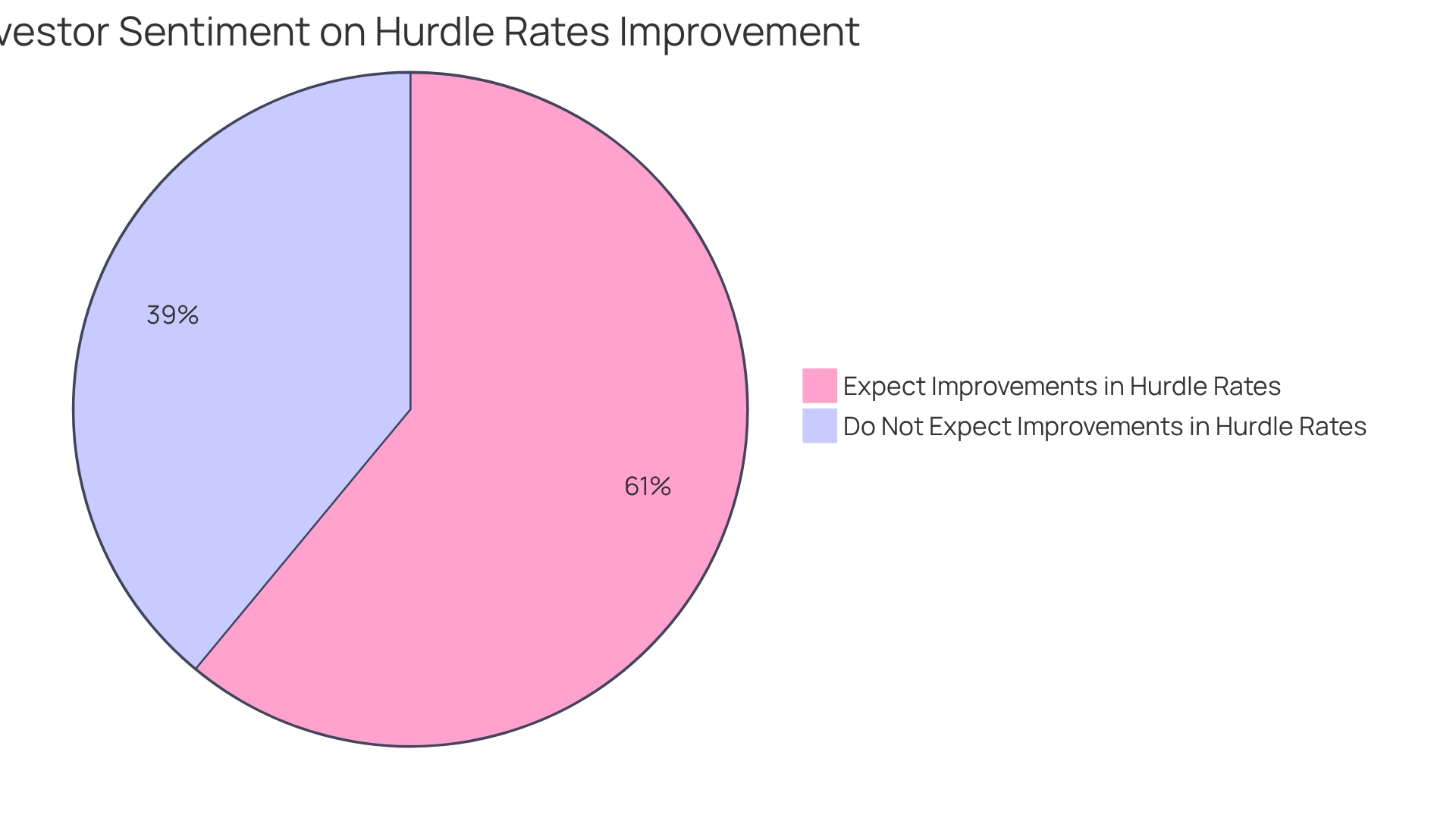

MSCI Real Capital Analytics plays a pivotal role in monitoring commercial property transactions, delivering essential insights into market trends and financial behaviors. Their 2025 reports highlight a robust recovery in transaction volumes, particularly within the multifamily and industrial sectors. Notably, 61% of global respondents anticipate improvements in hurdle rates over the next 12 to 18 months, signaling a positive outlook for investors.

