Overview

The article titled "7 Key Insights from Recent Real Estate News You Need to Know" delivers essential updates and trends that significantly impact the real estate market. It highlights crucial factors such as:

- The migration to low-tax states

- The influence of Millennials and Gen Z on housing preferences

- Stable mortgage rates that encourage buyer activity

- Increased housing inventory

- The effects of economic conditions on the market

This comprehensive overview provides current dynamics that investors and professionals must monitor to make informed decisions.

Introduction

In the dynamic realm of real estate, staying informed is paramount for both industry professionals and enthusiasts alike. The market is continuously evolving, making resources like Zero Flux essential tools that offer curated insights to navigate the complexities of housing trends, investment opportunities, and demographic shifts.

As migration patterns shift towards low-tax states and younger generations prioritize sustainability, understanding these trends becomes crucial for making informed decisions. Furthermore, with the stabilization of mortgage rates and an increase in housing inventory, the landscape is ripe with both opportunities and challenges.

This article delves into the multifaceted influences shaping the real estate market in 2025, providing a comprehensive overview that empowers readers to stay ahead in this competitive field.

Zero Flux: Your Daily Source for Real Estate Market Insights

Zero Flux serves as a dedicated daily newsletter that meticulously compiles essential property trends and insights from over 100 diverse sources, including those hidden behind paywalls. By concentrating solely on factual information, Zero Flux has positioned itself as an invaluable resource for both industry professionals and enthusiasts. Subscribers benefit from a daily selection of 5-12 curated insights that cover critical topics such as:

- Housing market trends

- Investment opportunities

- Demographic shifts

This ensures they stay informed about recent real estate news and the latest developments in the property sector. The newsletter's commitment to data accuracy sets it apart from competitors, as it sources information from a wide array of credible outlets. This rigorous approach not only enhances subscriber engagement but also solidifies Zero Flux's status as a leading authority in property information dissemination. In a landscape where 81% of property sellers consult only one representative before making decisions, access to reliable information can significantly influence investor choices and strategies.

As Jealie Dacanay notes, understanding the number of agents in each state in 2024 is crucial for industry professionals navigating this competitive landscape. With the global property market projected to reach an astounding value of $637.80 trillion by 2024, the importance of staying informed cannot be overstated. Zero Flux addresses the challenge of information overload by filtering through vast amounts of data to highlight only the most relevant trends, such as insights into the most expensive states to live in, establishing itself as an essential resource for anyone looking to navigate the complexities of the real estate market effectively.

Migration to Low-Tax States: A Driving Force in Real Estate Demand

Recent trends indicate a significant migration of individuals and families toward low-tax states such as Florida and Texas. This shift is primarily driven by the pursuit of lower living costs and enhanced economic opportunities. As a result, housing demand in these regions has surged, leading to rising property values and a competitive market environment. For example, California saw a departure of 24,670 affluent taxpayers, each with an adjusted gross income (AGI) of $200,000 or more. This migration contributed to a $16.1 billion decline in the state's total AGI, highlighting the changing dynamics as residents seek more favorable tax conditions.

Investors should closely monitor these migration patterns, as they present lucrative opportunities in emerging markets. Notably, states experiencing higher domestic migration growth typically feature lower average top marginal state income tax rates. Katherine Loughead from the Tax Foundation observes, "In the bottom third, it's 3.2 percentage points higher, at about 6.7 percent." This migration trend not only influences housing demand but also reshapes the overall property market, making it crucial for investors to stay informed about the recent real estate news regarding these developments.

Moreover, states facing significant out-migration may need to consider strategies such as:

- Reducing taxes

- Streamlining government operations

- Cutting regulations

to retain current residents and attract newcomers. Zero Flux's commitment to delivering quality content enhances subscriber engagement, establishing it as a leading authority in real estate information dissemination. This makes it an indispensable resource for anyone involved in the industry.

