Overview

The key benefits of commercial real estate REITs for investors are compelling:

- They generate income through dividends

- Diversify investment portfolios

- Enhance liquidity

These factors collectively improve accessibility and potential returns. REITs provide consistent income by distributing a significant portion of taxable income, allowing investors to enjoy a reliable revenue stream. Furthermore, they facilitate risk spreading across various property types, which mitigates exposure to market fluctuations. The ease of trading on stock exchanges positions REITs as an attractive investment option within the real estate market. With these advantages, investors are encouraged to consider the strategic incorporation of REITs into their portfolios.

Introduction

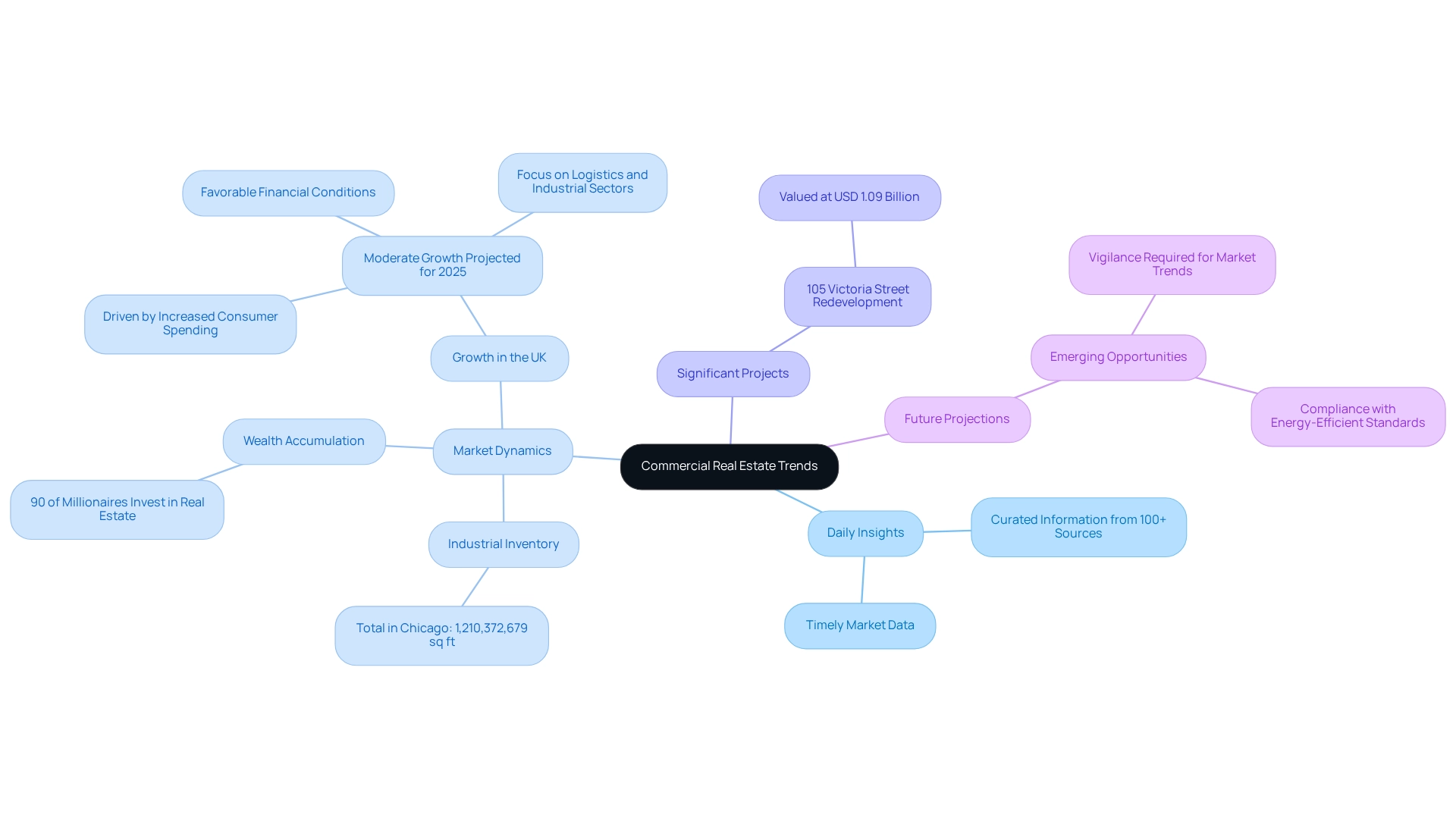

In the ever-evolving landscape of commercial real estate, investors continuously seek innovative approaches to navigate opportunities and mitigate risks. Zero Flux stands out as a vital resource, delivering daily insights that distill information from over 100 sources. This empowers investors to stay ahead of market trends. Notably, significant projects and robust statistics—such as Chicago's extensive industrial inventory—highlight the lucrative potential within this sector.

Furthermore, Real Estate Investment Trusts (REITs) offer a unique investment vehicle, allowing individuals to benefit from income-generating properties without the burdens of direct ownership. As the market shifts, grasping the intricacies of REITs—including their income generation, diversification benefits, and regulatory environment—becomes essential for investors aiming to capitalize on real estate's growth potential.

This article delves into the multifaceted world of commercial real estate investments, equipping readers with the knowledge necessary to make informed decisions in a dynamic market.

Zero Flux: Daily Insights on Commercial Real Estate Trends

Zero Flux provides critical daily insights tailored for individuals engaged in commercial real estate REITs. By meticulously curating information from over 100 diverse sources, it equips subscribers with the latest and most relevant data on market dynamics. This dedication to delivering timely insights enables investors to identify emerging opportunities and effectively assess potential risks. For example, the total industrial inventory in Chicago is an impressive 1,210,372,679 square feet, highlighting the vast potential within this sector.

Moreover, significant projects such as the USD 1.09 billion redevelopment of 105 Victoria Street in Westminster, London, illustrate the profitable prospects available in commercial real estate REITs. As noted, '90% of millionaires are wealthy as a result of their investments in commercial real estate REITs,' highlighting the importance of this sector for wealth accumulation. Additionally, the market for commercial real estate REITs in the UK is projected to experience moderate growth in 2025, driven by increased consumer spending and favorable financial conditions, particularly in the logistics and industrial sectors.

