Overview

The article "7 Key Insights on Debt Funds Real Estate for 2025" delves into the evolving landscape of real estate debt funds and their strategic implications for investors in 2025. It highlights significant trends, including:

- The increasing demand for innovative financing solutions

- The rise of private borrowing

- The critical role of data analytics in risk assessment

These trends underscore the necessity for investors to adapt their strategies in response to a rapidly changing market environment.

As the demand for innovative financing solutions grows, investors must recognize the importance of staying ahead of market shifts. The rise of private borrowing presents new opportunities, while data analytics enhances risk assessment capabilities, allowing for more informed decision-making. Collectively, these factors create a compelling case for investors to reassess and refine their investment strategies.

In conclusion, the insights presented in this article serve as a crucial guide for investors navigating the complexities of real estate debt funds in 2025. By embracing these trends and adapting their approaches, investors can position themselves for success in an increasingly dynamic market.

Introduction

As the real estate market braces for significant changes in 2025, understanding the dynamics of debt funds has become paramount for investors and financial professionals alike. With the surge in property values and the impending maturity of nearly $1 trillion in liabilities, the landscape for real estate financing is evolving rapidly. This evolution presents both challenges and opportunities for those involved. How can investors navigate this complex terrain and leverage emerging trends to optimize their strategies? This article delves into seven key insights on real estate debt funds, offering a roadmap for those looking to capitalize on the shifting market dynamics.

Zero Flux: Daily Insights on Real Estate Debt Strategies

Zero Flux delivers daily insights into property financing strategies, meticulously curating information from over 100 sources to provide a comprehensive overview of market trends. This resource is indispensable for investors and professionals seeking to navigate the complexities of real estate financing in 2025. With the average home value in the U.S. having surged over 65% in the last five years, grasping the dynamics of financing investments has never been more crucial. This increase significantly impacts borrowing costs and investment strategies, making informed decision-making essential.

By prioritizing factual information, Zero Flux empowers its subscribers to make well-informed decisions based on the latest sector developments. As nearly $1 trillion in liabilities matures this year, the demand for innovative financing solutions, such as bridge loans and mezzanine financing, is poised to rise, presenting unique investment opportunities. Furthermore, the integration of data analytics and AI in underwriting processes is revolutionizing how lenders assess risk and opportunity. These tools enhance predictive accuracy and streamline decision-making, fostering a more efficient financing landscape.

This emphasis on data-driven insights not only refines investment strategies but also positions Zero Flux as a leading authority in property information dissemination. Investors who leverage these insights are better equipped to navigate an evolving market and capitalize on emerging opportunities.