Millennials and Gen Z: Influencing Housing Market Trends

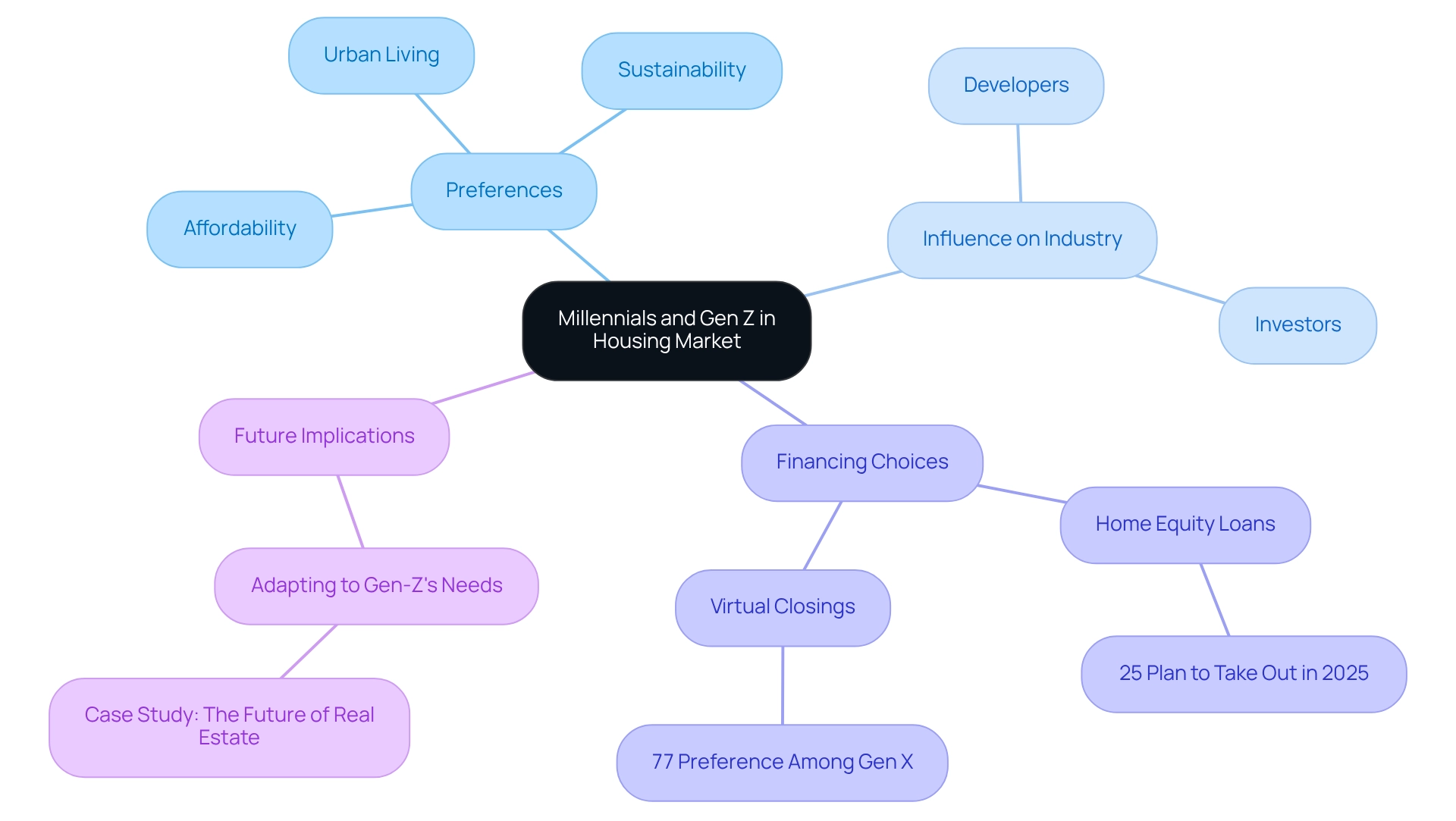

Millennials and Gen Z are increasingly entering the housing sector, prioritizing affordability and sustainability in their home-buying choices. Reports indicate that these younger generations are more inclined to purchase homes in urban areas that offer access to amenities and public transportation. As they form an expanding group of consumers, their preferences will significantly influence industry trends, prompting developers and investors to adapt to their requirements.

Recent data reveals that 25% of younger respondents plan to take out a home equity loan in 2025, reflecting a proactive approach to financing among these demographics. Furthermore, influencer-led content on homeownership and financial literacy is reshaping Gen Z's perspective on property, making them more informed and engaged buyers. This material not only educates them about the industry but also impacts their purchasing decisions, emphasizing sustainability and urban living.

As the housing sector evolves, understanding the preferences of Millennials and Gen Z will be crucial for stakeholders aiming to meet the needs of this emerging demographic. Their focus on sustainability and urban living not only shapes current market trends but also lays the groundwork for future developments in the property sector. The case study titled 'The Future of Real Estate: Adapting to Gen-Z's Needs' highlights the imperative for the real estate industry to adjust to these shifting preferences to maintain relevance.

Stable Mortgage Rates: Encouraging Home Buyer Activity

As of 2025, mortgage rates have stabilized at approximately 6.5%, fostering a renewed sense of confidence among homebuyers. This stability in borrowing costs encourages prospective homeowners to actively consider property ownership, likely stimulating increased sales activity in the sector. Real estate experts must remain vigilant regarding these rates, as even minor fluctuations can significantly influence purchaser sentiment and reshape industry dynamics.