By focusing on these trends, Zero Flux serves as an essential resource for navigating the complexities of the market, ensuring that participants remain informed and strategically positioned to capitalize on the evolving landscape. Investors must stay vigilant regarding market trends to seize emerging opportunities.

Real Estate Investment Trusts (REITs): Structure and Functionality

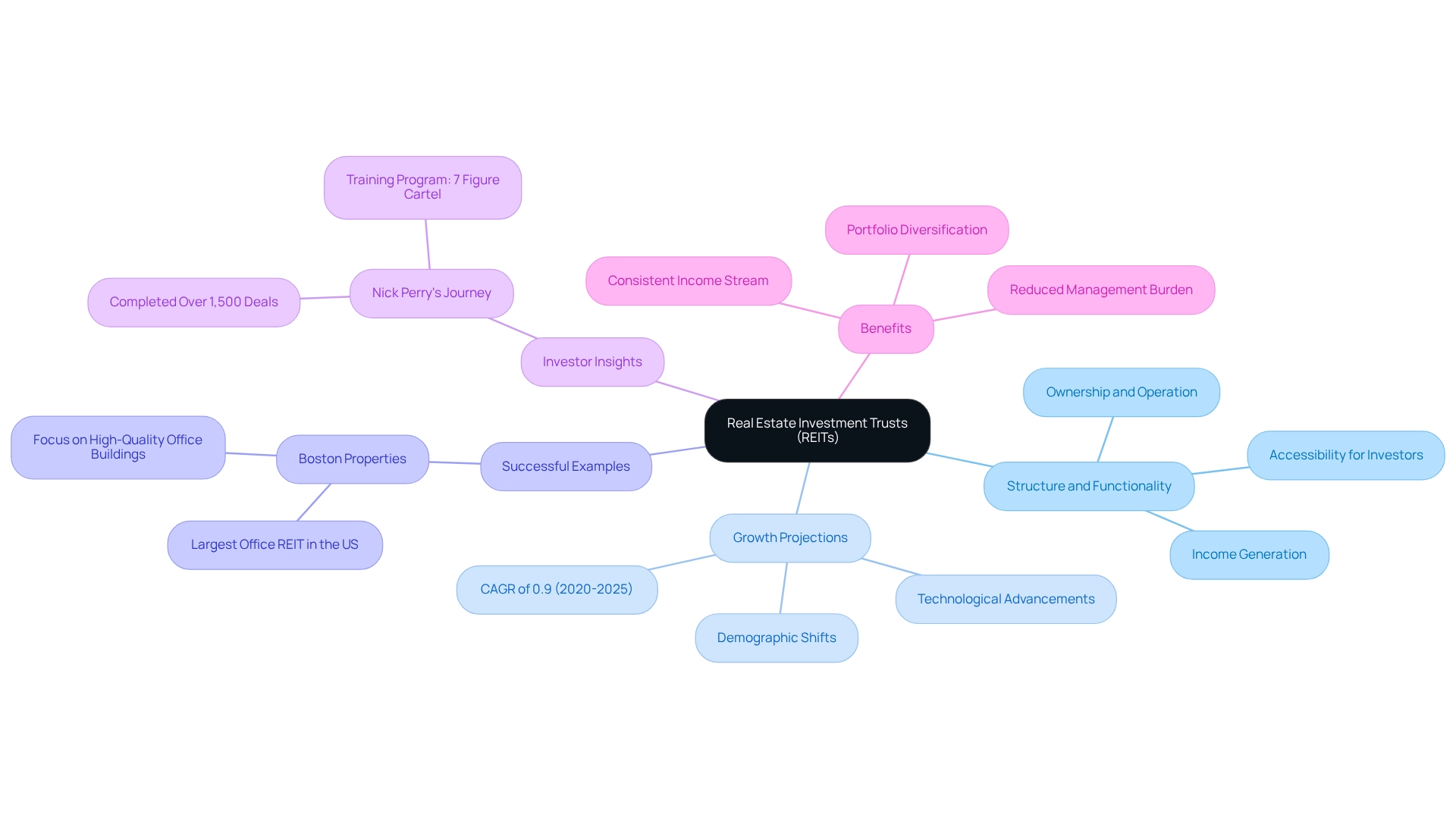

Commercial real estate REITs are specialized firms that own, operate, or finance income-producing real estate across various sectors, including commercial properties. By pooling funds from multiple contributors, REITs enable individuals to partake in the income generated by these properties without the burdens of direct ownership, management, or financing. This unique structure significantly enhances accessibility to real estate investments, allowing individuals to diversify their portfolios with relative ease.

Looking ahead to 2025, the real estate investment trust sector is poised to sustain its growth trajectory, driven by technological innovations and demographic shifts. Notably, the REIT sector in the United States has experienced a compound annual growth rate (CAGR) of 0.9% from 2020 to 2025, underscoring its resilience and attractiveness to stakeholders. Factors such as increased digitalization in property management and evolving population dynamics are pivotal to this growth.

Successful examples of real estate investment trusts, such as Boston Properties—the largest office trust in the U.S.—demonstrate the potential for substantial returns in high-quality office buildings situated in major metropolitan areas. Furthermore, private investors are becoming increasingly aware of the benefits of commercial real estate REITs, with a significant portion of the financial community leveraging these commercial real estate REITs to access commercial property.

Nick, a successful entrepreneur and real estate financier, highlights the importance of utilizing real estate investment trusts in his journey. He states, "I’m passionate about sharing my expertise and helping others achieve similar success through my specialized training program, the 7 Figure Cartel." His experience illustrates how individuals can achieve success in real estate investing, particularly through REITs.

The operational framework of real estate investment trusts not only democratizes property investment but also provides a consistent income stream through dividends, making them an appealing choice for both seasoned and novice investors. As the landscape of commercial real estate evolves, commercial real estate REITs remain a crucial component for those aiming to capitalize on market opportunities while minimizing the complexities associated with direct property ownership.