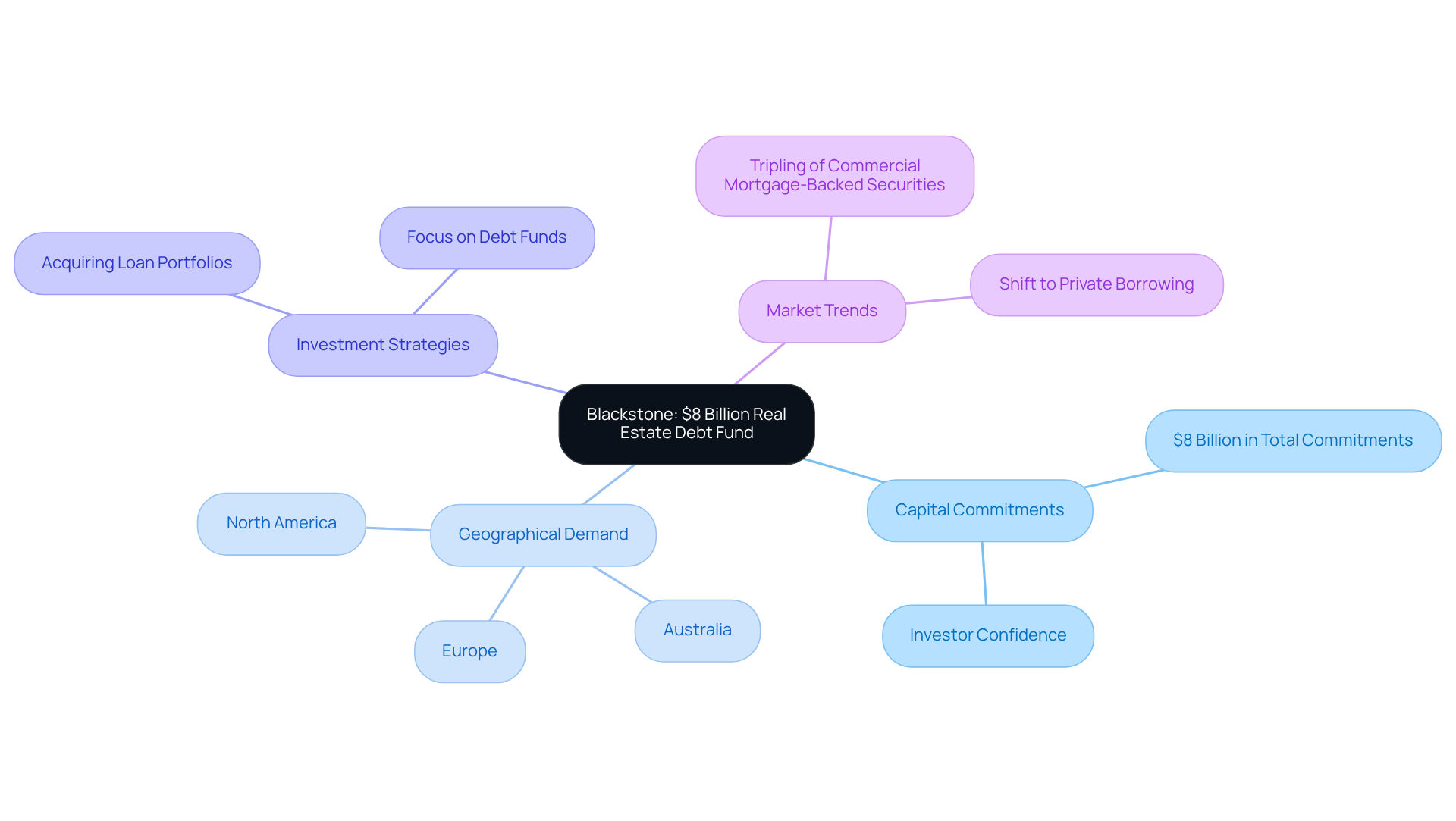

Blackstone: $8 Billion Real Estate Debt Strategies Fund

In March 2025, Blackstone successfully closed its $8 billion debt funds real estate, securing approximately $8 billion in capital commitments. This significant milestone underscores the robust demand for property financing investments across North America, Europe, and Australia. The investment pool is strategically positioned to capitalize on emerging market opportunities, particularly as conventional lending sources become increasingly constrained due to rising interest rates and market challenges. Blackstone's approach reflects a broader trend in which private borrowing is gaining traction, signaling a shift in investment strategies within the property sector.

The program's focus on acquiring loan portfolios from financial institutions and insurance firms further illustrates the evolving landscape of property financing, particularly through debt funds real estate. This shift is evident in the renewed investor confidence, highlighted by the tripling of commercial mortgage-backed securities volumes in 2024 compared to the previous year. Such context accentuates the stability and potential returns that investors are actively seeking amidst the fluctuations of the market. With these insights, investors are encouraged to reassess their strategies and consider the shifting dynamics of property financing.