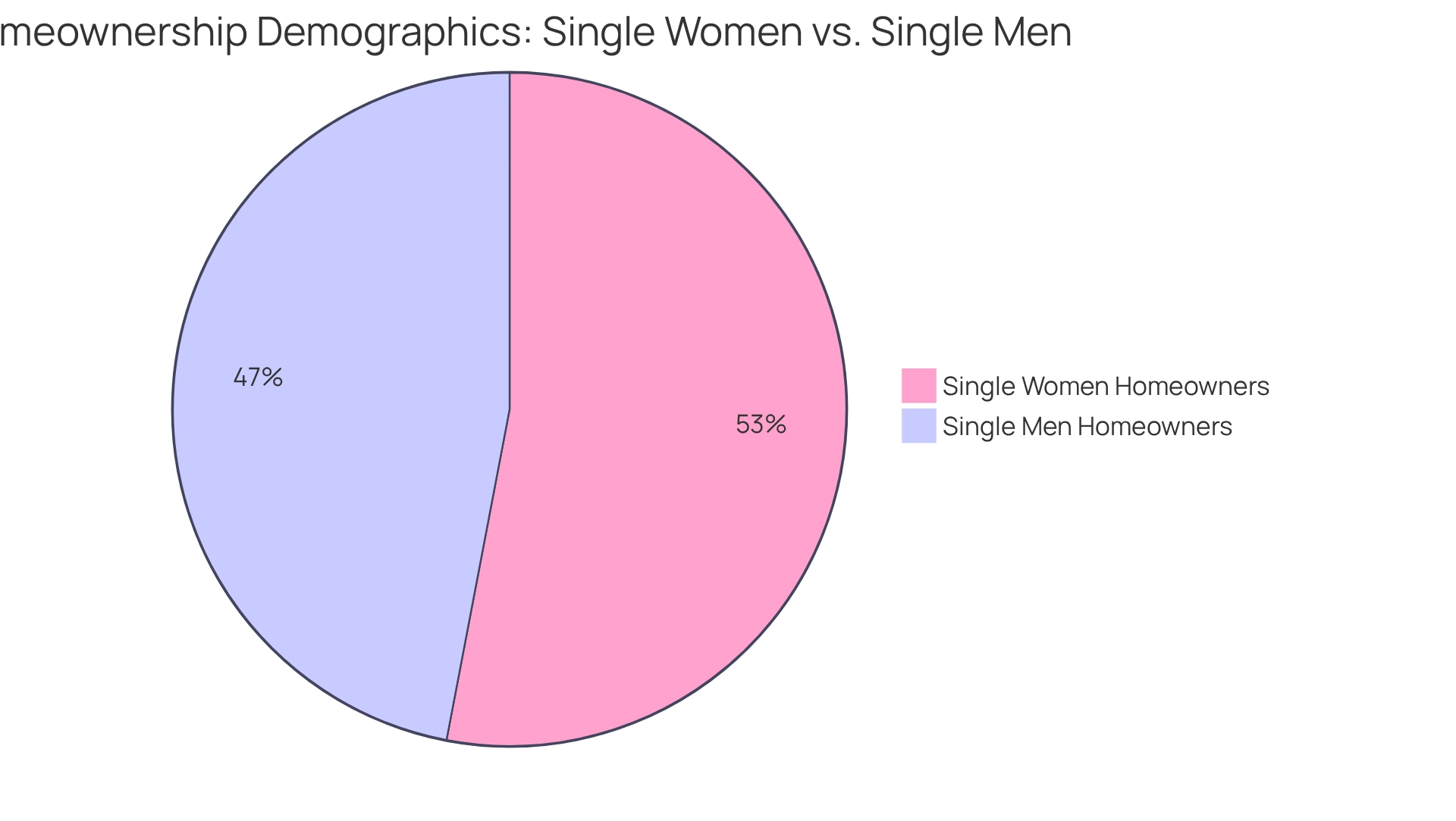

Historically, mortgage interest rates peaked at 18.63% in 1981, underscoring the importance of current rates in relation to past extremes. According to recent real estate news, stable mortgage rates are vital for enhancing buyer activity. For instance, a study by LendingTree indicates a notable demographic shift, showing that single women now own more homes than single men in 47 out of 50 states. This shift highlights the evolving landscape of homeownership, influenced in part by changing social dynamics and financial independence. However, the housing sector has faced sluggishness due to elevated mortgage rates and home prices, impacting overall economic conditions, according to recent real estate news.

Given these developments, financial analysts emphasize the importance of monitoring mortgage rate trends in 2025, as they play a crucial role in influencing the real estate sector. As Maggie Davis notes, the average purchase price for a home in the U.S. is $510,300 as of Q4 2024, illustrating the impact of stable mortgage rates on affordability and buyer activity. Additionally, economic factors such as trade agreements significantly affect the mortgage sector, further complicating the landscape. Real estate experts are encouraged to leverage this information to navigate the intricacies of the current environment more effectively.