Income Generation: The Dividend Advantage of REITs

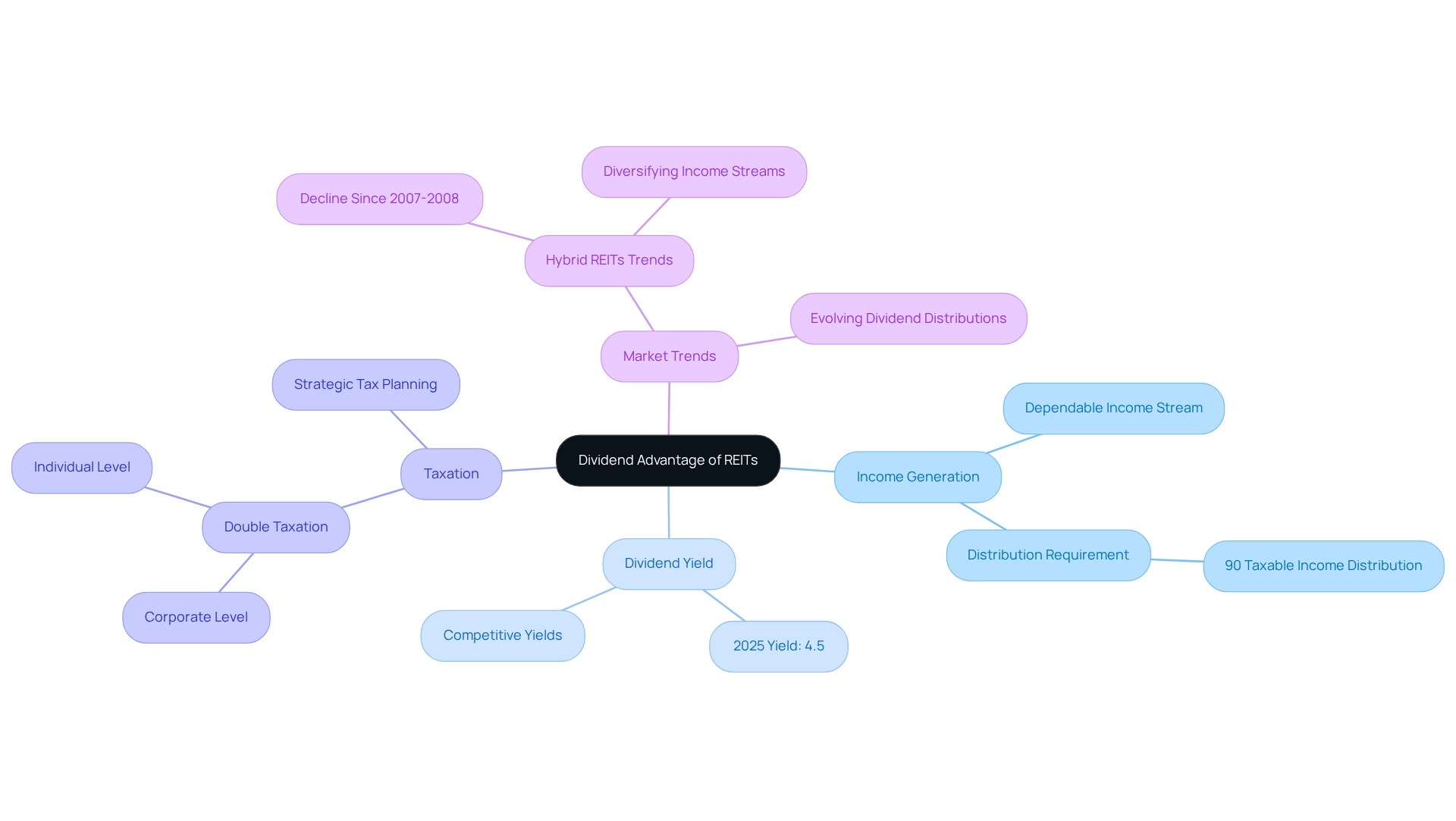

Investing in commercial real estate REITs presents a compelling advantage through robust income generation via dividends. Legally mandated to distribute at least 90% of their taxable income to shareholders, commercial real estate REITs provide a dependable income stream that attracts investors, particularly in low-interest-rate environments. In 2025, the average dividend yield of REITs is approximately 4.5%, making them an appealing choice for individuals seeking consistent cash flow.

Current trends indicate that REIT dividend distributions are evolving, with a notable emphasis on maintaining competitive yields while navigating market fluctuations. Investors must grasp the complexities surrounding REIT dividend taxation, as dividends can be subject to double taxation—once at the corporate level and again at the individual level—especially for those not held in retirement accounts. This highlights the importance of strategic planning to manage tax obligations effectively.

Furthermore, hybrid REITs, which allocate funds in both commercial real estate REITs and mortgages, have seen a decline since the 2007-2008 financial crisis, yet they continue to play a role in diversifying income streams for shareholders. As of 2025, commercial real estate REITs still persist in distributing a significant percentage of their taxable income as dividends, reinforcing their status as a vital component of a balanced investment portfolio. Understanding these dynamics is essential for those aiming to maximize their income potential from REIT dividends.

