Overview

This article provides essential insights for investors evaluating 800 Broad Street in Newark, NJ, by thoroughly analyzing various facets of the local real estate market. It highlights the property's prime location, demographic trends that favor younger renters, and the strong potential for rental income. Furthermore, it discusses market stability and underscores the significance of effective property management and financing strategies. Collectively, these factors enhance the property's appeal as a lucrative investment opportunity.

Introduction

Newark, NJ, is rapidly emerging as a hotspot for real estate investment, driven by a unique blend of urban revitalization and demographic shifts. Investors examining 800 Broad Street are presented with a wealth of opportunities, ranging from rising rental income potential to a resilient market landscape.

With Millennials and Gen Z increasingly seeking urban living, how can investors strategically position themselves to capitalize on this evolving market?

Zero Flux: Essential Insights on Newark's Real Estate Market

Zero Flux offers a comprehensive overview of the real estate landscape in the city, highlighting essential patterns and data points critical for investors. Drawing insights from over 100 sources, the newsletter provides a solid factual basis for understanding economic dynamics, encompassing housing demand, pricing trends, and unique investment opportunities in the area. This data-driven methodology equips investors with the most current information, enabling them to navigate the complexities of the market with confidence and precision.

Prime Location: Accessibility and Urban Amenities Near 800 Broad Street

800 Broad Street Newark NJ stands as a prime asset within the city, strategically positioned to offer superior access to public transportation, major highways, and urban amenities. Its proximity to Penn Station significantly enhances its appeal for commuters. Moreover, the surrounding eateries, parks, and cultural institutions foster a vibrant community atmosphere. These compelling factors not only attract prospective tenants but also bolster long-term property value appreciation, solidifying its status as an exceptional investment opportunity.

Demographic Trends: Attracting Millennials and Gen Z to Newark

The city is increasingly attracting Millennials and Gen Z, demographics that are drawn to urban living and affordable housing options. This trend is bolstered by the city's revitalization efforts, which encompass new developments and enhanced public spaces. Investors should consider how these emerging patterns may influence rental demand at 800 Broad Street Newark NJ. Younger tenants often prioritize location, amenities, and community involvement, making these factors critical in investment strategies.

Rental Income Potential: Evaluating 800 Broad Street for Investors

Investors must conduct a thorough analysis of the rental income potential at 800 Broad Street, Newark, NJ. Current economic trends indicate a significant demand for rental units in the city, with average rents showing consistent increases. By comparing similar properties in the vicinity, investors can estimate potential rental income and assess the overall return on investment. This approach enables informed decisions regarding asset acquisition, ultimately enhancing investment strategies.

Market Stability: Assessing Newark's Real Estate Resilience

Newark's real estate sector demonstrates remarkable resilience, even amidst economic downturns. Factors such as a diverse economy, ongoing urban development, and a growing population are pivotal in contributing to its stability. Investors should take these elements into account when evaluating the long-term potential of 800 Broad Street Newark NJ. A stable market not only mitigates investment risk but also enhances the likelihood of continued value appreciation. Understanding these dynamics is essential for making informed investment decisions.

Financing Options: Securing Investments at 800 Broad Street

Investors considering acquisition at 800 Broad Street Newark NJ should actively explore a variety of financing alternatives, such as:

- Conventional mortgages

- FHA loans

- Investment real estate loans

Each financing avenue presents unique advantages and requirements that can significantly impact the terms secured. Traditional mortgages often offer competitive rates, while FHA loans may provide lower down payment options, making them particularly attractive for first-time buyers or those with limited capital. Furthermore, investment property loans are tailored specifically for individuals looking to generate income through rental properties.

Utilizing local banks or credit unions can also yield customized financing options that align with the prevailing real estate conditions in the area. These institutions frequently possess a deeper understanding of the local landscape and can offer personalized service, potentially leading to more favorable financing terms. As of July 2025, average mortgage rates in Newark, NJ, reflect a competitive environment, underscoring the necessity for investors to remain informed about current trends and rates to optimize their financing strategies.