While the office sector continues to rebalance post-pandemic, experiencing ongoing valuation declines, the multifamily sector remains resilient, inspiring confidence among stakeholders. As Fogelman Properties observes, the continued resilience of the multifamily sector bolsters optimism as we approach 2026 and beyond. Furthermore, case studies illustrate that suburban offices are stabilizing, contrasting sharply with the de-prioritization of downtown offices, which have now fallen to ninth place in commercial real estate rankings.

Investors should leverage this data to pinpoint active areas and evaluate the feasibility of potential investments, particularly in the multifamily and industrial sectors, where recovery trends are most pronounced.

National Association of Realtors: Housing Statistics and Market Trends

The National Association of Realtors (NAR) offers vital housing data essential for understanding the dynamics of the real estate sector. For 2025, NAR reports indicate a modest increase in home prices, with the median price in the West recorded at $628,500, reflecting a slight decline of 0.2% from April 2024. This trend suggests a stabilizing environment, as experts do not foresee a housing collapse in the near future.

Stability is attributed to stricter lending standards and low inventory levels, critical factors influencing buyer confidence and overall market resilience. Inventory levels are gradually improving, reaching the highest amounts seen in nearly five years. This shift empowers consumers with increased negotiating power, as highlighted by NAR Chief Economist Lawrence Yun, who notes that while conditions remain mildly favorable to sellers, buyers are now better positioned to secure advantageous deals.

It is crucial to recognize that survey outcomes reflect owner-occupants and vary from monthly results from NAR, providing additional context regarding the data's relevance for investors in emerging real estate markets. Investors in emerging real estate markets should leverage NAR's statistics to evaluate current conditions and identify potential opportunities.

The fluctuation in mortgage rates, currently averaging 6.81% for a 30-year fixed-rate mortgage, plays a pivotal role in shaping buyer behavior. As rates decrease, an uptick in housing demand is anticipated, which could further influence market dynamics and create new funding prospects. By closely monitoring these trends and utilizing NAR's insights, individuals can make informed decisions that align with emerging real estate markets.

PwC: Emerging Trends in Real Estate Reports

PwC's Emerging Trends in Real Estate report offers a comprehensive perspective on the dynamics anticipated for 2025, highlighting a significant shift towards sustainability and technology-driven funding. As environmental concerns gain paramount importance, investors are encouraged to integrate sustainable practices into their strategies. This trend transcends mere compliance with regulatory pressures, reflecting a broader demand for resilient and eco-friendly properties.

Sustainability is evolving from a niche consideration to a core element of financial decision-making. Properties that emphasize resilience against climate change risks not only appeal more to tenants but also tend to achieve higher valuations. Case studies reveal that investments in resilient real estate can enhance property values while reducing operating costs, making them appealing to forward-thinking investors.

Insights from industry leaders underscore the necessity of adapting to these sustainability trends. With consumer preferences increasingly favoring greener options, the retail sector—characterized by robust and diversified growth—is also transforming. As consumer spending rises, particularly in eco-friendly products, stakeholders must remain acutely aware of how these trends influence business opportunities. Notably, Columbus has been recognized as the fastest-growing city in the US in 2023, showcasing significant demographic growth and potential that investors should consider.

Additionally, Florida's favorable business environment and cost structure present further funding opportunities, marking it as a sector worthy of exploration. In summary, aligning investment strategies with the findings from PwC's report is essential for capitalizing on opportunities within the emerging real estate markets, especially as sustainability continues to shape the future landscape. Investors should actively seek properties that not only meet current demand but also incorporate resilience strategies to enhance long-term value.