Increasing Housing Inventory: Implications for Buyers and Sellers

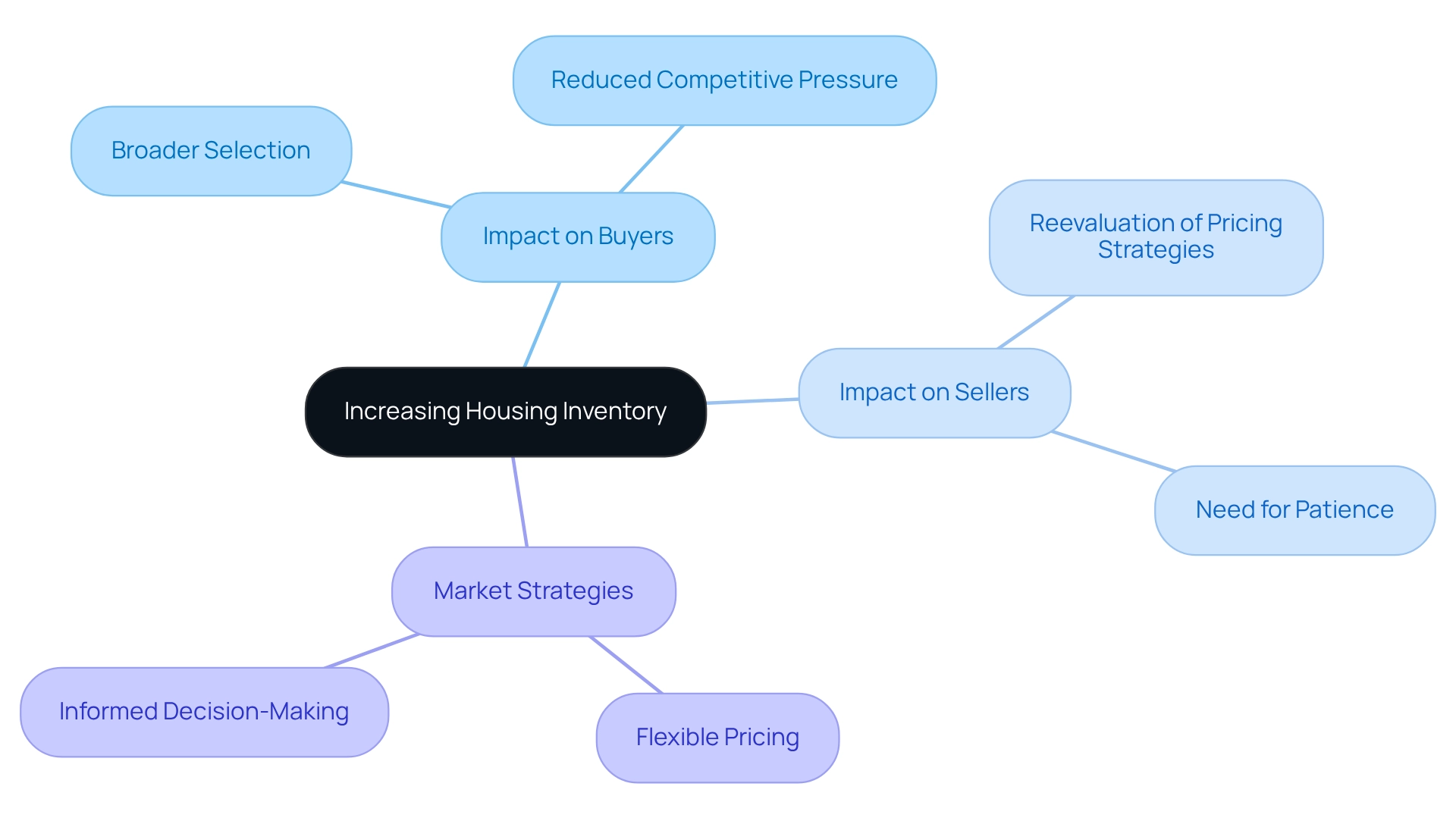

The housing sector is witnessing a remarkable surge in inventory, with new listings significantly increasing across major U.S. cities. This rise in available properties provides buyers with a broader selection, effectively alleviating some of the competitive pressures that defined previous years. Notably, 18 of the largest sectors have now surpassed their inventory levels from 2017-2019, with San Antonio leading the way at an impressive 75% increase. Furthermore, data from Realtor.com indicates that this is the highest April share recorded since at least 2016, underscoring the importance of the current inventory levels.

For sellers, this shift requires a reevaluation of pricing strategies to remain competitive in a more balanced market. As buyers gain more choices, sellers may need to adopt more flexible pricing and marketing strategies to attract interest. In Douglas County, for example, patience is becoming essential for vendors, as purchasers now have more time to deliberate before making decisions.

Understanding these dynamics is crucial for both buyers and sellers to navigate the evolving landscape effectively. As Mike Simonsen, creator of Altos Research, notes, "A true data enthusiast, Mike established Altos Research in 2006 to provide previously inaccessible insights on the US housing sector to those who require it." Real estate analysts emphasize that adapting to the changes outlined in recent real estate news will be key for success in 2025 and beyond. As inventory levels continue to rise, the recent real estate news suggests that the industry is likely to stabilize, creating opportunities for informed decision-making on both sides of the transaction. Zero Flux serves as an essential resource for industry professionals, assisting them in staying updated about these critical economic dynamics.