Diversification Benefits: Spreading Risk with REITs

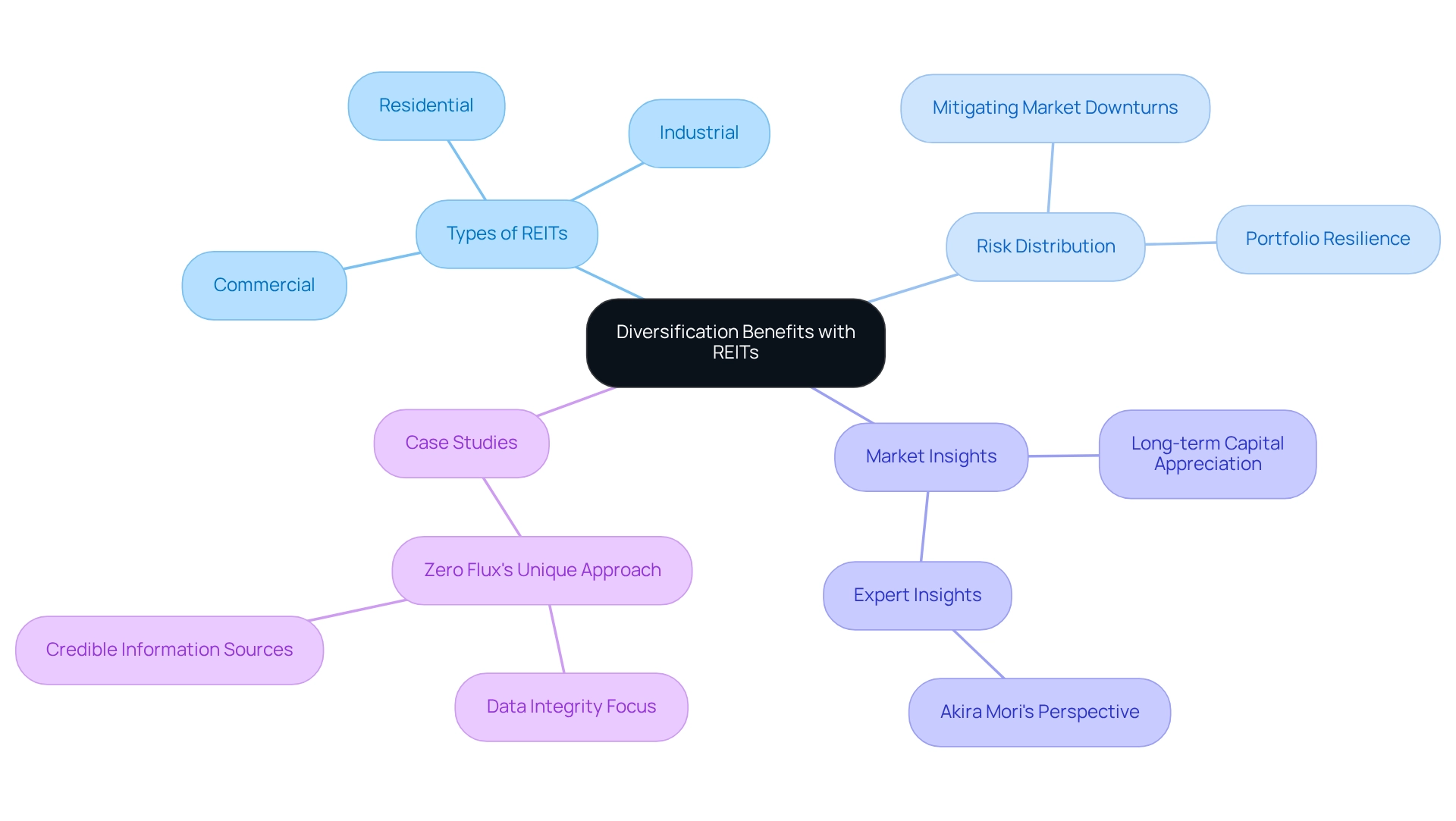

Investing in commercial real estate REITs offers a strategic avenue for individuals aiming to diversify their portfolios without the intricacies of directly acquiring multiple properties. REITs typically encompass a wide array of property types, including commercial real estate REITs, as well as residential and industrial real estate. This diversity is crucial, as it helps distribute risk across various sectors, thereby safeguarding stakeholders against downturns in any single market segment.

In 2025, the diversification advantages of real estate investment vehicles hold particular significance, granting participants access to approximately 225 publicly traded real estate entities in the United States, each with unique focus areas. This extensive selection not only bolsters portfolio resilience but also presents opportunities for long-term capital appreciation, given that real estate values generally trend upward.

Expert insights further highlight the importance of this diversification strategy. Industry leader Akira Mori states, "In my experience, in the real-estate business, past success stories are generally not applicable to new situations. We must continually reinvent ourselves, responding to changing times with innovative new business models." This underscores the necessity of adapting financial strategies, especially in a dynamic market.

Case studies illustrate the effectiveness of this approach, demonstrating how commercial real estate REITs have successfully mitigated risk and provided stable returns for investors. Ultimately, the strategic incorporation of commercial real estate REITs within a diversified portfolio not only enhances security but also allows participants to capitalize on the growth potential inherent in the real estate market.

Liquidity: Easy Access to Your Investment with REITs

REITs are prominently listed on major stock exchanges, offering investors unparalleled ease in buying and selling shares. This liquidity stands out as a significant advantage when compared to direct real estate purchases, which often require extensive time to sell—averaging several months—and can incur substantial transaction costs. In stark contrast, REIT shares can be traded almost instantaneously during market hours. This swift transaction capability empowers stakeholders to quickly adjust their portfolios in response to market fluctuations, positioning commercial real estate REITs as an exceptionally flexible investment option.

Furthermore, a case study focused on enhancing real estate portfolios through commercial real estate REITs illustrates that a diversified strategic allocation to these trusts not only enhances liquidity but also promotes transparency and diversification, ultimately leading to superior portfolio management.

As the market progresses in 2025, the liquidity advantages of investing in commercial real estate REITs continue to serve as a compelling rationale for investors to consider commercial real estate REITs a primary avenue for real estate exposure.