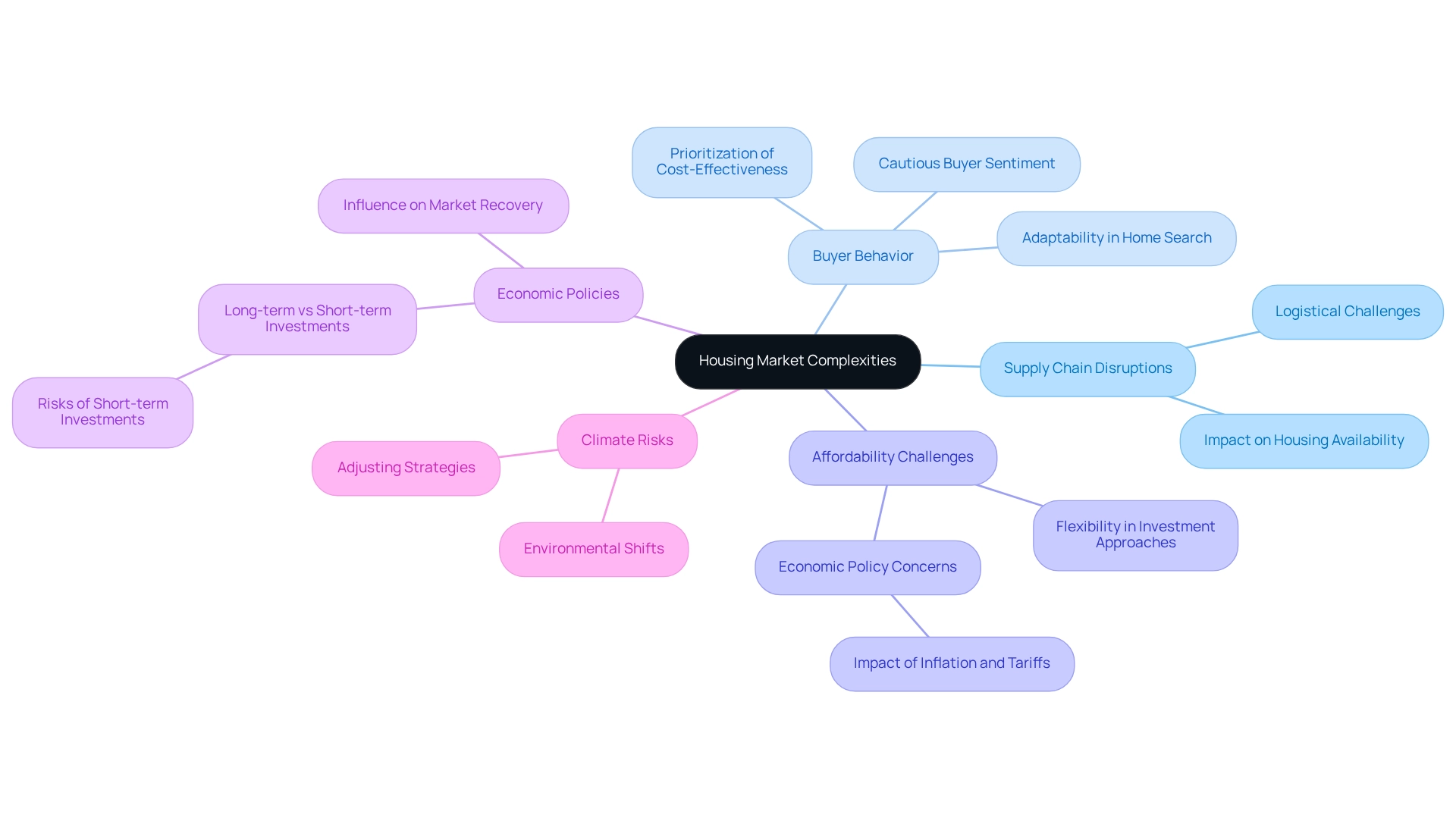

JBREC: Insights into Housing Market Complexities

John Burns Real Estate Consulting (JBREC) offers a comprehensive analysis of the housing sector's complexities, with a particular focus on supply chain disruptions and evolving buyer behavior. Their projections for 2025 indicate a strong demand for housing; however, significant affordability challenges are expected to impact buyer sentiment. Notably, 36.25% of individuals express concerns that economic policies may impede recovery, potentially leading to more cautious buyer behavior and affecting funding strategies.