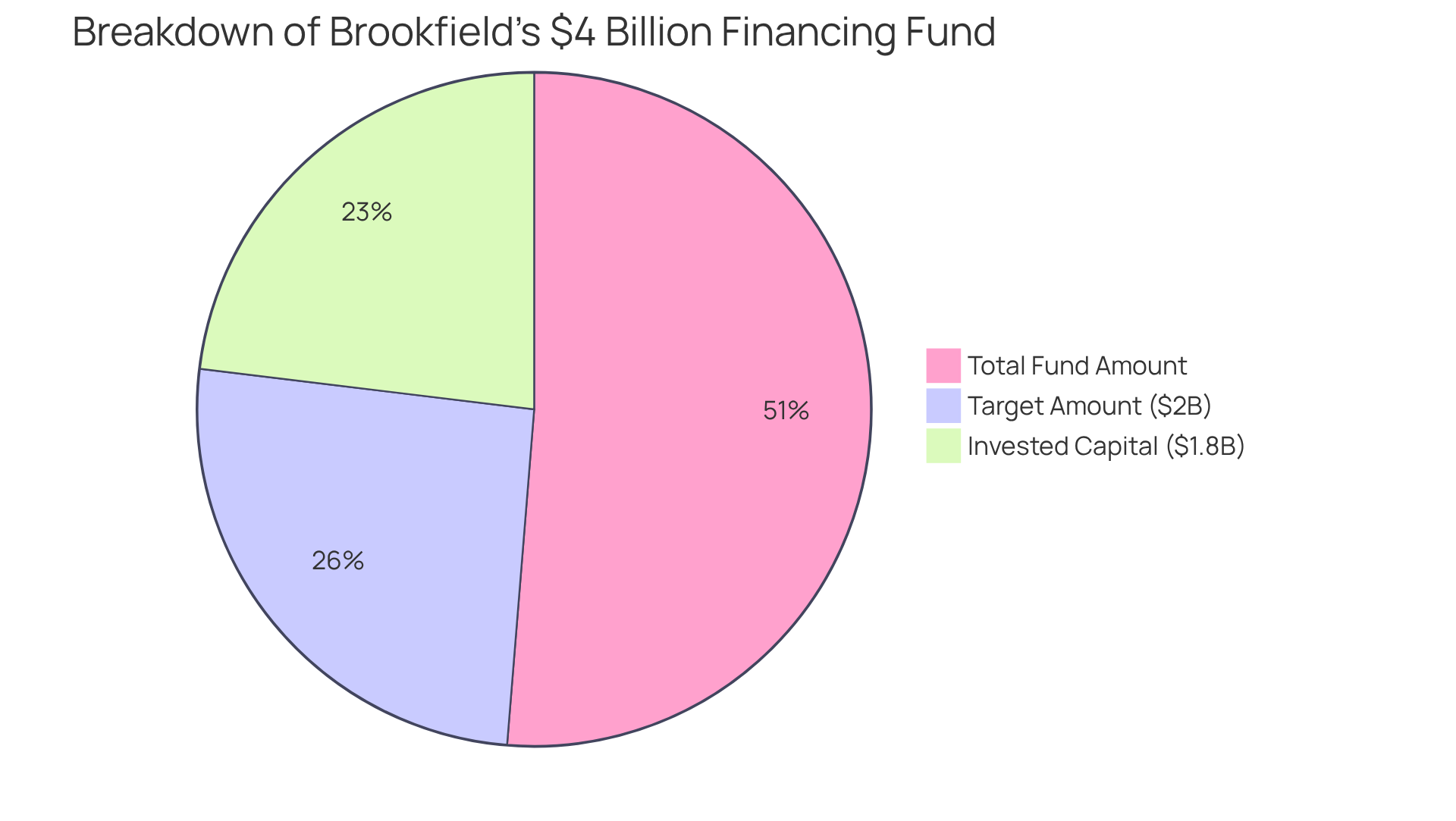

Brookfield: $4 Billion Commercial Real Estate Debt Fund

Brookfield has completed a remarkable $4 billion commercial property financing vehicle, strategically focusing on high-quality assets. This initiative is particularly significant as traditional banks retreat from the lending landscape, creating a heightened demand for flexible financing solutions. The investment pool's focus aligns with a growing trend among institutional investors who are increasingly seeking stable returns in an uncertain economic environment. In the first quarter of 2025, private equity vehicles collected an impressive $57.1 billion, a substantial rise from $32.5 billion the previous year, indicating a strong desire for property financing investments.

As noted by industry experts, the current market conditions present unique opportunities for investors to capitalize on discounted assets, with many properties trading at 20% to 40% below their peak values. Lowell Baron, Chief Investment Officer of Brookfield’s real-estate group, emphasized that asset prices are well below what it would cost to replace them, offering rare value. This shift underscores the resilience of debt funds real estate, which has historically demonstrated lower delinquency rates and stability during market fluctuations.