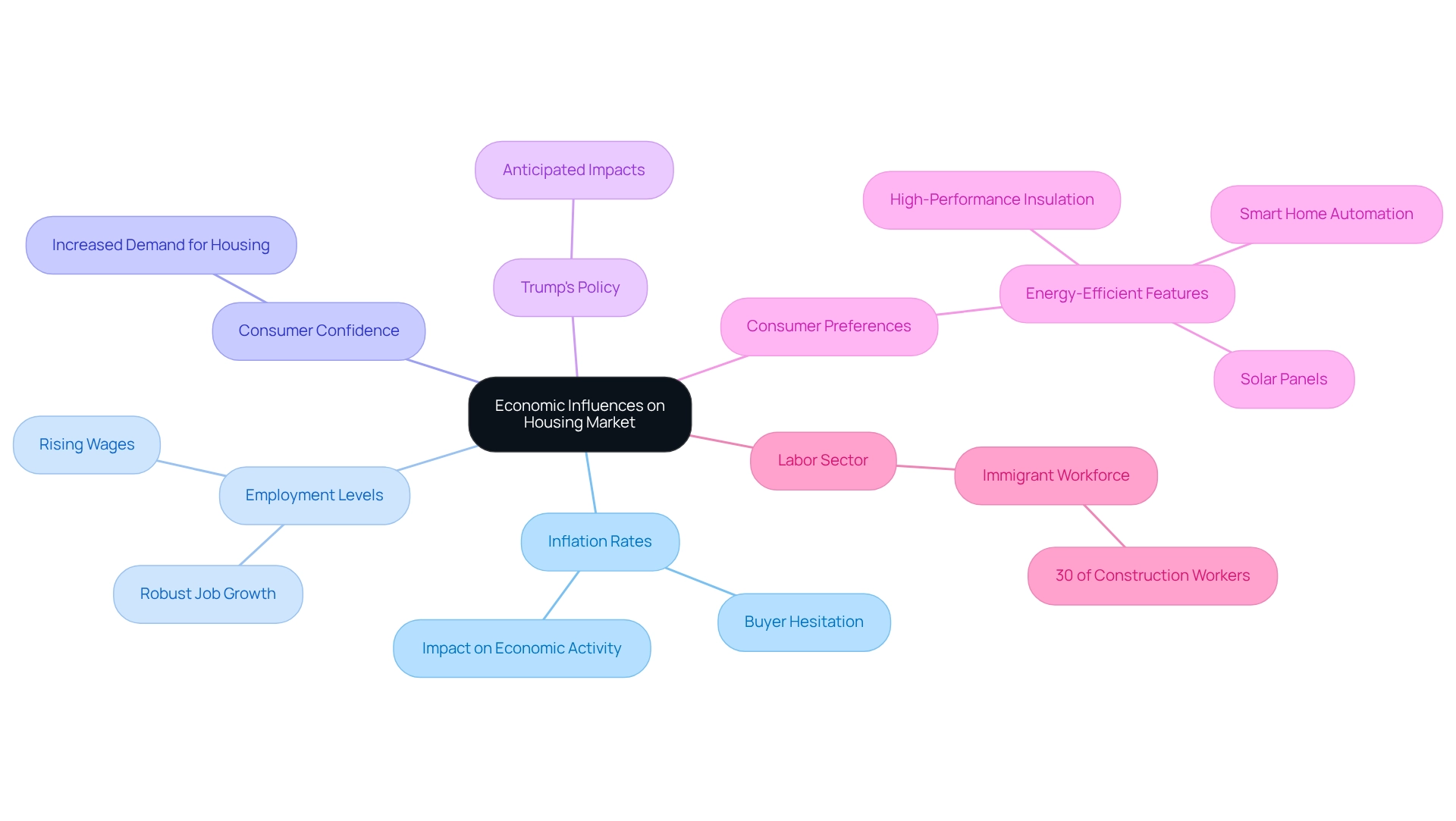

Economic Influences: Key Factors Affecting the Housing Market

The housing sector in 2025 is significantly influenced by a range of economic factors, including inflation rates, employment levels, and consumer confidence. Inflation remains a pressing concern, causing many prospective customers to hesitate in making large acquisitions, which consequently impacts overall economic activity. Conversely, robust job growth and rising wages can bolster buyer confidence, leading to heightened demand for housing. Furthermore, various elements of Trump's policy are anticipated to influence the housing sector, although specific proposals are yet to be revealed. Notably, approximately 30% of construction workers are immigrants, underscoring the labor sector's critical role in shaping housing supply and demand dynamics.

Real property experts must remain vigilant regarding these economic signals to effectively anticipate changes in the industry and adjust their strategies accordingly. As Joy Aumann, a licensed realtor, observes, "More buyers are prioritizing energy-efficient features like solar panels, high-performance insulation, and smart home automation." This shift in consumer preferences indicates a potential evolution in market trends, further emphasizing the need for industry professionals to adapt their approaches to meet emerging demands.

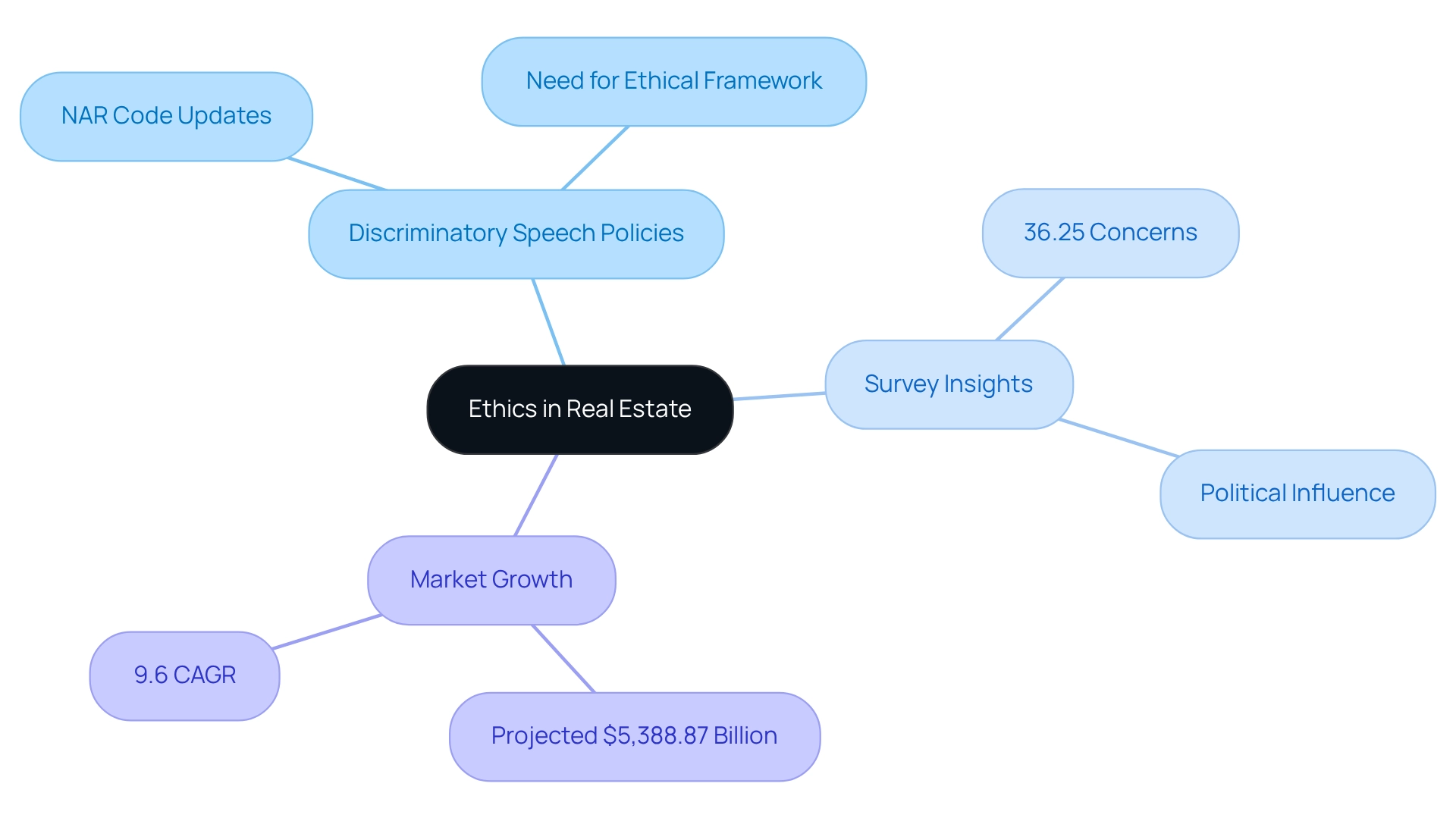

Ethics in Real Estate: Addressing Discriminatory Speech Policies

In 2025, the property sector faces increasing scrutiny regarding discriminatory speech policies. The National Association of Realtors (NAR) is actively contemplating updates to its Code of Ethics to more effectively combat hate speech and discrimination. Upholding ethical standards is essential for fostering a fair and inclusive environment. A recent survey reveals that 36.25% of individuals believe current policies, influenced by political figures, could adversely affect recovery. This highlights the urgent need for a robust ethical framework in property practices.