JBREC's case studies illustrate how these affordability issues can deter potential buyers, underscoring the necessity for flexibility in investment approaches. For instance, purchasers may prioritize cost-effectiveness and adaptability in their home search, which could shift demand trends within the industry.

Furthermore, stakeholders must acknowledge the significance of adjusting their strategies to account for climate risks and changing economic conditions. By understanding these complexities and assessing the potential risks associated with short-term investments, as highlighted by Robin Rothstein, individuals can navigate the current financial landscape more effectively.

To address these challenges, investors are encouraged to remain agile and responsive to environmental shifts, ensuring their strategies align with evolving buyer preferences and economic conditions.

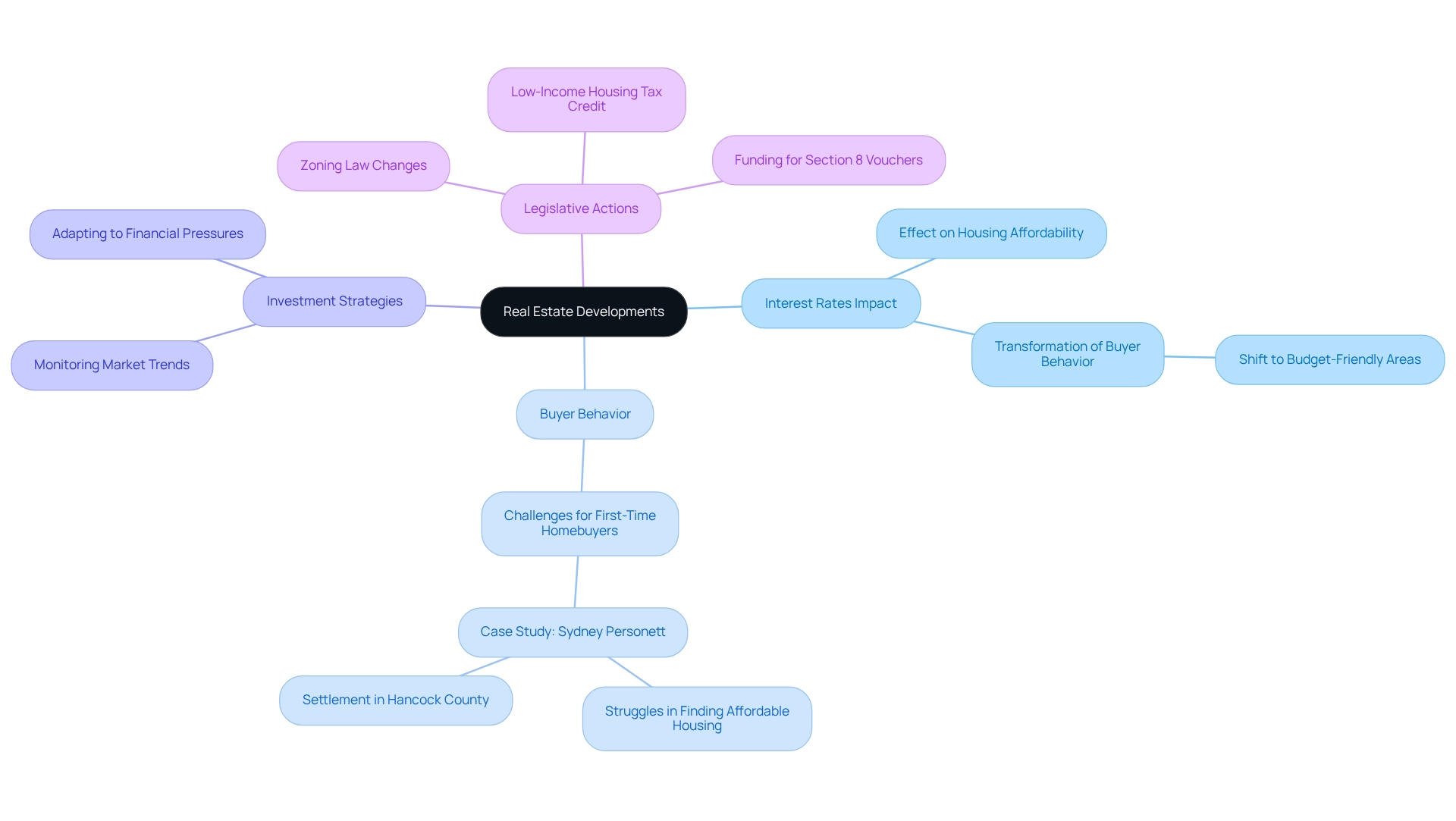

NBC News: Coverage of Significant Real Estate Developments

NBC News provides comprehensive coverage of pivotal real estate developments, focusing on policy changes, economic shifts, and emerging industry trends for 2025. Their analysis highlights the significant impact of rising interest rates on housing affordability, which is transforming buyer behavior and investment strategies. As interest rates continue to climb, prospective homebuyers are facing increased financial pressure, leading to a shift in demand toward more budget-friendly areas. Investors must closely monitor these trends, as they are critical for adapting strategies in a rapidly evolving landscape.

For example, the challenges encountered by first-time homebuyers, such as Sydney Personett and her husband, illustrate the real-world implications of these trends. After struggling to find affordable housing near Indianapolis, they ultimately settled in Hancock County, accepting higher payments to achieve homeownership. This case underscores the necessity for stakeholders to understand local economic dynamics and the importance of affordable housing options.

Moreover, lawmakers are actively pursuing solutions to enhance housing supply, including:

- Streamlining zoning laws

- Expanding the low-income housing tax credit

These initiatives could significantly influence market conditions, making it essential for stakeholders to remain informed and agile in their decision-making processes. As Caitlin Sugrue Walter, vice president of research at the National Multifamily Housing Council, remarked, "I worry more about like 2025 and 2026 when we worked through the existing supply, and we're not building — we're not starting much right now." This statement emphasizes the urgency for stakeholders to address future supply challenges. Additionally, Zero Flux compiles 5-12 selected property insights each day, providing a tailored resource for investors to navigate these complexities effectively.

We Know Boise: Local Insights into Emerging Markets