Moreover, Brookfield aims to secure an additional $2 billion prior to the final closure, reflecting continued investor trust and the potential for further expansion. Significantly, Brookfield has already invested $1.8 billion, approximately 25% of its capital, into discounted apartments and warehouses, highlighting its proactive investment strategy.

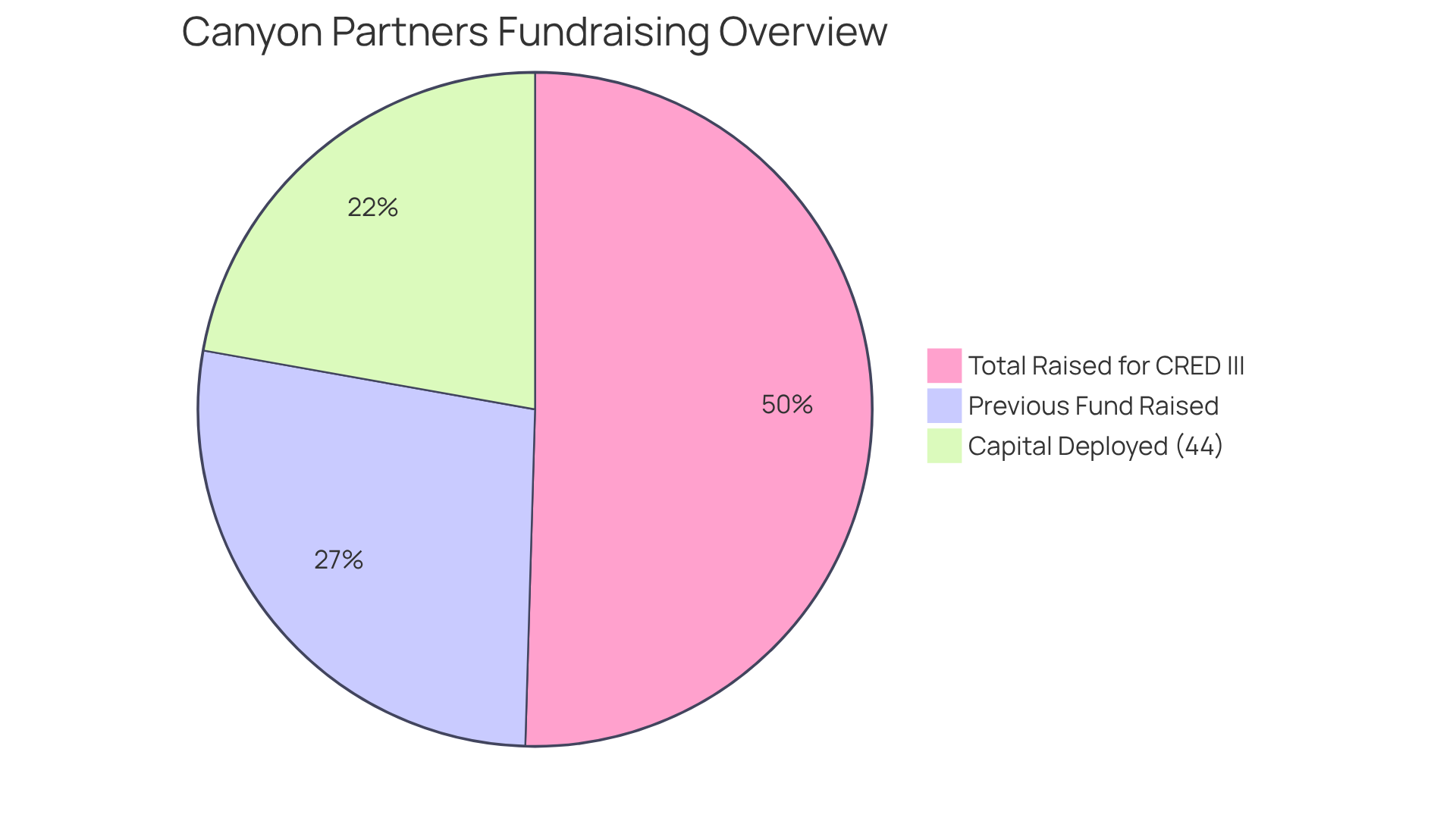

Canyon Partners: $1.2 Billion Raised for Real Estate Debt Strategy

Canyon Partners has successfully raised approximately $1.2 billion for its real estate financing strategy, exceeding its initial goal of $1 billion. This substantial pool nearly doubles the size of its predecessor, which raised $650 million, and is designed to provide tailored financing solutions across various asset classes.