Moreover, with over 30,000 subscribers, Zero Flux stands as a trusted source for insights into the real estate market, emphasizing the critical importance of understanding various financing options. A recent case study highlights the necessity of having a clear investment strategy and conducting thorough due diligence when navigating real estate investment financing. By comprehending these options and employing effective financing strategies, investors can significantly enhance their chances of securing profitable investments at 800 Broad Street Newark NJ, a prime location.

Property Management Strategies: Maximizing Returns at 800 Broad Street

To maximize returns at 800 Broad Street Newark NJ, investors must implement effective management strategies for their assets. This includes:

- Regular maintenance

- Proactive tenant communication

- Targeted marketing efforts to attract quality tenants

Utilizing management software can significantly streamline operations. Furthermore, establishing clear rental policies not only enhances tenant satisfaction but also improves retention rates. Ultimately, these strategies lead to higher profitability, making them essential for any investor looking to succeed in this competitive market.

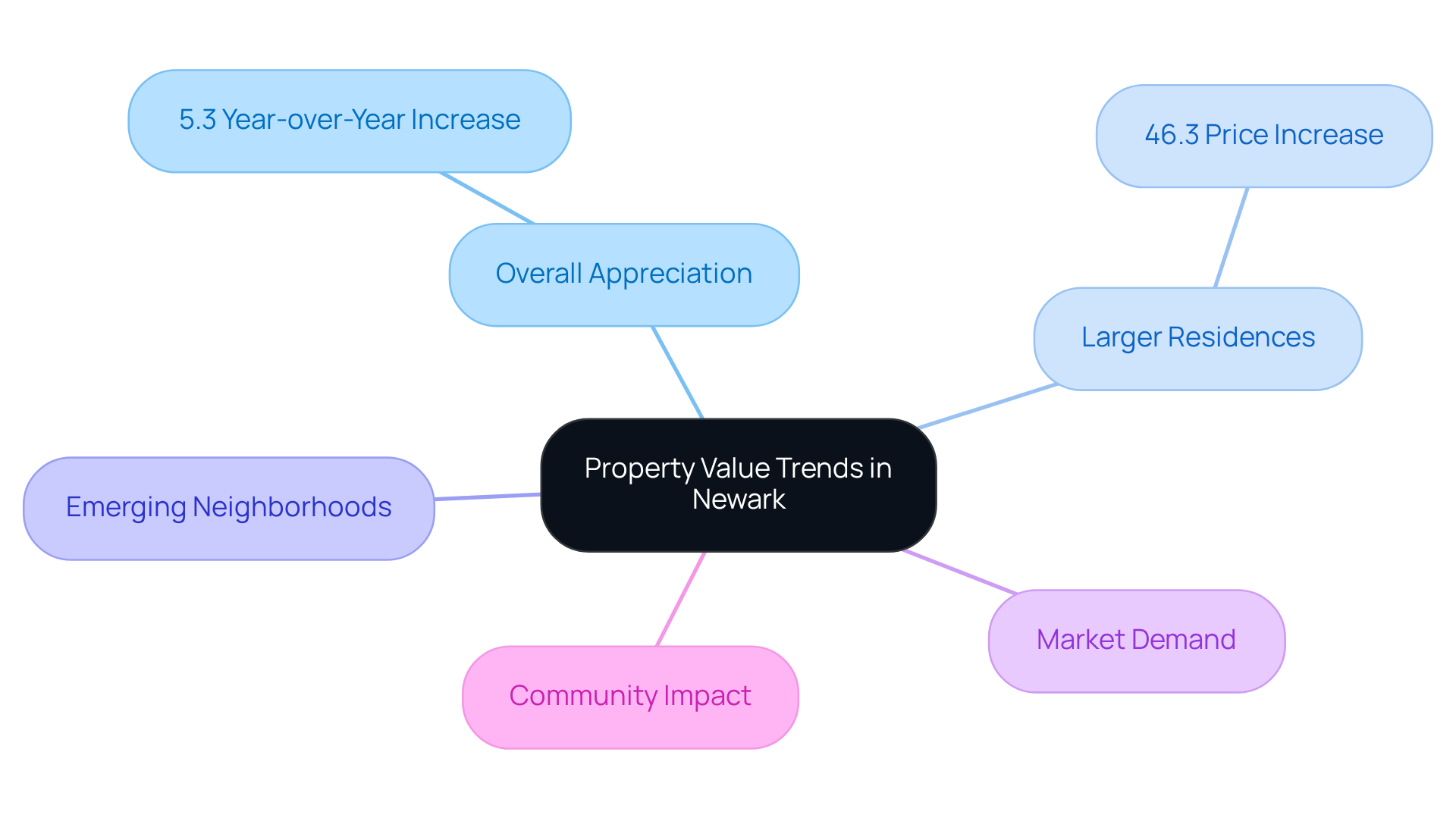

Historical Appreciation: Evaluating Property Value Trends in Newark

A thorough analysis of historical property value trends in the area reveals a consistent pattern of appreciation, particularly in emerging neighborhoods. As of December 2023, residential prices in the city have risen by 5.3% year-over-year, with the median price reaching $420,000. This trend is underscored by the observation that, "Over the past year, the real estate sector in the city has experienced home prices rise by 5.3%, suggesting a robust and growing environment despite various economic pressures." Notably, larger residences with five or more bedrooms have seen a staggering 46.3% increase in price as of February 2024, highlighting the competitive nature of this segment.

Current patterns in the Newark real estate sector reflect a continuous rise in home prices and a strong demand for housing amid urban revitalization initiatives and economic expansion. Investors should analyze previous sales data and industry reports to understand how 800 Broad Street Newark NJ aligns with these trends. By identifying areas experiencing growth and revitalization—particularly neighborhoods shaped by historical significance and community engagement—investors can make informed predictions about future value increases, thereby enhancing their strategic investment decisions.

Furthermore, it is crucial for investors to consistently monitor community changes and market updates to stay informed about shifts.