We Know Boise delivers crucial insights into the Boise real estate sector, focusing on pivotal trends in home prices, inventory levels, and buyer behavior. Their 2025 analysis indicates a robust demand for housing, driven by substantial population growth and ongoing economic development in the region.

For example, Nampa's median home price has escalated to $417,495, representing a 1.8% increase, while the area has witnessed home values soar by 45% over the past year, illustrating a strong upward trajectory. This increase underscores the importance of current listings, which provide a more accurate perspective on economic dynamics than outdated sales data.

Investors must closely monitor these local trends, as they unveil valuable opportunities in emerging real estate markets. As 2025 unfolds, prospective buyers are encouraged to explore areas such as Star in Ada County and Caldwell in Canyon County, where new developments and declining median prices create favorable conditions for financial prospects.

With builders offering incentives of up to $35,000, including assistance with interest rates and closing costs, the Boise area is poised for continued growth. It is imperative for stakeholders to keep a vigilant eye on current interest rates, as these can significantly impact investment decisions. Consequently, astute investors should actively pursue local listings and consider these emerging real estate markets within the Boise area.

Conclusion

As the real estate landscape evolves, insights from various authoritative sources illuminate key trends that investors and professionals must consider. Projected increases in home prices, alongside a notable shift towards sustainable investments, underscore the necessity of understanding these dynamics for effective decision-making. The data reveals a stabilizing mortgage rate environment, anticipated to encourage greater market participation and provide buyers with more options.

Regional trends, particularly in areas like Boise, highlight the significance of localized market knowledge. With significant population growth and rising home values, investors encounter unique opportunities that demand keen awareness of current listings and local economic conditions. Furthermore, the emphasis on sustainability is reshaping investment strategies, making it imperative for stakeholders to adapt to evolving consumer preferences and regulatory landscapes.

In summary, remaining informed about emerging market trends, leveraging comprehensive data, and grasping regional nuances can empower investors to navigate the complexities of the real estate market effectively. By aligning investment strategies with these insights, there is potential for lucrative opportunities in a landscape increasingly influenced by economic shifts and buyer behavior. Embracing this knowledge will be crucial for achieving success in the dynamic world of real estate.