The investment pool has attracted a diverse international group of investors, underscoring the growing demand for specialized financing strategies in today's market. This approach by Canyon Partners signifies a notable shift towards more targeted investment opportunities in debt funds real estate, addressing the evolving needs of investors who seek flexible capital solutions in a competitive landscape.

Importantly, CRED III has already deployed 44% of its capital, demonstrating the entity's active engagement in the market.

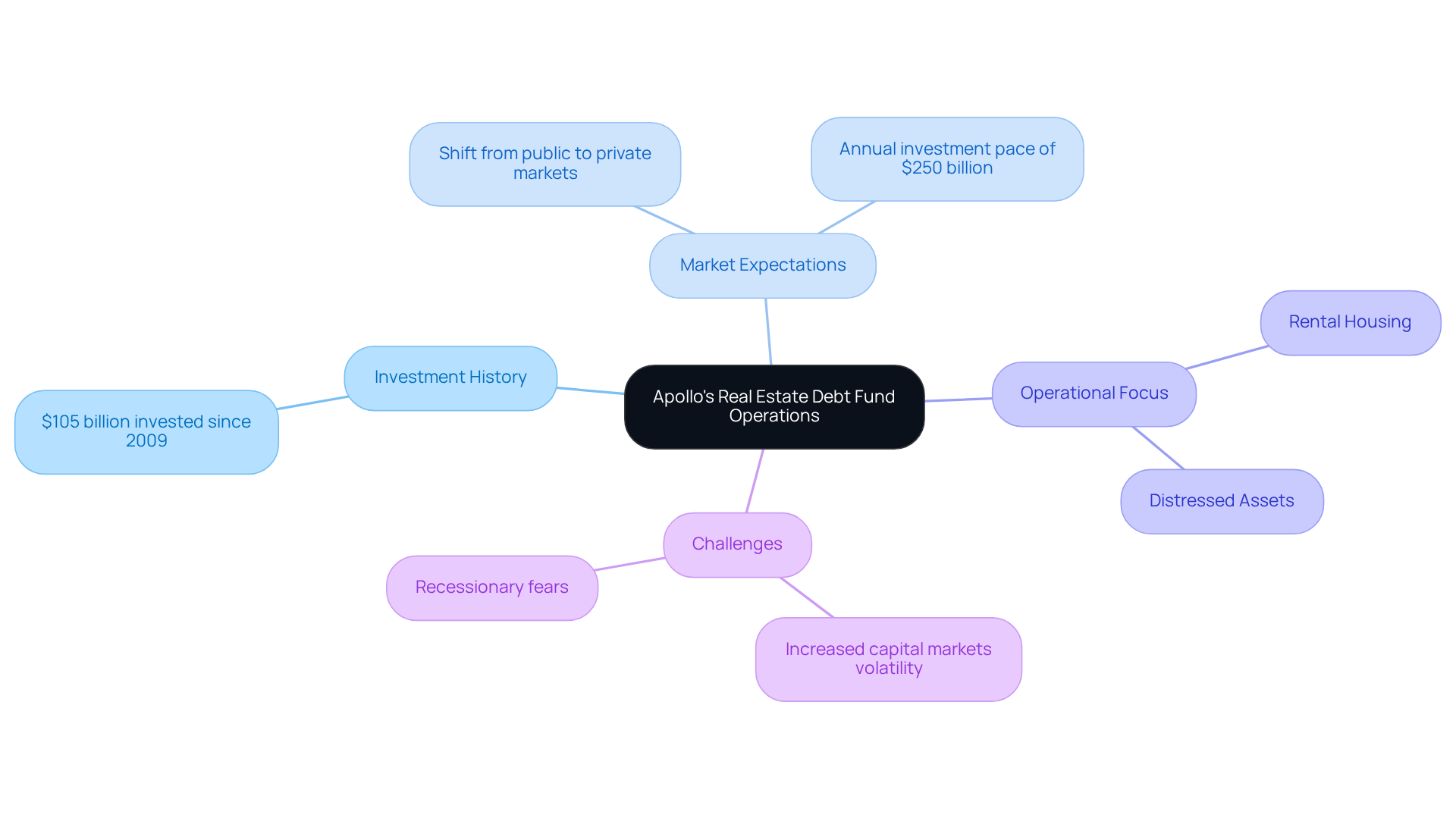

Apollo: Understanding Real Estate Debt Fund Operations

Apollo's property financing fund activities are centered on creating loans backed by high-quality assets, demonstrating a robust strategy in a competitive market. Since 2009, the company has invested over $105 billion in commercial property financing, underscoring its extensive expertise in navigating the complexities of the financing landscape. As the market evolves, Apollo anticipates a significant shift of investor capital from public to private markets, aiming to expand its private-debt operations to an annual investment pace of up to $250 billion over the next five years. This strategic focus positions Apollo to capitalize on emerging opportunities, particularly in sectors such as rental housing and active adult living, which are expected to thrive despite broader economic uncertainties.

The firm’s commitment to financing origination is crucial for achieving higher returns, making it an essential part of its business strategy. Investors looking to enter the debt funds real estate sector can gain valuable insights from Apollo's operational strategies, especially as the landscape for commercial real property investment continues to evolve in 2025. However, it is essential for investors to remain cognizant of anticipated challenges, such as increased capital markets volatility and recessionary fears, which could influence investment decisions.

Additionally, Apollo is focusing on distressed assets and value-add opportunities in response to the 'higher for longer' interest rate environment, providing a clearer picture of its operational focus. For those contemplating investments, understanding these dynamics and exploring opportunities in residential properties and data centers, where Apollo committed $650 million in new loans in Q1, could prove beneficial.

AlphaI: Distinct Features of Real Estate Debt Funds