Moreover, the global property sector is projected to reach $5,388.87 billion by 2026, with a compound annual growth rate (CAGR) of 9.6%. This growth projection emphasizes that ethical practices will be crucial in sustaining market expansion. As the sector evolves, a commitment to ethical standards will not only enhance the integrity of property practices but also build trust among clients and stakeholders. As the National Fair Housing Alliance states, "If you believe in justice, if you believe in equity, we ask you to stand with us now.

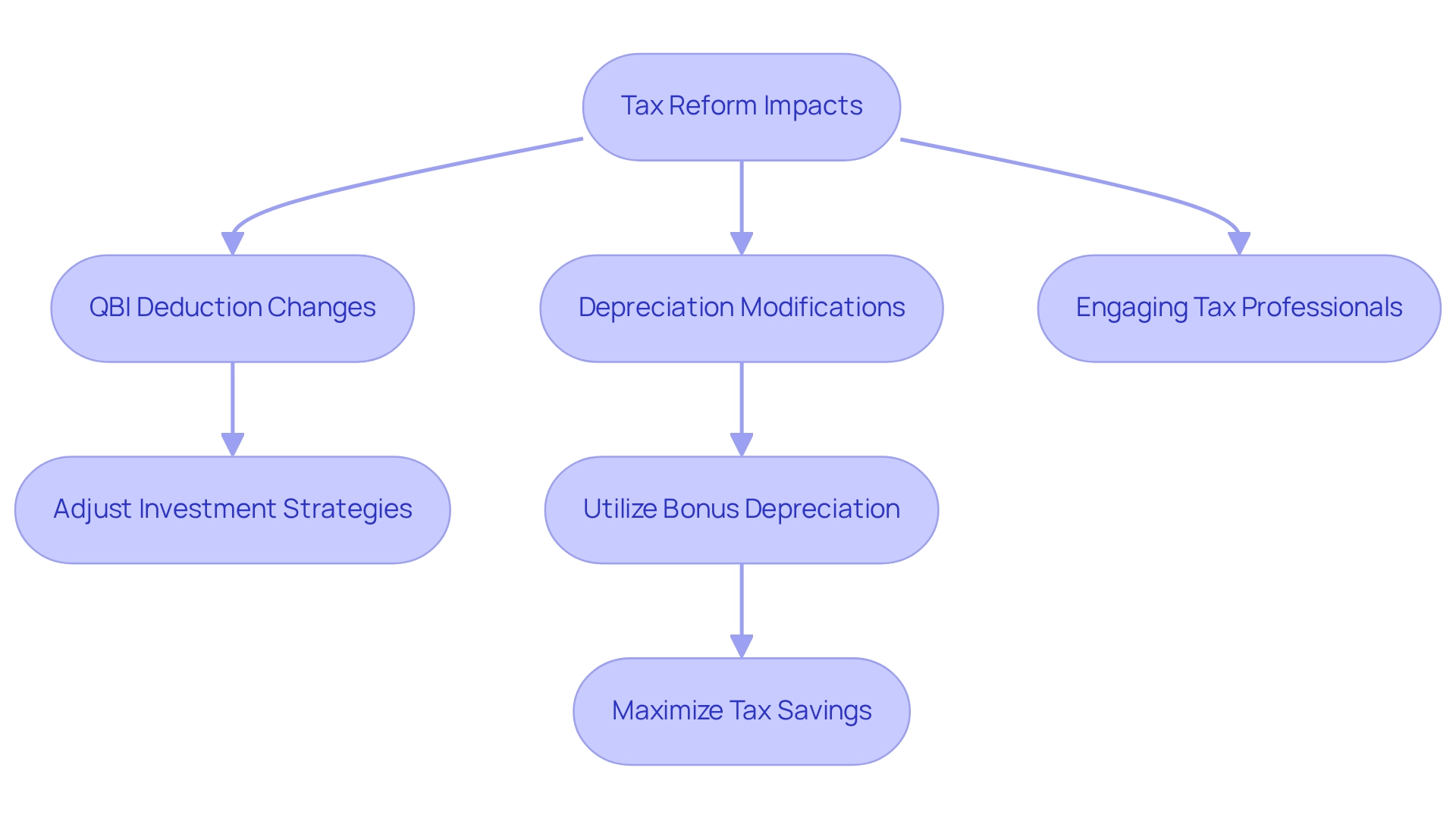

Tax Reform Impacts: What Real Estate Investors Need to Know

The recent tax reform package approved by the House, as reported in the recent real estate news, introduces several important provisions that could transform the environment for property investors. Notably, adjustments to the Qualified Business Income (QBI) deduction are set to take effect in 2025, potentially altering the tax benefits available to many investors. These changes may lead to a reduction in the deduction percentage, impacting cash flow and overall investment strategies. Understanding these adjustments is crucial for investors to navigate the evolving tax landscape effectively.

Additionally, potential modifications to depreciation rules, including the utilization of bonus depreciation, present opportunities for investors to optimize their tax savings. For instance, leveraging cost segregation strategies can enhance the benefits of bonus depreciation, making 2024 a pivotal year for maximizing savings. A recent case study titled 'Bonus Depreciation in 2024' emphasizes how property investors can employ these strategies to save considerably on taxes.

Statistics indicate that the latest potential date for tax legislation to pass is January 1, 2026, underscoring the urgency for investors to stay informed and adapt their strategies accordingly. Engaging with tax professionals is crucial for navigating these complexities and ensuring that investment returns are maximized in light of the evolving tax landscape. As Paul Munter, Chief Accountant at the SEC, noted, "Investors must be proactive in understanding these changes to maintain their competitive edge." As the property market continues to adjust to these reforms, understanding the recent real estate news will be crucial for investors seeking to retain a competitive advantage.