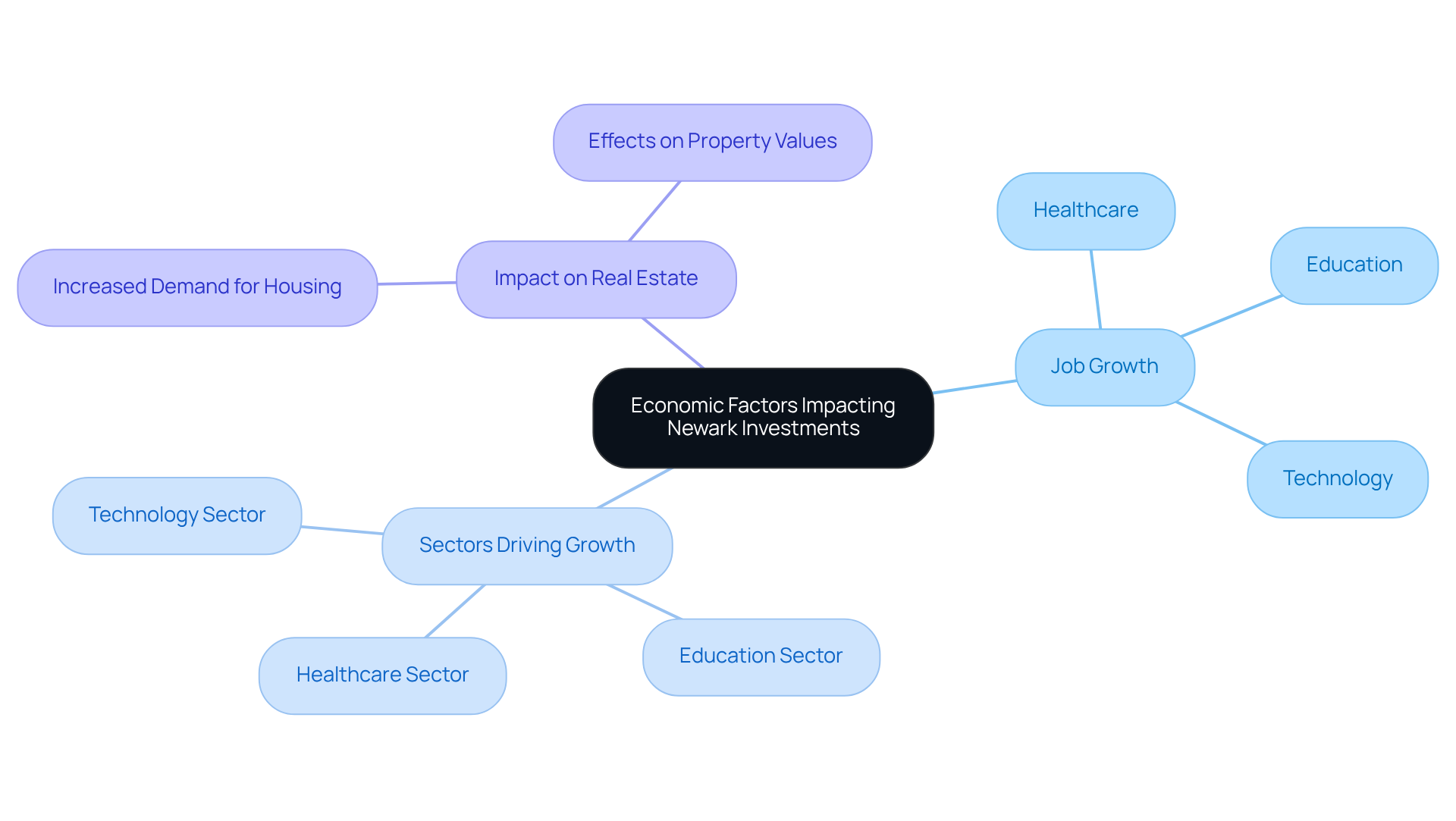

Economic Factors: Job Growth and Industry Impact on Newark Investments

The economy of Newark's area is experiencing notable growth, driven by robust job creation across various sectors, including healthcare, education, and technology. This job growth serves as a positive indicator for real estate investors, as it leads to increased demand for housing.

Investors should keenly observe local economic changes and industry patterns to assess the potential effects on rental demand and real estate values at 800 Broad Street Newark NJ. Understanding these dynamics is crucial for making informed investment decisions.