Real estate debt funds offer distinct features that appeal to investors. These resources typically exhibit lower volatility than stock investments, creating a more stable investment environment. Furthermore, debt funds real estate offer predictable income streams through regular interest payments, which can be particularly attractive during uncertain economic conditions. The collateralized nature of loans within these debt funds real estate pools also offers downside protection, mitigating risks associated with market fluctuations.

Understanding the asset manager's strategy regarding leverage is crucial, as it helps align investment goals with risk/reward profiles. Investors should also consider the potential tax implications tied to debt funds real estate, as earnings from these investments are generally taxed as ordinary income. Typical loan types supported by financing sources, such as bridge loans and construction loans, present unique opportunities for diversification.

As investors strive to diversify their portfolios, grasping the benefits of debt funds real estate is essential for making informed decisions about incorporating property financing into their investment strategies.

Capital Fund Law: Structuring Real Estate Debt Funds

Organizing real estate debt investments requires meticulous attention to various legal and financial factors. As outlined by Capital Fund Law, selecting the right investment structure—be it open-end or closed-end—is crucial for aligning with investor preferences and regulatory requirements. Open-end vehicles offer flexibility and liquidity, appealing to investors who seek continuous access to their capital. In contrast, closed-end options typically provide a defined investment duration, which can enhance fundraising efforts by attracting those in pursuit of stable, long-term returns.

In 2025, asset managers must navigate a shifting landscape where investor preferences are evolving, with many now favoring arrangements that emphasize clarity and flexibility. Legal considerations are paramount; ensuring compliance with applicable laws not only mitigates risks but also strengthens investor confidence. A well-organized financial resource can significantly enhance fundraising initiatives for debt funds real estate, making it a critical focus for managers aiming to succeed in the competitive property market.

With the U.S. property market projected to reach a staggering value of $136.6 trillion by 2025, understanding these dynamics will be essential for effectively meeting investor requirements and ensuring compliance. Additionally, the implications of distressed assets in the U.S. commercial property sector, alongside the effects of geopolitical tensions and domestic political developments, represent vital considerations that debt funds real estate managers must incorporate into their strategies.