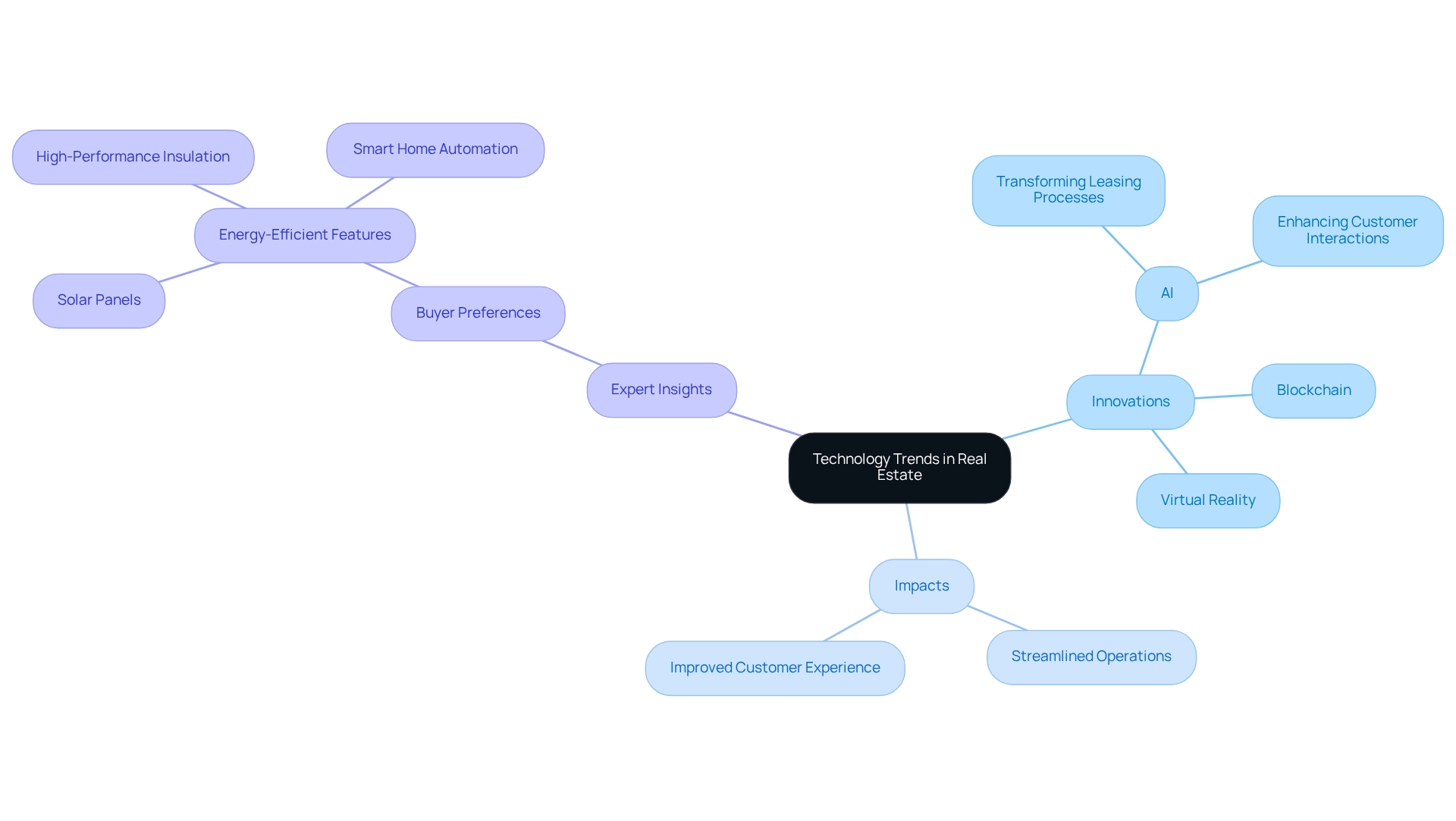

Technology Trends: Innovations Shaping the Real Estate Industry

In 2025, the real property sector is undergoing a significant transformation driven by technological advancements such as AI, blockchain, and virtual reality. These innovations are not merely streamlining processes; they are also enhancing customer experiences and improving data analysis capabilities. Notably, 90% of companies anticipate that AI will revolutionize leasing processes by 2029, resulting in more efficient operations and superior customer interactions.

Real estate professionals who embrace these technologies stand to gain a competitive edge, providing more effective services to their clients. The integration of AI-driven tools is especially remarkable, as it presents unprecedented opportunities for growth and innovation within the sector. Major players in the market, including Compass Inc., Redfin Corporation, and Zillow Group Inc., are prioritizing technological advancements to enhance their offerings and elevate customer experiences.

Expert insights highlight the importance of these trends. Joy Aumann, a licensed realtor and interior designer, emphasizes that buyers are increasingly valuing energy-efficient features, such as solar panels, high-performance insulation, and smart home automation technologies. As the sector evolves, staying informed about these technological trends is crucial for success in the dynamic property landscape.