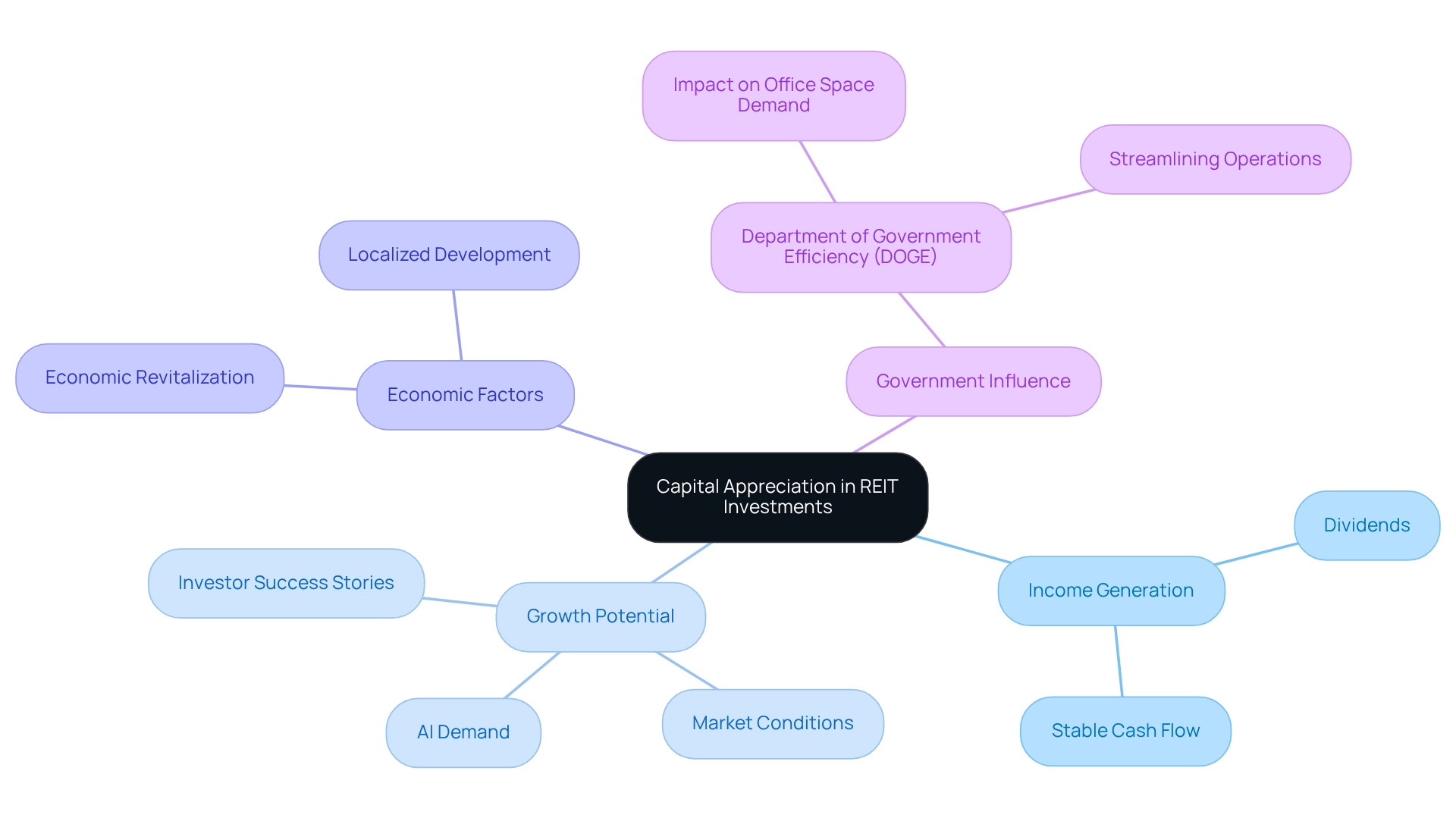

Capital Appreciation: Growth Potential in REIT Investments

In addition to generating income through dividends, commercial real estate REITs offer the potential for capital appreciation. As the value of the underlying properties increases, so too can the worth of REIT shares. This dual advantage of income and growth makes commercial real estate REITs an appealing choice for individuals who aim to accumulate wealth over time.

For instance, the average yearly growth potential of real estate trusts in 2025 is expected to remain robust, driven by factors such as AI-driven demand in data centers and disciplined financial management across various sectors. This projection indicates that stakeholders can anticipate ongoing expansion in their real estate holdings, particularly in regions experiencing economic revitalization. Success stories from investors further illustrate the rising value of REITs, demonstrating how increases in property value directly enhance their shares. In areas where targeted economic growth is spurred by contributions from real estate trusts, investors have witnessed substantial returns.

Moreover, the influence of the Department of Government Efficiency (DOGE) on federal office space demand serves as a pertinent case study. As DOGE seeks to streamline operations, it may create fluctuations in demand for office spaces, which can impact REIT performance. This connection underscores the importance of strategic investments in REITs, even amid economic uncertainties.

Expert insights suggest that while 2025 presents several uncertainties, the identifiable drivers of recovery for commercial real estate REITs indicate a favorable outlook for capital appreciation. As the real estate landscape evolves, the potential for capital appreciation within REITs remains a compelling reason for individuals to consider them as a key component of their investment portfolios.