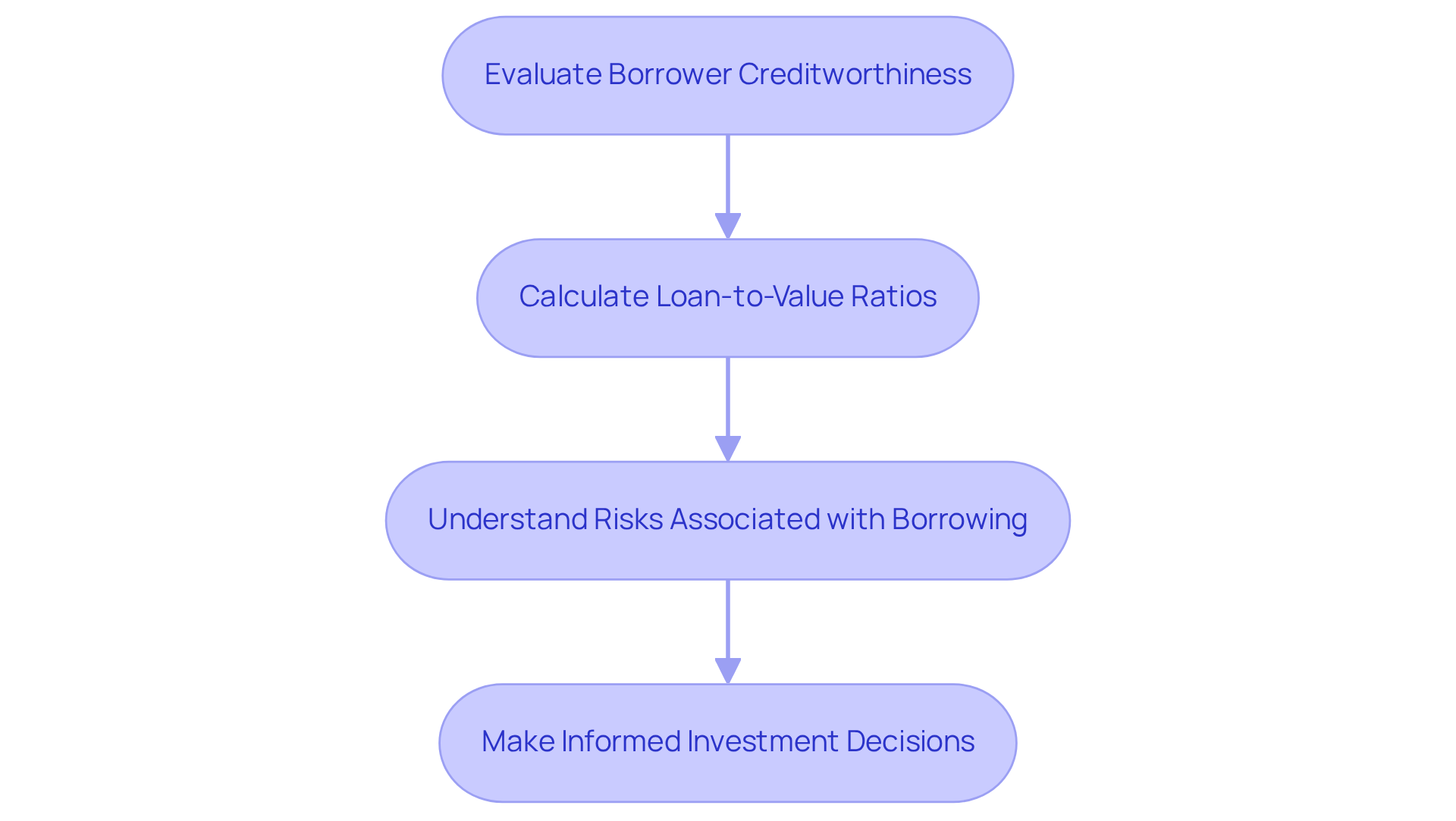

Concreit: Mechanics of Real Estate Debt Investing

Property financing investing involves offering loans that are supported by debt funds real estate. Concreit elucidates the mechanics of this investment approach in debt funds real estate, which includes:

- Evaluating borrower creditworthiness

- Calculating loan-to-value ratios

- Understanding the risks associated with various forms of borrowing

Investors must be well-versed in the mechanics of debt funds real estate to make informed decisions in the property financing market.