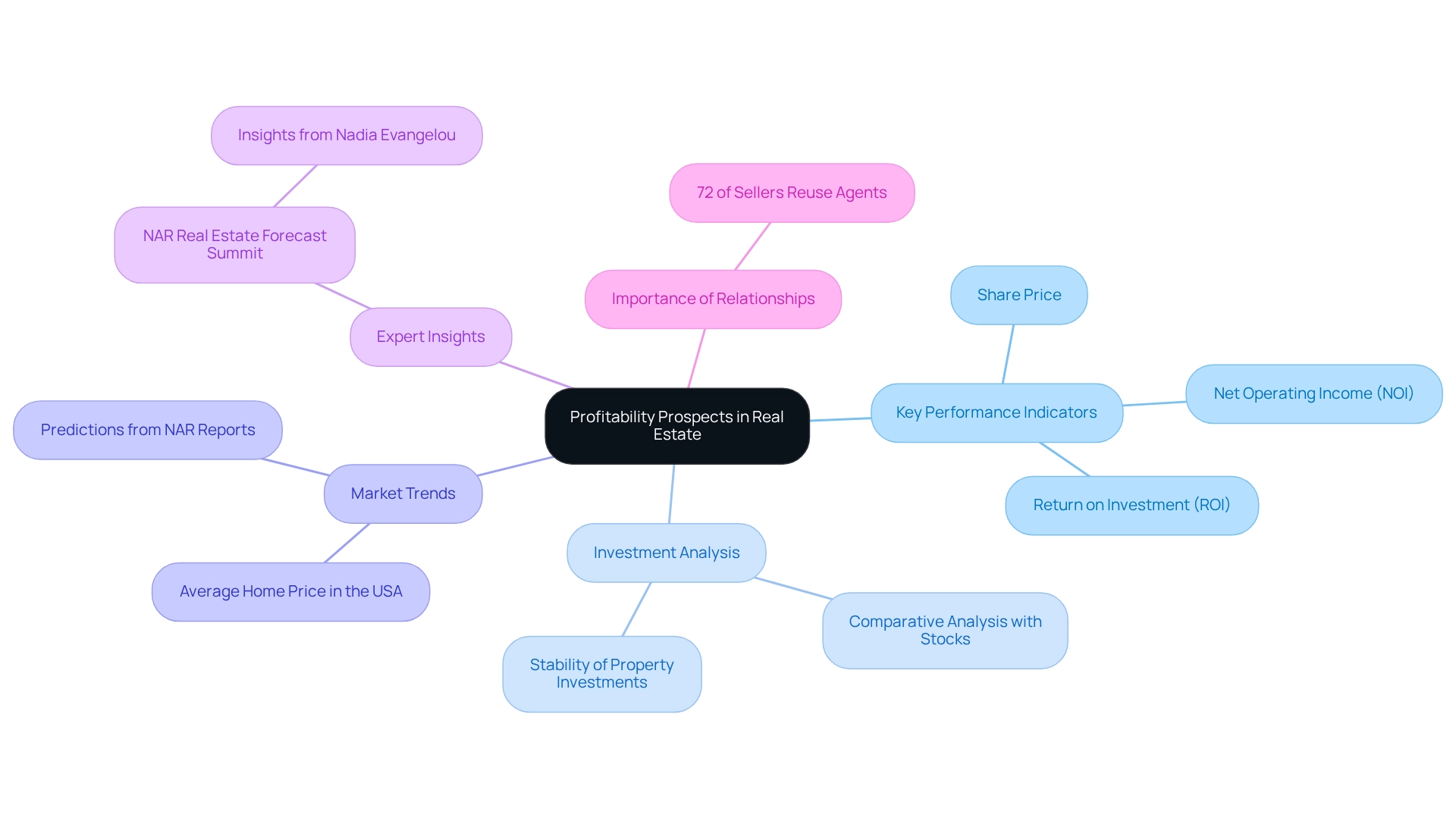

Profitability Prospects: Evaluating Real Estate Firm Performance

In the ever-evolving property sector, assessing the profitability potential of companies is crucial for making informed investment choices. Key performance indicators (KPIs) such as return on investment (ROI), net operating income (NOI), and share price serve as vital metrics for evaluating potential partners and opportunities. For example, the National Association of REALTORS® reveals that 72% of sellers would opt to work with the same agent again, highlighting the significance of strong relationships and performance in the industry.

Investors must rigorously analyze these financial health metrics to effectively navigate the competitive landscape. According to recent real estate news, recent profitability data indicates that property investments typically offer greater stability than shares, positioning them as a more secure financial asset during economic fluctuations, as underscored by recent industry evaluations. By 2025, grasping these KPIs, particularly ROI and NOI, not only aids in identifying robust investment opportunities but also enhances strategic decision-making, ensuring that investors align with firms demonstrating solid financial performance.

Insights from the March 2025 NAR Real Estate Forecast Summit, presented by Senior Economist Nadia Evangelou, further underscore the necessity of evaluating profitability in both residential and commercial sectors. This comprehensive overview provides valuable predictions and trends that can assist investors in their pursuit of profitable ventures in real estate. Moreover, examining the average home price in the USA through NAR's reports can offer additional context to the profitability analysis and market trends.

Conclusion

The real estate landscape in 2025 is shaped by a myriad of dynamic factors, each influencing market trends and investment strategies. Zero Flux stands out as an essential resource, delivering curated insights that empower both industry professionals and enthusiasts to navigate this complex environment effectively. With critical topics such as migration patterns to low-tax states, the rising influence of Millennials and Gen Z, stable mortgage rates, and increasing housing inventory, understanding these trends is paramount for making informed decisions.

As younger generations prioritize affordability and sustainability, their preferences are reshaping the market, prompting developers and investors to adapt accordingly. The stabilization of mortgage rates is encouraging homebuyer activity, while the influx of new housing inventory is providing buyers with more choices, thus alleviating previous market pressures. Additionally, economic factors and tax reforms are continually altering the landscape, making it essential for stakeholders to remain vigilant and informed.

Ultimately, the convergence of these trends illustrates a pivotal moment in the real estate market, highlighting the importance of ethical practices and technological innovations. By staying informed and adapting to these changes, industry professionals can not only enhance their strategies but also foster a more inclusive and equitable market. With resources like Zero Flux at their disposal, navigating the complexities of real estate in 2025 becomes a more achievable endeavor, ensuring that stakeholders can capitalize on the opportunities that lie ahead.