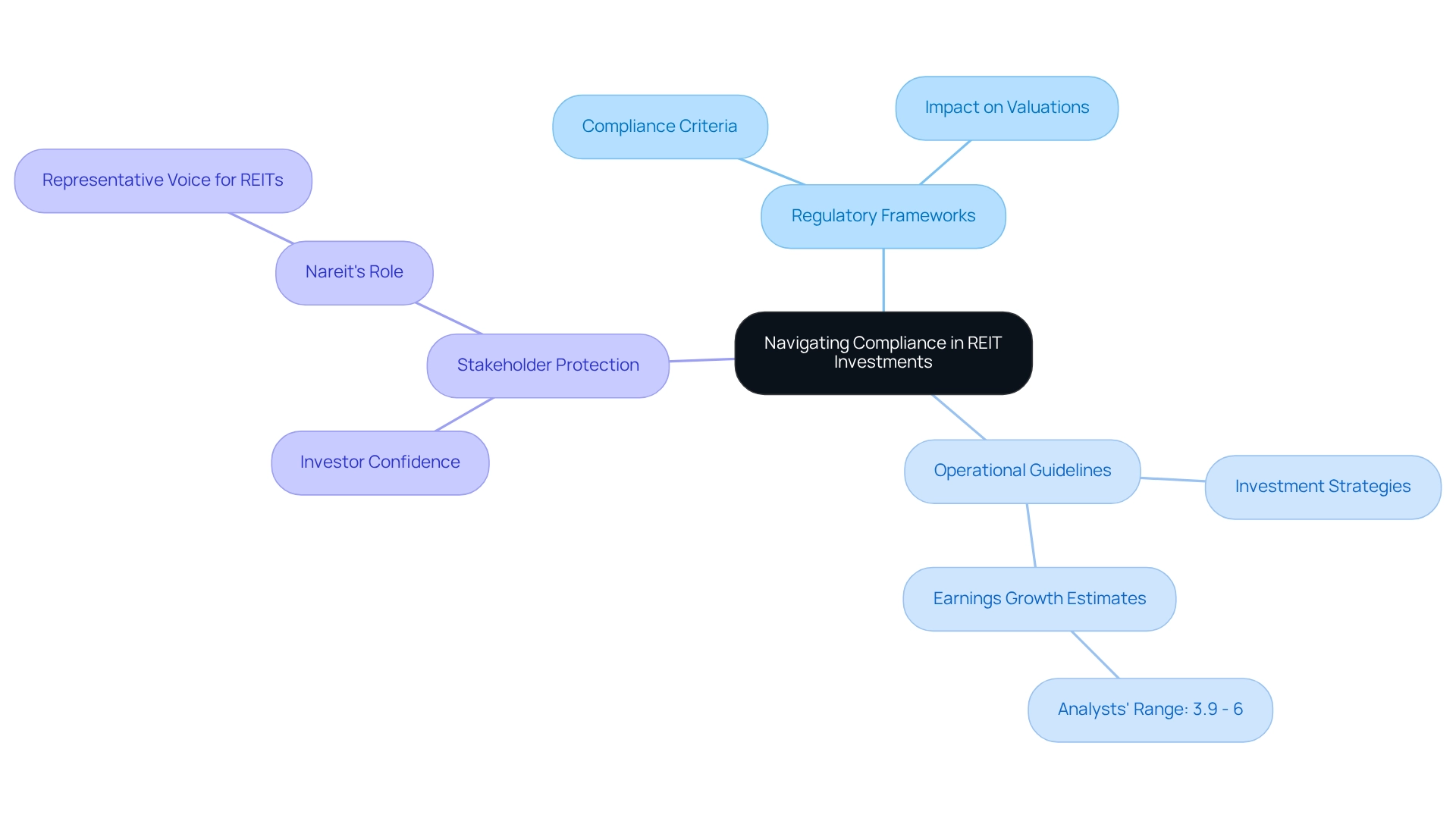

Regulatory Environment: Navigating Compliance in REIT Investments

Real estate investment trusts (REITs) operate within specific regulatory frameworks that mandate adherence to particular operational guidelines. These regulations not only ensure clarity but also protect stakeholders, positioning REITs as a relatively secure investment option for capital.

Understanding the compliance criteria is essential for investors; it enables them to navigate the complexities of real estate trust holdings effectively and make informed decisions. By grasping these regulations, investors can enhance their strategic approach to real estate investment.

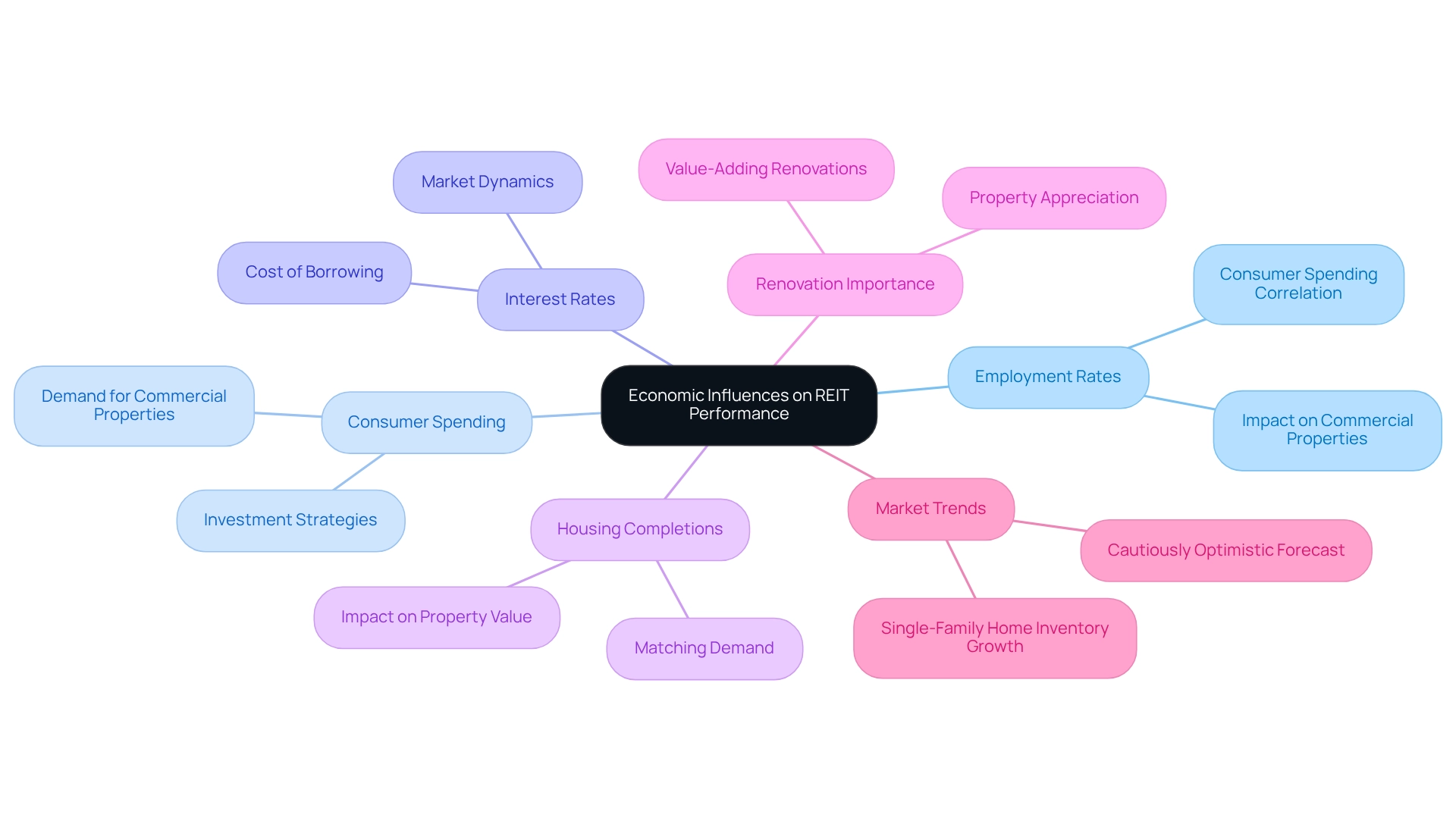

Market Trends: Economic Influences on REIT Performance

The performance of real estate investment trusts (REITs) is intricately linked to various economic conditions, including employment rates, consumer spending, and interest rates. As we look toward 2025, the economic landscape offers a cautiously optimistic forecast for direct real estate investments. Strong fundamentals for residential properties are supported by steady household formation and matching housing completions. Significantly, the supply of single-family existing homes has increased by 20% compared to the previous year, indicating a shift in market dynamics that could impact REIT profitability.