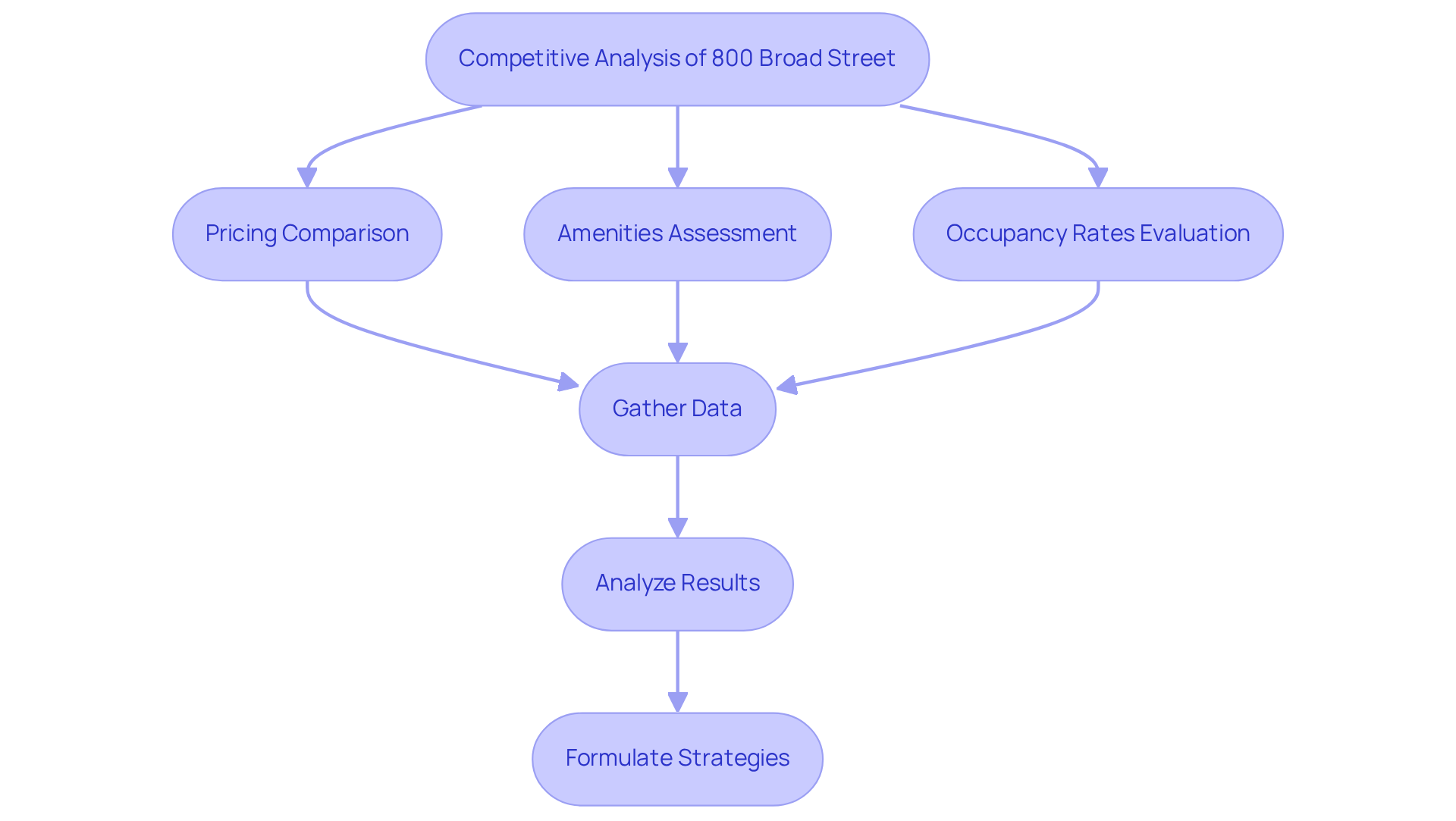

Competitive Analysis: Positioning 800 Broad Street in Newark's Real Estate Market

Investors must conduct a competitive assessment of 800 Broad Street Newark NJ by comparing it with similar assets in Newark. This analysis should encompass:

- Pricing

- Amenities

- Occupancy rates

By understanding how 800 Broad Street Newark NJ measures up against its competitors, investors can develop informed pricing strategies and effective marketing efforts. Such insights are crucial for ensuring the property remains appealing to both potential tenants and investors.

Conclusion

Investing in 800 Broad Street, Newark, NJ, offers a compelling opportunity, grounded in a thorough understanding of local real estate dynamics. The insights presented here underscore the critical nature of strategic investment decisions, highlighting the property’s prime location, demographic trends, rental income potential, and market resilience. By harnessing this knowledge, investors can adeptly navigate the complexities of Newark's evolving real estate landscape.

Key arguments illustrate the importance of:

- Accessibility

- Urban amenities

- Increasing interest from Millennials and Gen Z—factors that are pivotal in driving demand.

Furthermore, an analysis of historical appreciation trends and economic indicators, such as job growth, reinforces the case for investing in this area. A solid grasp of financing options and effective property management strategies can further enhance the potential for lucrative returns.

Given these insights, it is imperative for investors to remain proactive and well-informed about Newark's real estate market trends. Engaging with local resources and continuously monitoring community developments will not only refine investment strategies but also position investors for success in a competitive environment. As Newark continues to evolve, the potential for growth and appreciation at 800 Broad Street remains promising for those poised to seize this opportunity.