Understanding these fundamentals not only enhances an investor's ability to assess potential opportunities in debt funds real estate but also mitigates risks that could arise from uninformed choices. For instance, grasping the nuances of loan-to-value ratios can significantly impact the overall investment strategy. As such, a comprehensive understanding of these elements is crucial for anyone looking to navigate the complexities of debt funds real estate financing effectively.

FNPR USA: Guide to Commercial Real Estate Debt Investing

The terrain of commercial property financing is evolving rapidly, with several significant trends shaping the market landscape in 2025. As the industry confronts a formidable financing challenge, approximately $600 billion in loans are set to mature annually through 2028, culminating in a staggering total of $2.3 trillion. This impending deadline compels strategic planning from both investors and lenders.

Current trends indicate a notable increase in commercial property lending, highlighted by a substantial rise in financing volumes observed in Q1 2025. The CBRE Lending Momentum Index reported an impressive 90% year-over-year increase, illustrating a robust recovery in lending activity despite ongoing economic uncertainties. Furthermore, commercial mortgage loan spreads have tightened considerably, averaging 183 basis points, down 29 basis points from the previous year, potentially creating favorable conditions for borrowers.

The market is also experiencing a shift in lender composition. Alternative lenders represented 19% of non-agency loan closings, a significant drop from 48% a year prior, signaling a consolidation of lending sources. This trend underscores the growing importance of traditional financing avenues as investors seek stability in a volatile market.

Case studies highlight both challenges and opportunities within the commercial property financing sector. For example, the ongoing transformation of abandoned office spaces into residential units reflects a strategic pivot in response to evolving market demands. This trend not only addresses the housing crisis but also presents unique investment opportunities for funding sources.

Expert insights further illuminate the landscape. As emphasized by industry leaders, the commercial property sector is expected to shift from defensive to proactive strategies, with 68% of surveyed executives anticipating improvements in financing conditions and property values in 2025. This optimism is reinforced by the expectation of interest rate cuts, which could enhance borrowing conditions and invigorate market activity.

In summary, the commercial property financing market in 2025 is characterized by significant challenges and emerging opportunities. Investors must remain vigilant and adaptable, leveraging insights and data to navigate this complex landscape effectively.

PGIM: Strategic Use of Real Estate Debt Funds

PGIM emphasizes the tactical application of property financing funds to enhance portfolio performance. By focusing on senior loans and mezzanine financing, PGIM aims to provide investors with stable income and opportunities for capital growth. Understanding these strategies is crucial for investors seeking to effectively leverage debt funds in real estate to achieve their financial objectives.

How can these insights shape your investment approach? By integrating these methods, investors can not only secure steady returns but also position themselves for long-term success in the dynamic real estate market using debt funds in real estate.

Conclusion

The landscape of real estate debt funds is rapidly evolving, presenting significant implications for investors in 2025. Insights gathered from various industry leaders underscore the necessity of understanding the complexities involved in property financing. As demand for innovative financing solutions grows, it is crucial for investors to remain informed and adaptable to capitalize on emerging opportunities.

Key trends highlighted in this analysis include:

- The increasing reliance on private debt strategies as traditional lending sources become constrained.

- The substantial capital raised by major players like Blackstone and Brookfield.

- The strategic focus on high-quality assets and distressed opportunities.

- The integration of advanced data analytics and AI in underwriting processes, reshaping how risk is assessed and enhancing decision-making capabilities for investors navigating this complex market.

In light of these developments, stakeholders must engage deeply with the mechanics of real estate debt investing. By leveraging the insights provided, investors can make informed decisions that align with their financial objectives while mitigating risks. As the commercial real estate sector faces both challenges and opportunities, proactive strategies will be essential for thriving in this dynamic environment. Embracing the evolving nature of real estate debt funds will not only enhance portfolio performance but also secure a competitive edge in the market.