Understanding these economic indicators is essential for individuals navigating the complexities of the real estate investment sector. Employment rates are pivotal; higher employment typically leads to increased consumer spending, which in turn drives demand for commercial properties. This relationship highlights the necessity of staying informed about current employment trends and their potential impact on commercial real estate REITs. Furthermore, renovations that enhance property value are increasingly important for commercial real estate REITs as housing completions align with demand, thereby fostering property appreciation. Investors who understand these economic influences can strategically position themselves to capitalize on emerging opportunities within commercial real estate REITs. By closely monitoring specific economic indicators, such as employment rates and consumer spending, investors can make informed decisions that enhance their portfolio's performance.

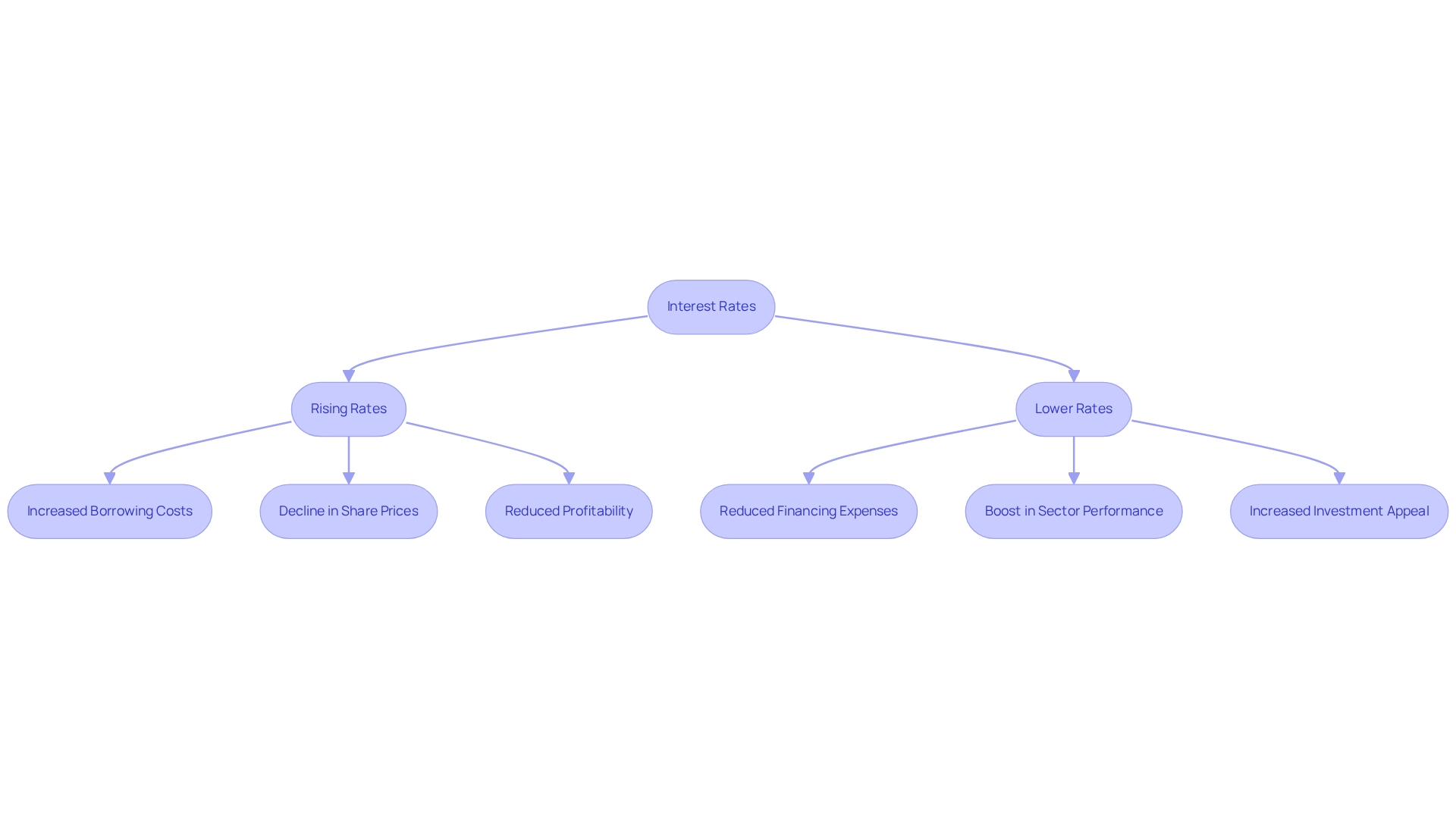

Interest Rates: Their Impact on REIT Investment Viability

Interest rates play a pivotal role in shaping the performance of commercial real estate REITs. As borrowing costs rise, the profitability of commercial real estate REITs can suffer, often resulting in declines in share prices and distributions. Conversely, lower interest rates typically reduce financing expenses, making investments in commercial real estate REITs more appealing and potentially boosting their performance.

Historical data underscores the strong correlation between interest rates and the returns of commercial real estate REITs, with periods of low rates frequently aligning with robust sector performance. In 2025, the current interest rate landscape presents both challenges and opportunities for investors in commercial real estate REITs.

For example, industrial REITs, which benefit from the e-commerce boom, demonstrate resilience despite rising rates, as demand for warehouse and logistics spaces remains strong. This stability highlights the importance of sector selection within the commercial real estate REITs landscape, as investors must closely monitor interest rate trends and their implications for real estate trusts.

A strategic approach to navigating current market conditions can render mortgage real estate investment trusts (mREITs) a valuable component of a diversified portfolio, particularly as they may offer unique opportunities in a fluctuating interest rate environment. Understanding the nuances of how rising rates impact REIT profitability is crucial for making informed investment decisions.

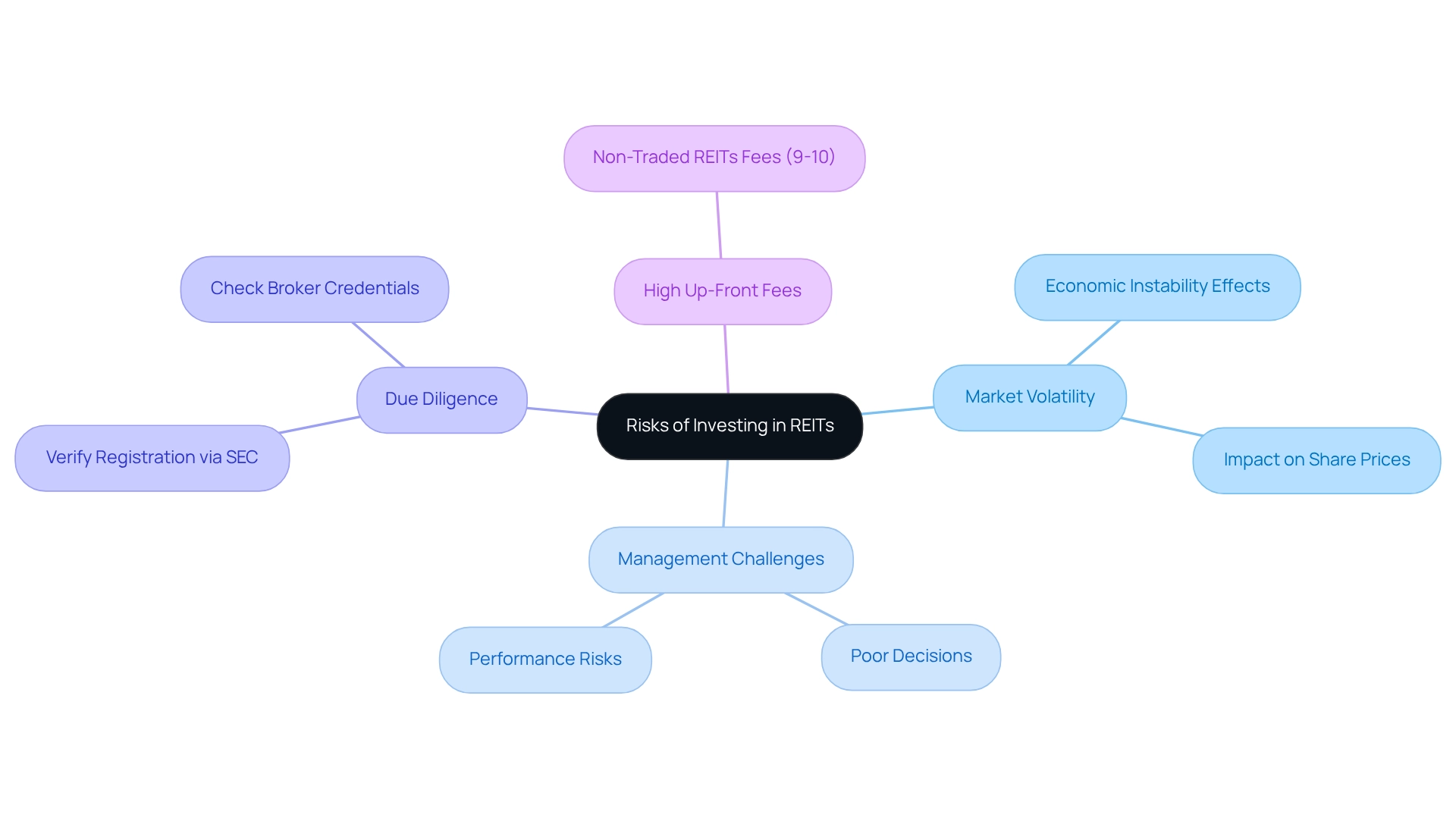

Risks of REITs: Understanding Market Volatility and Management Challenges

Investing in commercial real estate REITs presents numerous advantages, yet it is crucial to recognize the inherent risks involved. Market volatility significantly impacts the share prices of commercial real estate REITs, often leading to fluctuations that can affect investor returns. For instance, during periods of economic instability, both rental income and property values may decline, exacerbating the volatility associated with commercial real estate REITs. Investors must remain vigilant regarding potential management issues within these entities. Poor management decisions can lead to underperformance, which diminishes the potential benefits of these investments.

A compelling case study underscores the importance of due diligence: stakeholders are strongly advised to verify the registration of REITs through the SEC’s EDGAR system to avoid unregistered offerings, which pose substantial risks. By utilizing these resources, investors can safeguard themselves against potential fraud and ensure informed decision-making.

As we look ahead to 2025, the REIT landscape continues to evolve. Current market volatility statistics reveal that investors may encounter up-front fees ranging from 9% to 10% for commercial real estate REITs that are non-traded. These charges, coupled with the risks of market fluctuations and management challenges, highlight the necessity for thorough research and strategic planning when considering commercial real estate REITs. Understanding these dynamics is essential for effectively navigating the complexities of the REIT market.

Conclusion

The commercial real estate sector offers a wealth of opportunities for investors, particularly through innovative resources like Zero Flux, which distills insights from over 100 sources to illuminate market trends. With significant statistics, such as Chicago's extensive industrial inventory and promising projects like the redevelopment of 105 Victoria Street, the potential for lucrative investments is undeniably robust.

Real Estate Investment Trusts (REITs) emerge as a vital avenue for accessing this market without the burdens of direct property ownership. They not only facilitate income generation through dividends but also provide diversification benefits, allowing investors to spread risk across various property types. As the REIT sector continues to grow, driven by technological advancements and demographic shifts, it presents an accessible and attractive investment vehicle for both seasoned and novice investors.

Understanding the regulatory environment and the influence of economic conditions on REIT performance is crucial for navigating this landscape. Factors such as interest rates, employment rates, and consumer spending significantly impact REIT profitability. While inherent risks, including market volatility and management challenges, exist, informed decision-making and strategic planning can effectively mitigate these concerns.

In conclusion, the dynamic nature of commercial real estate and the strategic use of REITs present compelling opportunities for wealth accumulation. By staying informed and leveraging the available insights, investors can position themselves to capitalize on the evolving market, ensuring they remain at the forefront of this lucrative sector.